IST,

IST,

Chapter I : Macro-Financial Risks

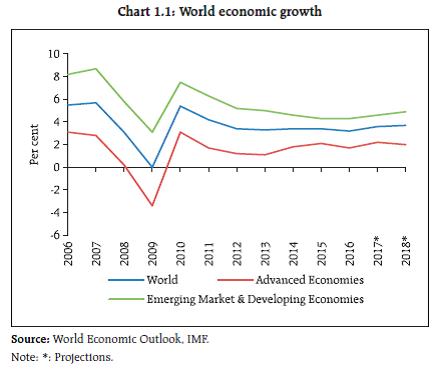

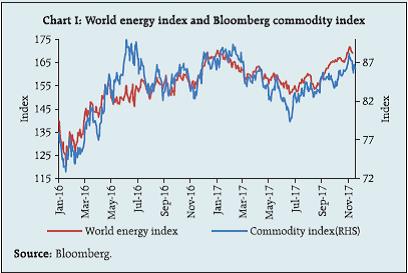

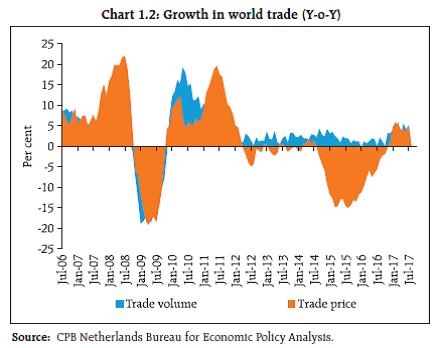

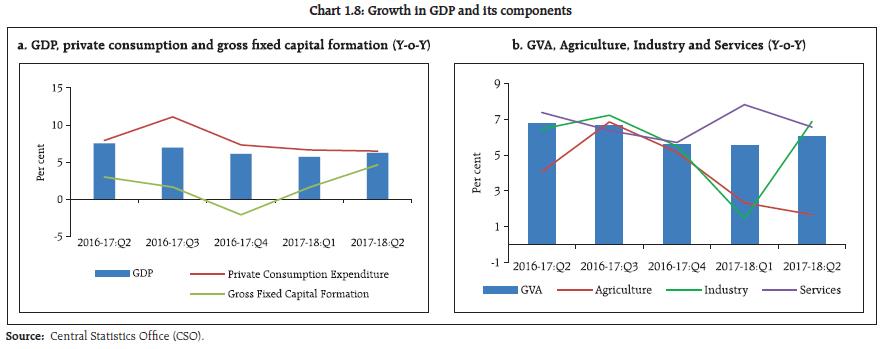

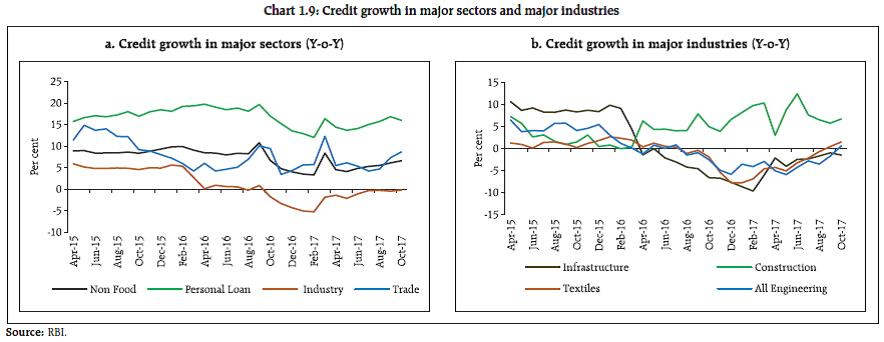

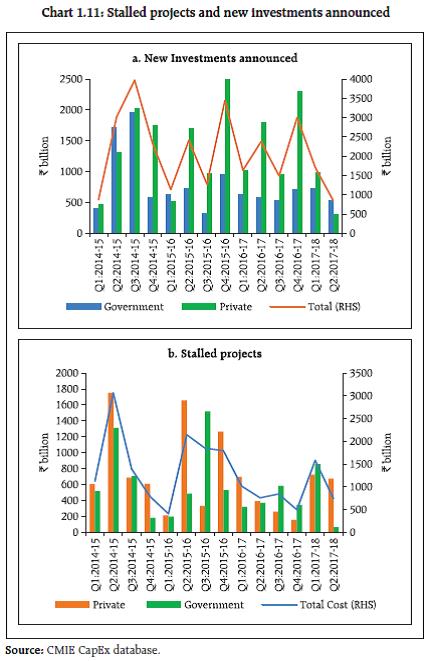

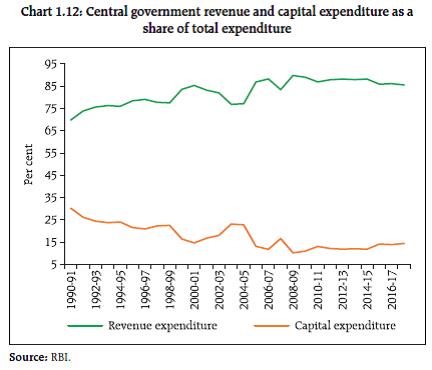

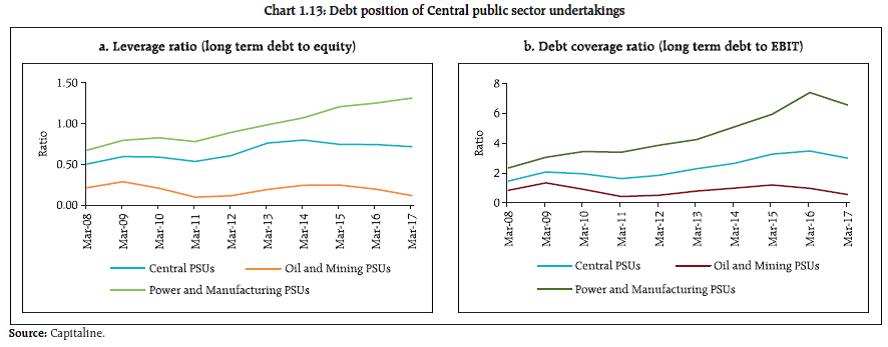

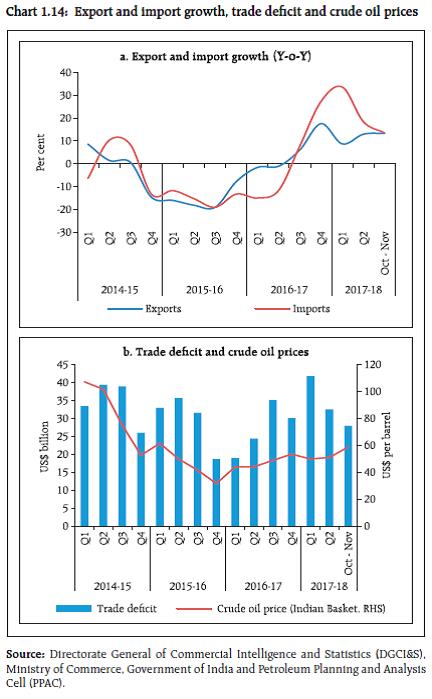

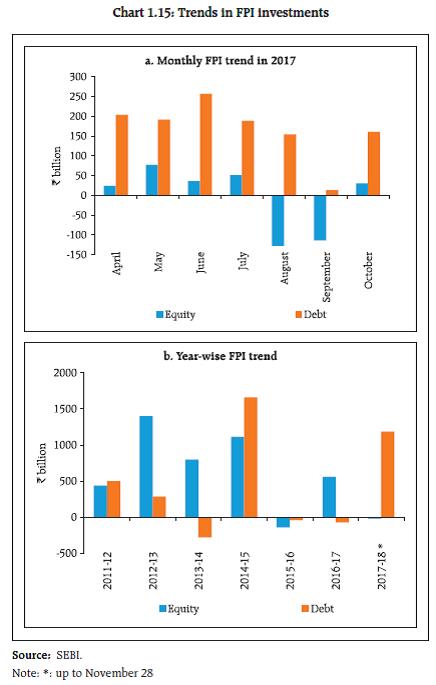

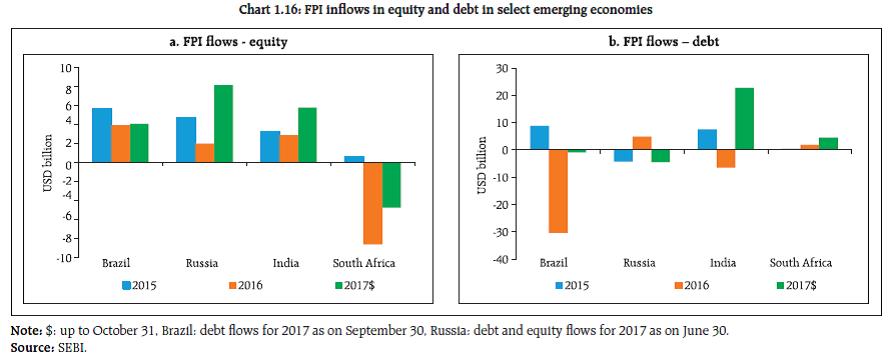

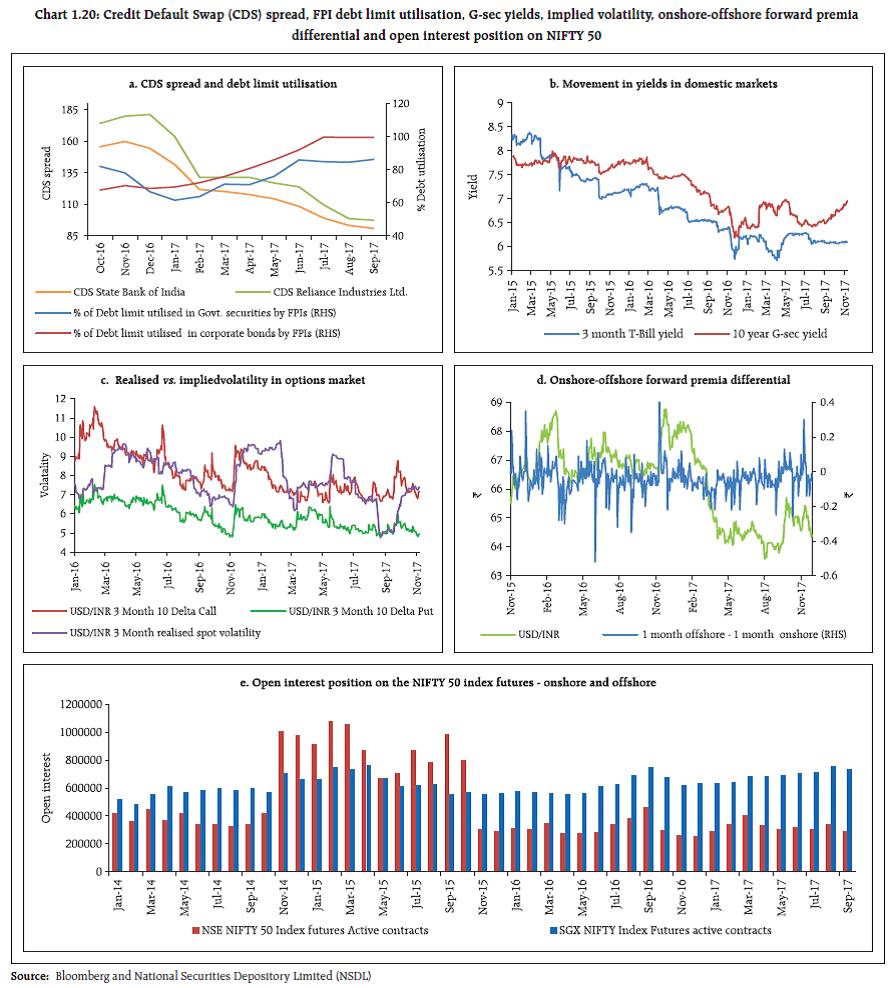

The global economy has picked up steam and the growth momentum appears sustainable. Notwithstanding efforts to normalise monetary policy by the Federal Reserve and the Bank of England, financial conditions in the advanced economies remain accommodative. The commodities space is firming up and increased geopolitical risks imply likely volatility in commodity prices. In the emerging market context, exports are growing at their fastest clip in six years on the back of a pick-up in global growth. On the domestic front, gross value added (GVA) rebounded in 2017-18:Q2 after initial hiccups associated with the rollout of the nationwide goods and services tax (GST) coming on the back of demonetisation. The ongoing deleveraging in the heavily indebted parts of the corporate sector and credit growth in public sector banks (PSBs) present a downside risk to growth. The overall investment climate remains challenging though the situation has shown improvement since 2017-18:Q1. The positive signals of improvement – ‘the decline in number and cost of stalled projects in 2017-18:Q2’, ‘the efforts to improve the quality of government expenditure’, ‘ease of doing business ranking’, ‘India’s sovereign rating upgrade by Moody’s’ and the ‘bank recapitalisation announcement’ are expected to provide a significant fillip to investment sentiments in the coming quarters. Global backdrop Economy and trade 1.1 According to the World Economic Outlook (October 2017 update), the global output is projected to expand by 3.6 per cent in 2017 and 3.7 per cent in 2018 on the back of a pick-up in investments, trade and industrial production (Chart 1.1). While falling energy prices in 2017:H1 boosted household demand, the global energy prices rebounding to their highest level in two years make the risk of reversal of household purchasing power significant. Nevertheless, improved global fundamentals with a broad-based growth outlook for both advanced and emerging economies provide a significant buffer to growth risk. In contrast, heightened geopolitical risks and still unclear contours of the US tax reform have the potential to adversely affect elevated market valuations and dampen the growth momentum. 1.2 Looking at the advanced economies (AEs), the US real gross domestic product (GDP) increased at an annual rate of 3.3 per cent in 2017:Q3, due to higher personal consumption expenditure, non-residential fixed investments and the federal government’s spending. The US economy’s performance is comforting, notwithstanding its low productivity growth and a slowly ageing population. The Euro area also maintained its pace of expansion in 2017:Q3, growing at an annual rate of 2.6 per cent which makes it one of its best performances in a decade. Germany expanded by 2.8 per cent, while growth in Italy accelerated to 1.7 per cent, its best performance since 2010. Japan grew at a faster-than-expected 2.5 per cent in 2017:Q3 on account of strong export growth overcoming weak domestic demand. Overall, there is a perceptible momentum in terms of the geographical spread of the growth, lending support to an above average global growth rate. 1.3 In the emerging market economies (EMEs), exports are growing at their fastest pace in six years; these are being aided by a pick-up in global economic growth. With unit prices for exports rising, thanks to an ongoing recovery in commodity prices from last year’s lows, 2017 looks set to be the most positive year for emerging market exporters since 2011 (Box 1.1). According to the World Trade Organisation (WTO), trade growth is becoming more synchronised across regions than it had been for many years (Chart 1.2).

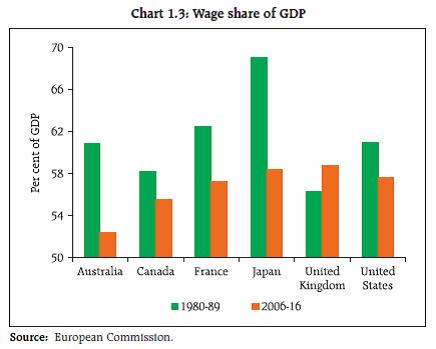

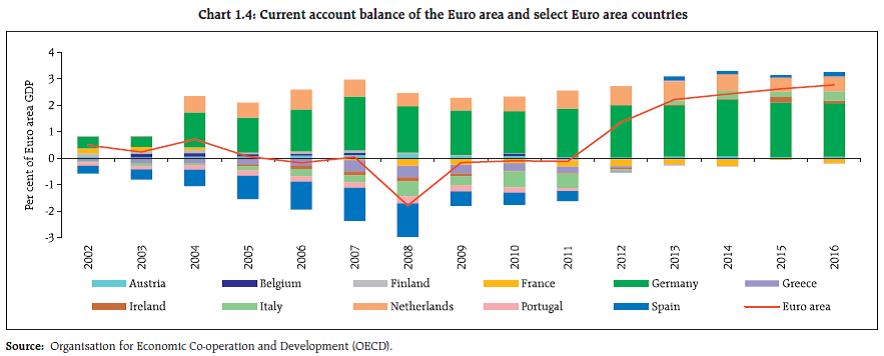

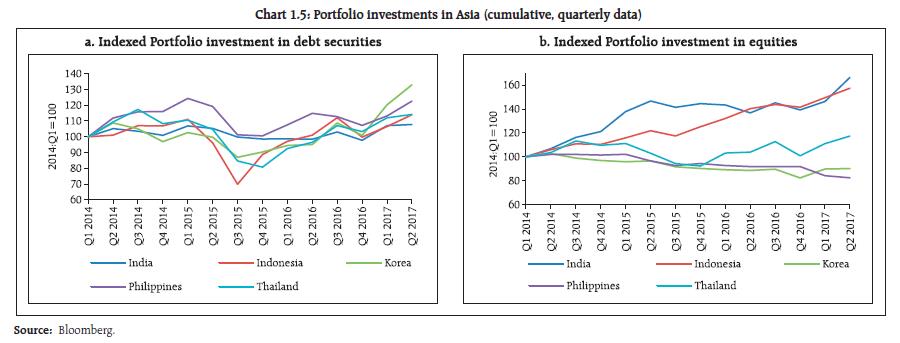

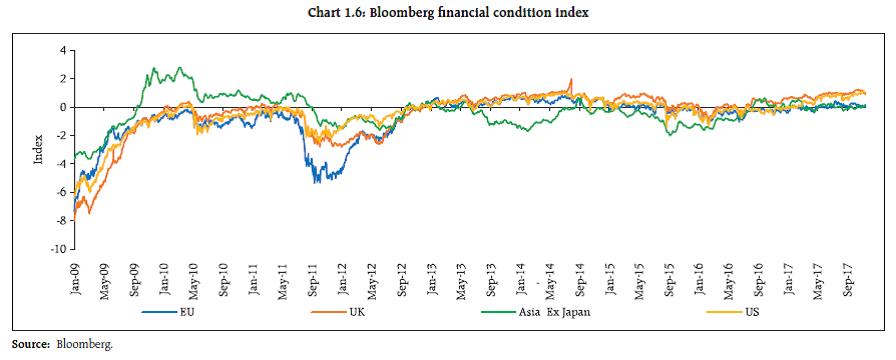

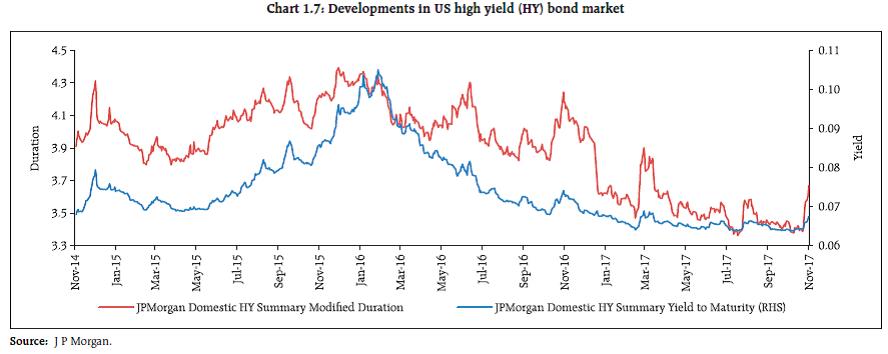

1.4 In terms of structural change, the information technology-led growth is possibly making the world a lot more unequal, thereby challenging the post-World War II political economies across the world. The increasing returns to scale inherent in the information technology industry have made technology giants progressively more dominant. There is a significant shift of wealth from tangibles to intangibles. In this context, the declining wage share of GDP in AEs is likely to have implications for their political economies (Chart 1.3). As regards emerging market and developing economies, the International Labour Organisation (ILO) finds that in many of these countries the decline in the labour income share is even more pronounced than in advanced economies, with considerable declines in Asia and North Africa. The wage shares in Latin America are more stable but still declining3. This requires sustained policy attention. Capital flows and the rate markets 1.5 While the Euro area as a whole is showing remarkable ‘across the board recovery,’ the general impact of Euro zone growth on the ‘global savings glut’ (Chart 1.4) and hence on global savings imbalances may not be insignificant since it requires the rest of the world to run current account deficits so as to absorb such a significant savings pool, on a sustainable basis. Yet among the major economies of the rest of the world, an ageing Japan has large and increasing current account surplus; in the UK domestic demand is increasingly affected by Brexit related transition issues; and while US domestic demand and consequent current account deficit is large, such a large deficit is being increasingly subjected to bilateral trade negotiations. 1.6 Capital flows since the taper tantrum to five large Asian economies, ex-China, seem to reflect country-specific pull factors (Chart 1.5). Going forward, it is expected that non-resident investors will continue to differentiate the countries on the basis of fundamentals, structural reforms and political outlook. In India, bank-related headwinds are expected to wane in the wake of planned recapitalisation package and this should strengthen capital inflows. 1.7 Financial conditions in AEs remained accommodative so far (Chart 1.6), though they may turn relatively tighter in the UK and the US. Going forward, ECB’s policy stance may continue to remain accommodative. While the financial condition in Asia remains accommodative, it may reverse given the rising commodity prices. With the monetary policy stance of central banks in AEs at considerable variance, the mechanism to condition market expectations of policy paths remains a communication challenge (Box 1.2). 1.8 In the meantime, the recent hardening of US interest rates and movement in commodity prices has led to a gradual upward shift in US long term rates. However, while the high yield bond yield is off the lows (notwithstanding a gradual reduction in duration), there is no discernible trend in the reversion of risk appetite (Chart 1.7). Domestic economy Domestic macro-financial developments 1.9 India’s gross domestic product (GDP) growth rebounded to 6.3 per cent in 2017-18:Q2 from 5.7 per cent since 2017-18:Q1 (Chart 1.8a) after the initial hiccups associated with the rollout of nation-wide goods and services tax (GST), coming on the back of demonetisation. Gross value added (GVA) also posted 6.1 per cent rise in 2017-18:Q2 from 5.6 per cent in previous quarter (Chart 1.8b). 1.10 The ongoing deleveraging in the heavily indebted parts of the corporate sector and muted credit growth in public sector banks (PSBs) pose a risk to growth. Subdued credit, which may also be a consequence of thin capital buffers of PSBs, leads to lower investments in the economy. Credit growth in major sectors as well as industries has witnessed a decline4 over the past two years (Chart 1.9). Personal loans remain a bright spot in an otherwise muted credit growth environment. It is expected that the recent recapitalisation move for PSBs will give a significant fillip to credit growth. 1.11 Investment demand, as measured by gross fixed capital formation (GFCF), remained depressed with its share in GDP declining from 34.3 per cent in 2011-12 to 29.5 per cent in 2016-17 (Chart 1.10). Investments exhibited a slender recovery in 2017-18:Q1. According to the Centre for Monitoring Indian Economy (CMIE), new investment proposals significantly declined in 2017-18:Q2 in terms of both numbers and value (Chart 1.11a). However, the number and cost of stalled projects reported in 2017-18:Q2 (Chart 1.11b) showed a decline. 1.12 The quality of government expenditure has shown signs of improvement in recent years (Chart 1.12). While public sector undertakings (PSUs5) increased their investments, this stretched their leverage (Chart 1.13). The recapitalisation plan for the banking sector is likely to boost investment growth going forward. External sector 1.13 Against the backdrop of improving global trade, the recovery in the growth of Indian merchandise exports is underway. After registering negative growth for seven consecutive quarters, exports have been growing since 2016-17:Q3 (Chart 1.14a). Merchandise import growth which has been higher than export growth in the recent past (Chart 1.14b) appears to have converged as per the latest data. While the trade deficit moderated in 2017-18:Q2 from its level in the previous quarter, sustained higher growth in imports relative to exports against the backdrop of a rebound in oil price potentially reduces the external sector’s resilience. Financial markets 1.14 The significant increase in liquidity in financial markets in the wake of demonetisation has led to unprecedented fund flows to both equity and debt mutual funds (Chart 1.15a). Foreign portfolio investment (FPI6) flows into the capital market also remained buoyant with a greater preference for debt (Chart 1.15b), until recently. Among BRICS nations (ex-China), India received the second highest FPI equity flows during January to October 2017, following Russia (Chart 1.16a). India experienced the highest FPI inflows in the debt segment (Chart 1.16b). 1.15 In the capital market, the relative movement in earnings-per-share (EPS) estimates of Sensex vis-à-vis MSCI Asia Pacific index shows a relative downgrade of approximately 11 per cent for Sensex as compared to an upgrade of about 4 per cent for MSCI Asia Pacific7 (Chart 1.17a). Sectoral forward earnings (2017-18) estimates of Asia-Pacific companies vis-à-vis India show better performance of Indian corporates in major domestic-focused sectors (Chart 1.17b). On trailing PE based measures Indian valuation continues to outpace its Asian peers (Chart 1.18). 1.16 Given the significant increase in the mutual funds’ (MFs) corpus and an excess monthly return of almost 250 bps (annualised) from a representative money market fund over the Clearing Corporation of India Ltd. (CCIL) liquid T-bill benchmark8, there seems to be some risk migration from the banks to the mutual funds. On a different scale, the top-5 fund houses contributed approximately 50 per cent of the aggregate corpus of liquid and money market mutual funds (MMMFs). 1.17 Another manifestation of the swelling MF corpus and consequent investment in corporate bonds is a gradual contraction in higher rated corporate bond spreads9 (Chart 1.19). The unexpected rise in BBB corporate spreads maybe on account of lack of liquidity in lower rated corporates in the wake of demonetisation and a consequent revision in the spread determination methodology for such rating grades. 1.18 A significant differential between the risk-free rate (T-bill yield) and bank Marginal Cost of Funds based Lending Rate (MCLR10) expands the scope for disintermediation of bank financing by corporate bonds in case of quality corporates; the corporates might find it advantageous to place issues with MFs rather than accessing bank finance (Table 1.1). The table shows that bank financing is competitive below the rating grade ‘AA-’ based on recent FIMMDA valuation (August 2017)11. Such disintermediation trends are consistent across tenors as can also be seen from Table 1.112. To stem the erosion in the quality of credit portfolios, some of the well-capitalised banks have reportedly started resorting to risk-free benchmark based pricing as opposed to MCLR linked pricing. 1.19 The effects of pervasive domestic liquidity in financial markets following demonetisation and abundant liquidity induced as a result of foreign exchange operations have pushed down borrowing costs for higher rated Indian corporates. The risk appetite in FPIs for unhedged government and corporate bond exposure has also increased (Chart 1.20a). The recent upgrade in India’s sovereign rating by Moody’s implies that Indian corporates’ dollar borrowing cost is likely to remain benign. However, there has been a slight firming of long term yields in domestic debt markets (Chart 1.20b). Implied volatility in foreign exchange options in the shorter tenure has also shown some upward movement (Chart 1.20c). Finally the significant build up in offshore index futures13 relative to onshore can have spillover effects to related onshore markets during times of stress (Chart 1.20d and 1.20e). House prices 1.20 The all-India residential property price index (RPPI) rose by 8.7 per cent in 2017-18:Q1 as compared to 7.3 per cent growth in the corresponding quarter of the previous year (Chart 1.21). The gross non-performing advances (GNPAs) ratio for housing finance assets remained flat at 1.55 per cent in September 201714. The retail housing segment does not appear to pose any significant systemic risks in the Indian context at present. 1Weighted average of prices for petroleum blends produced by OPEC countries. 2The Sharpe ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk. 3International Labour Office (ILO) (2011) ‘World of Work Report 2011: Making markets work for jobs’, Geneva, Available at http://www.ilo.org/wcmsp5/groups/public/---dgreports/---dcomm/---publ/documents/publication/wcms_166021.pdf 4In the backdrop of lower inflation, lower oil prices reducing credit limits utilised by oil companies and conversion of loans to state-owned electricity distribution companies (DISCOMS) into bonds implying corresponding reduction in loans and advances. 5A total of 26 large Central PSUs were considered. The sectoral decomposition was – Oil (8), Mining (4), Power (4) and Manufacturing (10). 6The above analysis excludes FDI flows since such flows are not amenable to sudden reversal unlike FPI flows. 7If original MSCI Asia Pacific / S&P Sensex EPS estimate was indexed at 100 (as on April, 2017), EPS estimate of MSCI Asia Pacific stands at approx. 104 and that of S&P Sensex stands at approx. 89 as on Nov, 2017 8duration of approximately 0.30 years 9FIMMDA valuation spreads are used for illustration. 10The Marginal Cost of Funds-based Lending Rate (MCLR), introduced in April 2016 by the Reserve Bank, is an internal benchmark used by banks for pricing credit. The objective was to improve the efficiency of monetary policy transmission. Under the MCLR system, banks are required to use the marginal cost of funds for computing the cost of funds as opposed to the blended cost of funds used under the previous Base Rate system. SBI MCLR, the least among banks is illustratively used for comparison. 11To illustrate, for rating grades above ‘A+’, for say 1 year tenor, FIMMDA valuation of ‘AA-’ at 7.68 per cent is lower than the reference MCLR of 8.30 per cent implying scope of disintermediation. 12A comparison of a fixed rate coupon to a floating rate MCLR indexed loan (for tenors more than 1 year) as attempted above, prima facie, may appear to be inconsistent since it entails comparing a floating rate fixing to a fixed rate coupon. However, a fixing of MCLR significantly above the fixed-rate coupon implies at the least, a short-term negative carry. This may have a bearing on investment decisions of commercial banks subjected to short-term P&L pressure. 13SGX Open Interest has been adjusted for contract size differential vis-à-vis onshore Nifty futures. 14For scheduled commercial banks as at end-September 2017 (RBI Supervisory Returns). |

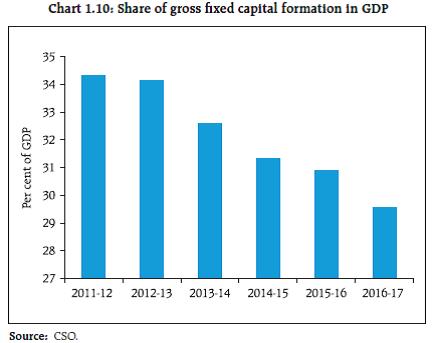

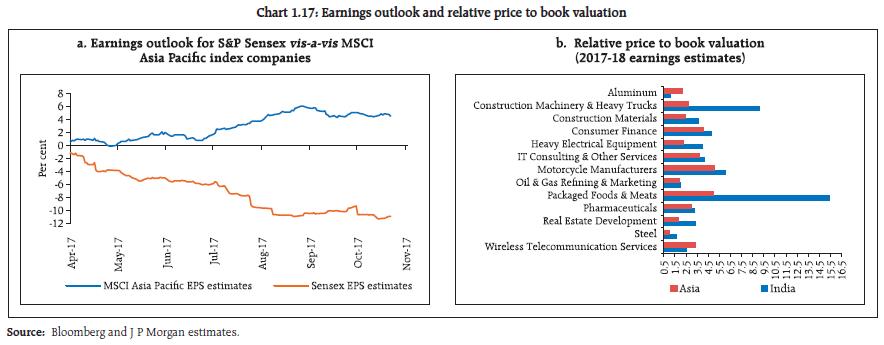

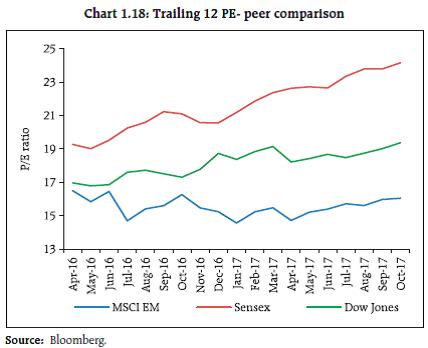

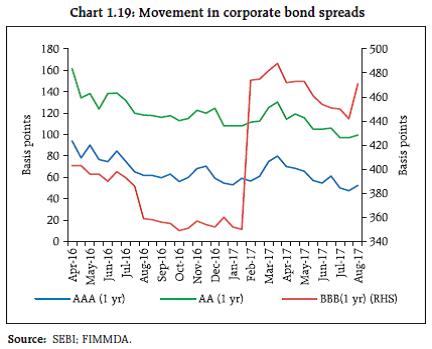

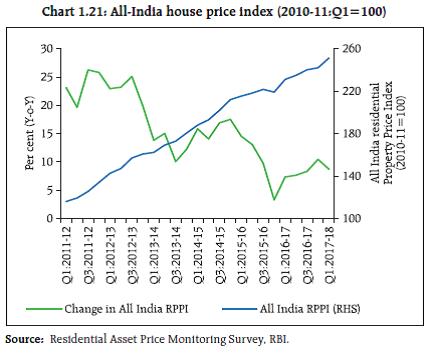

ପେଜ୍ ଅନ୍ତିମ ଅପଡେଟ୍ ହୋଇଛି: