IST,

IST,

OBICUS Survey on the Manufacturing sector - Q2:2019-20

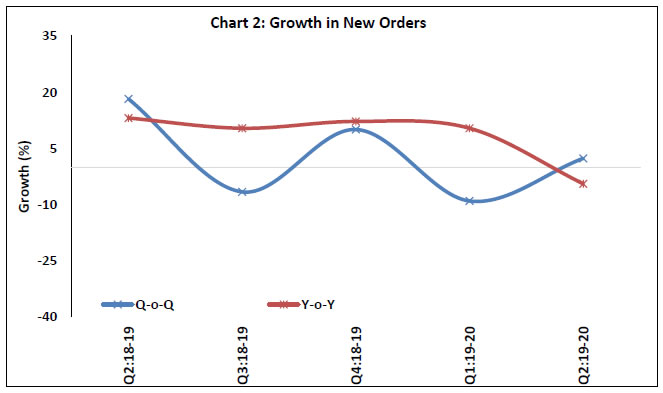

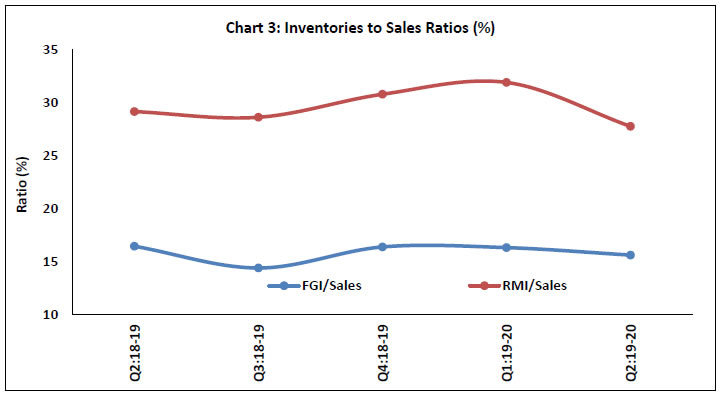

Today, the Reserve Bank released the results of the 47th round of the Order Books, Inventories and Capacity Utilisation Survey (OBICUS) for the quarter July-September 2019 covering 866 manufacturing companies. The survey provides a snapshot of demand conditions in India’s manufacturing sector1. Highlights: 1) Capacity Utilisation (CU): At the aggregate level, CU declined to 69.1 per cent in Q2:2019-20 from 73.6 per cent in the previous quarter, broadly tracking the de-trended index of industrial production (IIP) (Chart 1). Seasonally adjusted CU also declined by 4.5 percentage points to 70.0 per cent in Q2:2019-20.  2) Order Books: Orders received in Q2:2019-20 were lower compared with level a year ago, though they were higher as compared with the new orders in the previous quarter (Chart 2). 3) Finished Goods Inventory (FGI) to Sales Ratio: The FGI to sales ratio declined marginally in Q2:2019-20 as FGI fell at a faster pace than sales (Chart 3). 4) Raw Material Inventory (RMI) to Sales Ratio: The RMI to sales ratio fell sharply in Q2:2019-20, mainly reflecting moderation in RMI (Chart 3). Historical time series have been made available in excel format. ANNEX 1: Data Tables

1 The survey responses are voluntary. The 46th round of the OBICUS covering 818 manufacturing companies with reference period as April-June 2019 was released on the RBI website on October 04, 2019. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ପେଜ୍ ଅନ୍ତିମ ଅପଡେଟ୍ ହୋଇଛି: