IST,

IST,

Strengthening Our Debt Markets

Dr. Raghuram G. Rajan, Governor, Reserve Bank of India

delivered-on ଅଗଷ୍ଟ 26, 2016

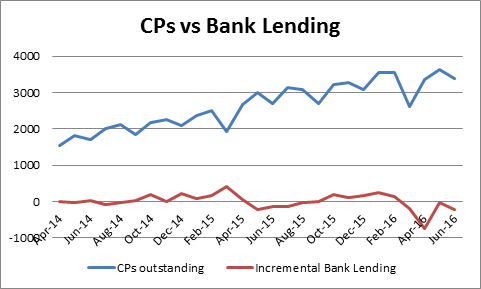

Thank you for inviting me to speak to FEDAI. In the last few weeks, in successive speeches, I have outlined the RBI’s approach to inflation, distressed debt, financial inclusion, and banking sector reform. I want to speak today about debt markets and associated derivatives; why we need them to be deep and liquid, why, in addition to central and state governments, we need riskier firms and projects to be able to access the bond markets for funds, why we need to encourage product innovation, and finally the dilemmas that regulators like the RBI face. In the process, I hope to touch on some of our recent successes, as well as failures, and our ambitions for the future. There are three important reasons why debt markets have become a lot more attractive in recent months. First, we finally have a framework that commits us to low and stable inflation. Yes, July’s inflation reading was a high 6.07%, but I have no doubt that inflation will fall in the months ahead. The key point is that market participants know that the Monetary Policy Committee has to maintain low and stable inflation, certainly over the next five years for which its remit has been set, and it will do what it takes. This lowers the inflation risk premium, and thus reduces the nominal fixed interest rate for everyone, from the government to the riskiest borrower. In this regard, I am confident that Dr. Urjit Patel, who has worked closely with me on monetary policy for the last three years, will ably guide the Monetary Policy Committee going forward in achieving our inflation objectives. A second development has been the reluctance of public sector banks (PSBs) to lend, and together with private sector banks, the reluctance to fully pass through past policy rate cuts into bank lending rates. Short term market rates, however, have seen full pass-through. No wonder highly rated firms are bypassing banks to borrow from the commercial paper (CP) markets, with outstanding commercial paper having more than doubled in the last two years to over 3 lakh crores (see chart below on CP outstanding juxtaposed against incremental bank lending).  But what of lower rated firms? Unfortunately, the difficulty of debt recovery in India has meant that credit spreads are wider than elsewhere. This is where the third notable development comes in. Recent reforms of the SARFAESI Act and Debt Recovery Tribunals in the short term, and the new Bankruptcy Code in the medium term, should help in enhancing the prospects of repayment, thus reducing credit spreads. Given these developments, what should the objectives of fixed income market regulation? The Objectives of Market Regulation As a developing country regulator, the RBI is focused on enhancing growth while maintaining stability. In the past, this has meant that the RBI has moved cautiously on liberalizing fixed income and derivatives markets. What is there about these markets for central banks to worry about? Typically three issues. We have always worried that markets attract speculators, and that in thin markets, the speculative element can move market prices away from fundamentals. This is certainly a concern, but we should also remember that not all speculators think the same way. So long as there is no concerted move to manipulate markets (and this concerted manipulation can be prevented by regulation), the varied opinions of speculators can provide liquidity, which in turn can make the markets more immune to manipulation. In other words, excessive fear of speculation in markets is self-fulfilling – it renders markets illiquid and prone to manipulation. Second, markets can be a source of competition for established institutional players. For instance, as I noted above, high quality corporate credits can migrate from banks to debt markets. This may push banks into higher risk lending. Once again, there is merit in these concerns. However, too much can also be made of them. After all, banks are supposed to lend to riskier clients that need monitoring and hand-holding, while markets are supposed to lend to clients who do not need such attention. Moreover, the problem in India is too much risk ends up on bank balance sheets, either directly or indirectly. For example, Non-Bank Finance Companies (NBFCs) are supposed to take on greater risk, such as loans to real estate developers, because their liabilities are longer term. In actuality, though, many have substantial borrowings from banks. It would be better from the perspective of systemic risk if they replaced bank debt with market borrowing. More generally, some of the very large single and group exposures of banks should be brought down by forcing large borrowers to raise more market financing. Third, we worry about unbridled innovation that attempts to get around prudential and supervisory norms and ends up creating uncertain valuations and systemic risk. For instance, the fixed income products and derivatives structured around housing mortgage pools in the United States became hard to value as house prices turned down. This was a primary factor in the Global Financial Crisis. Once again, though, financial innovation has been useful in opening credit to the hitherto underserved – the unfortunately named “junk” bonds have indeed facilitated the growth of a variety of enterprises and sectors, most recently shale oil. While regulators have to weigh carefully the benefits versus the systemic risks posed by every new product, we cannot simply ban all innovation just because it makes us feel safer. The broader point is that a measured and well-signaled liberalization of fixed income and derivative markets will probably allow us to reap the benefits of deeper and more liquid markets, while minimizing the risks associated with speculation, competition, and innovation. Over the last few years, we have had to proceed somewhat cautiously on market development because we worried about creating vulnerabilities when global financial markets were fragile. But as macroeconomic stability has strengthened, the movement has always been forward. Yesterday’s announcements were simply the next steps in steady, measured liberalization. Let me explain. Participation Greater participation adds liquidity. Over the years, we have tried to enhance participation. Most recently, even though retail investors form a small part of the global fixed income market, we are working to enhance their access to the institution-dominated screen-based NDS-OM market so that they can trade G-Secs, and also so that they can use their de-mat accounts to do so. However, in markets that require sophisticated understanding, such as complex derivatives, we continue to be careful about broadening retail access. We can be more relaxed about institutional participation. Foreign Portfolio Investors (FPIs) will now have direct access to a variety of markets including NDS-OM , corporate bond trading and perhaps other market segments going forward. One reason we limited institutional participation in the past was to prevent speculation. So, for example, we required participants to be long an underlying exchange asset, say dollars, in order for them to take a short position in financial markets, and vice-versa. But sometimes the volume of importers hedging prospective imports by buying dollars forward far outweighs the volume of exporters, who hedge future receipts by selling dollars forward. To satisfy the net demand for forward dollar hedging, typically banks have taken the other side. However, to ensure bank stability, we have limited the extent of open positions that banks can hold. There is a cost to these limits. Every time the market gets imbalanced, exchange rates have to move substantially to equalize temporary imbalances between demand and supply, even if unwarranted by medium term fundamentals. This puts more pressure on the central bank to intervene. We can certainly increase bank open position limits, and will do so over time, but it would not be prudent to place all the exchange risk on banks. A better option would be to allow more players to hold open positions without an underlying, with some limits so that we do not get excessive speculation or attempts at manipulation by single traders. This can rectify market imbalances, improving exchange market liquidity and depth, without imposing large demands on banks or on the RBI. The RBI took a fundamental step in this direction yesterday by allowing a moderate open position to all market participants. Based on experience, the RBI will decide further moves. Finally, not all participation adds to liquidity and depth in Indian markets. For example, some foreign organizations have suggested allowing trading of domestically issued Indian securities abroad, only reporting the trades domestically. Unfortunately, this could subtract trading on Indian exchanges, and thereby diminish liquidity. We have suggested to such organizations that they either conduct their trades on the Indian exchanges, or that they direct their clients to Masala bonds. The former is still under discussion. Innovation Financial innovation is sometimes seen in a bleak light as a way to evade or avoid taxes and regulations. Properly done, however, financial innovation can slice and dice risks so that they are placed on the right shoulders. One example of such an instrument is interest rate futures, where after an overhaul in 2013-14, the last 12 months’ average daily trading volume was close to Rupees 23 billion (despite falling in recent months). An investor, bank, or corporation can use the IRF market to gain or shed interest exposures as they desire. The key to the success of this market has been to allow the design of the relevant instrument to be governed by market participants, while ensuring regulatory concerns are satisfied. We are proceeding in a similar way with money market futures contracts. Not all innovative instruments have been successful. Inflation Indexed Bonds (IIBs) tied to the Wholesale Price Index (WPI) have not been very popular because the RBI has moved away from a focus on the WPI to a focus on CPI. Even the market for CPI indexed IIBs has been lukewarm. The moderate investor interest perhaps reflects the disinflationary environment, where inflation protection is less sought after. Also, unlike the more tax-protected Gold Monetization Bonds, the CPI indexed IIBs are not fully tax protected against inflation. Going forward, a level playing field on taxes is warranted for all instruments, so that instruments do not gain favor simply because they get better tax treatment. The lesson from these examples is that financial innovation needs support, not to create tax or regulatory arbitrage, but so that appealing features are encouraged. Innovation also requires tinkering, to modify what does not work until something more appealing can be found – the first versions of Interest Rate Futures were not attractive, but later versions have succeeded. This is why the RBI has moved to a sandbox approach, where we are liberal towards early product innovations so long as they are not clearly problematic, regulating more carefully only when interest picks up and the product looks like it might become of systemic importance. Finally, an important function for the regulator in encouraging financial innovation is to create the necessary infrastructure. For instance, a number of financial contracts are structured off benchmarks. RBI has encouraged the setting up of the Financial Benchmarks India Pvt. Limited (FBIL) which is building a series of market benchmarks. I am hopeful that these will soon be used in innovative financial contracts. Internationalization As a current account deficit country, India needs financing from abroad. Ideally, we would like to attract risk capital, which is in short supply in this country. This means encouraging Foreign Direct Investment, as well as equity investment. Foreign investors can also help deepen debt and derivative markets as they contribute to price discovery and liquidity. Not all domestic entities should issue claims held by foreign investors. Ideally, of course, companies should be left to make decisions about what currency they borrow in, and how much they hedge, but given our weak bankruptcy system, there is moral hazard built into unhedged foreign borrowing – if the rupee appreciates, the promoter takes all the upside associated with paying the low dollar interest rate and the now-lower principal, if the rupee depreciates, the occasional unscrupulous promoter goes to his Indian bankers and asks them to bail him out. This is why the issuance of short term dollar or yen denominated debt by infrastructure companies, if left unhedged, could be severely problematic in case of rupee depreciation. Therefore, we have encouraged companies that do not have foreign exchange earnings to either issue long term dollar bonds, fully hedged shorter term bonds, or rupee denominated Masala bonds abroad. The first issues recently of Masala Bonds reflect a coming of age of Indian debt that has been insufficiently remarked upon – for the first time in recent decades, the rupee’s value is trusted enough in international markets that corporations can issue there in domestic currency. Going forward, we hope a more vibrant Masala bond market abroad will complement a vibrant domestic corporate bond market. Even though FDI flows are enough to cover our current account deficit, we are also encouraging inflows into the debt markets to improve depth and liquidity. We have progressively expanded FPI limits in government debt, and recently specified how these limits will expand for the foreseeable future. We have also opened up investment in state government debt, and laid out the medium term plan for those limits also. In general, our aim is to liberalize steadily, but in a thoughtful way, continuously asking how further liberalization will strengthen our domestic markets. We have not been persuaded by every market plea. For example, a number of investment banks want a dollar denominated G-Sec issued internationally – ostensibly to create a benchmark dollar yield curve for Indian instruments. While I agree such an instrument would be attractive for investors in the yield-starved world, I am not persuaded it is useful for India. When much of the emerging world would love to move from issuing dollar debt to issuing in its own currency so as to avoid currency risk, I don’t see why we should move the other way. Instead, let us build out an international quasi-sovereign rupee yield curve, so that rupee issuances can be priced easily. It is with this in mind that we have allowed banks to issue Masala bonds yesterday, with bank bonds being a good quasi-sovereign proxy. Liquidity Of course, not all parts of the rupee yield curve are liquid, even in the domestic G-Sec market. At the very short end, we are trying to bring more liquidity and better pricing through the auctioning of term repos. At the longer end, we have been trying to focus on more illiquid securities in our open market operations so that the term curve evens out. We are also proposing to encourage market making in specific G-Sec instruments by involving Primary Dealers. One way to bring liquidity to corporate debt is to enable them to be used as collateral in repo transactions with the central bank, with appropriate haircuts, of course. As banks become able to borrow against their high quality corporate bonds, yields will fall, and more issuers will come to the market. With this in mind, we have initiated the process with the Government to amend the RBI Act to allow the RBI to conduct repos of corporate bonds with banks and other financial institutions. Ratings, Contingent Support, and Supply The ratings put out by credit rating agencies are important in assuring arm’s length investors about corporate credit quality. In order for their ratings to be accurate, agencies need both up-to-date information, as well as good analysis. Agencies have asked the RBI to give them information about corporate bank borrowings. Since these are available from the credit information bureaus (CIBs), the RBI has suggested the credit rating agencies become members of CIBs. Hopefully, incidents where a highly rated corporate bond plummets without warning into default will become increasingly rare as rating agencies exercise due diligence. Some have argued that the easy access to bank cash credit keeps large corporations from going to the money and bond markets for funds. This phenomenon also raises bank exposures to single names or groups, increasing their risk concentration. While as suggested earlier, we are seeing some movement of corporations to the money and bond markets in this period of bank stress, we will nudge corporations further by imposing higher provisioning and capital requirements for banks on such corporate lending when exposures become large. Many of the measures proposed so far will enhance the attractiveness of highly rated corporate bonds to investors. But infrastructure projects that need substantial amounts of financing may not start out highly rated. To enable such entities to issue, we have allowed banks to offer credit enhancement to such bonds. We have been careful to set the capital requirement for such credit enhancement commensurate with the risk banks are taking on so that there is no arbitrage. Yesterday’s announced measures should make it easier for banks to offer appropriate amounts of credit enhancement. One area that needs greater clarification is obligations of state governments as well as state-government guaranteed obligations. In order for state government obligations to have zero risk weight, and have the highest rating, it is important that there be no explicit or implicit default or restructuring of such obligations. While a restructuring may seem like a way to postpone obligations, its ramifications, not just for the yield the market will demand of the particular state government issuer in the future but also for the yields on obligations of other state governments, are large enough that such actions should continue to remain “unthinkable”. Regulations We are conscious of the limitations placed on netting of derivative contracts, and thus the higher associated capital requirements on banks. The issue has been taken up with the Government, and we hope to amend the RBI Act to make such netting possible. As with the tax issues associated with securitization, which have recently been addressed by the Government, resolving this issue should hopefully lead to substantial market activity. Finally, while the RBI is a liberalizer, we have to be careful not to relax prudential regulations simply because an entity or activity is deemed of national importance. Dispensation on prudential regulation is the wrong instrument to favor such activities. A nationally important activity such as infrastructure may be very risky. To require lower provisions, or to allow higher leverage or ECBs against such activities, may increase systemic risk. In the long run, the activity may be damaged by the regulatory dispensation (too many infrastructure projects that do not have dollar earnings will be financed with dollar or yen loans and cannot repay) and stability may also be compromised. It is far better for the Government to directly subsidize such activities if it deems them important than for RBI to sacrifice systemic stability on the altar of national importance. Conclusion Let me conclude. While the RBI has been cautious in reforming during the recent period of global market turmoil, it has not stood still. Market reforms have proceeded at a steady measured pace. Observers may be impatient, but my belief is that steady and irreversible reform and “mini Bangs” like yesterday’s rather than “Big Bang” is the need of the hour. As global conditions become less uncertain, the pace of reform can pick up. The lessons we have learnt during this period on what works will be invaluable then. Thank you. 1 Governor Dr. Raghuram G. Rajan’s Annual Day Address to Foreign Exchange Dealers Association of India on August 26, 2016 at Mumbai |

ପେଜ୍ ଅନ୍ତିମ ଅପଡେଟ୍ ହୋଇଛି: