IST,

IST,

Non-Banking Financial Institutions

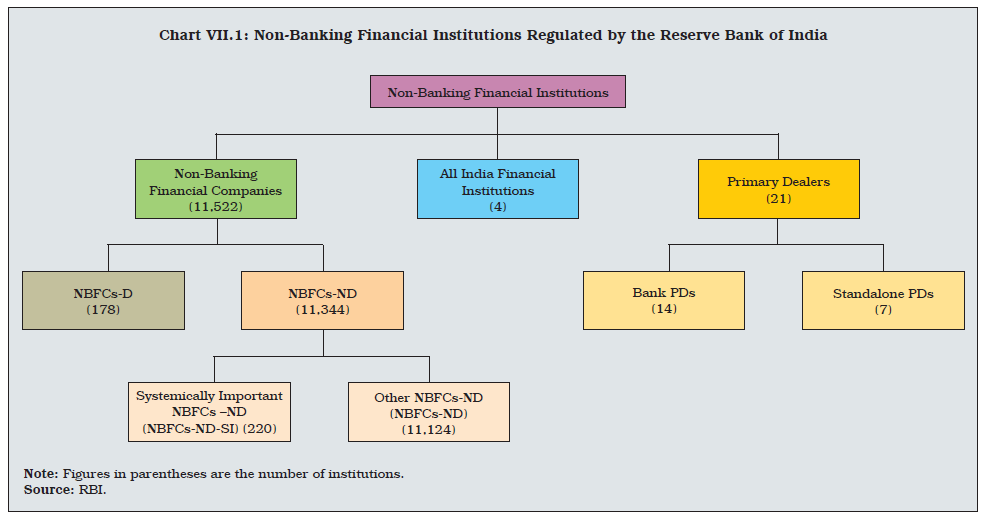

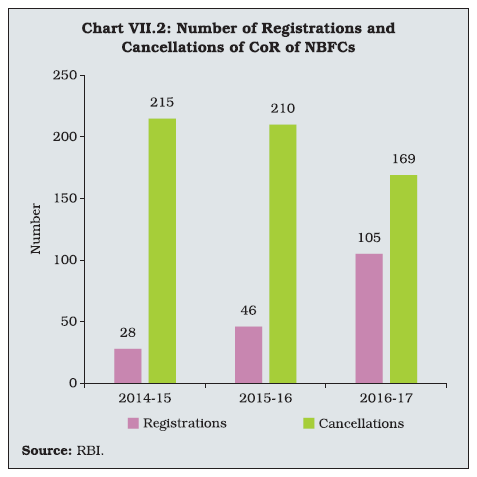

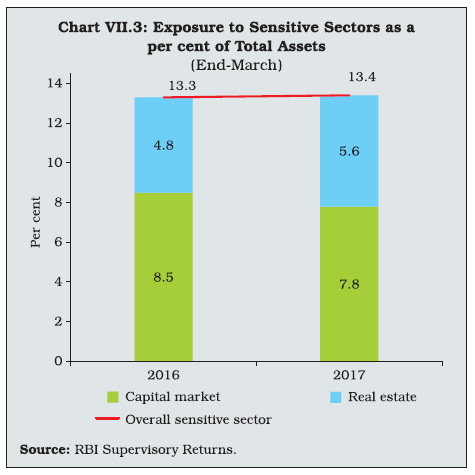

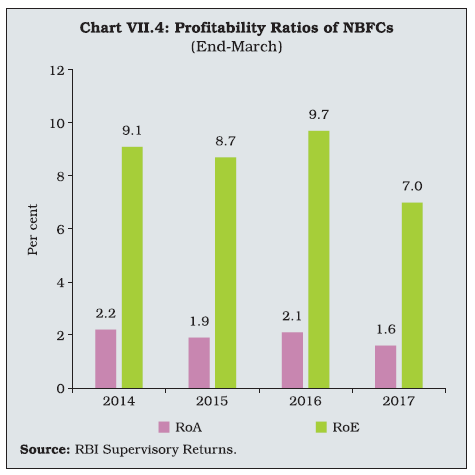

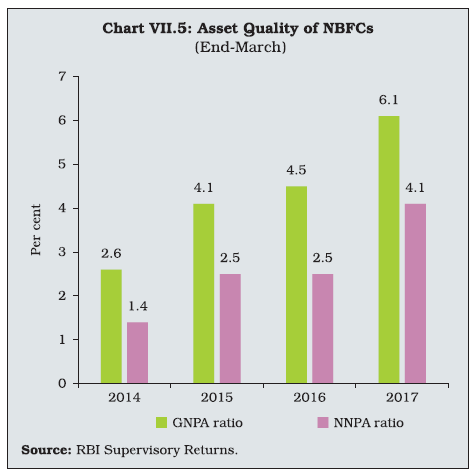

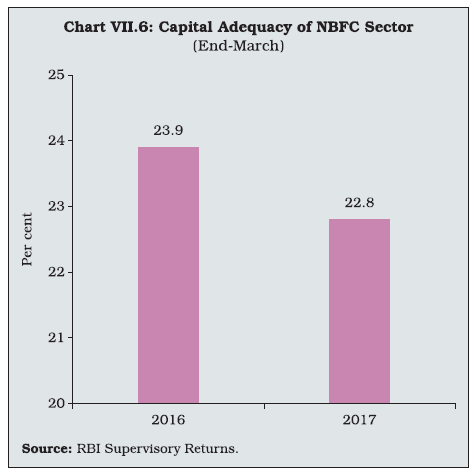

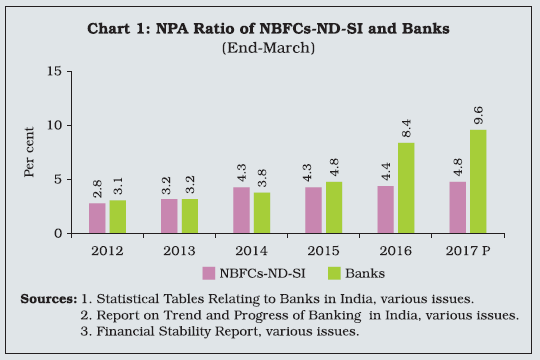

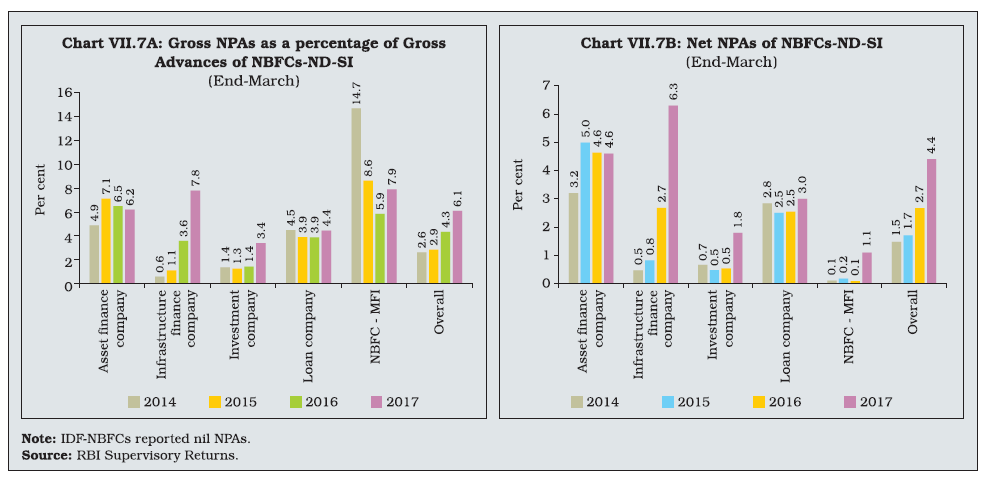

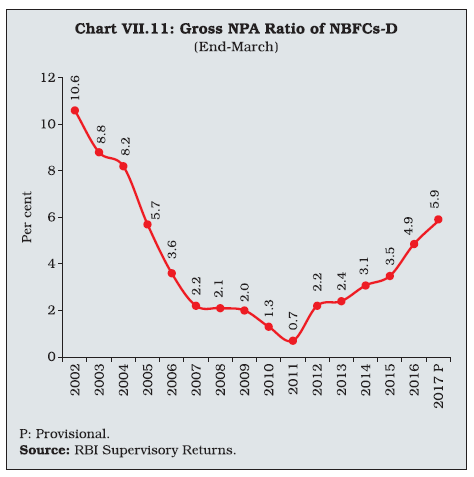

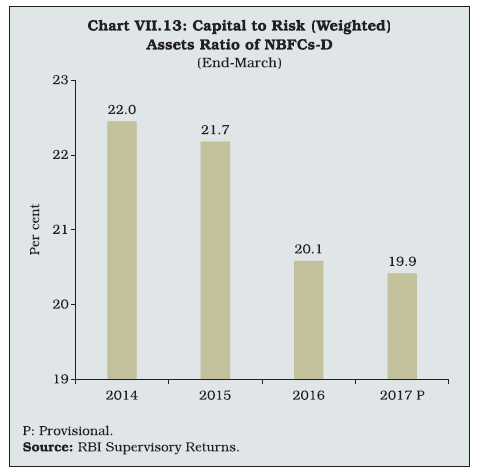

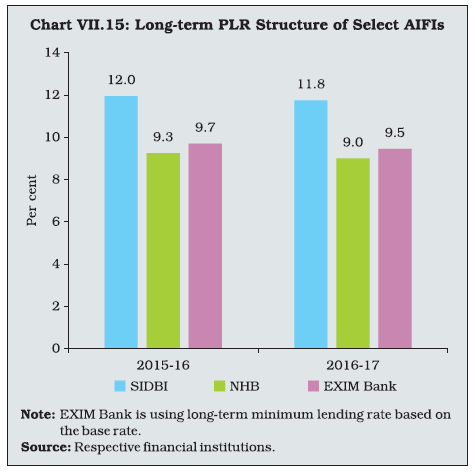

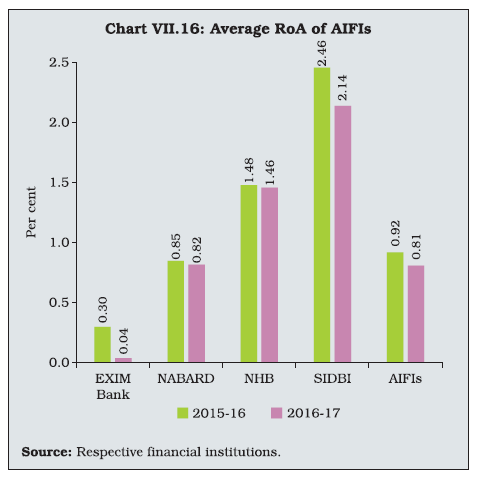

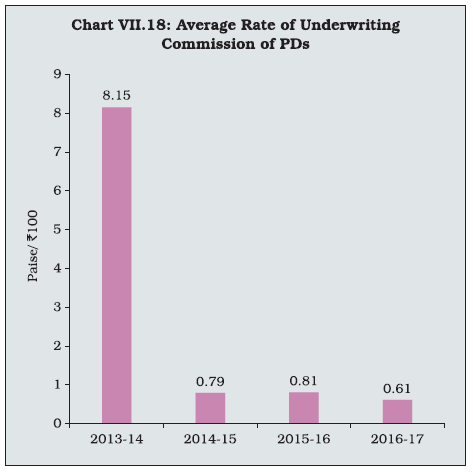

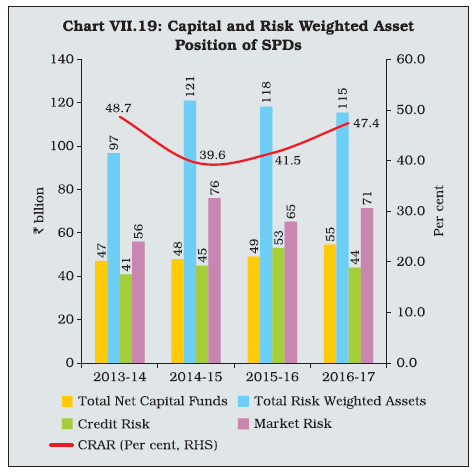

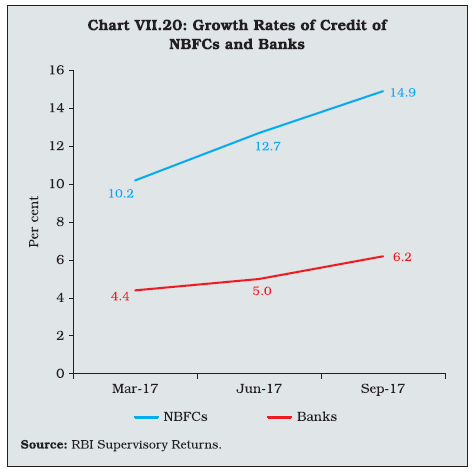

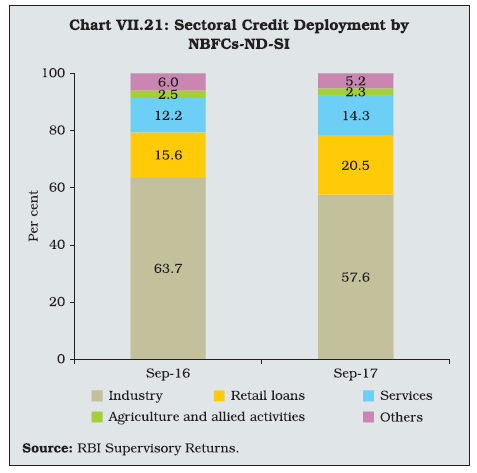

Non-banking financial institutions (NBFIs) are an important alternative channel of finance for the commercial sector in India’s bank dominated financial sector. Their role in promoting financial inclusion and catering to the needs of small businesses and specialised segments is an additional dimension of their relevance in the Indian context. Regulations relating to governing non-banking financial companies (NBFCs) are being increasingly harmonised with those of banks to forge the right balance for financial stability while encouraging them to focus on specialised areas. I. Introduction VII.1 Non-banking financial institutions (NBFIs) have been intermediating a growing share of the resource flows to the commercial sector. NBFIs regulated by the Reserve Bank are all-India financial institutions (AIFIs), non-banking financial companies (NBFCs) and primary dealers (PDs) (Chart VII.1). AIFIs, largely an outcome of development planning in India, were created as apex public entities for providing long-term financing / refinancing to specific sectors. NBFCs, on the other hand, are mostly private sector institutions that specialise in meeting the credit needs and a variety of financial services of niche areas which, inter alia, include financing of physical assets, commercial vehicles and infrastructure loans. PDs, which came into existence in 1995, play an important role in both the primary and secondary markets for government securities. In terms of balance sheet size, AIFIs constitute 23 per cent of NBFIs’ total assets, while NBFCs represent 76 per cent and standalone PDs constitute 1 per cent. VII.2 Against this background, this chapter presents an analysis of the financial performance of each of these NBFIs in 2016-17. The chapter is organised into seven sections. Section 2 provides an aggregated view of the NBFC sector – both deposit-taking NBFCs (NBFCs-D) and non-deposit taking systemically important NBFCs (NBFCs-NDSI). Section 3 discusses the financial performance of payments banks – a newly created form of differentiated banks. The finances of AIFIs are analysed in Section 4, followed by an evaluation of the role of primary dealers in Section 5. Section 6 sets out the latest developments and Section 7 concludes with an overall assessment. II. Non-Banking Financial Companies VII.3 NBFCs are classified on the basis of their liability structures, the type of activities they undertake and their systemic importance. In terms of liability structure, NBFCs are classified into two categories – deposit-taking NBFCs or NBFCs-D, which accept and hold public deposits and non-deposit taking NBFCs or NBFCs-ND, which do not accept public deposits. Among NBFCs-ND, those with an asset size of ₹5 billion or more are classified as non-deposit taking systemically important NBFCs (NBFCs-ND-SI). For the purpose of issuing certificates of registration (CoRs), NBFCs were categorised as Type I and Type II companies in June 2016. The applications for Type I NBFCs, which do not have / intend to accept public funds and do not have / intend to have customer interface, are considered on a fast-track basis. NBFCs are also categorised on the basis of the activities undertaken by them with a view to meeting sector-specific requirements, entailing appropriate modulation of the regulatory regime. With addition of new categories over time, there were 12 types of NBFCs as of date under this categorisation (Table VII.1). VII.4 At end-March 2017, there were 11,522 NBFCs registered with the Reserve Bank, of which 178 were NBFCs-D and 220 were NBFCs-ND-SI. The number of NBFCs has been declining over time with cancellations of registrations exceeding new registrations on account of voluntary surrender or cancellation of CoR due to noncompliance of revised criteria of net owned fund (NOF) (Chart VII.2). Balance Sheet VII.5 Double-digit growth in credit extended by NBFCs has improved resilience and stability of the economy by filling up the financing gap opened up by the muted bank credit growth from 2014-15. NBFCs’ consolidated balance sheet1 turned around and expanded during 2016-17 from a marginal decline in the previous year. Borrowings by NBFCs from various sources, which accounted for 70 per cent of their total liabilities, increased by 12.1 per cent in 2016-17 mainly through market-based instruments such as commercial paper (CPs) and debentures even as borrowings from banks contracted. Growth in public deposits decelerated which is, however, attributable to the revised regulatory guidelines issued in November 2014 mandating that only rated NBFCs-D can accept and maintain public deposits. Unrated companies were required to get rated by March 31, 2016 to be able to renew existing deposits / accept fresh deposits or else return deposits to the public. Further, the limit on acceptance of deposits for rated asset finance companies (AFCs) was reduced from 4 times to 1.5 times of their NOF as part of harmonisation across the sector. Loans and advances, constituting three-fourth of total assets, picked up sharply as space opened up with the reduced pace of bank credit growth. Investments too reversed from contraction in the previous year and rose strongly during 2016-17 reflecting higher investments in equity shares in the wake of ebullient market (Table VII.2). Sectoral Credit of NBFCs VII.6 NBFCs specialise in catering to sectorspecific financial needs covering retail; consumer and vehicle loans; micro, small and medium enterprises (MSMEs); large industry / infrastructure; and micro finance among others. A significant growth in credit to retail and services segments also underlines their increasing role in financial inclusion. Industry receives about 60 per cent of total credit by NBFCs, followed by retail, services and agriculture. VII.7 Within the sectoral deployment, retail credit increased at the highest pace on account of consumer durables and credit card receivables; this was followed by services and industry. On the other hand, credit to agriculture and allied activities contracted perhaps on account of transitory disruptions in cash-intensive value chains due to demonetisation (Table VII.3). Credit to the micro and small segments in both industry and services sectors displayed robust growth while vehicle loans declined during 2016-17 reflecting the transient impact of demonetisation (Appendix Table VII.1). Exposure to Sensitive Sectors VII.8 The Reserve Bank defines the capital market, real estate and commodities as sensitive sectors in view of the risks associated with fluctuations in prices of such assets. NBFCs’ exposure to real estate increased during 2016-17 reflecting search for higher yields (Chart VII.3). Financial Performance of NBFCs VII.9 NBFCs’ profitability declined during 2016-17 due to increased provisioning requirements (Table VII.4). Their cost to income ratio increased reflecting deterioration in operational efficiency. VII.10 Reflecting the slowdown in net profits, NBFCs’ return on equity (RoE) and return on assets (RoA) – the two major profitability indicators – were lower during 2016-17 than a year ago (Chart VII.4). Asset Quality VII.11 During the year, NBFCs faced some deterioration in their asset quality mainly on account of the sluggishness in industrial activity. Both their gross non-performing assets (GNPAs) ratio and net non-performing assets (NNPAs) ratio increased during 2016-17. The recent spike in these ratios also reflects the revision in the recognition norms of NPAs being implemented in a phased manner beginning 2015-162 (Chart VII.5). VII.12 Deterioration of asset quality was also evident in the increased share of doubtful assets denoting the aging of NPAs in the sector (Table VII.5). Capital Adequacy VII.13 With a moderate deterioration in asset quality and expansion in the credit portfolio, NBFC sector’s capital to risk-weighted assets ratio (CRAR) declined in 2016-17 (Chart VII.6). Nevertheless, it remained well above the stipulated norm of 15 per cent. Non-Deposit taking Systemically Important NBFCs VII.14 NBFCs-ND-SI constitute 86 per cent of the total assets of the NBFC sector. The number of these companies declined by more than half in 2015-16 in view of the revised regulatory framework for NBFCs, which raised threshold asset size for NBFCs-ND-SI to ₹5 billion or more from ₹1 billion. Accordingly, many of the NBFCs-ND-SI were reclassified as NBFC-ND in view of the changed definition. In terms of ownership, non-government NBFCs-ND-SI held 62.9 per cent of the total assets of NBFCs-ND-SI (Table VII.6). Balance Sheet VII.15 The consolidated balance sheet of NBFCs-ND-SI expanded strongly in 2016-17 due to growth in credit, which has improved the resilience and stability of the economy by filling up the financing gap opened up by the muted bank credit growth (Box VII.1). VII.16 The accretion to liabilities was mainly on account of share capital, debentures and CPs; on the other hand, borrowings from both banks and the government declined during the year. Although loans and advances of NBFCs-ND-SI increased during the year, investments grew at a faster pace reflecting a preference to park funds in high yield instruments such as debentures, corporate bonds, equity shares and mutual fund units (Table VII.7). VII.17 Category-wise, loan companies (LCs) contributed the most to the increase in the consolidated balance sheet of NBFCs-ND-SI during 2016-17, supported by a healthy growth in the retail segment, especially in consumer durables. The balance sheet of infrastructure finance companies (NBFCs-IFC), the other major category of NBFCs-ND-SI, was subdued by risk aversion due to asset quality concerns in the sector. The balance sheet of AFCs was almost unchanged, reflecting postponement of decisions to purchase assets after demonetisation. The subdued growth of the NBFCs-micro finance institution (NBFCs-MFI) balance sheet was partially due to the conversion of a few large NBFCs-MFI into small finance banks (Table VII.8). Balance sheet of investment companies expanded moderately; while loans and advances increased, their investments declined.

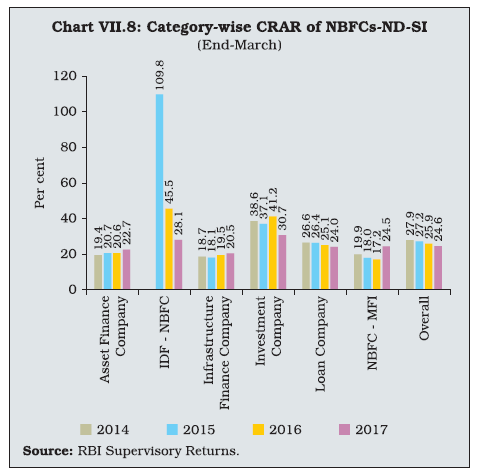

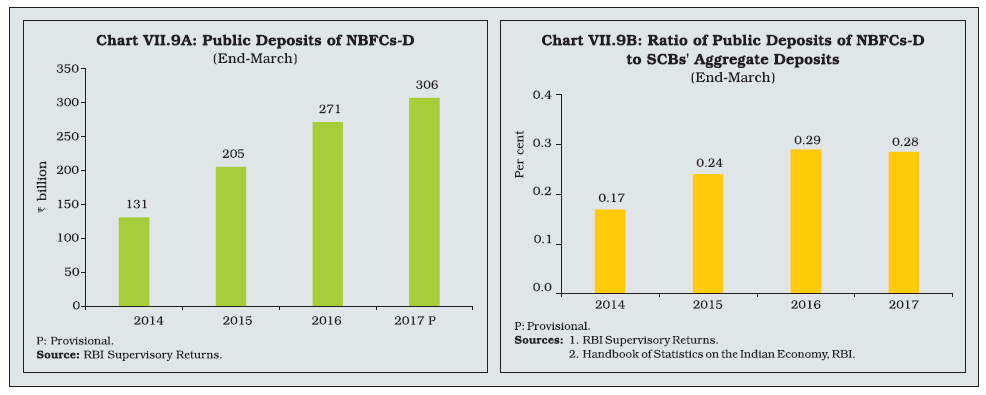

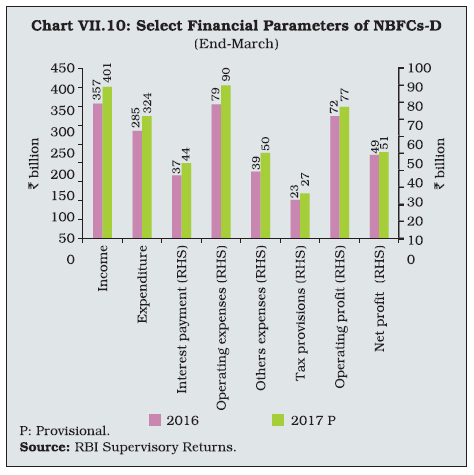

Resource Mobilisation VII.18 NBFCs-ND-SI increased resources raised through debentures and CPs while their borrowings from banks and government declined during the year (Table VII.9). Financial Performance VII.19 The net profits of NBFCs-ND-SI declined in 2016-17 due to increased expenditure and tax provisions (Table VII.10). Their cost-to-income ratio increased during the year. Soundness Indicators VII.20 Gross NPAs of NBFCs-ND-SI increased further during 2016-17, partly reflecting the progressive harmonisation of the NPA norms vis-à-vis banks. All categories of NBFCs-ND-SI, except AFCs, reported deterioration in asset quality with it being more pronounced in the case of NBFCs-MFI reflecting transient disruption in cash flows due to demonetisation (Chart VII.7A). Net NPAs broadly followed the pattern of gross NPAs (Chart VII.7B). VII.21 The CRAR of NBFCs-ND-SI was well above the stipulated norm for the sector across all categories as of March 2017. The overall CRAR, however, showed a marginal decline from the previous year’s level with infrastructure debt fund – NBFCs (IDF-NBFCs), Investment Companies (ICs) and LCs having expanded their loan portfolios considerably during the year (Chart VII.8). Banks’ Exposure to NBFCs-ND-SI VII.22 Borrowings from banks accounted for 21 per cent of NBFCs-ND-SI borrowings. Group-wise, new private banks emerged as the largest lender to NBFCs-ND-SI replacing nationalised banks. NBFCs-ND-SI borrow from banks primarily in the form of term loans and debentures. Traditional lenders, nationalised banks, largely lent in the form of term loans, while new private banks lent through debentures indicating their expectations of capital gains in the monetary easing phase (Table VII.11). Deposit-taking NBFCs VII.23 NBFCs-D accounted for 14.0 per cent of total assets and 16.2 per cent of the total credit deployed by NBFCs at the end of March 2017. NBFCs-D are allowed to accept fixed deposits from the public for a tenure of 12 to 60 months. Deposits constituted 11.1 per cent of NBFCs-D funds as of end-March 2017; however, borrowings (debentures, bank borrowings and CPs) remained the largest source of funds with a share of 66.7 per cent in total funds. The assets of non-government-owned NBFCs increased in 2016-17 while those of government-owned NBFCs contracted (Table VII.12). Balance Sheet VII.24 The consolidated balance sheet of NBFCs-D expanded in 2016-17 on the back of robust credit growth as well as strong investments as NBFCs searched for yields (Table VII.13). Credit was mainly extended to transport operators, consumer durables, and medium and large industries sectors. Among liabilities, the expansion was mainly in debentures, public deposits and CPs. There was a gradual decline in bank borrowings as NBFCs-D diversified their sources of funds in favour of market-based instruments. Debentures emerged as the largest source of funding for NBFCs-D. Category-wise Key Indicators of NBFCs-D VII.25 There are three categories of NBFCs-D – AFCs, LCs and ICs, the last one being negligible in terms of balance sheet size. Category-wise, deposits of AFCs shrank during the year reflecting both a decline in the number of companies under this category as well as a reduction in the limit for acceptance of deposits for rated AFCs from 4 times to 1.5 times of NOF as part of harmonisation of limits across all NBFC-D. The growth in LCs’ deposits decelerated to 22.2 per cent in 2016-17 while borrowings increased at a faster pace to finance credit. In terms of assets, credit constituting 87.3 per cent of total assets showed strong growth, albeit some deceleration was seen over the previous year (Table VII.14). NBFCs-D Deposits VII.26 The Reserve Bank has not issued any new CoR for NBFC-D since 1997. It has also mandated a minimum investment grade rating for NBFCs-D from March 2016 to ensure that only sound and well-managed entities can accept public deposits. Consequently, the number of NBFCs-D declined with many of them converting to non-deposit taking NBFCs. As a result, their deposit growth decelerated from 32.2 per cent in 2015-16 to 12.9 per cent in 2016-17 (Chart VII.9A). Accordingly, the ratio of NBFCs’ public deposits to aggregate deposits of scheduled commercial banks (SCBs) declined marginally in 2016-17, after witnessing increases in the previous three years (Chart VII.9B). Financial Performance VII.27 NBFCs-D income increased by 12.3 per cent in 2016-17 whereas their expenditure grew at a higher pace of 13.7 per cent on account of both operating expenses and interest payments. As a result, the growth in the net profits of NBFCs-D moderated during the year (Chart VII.10). VII.28 The cost to income ratio of NBFCs-D has been rising from 2013-14, reflecting a decline in operational efficiency. Their RoA has also declined in recent years in the wake of slowdown in revenue growth in a competitive lending rate environment, coupled with downward trend in interest rates (Table VII.15). Soundness Indicators VII.29 GNPAs of NBFCs-D have shown a rising trend since 2010-11, reflecting a combination of factors including the slowdown in economic activity and sector-specific developments such as deterioration of asset quality with respect to transport operators and construction sectors. The recent increase may partly be attributed to the progressive harmonisation of NPA norms vis-à-vis banks (Chart VII.11). VII.30 Accretion to NPAs was reported under commercial vehicle and tractor loans. Category-wise, the deterioration was more pronounced in respect of AFCs, which have the maximum exposure to vehicle and tractor loans (Chart VII.12). VII.31 The CRAR of NBFCs-D has been declining since 2013-14 with the expansion of their credit portfolios as well as deterioration in asset quality (Chart VII.13). Nevertheless, the CRAR of NBFCs-D was comfortably above the stipulated norm of 15 per cent. Residuary Non-Banking Companies VII.32 The principal business of Residuary Non-Banking Companies (RNBCs) is collecting deposits and deploying them as specified by the Reserve Bank. As of March 2015, only two RNBCs were registered with the Reserve Bank. In September 2015, the registration of Sahara India Financial Corporation Limited was cancelled. Both the RNBCs have stopped accepting deposits and are in the process of repaying old deposits. VII.33 Overall, the NBFC sector’s balance sheet expanded on strong credit growth as it filled the financing gap due to a slowdown in bank credit. Credit to commercial real estate, micro and small-scale enterprises, and consumer durables increased significantly during the year. Deposit mobilisation decelerated in response to regulatory initiatives. There was some deterioration in asset quality, which was mainly due to harmonisation of regulations vis-à-vis the banking system and the transitory impact of demonetisation. NBFCs’ capital position remained above the regulatory minimum in 2016-17 although there was a modest depletion relative to a year ago on account of enhanced provisions for asset impairment. VII.34 Payments banks (PBs) were set up in India on the recommendations of the Committee on Comprehensive Financial Services for Small Businesses and Low Income Households (Chairman: Shri Nachiket Mor, 2014) with the aim of expanding financial inclusion by providing (i) small savings accounts, and (ii) payments/ remittance services using the digital medium to to migrant labour, small businesses, low income households and other entities in the unorganised sector. PBs are allowed to accept demand deposits up to ₹ one lakh per customer; they are prohibited from issuing credit cards or accepting deposits from non-resident Indians or undertaking lending activities. These banks are covered by deposit insurance from the Deposit Insurance and Credit Guarantee Corporation (DICGC). VII.35 The Reserve Bank began issuing PB licenses in 2015-16. So far, seven licenses have been issued out of which two banks – Airtel Payments Bank and India Post Payments Bank – had commenced operations before March 31, 2017 and two others – Paytm and Fino – had started operations by the quarter ending-June 2017 (Table VII.16). Balance Sheet VII.36 At end-March 2017, the capital and reserves of the two PBs in operation were the major liabilities with their deposits being only 5.7 per cent. Balances with banks and money at call / short notice constituted two-third of their assets while investments constituted the remaining one-third. The asset composition reflects the nature of their operations as they are not permitted to undertake lending activities (Chart VII.14). Financial Performance VII.37 PBs’ profit after tax and earning before provisions and taxes (EBPT) were negative in 2016-17 mainly due to large expenses on creating new infrastructure in the initial stages of their operations (Table VII.17). VII.38 The impact of the starting-up expenditure was reflected in the negative readings of RoA and RoE, notwithstanding a positive net interest margin (Table VII.18). VII.39 A more realistic assessment of PBs’ financial and operational performance will be possible once more data are available and as these banks expand their operations. IV. All India Financial Institutions VII.40 There are three broad categories of non-bank financial institutions: First, term-lending institutions such as the Export Import Bank of India (EXIM Bank) that engage in direct lending by way of term loans and investments. Second, institutions such as the National Bank for Agriculture and Rural Development (NABARD), the Small Industries Development Bank of India (SIDBI) and the National Housing Bank (NHB), which mainly extend refinance to banks and NBFIs. Third, investment institutions such as the Life Insurance Corporation of India (LIC), which deploy their funds largely in marketable securities. State/regional level institutions are another distinct group and comprise State Financial Corporations (SFCs), State Industrial and Development Corporations (SIDCs) and North-Eastern Development Finance Corporation Ltd. (NEDFi). VII.41 Four AIFIs viz., the EXIM Bank, the NABARD, the NHB and the SIDBI, are under the oversight of the Reserve Bank (Table VII.19). AIFIs’3 Operations VII.42 Financial assistance sanctioned by AIFIs during 2016-17 increased by 15.7 per cent whereas their disbursement growth was moderate at 7.7 per cent amidst sluggish demand conditions. Notably, disbursements by the SIDBI contracted during the year indicating moderation in industrial activity while those by the EXIM Bank declined due to deleveraging in view of bad assets and provisioning requirements. The increase in disbursements by the NABARD and the NHB reflects resilience in the agriculture and housing sectors (Table VII.20) (Appendix Table VII.2). Balance sheet VII.43 AIFIs’ consolidated balance sheet expanded during 2016-17 on the back of loans and advances, which constituted the largest share of assets (Table VII.21). Investments contracted in contrast, with the NHB showing a significant decline due to redemption of treasury bills (T-bills) in June 2017. Notably, AIFIs’ cash and bank balances at the close of 2016-17 were 30 per cent lower than a year ago as they did not renew their fixed deposits with banks that matured towards the end of the year and instead used them for normal business activities. Growth in deposit mobilisation was moderate leading to a decline in their share in total liabilities over the year. On the other hand, resources raised through borrowings expanded sizeably during the year. VII.44 The resources mobilised by the AIFIs picked up during 2016-17 resulting in the utilisation of about 83 per cent of their ‘umbrella limit’ for raising resources from the money market as compared to 71 per cent a year ago. Mobilisation through CPs increased significantly, reflecting competitive interest rates on these instruments (Table VII.22). Sources and Uses of Funds VII.45 During the year, internal sources of funds increased with scaling up of operations as well as higher capital and reserves. External sources, which include resources raised from the market and capital infusion from the government, increased marginally (Table VII.23). The deployment of resources during 2016-17 indicates a preference for investments followed by fresh deployment and repayment of past borrowings. The share of interest payments in the deployment of funds has declined in 2016-17. Maturity and Cost of Borrowings and Lending VII.46 The weighted average cost (WAC) of rupee resources raised by AIFIs declined in 2016-17 for all AIFIs with faster transmission of monetary policy accommodation. The weighted average maturity (WAM) of rupee resources increased for the NHB and the EXIM Bank while it declined for the SIDBI and the NABARD. The EXIM Bank had the highest WAC of rupee resources while the NHB had the longest WAM (Table VII.24). VII.47 The long-term prime lending rate (PLR) of all AIFIs declined in 2016-17 reflecting a reduction in the cost of funds for the borrowers. The SIDBI and the NHB had the highest and the lowest PLRs, respectively (Chart VII.15). Financial Performance VII.48 AIFIs posted a modest growth in income during the year, partly reflecting the impact of declining interest rates, lower bank balances and subdued activity under bill discounting / rediscounting. Non-interest income showed strong growth (Table VII.25). VII.49 Although the operating profit ratio improved, relatively higher growth in the wage bill moderated net profits (Table VII.26). VII.50 Net profit per employee declined across AIFIs in 2016-17 except for NABARD where it remained unchanged. The SIDBI registered the highest net profit per employee while the EXIM Bank reported the lowest (Table VII.27). Barring the NHB, the ratio of operating profits to average working funds of AIFIs declined, indicating loss of efficiency in the use of working capital. As a result, AIFIs reported lower RoA during 2016-17; it was the highest for SIDBI and the lowest for EXIM Bank (Chart VII.16). Soundness Indicators VII.51 The total amount of AIFIs’ net NPAs increased during 2016-17 on account of the EXIM Bank’s reduction in the provisioning coverage ratio (PCR) even as the other AIFIs’ net NPAs declined during the year (Table VII.28). VII.52 The share of AIFIs’ standard assets declined in 2016-17 again on account of the EXIM Bank (Table VII.29). VII.53 AIFIs reported a marginal improvement in CRAR at the aggregate level even as they exceeded the stipulated minimum of 9 per cent. Institution-wise, CRARs of EXIM Bank and NABARD improved over the year while they declined marginally for the others (Chart VII.17). VII.54 As on March 31, 2017, there were 21 primary dealers (PDs) – 14 run by banks and 7 standalone PDs registered as NBFCs under Section 45 IA of the RBI Act, 1934. Operations and Performance of PDs VII.55 PDs have mandatory obligations to participate in underwriting and auctions of government dated securities. They are also mandated to achieve a minimum success ratio (bids accepted to the bidding commitment) of 40 per cent in primary auctions of T-bills and Cash Management Bills (CMBs), assessed on a half-yearly basis. VII.56 During 2016-17, the government auctioned dated securities of ₹5,820 billion, marginally lower than ₹5,850 billion during the previous year. PDs’ share of subscriptions in the primary issuance of dated securities declined during 2016-17. Partial devolvement took place on four instances for ₹53 billion during 2016-17 as against seven instances for ₹110 billion in 2015-16. The underwriting commission paid to PDs during 2016-17 was lower at ₹356.6 million as compared to ₹470.9 million in the previous year. Reflecting the lower devolvement during the year, the average rate of underwriting commission in 2016-17 declined on a year-on-year basis (Chart VII.18). VII.57 With respect to auctions of T-bills and CMBs, all PDs achieved the stipulated minimum success ratio. PDs placed higher bids (in relation to their bidding commitments) in 2016-17; their share in subscription of T-Bills / CMBs issued during the year, however, declined marginally to 74 per cent from 75 per cent in the previous year (Table VII.30). VII.58 In the secondary market, all the 21 PDs individually achieved the required minimum annual total turnover (outright and repo transactions) ratio of 5 times in G-secs and 10 times in T-bills during 2016-17 and also the minimum annual outright turnover ratio of 3 times in G-secs and 6 times in T-bills. Performance of Standalone PDs VII.59 The secondary market volume of standalone primary dealers (SPDs) increased by 22.6 per cent in 2016-17 over 2015-16. Yet, their share in total market turnover declined over the year partly due to a reduction in government borrowings (Table VII.31). Sources and Application of SPDs’ Funds VII.60 Funds mobilised by SPDs shrank by about 18.5 per cent during 2016-17 mainly reflecting lower recourse to market repo. Nevertheless, borrowings remained the major source of their funding accounting for 83.7 per cent of the total sources of funds as compared to 88.1 per cent at the end of the previous year. Unsecured loans increased during the year reflecting higher access to call money market. The decline in funds mobilised is attributable to a contraction of current assets during 2016-17 owing to reduction in market borrowings by the government during the last quarter of the year (Table VII.32). SPDs’ Financial Performance VII.61 SPDs’ profit after tax improved significantly in 2016-17 on account of favourable yields, with all seven SPDs posting substantially higher profits than the previous year (Appendix Table VII.3). Their income rose due to a significant increase in trading profits while their expenditure posted a marginal decline (Table VII.33). VII.62 In line with the increase in PAT, SPDs’ return on net worth increased in 2016-17. Reflecting improvement in operational efficiency, the cost-income ratio of these PDs also improved during the year (Table VII.34). VII.63 The combined CRAR of standalone PDs improved during 2016-17 and remained comfortably above the regulatory stipulation of 15 per cent (Chart VII.19) (Appendix table VII.4). VII.64 PDs’ share in the subscription of primary issuances of dated securities declined in 2016-17 due to lower devolvement and increased appetite from other market participants amidst reduction in government borrowings and lower bank credit off-take. The average underwriting commission paid to PDs during the year also declined. Though the share of SPDs declined in the total market turnover, their net profits improved considerably in 2016-17 on account of higher trading profits. VII.65 This section discusses developments in the NBFI sector during April-September 2017.4 In view of the limited availability of data for this period, the discussion is focussed on select variables. NBFCs Sector VII.66 NBFCs’ consolidated balance sheet in the first half of 2017-18 expanded on the back of strong credit growth financed through higher borrowings (Table VII.35). VII.67 NBFCs’ credit growth during April-September 2017 was about seven percentage points higher than in the previous year on the back of retail and services sectors (Chart VII.20). VII.68 Disaggregation of credit extended by the NBFCs-ND-SI segment indicates a sharp growth in credit provided by LCs, followed by AFCs and ICs. LCs have relatively large exposure to commercial real estate, which saw a sharp increase in credit, signifying the revival of economic activity. NBFCs-IFC credit growth, on the other hand, remained subdued during the first half of 2017-18 amidst asset quality concerns in the sector. The share of retail and services sectors improved during the first half of 2017-18 (Chart VII.21). Lending rates of NBFCs-ND-SI VII.69 The weighted average lending rates (WALR) of NBFCs-ND-SI have been declining in line with the monetary easing cycle across all categories barring NBFCs-MFI which showed some uptick in the WALR (Table VII.36). VII.70 NPAs of NBFCs-ND-SI, which recorded some deterioration in the quarter ending-June 2017, improved at end-September 2017 partly reflecting higher write-offs (Chart VII.22). Payments Banks VII.71 Among the payments banks, Airtel PB became the first payments bank in India to integrate the unified payments interface (UPI) on its digital platform. Jio Payments Bank, a joint venture of Reliance Industries Ltd. (RIL) and the State Bank of India (SBI), is expected to begin operations in December 2017. The government is working on expanding India Post payments bank’s branches for reaching out to rural people. These developments indicate the potential role of payments banks in promoting financial inclusion in the country. New categories of NBFCs engaged in P2P lending and account aggregation are expected to evolve over time (Box VII.2). VII.72 The number of NBFCs has declined because of the regulatory initiatives aimed at protecting depositors’ interests and safeguarding financial stability. Nevertheless, the overall balance sheet size of NBFCs has expanded with their credit growth recording a higher reading in 2016-17 when bank credit witnessed historically low growth. More importantly, credit to the micro and small segments, both in industry and services sectors, displayed robust growth. Financial performance of these companies came under stress with a decline in profitability and deterioration in asset quality. Their capital positions also deteriorated during 2016-17 though they remained well above the stipulated norms. Their exposure to sensitive sectors such as capital markets and real estate at 13.4 per cent of their total assets as of March 2017 was marginally higher than the previous year. Notwithstanding a double-digit growth in public deposits mobilised by NBFCs, they remained well below 1 per cent of bank deposits. NBFCs took higher recourse to market-based instruments for resource mobilisation while reducing their dependence on bank borrowings. Conversion of a few large NBFCs-MFI into small finance banks may have implications for credit to the microfinance segment. VII.73 Primary dealers reported an increase in profits during the year due to favourable yields and higher trading profits. Payments banks reported negative profits due to high operational expenditures in the initial stage. Financial assistance sanctioned by AIFIs during 2016-17 increased by about 16 per cent while growth in disbursements was moderate at 7.7 per cent, a possible indication of demand conditions turning lacklustre during the year. NABARD and NHB disbursed significantly higher financial assistance supporting agriculture and housing sectors. VII.74 Regulations governing NBFCs are being increasingly harmonised with the banking sector while encouraging them to focus on specialised areas as evidenced by the recent notifications for setting up two new types of NBFCs by the Reserve Bank – Account Aggregator and Peer-to-Peer Lending Platform. Another recent regulatory development in the sector was the issuance of a comprehensive Information Technology Framework for NBFCs-ND to be adopted by June 30, 2018. VII.75 In the context of a regulatory regime for the sector, Financial Stability Board’s peer review of India has suggested that there is need for improving the sector’s risk assessment capacity and developing appropriate policy tools for non-banking financial entities (NBFEs) to ensure sustainable market-based finance and balance between promoting financial inclusion for supporting economic development with the consideration of financial stability risks. The review also suggested that the Reserve Bank may revisit the business criteria definition for NBFCs on a regular basis, review the merits of deposit-taking activities by non-financial firms, eliminate regulatory exemptions for government-owned NBFCs, rationalise the number of NBFC categories and continue harmonising NBFC prudential rules with those for banks. Also, there is a need to improve the timeliness and granularity of data collected from NBFEs, and enhancing its analysis. VII.76 The latest developments suggest a healthy growth in NBFCs’ credit during the first half of 2017-18 particularly in the retail and services sectors. A substantial improvement in credit to commercial real estate during the current year up to September portends well for economic activity. Available data also show improvements in NBFCs’ asset quality in the recent quarter pointing to the fading impact of demonetisation. The goods and services tax related adjustments may, however, need to be watched going forward. 1 Analysis is based on the consolidated balance sheet of NBFCs-D and NBFCs-ND-SI. 2 Time period for classification as NPAs for assets other than hire purchase was progressively reduced to 5 months for the year ending March 2016, 4 months for the year ending March 2017 and 3 months for the year ending March 2018. 3 The financial year for EXIM Bank, SIDBI and NABARD runs from April to March and for NHB it runs from July to June. 4 Analysis is based on the provisional data for April-September 2017. |

ପେଜ୍ ଅନ୍ତିମ ଅପଡେଟ୍ ହୋଇଛି: