IST,

IST,

Estimation of Threshold Inflation

Annex 3 Estimation of Threshold Inflation Estimates of Threshold Inflation from Past Empirical Studies

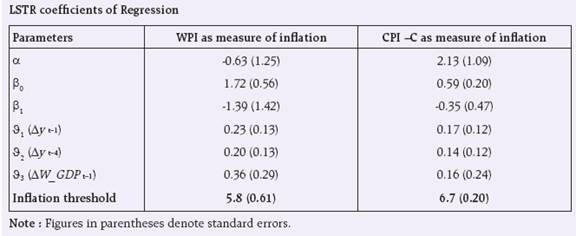

1. Univariate approach A Logistic Smooth Transition Regression (LSTR) model proposed by Teräsvirta (19941; 19982) is used to estimate the inflation threshold (Espinoza et al. (2010)3) The model specification is as proposed by McAleer & Medeiros (2008)4 which employs a quasi maximum likelihood (QML) estimator of smooth transition regression with multiple regimes.5  Quarterly data from 1996-97 to 2012-13 is used in the analysis. Apart from inflation and lagged values of GDP growth, a control variable capturing world GDP growth is also used. GDP growth for OECD countries is used as proxy for world GDP data. The impact of domestic factors is controlled using GDP lags.  2. Multivariate Approach A Threshold Vector Auto Regression (TVAR) is a non-linear multivariate system of equations. TVARs approximate the non-linear relationship by several regime-dependent formulations which are linear. Each regime is defined in terms of threshold values and coefficients of the VAR system are specific to each regime. The system of equations that is estimated for the reduced-form VAR with one threshold is given by  The chart indicates that in the case of both WPI and CPI-Combined, inflation above threshold reduces output growth.

1Teräsvirta, T.(1994) “Specification, Estimation, and Evaluation of Smooth Transition Autoregressive Models,” Journal of the American Statistical Association, Vol. 89, pp. 208–218. 2Teräsvirta, T. (1998) “Modelling Economic Relationships with Smooth Transition Regressions,” in Handbook of Applied Economic Statistics, ed. by A. Ullah and D.E. Giles, pp. 507-552, New York: Marcel Dekker. 3Espinoza, R., Leon, H., & Prasad, A. (2010) “Estimating the Inflation-Growth Nexus – A Smooth Transition Model” IMF Working Paper, WP/10/76 4McAleer M., & Medeiros, M.C. (2008). “A multiple regime smooth transition Heterogeneous Autoregressive model for long memory and asymmetries” Journal of Econometrics 147, pp 104-119 5Matlab codes developed by Marcelo C. Medeiros available at http://sites.google.com/site/marcelocmedeiros/Home/codes 6Julia Schmidt (2013) “Country risk premia, endogenous collateral constraints and non-linearities: A Threshold VAR approach” |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ପେଜ୍ ଅନ୍ତିମ ଅପଡେଟ୍ ହୋଇଛି: