IST,

IST,

Monetary Policy Report - September 2022

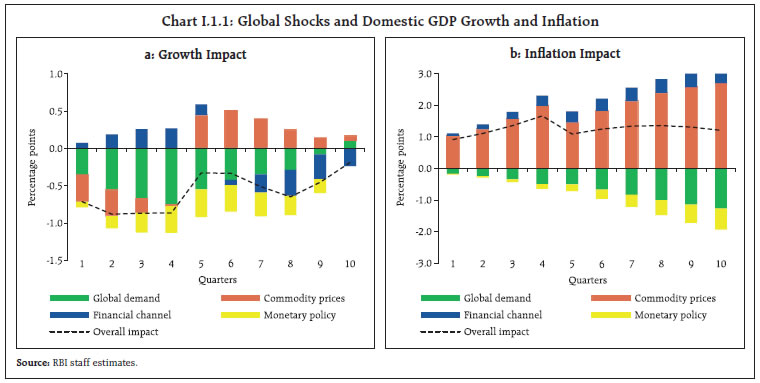

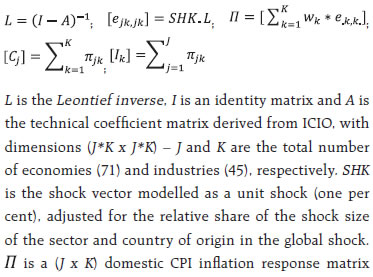

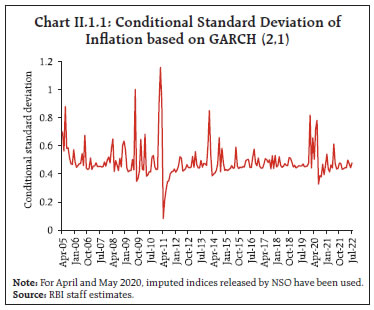

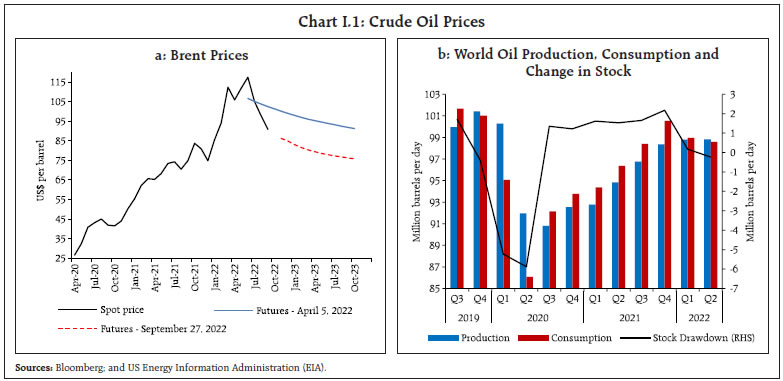

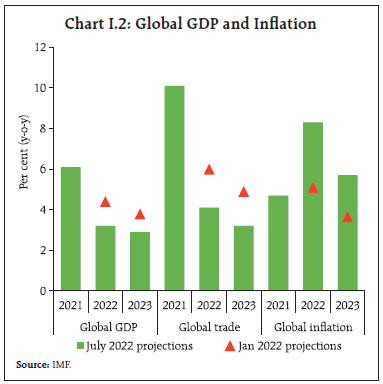

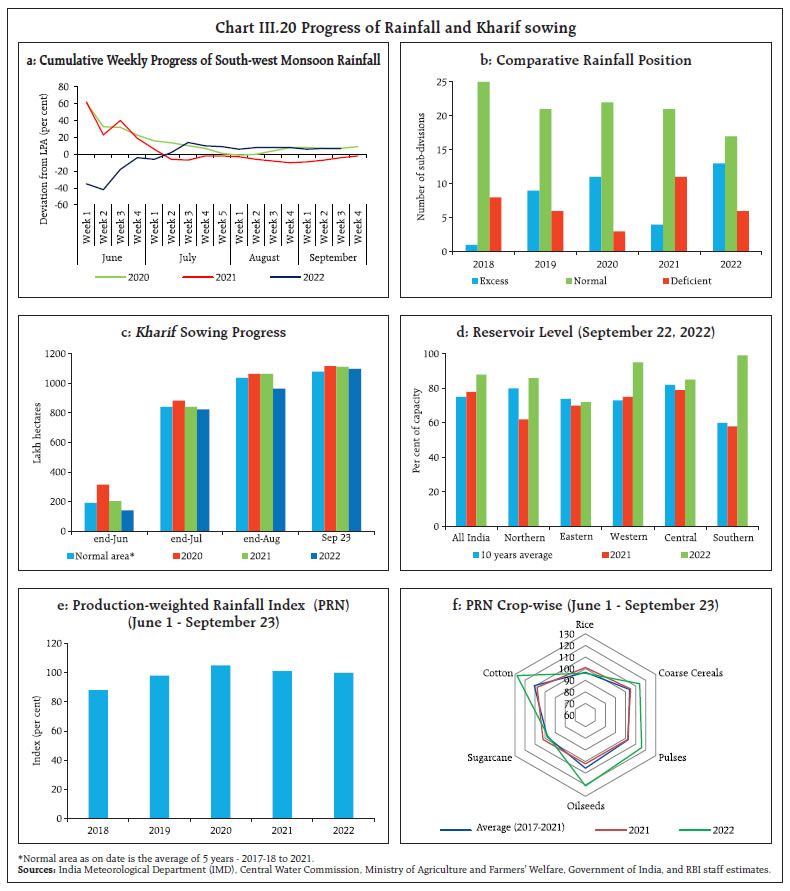

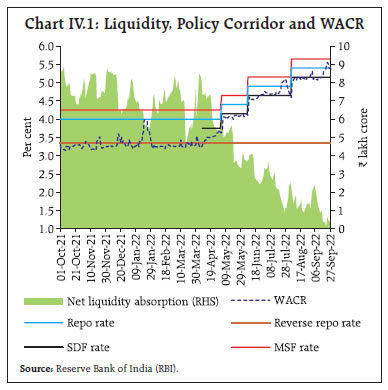

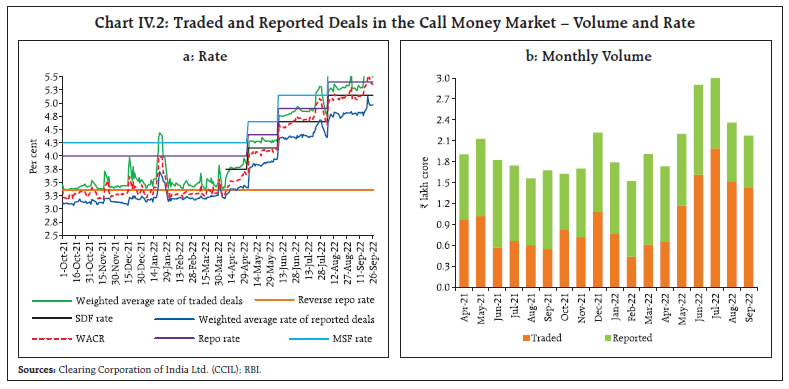

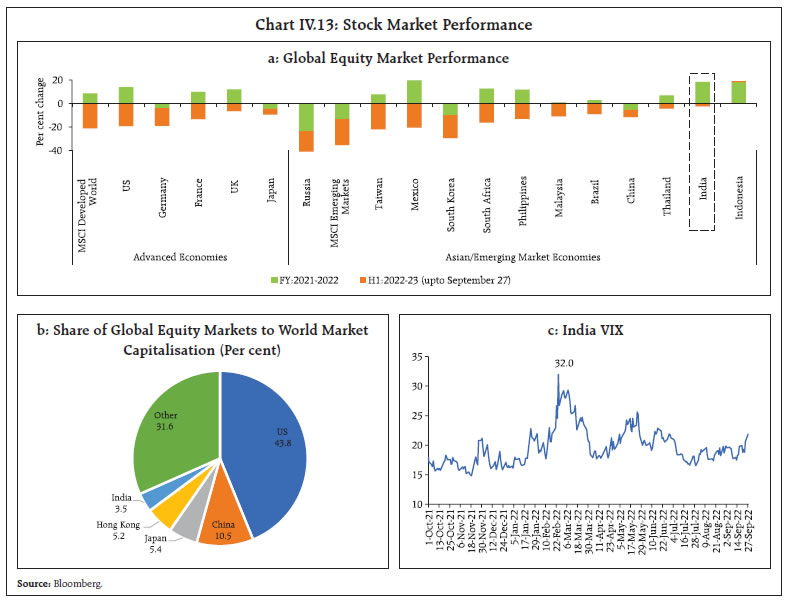

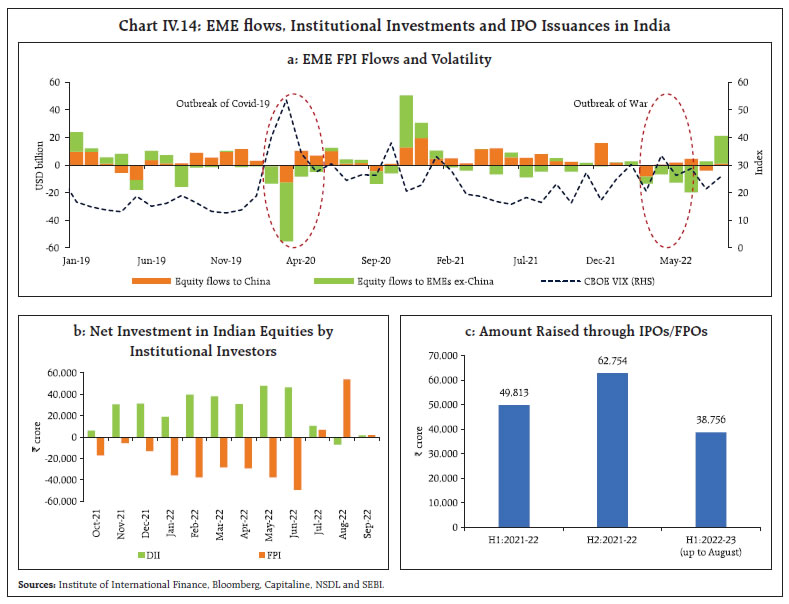

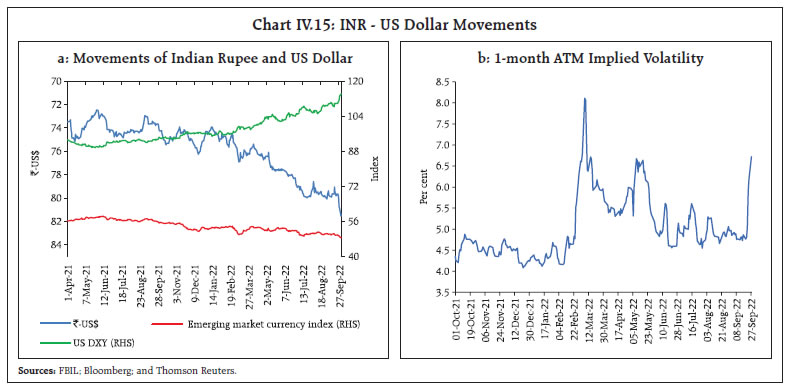

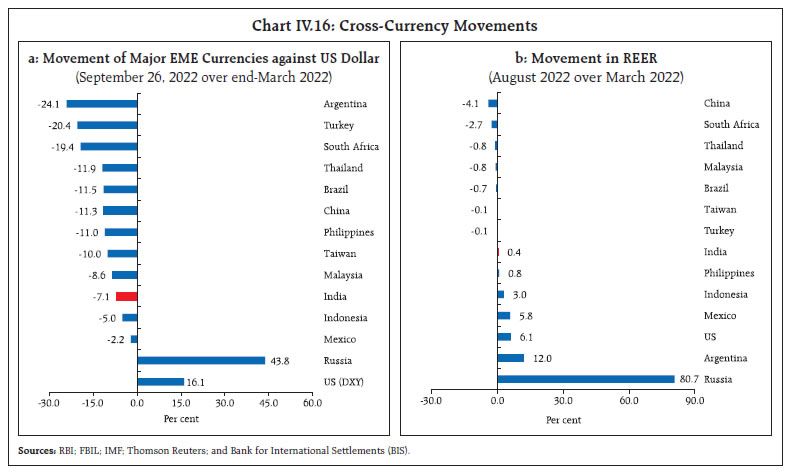

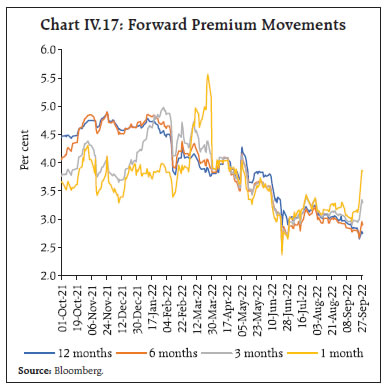

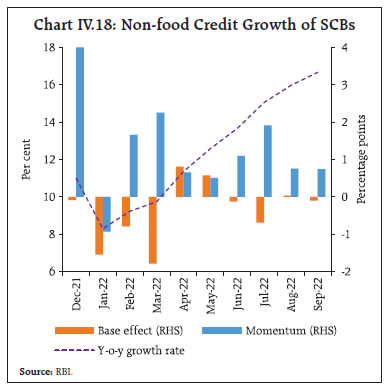

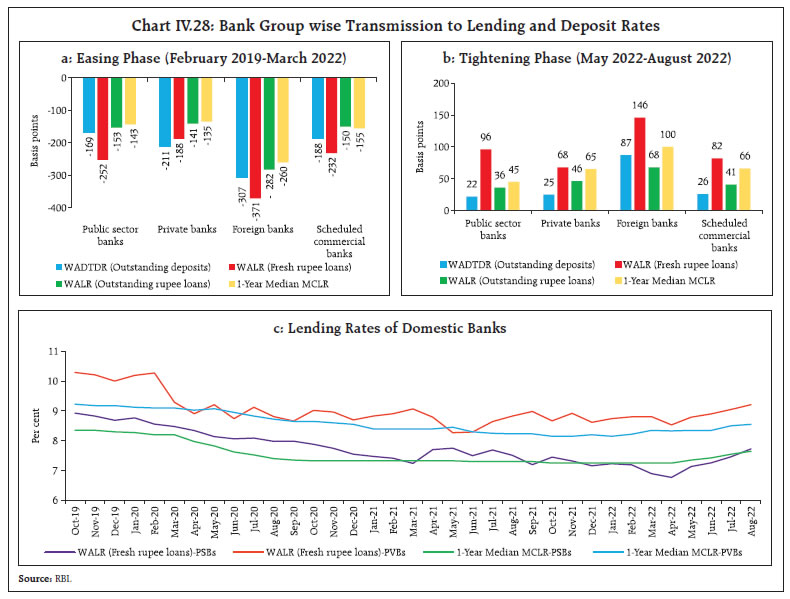

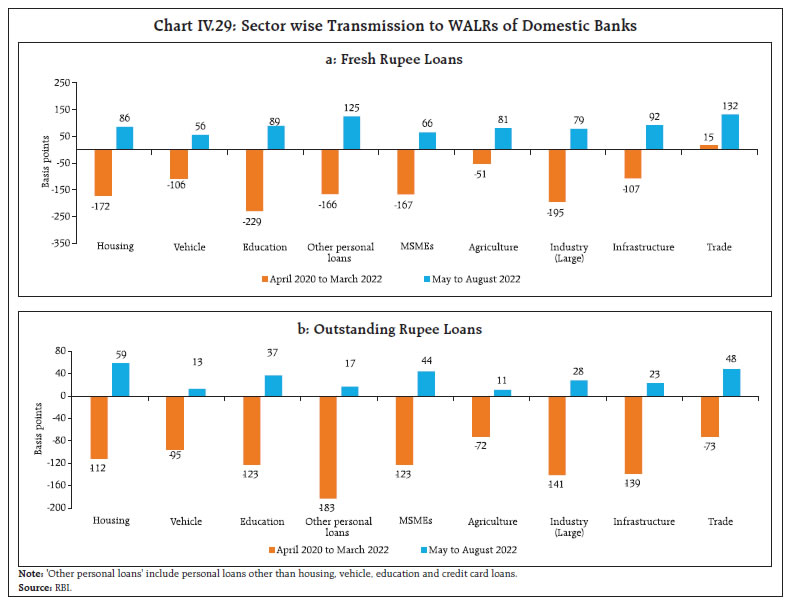

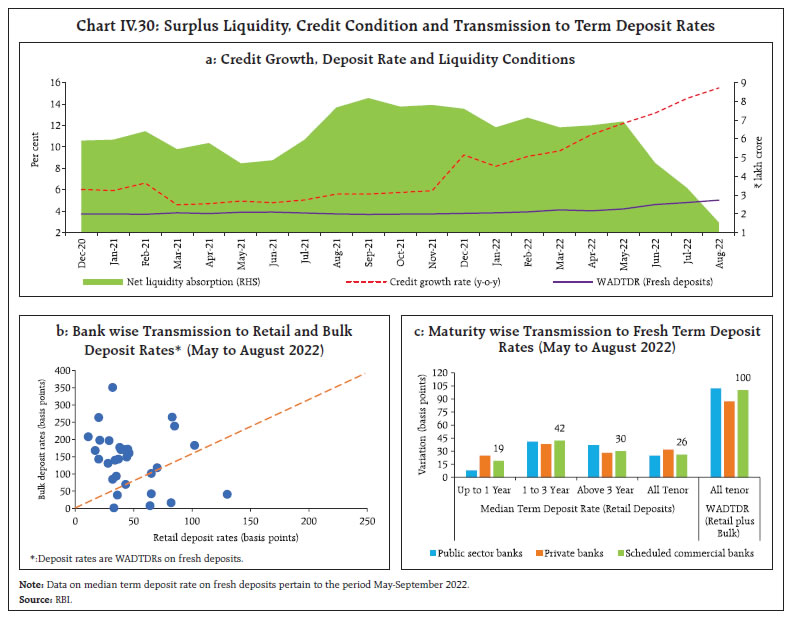

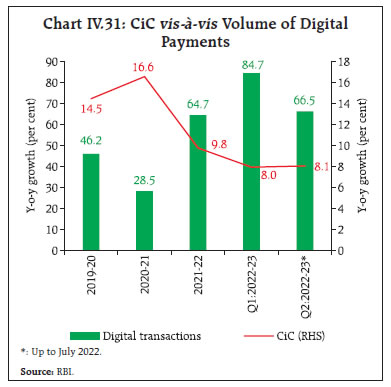

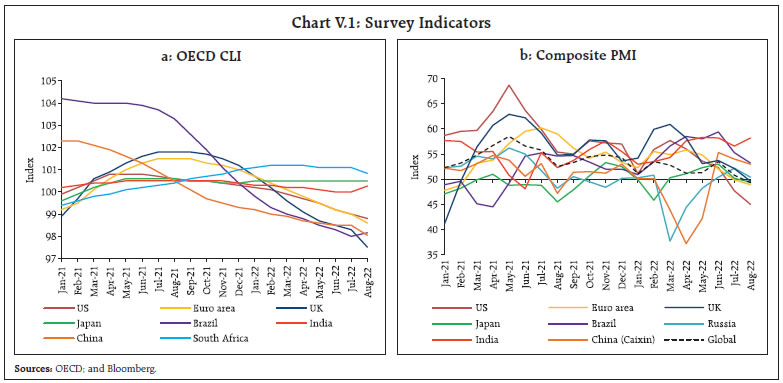

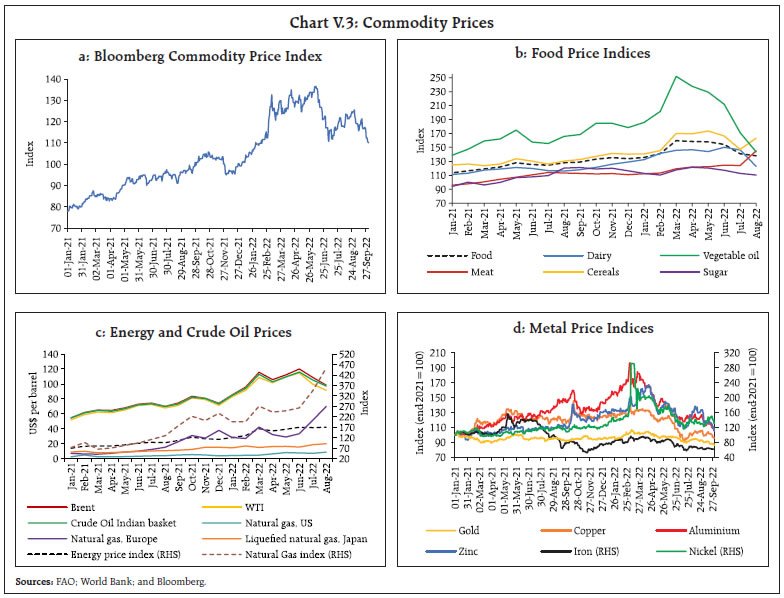

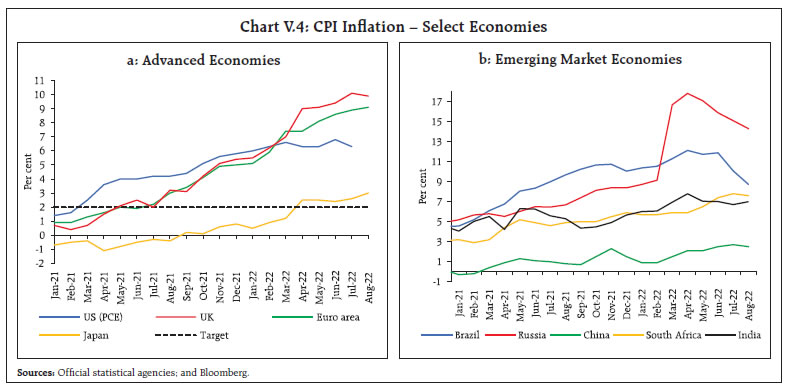

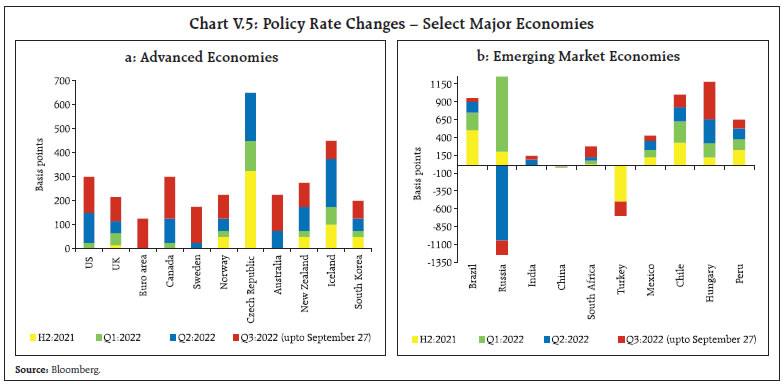

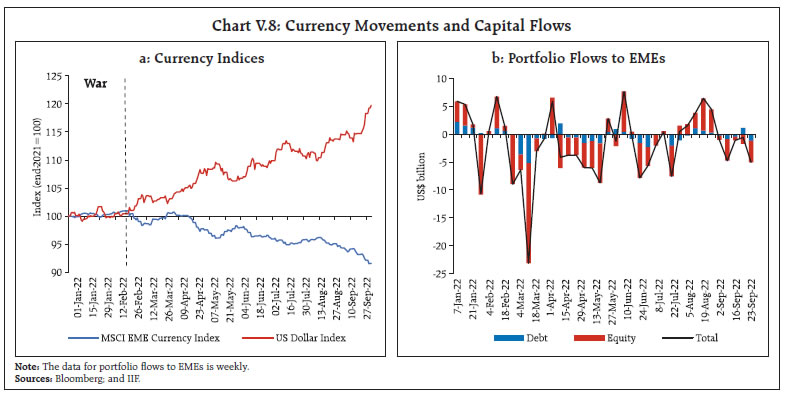

Aggregate supply conditions are improving. This augurs well for demand ahead of the festival season. Consumer price inflation is ruling above the upper threshold around the target. Monetary policy has moved into the withdrawal of accommodation mode and remains focussed to ensure that inflation returns to the target while supporting growth. The daunting global environment imparts considerable uncertainty to the outlook. I.1 Key Developments since the April 2022 MPR Since the release of the April 2022 Monetary Policy Report (MPR), the global economic environment has been marked by slowing growth with rising risks of recession, elevated inflationary pressures, and tightening financial conditions engendered by aggressive and synchronised monetary policy actions and stances. For emerging market economies (EMEs), these developments have translated into currency depreciations brought on by a surging US dollar and capital outflows, leading to reserve losses. The conflict in Ukraine lingers on and the pandemic continues to weigh on economic activity even as issues in green transition, real and financial fragmentation, trade restrictions and reshoring pose formidable challenges to the global economy. Financial markets remain volatile and global spillovers pose significant headwinds. Brent crude prices remain at elevated levels, given the tight demand-supply balance, despite recent correction. Global food prices have declined by 14 per cent from an all-time high in March but are ruling 8 per cent over last year’s level1. The Bloomberg commodity index was 10 per cent higher on September 27 (year-on-year (y-o-y) basis), notwithstanding some easing since June. Sovereign bond yields have hardened and reached multi-year highs in major advanced economies (AEs) as investors brace for the future course of monetary policy across the world. Yield curves have inverted, foretelling future recession. Equity markets in AEs and EMEs corrected sharply by 21 per cent and 18 per cent, respectively, since end-March (upto September 27, 2022) amidst high volatility. In currency markets, the US dollar has strengthened to a 20-year high while all other major currencies have depreciated. Turning to the domestic economy, real gross domestic product (GDP) rose by 13.5 per cent (y-o-y) in Q1: 2022-23, driven by base effects, even as momentum slipped due to the drag from net exports and restrained government spending. Aggregate supply conditions have been steadily improving and this augurs well for demand, both urban and rural, ahead of the festival season. The late pick-up in south-west monsoon and the recent spread of it to deficient regions is enabling a catch-up in kharif sowing, though paddy and pulses remain undersown relative to a year ago. Manufacturing is steadily gaining strength and services are posting strong growth, led by contact-sensitive sectors. Inflationary pressures, however, persisted at elevated levels during H1:2022-23 and remain a key policy concern. Consumer price index (CPI) inflation has been at or above the upper tolerance threshold of 6 per cent since January 2022, driven by adverse supply shocks emanating from geopolitical tensions. While inflation has eased from its April peak of 7.8 per cent, it remains at unacceptably high levels. In order to anchor inflationary expectations and contain the second round effects, the Reserve Bank of India (RBI) narrowed the policy corridor in April and the Monetary Policy Committee (MPC) increased the policy repo rate by 140 basis points (bps) during May-August. Monetary policy remains focussed on withdrawal of accommodation. Monetary Policy Committee: April-September 2022 During April-September 2022, the MPC met four times, including an off-cycle meeting in May 2022. At the time of the MPC meeting in April 2022, the global economic and financial environment had turned challenging due to the sharp jump in international commodity prices and uncertainties around the pace of monetary policy normalisation globally. CPI inflation was at or above the upper threshold of 6 per cent for two successive months in January and February 2022. The MPC assessed that the ratcheting up of geopolitical tensions, the generalised hardening of global commodity prices, the likelihood of prolonged supply chain disruptions, dislocations in trade and capital flows, divergent monetary policy responses and volatility in global financial markets posed sizeable upside risks to the inflation trajectory and downside risks to domestic growth. Accordingly, the inflation forecast for 2022-23 was raised by 120 bps (relative to the February 2022 projections) to 5.7 per cent while the real GDP growth forecast was revised downward by 60 bps to 7.2 per cent. Faced with the twin challenge of high inflation and worsening growth outlook, the MPC decided to keep the policy repo rate unchanged at 4 per cent. Although still accommodative, the stance of monetary policy focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. Concomitantly, the Reserve Bank introduced the standing deposit facility (SDF) at 40 bps above the fixed rate reverse repo rate as the floor of the liquidity adjustment facility (LAF) corridor, thus making the corridor symmetrical with a width of +/- 25 bps around the policy repo rate (see Chapter IV).2 With the CPI inflation print of March 2022 rising sharply to 7 per cent and significant upside risks to the near-term trajectory from higher food, crude oil and commodity prices materialising due to geopolitical tensions and sanctions, the MPC decided to hold an off-cycle meeting in May 2022. It noted that while economic activity was resilient, inflation at elevated levels warranted resolute and calibrated steps to anchor inflation expectations and contain second round effects. The MPC voted unanimously to increase the policy repo rate by 40 bps and reiterated the stance as set out in the April resolution. By the June 2022 MPC meeting, CPI inflation had risen further to 7.8 per cent in the April 2022 print, with considerable uncertainty around the outlook on account of the geopolitical situation. The MPC was of the view that continued shocks to food inflation, elevated international crude oil prices and pending pass-through of input costs to selling prices were likely to sustain pressures on headline inflation. Accordingly, the inflation forecast for 2022-23 was revised upwards by 100 bps from the April meeting to 6.7 per cent. Against this backdrop, the MPC judged that there was a need for calibrated monetary policy action to keep inflation expectations anchored and restrain the broadening of price pressures. Accordingly, it unanimously decided to increase the policy repo rate by 50 bps. The MPC focused the stance of policy on withdrawal of accommodation. At the time of the MPC’s August 2022 meeting, CPI inflation had eased to 7 per cent during May-June 2022 from 7.8 per cent in April but remained above the upper tolerance threshold of 6 per cent. The MPC observed that while there was some let up in global commodity prices, spillovers from geopolitical shocks were imparting considerable uncertainty to the inflation trajectory. Domestic economic activity was seen as resilient. With inflation projected to remain above the upper tolerance level of 6 per cent through the first three quarters of 2022-23, entailing the risk of destabilising inflation expectations and triggering second round effects, the MPC was of the view that further calibrated monetary policy action was needed to contain inflationary pressures, pull back headline inflation within the tolerance band closer to the target, and keep inflation expectations anchored to ensure sustained growth. Accordingly, the MPC unanimously decided to increase the repo rate by 50 basis points and maintained its stance of June 2022 with a majority of 5 to 1. The MPC’s voting pattern reflects the diversity in individual members’ assessments, expectations and policy preferences, a characteristic also reflected in voting patterns of other central banks (Table I.1). Macroeconomic Outlook Chapters II and III analyse macroeconomic developments related to inflation and economic activity during H1:2022-23 (April-September). The evolution of key macroeconomic and financial variables over the past six months warrants revisions in the baseline assumptions (Table I.2). First, international crude oil prices have exhibited large volatility in H1. Brent crude oil prices hardened to US$ 121 per barrel by mid-June, driven by supply concerns due to sanctions on Russia. Prices have cooled off since then, as global demand is weakening. Continued supply management by the Organization of Petroleum Exporting Countries (OPEC) plus and gas-to-oil switching due to record natural gas prices have supported crude oil prices while the geopolitical conflict and sanctions weigh heavily on the outlook (Chart I.1.a & Chart I.1.b). Taking into account these developments, crude prices (Indian basket) are assumed at US$ 100 per barrel in the baseline, same as in the April MPR baseline.  Second, the INR exhibited a depreciating bias vis-à-vis the US dollar during H1 on the back of generalised strengthening of the US dollar against currencies, elevated crude oil prices and portfolio outflows. The US dollar index strengthened by 16 per cent between end-March 2022 and September 27, reflecting aggressive monetary policy tightening by the US Fed and expectations of future hikes. Taking these developments into consideration, the exchange rate is assumed at INR 80 per US dollar in the baseline as against INR 76 in the April 2022 MPR, a depreciation of 5 per cent. Third, global economic prospects have weakened significantly since the April MPR, due to multi-pronged headwinds discussed earlier (Chart I.2). Global trade is slowing down and there are increasing concerns of recessions in major economies. The global composite Purchasing Managers Index (PMI) fell into contraction zone in August 2022 for the first time since June 2020. Global factors exert downward pressures on domestic activity and upward pressures on domestic inflation through a variety of channels (Box I.1).

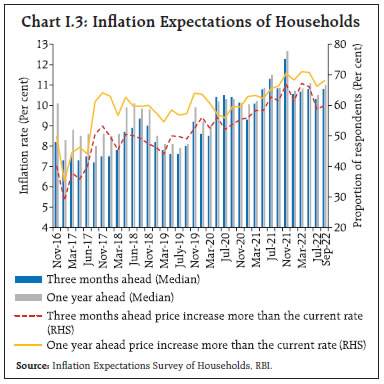

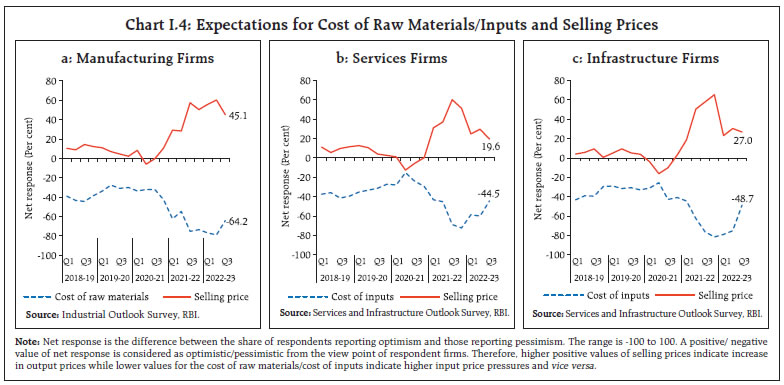

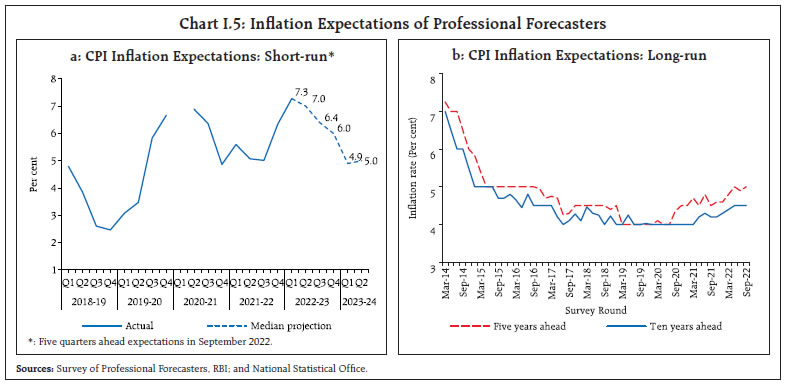

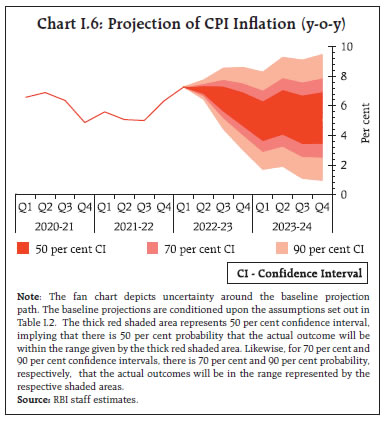

CPI inflation has ruled at or above the upper tolerance threshold of 6 per cent since January 2022 albeit with some moderation in recent months (Chapter II). Looking ahead, the three months and one year ahead median inflation expectations of urban households increased by 50 bps each in the September 2022 round of the Reserve Bank’s survey compared to the previous round4. The proportion of respondents expecting the general price level to increase by more than the current rate also increased in both the three months and one year ahead horizons vis-à-vis the previous round (Chart I.3). Manufacturing firms polled in the July-September 2022 round of the Reserve Bank’s industrial outlook survey expected reduction in cost of raw materials as well as selling prices in Q3:2022-23 (Chart I.4a).5 Services and infrastructure sector companies also expected softening in input costs and selling prices in Q3:2022-23 (Charts I.4b and I.4c).6 The respondents in manufacturing and services PMI reported increase in input and output prices in August 2022, although with some moderation in the pace of inflationary pressures.   Professional forecasters surveyed by the Reserve Bank in September 2022 expected CPI inflation to soften from 7.3 per cent in Q1:2022-23, to 6.0 per cent in Q4, and 4.9-5.0 per cent in H1:2023-24 (Chart I.5a and Table I.3).7 Long-run inflation expectations of professional forecasters – measured by their 5- and 10-year ahead expectations – remained broadly aligned around the inflation target, albeit with a slight upward drift during the pandemic period. In the September round, the 5-year ahead expected inflation rose by 10 bps to 5.0 per cent while the 10-year ahead expectation remained unchanged at 4.5 per cent (Chart I.5b). Looking ahead, several exogenous factors – global and domestic – will impinge on the inflation outlook. Global commodity prices have come off their highs on weaker global prospects but remain elevated and volatile. Global supply chains are gradually normalising, although they remain vulnerable to geopolitical disturbances, pandemic-related lockdowns in major production hubs, and financial market volatility. Domestically, the record foodgrains production in 2021-22, the above normal south-west monsoon during 2022, the recovery in kharif sowing, ample buffer stocks and improved reservoir position augur well for agricultural prospects and the future trajectory of food inflation. Taking into account the initial conditions, signals from forward-looking surveys and estimates from structural and other time-series models, CPI inflation is projected to average 6.7 per cent in 2022-23 – 7.1 per cent in Q2, 6.5 per cent in Q3 and 5.8 per cent in Q4, with risks evenly balanced (Chart I.6). The 50 per cent and the 70 per cent confidence intervals for headline inflation in Q4:2022-23 are 4.7-6.9 per cent and 4.0-7.6 per cent, respectively. For 2023-24, assuming a normal monsoon, a progressive normalisation of supply chains, and no further exogenous or policy shocks, structural model estimates indicate that inflation will average 5.2 per cent. In Q4:2023-24, CPI inflation is projected at 5.2 per cent, with the 50 per cent and the 70 per cent confidence intervals at 3.5-7.0 per cent and 2.5-7.9 per cent, respectively.  The baseline forecasts are subject to several upside and downside risks. The upside risks emanate from a further ratcheting up of geopolitical tensions, higher global crude and commodity prices, escalation in global financial market volatility due to aggressive monetary policy actions, longer-than-expected supply chain disruptions with shocks getting transmitted through highly integrated global supply chains (Box I.2), shortfall in kharif production, unseasonal rainfall and larger pass-through of input cost pressures to output prices as demand strengthens. The downside risks could arise from an early resolution of geopolitical tensions, further correction in global commodity prices due to slowing global demand, and further improvement in supply conditions with the ebbing of the pandemic.

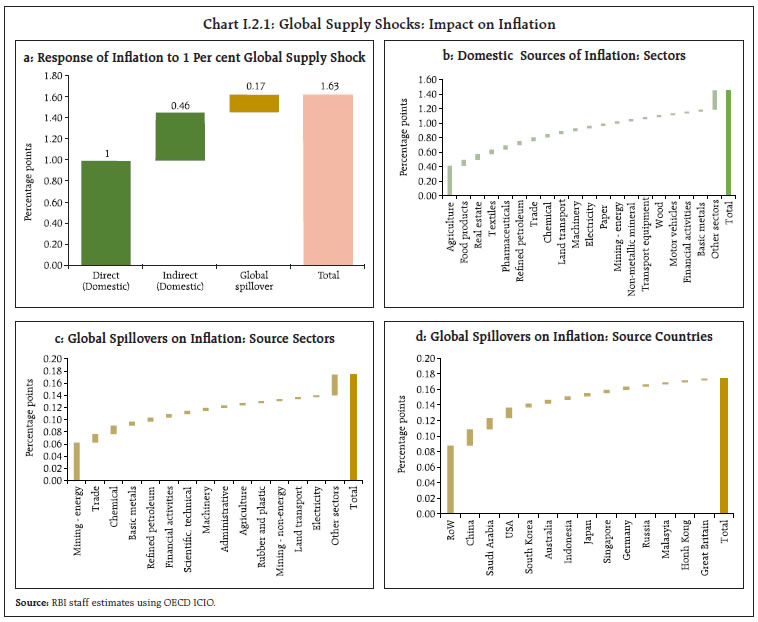

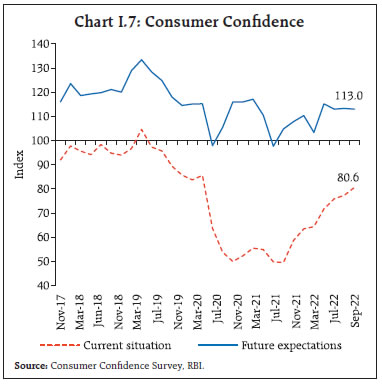

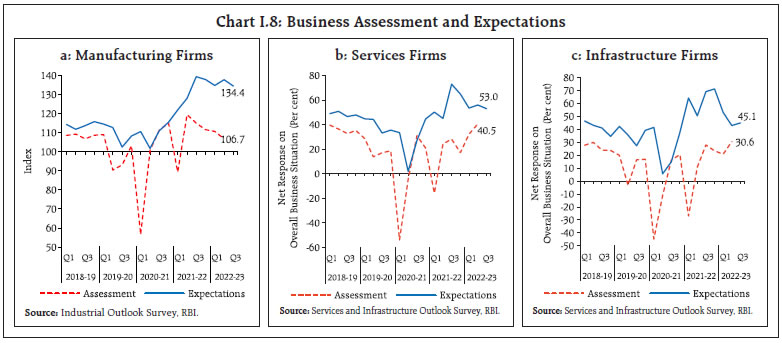

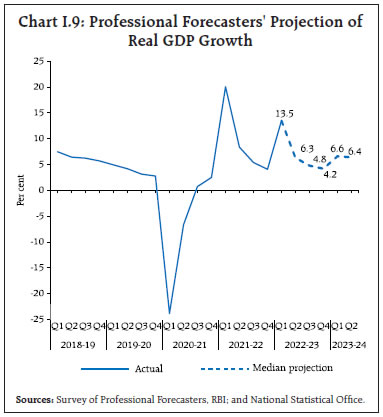

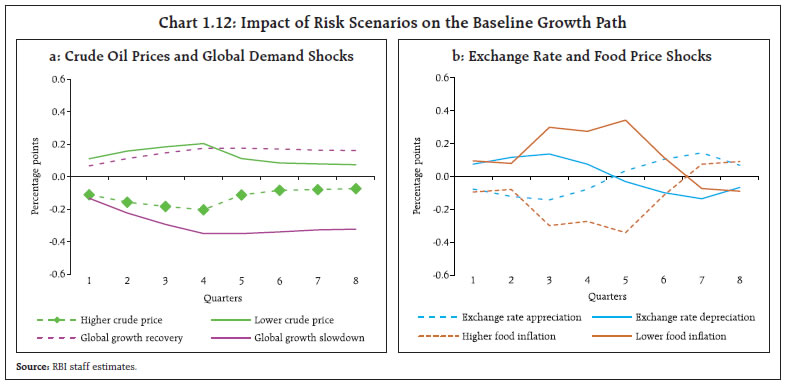

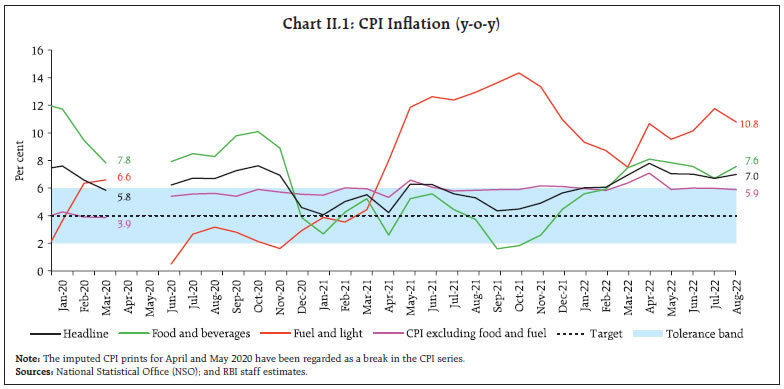

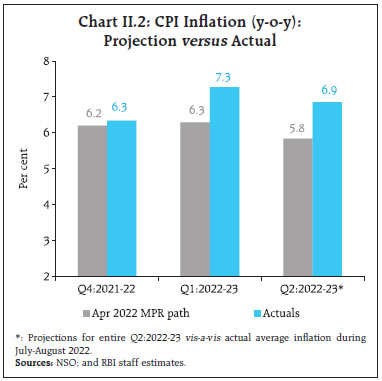

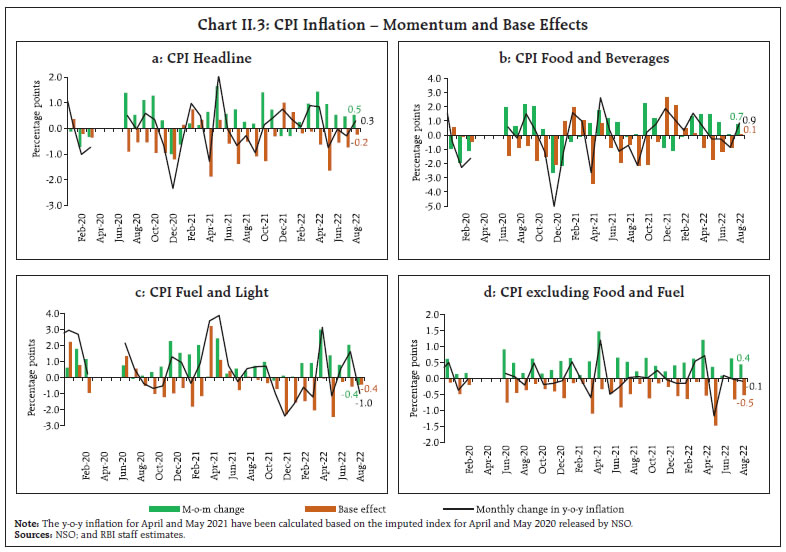

Ebbing COVID-19 infections and improving consumer sentiment facilitated a rebound in demand for contact-intensive services and supported domestic demand in H1:2022-23. Industry and services sectors are holding up well and kharif sowing has seen a smart recovery. The above-normal south-west monsoon has improved reservoir levels which bodes well for the winter crops. Investment activity is expected to benefit from the government’s capex push, growth in bank credit, improving demand conditions and rising capacity utilisation. Geopolitical tensions, the upsurge in global financial market volatility and tightening global financial conditions, however, weigh heavily on the outlook. Turning to the key messages from forward-looking surveys, consumer confidence (the current situation index) increased further in the September 2022 survey round on account of improved perception on general economic situation and overall spending, though overall confidence remained in the pessimistic zone. Households remained optimistic for the year ahead, with the future expectations index remaining unchanged vis-à-vis the July 2022 survey round (Chart I.7).10   Optimism on demand conditions in the manufacturing sector for the quarter ahead waned marginally in the July-September 2022 round of the Reserve Bank’s industrial outlook survey, though it remained well in the expansion zone (Chart I.8a). Services sector companies expected slight moderation while infrastructure companies expected a minor uptick in Q3:2022-23 in terms of the overall business situation (Charts I.8b and I.8c). Recent surveys by other agencies indicate a dip in business expectations over their respective previous rounds (Table I.4). In the August 2022 round of the PMI survey, business expectations of manufacturing and services firms improved to multi-year highs on optimism over strengthening demand. Professional forecasters polled in the September 2022 round of the Reserve Bank’s survey expected real GDP growth at 6.3 per cent in Q2:2022-23, 4.8 per cent in Q3 and 4.2 per cent in Q4, and at 6.4-6.6 per cent in H1:2023-24 (Chart I.9 and Table I.3). Taking into account the baseline assumptions, survey indicators and model forecasts, real GDP growth is expected at 7.0 per cent in 2022-23 – 6.3 per cent in Q2; and 4.6 per cent each in Q3 and Q4 – with risks broadly balanced around this baseline path (Chart I.10 and Table I.3). For 2023-24, assuming a normal monsoon, and no major exogenous or policy shocks, the structural model estimates indicate real GDP growth at 6.5 per cent. There are upside and downside risks to the baseline growth path. Upside risks to the baseline trajectory could emanate from stronger-than-expected expansion in demand for contact-intensive services with the receding threat of the pandemic and festival spending; a boost to private investment activity from government’s capex push, improving bank credit, rising capacity utilisation, and healthier corporate balance sheets; and a favourable terms of trade shock in the case of a sharp correction in crude and commodity prices. On the contrary, an escalation in geopolitical tensions, further hardening of international crude oil and other commodity prices, sustained disruptions to supply chains, the upsurge in global financial market volatility, and a sharper loss of momentum in global trade and demand pose downside risks to the baseline growth path.  Baseline projections of inflation and growth are conditional on assumptions of the future course of key domestic and international macroeconomic variables set out in Table I.2. There are, however, sizeable uncertainties around the baseline assumptions, as stated earlier. This section explores plausible alternative scenarios to assess the balance of risks around the baseline projections.  (i) Global Growth Uncertainties The downside risks to global growth flagged in the April 2022 MPR have materialised. Headwinds from the war, elevated commodity prices, tightening financial conditions, capital outflows from emerging economies, and the slowing global activities could pull global growth further below the baseline. There are growing concerns of recession in major economies and the global outlook is bleak and risks are tilted to the downside. In such a scenario, if global growth is 100 bps below the baseline, domestic growth and inflation could be around 40 bps and 20 bps, respectively, below the baseline trajectories. Conversely, if there is an early de-escalation in geopolitical tensions, the recent trend in falling commodity prices continues, and global inflation ebbs faster than expected, there can be a fillip to global growth. In this scenario, assuming that global growth surprises by 50 bps on the upside, domestic growth and inflation could edge higher by around 20 bps and 10 bps, respectively (Charts I.11a and I.12a).  (ii) International Crude Oil Prices Global crude oil prices remain at elevated levels, driven by geopolitical tensions, sanctions and supply management by OPEC plus. Further production curtailment by OPEC plus and the spike in the seasonal winter demand for energy amidst high natural gas prices could harden international crude oil prices. Assuming crude oil prices (Indian basket) to be 10 per cent above the baseline of US$ 100 per barrel, domestic inflation and growth could be higher by 30 bps and weaker by around 20 bps, respectively, over the baseline. Conversely, crude oil prices could soften below the baseline owing to global demand losing momentum and an easing of geopolitical tensions. As a result, if the Indian basket of crude prices falls by 10 per cent relative to the baseline, inflation could ease by around 30 bps with a boost of 20 bps to growth (Charts I.11a and I.12a). (iii) Exchange Rate The INR depreciated in H1, driven by the generalised strengthening of the US dollar, higher crude oil prices and sales by foreign portfolio investors. Volatility in global financial markets is expected to persist due to the uncertainty around monetary policy normalisation in the US and other major advanced economies, which could put downward pressure on the INR. Should the INR depreciate by 5 per cent from the baseline, inflation could edge up by around 20 bps while GDP growth could be higher by around 15 bps through boost to exports. On the other hand, given India’s relatively better growth performance and outlook and strong domestic macroeconomic fundamentals, portfolio equity flows turned significantly positive in August 2022 and could increase further. In this scenario, if the INR appreciates by 5 per cent relative to the baseline, inflation and GDP growth could moderate by around 20 bps and 15 bps, respectively (Charts I.11b and I.12b).  (iv) Food Inflation Food inflation remained high during H1, driven by the war-induced jump in global food prices. Global food prices have started correcting and these are being reflected in the softening of domestic edible oil prices. Furthermore, kharif sowing has caught up with its long-term average. Reservoir levels are above last year’s and the decadal average, which augur well for the rabi crop. Although the area under paddy sowing has been lower than a year ago due to uneven distribution of south-west monsoon rainfall, ample buffer stocks of rice and effective supply management measures could soften food inflation more than anticipated, and push headline inflation 50 bps below the baseline. Conversely, global food prices could harden in view of the fragile geopolitical outlook and sustained input price pressures on critical inputs like energy and fertilisers. Furthermore, unseasonal heavy rainfalls during the harvesting period could impact the domestic crop. In such a scenario, there could be upward pressures on food prices and headline inflation could be around 50 bps above the baseline (Charts I.11b and I.12b). The Indian economy is advancing steadily, and is expected to be one of the fastest growing major economies in 2022. The above-normal south-west monsoon, improved reservoir position, government’s capex push, improvement in capacity utilisation, a broad-based revival in credit growth, strong corporate and bank balance sheets, upbeat consumer and business confidence and receding threat of the pandemic are all factors likely to provide impetus to growth. While inflation has eased somewhat from the April high, supported by some correction in global prices, it has ruled above the upper tolerance threshold around the target since January 2022. Monetary policy has moved into the withdrawal of accommodation mode and remains focussed to ensure that inflation returns to the target while supporting growth. The daunting global environment, however, imparts considerable uncertainty to the outlook. __________________________________________________________________________________ 1 Based on Food and Agriculture Organisation’s (FAO’s) food price index for August 2022. 2 To manage the excess liquidity effectively during the pandemic phase, the LAF corridor was made asymmetric during March-April 2020, with reverse repo rate at 65 bps below the repo rate (25 bps prior to the pandemic) and the marginal standing facility (MSF) rate at 25 bps above the repo rate. 3 The QPM belongs to the genre of consensus macroeconomic new Keynesian open economy structural models and is calibrated to incorporate the India-specific characteristics (Benes et al., 2016). 4 The Reserve Bank’s inflation expectations survey of households is being conducted in 19 cities since March 2021 (18 cities in the previous rounds) and the results of the September 2022 round are based on responses from 6,052 households. 5 The results of the July-September 2022 round of the industrial outlook survey are based on responses from 1,234 companies. 6 Based on 469 services and 124 infrastructure companies polled in the July-September 2022 round of the services and infrastructure outlook survey. 7 41 panellists participated in the September 2022 round of the Reserve Bank’s survey of professional forecasters. 8 Intermediate goods accounted for almost half of all global trade, with trade comprising about 30 per cent of world output in 2021 (United Nations Conference on Trade and Development, 2022). 9 These estimates assume the absence of other channels of transmission like exchange rate and inflation expectations and no offsetting macroeconomic policy actions. 10 The Reserve Bank’s consumer confidence survey is being conducted in 19 cities since March 2021 (13 cities in the previous rounds) and the results of the September 2022 round are based on responses from 6,062 respondents. The trajectory of consumer price index (CPI) inflation since February 2022 has been altered by spillovers from the conflict in Ukraine. CPI inflation peaked in April 2022 and has since then moderated but persists above the pre-war levels and also above the upper tolerance band. During H1:2022-23, industrial and farm input pressures remained firm, notwithstanding some softening. Nominal rural wage growth was muted. Since February 2022, the trajectory of headline CPI inflation1 has been altered by spillovers from adverse global commodity price shocks triggered by the conflict in Ukraine. In February, it was anticipated that the pandemic-induced global supply chain disruptions would ease with the ebbing of COVID-19 infections, the combination of domestic supply side measures and a normal monsoon would bring about a durable softening of domestic inflation over the course of the year. The war upended this narrative with a broad-based spike in global commodity prices, the resurgence of supply chain and logistics bottlenecks, sanctions and second-round effects. Global financial market volatility engendered by aggressive monetary tightening and consequent spillovers to domestic financial markets exacerbated inflationary pressures. Headline CPI inflation was already testing the upper tolerance threshold of 6 per cent during January-February 2022, due to adverse base effects, and a sticky core component.2 Starting March, the fallout of the adverse global commodity price shocks spread across items. In April, the heat wave and consequent production losses added to a sharp pick-up in prices.  As a result, headline inflation surged by 173 basis points in two months – from 6.1 per cent in February to 7.8 per cent in April across food, fuel and core components. Judicious supply side interventions by the government and some softening of global commodity prices from their peak March 2022 levels enabled inflation to moderate to 6.7 per cent in July before it edged up to 7.0 per cent in August on a surge in food inflation (Chart II.1). The Reserve Bank of India (RBI) Act enjoins the RBI to set out deviations of actual inflation outcomes from projections, if any, and explain the underlying reasons thereof. The April 2022 MPR projected inflation at 6.3 per cent for Q1:2022-23 and 5.8 per cent for Q2. War-induced price pressures as well as domestic supply shocks turned out to be stronger and more persistent than anticipated, resulting in actual inflation exceeding projections by around 100 bps each in Q1 and Q2 (July-August) (Chart II.2). This came about largely from substantial upward surprises in food inflation.3 The unprecedented increase in global food prices in March led to sharp increases in domestic prices of edible oils, animal-based proteins through high feed costs, and wheat through export linkages. At the same time, the adverse impact of the intense heat wave caused damage to the rabi wheat crop, and tomato prices jumped by 158.4 per cent (on a year-on-year basis) in June 2022. Processed food prices also registered increases as higher input costs were passed on to selling prices. The depreciation of the Indian rupee from the baseline of ₹76 per US$ to around ₹79-80 per US$ by August-September also contributed to projection errors, partly offset by the cut in excise duties on petrol and diesel in May 2022.  As explained in the preceding section, the surge in headline inflation in April was sharp and broad-based. Thereafter, a deceleration of the momentum of prices, supported by a large favourable base effect, brought down inflation to 7.0 per cent in May-June.4 The deceleration in momentum in May was located in the core component, even as food price momentum remained robust. In June, headline momentum moderated further, across all major groups. In July, even as headline CPI momentum remained unchanged at June level, favourable base effect led to a softening in inflation by 30 bps to 6.7 per cent. August was the third successive month with a steady momentum of 0.5 per cent; inflation, however, edged up by around 30 basis points as the favourable base effects waned (Chart II.3).  The mean of the CPI inflation distribution rose to 6.8 per cent in 2022 (January-August) from 5.3 per cent during the corresponding period in 2021 and the pre-COVID average of 3.4 per cent for 2017-19 (January-August). This was accompanied by higher median rates and lower dispersion in the sub-group/group-wise distribution of inflation rates signifying generalisation of inflation (Chart II.4), and heightened uncertainty about future inflation (Box II.1).

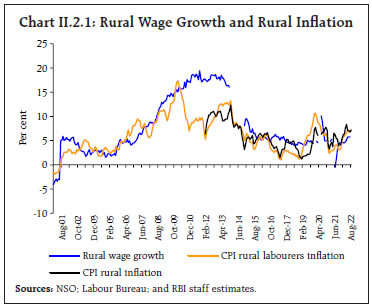

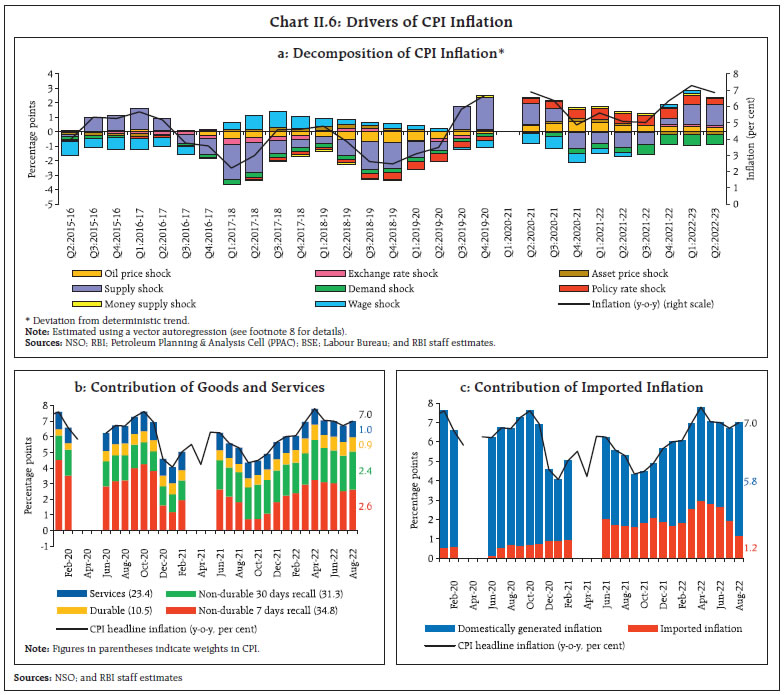

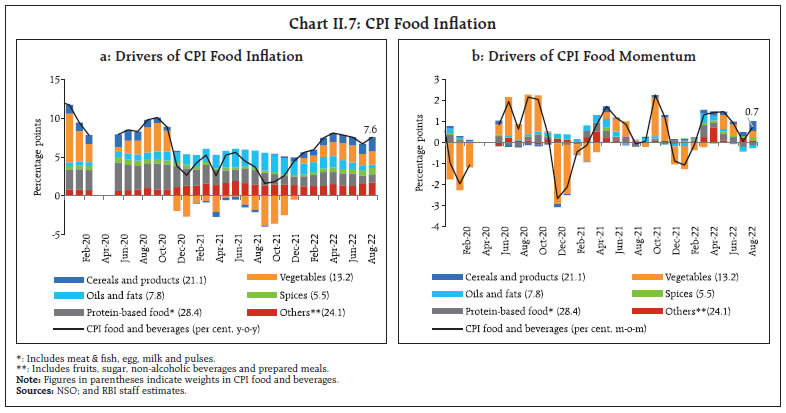

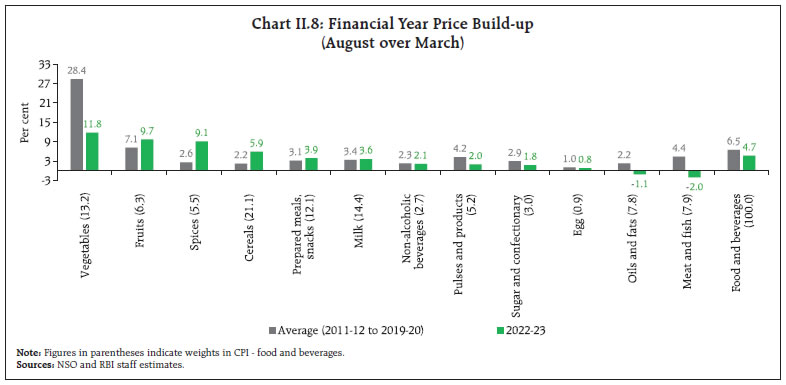

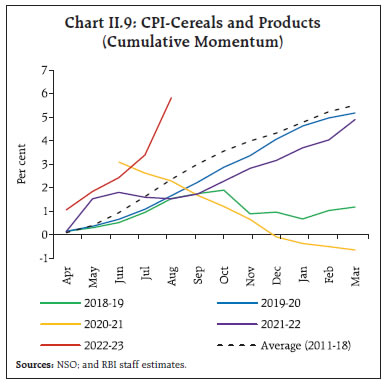

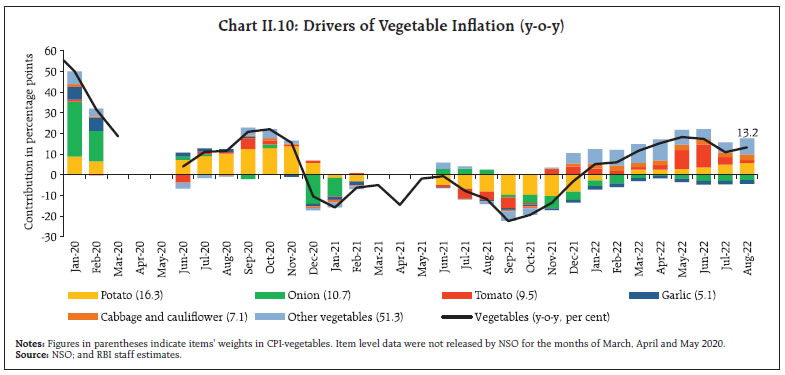

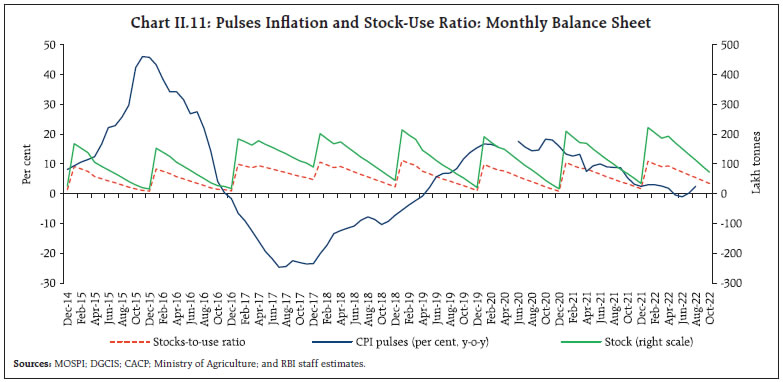

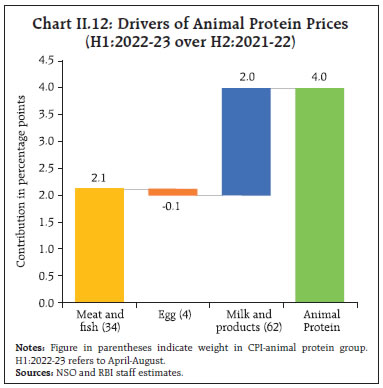

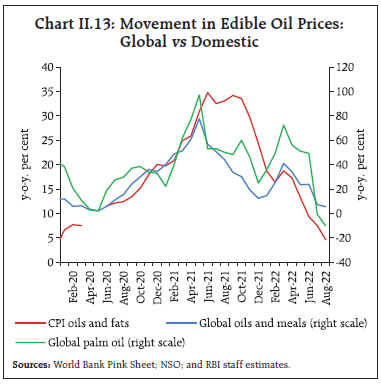

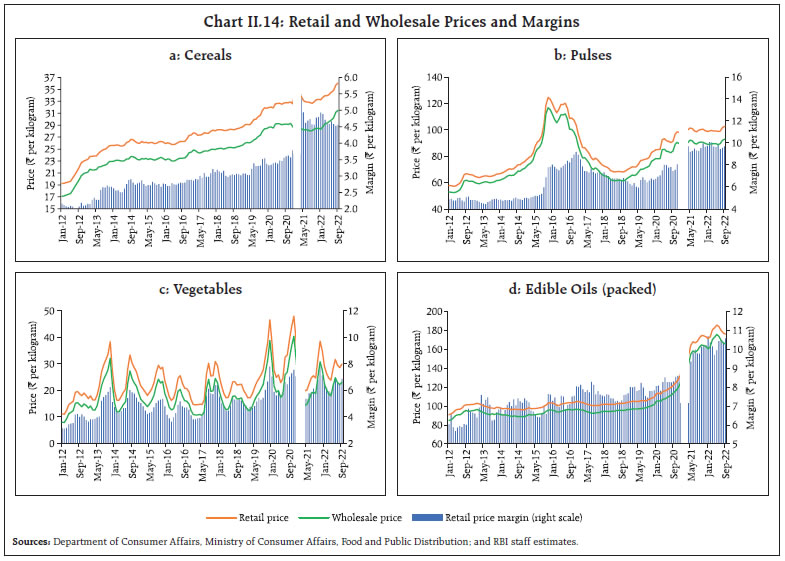

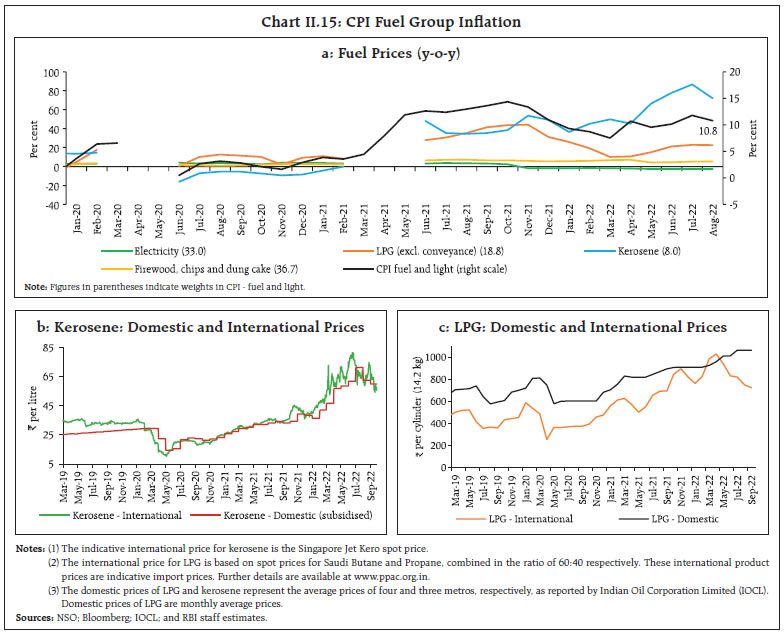

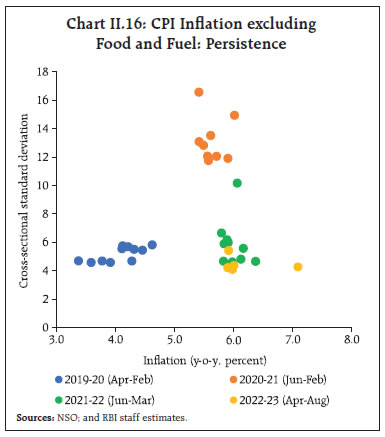

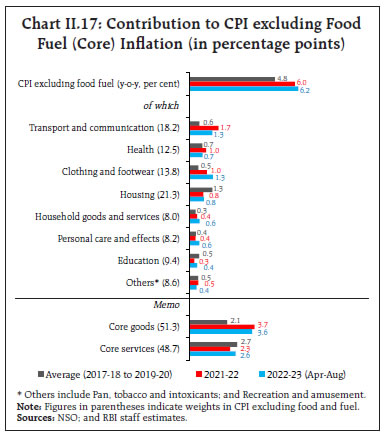

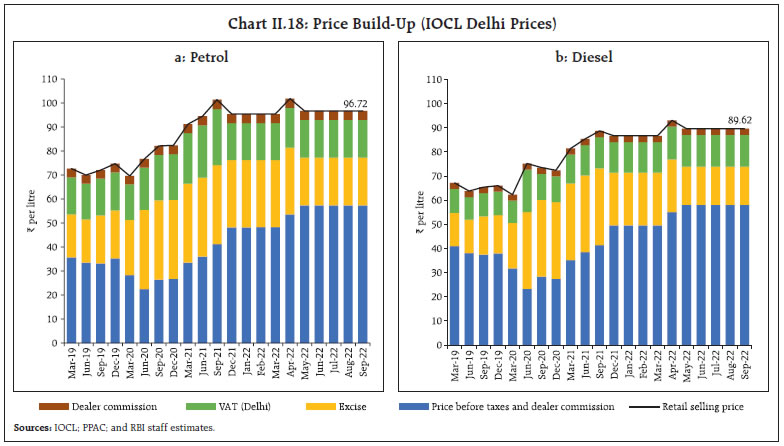

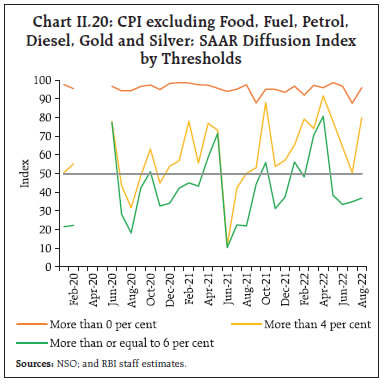

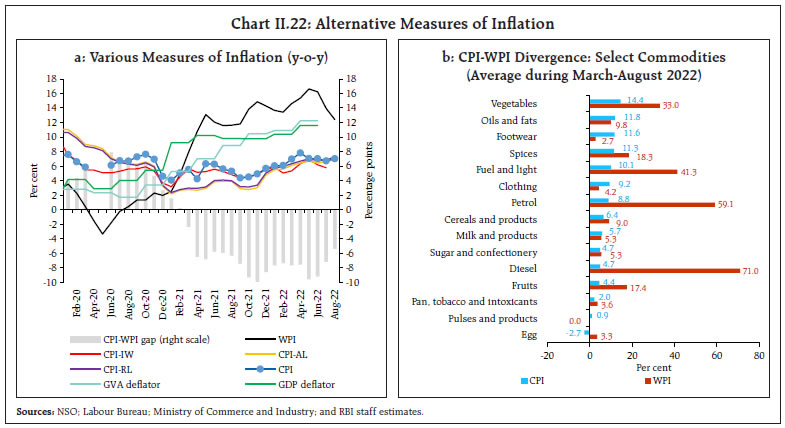

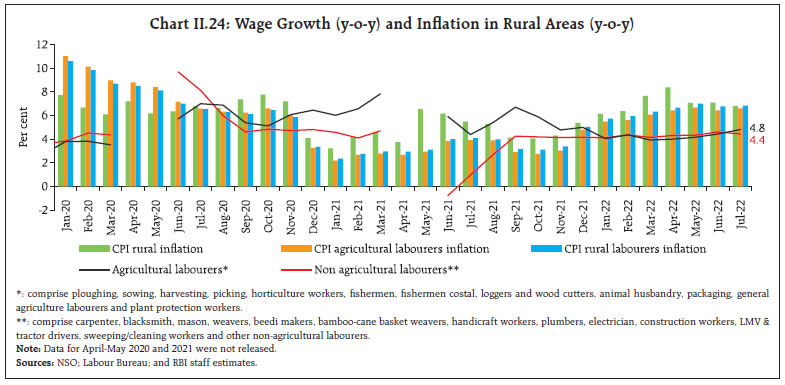

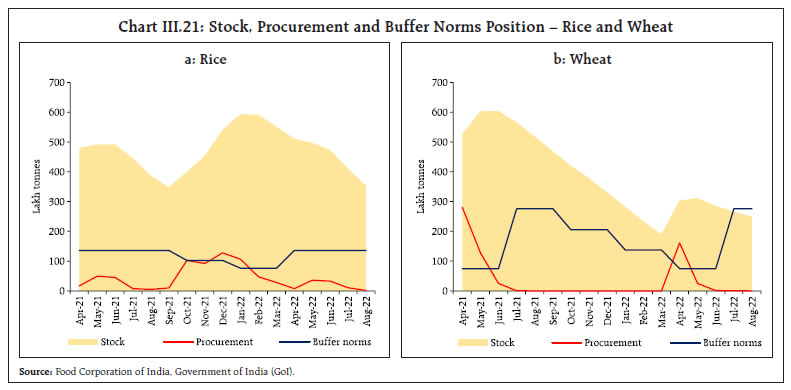

Diffusion indices (DIs)6 also attest to generalised price increases across the CPI basket during March-April 2022 (Chart II.5a). A majority of the items in the CPI basket showed threshold DIs7 in excess of 4 per cent and 6 per cent, based on a seasonally adjusted annualised rate (saar). Though there was some let up during May-June, the spread of price increases accelerated during July-August. In August, a majority of CPI basket registered prices increases in excess of 4 per cent (saar) (Chart II.5b).  A historical decomposition of inflation using vector autoregression (VAR)8 analysis to ascertain the relative role of various macro factors indicates that the rise in inflation during H1:2022-23 can be primarily attributed to adverse supply-side shocks from food along with fuel price shocks, while aggregate demand conditions continued to exert downward pressure on inflation (Chart II.6a). During March-August 2022, goods inflation contributed 86 per cent of headline inflation. Perishables (non-durable goods with a 7-day recall9) like milk, tomatoes, potatoes, edible oils, cooked meals and chicken as well as semi-perishable goods (non-durable goods with a 30-day recall), particularly, petroleum products like kerosene, liquified petroleum gas (LPG) and petrol along with cereals and medicines were the main drivers of goods inflation (Chart II.6b). Durable goods contributed 12.8 per cent of overall inflation. The contribution of services (with a weight of 23.4 per cent in overall CPI) remained muted at around 14 per cent of headline inflation (Chart II.6b).  The increase in global commodity prices following the conflict in Ukraine contributed to a surge in the contribution of imported components10 to headline inflation during March-June 2022. Subsequently, the decline in international commodity prices in July-August 2022 lowered imported inflation. The cut in central excise duties on petrol and diesel in May 2022 reduced domestically generated inflation (Chart II.6c). Food Food and beverages (with a weight of 45.9 per cent in CPI) inflation rose to 8.1 per cent in April 2022, owing to global supply shortages and adverse domestic weather conditions. Thereafter, food inflation eased to 6.7 per cent in July, supported by the Government’s supply-side measures, some easing of international food prices and a substantial correction in tomato prices. In August, food inflation turned around to register a substantial pick-up, with cereals and vegetables being its key drivers (Chart II.7a and II.7b).   Even as food inflation remained elevated, the food price build-up in the current financial year (August over March) so far was muted relative to historical patterns. First, food prices registered a sharp pick-up in March 2022 itself, primarily on account of meat and fish, and edible oils. Second, while the price build-up in cereals (which constitutes more than a fifth of the food basket) was higher than its long-term average as was those of fruits, spices, prepared meals and milk, these were offset by a substantial correction in edible oils, and meat and fish prices from historic highs in May and June. Third, the summer seasonal increase in vegetable prices was lower than usual due to a softer build-up in onion, garlic and some other vegetables prices in view of higher production (Chart II.8). Inflation in the prices of cereals (weight of 9.7 per cent in the CPI and 21.1 per cent in the food and beverages group) rose from 5.0 per cent in March 2022 to 9.6 per cent in August driven by sharp pick up in momentum (Chart II.9). Within cereals, wheat prices have increased sharply since March on account of lower domestic production ((-) 2.5 per cent in 2021-22) due to heat waves in major wheat producing states, elevated global prices due to the war, higher exports (157 per cent y-o-y during April-July 2022), and decline in stocks (0.9 times the buffer norms as on September 1, 2022). In response, restrictions on wheat exports were imposed since May 2022, and exports of wheat flour were banned from August 27, 2022. Rice prices increased due to the substitution of wheat by rice under Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) for May-September 2022, higher exports (9.0 per cent y-o-y during April-July 2022), and a fall in area under kharif sowing and expected lower production. Large stocks of rice (2.6 times the buffer norm as of September 1, 2022) and restrictions on broken rice exports along with imposition of 20 per cent export duty on rice other than basmati and par-boiled rice are expected to withhold undue price pressures.  Vegetable prices (weight of 6.0 per cent in the CPI and 13.2 per cent in the food and beverages group) inflation remained in double digits during March-August 2022, peaking in May. The spike in tomato prices (113.5 per cent during April-June 2022), along with price increases in other vegetables reflecting the usual summer uptick, remained the main drivers (Chart II.10). The negative contribution of onions and garlic, on an average, during April-August partly offset the inflationary pressures. Among key vegetables, onion prices moderated during March-May 2022 on account of higher production (an increase of 19 per cent in 2021-22) and record procurement (buffer stock of 2.5 lakh metric tonnes (LMT) in 2022-23). Subsequently, prices rose during June-August 2022 in line with the usual seasonal pattern. Potato prices increased during March-August 2022 due to lower production ((-) 4.6 per cent in 2021-22). To rein in price pressures, free imports of potatoes were allowed from Bhutan until June 30, 2023. Tomato prices picked up dramatically during April-June 2022 due to the decline in production ((-) 4.0 per cent in 2021-22) coming from lower area sown, heat waves in north India and excess rains and cyclone in Karnataka. The upbeat production response to elevated prices led to robust mandi arrivals and the easing of tomato prices during July-August 2022. Inflation in prices of fruits (weight of 2.9 per cent in the CPI and 6.3 per cent within the food and beverages group) increased from 2.5 per cent in March 2022 to 7.4 per cent in August due to higher prices of bananas, apples, grapes and dry fruits. A spike in mango prices in April 2022 due to crop damage caused by heat waves and unseasonal rains also contributed to fruit price momentum. Pulses (plant-based protein) price inflation (weight of 2.4 per cent in the CPI and 5.2 per cent in the food and beverages group) moderated from March 2022 until June after which it picked up during July-August. Prices moderated in Q1:2022-23 in line with supply side measures by the government, including the extension of tur and urad imports under the ‘free category’ until March 31, 2023; the reduction in Agriculture Infrastructure and Development Cess (AIDC) on lentils to 0 per cent from 10 per cent extended till March 31, 2023; and higher production (8.8 per cent in 2021-22). However, inflation in pulses picked up gently during July-August, driven by shortfall in kharif sowing and the expected shortfall in production of tur and urad. Adverse base effects also contributed to the pick up in pulses inflation. The higher stock-to-use (STU) ratio (Chart II.11), aggressive procurement for central pool and supply-side interventions – like open market operations along with the decision to release chana dal at a discount to states and union territories (UTs) for welfare schemes – are, however, expected to contain pressures in pulses price in H2.   Regarding animal-based protein items, prices increased sharply in H1:2022-23, driven by meat and fish (weight of 3.6 per cent in the CPI and 7.9 per cent within the food and beverages group) and milk and products (weight of 6.6 per cent in the CPI and 14.4 per cent within the food and beverages group) (Chart II.12). In the case of meat and fish, prices rose during March-June 2022, reflecting feed cost pressures amidst the early onset of summer, accompanied by heat waves. Price pressures eased in July-August 2022 due to reduced seasonal demand (on account of Sravana month) and imports of genetically modified (GM) soymeal. In contrast, a fall in prices along with favourable base effects dragged eggs price into deflation during April-August 2022. Milk and products prices increased consistently during March-August 2022, as major milk cooperatives (like Amul and Mother Dairy) raised retail prices by ₹2 per litre each in March and August 2022, citing an increase in input costs. This was followed by price increases by other state cooperatives. Inflation in prices of oils and fats (weight of 3.6 per cent in the CPI and 7.8 per cent within the food and beverages group) eased during H1:2022-23, reaching 4.6 per cent in August, after remaining in double digits for more than two years (Chart II.13). The moderation in inflation was supported by easing global prices, supply-side measures undertaken by the government and higher domestic production (4.9 per cent in 2021-22). Global prices of edible oils, which had surged in March with the onset of the war, corrected with the lifting of the export ban (imposed on April 28, 2022) effective from May 23, 2022, the removal of export levy until August 31, 2022, and the reduction in export duties by Indonesia. Price pressures also abated due to the supply side steps by the government, including an extension of stock limits on edible oils and oilseeds up to December 31, 2022, the reduction in basic customs duty (BCD) to 0 per cent till March 31, 2023, allocation of tariff rate quota (TRQ) import of 2.0 million tonnes each for crude soybean and sunflower oil for the financial year 2022-23 and 2023-24 at 0 per cent BCD and AIDC and hike in minimum support prices (MSPs) of kharif oilseeds for 2022-23 (5.4 per cent to 8.9 per cent increase). On the other hand, rising milk prices resulted in upside pressures in ghee and butter prices.   Prices of sugar and confectionery (weight of 1.4 per cent in the CPI and 3.0 per cent in the food and beverages group) remained muted during March-July 2022 on the back of higher production (7.7 per cent increase in sugarcane production in 2022-23) and export restrictions on sugar effective from June 1, 2022 to ensure ample domestic supplies. However, prices increased in August 2022 on higher exports (which rose by 32.5 per cent y-o-y during April-July 2022) coming from a relaxation of export limits and from expectations of a healthy festive demand. Among other food items, inflation in prices of spices remained in double digits during H1:2022-23, reflecting lower production ((-) 1.9 per cent in 2021-22), especially in the case of key spices like coriander, cumin, black pepper and red chillies. Furthermore, prepared meals witnessed a rise in prices, due to an increase in input costs such as edible oils, LPG and transport charges. Retail Margins Retail price margins – the difference of retail and wholesale prices11 – for cereals and pulses, which had been on the rise since the outbreak of the COVID-19 pandemic, remained at elevated levels during H1.  Margins in edible oils moderated somewhat in April 2022 due to a higher degree of softening in retail mustard oil prices relative to wholesale prices. In the case of vegetables, margins rose in May-June 2022, driven by the sharp uptick in tomato retail prices, but they moderated subsequently with the correction in tomato prices (Chart II.14). Fuel CPI fuel inflation surged from 7.5 per cent in March 2022 to 11.8 per cent by July 2022 on the back of sharp increases in LPG and subsidised kerosene (PDS) prices which, in turn, reflected the sharp jump in global energy prices following the conflict in Ukraine. Fuel inflation moderated to 10.8 per cent in August due to decline in kerosene (PDS) prices reflecting pass through of the fall in international prices. Electricity prices have remained in deflation in 2022 so far (Chart II.15). Core Core inflation, i.e., CPI inflation excluding food and fuel, increased sharply after the start of the war to 7.1 per cent in April 2022 from 5.8 per cent in February. It moderated thereafter on favourable base effects, the reduction in excise duties on petrol and diesel and some deceleration in price momentum. During June-August, core inflation remained steady at around 6.0 per cent, including when other volatile items such as petrol, diesel, gold and silver are excluded (Table II.1). Core inflation has been persistent and elevated since 2021, due to repeated cost-push shocks in manufacturing and services (Chart II.16). During 2022-23 (April-August), core inflation averaged 6.2 per cent (5.9 per cent a year ago), with pressures broad-based, particularly in the goods component (Chart II.17).  The jump in core inflation by 126 basis points between February and April 2022 was considerably influenced by spillovers from the increases in international crude oil and gold prices following the start of the war in end-February. As international crude oil prices inched upwards of US$ 120 per barrel in March, domestic petrol and diesel pump prices rose by around ₹10 per litre between March 22 and April 6, 2022 and then remained unchanged till May 22, 2022. Pump prices then fell, following the reduction in excise duties by ₹8 per litre on petrol and by ₹6 per litre on diesel (Chart II.18).   Coupled with favourable base effects, the cut in excise duties resulted in CPI petrol and diesel prices moving to the deflationary zone by August 2022. Price increases in WPI petrol and diesel were higher at 53 per cent (y-o-y) in August, largely reflecting the fact that indirect taxes are included in CPI but excluded from WPI (Chart II.19). On the whole, the reduction in excise duties had a direct softening impact of 43 bps on core inflation and 20 bps on headline inflation. The decline in gold prices during May-July also contributed to the moderation of core inflation.   Threshold diffusion indices for CPI excluding food, fuel, petrol, diesel, gold and silver indicate that a large majority of items exhibited price increases in excess of 4 per cent and 6 per cent (on a saar basis) during March-April 2022. Although pressures relaxed to some extent during May-July, these firmed up again for a majority of items in August (Chart II.20). Inflation in CPI excluding food, fuel, petrol, diesel, gold and silver registered increases across both goods and services during March-August 2022, reflecting pass-through of pent-up input cost pressures to output prices (Chart II.21a). During this period, core goods inflation remained significantly higher than core services inflation. Inflation in the goods component (with a weight of 20.7 per cent in the headline CPI) increased from 7.1 per cent in February 2022 to 7.7 per cent in April, driven by clothing and footwear items, household goods and personal care items (including fast-moving consumer goods (FMCGs) and household utensils) along with health, transport and communications goods. Though core goods inflation moderated to 6.5 per cent in May, the respite was short-lived as it edged up by around 72 bps during June-August, coming mainly from a further rise in inflation in clothing and footwear, and household goods and personal care items.  Core services inflation (with a weight of 23.0 per cent in the headline CPI) also rose from 4.7 per cent in February 2022 to 5.2 per cent in August (Chart II.21b), due to pressures from education (tuition and other fees), transport services (bus/tram/taxi fare, airfare, steamer/boat charges) and housing. Despite some rise, inflation in housing, the largest component in services, remained muted in H1 (averaging 3.8 per cent between April-August).  Like exclusion-based core inflation indicators, trimmed mean measures12 point towards a generalised upsurge in inflation with a peak in April 2022 and some moderation thereafter till July. The trimmed measures picked up again in August (Table II.2). Other Measures of Inflation Inflation measured by sectoral CPIs for agricultural labourers (CPI-AL) and rural labourers (CPI-RL) remained below CPI headline inflation during July 2020-June 2022. Lower food inflation, combined with the high weightage of food in the CPI-AL and the CPI-RL vis-à-vis the CPI, contributed to the lower inflation prints during this period. In August 2022, with the rise in food prices, CPI-AL and CPI-RL inflation moved close to/marginally above CPI headline inflation. Inflation measured by the CPI for industrial workers (CPI-IW) persisted below the CPI headline during March-July 2022 as food inflation was generally lower in the CPI-IW vis-à-vis the CPI. Moreover, lower housing inflation in CPI-IW, paired with high weightage of housing vis-à-vis the headline, also added to the softness in CPI-IW inflation prints. WPI inflation has been in double digits since April 2021 and increased to an all-time high of 16.6 per cent (as per the WPI series, 2011-12=100) in May 2022 before moderating during June-August. Despite strong favourable base effects, the spike in crude oil and commodity prices following the war drove WPI inflation during March-May 2022. The steep rise in international commodity prices resulted in WPI non-food manufactured products inflation persisting in double digits during May 2021-May 2022. WPI inflation moderated to 12.4 per cent in August 2022 on account of an easing of price pressures in basic metals, textiles, and food products, particularly vegetable and animal oils and fats, in an environment of favourable base effects. In line with WPI inflation, the deflators for gross value added (GVA) and gross domestic product (GDP) edged up sharply between Q4:2021-22 to Q1:2022-23 (Chart II.22a). During March-August 2022, all the major sub-groups of WPI remained substantially above their corresponding CPI subgroups (Chart II.22b). Petrol and diesel prices inflation in WPI exceeded CPI inflation, largely reflecting the reductions in excise duty and state VAT rates which are captured in CPI but are excluded in WPI. High energy prices in the international market are mirrored in the fuel and power group of the WPI. The spike in international commodity prices and industrial intermediaries resulted in a hardening of WPI non-food manufactured products inflation, which also contributed to WPI inflation ruling above the CPI. Within food, WPI inflation was higher than CPI in cereals, vegetables, fruits, eggs and spices. Moreover, WPI does not include services, which is witnessing lower inflation compared with goods inflation in the CPI.  During H1:2022-23 (up to August), cost pressures measured by WPI inflation in industrial raw materials and farm inputs remained firm, notwithstanding some softening. Inflation in the prices of industrial inputs – such as high-speed diesel (HSD), naphtha, aviation turbine fuel (ATF), bitumen, petroleum coke, and furnace oil – which had peaked at 34.1 per cent in May 2022 under the impact of high crude oil prices moderated to 22.1 per cent in August with the correction in crude prices (Chart II.23). After hardening during March-May 2022, the prices of non-food primary articles eased from June 2022 due to the moderation in the prices of fibres and oilseeds mirroring international price trends. Prices of minerals, despite mixed trends and high volatility, broadly eased during March-August 2022. During July-August 2022, the pressures on industrial raw materials prices ebbed in line with the easing global metal prices. The export duty hike on iron ore and certain steel products also helped to contain price pressures (Chart II.23). The farm input price inflation was largely driven by increase in HSD prices, agricultural and forestry machinery, fodder on account of dry weather conditions, and fertilisers. Inflation in price of WPI electricity – a key input in both industrial and farm inputs – increased sharply due to positive momentum as well as adverse base effects.  Nominal rural wage growth for both agricultural and non-agricultural labourers remained muted during H1:2022-23 (up to July) (Chart II.24). This can be expected to contain the build-up of a wage-price spiral (Box II.2).

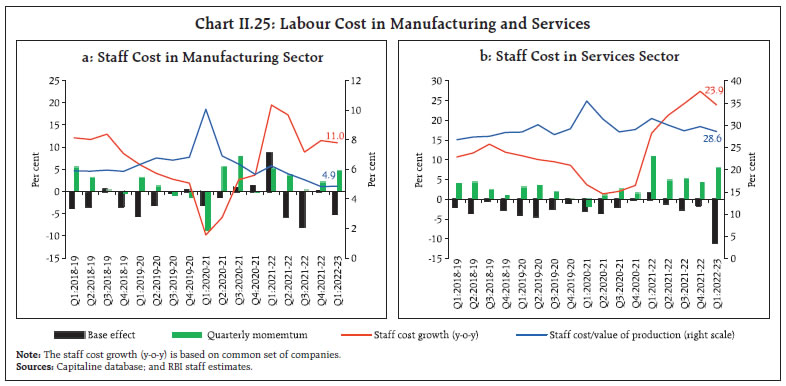

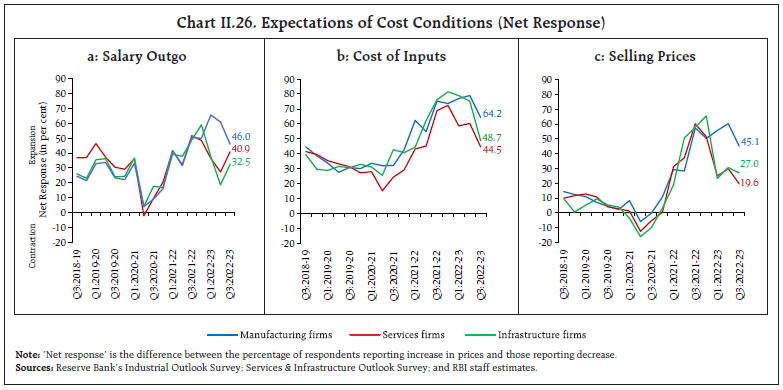

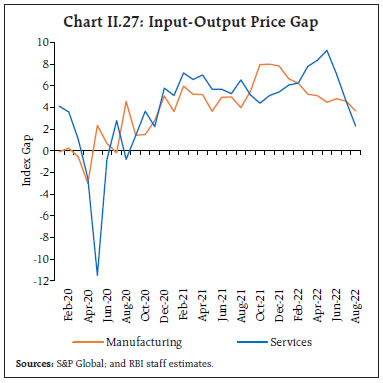

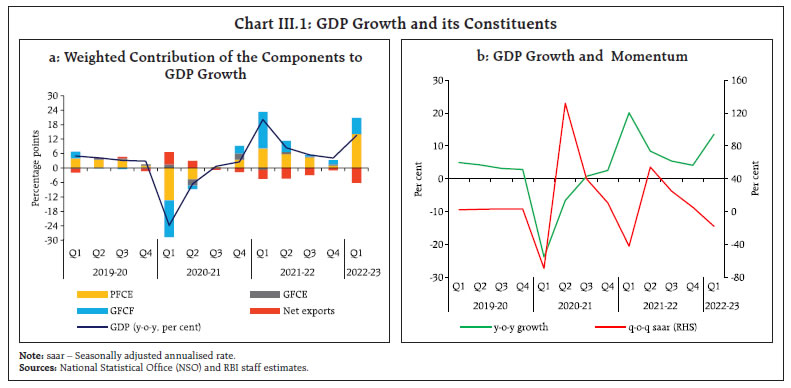

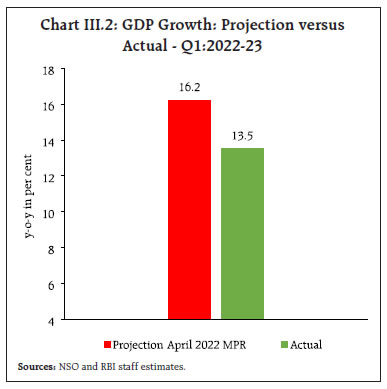

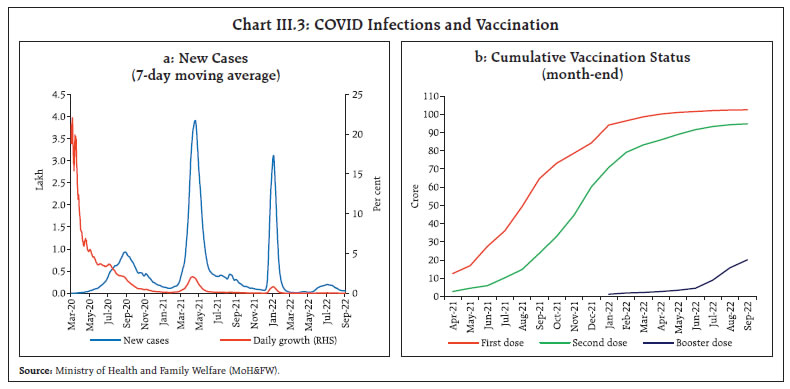

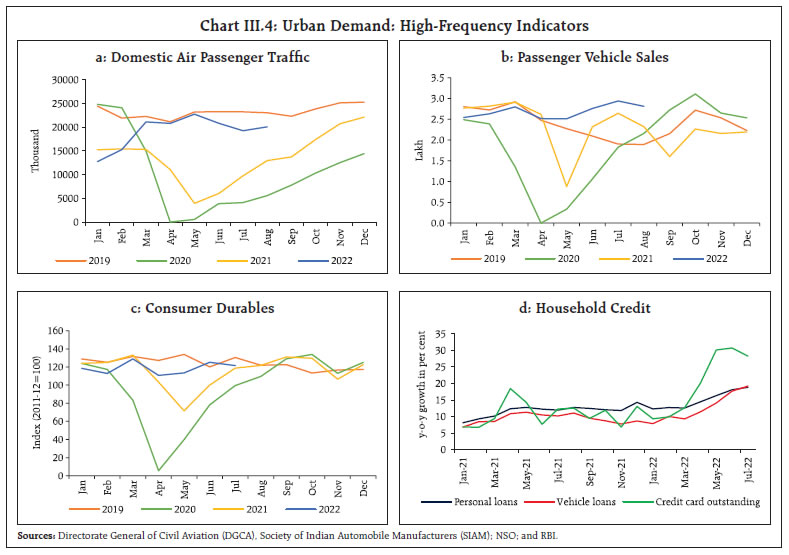

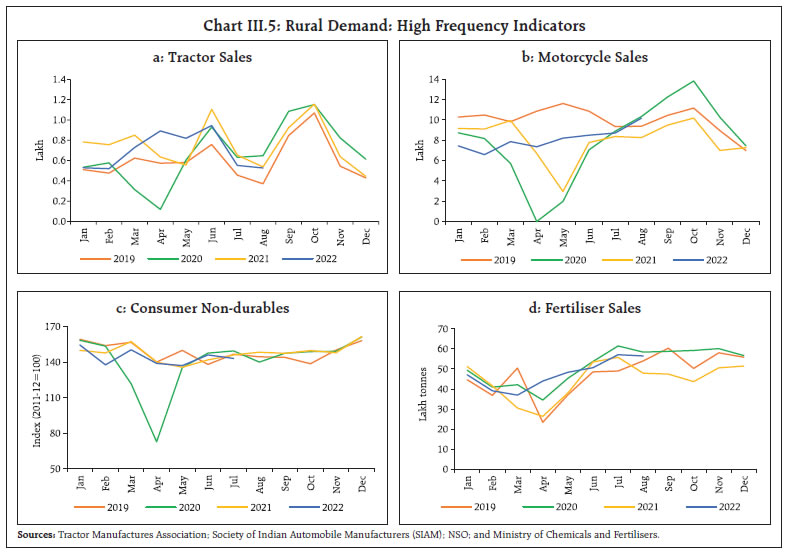

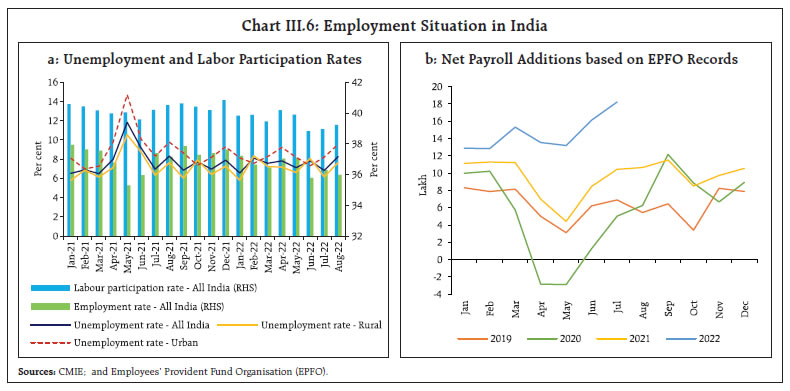

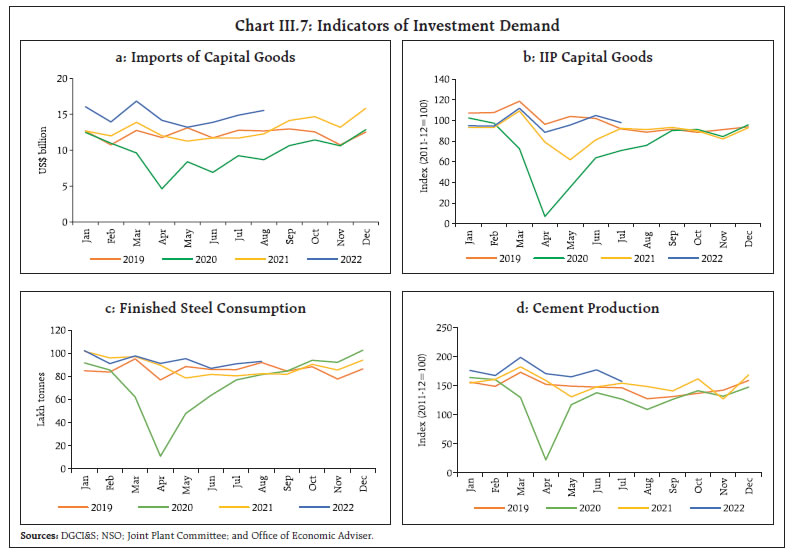

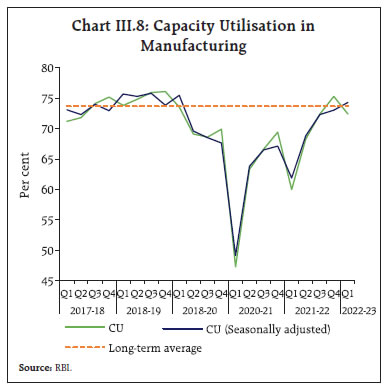

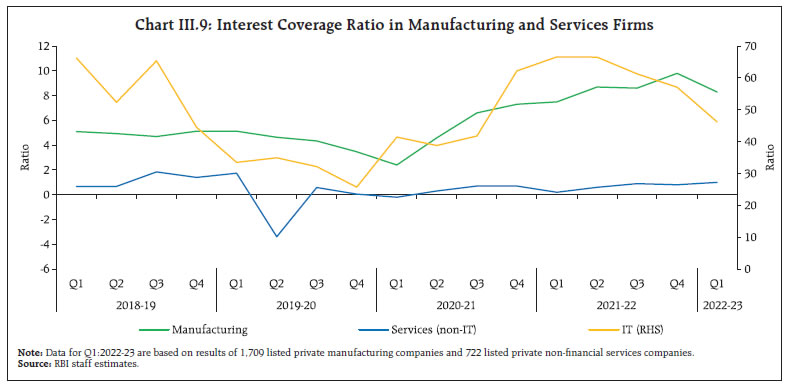

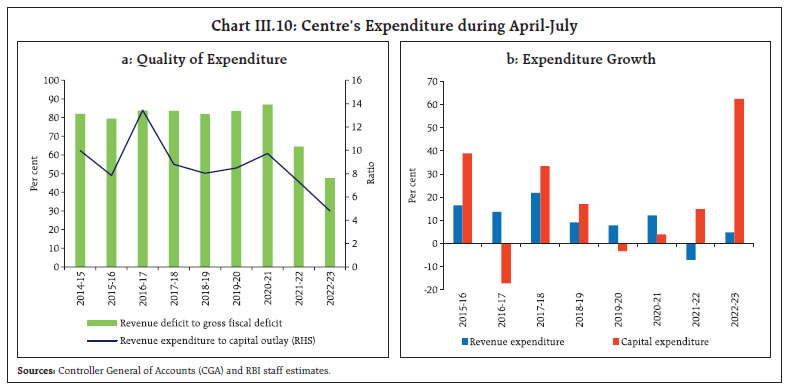

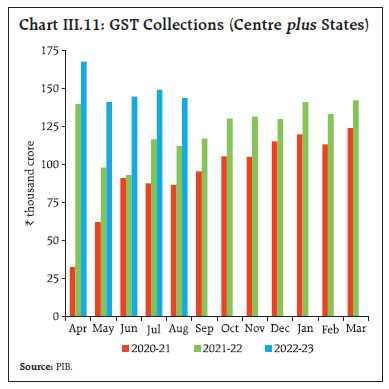

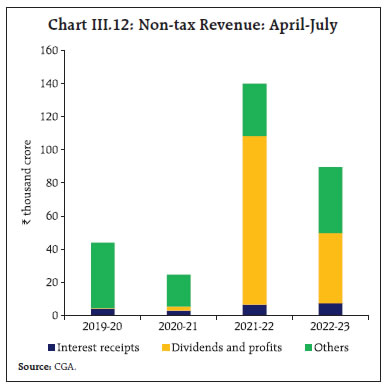

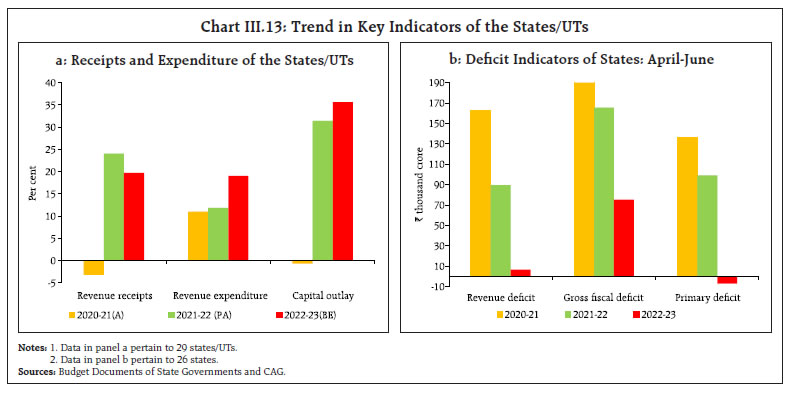

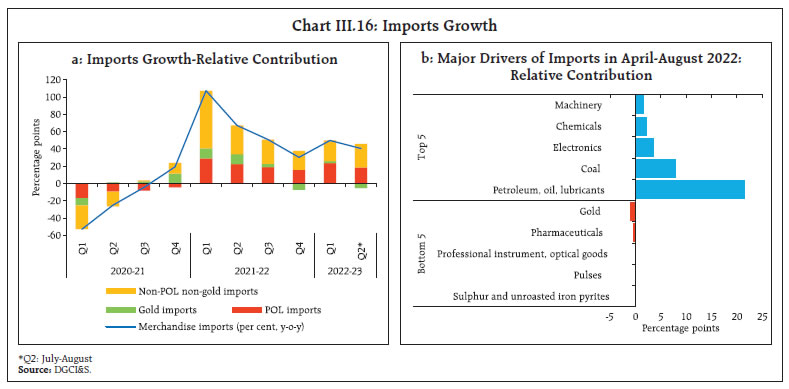

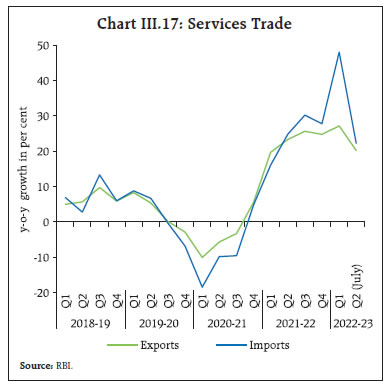

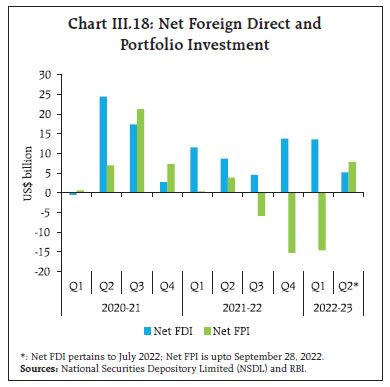

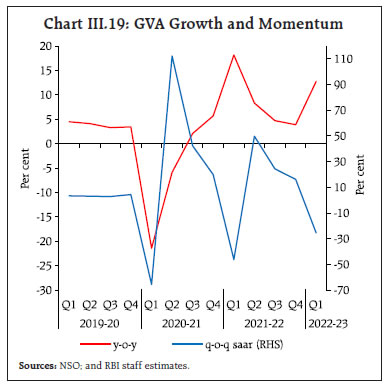

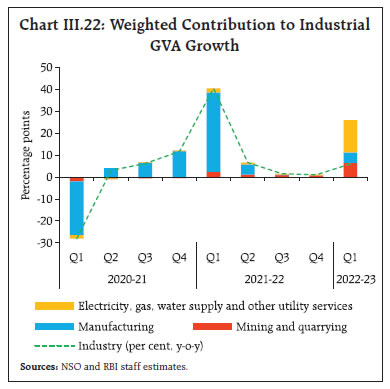

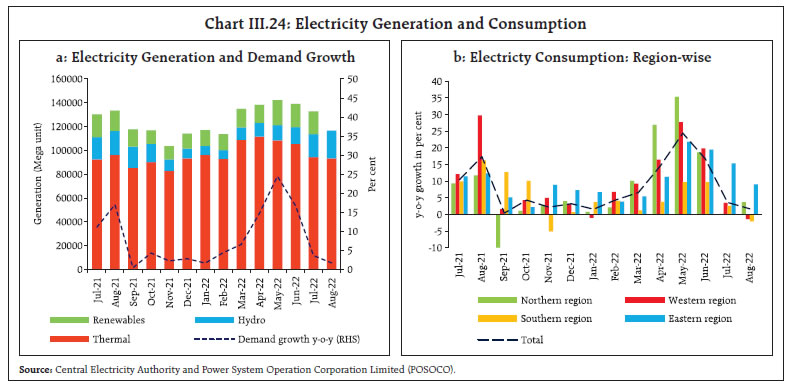

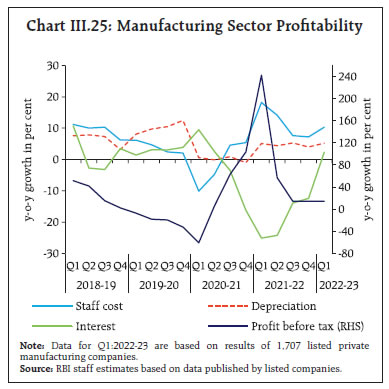

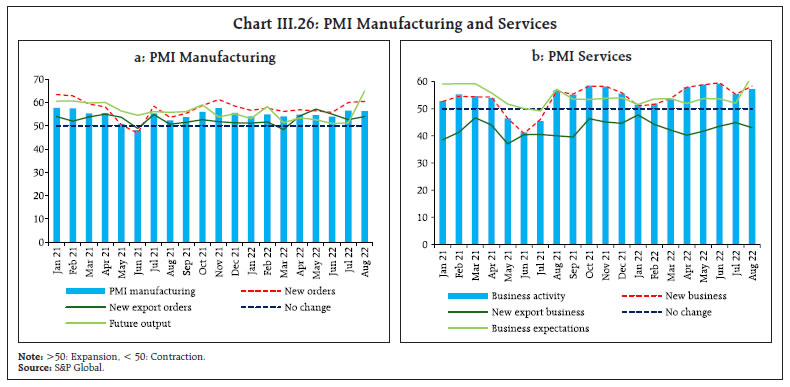

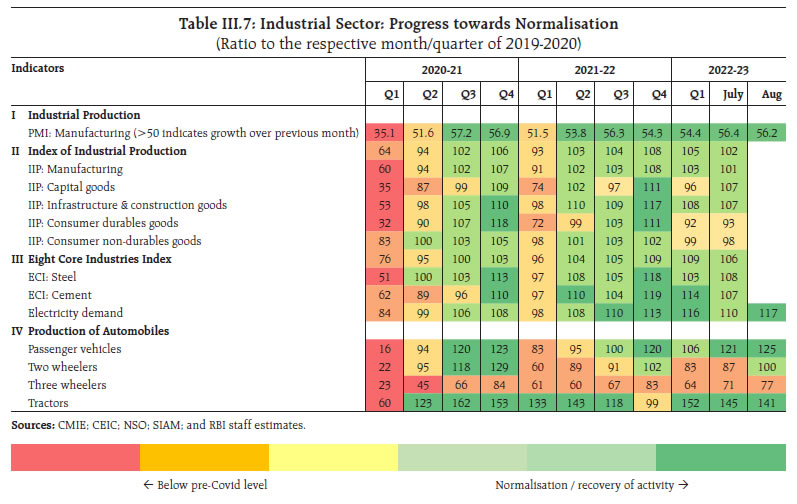

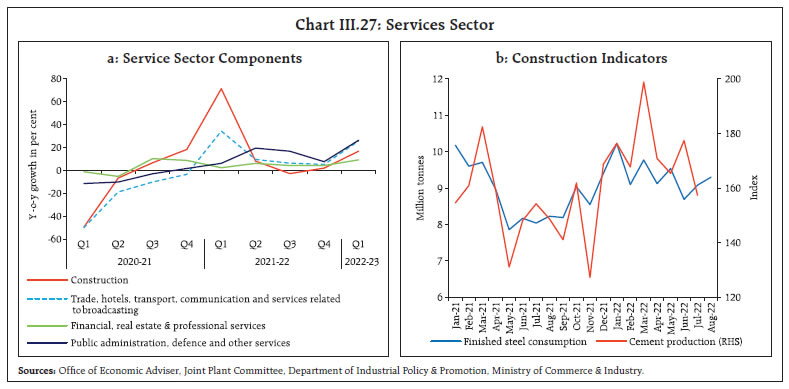

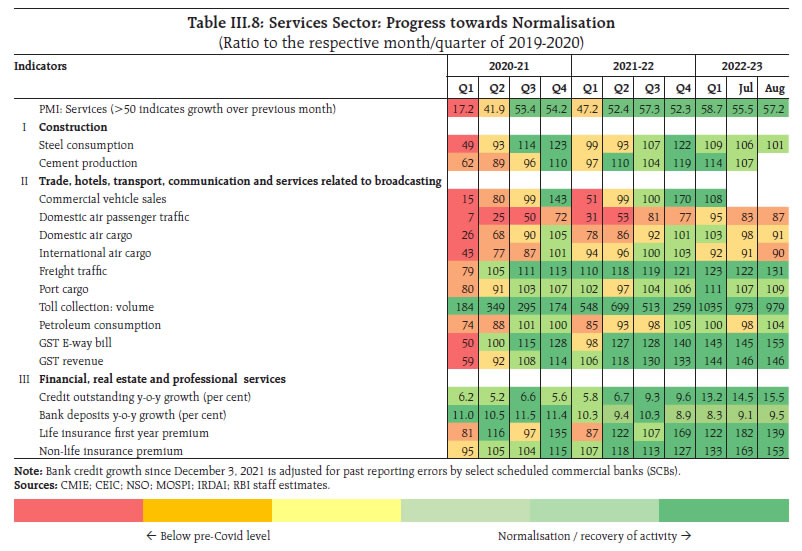

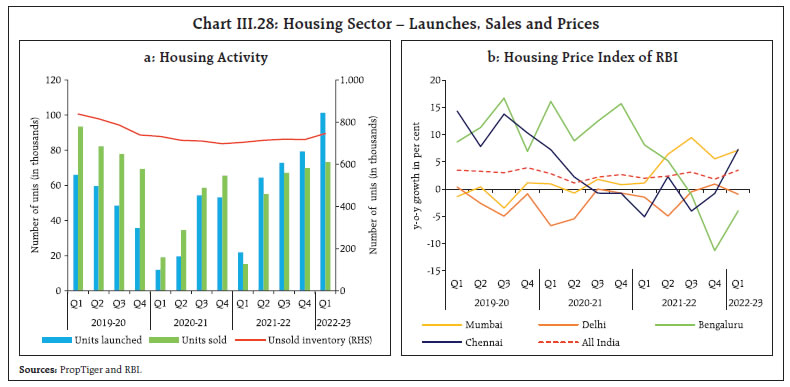

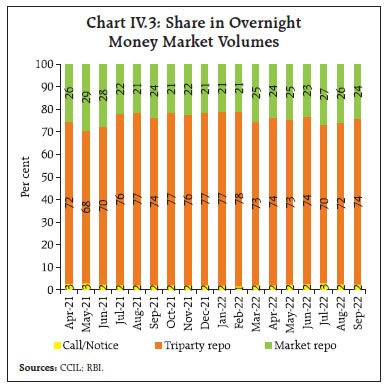

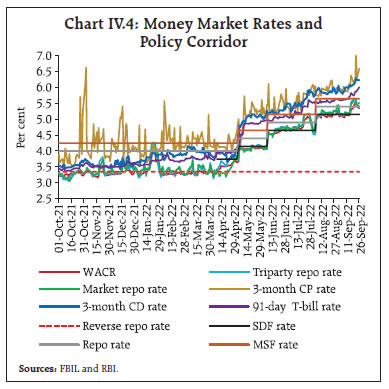

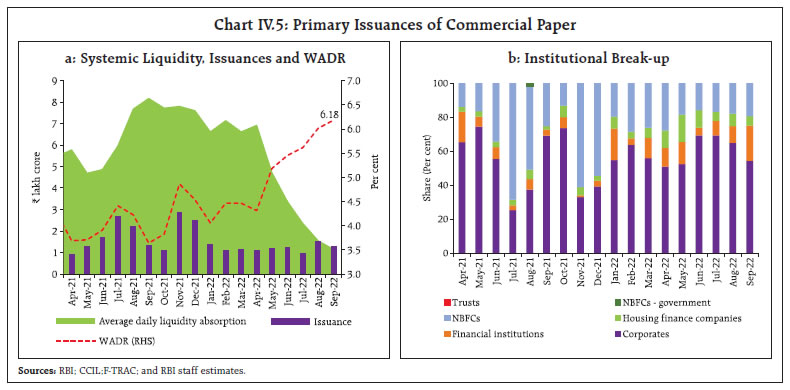

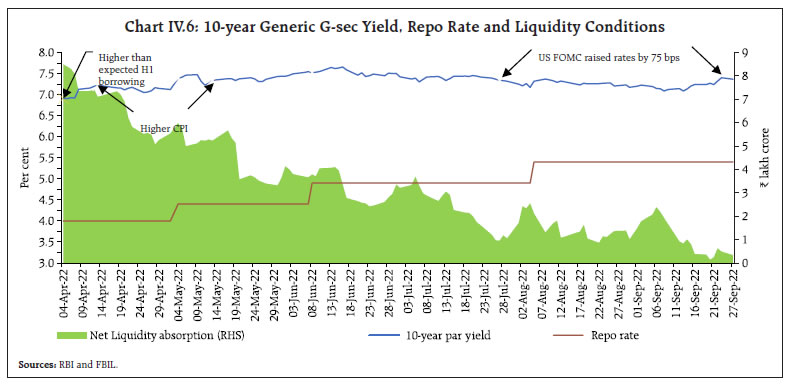

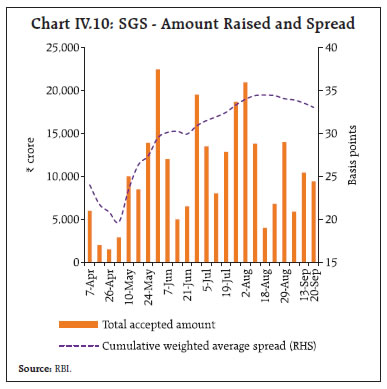

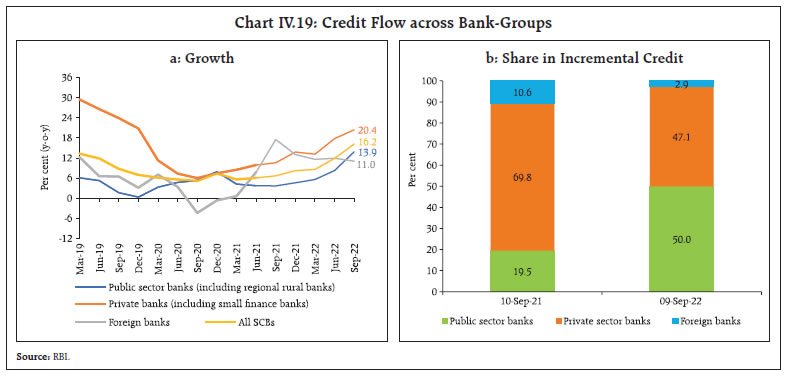

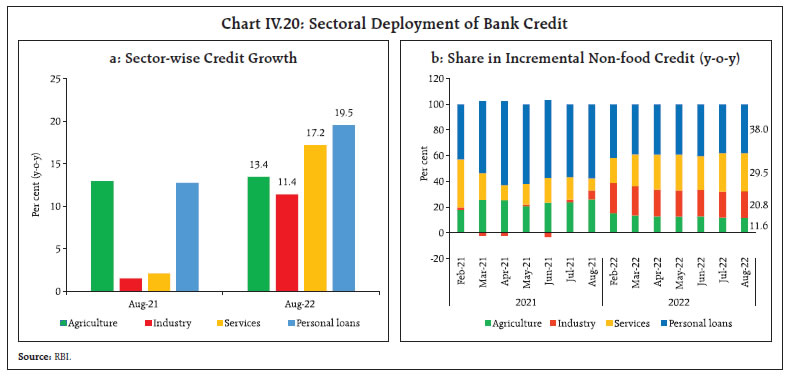

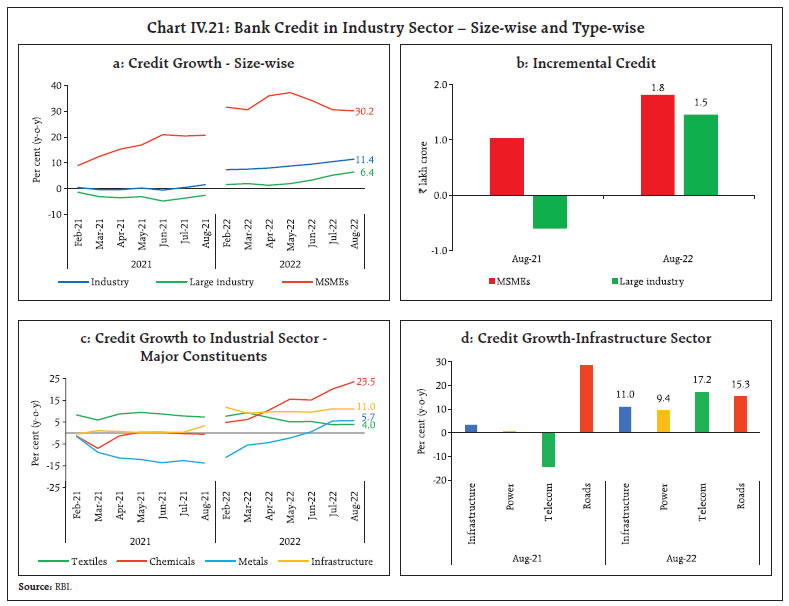

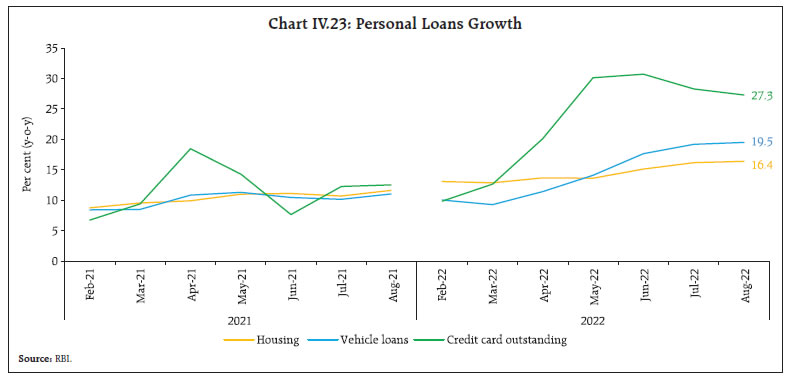

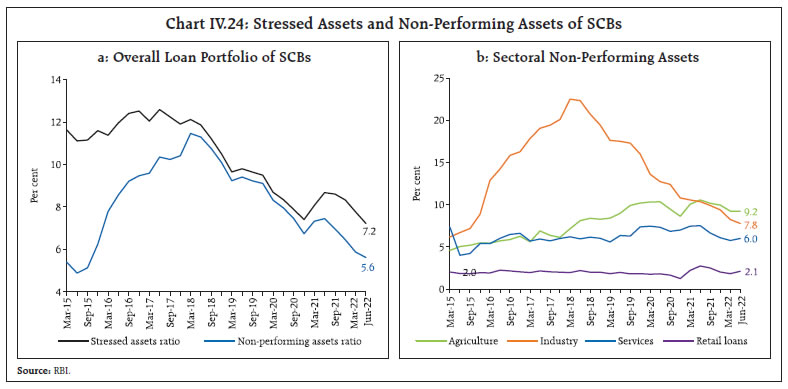

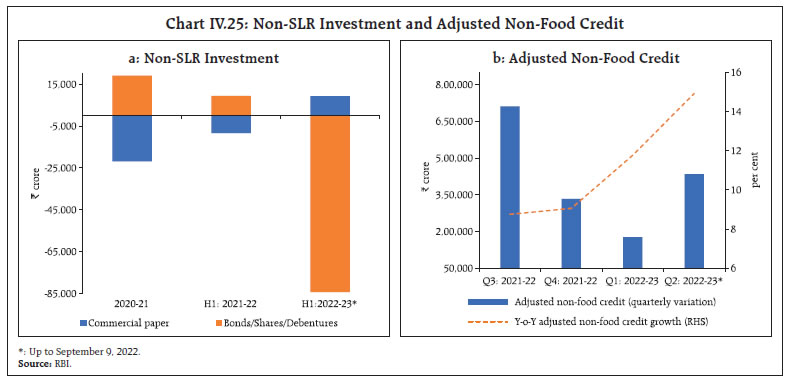

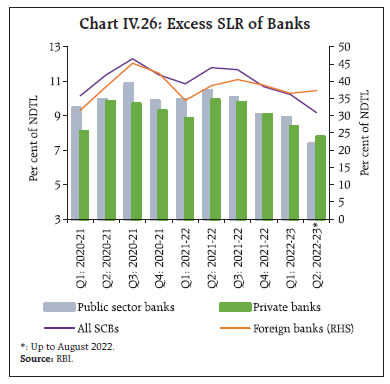

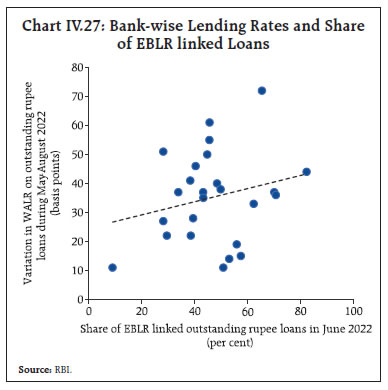

In the organised sector, growth in staff cost (y-o-y basis) decelerated in Q1:2022-23 in both manufacturing and services sectors. The share of staff cost in the value of production was broadly unchanged in the manufacturing sector in Q1 compared to the previous quarter, while it decreased marginally in the services sector (Chart II.25).  As per the firms polled in the Reserve Bank’s enterprise surveys13, the pace of salary outgoes for the manufacturing sector is expected to moderate in Q3:2022-23 while the services and infrastructure sectors may see higher pressures. Input costs and selling prices for the manufacturing, services and infrastructure sector firms are likely to soften in Q3 (Chart II.26).  One-year ahead business inflation expectations after peaking in April 2022, fell during May-July but ticked up in August 2022, according to the survey by the Indian Institute of Management, Ahmedabad.14 Survey respondents also reported that cost pressures re-emerged in August and optimism on sales and profit margins fell. According to manufacturing firms polled in the purchasing managers’ index (PMI) surveys, while input prices rose, there was an easing of the momentum during May-August 2022 due to softening metal and intermediate goods prices. In PMI services, input prices remained elevated, with an easing of the momentum in June-August 2022. Output price inflation for both manufacturing and services sectors was benign relative to input price inflation and the input-output price gap has moderated due to the softening input prices momentum, coupled with gradual pass-through of cost burdens (Chart II.27). Inflationary pressures have escalated globally due to the successive black swan events – the COVID-19 pandemic and the conflict in Ukraine. Mirroring global developments, India also experienced a sharp pick-up in inflationary pressures in H1, following the jump in global commodity prices as well as due to adverse domestic weather shocks. Consumer price inflation peaked in April 2022. It has since then moderated, but persists above the pre-war levels and also above the upper tolerance band. Its return to the target is expected to be gradual. The outlook is, however, fraught with considerable uncertainties, given the highly volatile geopolitical situation, spillovers from the elevated global financial market volatility and recurring adverse climatic conditions. Monetary policy remains focused on ensuring that inflation remains within the target going forward, while supporting growth.  __________________________________________________________________________________ 1 Headline inflation is measured by year-on-year (y-o-y) changes in the all-India consumer price index (CPI) produced by the National Statistical Office (NSO). 2 Core CPI, i.e., CPI excluding food and fuel is worked out by eliminating the groups ‘food and beverages’ and ‘fuel and light’ from the headline CPI. 3 The April 2022 MPR had largely accounted for the persistence of international crude prices at elevated levels during 2022-23, with an assumption of US$ 100 per barrel. 4 A change in CPI y-o-y inflation between any two months is the difference between the current month-on-month (m-o-m) change in the price index (momentum) and the m-o-m change in the price index 12 months earlier (base effect). For more details, see Box I.1 of the MPR, September 2014. 5 A conditional least square estimation of the ARMA (1,1) model confirms that there are significant ARCH effects. 6 The CPI diffusion index, a measure of dispersion of price changes, categorises items in the CPI basket according to whether their prices have risen, remained stagnant or fallen over the previous month. The higher the reading is above 50 for the diffusion index, the broader is the expansion or generalisation of price increases; the further is the reading below 50, the broader is the price decline across items. 7 Threshold diffusion indices capture the dispersion of price increases in CPI basket beyond the specified saar thresholds of 4 per cent and 6 per cent. 8 Historical decomposition estimates the contribution of each shock to the movements in inflation over the sample period (Q4:2010-11 to Q2-2022-23) based on a vector autoregression (VAR) with the following variables (represented as the vector Yt) – crude oil prices (US$ per barrel); exchange rate (INR per US$), asset price (BSE Sensex), CPI; the output gap; rural wages; the policy repo rate; and money supply (M3). All variables other than policy repo rate are y-o-y growth rates. The VAR can be written in reduced form as: Yt =c + A Yt-1 + et; where et represents a vector of shocks. Using Wold decomposition, Yt can be represented as a function of its deterministic trend and sum of all the shocks et. This formulation facilitates decomposition of the deviation of inflation from its deterministic trend into the sum of contributions from various shocks. 9 The CPI weighting diagrams use the modified mixed reference period (MMRP) data based on the 2011-12 Consumer Expenditure Survey conducted by the National Sample Survey Office (NSSO). Under MMRP, data are collected on expenditures incurred for frequently purchased items – edible oil, eggs, fish, meat, vegetables, fruits, spices, beverages, processed foods, pan, tobacco and intoxicants – during the last seven days; for clothing, bedding, footwear, education, medical (institutional), durable goods, during the last 365 days; and for all other food, fuel and light, miscellaneous goods and services including non-institutional medical services, rents and taxes, data relate to the last 30 days. 10 Global commodities that drive domestic prices include petroleum products; coal; electronic goods; gold; silver; chemical products; metal products; textiles; cereals; milk products, and vegetables oils – these together have a weight of 36.4 per cent in the CPI basket. 11 Item level retail and wholesale prices are aggregated at respective subgroups using item level CPI weights. Data for January-March 2021 have been excluded due to changes in price collection mechanism and item varieties (DCA). 12 While exclusion-based measures drop a fixed set of volatile items (for example, food and fuel) in each period, trimmed measures exclude items located in the tails of the inflation distribution - items displaying changes more than the specified threshold in prices each month are excluded and the items dropped differ from month to month. 13 Industrial Outlook Survey; and Services and Infrastructure Outlook Survey. 14 The monthly Business Inflation Expectations Survey (BIES) of the Indian Institute of Management, Ahmedabad, polls a panel of businesses, primarily the manufacturing sector, about their inflation expectations in the short and medium term. The latest survey (August 2022 round) was based on the responses of around 900 companies. Domestic economic activity exhibited resilience in H1:2022-23. The buoyancy in aggregate demand was supported by private consumption and investment demand. Geopolitical tensions, tightening of global financial markets and global economic slowdown, however, pose downside risks to the domestic outlook. Domestic economic activity exhibited resilience in H1:2022-23 in spite of some moderation in momentum relative to H2:2021-22. With the recovery of manufacturing and contact-intensive services, aggregate supply conditions are improving. Aggregate demand is underpinned by private consumption, which is holding up well and set to be boosted in the festival season. Investment activity gained traction with robust government capex. On the other hand, subdued government consumption and the contraction in net exports have operated as drags. Headwinds from intensified geopolitical tensions, elevated international commodity prices, heightened volatility in global financial markets, and slowdown in external demand are the key downside risks to the outlook. Real gross domestic product (GDP) posted a growth of 13.5 per cent (year-on-year, y-o-y) in Q1:2022-23, aided by favourable base effects. Accordingly, real GDP surpassed pre-pandemic level by 3.8 per cent (Chart III.1 and Table III.1). All constituents of aggregate demand recorded expansion in Q1 and were above their respective pre-pandemic levels. The momentum – the quarter-on-quarter (q-o-q) seasonally adjusted annualised growth rate (saar) - was, however, negative in Q1:2022-23, pulled down by government consumption and a sharp jump in imports (Chart III.1a and b). Available data for Q2 indicate that aggregate demand remained buoyant, supported by the ongoing recovery in private consumption and investment demand.  GDP Projections versus Actual Outcomes The April 2022 Monetary Policy Report (MPR) had projected real GDP growth at 16.2 per cent for Q1:2022-23. Actual growth undershot the projection by 270 basis points (bps) (Chart III.2), due to a larger-than-expected drag from net exports and sluggish growth in government expenditure. The growth in imports at 37.2 per cent in Q1 surprised significantly on the upside.  III.1.1 Private Final Consumption Expenditure Private final consumption expenditure (PFCE) – the mainstay of aggregate demand – recorded a solid growth of 25.9 per cent in Q1:2022-23 and its share in overall GDP inched up to 59.9 per cent from 54.0 per cent a year ago. Expanded vaccination coverage and milder new COVID-19 infections (Chart III.3) provided a fillip to consumer confidence and discretionary spending, particularly on travel, hotels and restaurants, recreation and culture. Amongst the high frequency indicators (HFIs) of urban consumption, domestic air passenger traffic recorded a sustained recuperation, albeit still lagging its pre-pandemic levels (Chart III.4a). Passenger vehicle sales posted strong growth in Q1 and Q2, surging past pre-pandemic levels, despite headwinds from protracted supply chain disruptions (Chart III.4b). The production of consumer durables gained traction, boosted by discretionary spending (Chart III.4c). Improving urban consumption was also reflected in the acceleration in bank credit to households (Chart III.4d).  Rural demand remained muted in Q1:2022-23, with some signs of recovery in Q2. Work demanded under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) declined sharply in July-August 2022, with improving conditions in the rural farm labour market. Motorcycle sales expanded y-o-y and exceeded pre-pandemic levels in August. The production of consumer non-durables remained subdued in H1. Tractor sales remained above their pre-pandemic levels, although they were lower y-o-y in July-August partly due to the high base of record sales registered last year. Fertiliser sales recovered in August with the progress of kharif sowing (Chart III.5).   As per the Centre for Monitoring Indian Economy’s (CMIE) Consumer Pyramids data, the labour force participation rate recovered in Q2 from the dip seen in June, which pulled up the unemployment rate in August across urban and rural segments (Chart III.6a). The Employees’ Provident Fund Organisation (EPFO) payrolls data pointed to improving employment conditions in the organised sector during July 2022 (Chart III.6b). According to Naukri Jobspeak data, increased hiring was witnessed in hospitality, retail, insurance, real estate, banking and financial services segments. III.1.2 Gross Fixed Capital Formation Gross fixed capital formation (GFCF) recorded a growth of 20.1 per cent in Q1:2022-23; consequently, the share of GFCF in GDP rose to 34.7 per cent in Q1 from 32.8 per cent a year ago. Construction activity exhibited buoyancy, with the housing sector recording an uptick in terms of both units launched and sold during Q1. The proximate coincident indicators of construction activity – steel consumption and cement production – posted strong growth in H1 Chart III.7). Imports of capital goods were led by electronics goods while the domestic production of capital goods crossed its pre-pandemic level in June- July 2022.   According to the RBI’s survey1, capacity utilisation (CU) in the manufacturing sector declined to 72.4 per cent in Q1:2022-23 from 75.3 per cent in the previous quarter, reflecting seasonal pattern. Seasonally adjusted capacity utilisation, however, rose to 74.3 per cent in Q1:2022-23 – the highest in the last three years – from 73.0 per cent in the previous quarter (Chart III.8). Manufacturing firms recorded a sequential uptick in new orders during Q1:2022-23. Infrastructure firms displayed optimism on the overall business situation. turnover and employment in Q2:2022-23. The interest coverage ratio (ICR)2 of listed nonfinancial private companies in the manufacturing and information technology (IT) sectors remained high in Q1:2022-23, and indicates comfortable debt servicing capacity and conducive conditions for expansion in capacity (Chart III.9). III.1.3 Government Consumption The growth in government final consumption expenditure (GFCE) remained muted at 1.3 per cent in Q1:2022-23 [(-) 4.8 per cent a year ago], which dampened GDP growth (Table III.1). Revenue expenditure of the central government rose by 4.8 per cent (y-o-y) during April-July 2022 as against a contraction of 7.0 per cent a year ago. Component-wise, the impact of higher outgoes on interest payments was cushioned by lower spending on major subsidies, especially food. Capital outlay, on the other hand, surged by 59.4 per cent during April-July 2022, reflecting the government’s sustained thrust on infrastructure. This led to a qualitative improvement in spending – the revenue expenditure to capital outlay (RECO) ratio decreased to 4.8 in April-July 2022 from 7.3 in the corresponding period of the previous year (Chart III.10a). Frontloaded capital expenditure was driven by increased spending in road and railway sectors (Chart III.10b).     On the receipts side, the central government’s gross tax revenues remained buoyant, registering a growth of 24.9 per cent during April-July 2022, driven by direct tax and GST collections. Monthly GST collections (Centre plus states) remained above ₹1.4 lakh crore since March 2022, benefitting from improving economic activity and compliance (Chart III.11). Union excise duties and customs duties, however, contracted on the back of cuts in excise duty on petrol and diesel in May 2022 and a reduction in customs duty on commodities such as cotton and palm oil. The central government’s non-tax revenues fell during April-July due to lower dividends and profits (Chart III.12). The recently concluded 5G spectrum auctions would provide a total revenue of ₹1.5 lakh crore; of this, the first annual instalment would amount to ₹17,875 crore. Disinvestment receipts jumped to ₹24,560 crore from ₹8,371 crore, driven by the proceeds of the initial public offer (IPO) of the Life Insurance Corporation (LIC).  During April-July 2022, the gross fiscal deficit (GFD) and the revenue deficit (RD) of the central government at 20.5 per cent and 16.4 per cent of the full-year budget estimate (BE), respectively, were lower than in the previous year. As regards state governments, their consolidated GFD is budgeted at 3.3 per cent of their conslolidated GSDP in 2022-233 – within the 4 per cent4 limit allowed by the Centre – supported by a healthy growth in revenue receipts (Table III.3 and Chart III.13a). The states have continued their focus on capital expenditure, with a budgeted growth of 36 per cent in capital outlay. This would increase the capital outlay-GSDP ratio to 2.7 per cent in 2022-23 from 2.2 per cent in 2021-22 (PA). According to available data, the states’ GFD declined substantially in Q1:2022-23 on account of higher revenues and devolution from the Centre (Chart III.13b). Revenue expenditure of states grew by 14.3 per cent while capital expenditure contracted by 9.6 per cent.  The Union Budget 2022-23 provided for a 50-year interest-free loan of ₹1 lakh crore to states under the ‘Special Assistance to States for Capital Investment’ scheme, over and above the borrowing limit of 4 per cent of GSDP. In August 2022, the Centre released two instalments of tax devolution amounting ₹1.16 lakh crore to the states to boost their capex. In the Union Budget 2022-23, gross and net market borrowings were placed at ₹14.95 lakh crore and ₹11.19 lakh crore, respectively. Taking into account the switch operations conducted just before the Union Budget 2022-23, the gross market borrowings through dated securities for 2022-23 are estimated at ₹14.31 lakh crore. The centre’s gross issuances of market borrowings during H1:2022-23 (up to September 27, 2022) were ₹7.96 lakh crore (55.6 per cent of the full year’s budgeted amount) as against ₹8.45 lakh crore planned in the calendar for H1 (Table III.4). The weighted average cost and maturity of issuances during H1 (up to September 27, 2022) were 7.3 per cent and 15.7 years, respectively, as against 6.2 per cent and 16.7 years, respectively, during 2021-22. States raised gross market borrowings of ₹2.76 lakh crore during H1 (up to September 27, 2022), 68.8 per cent of the indicative calendar. The Ways and Means Advances (WMA) limit for the Central Government for H1:2022-23 was enhanced to ₹1.5 lakh crore from ₹1.2 lakh crore in H1:2021-22 for bridging temporary mismatches between receipts and expenditure. For states/union territories, the WMA limits were fixed at ₹47,010 crore effective from April 1, 2022 as recommended by the Advisory Committee on Ways and Means Advances to State Governments (Chairman: Shri Sudhir Shrivastava). III.1.4 External Demand Amidst persisting geopolitical tensions and slowing external demand, merchandise exports lost pace during Q2 (July-August) after remaining resilient during Q1. Merchandise imports, however, remained buoyant during both Q1 and Q2 (July-August), reflecting strong domestic demand conditions. These developments led to a widening of the merchandise trade deficit (Chart III.14). Services trade, both exports and imports registered an impressive performance in Q1. With the growth of imports well above that of exports, net exports dragged down aggregate demand in Q1:2022-23 [(-) 8.1 per cent of GDP as compared with (-) 5.0 per cent in Q4:2021-22 and (-) 3.0 per cent a year ago].  In April-August 2022, merchandise exports were driven by petroleum products, electronics, chemicals, engineering goods and ready-made garments. Exports of iron ore, cotton yarn, plastic and linoleum, handicrafts and carpets were, however, restrained (Chart III.15). Export restrictions on a few commodities such as wheat, steel and sugar due to domestic demand-supply balance also weighed on merchandise exports.   Rising domestic demand and high international commodity prices propelled merchandise imports in H1:2022-23 (April-August). Oil imports accounted for around half of this growth. Non-oil non-gold imports also remained strong led by coal, electronics, chemicals, and machinery. Coal imports grew substantially, despite elevated international prices, as the domestic demand for energy soared. The trade deficit more than doubled to US$ 124.5 billion in April-August 2022 from US$ 53.8 billion a year ago. Merchandise exports are sensitive to global trade volumes while merchandise imports are driven by domestic demand (Box III.1). Services sector trade posted a robust growth in H1:2022-23 (April-July), building upon the significant recovery during 2021-22 (Chart III.17). Services exports growth remained in double digits for the fifth consecutive quarter in Q1, buoyed by software services, business, travel and transportation services. Software and business services together constitute more than 60 per cent share of India’s total services exports. Although the risks of a recession in the US and Europe weigh on the software services sector, India’s offshoring capabilities and competencies and significant investments made by the major IT companies towards automation, cost efficiency, cloud adoption and technology are expected to keep the sector resilient. Services imports increased during Q1 on the back of a significant upsurge in outgoes under travel, transportation and business services. In July, services exports and imports remained buoyant, albeit the growth moderated.