International

Financial Markets

During 2006-07 (April-March), short-term interest

rates increased further in major advanced economies as well as emerging market

economies (EMEs) (Table 40) as many central banks continued

monetary tightening to contain inflation and stabilise inflationary expectations

as detailed in the previous chapter. During the year, the US Federal Reserve increased

the fed funds rate target twice by 25 basis points each in May 2006 and June 2006.

It has since then paused. The European Central Bank increased its policy rate

five times by 25 basis points each in June 2006, August 2006, October 2006, December

2006 and March 2007. The UK also raised its policy rate thrice by 25 basis points

each in August 2006, November 2006 and January 2007. Other advanced economies

such as Australia, Canada, Japan, New Zealand, Norway, Sweden and Switzerland

also increased their policy rates during the year. The increase in short-term

rates in the US during 2006-07 was lower than other major advanced economies reflecting

the pause by the US Fed since end-June 2006. Central banks in many EMEs such as

China, South Africa, South Korea, Taiwan and Turkey also increased their policy

rates. Other EMEs such as Israel and Thailand initially raised their policy rates

during the year but subsequently cut their policy rates to support growth; Brazil

Table

40: Short-term Interest Rates | (Per

cent) | Region/Country

1 | At end of |

March | March | June | September | December | March |

2005 | 2006 | 2006 | 2006 | 2006 | 2007 |

2 | 3 | 4 | 5 | 6 | 7 |

Advanced Economies | | | | | | |

Euro Area | 2.15 | 2.80 | 3.06 | 3.38 | 3.70 | 3.91 |

Japan | | 0.02 | 0.04 | 0.24 | 0.34 | 0.44 | 0.57 |

Sweden | | 1.97 | 1.99 | 2.23 | 2.55 | 2.94 | 3.21 |

UK | | 4.95 | 4.58 | 4.70 | 5.02 | 5.27 | 5.55 |

US | | 2.90 | 4.77 | 5.48 | 5.21 | 5.25 | 5.23 |

Emerging Market Economies | | | | | | |

Argentina | | 4.56 | 9.63 | 10.00 | 10.38 | 10.63 | 9.63 |

Brazil | | 19.25 | 16.54 | 15.18 | 14.17 | 13.19 | 12.68 |

China | | 2.25 | 2.40 | 3.00 | 2.95 | 2.88 | 2.86 |

Hong Kong | 2.79 | 4.47 | 4.67 | 4.20 | 3.97 | 4.17 |

India | | 5.37 | 6.11 | 6.36 | 6.60 | 7.18 | 7.98 |

Malaysia | | 2.82 | 3.51 | 3.93 | 3.85 | 3.73 | 3.64 |

Philippines | 7.25 | 7.38 | 8.00 | 7.63 | 6.56 | 5.31 |

Singapore | 2.06 | 3.44 | 3.50 | 3.44 | 3.44 | 3.00 |

South Korea | 3.54 | 4.26 | 4.57 | 4.63 | 4.73 | 4.94 |

Thailand | | 2.64 | 5.10 | 5.40 | 5.40 | 5.20 | 4.45 |

Note : Data for India refer

to 91-day Treasury Bills rate and for other countries 3-month money market rates.

Source : The Economist. |

continued

to reduce policy rates throughout the year. Short-term interest rates, therefore,

declined in such EMEs.

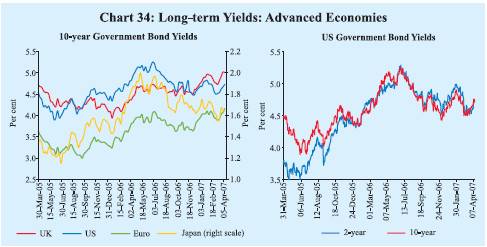

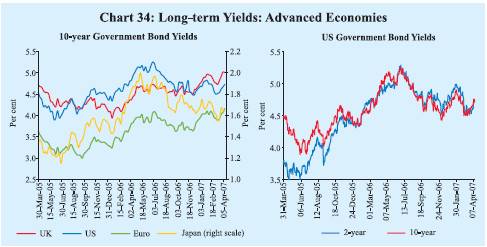

Long-term Government bond yields exhibited mixed

trends in major advanced economies during 2006-07. During the year, 10-year yield

declined by 18 basis points in the US and 12 basis points in Japan but increased

by 56 basis points in the UK and 32 basis points in the euro area. The decline

in the yield in the US could be attributed to easing of crude oil prices, weakening

of economic growth and pause in monetary tightening by the Federal Reserve (Chart

34). The hardening of yields in the euro area and the UK could be attributed

to higher short-term rates in the wake of further tightening and improved growth

prospects. Since early June 2006, 10-year US bond yields have generally remained

below those on 2-year bonds. Spreads on risky corporate debt in major advanced

economies fell during the year, reaching record lows in the first quarter of 2007

on the back of strong risk appetite and sound corporate balance sheets. Spreads

on emerging market debt also eased to record lows in the first quarter of 2007.

Global equity markets recorded further gains during 2006-07, interspersed

with intermittent corrections (Chart 35). Equity markets

initially registered losses between mid-May and early June 2006 in a number of

economies reflecting concerns about growing inflationary pressures and concomitant

increase in risk aversion. Global equity markets recovered part of the losses

during the second and third quarters of 2006-07 reflecting strong corporate results,

decline in crude oil prices, better than expected growth in the euro area, strong

merger and acquisition activity and pause by the US Federal Reserve. Stock markets

in a number of economies declined on December 19, 2006 following the decision

of the Bank of Thailand (BoT) to impose unremunerated reserve requirement (URR)

of

30 per cent on short-term capital flows to discourage speculative short-term capital

flows, with the market in Thailand, in particular, declining by 14.8 per cent

on December 19, 2006 (over its level on the previous day). The markets, however,

recovered some of these losses the next day as the BoT exempted investments in

stock markets from the URR. During the last week of February 2007, equity markets

in many advanced as well as EMEs fell. The Chinese stock markets declined by 9.0

per cent on February 27, 2007 but recovered some of these losses in the subsequent

days. The equity markets in the US and several other developed and EMEs declined

again in March 2007 on concerns over sub-prime mortgage lending and slowdown in

the US economy. Notwithstanding these corrections during the course of the year,

the MSCI World and MSCI emerging markets indices at end-March 2007 were higher

by 13.4 per cent and 18.3 per cent, respectively, over their levels at end-March

2006. These gains were led by stock markets in China (143.6 per cent), followed

by Russia (38.4 per cent), Indonesia (36.1 per cent), Malaysia (32.4 per cent),

South Africa (32.0 per cent), Singapore (27.0 per cent) and the Hong Kong (24.2

per cent).

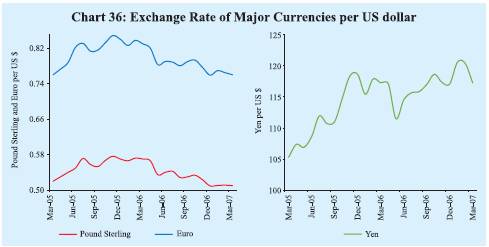

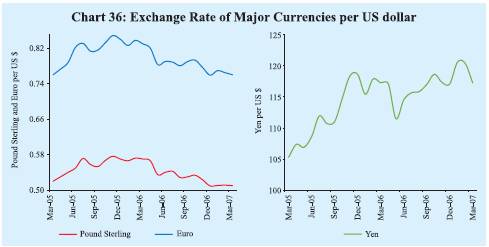

In the foreign exchange market, the US dollar depreciated

against the major currencies during 2006-07, reflecting narrowing of interest

rate differentials, moderation of activity in the US and robust growth in the

euro area and Japan (Chart 36). Between end-March 2006

and end-March 2007, the US dollar depreciated by 11.4 per cent against the Pound

sterling and 9.1 per cent against the euro but appreciated by 0.2 per cent against

the yen. Amongst Asian currencies, the US dollar depreciated by 6.2 per cent against

the Malaysian ringgit, 9.9 per cent against the Thai baht, 3.5 per cent against

the Chinese yuan and 3.6 per cent against the Korean won over the same period.

Between end-March 2006 and end-March 2007, the euro appreciated by 10.0 per cent

against

the US dollar and 10.3 per cent against the yen, but depreciated by 2.5 per cent

against the Pound sterling. Over the same period, the euro appreciated by 3.2

per cent against the Malaysian ringgit, 6.1 per cent against the Chinese yuan

and 6.0 per cent against the Korean won; however, it depreciated by 0.9 per cent

against Thai baht. The Japanese yen recorded depreciation against almost all the

major currencies, i.e., by 0.2 per cent against the US dollar, 9.3 per

cent against the euro, 11.6 per cent against the Pound sterling, 10.1 per cent

against the Thai baht, 6.4 per cent against the Malaysian ringgit, 3.9 per cent

against the Korean won and 3.7 per cent against the Chinese yuan over the same

period.

Domestic Financial Markets

Indian financial

markets remained generally orderly for most part of 2006-07. There were, however,

some spells of volatility at different points of time during the year reflecting

developments in liquidity conditions on account of large and sudden changes in

capital flows and cash balances of the Governments. Interest rates in various

segments increased during the year. The call money rate edged up during the year

in tandem with movements in policy rates. The call rate remained mostly within

the corridor set by the Reserve Bank's repo and reverse repo rates during April-November

2006. In the subsequent months, there were a few brief episodes (last week of

December 2006 and second half of March 2007) of higher volatility when the call

rate exceeded the repo rate significantly. Interest rates in the collateralised

segment of the overnight money market also hardened, but remained below the call

rate during the year. In the foreign exchange market, the Indian rupee exhibited

two-way movements with a strengthening bias since mid-July 2006.

Table

41: Domestic Financial Markets at a Glance | Month | Call

Money | Government Securities | Foreign

Exchange | Liquidity

Management | Equity |

Average Daily Turnover

(Rs. crore) | Average

Call Rates*

(Per cent) | Average

Turnover in

Govt.

Securities

(Rs. crore)+ | Average10-Year

Yield@

(Per cent) | Average Daily

Inter- bank Turnover

(US $ million) | Average

Exchange Rate(Rs. per US $) | RBI’s

net

Foreign Currency Sales (-)/Purchases

(+)

(US $ million) | Average

Forward Premia3-month(Per cent) | Average

MSS Out- standing#(Rs. crore) | Average

Daily Reverse Repo

(LAF)

Out- standing

(Rs. crore) | Average

Daily BSE Turnover

(Rs. crore) | Average

Daily

NSE Turnover

(Rs. crore) | Average

BSE Sensex** | Average S&P

CNX

Nifty** | 1 | | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

2004-05 | 14,170 | 4.65 | 4,826 | 6.22 | 8,892 | 44.93 | 20,847## | 1.66 | 46,445 | 35,592 | 2,050 | 4,506 | 5741 | 1805 |

2005-06 | 17,979 | 5.60 | 3,643 | 7.12 | 12,738 | 44.27 | 8,143## | 1.60 | 58,792 | 10,986 | 3,248 | 6,256 | 8295 | 2518 |

April | | 17,213 | 4.77 | 3,001 | 7.02 | 9,880 | 43.74 | 0 | 1.96 | 65,638 | 30,675 | 1,890 | 4,136 | 6379 | 1987 |

May | | 15,269 | 4.99 | 3,805 | 7.11 | 10,083 | 43.49 | 0 | 1.57 | 68,539 | 22,754 | 1,971 | 3,946 | 6483 | 2002 |

June | | 20,134 | 5.10 | 6,807 | 6.88 | 10,871 | 43.58 | -104 | 1.40 | 70,651 | 13,916 | 2,543 | 4,843 | 6926 | 2134 |

July | | 20,046 | 5.02 | 3,698 | 7.13 | 11,003 | 43.54 | 2,473 | 1.56 | 70,758 | 10,754 | 3,095 | 6,150 | 7337 | 2237 |

August | 16,158 | 5.02 | 4,239 | 7.04 | 11,749 | 43.62 | 1,552 | 0.69 | 71,346 | 34,832 | 3,452 | 6,624 | 7726 | 2358 |

September | 16,292 | 5.05 | 5,207 | 7.04 | 11,040 | 43.92 | 0 | 0.62 | 67,617 | 30,815 | 3,871 | 6,923 | 8272 | 2512 |

October | 17,164 | 5.12 | 2,815 | 7.14 | 13,087 | 44.82 | 0 | 0.69 | 68,602 | 18,608 | 2,955 | 6,040 | 8220 | 2487 |

November | 22,620 | 5.79 | 3,314 | 7.10 | 11,228 | 45.73 | 0 | 0.67 | 67,041 | 3,268 | 2,635 | 5,480 | 8552 | 2575 |

December | 21,149 | 6.00 | 2,948 | 7.13 | 13,808 | 45.64 | -6,541 | 1.51 | 52,040 | 1,452 | 3,516 | 6,814 | 9162 | 2773 |

January | 17,911 | 6.83 | 3,094 | 7.15 | 16,713 | 44.40 | 0 | 2.60 | 40,219 | -15,386 | 3,966 | 7,472 | 9540 | 2893 |

February | 13,497 | 6.95 | 2,584 | 7.32 | 15,798 | 44.33 | 2,614 | 2.85 | 33,405 | -13,532 | 3,688 | 7,125 | 10090 | 3019 |

March | | 18,290 | 6.58 | 2,203 | 7.40 | 17,600 | 44.48 | 8,149 | 3.11 | 29,652 | -6,319 | 5,398 | 9,518 | 10857 | 3236 |

2006-07 | 21,725 | 7.22 | 4,863 | 7.78 | 18,540 | 45.25 | 24,517## | 2.14 | 37,698 | 21,973 | 3,877 | 7,883 | 12319 | 3585 |

April | | 16,909 | 5.62 | 3,685 | 7.45 | 17,712 | 44.95 | 4,305 | 1.31 | 25,709 | 46,088 | 4,860 | 9,854 | 11742 | 3494 |

May | | 18,074 | 5.54 | 3,550 | 7.58 | 18,420 | 45.41 | 504 | 0.87 | 26,457 | 59,505 | 4,355 | 9,155 | 11599 | 3437 |

June | | 17,425 | 5.73 | 2,258 | 7.86 | 15,310 | 46.06 | 0 | 0.73 | 31,845 | 48,610 | 3,261 | 6,828 | 9935 | 2915 |

July | | 18,254 | 5.86 | 2,243 | 8.26 | 14,325 | 46.46 | 0 | 0.83 | 36,936 | 48,027 | 2,605 | 5,652 | 10557 | 3092 |

August | 21,294 | 6.06 | 5,786 | 8.09 | 15,934 | 46.54 | 0 | 1.22 | 40,305 | 36,326 | 2,869 | 5,945 | 11305 | 3306 |

September | 23,665 | 6.33 | 8,306 | 7.76 | 18,107 | 46.12 | 0 | 1.31 | 40,018 | 25,862 | 3,411 | 6,873 | 12036 | 3492 |

October | 26,429 | 6.75 | 4,313 | 7.65 | 16,924 | 44.47 | 0 | 1.67 | 41,537 | 12,983 | 3,481 | 6,919 | 12637 | 3649 |

November | 25,649 | 6.69 | 10,654 | 7.52 | 20,475 | 44.85 | 3,198 | 2.07 | 38,099 | 9,937 | 4,629 | 8,630 | 13416 | 3869 |

December | 24,168 | 8.63 | 5,362 | 7.55 | 19,932 | 44.64 | 1,818 | 3.20 | 38,148 | -1,713 | 4,276 | 8,505 | 13647 | 3918 |

January | 22,360 | 8.18 | 4,822 | 7.71 | 21,065

P | 44.33 | 2,830 | 4.22 | 39,553 | -10,738 | 4,380 | 8,757 | 13984 | 4037 |

February | 23,254 | 7.16 | 4,386 | 7.90 | 20,050

P | 44.16 | 11,862 | 3.71 | 40,827 | 648 | 4,680 | 9,483 | 14143 | 4079 |

March | | 23,217 | 14.07 | 2,991 | 8.00 | 24,231

P | 44.03 | – | 4.51 | 52,944 | -11,858 | 3,716 | 7,998 | 12850 | 3731 |

*: Average of daily weighted call money

borrowing rates.

+ : Average of daily outright turnover in Central

Government

dated securities.

@: Average of daily closing rates.

# : Average of weekly

outstanding MSS.

**: Average of daily closing indices.

## : Cumulative

for the financial year.

LAF: Liquidity Adjustment Facility.

BSE : Bombay

Stock Exchange Limited.

MSS: Market Stabilisation Scheme.

– : Not

available.

NSE: National Stock Exchange of India Ltd.

P : Provisional.

Note : In column 11, (-) indicates injection of liquidity, while

(+) indicates absorption of liquidity. | Yields in the

Government securities market hardened during the year and the yield curve flattened.

Banks' deposit and lending rates edged up, especially in the second half of the

year. The stock markets reached record highs during the year interspersed with

periodic corrections (Table 41). The primary market segment

of the capital market continued to exhibit buoyancy.

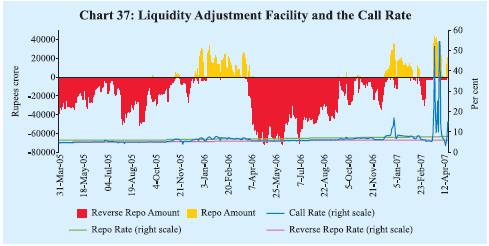

Money Market

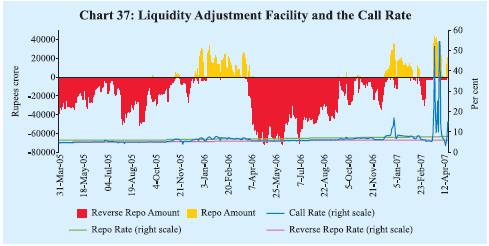

Money market rates edged up during the year, broadly moving in line

with the policy rates, with intra-year movements depending upon the evolving liquidity

conditions. The call money rate was generally anchored close to the reverse repo

rate up to mid-September 2006 (Chart 37). Liquidity conditions

became relatively tighter in the second half of September 2006, inter alia,

on account of liquidity pressures emanating from advance tax outflows and festive

season currency demand coupled with high credit demand. The call rate crossed

the repo rate and touched 7.38 per cent on September 29, 2006. The call rate eased

below the repo rate by early October 2006 partly on account of reduction in Centre’s

surplus cash balances with the Reserve Bank and remained mostly within repo-reverse

repo corridor between end-October to second week of December 2006. The call rates

eased to near reverse repo levels by the last week of November 2006, before the

announcement on December 8, 2006 of a hike of 25 basis points each in the cash

reserve ratio (CRR) effective the fortnights beginning December 23, 2006 and January

6, 2007. The call rate again edged up from the second week of December 2006 crossing

the repo rate to touch 16.88 per cent on December 29, 2006 under the impact of

advance tax outflows and the CRR hike. The call rate eased from the elevated levels

in the first week of January 2007 on the back of improvement in liquidity conditions.

Notwithstanding an increase in the repo rate by 25 basis points on January 31,

2007 (reverse repo rate remained unchanged), the call rate eased further to around

6.5 per cent by the second week of February 2007 due to forex induced liquidity.

Following the announcement

(on

February 13, 2007) of the hike of 25 basis points each in the CRR effective the

fortnights beginning February 17, 2007 and March 3, 2007, the call rate again

firmed up to about 8.0 per cent by mid-February 2007 but quickly eased to around

6.1 per cent by end-February 2007. It further declined to below the lower bound

of the corridor between March 5-15, 2007 as liquidity conditions eased. Modified

arrangements of liquidity

management

were put in place effective March 5, 2007 under which a flexible arrangement of

MSS auctions of dated securities was introduced along with a ceiling of Rs.3,000

crore under the LAF reverse repo (see Chapter III). The call money rate hardened

in the second half of March 2007 as liquidity conditions tightened due to advance

tax outflows, year-end considerations, sustained credit demand and asymmetric

distribution of Government securities holdings across the banks. The call rate

averaged 21.99 per cent during March 16-30, 2007 and reached an intra-year high

of 54.3 per cent as on March 30, 2007. The call rate eased to 3.3 per cent on

April 12, 2007 with the easing of liquidity conditions. It was 12.0 per cent on

April 18, 2007.

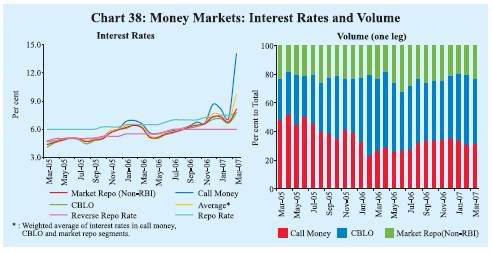

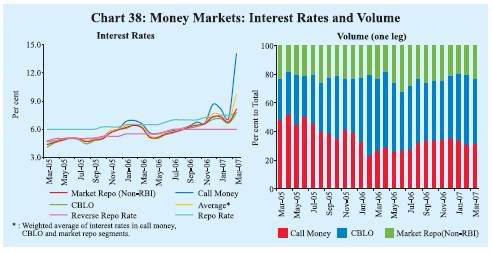

The interest rates in the collateralised segments of the

money market –the market repo (outside the LAF) and the Collateralised Borrowing

and Lending Obligation (CBLO) – increased in line with the call rate, and

continued to remain below the call rate during 2006-07. The rates in these segments

exhibited relative stability vis-à-vis the call rate. For the

financial year 2006-07, as a whole, the interest rates averaged 6.24 per cent

and 6.34 per cent in the CBLO and market repo segments, respectively, as compared

with 7.22 per cent in the call money market. The collateralised market is now

the predominant segment in the money market, accounting for about 70 per cent

of the total volume during 2006-07 (Chart 38 and Table 42).

Mutual funds and insurance companies are the major lenders in the CBLO market

with nationalised banks, primary dealers and non-financial companies being

the major borrowers. In the market repo segment, mutual funds and foreign banks

are the major provider of funds, while the foreign banks, private sector banks

and primary dealers are the major borrowers.

Table

42: Activity in Money Market Segments | (Rupees

crore) | | Average

Daily Volume (One Leg) | Commercial

Paper | Certificates

of Deposit Outstanding | Month | Call

Money Market | Repo Market

(Outside the LAF) | Collateralised

Borrowing and Lending Obligation(CBLO) | Term

Money Market | Out- standing | Amount

Issued | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

2004-05 | 7,085 | 4,284 | 3,349 | 263 | 11,723 | 1,090 | 6,052 |

2005-06 | 8,990 | 5,296 | 10,020 | 417 | 17,285 | 3,140 | 27,298 |

April | 8,607 | 3,044 | 5,185 | 331 | 15,598 | 3,549 | 16,602 |

May | 7,635 | 3,422 | 6,117 | 273 | 17,182 | 3,824 | 17,689 |

June | 10,067 | 4,291 | 5,896 | 267 | 17,797 | 2,925 | 19,270 |

July | 10,023 | 4,526 | 7,646 | 359 | 18,607 | 3,360 | 20,768 |

August | 8,079 | 5,331 | 7,272 | 377 | 19,508 | 4,110 | 23,568 |

September | 8,146 | 4,718 | 8,572 | 558 | 19,725 | 2,519 | 27,641 |

October | 8,582 | 5,245 | 10,882 | 367 | 18,726 | 2,892 | 29,193 |

November | 11,310 | 6,415 | 10,248 | 459 | 18,013 | 2,483 | 27,457 |

December | 10,575 | 6,394 | 10,633 | 388 | 17,234 | 3,304 | 32,806 |

January | 8,956 | 6,149 | 12,817 | 545 | 16,431 | 1,937 | 34,521 |

February | 6,749 | 6,024 | 17,081 | 407 | 15,876 | 3,160 | 34,487 |

March | 9,145 | 7,991 | 17,888 | 669 | 12,718 | 2,813 | 43,568 |

2006-07 | 10,863 | 8,419 | 16,195 | 506 | 21,478 | 4,537 | 64,954 |

April | 8,455 | 5,479 | 16,329 | 447 | 16,550 | 6,065 | 44,059 |

May | 9,037 | 9,027 | 17,147 | 473 | 17,067 | 4,701 | 50,228 |

June | 8,713 | 10,563 | 13,809 | 628 | 19,650 | 4,981 | 56,390 |

July | 9,127 | 9,671 | 15,670 | 432 | 21,110 | 5,812 | 59,167 |

August | 10,647 | 7,764 | 15,589 | 510 | 23,299 | 6,460 | 65,621 |

September | 11,833 | 9,185 | 14,771 | 568 | 24,444 | 5,220 | 65,274 |

October | 13,214 | 9,721 | 16,964 | 466 | 23,171 | 3,373 | 65,764 |

November | 12,825 | 9,374 | 16,069 | 348 | 24,238 | 6,392 | 68,911 |

December | 12,084 | 7,170 | 15,512 | 481 | 23,536 | 3,080 | 68,619 |

January | 11,180 | 6,591 | 15,758 | 515 | 24,398 | 3,490 | 70,149 |

February | 11,627 | 7,794 | 19,063 | 467 | 21,167 | 2,763 | 72,795 |

March | 11,608 | 8,687 | 17,662 | 739 | 19,102

* | 2,106 | 92,468# |

* : As on March 15, 2007.

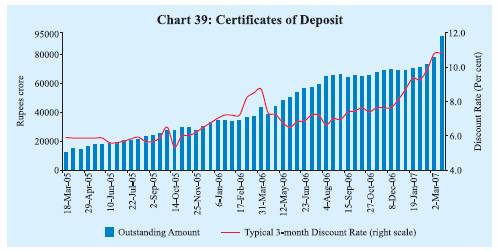

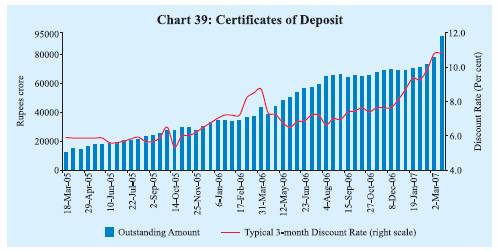

# : As on March 16, 2007. | Certificates of Deposit

The outstanding amount of certificates of deposit (CDs) more than doubled

from Rs.43,568 crore at end-March 2006 (4.8 per cent of aggregate deposits of

issuing banks) to Rs.92,468 crore (4.9 per cent) by March 16, 2007 as banks continued

to supplement their efforts at deposit mobilisation to support sustained credit

demand (Table 42 and Chart 39). The weighted average discount

rate (WADR) of CDs increased by 215 basis points during the year to 10.77 per

cent as on March 16, 2007. Mutual funds are amongst the major investors in the

CDs. Since CDs can be traded and easily liquidated, mutual funds find them quite

attractive.

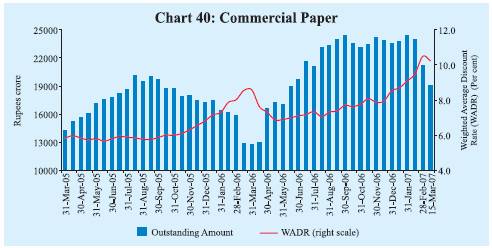

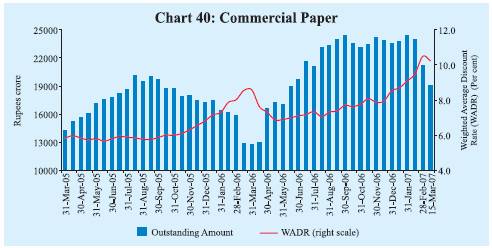

Commercial Paper

Issuances of commercial papers

(CPs) increased sharply in the first half of 2006-07, but fell during the second

half of the year. Outstanding CPs rose from

Rs.12,718

crore at end-March 2006 to Rs.24,444 crore as on September 30, 2006 before declining

to Rs.19,102 crore as on March 15, 2007 (Chart 40).

The weighted average discount rate (WADR) on CPs increased from 8.59 per cent

during the fortnight ended March 31, 2006 to 10.24 per cent during the fortnight

ended March 15, 2007 in tandem with the increase in the money market rates. The

discount rate on CPs moved from a range of 6.69-9.25 per cent during the fortnight

ended March 31, 2006 to 7.50-13.35 per cent during the fortnight ended March 15,

2007.

Leasing and finance companies continued to remain the pre-dominant issuers

of CPs in the absence of the access of these companies to public deposits (Table

43).

Table

43: Commercial Paper – Major Issuers | (Rupees

crore) | Category of Issuer | End

of | | March | March | June | September | December | March

# | | 2005 | 2006 | 2006 | 2006 | 2006 | 2007 |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

Leasing and Finance | 8,479 | 9,400 | 13,460 | 15,817 | 15,060 | 12,803 |

| (59.6) | (73.9) | (68.5) | (64.7) | (64.0) | (67.0) |

| | | | | | |

Manufacturing | 2,881 | 1,982 | 4,155 | 4,847 | 4,811 | 3,204 |

| (20.2) | (15.6) | (21.1) | (19.8) | (20.4) | (16.8) |

| | | | | | |

Financial Institutions | 2,875 | 1,336 | 2,035 | 3,780 | 3,665 | 3,095 |

| (20.2) | (10.5) | (10.4) | (15.5) | (15.6) | (16.2) |

| | | | | | |

Total | 14,235 | 12,718 | 19,650 | 24,444 | 23,536 | 19,102 |

| (100.0) | (100.0) | (100.0) | (100.0) | (100.0) | (100.0) |

| | | | | | |

#: As on March 15, 2007.

Note : Figures in parentheses are percentage shares in the total. |

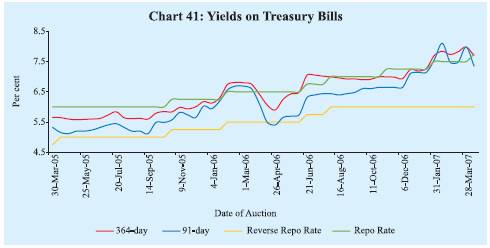

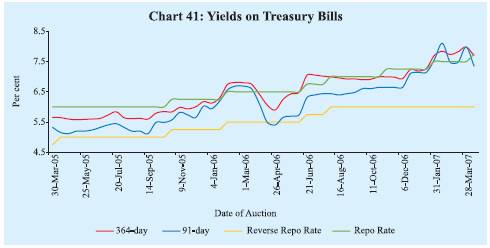

Treasury Bills

The primary market yields on Treasury

Bills (TBs) increased in the range of 117-132 basis points during 2006-07. In

the first quarter of 2006-07, yields on Treasury Bills firmed up over concerns

of higher inflation, hike of fed funds rate target, larger issuances on account

of reintroduction of the Market Stabilisation Scheme (MSS) and the hike in the

repo and reverse repo rates by 25 basis points each effective June 9, 2006. After

remaining broadly unchanged during July-November 2006, yields on Treasury Bills

increased from December 2006 following hikes in the CRR and the repo rate (Chart

41). The yield spread between

Table

44: Treasury Bills in the Primary Market | Month | Notified | Average

Implicit Yield at | Average

Bid-Cover Ratio | | Amount

(Rupees crore) | Minimum

Cut-off Price

(Per cent) | | | |

| | 91-day | 182-day

364-day | 91-day | 182-day | 364-day |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| | | | | | | |

2004-05 | 1,38,500

@ | 4.91 | – | 5.16 | 2.43 | – | 2.52 |

2005-06 | 1,55,500

@ | 5.68 | 5.82 | 5.96 | 2.64 | 2.58 | 2.45 |

April | 19,000 | 5.17 | 5.36 | 5.62 | 4.03 | 4.48 | 2.54 |

May | 15,000 | 5.19 | 5.35 | 5.58 | 3.30 | 3.37 | 2.29 |

June | 18,500 | 5.29 | 5.37 | 5.61 | 1.54 | 2.42 | 1.81 |

July | 11,500 | 5.46 | 5.67 | 5.81 | 1.21 | 1.79 | 1.68 |

August | 21,000 | 5.23 | 5.42 | 5.63 | 3.07 | 2.68 | 2.54 |

September | 23,000 | 5.24 | 5.37 | 5.70 | 1.52 | 1.45 | 1.61 |

October | 15,000 | 5.50 | 5.71 | 5.84 | 1.69 | 1.53 | 3.44 |

November | 11,000 | 5.76 | 5.85 | 5.96 | 2.12 | 1.92 | 2.30 |

December | 5,000 | 5.89 | 6.00 | 6.09 | 3.07 | 2.97 | 2.36 |

January | 5,000 | 6.25 | 6.22 | 6.21 | 2.86 | 2.83 | 2.72 |

February | 5,000 | 6.63 | 6.74 | 6.78 | 3.04 | 2.07 | 2.71 |

March | 6,500 | 6.51 | 6.66 | 6.66 | 4.17 | 3.43 | 3.36 |

2006-07 | 1,86,500@ | 6.64 | 6.91 | 7.01 | 1.97 | 2.00 | 2.66 |

April | 5,000 | 5.52 | 5.87 | 5.98 | 5.57 | 4.96 | 2.02 |

May | 18,500 | 5.70 | 6.07 | 6.34 | 1.88 | 1.84 | 1.69 |

June | 15,000 | 6.14 | 6.64 | 6.77 | 1.63 | 1.35 | 2.11 |

July | 16,500 | 6.42 | 6.75 | 7.03 | 1.82 | 1.55 | 3.12 |

August | 19,000 | 6.41 | 6.70 | 6.96 | 2.03 | 2.71 | 3.48 |

September | 15,000 | 6.51 | 6.76 | 6.91 | 1.35 | 1.80 | 2.92 |

October | 15,000 | 6.63 | 6.84 | 6.95 | 1.31 | 1.20 | 2.02 |

November | 18,500 | 6.65 | 6.92 | 6.99 | 1.33 | 1.22 | 2.49 |

December | 15,000 | 7.01 | 7.27 | 7.09 | 1.19 | 1.29 | 3.34 |

January | 19,000 | 7.28 | 7.45 | 7.39 | 1.02 | 1.35 | 1.74 |

February | 15,000 | 7.72 | 7.67 | 7.79 | 2.48 | 2.56 | 3.16 |

March | 15,000 | 7.68 | 7.98 | 7.90 | 2.08 | 2.15 | 3.87 |

@ : Total for the financial year.

Note : 1. 182-day TBs were reintroduced with effect from April

2005.

2. Notified amounts are inclusive of issuances under the Market Stabilisation

Scheme (MSS). | 364-day and 91-day TBs was 22 basis points

in March 2007, marginally higher than that in March 2006 (15 basis points) (Table

44). The notified amount of Rs.1,500 crore each for auctions of the 91-day

TBs under the MSS was not fully subscribed at some of the auctions during the

year, reflecting tight liquidity conditions. There was, however, no devolvement

on the PDs.

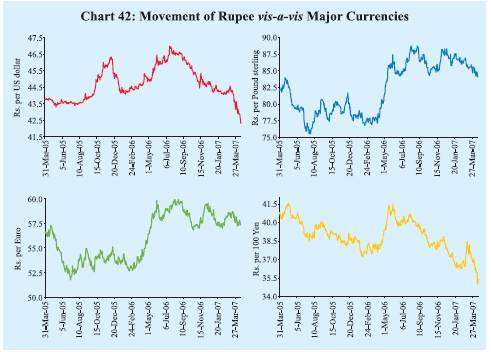

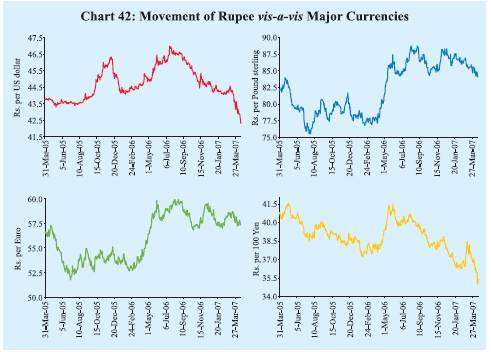

Foreign Exchange

Market

In the foreign exchange market, the Indian rupee exhibited

two-way movements during 2006-07 moving in a range of Rs.43.14–46.97 per

US dollar (Chart 42). The rupee initially depreciated against

the US dollar during the year, reaching Rs.46.97 on July 19, 2006, reflecting

higher crude oil prices, FII outflows and geo-political risks in the Middle East

region. The rupee, however, strengthened thereafter on the back of moderation

in crude oil prices, revival of FII inflows and weakness of the US dollar in the

international markets. The rupee appreciated further in the second half of March

2007 to reach Rs.43.14 per US dollar on March 28, 2007, due to increased supply

of dollars in the market. The exchange rate at Rs.43.60 per US dollar as on March

30, 2007 recorded an appreciation of

2.3

per cent over its level as on March 31, 2006 (Rs.44.61 per US dollar). Reflecting

cross-currency movements, the rupee depreciated by 9.1 per cent against the Pound

sterling and 6.8 per cent against the euro but appreciated by 2.7 per cent against

the Japanese yen over the same period. The exchange rate was Rs.41.91 per US dollar

as on April 18, 2007.

The nominal effective exchange rate (NEER) of the

Indian rupee (six-currency trade-based weights) appreciated by 3.1 per cent between

April 2006 and April 18, 2007. Over the same period, the real effective exchange

rate (REER) of the Indian rupee (six-currency trade-based weights) appreciated

by 7.8 per cent (Table 45).

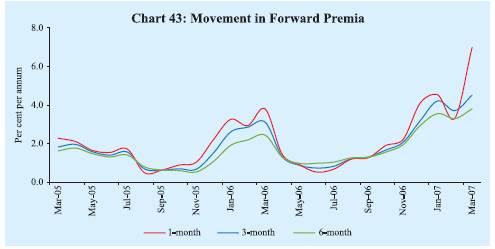

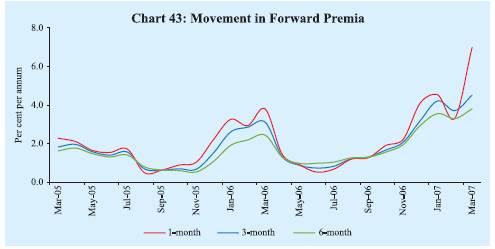

Forward premia increased

during 2006-07 reflecting growing interest rate differential in view of increase

in domestic interest rates (Chart 43). While one-month

forward premia increased from 3.79 per cent in March 2006 to 6.99 per cent in

March 2007, the six-month premia increased from 2.43 per cent to 3.80 per cent

over the same period.

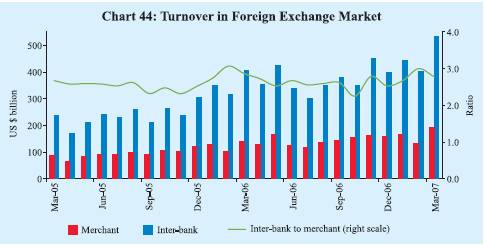

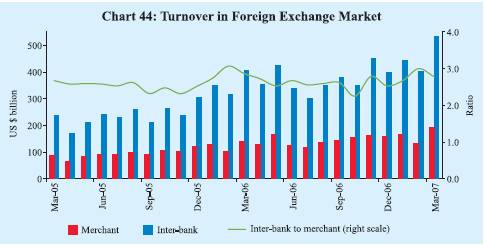

The turnover in the inter-bank segment of the foreign

exchange market increased from US $ 405 billion in March 2006 to US $ 533 billion

in March 2007 and that in the merchant segment from US $ 141 billion to US $ 192

billion

Table

45: Indices of Nominal and Real Effective

Exchange Rate of the Indian Rupee

(6-Currency Trade Based Weights) | Year/Month | Base

: 1993-94 (April-March) = 100 | NEER | | REER |

1 | 2 | | 3 |

| | | |

1993-94 | 100.00 | | 100.00 |

2000-01 | 77.30 | | 102.64 |

2001-02 | 75.89 | | 102.49 |

2002-03 | 71.09 | | 97.43 |

2003-04 | 69.75 | | 98.85 |

2004-05 | 69.26 | | 101.35 |

2005-06 | 71.41 | | 106.67 |

2006-07 (P) | 68.13 | | 104.91 |

March 2006 | 71.61 | | 108.11 |

April 2006 | 70.22 | | 104.12 |

May 2006 | 67.95 | | 101.91 |

June 2006 | 67.39 | | 101.79 |

July 2006 | 66.79 | | 101.26 |

August 2006 (P) | 66.28 | | 101.20 |

September 2006 (P) | 67.04 | | 103.86 |

October 2006 (P) | 68.31 | | 106.49 |

November 2006 (P) | 68.53 | | 107.12 |

December 2006 (P) | 68.01 | | 105.99 |

January 2007 (P) | 68.97 | | 108.20 |

February 2007(P) | 69.10 | | 108.57 |

March 2007(P) | 68.91 | | 108.35 |

April 18, 2007 (P) | 72.40 | | 112.21 |

NEER: Nominal Effective Exchange

Rate.

REER: Real Effective Exchange Rate.

P: Provisional.

Note:

Rise in indices indicates appreciation of the rupee and vice versa. |

(Chart 44). The ratio of inter-bank to merchant

turnover at 2.8 during 2006-07 was almost the same as in 2005-06.

Credit

Market

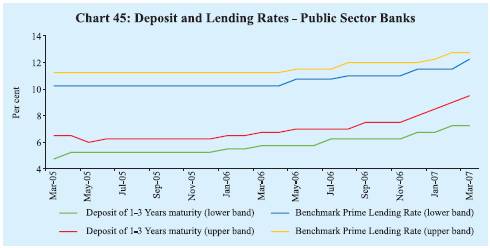

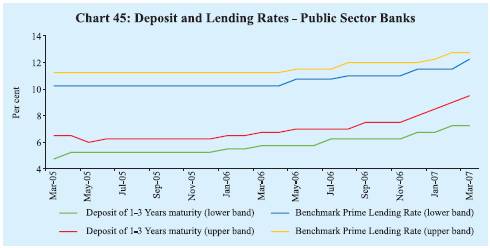

Both the deposit and lending rates of scheduled commercial

banks (SCBs) increased during 2006-07. Interest rates offered by public sector

banks (PSBs) on deposits of maturity of one year to three years were placed in

the range of 7.25-9.50 per cent in March 2007 as compared with 5.75-6.75 per cent

in March 2006, while those on deposits of maturity of above three years were placed

in the range of 7.50-9.50 per cent in March 2007 as compared with 6.00-7.25 per

cent in March 2006 (Table 46 and Chart 45). Similarly, interest rates offered

by private sector banks on deposits of maturity of one year to three years were

placed higher in the range of 6.75-9.75 per cent in March 2007 as compared with

5.50-7.75 per cent in March 2006, while those on deposits of maturity above three

years were placed in the range of 7.75-9.60 per cent in March 2007 as compared

with 6.00-7.75 per cent in March 2006. The rates offered by foreign banks on deposits

of maturity of one year to three years were placed in the range of 3.50-9.50 per

cent in March 2007 as compared with 4.00-6.50 per cent in March 2006. As

regards lending rates, the Benchmark Prime Lending Rates (BPLRs) of PSBs were

placed in the range of 12.25-12.75 per cent in March 2007 as compared with that

of 10.25-11.25 per cent in March 2006 (Table 46). The weighted

average BPLR of public sector banks increased from 10.7 per cent in March 2006

to 11.6 per cent in December 2006 and further to 12.5 per cent in March 2007.

Over the same period, the weighted average BPLR of private sector banks increased

from 12.4 per cent in March 2006 to 13.2 per cent in December 2006 and further

to 14.1 per cent in March 2007. The weighted average BPLR of foreign banks

at 12.7 per cent in March 2007 was the same as in December 2006 and in March 2006.

Table

46: Deposit and Lending Rates | (Per

cent) | Interest

Rate | March

2005 | March

2006 | June

2006 | September

2006 | December

2006 | March2007 |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

1. | Domestic

Deposit Rate | | | | | | |

| Public

Sector Banks | | | | | | |

| Up

to 1 year | 2.75-6.00 | 2.25-6.50 | 2.75-6.50 | 2.75-7.00 | 2.75-7.00 | 2.75-8.75 |

| More

than 1 year and up to 3 years | 4.75-6.50 | 5.75-6.75 | 5.75-7.00 | 6.25-7.50 | 6.75-8.00 | 7.25-9.50 |

| More

than 3 years | 5.25-7.00 | 6.00-7.25 | 6.00-7.25 | 6.50-8.00 | 7.00-8.00 | 7.50-9.50 |

| Private

Sector Banks | | | | | | |

| Up

to 1 year | 3.00-6.25 | 3.50-7.25 | 3.50-6.75 | 3.00-7.25 | 3.00-8.00 | 3.00-9.00 |

| More

than 1 year and up to 3 years | 5.25-7.25 | 5.50-7.75 | 6.50-7.75 | 6.75-8.25 | 6.40-8.50 | 6.75-9.75 |

| More

than 3 years | 5.75-7.00 | 6.00-7.75 | 6.50-8.25 | 6.75-8.50 | 7.00-8.50 | 7.75-9.60 |

| Foreign

Banks | | | | | | |

| Up

to 1 year | 3.00-6.25 | 3.00-6.15 | 3.25-6.50 | 3.00-7.50 | 3.00-7.25 | 3.00-9.50 |

| More

than 1 year and up to 3 years | 3.50-6.50 | 4.00-6.50 | 5.00-6.50 | 3.50-8.15 | 3.50-8.15 | 3.50-9.50 |

| More

than 3 years | 3.50-7.00 | 5.50-6.50 | 5.50-6.75 | 4.00-8.25 | 4.05-8.25 | 4.05-9.50 |

| | | | | | | |

2. | Benchmark

Prime Lending Rate | | | | | | |

| Public

Sector Banks | 10.25-11.25 | 10.25-11.25 | 10.75-11.50 | 11.00-12.00 | 11.50-12.00 | 12.25-12.75 |

| Private

Sector Banks | 11.00-13.50 | 11.00-14.00 | 11.00-14.50 | 11.50-15.00 | 11.50-15.00 | 12.00-16.50 |

| Foreign

Banks | 10.00-14.50 | 10.00-14.50 | 10.00-14.50 | 10.00-14.50 | 10.00-14.50 | 10.00-15.50 |

| | | | | | | |

3. | Actual

Lending Rate* | | | | | | |

| Public

Sector Banks | 2.75-16.00 | 4.00-16.50 | 4.00-16.50 | 4.00-16.50 | 4.00-16.50 | – |

| Private

Sector Banks | 3.15-22.00 | 3.15-20.50 | 3.15-26.00 | 3.15-24.00 | 3.15-24.00 | – |

| Foreign

Banks | 3.55-23.50 | 4.75-26.00 | 4.75-25.00 | 4.50-23.00 | 4.50-26.50 | – |

* : Interest rate on non-export

demand and term loans above Rs.2 lakh excluding lending rates at the extreme five

per cent on both sides.

– : Not available. |

Government

Securities Market

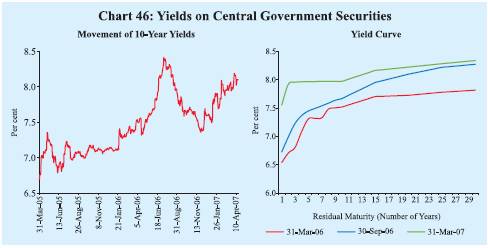

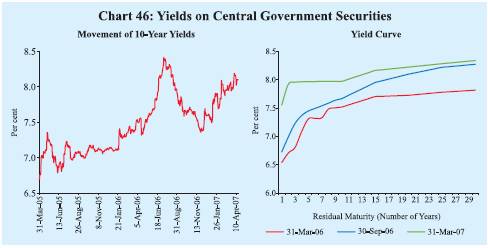

The yields in the Government securities market

hardened during 2006-07. Yields moved up from mid-April 2006 reflecting sustained

credit demand, monetary policy tightening in the US and other economies, volatile

crude oil prices, apprehensions over domestic fuel price hike, and hike in the

reverse repo rate by 25 basis points effective June 9, 2006. Reflecting these

factors, yields on 10-year paper reached an intra-year peak of 8.40 per cent on

July 11, 2006, an increase of 88 basis points over end-March 2006. Subsequently,

yields softened in consonance with easing of Government bond yields in the US,

the Fed’s decision to keep the fed funds rate target unchanged since end-June

2006, easing of crude oil prices, increased demand for gilts from banks to meet

their SLR requirements and the announcement of the borrowing calendar of the Central

Government for the second half of 2006-07 which was in accordance with market

expectations. The 10-year yield reached a low of 7.38 per cent as on November

28, 2006. There was again some hardening of the yields from the second half of

December 2006 in tandem with tightness in domestic liquidity conditions on the

back of advance tax outflows, higher inflation and hikes in the CRR. The 10-year

yield was 7.97 per cent as on March 31, 2007, 45 basis points higher than the

level as on March 31, 2006 (7.52 per cent) (Chart 46).

The yield was 8.07 per cent as on April 18, 2007. The yield curve flattened during

2006-07, with the spread between 1-10 year yields narrowing down to 42 basis points

at end-March 2007 from 98 basis pints at end-March 2006. The spread between 10-year

and 30-year yields, however, widened to 37 basis points at end-March 2007 from

30 basis points at end-March 2006.

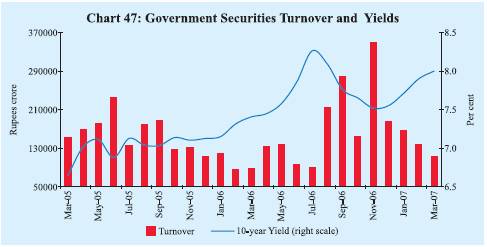

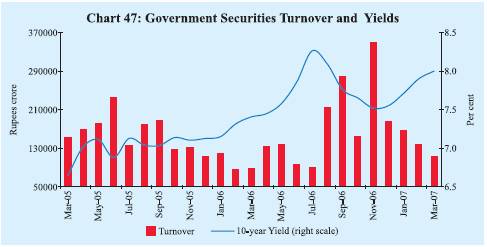

The turnover in the Government securities

market continued to be influenced by trends in yields. The turnover remained subdued

during April-July 2006 as

banks

preferred to hold securities, rather than trade, in an environment of hardening

of yields. The turnover, however, increased during August-November 2006 (the highest

since June 2005) as yields trended downwards. The decline in turnover in October

2006 partly reflected lower number of trading days. The turnover again turned

subdued from December 2006 as yields started hardening (Chart

47).

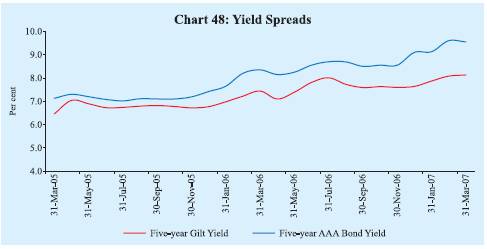

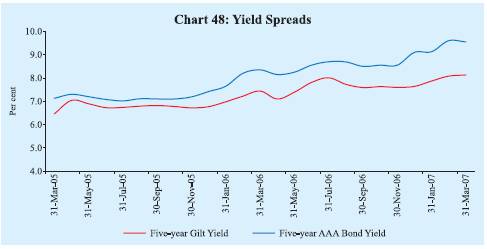

The yields on 5-year AAA-rated corporate bonds increased during

2006-07 in tandem with higher Government securities yield. The yield spread between

5-year AAA-rated bonds and 5-year Government securities, however, widened to 142

basis points at end-March 2007 from that of 91 basis points at end-March 2006

(Chart 48).

Equity

Market

Primary Market

Resources raised through the public

issues increased by 20.2 per cent to Rs.32,382 crore during 2006-07 (Table

47). The average size of issues increased to Rs.272 crore from Rs.195 crore

during the corresponding period of the previous year. All issues, except one,

during 2006-07 were by non-Government public limited companies (private sector)

and mostly by non-financial companies. Out of 119 issues during the year, 75 issues

were initial public offerings (IPOs) constituting 85.0 per cent of total resource

mobilisation.

Mobilisation of resources through private placement increased

by 50.8 per cent to Rs.1,03,169 crore during April-December 2006 over the corresponding

period of the previous year (Table 47). This was mainly

on account of a near doubling of resources mobilised by private sector entities

to Rs.59,796 crore. Resources raised by public sector entities increased by only

11.4 per cent. Private sector entities, thus, raised more resources than public

sector entities in contrast to the trend in 2005-06. Financial intermediaries

(both from public sector and private sector) continued to account for the bulk

of resource mobilisation from the private placement market (69.4 per cent of the

total during April-December 2006 as compared with 64.1 per cent during April-December

2005).

Table

47: Mobilisation of Resources from the Primary Market |

(Amount in Rupees crore) |

Item | No.

of Issues | Amount | No.

of Issues | Amount |

1 | 2 | 3 | 4 | 5 |

| 2005-06 | | 2006-07

P | | A. | Prospectus

and Rights Issues* | | | | |

| 1. | Private

Sector (a+b) | 131 | 21,154 | 118 | 31,600 |

| | a) | Financial | | 11 | 7,746 | 9 | 2,420 |

| | b) | Non-financial | 120 | 13,408 | 109 | 29,180 |

| 2. | Public

Sector (a+b+c) | 7 | 5,786 | 1 | 782 |

| | a) | Public

Sector Undertakings | – | – | – | – |

| | b) | Government

Companies | 1 | 373 | – | – |

| | c) | Banks/Financial

Institutions | 6 | 5,413 | 1 | 782 |

| 3. | Total

(1+2) | | 138 | 26,940 | 119 | 32,382 |

| | Of

which: (i) | Equity | 136 | 26,695 | 116 | 31,535 |

| | | (ii) | Debt | 2 | 245 | 3 | 847 |

B. | Private

Placement@ | | | | |

| 1. | Private

Sector | 673 | 29,501 | 1,111 | 59,796 |

| | a) | Financial | | 281 | 18,191 | 450 | 35,887 |

| | b) | Non-financial | 392 | 11,310 | 661 | 23,909 |

| 2. | Public

Sector | 108 | 38,926 | 84 | 43,373 |

| | a) | Financial | | 84 | 25,677 | 71 | 35,734 |

| | b) | Non-financial | 24 | 13,249 | 13 | 7,639 |

| 3. | Total

(1+2) | | 781 | 68,427 | 1,195 | 1,03,169 |

| | Of

which: (i) | Equity | 1 | 150 | 1 | 57 |

| | | (ii) | Debt | 780 | 68,277 | 1,194 | 1,03,112 |

C. | Euro

Issues | | 48 | 11,352 | 40 | 17,005 |

P : Provisional. * : Excluding offers for

sale.

– : Nil/Negligible. @: Data pertain to April-December. |

Table

48: Resource Mobilisation by Mutual Funds | (Rupees

crore) | Mutual Fund | 2005-06 | 2006-07 |

Net | Net | Net | Net |

Mobilisation @ | Assets | Mobilisation

@ | Assets | 1 | 2 | 3 | 4 | 5 |

| | | | |

Private Sector | 42,977 | 1,81,515 | 79,038 | 2,62,079 |

Public Sector | 6,379 | 20,829 | 7,621 | 28,725 |

UTI | 3,424 | 29,519 | 7,326 | 35,488 |

Total | 52,780 | 2,31,862 | 93,985 | 3,26,292 |

@: Net of redemptions.

Source:

Securities and Exchange Board of India. | The

resources raised through Euro issues - American Depository Receipts (ADRs) and

Global Depository Receipts (GDRs) - by Indian corporates increased by 49.8 per

cent to Rs.17,005 crore during 2006-07.

During 2006-07, net mobilisation of

resources by mutual funds increased substantially by 78.1 per cent to Rs.93,985

crore over the corresponding period of previous year (Table 48).

Bulk of the net mobilisation of funds (68.2 per cent of total) was under income/debt-oriented

schemes, while growth/equity-oriented schemes accounted for 30.0 per cent of the

net mobilisation of funds.

Secondary Market

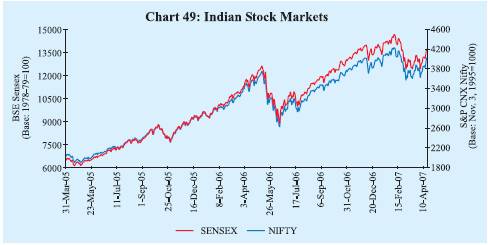

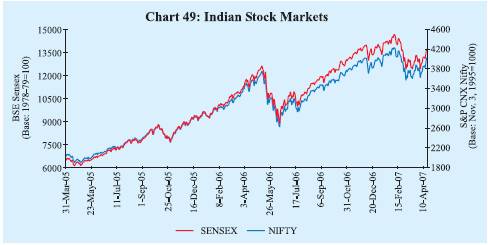

The domestic

stock markets recorded further gains during 2006-07 (Chart

49). FIIs investments in the domestic stock markets during 2006-07 were lower

than a year ago. Mutual funds investments in the domestic stock markets were also

lower than a year ago. Growth in corporate profitability remained buoyant.

Stock

market gains were interspersed by some sharp corrections during the course of

the year. In consonance with the trends in global equity markets, domestic stock

markets witnessed correction during May-June 2006, December 2006 and February/

March 2007. The BSE Sensex reached an intra-year low of 8929 as on June 14, 2006,

a decline of 29.2 per cent over the then all-time high of 12612 reached on May

10, 2006. The stock markets recouped these losses in the subsequent months and

the BSE Sensex reached an all-time high of 14652 on February 8, 2007. The markets,

however, witnessed some correction thereafter. The BSE Sensex closed at 13072

on March 30, 2007. The BSE Sensex, thus, increased by 15.9 per cent during 2006-07

(year-on-year) as compared with a gain of 73.7 per cent during 2005-06. The BSE

Sensex was 13672 as on April 18, 2007.

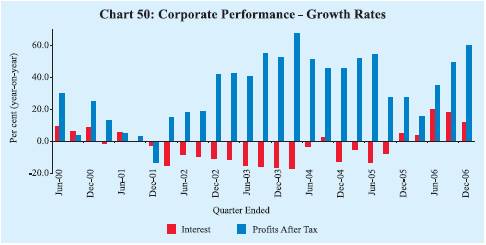

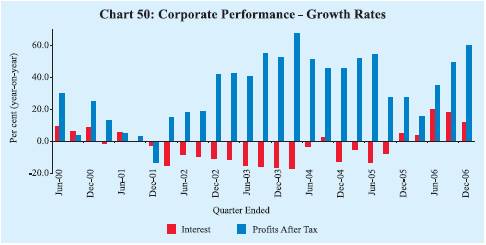

Profits after tax of corporates

improved sharply in each of the first three quarters of 2006-07. Profits after

tax of select non-Government non-financial companies increased by 48.7 per cent

during April-December 2006 on top of 36.8 per cent growth recorded in the corresponding

period of 2005. Ratio of profits after tax to sales improved to 11.0 per cent

during the quarter ended December 2006 from 8.6 per cent a year ago (Table

49 and Chart 50).

Table

49: Corporate Financial Performance | (Growth

rates in per cent) | Item | 2004-05 | 2005-06 | 2005 | 2006 | 2005-06

| 2006-07 |

April-December | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

Sales | | 24.1 | 16.9 | 16.1 | 28.9 | 18.5 | 16.4 | 13.2 | 19.5 | 25.6 | 29.2 | 30.3 |

Expenditure | 21.9 | 16.4 | 15.6 | 26.3 | 18.0 | 16.3 | 12.7 | 18.9 | 24.6 | 26.6 | 26.9 |

Depreciation Provision | 11.2 | 10.2 | 7.0 | 16.7 | 4.4 | 7.4 | 10.2 | 13.2 | 14.9 | 16.4 | 16.8 |

Gross Profits | 32.5 | 20.3 | 24.8 | 45.4 | 32.0 | 19.1 | 21.2 | 16.6 | 33.9 | 45.9 | 51.8 |

Interest | | -5.8 | 1.9 | -5.5 | 17.7 | -13.5 | -8.0 | 4.6 | 3.8 | 19.9 | 18.0 | 11.9 |

Profits After Tax | 51.2 | 24.2 | 36.8 | 48.7 | 54.2 | 27.5 | 27.0 | 15.1 | 34.7 | 49.4 | 59.5 |

Select Ratios (Per

cent) | Gross Profits

to Sales | 11.9 | 13.0 | 13.8 | 16.1 | 13.1 | 13.0 | 12.8 | 12.7 | 15.6 | 15.9 | 15.8 |

Profits After Tax to Sales | 7.2 | 8.7 | 9.1 | 11.1 | 8.6 | 8.5 | 8.6 | 8.7 | 10.6 | 11.0 | 11.0 |

Interest Coverage Ratio | 4.6 | 6.4 | 6.1 | 7.8 | 6.0 | 6.2 | 6.2 | 7.3 | 7.2 | 7.8 | 8.0 |

Interest to Sales | 2.6 | 2.0 | 2.3 | 2.1 | 2.2 | 2.1 | 2.1 | 1.7 | 2.2 | 2.0 | 2.0 |

Interest to Gross Profits | 21.8 | 15.7 | 16.4 | 12.9 | 16.6 | 16.2 | 16.2 | 13.7 | 13.9 | 12.8 | 12.5 |

Memo: | (Amount

in Rupees crore) | No. of Companies | 2,214 | 2,210 | 2,251 | 1,933 | 2,355 | 2,361 | 2,366 | 2,415 | 2,228 | 2,263 | 2,258 |

Sales | | 5,49,449 | 7,74,578 | 5,79,881 | 6,80,662 | 1,94,608 | 2,12,693 | 2,19,098 | 2,49,971 | 2,34,610 | 2,51,125 | 2,60,064 |

Expenditure | 5,14,574 | 6,66,690 | 4,95,284 | 5,64,331 | 1,66,972 | 1,83,717 | 1,88,934 | 2,18,511 | 1,95,556 | 2,09,437 | 2,16,053 |

Depreciation Provision | 22,697 | 28,883 | 22,044 | 24,557 | 7,137 | 7,617 | 7,748 | 8,340 | 8,449 | 8,892 | 9,172 |

Gross Profits | 65,301 | 1,00,666 | 79,937 | 1,09,432 | 25,577 | 27,620 | 28,135 | 31,652 | 36,567 | 40,041 | 41,169 |

Interest | | 14,268 | 15,789 | 13,095 | 14,137 | 4,241 | 4,467 | 4,555 | 4,348 | 5,083 | 5,121 | 5,162 |

Profits After Tax | 39,599 | 67,506 | 52,891 | 75,460 | 16,726 | 18,169 | 18,790 | 21,634 | 24,845 | 27,710 | 28,698 |

Note :

1. Growth rates

are percentage changes in the level for the period under reference over the corresponding

period of the previous year.

2. Data in column (2) are based on audited balance

sheets, while those in column (3) onwards are based on the abridged results of

the sample non-Government non-financial companies.

3. Data for the full year

and for the nine months period may not add to the quarterly totals due to difference

in the number of companies covered. |

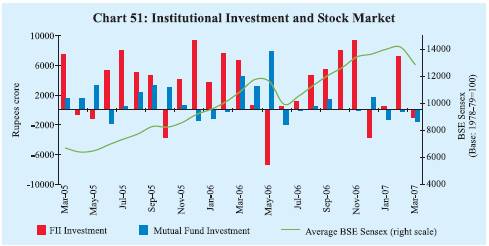

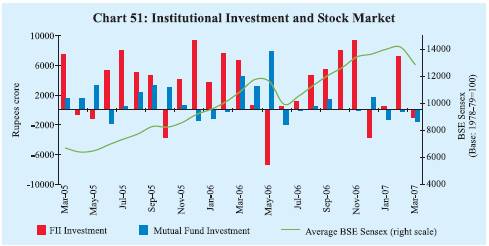

According

to the Securities and Exchange Board of India (SEBI), FIIs made net purchases

of Rs.25,236 crore (US $ 6.0 billion) during 2006-07 on top of net purchases of

Rs.48,542 crore (US $ 11.0 billion) during the previous year. Mutual funds also

made net investments of Rs.9,024 crore during 2006-07 as compared with net purchases

of Rs.14,302 crore during the previous year (Chart 51).

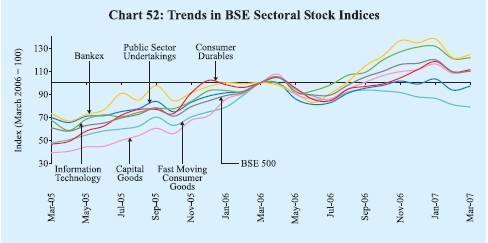

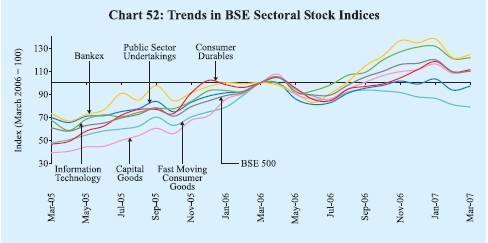

Major stock indices and sectors showed mixed trends during 2006-07 (Chart

52). On a point-to-point basis, the BSE 500 and the BSE Mid-cap increased by 9.7

per cent and 0.7 per cent, respectively, while the BSE Small-cap declined

by 1.9 per cent. Amongst major sectors, oil and gas stocks recorded gains of 30.5

per cent, followed by bank stocks (24.2 per cent), IT (21.6 per cent), consumer

durables (11.1 per cent) and capital goods (11.1 per cent). However, losses were

noticed in the fast moving consumer goods sector (21.4 per cent), auto sector

stocks (8.7 per cent), healthcare (5.4 per cent), metals (4.3 per cent) and PSUs

(3.2 per cent).

The price-earnings (P/E) ratio for the 30 scrips included

in the BSE Sensex declined from 20.9 at end-March 2006 to 20.3 at end-March 2007

(Table 50). The market capitalisation of the BSE increased

by 17.3 per cent between end-March 2006 and end-March 2007.

Table

50: Stock Market Indicators | Indicator | | BSE | | | NSE | |

2004-05 | 2005-06 | 2006-07 | 2004-05 | 2005-06 | 2006-07 |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

BSE Sensex / S&P CNX Nifty* | | | | | | |

End-period | 6493 | 11280 | 13072 | 2036 | 3403 | 3822 |

Average | 5741 | 8280 | 12277 | 1805 | 2513 | 3572 |

Volatility# (Per cent) | 11.2 | 16.7 | 9.0 | 11.3 | 15.6 | 10.5 |

P/E Ratio (end-period)* | 15.6 | 20.9 | 20.3 | 14.6 | 20.3 | 18.4 |

Turnover (Rupees crore) | 5,18,716 | 8,16,074 | 9,56,185 | 11,40,071 | 15,69,556 | 19,44,645 |

Market Capitalisation | | | | | | |

(Rupees crore) (end-period) | 16,98,429 | 30,22,190 | 35,45,041 | 15,85,585 | 28,13,201 | 33,67,350 |

* : For 30 scrips included in

the BSE Sensex and 50 scrips included in the S&P CNX Nifty.

# : Volatility

is measured by coefficient of variation.

Source : Bombay

Stock Exchange Limited (BSE) and National Stock Exchange of India Limited (NSE). |

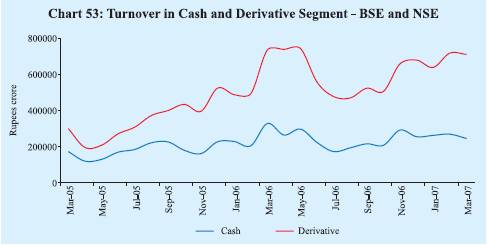

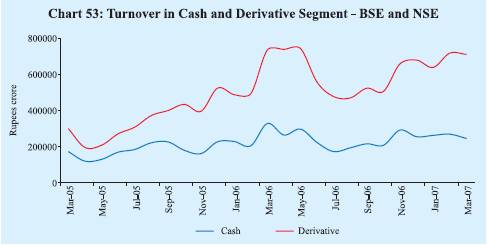

Total turnover (BSE and NSE) in the cash segment during 2006-07 at

Rs.29,00,830 crore was 21.7 per cent higher than that in the corresponding period

of 2005-06 (Chart 53). Total turnover (BSE and NSE) in

the derivative segment increased by 53.7 per cent during 2006-07 to Rs.74,15,448

crore.

|

IST,

IST,