“Overcoming poverty is not a gesture of charity. It is an act of justice. It is the protection of a fundamental human right, the right to dignity and a decent life. While poverty persists, there is no true freedom.

Sometimes it falls upon a generation to be great. You can be that great generation. Let your greatness blossom. Of course, the task will not be easy. But not to do this would be a crime against humanity, against which I ask all humanity now to rise up."

- Nelson Mandela

“The test of our progress is not whether we add more to the abundance of those who have much; it is whether we provide enough for those who have too little.”

- Franklin D. Roosevelt

“Poverty is the worst form of violence.”

- Mahatma Gandhi

“If the misery of the poor be caused not by the laws of nature, but by our institutions, great is our sin.”

- Charles Darwin

Introduction

The Government of India and the Reserve Bank of India have been making concerted efforts to promote financial inclusion as one of the important national objectives of the country. Some of the major efforts made in the last five decades include - nationalization of banks, building up of robust branch network of scheduled commercial banks, co-operatives and regional rural banks, introduction of mandated priority sector lending targets, lead bank scheme, formation of self-help groups, permitting BCs/BFs to be appointed by banks to provide door step delivery of banking services, zero balance BSBD accounts, etc. The fundamental objective of all these initiatives is to reach the large sections of the hitherto financially excluded Indian population.

The speech is organized in five sections:

Section 1 - Definitions

Section 2 - Extent of Financial Exclusion

Section 3 – RBI Policy Initiatives and Progress in Financial Inclusion

Section 4 – Stakeholder-wise Issues in Financial Inclusion

Section 5 – Conclusion and Way forward

Section - 1

Definitions

1.1 Financial inclusion may be defined as the process of ensuring access to financial services and timely and adequate credit where needed by vulnerable groups such as weaker sections and low income groups at an affordable cost (The Committee on Financial Inclusion, Chairman: Dr. C. Rangarajan).

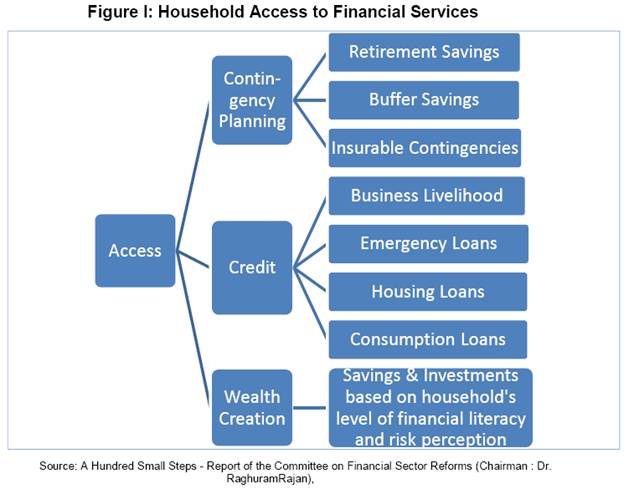

1.2 Financial Inclusion, broadly defined, refers to universal access to a wide range of financial services at a reasonable cost. These include not only banking products but also other financial services such as insurance and equity products (The Committee on Financial Sector Reforms, Chairman: Dr.Raghuram G. Rajan). Household access to financial services is depicted in Figure I.

1.3 The essence of financial inclusion is to ensure delivery of financial services which include - bank accounts for savings and transactional purposes, low cost credit for productive, personal and other purposes, financial advisory services, insurance facilities (life and non-life) etc.

Why Financial Inclusion ?

1.4 Financial inclusion broadens the resource base of the financial system by developing a culture of savings among large segment of rural population and plays its own role in the process of economic development. Further, by bringing low income groups within the perimeter of formal banking sector; financial inclusion protects their financial wealth and other resources in exigent circumstances. Financial inclusion also mitigates the exploitation of vulnerable sections by the usurious money lenders by facilitating easy access to formal credit.

1.5 In rural areas, the Gini’s2 coefficient rose to 0.28 in 2011-12 from 0.26 in 2004-05 and during the same period to an all-time high of 0.37 from 0.35 in urban areas.

Section 2

Extent of Financial Exclusion

In this section, the extent of financial exclusion from different perspectives / angularities is presented based on five different data sources viz.:

(a) NSSO 59th Round Survey Results,

(b) Government of India Population Census 2011,

(c) CRISIL-Inclusix

(d) RBI Working Paper Series Study on ‘Financial Inclusion in India: A Case-study of West Bengal’ and

(e) World Bank ‘Financial Access Survey’ Results.

NSSO 59th Round Survey Results3

-

51.4% of farmer households are financially excluded from both formal/ informal sources.

-

Of the total farmer households, only 27% access formal sources of credit; one third of this group also borrowed from non-formal sources.

-

Overall, 73% of farmer households have no access to formal sources of credit.

-

Across regions, financial exclusion is more acute in Central, Eastern and North-Eastern regions. All three regions together accounted for 64% of all financially excluded farmer households in the country. Overall indebtedness to formal sources of finance of these three regions accounted for only 19.66%.

-

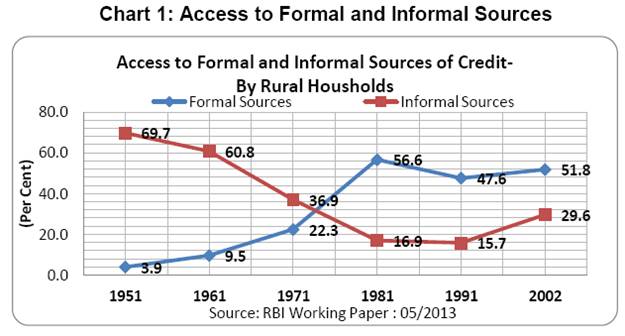

However, over the period of five decades, there has been overall improvement in access to formal sources4 of credit by the rural households (Chart 1).

2.2 Government of India Population Census 2011

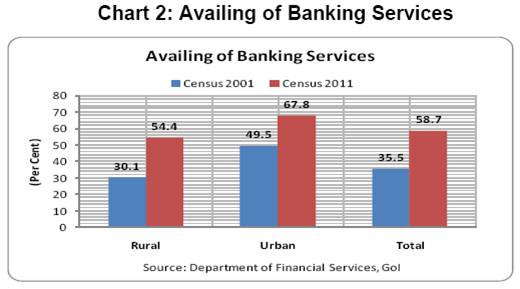

- As per census 2011, only 58.7% of households are availing banking services in the country. However, as compared with previous census 2001, availing of banking services increased significantly largely on account of increase in banking services in rural areas (Chart 2).

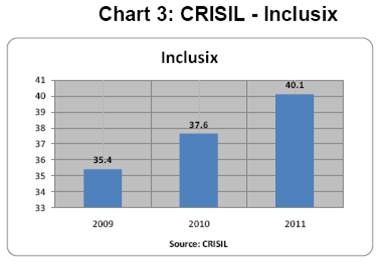

2.3 CRISIL Financial Inclusion Index (Inclusix)

-

In June 2013, CRISIL first time published a comprehensive financial inclusion index (viz.,Inclusix). For constructing the index, CRISIL identified three critical parameters of basic banking services namely branch penetration5, deposit penetration6 and credit penetration7.

-

The CRISIL Inclusix indicate that there is an overall improvement in the financial inclusion in India (Chart 3).

-

CRISIL –Inclusix (on a scale of 100) increased from 35.4 in March 2009 to 37.6 in March 2010 and to 40.1 in March 2011.

2.4 RBI Working Paper Study

- Sadhan Kumar8 (2011) worked out an Index on financial inclusion (IFI) based on three variables namely penetration (number of adults having bank account), availability of banking services (number of bank branches per 1000 population) and usage (measured as outstanding credit and deposit). The results indicate that Kerala, Maharashtra and Karnataka has achieved high financial inclusion (IFI >0.5), while Tamil Nadu, Punjab, A.P, H.P, Sikkim, and Haryana identified as a group of medium financial inclusion (0.3 <0.5) and the remaining states have very low financial inclusion.

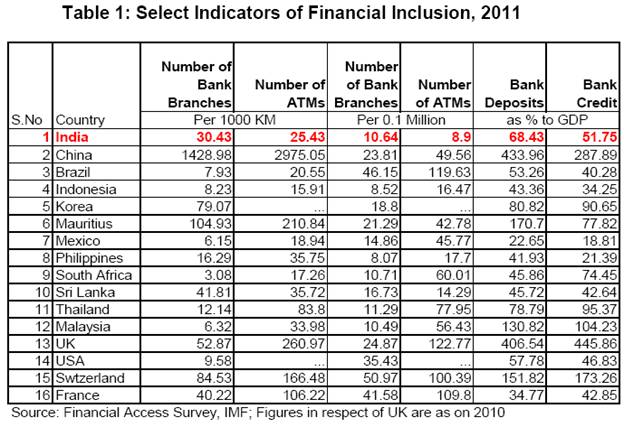

2.5 World Bank ‘Financial Access Survey’ Results

- From the table 1 given below, it would be observed that in our country, financial exclusion measured in terms of bank branch density, ATM density, bank credit to GDP and bank deposits to GDP is quite low as compared with most of developing countries in the world.

Section – 3

3.1. Financial Inclusion – RBI Policy Initiatives

- RBI has adopted a bank-led model for achieving financial inclusion and removed all regulatory bottle necks in achieving greater financial inclusion in the country. Further, for achieving the targeted goals, RBI has created conducive regulatory environment and provided institutional support for banks in accelerating their financial inclusion efforts (Box-I).

Box-I :Financial Inclusion Initiatives

-

Advised all banks to open Basic Saving Bank Deposit (BSBD) accounts with minimum common facilities such as no minimum balance, deposit and withdrawal of cash at bank branch and ATMs, receipt/ credit of money through electronic payment channels, facility of providing ATM card.

-

Relaxed and simplified KYC norms to facilitate easy opening of bank accounts, especially for small accounts with balances not exceeding Rs. 50,000 and aggregate credits in the accounts not exceeding Rs. one lakh a year. Further, banks are advised not to insist on introduction for opening bank accounts of customers. In addition, banks are allowed to use Aadhar Card as a proof of both identity and address9.

-

Simplified Branch Authorization Policy, to address the issue of uneven spread bank branches, domestic SCBs are permitted to freely open branches in Tier 2 to Tier 6 centers with population of less than 1 lakh under general permission, subject to reporting. In North-Eastern Sates and Sikkim domestic SCBs can open branches without having any permission from RBI. With the objective of further liberalizing, general permission to domestic scheduled commercial banks (other than RRBs) for opening branches in Tier 1 centres, subject to certain conditions.

-

Compulsory Requirement of Opening Branches in Un-banked Villages, banks are directed to allocate at least 25% of the total number of branches to be opened during the year in un-banked (Tier 5 and Tier 6) rural centers.

-

Opening of intermediate brick and mortar structure, for effective cash management, documentation, redressal of customer grievances and close supervision of BC operations, banks have been advised to open intermediate structures between the present base branch and BC locations. This branch could be in the form of a low cost simple brick and mortar structure consisting of minimum infrastructure such core banking solution terminal linked to a pass book printer and a safe for cash retention for operating larger customer transactions.

-

Public and private sector banks had been advised to submit board approved three year Financial Inclusion Plan (FIP) starting from April 2010. These policies aim at keeping self-set targets in respect of rural brick and mortar branches opened, BCs employed, coverage of un-banked villages with population above 2000 and as well as below 2000, BSBD accounts opened, KCCs, GCCs issued and others. RBI has been monitoring these plans on a monthly basis.

-

Banks have been advised that their FIPs should be disaggregated and percolated down up to the branch level. This would ensure the involvement of all stakeholders in the financial inclusion efforts.

-

In June 2012, revised guidelines on Financial Literacy Centres (FLCs). Accordingly, it was advised that FLCs and all the rural branches of scheduled commercial banks should scale up financial literacy efforts through conduct of outdoor Financial Literacy Camps at least once a month, to facilitate financial inclusion through provision of two essentials i.e. ‘Financial Literacy’ and easy ‘Financial Access’. Accordingly, 718 FLCs have been set up as at end of March 2013. A total of 2.2 million people have been educated through awareness camps / choupals, seminars and lectures during April 2012 to March 2013.

3.2. Recent Measures –

-

Licensing of New Banks: The present round of licensing new banks is essentially aimed at giving further fillip to financial inclusion efforts in our country. Innovative business models aimed at furthering financial inclusion efforts would be looked into closely in processing applications for banking license. Financial inclusion plan would be an important criterion for procuring new bank licenses (Dr. D Subbarao).

-

Discussion Paper on Banking Structure in India – The Way Forward: The RBI has put out a discussion paper in August 2013 on Banking Structure for public comments. One of the main issues relates to “Differentiated Banking Licenses”. The subject of licensing ‘small banks and financial inclusion’ has been discussed therein. A view will be taken by RBI after factoring in the comments/suggestions received from the general public.

-

In this context, it needs to be mentioned that Urban Co-operative Banks (UCBs), Regional Rural Banks (RRBs) and Local Area Banks (LABs) numbering 1606, 64, and 4 respectively are, in fact, Small Finance Banks operating in this country. These apart, there is a 3- Tier rural co-operative structure with State Co-operative Central Banks (SCCBs) at the apex, District Central Co-operative Banks(DCCBs) at the intermediary level and Primary Agricultural Credit Societies (PACs) at the grass root level, which number 31, 371 and 92,432 respectively. Furthermore, we have around 12,225 NBFCs as on March 2013, which could be conceptually construed as semi-banks undertaking predominantly credit/investment activities.

3.3. Progress in Financial Inclusion

- Progress of financial inclusion since the launch of financial inclusion plans clearly indicates that banks are progressing in areas like opening of banking outlets, deploying BCs, opening of BSBD accounts, grant of credit through KCCs and GCCs. Detailed trends are furnished in the following charts.

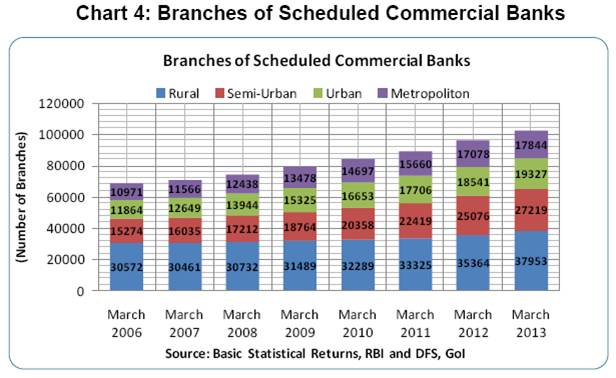

3.3.1. Number of Branches Opened (including RRBs)

-

Due to RBI’s concerted efforts since 2005, the number of branches of Scheduled Commercial Banks increased manifold from 68,681 in March 2006 to 1,02,343 in March 2013, spread across length and breadth of the country (Chart 4).

-

In rural areas, the number of branches increased from 30,572 to 37,953 during March 2006 to March 2013. As compared with rural areas, number of branches in semi-urban areas increased more rapidly.

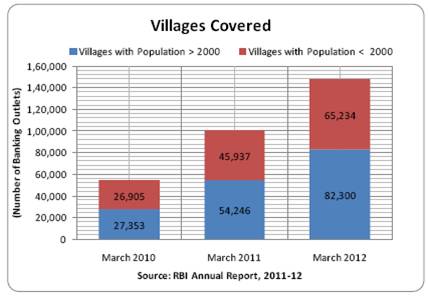

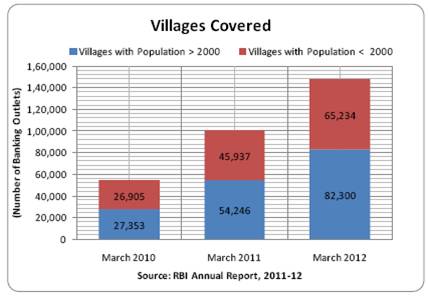

3.3.2 Villages Covered:

- The number of banking outlets in villages with population more than 2000 as well as less than 2000 increased consistently since March 2010 (Chart 5).

Chart 5: Villages Covered

3.3.3 Total Bank Outlets (including RRBs)

- Total number of banking outlets in villages increased from 67,694 in March 2010 to 2,68,454 in March 2013 (increased around 4 times during the period of three years). Of total branches, banking outlets through BCs increased from 34,174 to 2,21,341 during the same period (increased around 6.5 times).

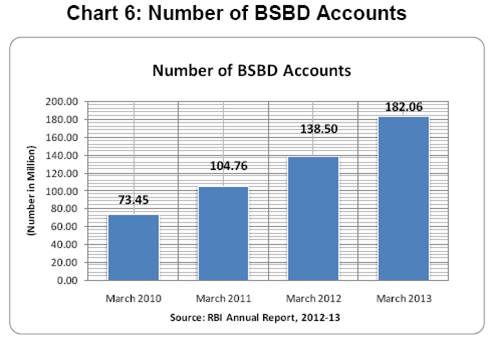

3.3.4 BSBD Accounts Opened

- The number of BSBD accounts opened increased from 73.45 million in March 2010 to 182.06 million in March 2013 (Chart 6).

- RBI advised banks to provide small overdrafts in BSBD accounts. Accordingly up to March 2013, 3.95 million BSBD accounts availed OD facility of Rs. 1.55 billion (These figures respectively, were 0.18 million and 0.10 billion in March 2010).

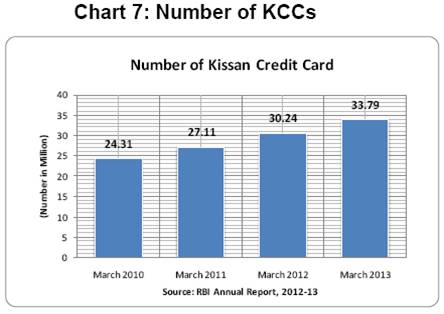

3.3.5 Kisan Credit Cards (KCC) Issued:

- Banks have been advised to issue KCCs to small farmers for meeting their credit requirements. Up to March 2013, the total number of KCCs issued to farmers remained at 33.79 million with a total outstanding credit of Rs.2622.98 billion (Chart 7).

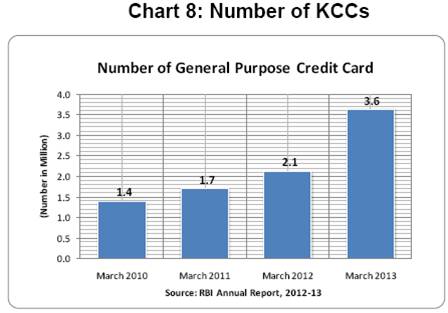

3.3.6 General Credit Cards (GCC) Issued:

- Banks have been advised to introduce General Credit Card facility up to Rs. 25,000/- at their rural and semi-urban branches. Up to March 2013, banks had provided credit aggregating to Rs.76.34 billion in 3.63 million GCC accounts (Chart 8).

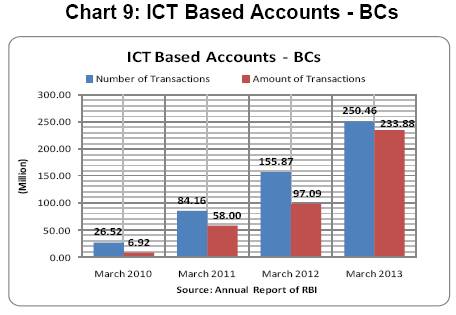

3.3.7 ICT Based Accounts - through BCs

-

In order to provide efficient and cost-effective banking services in the un-banked and remote corners of the country, RBI directed commercial banks to provide ICT based banking services – through BCs. These ICT enabled banking services have CBS connectivity to provide all banking services including deposit and withdrawal of money in the financially excluded regions.

-

The number of ICT-based transactions through BCs increased from 26.52 million in March 2010 to 250.46 million in March 2013, while transactions amount increased steadily from Rs.6.92 billion to Rs.233.88billion during the same period (Chart 9).

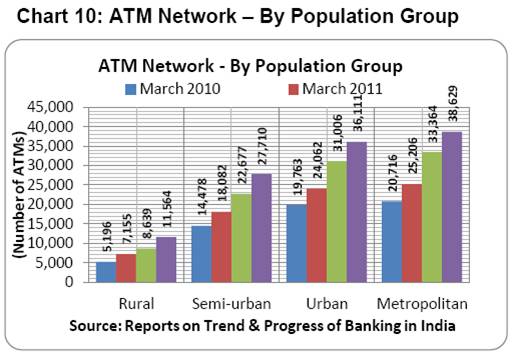

3.3.8 Expansion of ATM Network:

- The total number of ATMs in rural India witnessed a CAGR of 30.6% during March 2010 to March 2013. The number of rural ATMs increased from 5,196 in March 2010 to 11,564 in March 2013 (Chart 10).

3.3.9 Financial Literacy Initiatives

- Financial education, financial inclusion and financial stability are three elements of an integral strategy, as shown in the diagram below. While financial inclusion works from supply side of providing access to various financial services, financial education feeds the demand side by promoting awareness among the people regarding the needs and benefits of financial services offered by banks and other institutions. Going forward, these two strategies promote greater financial stability.

-

Financial Stability Development Council (FSDC) has explicit mandate to focus on financial inclusion and financial literacy simultaneously.

-

RBI has issued revised guidelines on the Financial literacy Centres (FLC) on June 6, 2012, for setting up FLCs, as detailed in Box 1 above.

3.3.10 Growth in SHG-Bank Linkage

- This model helps in bringing more people under sustainable development in a cost effective manner within a short span of time. As on March 2011, there are around 7.46 million saving linked SHGs with aggregate savings of Rs.70.16 billion and 1.19 million credit linked SHGs with credit of Rs. 145.57 billion (Source: NABARD, Status of Microfinance in India).

3.3.11 Growth of MFIs:

-

Though RBI has adopted the bank-led model for achieving financial inclusion, certain NBFCs which were supplementing financial inclusion efforts at the ground level, specializing in micro credit have been recognized as a separate category of NBFCs as NBFC-MFIs.

-

At present, around 30 MFIs have been approved by RBI. Their asset size has progressively increased to reach Rs. 19,000 crore as at end Sept 2013.

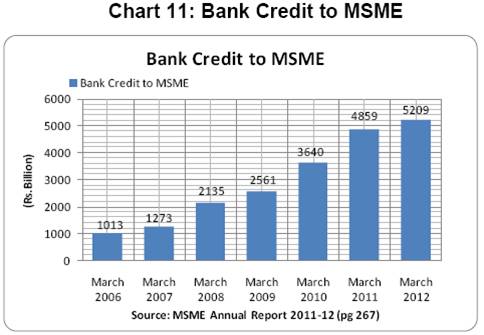

3.3.12 Bank Credit to MSME10

-

MSME sector which has large employment potential of 59.7 million persons over 26.1 million enterprises, is considered as an engine for economic growth and promoting financial inclusion in rural areas. MSMEs primarily depend on bank credit for their operations.

-

Bank credit to MSME sector witnessed a CAGR of 31.4% during the period March 2006 to March 2012. Of total credit to MSME, public sector banks contributed the major share of 76%, while private sector banks accounted for 20.2% and foreign banks accounted for only 3.8% as on March 31, 201211 (Chart 11).

3.3.13. Insurance Penetration in the Country

- The total insurance (life and non-life) penetration, in terms of the ratio of insurance premium as a percentage of GDP increased from 2.32 in 2000-01 to 5.10 in 2010-11. The life insurance penetration as a percentage of GDP stood at 4.40 in 2010-11 while the non-life insurance penetration remained at 0.71 during the same period12. In other words, there is vast untapped potential as regards insurance penetration.

3.3.14. Equity Penetration in the Country

- The number of investor accounts accounted for a meagre 1.71% of total population of the country13.

3.3.15. Financial Inclusion Initiatives – Private Corporates:

- A few large private corporate have undertaken projects such as E-Choupal/ E- Sagar(ITC), Haryali Kisan Bazaar (DCM), Project Shakti (HUL), etc. Reportedly, these pioneering projects have brought about vast improvement in the lives of the participants and set the tone for economic development in their command areas; which is a pre-requisite for Financial Inclusion efforts to be undertaken by the banking system.

Section - 4

4.1 Stakeholder-wise Issues in Financial Inclusion

- Taking into account the achievements stated in the previous section and based on our interactions with the stakeholders during our various outreach programmes, as also the feedback received from our meetings with the frontline managers, the more important issues which need to be attended; stakeholder-wise are listed in the table below,

Table 2: Stakeholder-wise Issues

S.No |

Issues |

Remarks |

1) |

Business Correspondents (BC):

For effective functioning of BC model in reaching poor villagers, the following need to be addressed:

-

BCs are not making enough income due to catering of services to low-income customers with low volume transactions. For optimum usage of BCs in reaching the poor villagers, BCs have to be adequately compensated so that they are sufficiently incentivized to promote financial inclusion as a viable business opportunity.

-

The usefulness of BC model is dependent on the kind of support provided by the bank branches. For effective supervision of BC operations and for addressing cash management issues as also to take care of customer grievances, banks should open small brick and mortar branches at a reasonable distance.

-

Further, banks should initiate suitable training and skill development programes for effective functioning of BCs.

|

Banks |

2) |

Tailor Made Services:

-

Innovative Products: Designing suitable innovative products to cater to the requirements of poor villagers at affordable rates is an absolute imperative.

-

To wean away villagers from borrowing from money lenders, banks should develop simplified credit disbursement procedures and also flexibility in their work processes.

|

Banks |

3) |

Technology Applications:

-

In an ICT enabled environment, technology is the main lever to achieve the eventual goal of financial inclusion at the earliest.

-

ATM-Network: ATM Network in rural areas accounted for only 10.1% of total ATMs in the country as on March 31, 201314. Banks should enhance their ATM network in rural and un-banked areas to serve poor villagers. While doing so, adequate care should be taken regarding safety/ security issues, which have come to the fore in recent times.

-

Rupay Network: To reduce the overall transaction costs associated with small ticket transactions in rural areas, domestic RuPay cards may be utilized15.

-

KCC/GCCs:To enable farmers to withdraw cash from ATMs anywhere in the country, banks need to convert KCCs/GCCs to electronic credit card. Further, banks may explore the possibility of issuing multipurpose cards which could function as debit cards, KCC and GCC as per the requirements in rural areas.

-

Mobile Banking: In rural India, there are 323.27 million16 mobile subscribers as on March 2012 (TRAI Annual Report, 2012). To examine the options/ alternatives, including the feasibility of using encrypted SMS based funds transfer using an application that can run on any type of handset for expansion of mobile banking in the country, RBI constituted a committee (Chairman: B. Sambamurthy)

-

Technology Service Providers (TSPs): There are a number of issues involving TSPs via-a-vis several banks.

|

Banks/RRBs, Co-op Banks

Banks/RRBs, Co-op Banks

Banks/RRBs

Banks

Banks |

4) |

BSBD Accounts: It is understood that nearly half of the BSBD accounts are dormant. For effective use of BSBD accounts economic activity needs to be improved. |

Governments – Central and State; Banks, Co-op Banks, RRBs |

5) |

Use of PACs and Primary Cooperatives as BCs:

PACs penetration in rural areas is far more than that of bank branches. Banks may make use of this largest rural network of cooperatives as business correspondents. Recent NABARD circular also envisaged that PACs can be utilized as BCs for CCBs/SCBs. |

Banks, RRBs, State Governments |

6) |

Financial Inclusion in Urban Areas:

Generally, urban financial inclusion leaves vast scope for improvement. Migration from rural to urban centres is also accentuating the problem. |

Banks |

7) |

Remittance Corridors:

Remittance facility for migrant population is of paramount importance. Providing of easy and cheap remittance facilities to migrant population is an absolute imperative. |

Banks |

8) |

Migrants are not Adequately Covered:

Migrants are facing difficulties in opening bank accounts. Commercial banks need to take care of the needs of the migrant population in their financial inclusion plans. |

RBI and Banks |

9) |

Human Face of Banking:

To deal with poor villagers, banks need to initiate training programmes to frontline staff and managers as well as BCs on the human side of banking. |

Banks |

10) |

Agriculture Advances:

While the number of farmers accounts with SCBs’ increased from just 63 lakh in March 2006 to 176 lakh in March 201017; in terms of credit, farmers with land holdings ‘above 5 acre’ accounted for largest share of 44% of total bank credit. To achieve meaningful financial inclusion, banks should give priority for small farmers as compared to large farmers while sanctioning credit. |

Banks |

11) |

Scalability of CBS Platform:

In order to handle the growing amount of work due to intensive financial inclusion efforts of country, banks/RRBs should ensure scalability of their CBS platforms. |

Banks/RRBs |

12) |

Electronic Benefit Transfer (EBT):

The EBT scheme being an important and integral part of the overall Financial Inclusion with its attendant benefits, banks should promote EBT systems effectively for boosting their financial inclusion plans. |

Banks |

13) |

Ultra Small Branches18:

Ultra Small Branches may be set up between the base branch and BCs to provide support to about 8-10 BC units at a reasonable distance |

New Private Banks/ RRBs |

14) |

Low Credit Share of Rural Areas: Although, in terms of number of branches, rural areas account for nearly 30% of total branches of scheduled commercial banks, the share of rural credit account for less than 10% of total credit. Govt./Banks should initiate steps to increase the credit absorption capacity in rural areas by promoting employment and other opportunities. |

Banks/GoI |

15) |

Private Sector banks need to open more branches in rural areas: In the case of private sector banks, rural branches accounted for just 13.3% of their total branches in March 2013 (while in the case of public sector the same stood at 33.1%). There is an imperative need to ramp up the number of rural branches by the private sector banks |

Private Banks |

16) |

Penetration of RRBs in Financially excluded Regions: Though RRBs have more presence in central (30.7% as on March 2012) and eastern regions (23.1%), financial exclusion is more acute in these regions. |

RRBs |

17) |

Infrastructure Development: For up-scaling financial inclusion, adequate infrastructure such as digital and physical connectivity, uninterrupted power supply etc are prerequisites. Reportedly, out of six lakh villages in India, around 80,000 villages have no electricity and the constraints of electricity directly impact the working of banks. |

Central & State Governments |

18) |

Vernacular Languages

Financial inclusion efforts should necessarily be done in vernacular languages. In this context, the need for vernacularisation of all forms (including legal forms) is an absolute must, at least in major languages. As per Akosha19 there are 10,506 consumer complaints received20 against financial sector (includes banking, finance, insurance, real estate and construction) during the period January 2013 to March 2013.

As part of Financial Literacy initiatives, if banks were to undertake pro-active steps in helping the common public to get over their English phobia, it is felt that the number of complaints would increase manifold. |

Banks & Other FIs |

19) |

Private Corporate Initiatives A few large private corporates have undertaken projects such as E-Choupal / E- Sagar (ITC), Hariyali Kisan Bazar (DCM), Project Shakti (HUL), etc. Reportedly, these pioneering projects have brought about vast improvement in the lives of the participants and set the tone for economic development in their command areas; which is a pre-requisite for Financial Inclusion efforts to be undertaken by the banking system. |

Private Corporates |

20) |

Post-offices:

Post offices (POs) are closest to the rural people compared to bank branches. As on March 31, 2011, there are 1,54,866 post offices in India, of which 1,39,040 (89.8%) were in rural areas. All round efforts should be made to ensure that Post Offices play a greater and more active role due to known advantages. Progressively, more POs may be engaged to become BCs of banks due to well-known advantages. |

RBI and Government |

21) |

White Label ATMs:

RBI has already started allowing eligible private entities to establish White Label ATMs. There is case for its acceleration. |

RBI, Private Corporates |

22) |

MSME – Financial Exclusion:

The statistics based on 4th Census on MSME sector revealed that only 5.18% of the units (both registered and un-registered) had availed finance through institutional sources, 2.05% got finance from non-institutional sources. The majority of units i.e., 92.77% had no finance or depended on self-finance. SIDBI should go into the reasons for not getting access to formal sources of credit by the majority of MSME units. |

SIDBI/ Banks |

23) |

SHG-Bank Linkage - Penetration: Although SHG-Bank Linkage model is successful in rural areas, it has not spread evenly throughout India, the spread is poor especially in the financially excluded regions namely central and north-eastern. |

NABARD |

24) |

SHG-Bank Linkage Outstanding Bank Credit:

Outstanding bank loans against SHGs accounted for only 1.93% of gross bank credit as on March 31, 2011. It was observed that SHGs are not getting loans from banks even after more than one year of its formation and group activities. Certain difficulties are being experienced by SHGs in obtaining bank credit which NABARD should look into and inform RBI of the same. |

NABARD |

25) |

Insurance for Rural India:

Over 70% of total population resides in the rural areas of the country. However, insurance reaches less than 3% of the total population. Due to high competition and relatively high market saturation in the urban areas, rural areas provide ample business opportunities for insurance firms –both life and non-life. |

IRDA |

26) |

Scope for Further Research: In financial inclusion, there are a few potentially interesting areas for future research –viz., (a) the most appropriate delivery model (which banks are still trying to figure out) for different geographical regions given their unique characteristics, (b) The unbanked segments- beit in rural, urban or metropolitan areas are largely served by the un-organized sector even today. Research into the products, practices and procedures of this unorganized sectors an absolute imperative, to identify and understand the same which the bottom of the pyramid populace finds so convenient and comfortable to deal with. This could throw up valuable leads for the organized sector – banks and financial institutions to follow (c) Further, in order to measure the intensity of money lenders especially in rural areas, research agencies should, inter alia, conduct a census of money lenders in rural India. |

Research Agencies |

Section 5

Conclusion & Way Forward

Let me conclude by repeating what I have endeavoured to convey about assessment of Financial Inclusion efforts in our country. I began with a brief introduction of the subject and provided two major definitions of Financial Inclusion. Thereafter, the important policy initiatives of RBI and progress achieved / identified trends in Financial Inclusion have been explained to assess where we stand at the present juncture. I tried to identify stakeholder-wise issues in Financial Inclusion, based on such an assessment as also on the basis of feedback received by us during our financial outreach programmes and the conferences of front line managers which we have been conducting for the past few years. It is one’s earnest hope and desire that the issues raised herein would trigger an informed debate and discussion, which could provide an invaluable feedback in the run up to the Report of Nachiket Mor Committee, which at present is examining the entire gamut of issues surrounding Financial Inclusion. Further on, the research community may like to go into such aspects of Financial Inclusion, which would provide valuable leads to the regulators and all the stakeholders concerned in achieving meaningful and holistic Financial Inclusion at the earliest in our country.

Thank You,

References

Anand Sinha (2012), “Financial Inclusion and Urban Cooperative Banks”, edited transcript at the launch of the financial inclusion program of COSMOS Bank at Pune.

Chakrabarty K.C (2011), “Financial Inclusion and Banks: Issues and Perspectives”, RBI Bulletin, November, 2011.

Chakrabarty K.C (2011), “Financial Inclusion: A Road India Needs to Travel”, RBI Bulletin, November, 2011.

Chakrabarty K.C (2012), “Empowering MSMEs for Financial Inclusion and Growth – Role of Banks and Industry Associations”, address at SME Banking Conclave 2012.

Chakrabarty K.C (2013), “Financial Inclusion in India: Journey So Far And the Way Forward”, Key note address at Finance Inclusion Conclave Organised by CNBC TV 18 at New Delhi.

Chakrabarty K.C (2013), “Revving up the Growth Engine through Financial Inclusion”, address at the 32th SKOCH Summit held at Mumbai.

Leeladhar V (2005), “Taking Banking Services to the Common Man – Financial Inclusion”, Commemorative Lecture at the FedbankHormis Memorial Foundation at Ernakulam.

Mira Mendoza (2009), “Addressing Financial Exclusion through Microfinance: Lessons from the State of Madhya Pradesh, India”, The journal of International Policy Solutions, Vol 11, pp 25-35.

Narayan Chandra Pradhan (2013), “Persistence of Informal Credit in Rural India: Evidence from All-India Debt and Investment Survey and Beyond”, RBI Working Paper Series, WPS (DEPR): 5/2013

Radhika Dixit and M. Ghosh (2013) “Financial Inclusion For Inclusive Growth of India – A Study”, International Journal of Business Management & Research, Vol.3, Issue 1, pp. 147-156.

Rangarajan C (2008), “Report of the Committee on Financial Inclusion”

Raghuram G. Rajan (2009), “A Hundred Small Steps - Report of the Committee on Financial Sector Reforms”.

Reserve Bank of India - “Annual Reports and ‘Report on Trend and Progress of Banking in India”, various issues.

Sadhan Kumar Chattopadhyay (2011), “Financial Inclusion in India: A Case-study of West Bengal”. RBI Working Paper Series, WPS (DEPR): 8/2011.

Sarkar A.N (2013), “Financial Inclusion: Fostering Sustainable Economic Growth in India”, The Banker, Vol. VIII, No.4, pp.44-53.

Sarkar A.N (2013), “Financial Inclusion Part-II: Fostering Sustainable Economic Growth in India”, The Banker, Vol. VIII, No.5, pp.32-40.

Status of Microfinance in India: 2010-11, NABARD

|

IST,

IST,