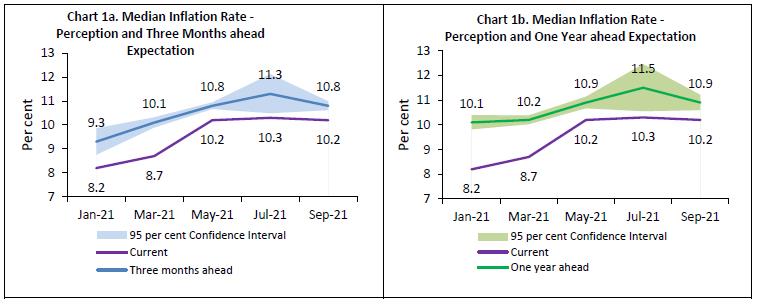

Today, the Reserve Bank released the results of the September 2021 round of the Inflation Expectations Survey of Households (IESH)1. The survey was conducted during August 29 to September 7, 2021 in 18 major cities predominantly through field interviews and around one per cent of the total sample was covered through telephonic interviews due to Covid-19 related restrictions. The results2 are based on responses from 5,958 urban households3. Highlights: i. For the third consecutive survey round, households’ median inflation perception for the current period hovered around 10 per cent [Charts 1a and 1b; Table 3]. ii. After increase in three successive rounds, median inflation expectations for three months and one year ahead periods moderated by 50 and 60 basis points, respectively, in September 2021 [Charts 1a and 1b; Table 3]. iii. Over 60 per cent of the respondents expect general inflation to rise in the next quarter as well as over the next one year. Cost of services are expected to ease marginally over both three months and one-year horizons [Tables 1a and 1b]. iv. The overall price and inflation expectations were generally more aligned to those for food products, non-food commodities and cost of services vis-à-vis the price movements in household durables and housing [Table 4]. Note: Please see the excel file for time series data.

| Table 1(a): Product-wise Expectations of Prices for Three Months ahead | | (Percentage of Respondents) | | Survey period ended | Sep-20 | Mar-21 | May-21 | Jul-21 | Sep-21 | | General | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Prices will increase | 81.6 | 0.78 | 86.6 | 0.74 | 83.7 | 0.68 | 85.9 | 0.79 | 84.9 | 0.77 | | Price increase more than current rate | 53.9 | 1.02 | 58.4 | 1.14 | 58.5 | 0.91 | 63.0 | 1.15 | 61.5 | 1.14 | | Price increase similar to current rate | 22.5 | 0.84 | 24.1 | 0.94 | 21.2 | 0.76 | 19.6 | 0.90 | 19.9 | 0.88 | | Price increase less than current rate | 5.2 | 0.46 | 4.1 | 0.50 | 4.0 | 0.37 | 3.3 | 0.38 | 3.5 | 0.40 | | No changes in prices | 15.9 | 0.74 | 11.1 | 0.71 | 14.0 | 0.63 | 11.3 | 0.70 | 12.9 | 0.72 | | Decline in prices | 2.5 | 0.31 | 2.3 | 0.29 | 2.3 | 0.30 | 2.8 | 0.40 | 2.2 | 0.29 | | Food Product | | | | | | | | | | | | Prices will increase | 80.4 | 0.80 | 85.2 | 0.70 | 84.4 | 0.72 | 84.0 | 0.81 | 84.8 | 0.74 | | Price increase more than current rate | 52.6 | 1.00 | 61.2 | 1.01 | 60.2 | 0.92 | 61.0 | 1.15 | 61.4 | 1.08 | | Price increase similar to current rate | 21.2 | 0.81 | 18.1 | 0.81 | 19.4 | 0.75 | 17.6 | 0.89 | 18.2 | 0.80 | | Price increase less than current rate | 6.6 | 0.51 | 6.0 | 0.55 | 4.8 | 0.38 | 5.4 | 0.53 | 5.3 | 0.50 | | No changes in prices | 14.3 | 0.70 | 9.3 | 0.60 | 11.8 | 0.63 | 10.5 | 0.65 | 10.8 | 0.64 | | Decline in prices | 5.3 | 0.46 | 5.5 | 0.45 | 3.9 | 0.39 | 5.5 | 0.53 | 4.4 | 0.40 | | Non- Food Product | | | | | | | | | | | | Prices will increase | 75.8 | 0.87 | 81.0 | 0.78 | 78.6 | 0.79 | 82.6 | 0.85 | 82.1 | 0.82 | | Price increase more than current rate | 47.3 | 0.99 | 57.0 | 1.00 | 53.1 | 0.95 | 59.0 | 1.17 | 58.8 | 1.15 | | Price increase similar to current rate | 21.9 | 0.82 | 19.4 | 0.77 | 19.8 | 0.75 | 18.8 | 0.92 | 18.2 | 0.83 | | Price increase less than current rate | 6.6 | 0.50 | 4.7 | 0.43 | 5.6 | 0.44 | 4.7 | 0.50 | 5.1 | 0.45 | | No changes in prices | 19.2 | 0.80 | 12.9 | 0.69 | 17.1 | 0.72 | 12.3 | 0.73 | 13.6 | 0.73 | | Decline in prices | 5.0 | 0.45 | 6.2 | 0.48 | 4.3 | 0.42 | 5.1 | 0.51 | 4.3 | 0.42 | | Household Durables | | | | | | | | | | | | Prices will increase | 56.3 | 1.02 | 68.1 | 0.92 | 58.8 | 0.96 | 65.6 | 1.10 | 67.3 | 0.97 | | Price increase more than current rate | 35.0 | 0.96 | 46.0 | 0.98 | 37.7 | 0.94 | 45.1 | 1.19 | 46.5 | 1.09 | | Price increase similar to current rate | 15.8 | 0.74 | 17.7 | 0.74 | 16.4 | 0.70 | 16.6 | 0.86 | 16.2 | 0.78 | | Price increase less than current rate | 5.5 | 0.47 | 4.4 | 0.44 | 4.7 | 0.40 | 4.0 | 0.43 | 4.6 | 0.43 | | No changes in prices | 30.7 | 0.94 | 24.6 | 0.84 | 32.2 | 0.90 | 25.3 | 0.99 | 25.0 | 0.87 | | Decline in prices | 13.1 | 0.69 | 7.3 | 0.50 | 9.0 | 0.56 | 9.1 | 0.66 | 7.7 | 0.53 | | Cost of Housing | | | | | | | | | | | | Prices will increase | 51.8 | 0.98 | 68.9 | 0.93 | 54.9 | 0.94 | 64.7 | 1.13 | 68.7 | 0.95 | | Price increase more than current rate | 32.8 | 0.93 | 48.4 | 1.03 | 36.5 | 0.92 | 45.9 | 1.21 | 49.6 | 1.07 | | Price increase similar to current rate | 14.4 | 0.69 | 16.7 | 0.75 | 14.4 | 0.67 | 14.5 | 0.79 | 15.1 | 0.77 | | Price increase less than current rate | 4.6 | 0.43 | 3.8 | 0.40 | 3.9 | 0.36 | 4.2 | 0.46 | 4.0 | 0.42 | | No changes in prices | 29.1 | 0.91 | 22.2 | 0.86 | 30.5 | 0.89 | 23.7 | 0.99 | 21.9 | 0.85 | | Decline in prices | 19.1 | 0.78 | 8.9 | 0.54 | 14.6 | 0.69 | 11.6 | 0.74 | 9.4 | 0.59 | | Cost of Services | | | | | | | | | | | | Prices will increase | 70.3 | 0.91 | 75.6 | 0.90 | 67.6 | 0.89 | 74.3 | 1.02 | 73.3 | 0.93 | | Price increase more than current rate | 45.5 | 1.01 | 51.6 | 1.02 | 44.6 | 0.94 | 52.5 | 1.19 | 52.1 | 1.10 | | Price increase similar to current rate | 19.1 | 0.79 | 19.4 | 0.79 | 18.0 | 0.71 | 17.3 | 0.83 | 16.8 | 0.75 | | Price increase less than current rate | 5.7 | 0.47 | 4.5 | 0.44 | 5.0 | 0.40 | 4.5 | 0.45 | 4.4 | 0.41 | | No changes in prices | 25.8 | 0.88 | 20.8 | 0.84 | 29.2 | 0.87 | 22.0 | 0.95 | 23.7 | 0.90 | | Decline in prices | 3.9 | 0.38 | 3.6 | 0.36 | 3.2 | 0.35 | 3.7 | 0.43 | 3.0 | 0.33 | Note:

1. The table provides estimates and standard errors for qualitative responses.

2. Constituent items may not add up to the corresponding total, due to rounding off. |

| Table 1(b): Product-wise Expectations of Prices for One Year ahead | | (Percentage of Respondents) | | Survey period ended | Sep-20 | Mar-21 | May-21 | Jul-21 | Sep-21 | | General | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Prices will increase | 84.8 | 0.73 | 88.7 | 0.61 | 86.9 | 0.65 | 86.8 | 0.78 | 87.7 | 0.72 | | Price increase more than current rate | 59.6 | 1.00 | 63.4 | 1.07 | 62.4 | 0.91 | 65.6 | 1.18 | 66.5 | 1.10 | | Price increase similar to current rate | 20.4 | 0.82 | 21.4 | 0.87 | 20.3 | 0.75 | 18.3 | 0.93 | 18.0 | 0.85 | | Price increase less than current rate | 4.7 | 0.43 | 3.8 | 0.44 | 4.2 | 0.38 | 2.9 | 0.38 | 3.3 | 0.36 | | No changes in prices | 12.1 | 0.67 | 8.5 | 0.54 | 10.4 | 0.58 | 10.1 | 0.68 | 9.3 | 0.61 | | Decline in prices | 3.1 | 0.35 | 2.8 | 0.32 | 2.7 | 0.33 | 3.1 | 0.41 | 2.9 | 0.36 | | Food Product | | | | | | | | | | | | Prices will increase | 77.3 | 0.85 | 81.7 | 0.74 | 81.7 | 0.76 | 80.8 | 0.87 | 81.6 | 0.79 | | Price increase more than current rate | 48.3 | 0.99 | 54.6 | 1.01 | 53.5 | 0.95 | 55.9 | 1.18 | 57.4 | 1.12 | | Price increase similar to current rate | 22.5 | 0.82 | 22.2 | 0.83 | 22.6 | 0.77 | 20.7 | 0.98 | 19.5 | 0.89 | | Price increase less than current rate | 6.4 | 0.51 | 4.9 | 0.46 | 5.6 | 0.43 | 4.2 | 0.45 | 4.7 | 0.45 | | No changes in prices | 14.8 | 0.72 | 12.0 | 0.61 | 12.5 | 0.64 | 12.6 | 0.73 | 11.9 | 0.66 | | Decline in prices | 7.9 | 0.55 | 6.3 | 0.45 | 5.8 | 0.46 | 6.6 | 0.54 | 6.5 | 0.47 | | Non- Food Product | | | | | | | | | | | | Prices will increase | 75.7 | 0.87 | 79.9 | 0.79 | 79.2 | 0.78 | 80.3 | 0.91 | 81.5 | 0.81 | | Price increase more than current rate | 47.3 | 1.00 | 54.0 | 1.02 | 51.8 | 0.96 | 56.8 | 1.21 | 57.9 | 1.13 | | Price increase similar to current rate | 22.2 | 0.83 | 21.4 | 0.83 | 21.8 | 0.76 | 19.0 | 0.91 | 19.5 | 0.85 | | Price increase less than current rate | 6.1 | 0.49 | 4.6 | 0.44 | 5.7 | 0.44 | 4.6 | 0.48 | 4.1 | 0.40 | | No changes in prices | 18.2 | 0.78 | 13.4 | 0.66 | 15.8 | 0.70 | 13.4 | 0.76 | 13.2 | 0.71 | | Decline in prices | 6.1 | 0.49 | 6.6 | 0.47 | 5.0 | 0.44 | 6.2 | 0.57 | 5.3 | 0.42 | | Household Durables | | | | | | | | | | | | Prices will increase | 62.3 | 0.98 | 70.3 | 0.90 | 64.7 | 0.94 | 69.1 | 1.06 | 71.5 | 0.98 | | Price increase more than current rate | 38.8 | 0.98 | 47.2 | 0.98 | 41.2 | 0.94 | 47.0 | 1.18 | 49.4 | 1.10 | | Price increase similar to current rate | 18.4 | 0.77 | 18.8 | 0.74 | 18.6 | 0.72 | 18.3 | 0.88 | 17.5 | 0.83 | | Price increase less than current rate | 5.1 | 0.45 | 4.4 | 0.42 | 4.9 | 0.39 | 3.8 | 0.41 | 4.5 | 0.45 | | No changes in prices | 26.5 | 0.88 | 22.7 | 0.81 | 26.7 | 0.86 | 22.7 | 0.97 | 22.3 | 0.89 | | Decline in prices | 11.2 | 0.64 | 6.9 | 0.48 | 8.6 | 0.55 | 8.2 | 0.62 | 6.2 | 0.47 | | Cost of Housing | | | | | | | | | | | | Prices will increase | 63.9 | 0.95 | 75.7 | 0.86 | 65.4 | 0.93 | 71.8 | 1.08 | 76.5 | 0.87 | | Price increase more than current rate | 42.0 | 0.99 | 53.8 | 1.04 | 43.5 | 0.97 | 50.9 | 1.21 | 55.2 | 1.09 | | Price increase similar to current rate | 17.4 | 0.75 | 18.3 | 0.79 | 17.5 | 0.71 | 16.6 | 0.87 | 16.8 | 0.81 | | Price increase less than current rate | 4.6 | 0.43 | 3.6 | 0.38 | 4.5 | 0.40 | 4.2 | 0.44 | 4.5 | 0.43 | | No changes in prices | 23.8 | 0.85 | 17.8 | 0.76 | 23.3 | 0.83 | 19.8 | 0.92 | 17.3 | 0.78 | | Decline in prices | 12.2 | 0.67 | 6.5 | 0.48 | 11.2 | 0.62 | 8.4 | 0.68 | 6.2 | 0.47 | | Cost of Services | | | | | | | | | | | | Prices will increase | 76.8 | 0.86 | 81.4 | 0.75 | 76.5 | 0.82 | 80.9 | 0.88 | 79.8 | 0.85 | | Price increase more than current rate | 48.5 | 1.01 | 55.2 | 1.02 | 50.0 | 0.94 | 55.9 | 1.17 | 56.7 | 1.14 | | Price increase similar to current rate | 22.0 | 0.83 | 21.5 | 0.82 | 21.3 | 0.75 | 20.5 | 0.91 | 18.8 | 0.85 | | Price increase less than current rate | 6.3 | 0.50 | 4.7 | 0.44 | 5.2 | 0.43 | 4.5 | 0.47 | 4.3 | 0.43 | | No changes in prices | 19.6 | 0.81 | 15.2 | 0.67 | 20.1 | 0.77 | 15.7 | 0.80 | 16.6 | 0.77 | | Decline in prices | 3.6 | 0.37 | 3.4 | 0.35 | 3.4 | 0.36 | 3.4 | 0.42 | 3.6 | 0.38 | Note:

1. The table provides estimates and standard errors for qualitative responses.

2. Constituent items may not add up to the corresponding total, due to rounding off. |

| Table 2: Inflation Expectations of Various Groups: Sep-21 | | | Current Perception | Three Months ahead Expectation | One Year ahead Expectation | | Mean | Median | Mean | Median | Mean | Median | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Overall | 10.4 | 0.11 | 10.2 | 0.06 | 11.4 | 0.11 | 10.8 | 0.10 | 10.8 | 0.13 | 10.9 | 0.16 | | Gender-wise | | | | | | | | | | | | | | Male | 10.8 | 0.14 | 10.4 | 0.07 | 11.7 | 0.13 | 11.5 | 0.48 | 11.0 | 0.16 | 11.5 | 0.50 | | Female | 10.0 | 0.16 | 9.8 | 0.32 | 11.3 | 0.15 | 10.7 | 0.11 | 10.6 | 0.18 | 10.7 | 0.11 | | Category-wise | | | | | | | | | | | | | | Financial Sector Employees | 10.4 | 0.56 | 9.5 | 0.80 | 11.6 | 0.57 | 11.5 | 1.23 | 10.4 | 0.77 | 10.2 | 1.48 | | Other Employees | 10.5 | 0.19 | 10.3 | 0.10 | 11.5 | 0.20 | 11.0 | 0.27 | 11.0 | 0.23 | 11.2 | 0.46 | | Self Employed | 10.9 | 0.22 | 10.4 | 0.11 | 11.8 | 0.21 | 11.7 | 0.61 | 10.8 | 0.26 | 11.2 | 0.56 | | Homemaker | 9.9 | 0.19 | 9.5 | 0.39 | 11.1 | 0.18 | 10.6 | 0.11 | 10.4 | 0.22 | 10.6 | 0.11 | | Retired Persons | 11.4 | 0.34 | 10.8 | 0.33 | 12.3 | 0.34 | 13.9 | 1.18 | 11.5 | 0.41 | 13.3 | 1.18 | | Daily Workers | 10.8 | 0.26 | 10.3 | 0.17 | 11.8 | 0.25 | 11.7 | 0.65 | 11.4 | 0.29 | 12.1 | 0.78 | | Other category | 9.7 | 0.24 | 9.2 | 0.52 | 11.1 | 0.24 | 10.5 | 0.18 | 10.6 | 0.29 | 10.9 | 0.42 | | Age Group-wise | | | | | | | | | | | | | | Up to 25 years | 9.3 | 0.20 | 8.5 | 0.24 | 10.6 | 0.20 | 10.2 | 0.19 | 10.2 | 0.24 | 10.4 | 0.15 | | 25 to 30 years | 10.2 | 0.20 | 9.9 | 0.32 | 11.2 | 0.20 | 10.6 | 0.17 | 10.5 | 0.26 | 10.6 | 0.16 | | 30 to 35 years | 10.1 | 0.21 | 10.0 | 0.24 | 11.1 | 0.21 | 10.5 | 0.12 | 10.7 | 0.26 | 10.7 | 0.25 | | 35 to 40 years | 10.5 | 0.22 | 10.2 | 0.15 | 11.6 | 0.21 | 11.1 | 0.45 | 10.9 | 0.27 | 11.0 | 0.47 | | 40 to 45 years | 10.9 | 0.23 | 10.5 | 0.09 | 11.9 | 0.22 | 11.9 | 0.61 | 11.3 | 0.29 | 12.0 | 0.65 | | 45 to 50 years | 11.0 | 0.23 | 10.5 | 0.12 | 12.0 | 0.24 | 12.2 | 0.64 | 11.3 | 0.30 | 12.5 | 0.89 | | 50 to 55 years | 10.9 | 0.32 | 10.5 | 0.11 | 12.0 | 0.31 | 13.0 | 1.24 | 10.9 | 0.41 | 11.7 | 0.98 | | 55 to 60 years | 11.0 | 0.31 | 10.6 | 0.20 | 12.0 | 0.30 | 12.7 | 1.04 | 11.1 | 0.41 | 12.2 | 0.81 | | 60 years and above | 11.3 | 0.31 | 10.7 | 0.36 | 12.1 | 0.30 | 13.3 | 1.42 | 11.3 | 0.39 | 13.0 | 1.22 | | City-wise | | | | | | | | | | | | | | Ahmedabad | 11.2 | 0.63 | 10.8 | 1.34 | 12.3 | 0.60 | 13.1 | 1.97 | 11.8 | 0.60 | 13.3 | 1.91 | | Bengaluru | 10.0 | 0.32 | 10.0 | 0.49 | 11.2 | 0.33 | 11.1 | 0.72 | 11.1 | 0.39 | 12.3 | 1.45 | | Bhopal | 8.8 | 0.66 | 8.1 | 1.65 | 10.2 | 0.69 | 10.1 | 1.14 | 9.8 | 0.65 | 10.1 | 1.05 | | Bhubaneswar | 9.5 | 0.57 | 9.0 | 1.32 | 10.2 | 0.51 | 10.0 | 0.74 | 8.1 | 1.11 | 8.8 | 1.77 | | Chennai | 10.5 | 0.39 | 10.4 | 0.15 | 11.8 | 0.36 | 11.8 | 1.28 | 11.7 | 0.44 | 13.6 | 1.51 | | Delhi | 10.8 | 0.23 | 10.4 | 0.10 | 11.9 | 0.23 | 11.9 | 0.73 | 11.2 | 0.28 | 12.0 | 0.89 | | Guwahati | 8.5 | 0.58 | 7.7 | 0.59 | 8.9 | 0.73 | 8.3 | 0.66 | 8.5 | 1.09 | 8.9 | 1.16 | | Hyderabad | 11.3 | 0.52 | 11.0 | 1.01 | 12.7 | 0.47 | 15.4 | 0.84 | 11.0 | 0.54 | 14.0 | 1.52 | | Jaipur | 9.2 | 0.29 | 9.3 | 0.35 | 10.0 | 0.40 | 10.0 | 0.36 | 9.9 | 0.36 | 10.2 | 0.30 | | Kolkata | 10.4 | 0.29 | 10.0 | 0.26 | 11.5 | 0.28 | 11.1 | 0.47 | 11.5 | 0.27 | 11.7 | 0.57 | | Lucknow | 10.7 | 0.53 | 9.8 | 0.81 | 11.1 | 0.49 | 10.4 | 0.68 | 10.0 | 0.60 | 10.2 | 0.58 | | Mumbai | 10.9 | 0.34 | 10.2 | 0.35 | 11.7 | 0.32 | 11.2 | 0.72 | 10.1 | 0.43 | 10.5 | 0.48 | | Nagpur | 9.0 | 0.53 | 7.8 | 0.93 | 10.6 | 0.53 | 9.7 | 1.09 | 10.1 | 0.61 | 9.7 | 0.75 | | Patna | 9.6 | 0.61 | 8.9 | 0.60 | 10.2 | 0.65 | 9.7 | 0.77 | 10.2 | 0.67 | 9.8 | 0.78 | | Thiruvananthapuram | 6.0 | 0.53 | 5.2 | 0.36 | 7.7 | 0.55 | 6.4 | 0.69 | 8.8 | 0.65 | 8.5 | 1.06 | | Chandigarh | 9.4 | 0.63 | 9.0 | 0.86 | 9.1 | 0.59 | 8.9 | 0.54 | 8.8 | 0.87 | 8.7 | 0.76 | | Ranchi | 8.2 | 0.29 | 8.1 | 0.36 | 8.6 | 0.31 | 8.7 | 0.47 | 7.7 | 0.52 | 8.4 | 0.89 | | Raipur | 7.1 | 0.37 | 6.8 | 0.25 | 8.6 | 0.42 | 8.0 | 0.30 | 11.4 | 0.89 | 11.5 | 0.96 | | Note: The table provides estimates and standard errors for quantitative responses. |

| Table 3: Household Inflation Expectations – Current Perception, Three Months and One Year Ahead Expectations | | | Current Perception | Three Months ahead Expectation | One Year ahead Expectation | | Mean | Median | Mean | Median | Mean | Median | | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | Estimate | SE | | Sep-20 | 9.9 | 0.10 | 9.8 | 0.25 | 10.8 | 0.10 | 10.4 | 0.07 | 9.9 | 0.12 | 10.3 | 0.08 | | Mar-21 | 9.4 | 0.11 | 8.7 | 0.16 | 10.4 | 0.11 | 10.1 | 0.11 | 10.0 | 0.12 | 10.2 | 0.09 | | May-21 | 10.4 | 0.09 | 10.2 | 0.04 | 11.4 | 0.09 | 10.8 | 0.07 | 10.7 | 0.11 | 10.9 | 0.12 | | Jul-21 | 10.5 | 0.11 | 10.3 | 0.06 | 11.7 | 0.11 | 11.3 | 0.42 | 11.0 | 0.13 | 11.5 | 0.49 | | Sep-21 | 10.4 | 0.11 | 10.2 | 0.06 | 11.4 | 0.11 | 10.8 | 0.10 | 10.8 | 0.13 | 10.9 | 0.16 | | Note: The table provides estimates and standard errors for quantitative responses. |

| Table 4: Households Expecting General Price Movements in Coherence with Movements in Price Expectations of Various Product Groups: Three Months Ahead and One Year Ahead | | (Percentage of Respondents) | | Survey period ended | Food | Non-Food | Households durables | Housing | Cost of services | | Three Months Ahead | | Sep-20 | 62.1 | 61.0 | 50.4 | 45.9 | 60.5 | | Mar-21 | 67.0 | 65.7 | 57.4 | 58.6 | 65.1 | | May-21 | 68.0 | 65.1 | 51.8 | 50.3 | 60.5 | | Jul-21 | 67.6 | 69.0 | 58.4 | 56.9 | 65.0 | | Sep-21 | 68.9 | 69.0 | 59.4 | 59.9 | 66.5 | | One Year Ahead | | Sep-20 | 63.0 | 64.8 | 55.5 | 53.6 | 66.6 | | Mar-21 | 69.6 | 70.1 | 62.4 | 65.5 | 71.6 | | May-21 | 68.3 | 67.1 | 57.7 | 57.1 | 67.2 | | Jul-21 | 70.1 | 71.0 | 63.3 | 63.5 | 71.4 | | Sep-21 | 71.4 | 72.8 | 64.7 | 67.0 | 73.6 | | Note: Figures are based on sample observations |

| Table 5(a): Cross-tabulation of Number of Respondents by Current Inflation Perception and Three Months Ahead Inflation Expectations: Sep-21 | | Three Months Ahead Inflation Rate (per cent) | | Current Inflation Rate (per cent) | | <1 | 1-<2 | 2-<3 | 3-<4 | 4-<5 | 5-<6 | 6-<7 | 7-<8 | 8-<9 | 9-<10 | 10-<11 | 11-<12 | 12-<13 | 13-<14 | 14-<15 | 15-<16 | >=16 | No idea | Total | | <1 | 3 | 2 | 1 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 7 | | 1-<2 | 1 | 15 | 15 | 4 | 0 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 38 | | 2-<3 | 0 | 9 | 44 | 38 | 23 | 15 | 3 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 134 | | 3-<4 | 0 | 1 | 9 | 68 | 28 | 40 | 11 | 2 | 4 | 0 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 166 | | 4-<5 | 0 | 1 | 3 | 7 | 72 | 63 | 33 | 10 | 11 | 0 | 6 | 0 | 1 | 0 | 0 | 0 | 1 | 0 | 208 | | 5-<6 | 0 | 3 | 5 | 16 | 23 | 320 | 122 | 166 | 91 | 9 | 100 | 0 | 2 | 0 | 0 | 15 | 1 | 0 | 873 | | 6-<7 | 1 | 0 | 0 | 3 | 5 | 1 | 107 | 61 | 84 | 23 | 24 | 2 | 2 | 0 | 1 | 0 | 2 | 0 | 316 | | 7-<8 | 0 | 1 | 0 | 1 | 3 | 7 | 4 | 171 | 87 | 74 | 62 | 8 | 5 | 2 | 3 | 1 | 3 | 0 | 432 | | 8-<9 | 1 | 0 | 1 | 0 | 2 | 2 | 4 | 2 | 166 | 76 | 142 | 20 | 15 | 2 | 2 | 2 | 3 | 0 | 440 | | 9-<10 | 0 | 0 | 0 | 0 | 1 | 2 | 1 | 3 | 5 | 85 | 52 | 33 | 22 | 6 | 5 | 4 | 2 | 1 | 222 | | 10-<11 | 0 | 0 | 3 | 0 | 0 | 21 | 5 | 7 | 23 | 12 | 388 | 58 | 164 | 48 | 15 | 264 | 150 | 1 | 1159 | | 11-<12 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 16 | 15 | 11 | 2 | 10 | 4 | 0 | 60 | | 12-<13 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 3 | 0 | 41 | 6 | 18 | 23 | 17 | 0 | 109 | | 13-<14 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 11 | 5 | 14 | 5 | 0 | 36 | | 14-<15 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 17 | 6 | 12 | 0 | 37 | | 15-<16 | 0 | 0 | 0 | 1 | 2 | 2 | 0 | 0 | 0 | 0 | 9 | 0 | 3 | 2 | 1 | 87 | 173 | 0 | 280 | | >=16 | 0 | 0 | 0 | 0 | 0 | 8 | 0 | 1 | 0 | 0 | 21 | 0 | 2 | 0 | 1 | 17 | 1380 | 11 | 1441 | | Total | 6 | 32 | 81 | 138 | 159 | 485 | 290 | 424 | 472 | 279 | 812 | 138 | 272 | 90 | 70 | 443 | 1754 | 13 | 5958 | | Note: Figures are based on sample observations |

| Table 5(b): Cross-tabulation of Number of Respondents by Current Inflation Perception and One Year Ahead Inflation Expectations: Sep-21 | | One Year Ahead Inflation Rate (per cent) | | Current Inflation Rate (per cent) | | <1 | 1-<2 | 2-<3 | 3-<4 | 4-<5 | 5-<6 | 6-<7 | 7-<8 | 8-<9 | 9-<10 | 10-<11 | 11-<12 | 12-<13 | 13-<14 | 14-<15 | 15-<16 | >=16 | No idea | Total | | <1 | 3 | 0 | 2 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 7 | | 1-<2 | 8 | 10 | 7 | 7 | 2 | 3 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 38 | | 2-<3 | 21 | 1 | 22 | 21 | 31 | 18 | 8 | 0 | 7 | 1 | 2 | 0 | 1 | 0 | 0 | 0 | 1 | 0 | 134 | | 3-<4 | 28 | 0 | 4 | 30 | 23 | 43 | 14 | 2 | 8 | 4 | 8 | 0 | 0 | 0 | 0 | 1 | 1 | 0 | 166 | | 4-<5 | 24 | 0 | 1 | 3 | 34 | 44 | 39 | 15 | 18 | 3 | 16 | 0 | 5 | 0 | 1 | 2 | 3 | 0 | 208 | | 5-<6 | 109 | 0 | 6 | 6 | 6 | 179 | 73 | 139 | 86 | 24 | 170 | 8 | 10 | 2 | 4 | 30 | 21 | 0 | 873 | | 6-<7 | 43 | 0 | 0 | 0 | 1 | 1 | 59 | 34 | 70 | 28 | 48 | 1 | 13 | 3 | 3 | 7 | 5 | 0 | 316 | | 7-<8 | 50 | 0 | 0 | 0 | 1 | 5 | 3 | 97 | 62 | 63 | 88 | 12 | 20 | 2 | 8 | 12 | 9 | 0 | 432 | | 8-<9 | 47 | 0 | 0 | 0 | 1 | 0 | 5 | 3 | 99 | 50 | 142 | 21 | 33 | 7 | 4 | 15 | 13 | 0 | 440 | | 9-<10 | 17 | 0 | 0 | 0 | 0 | 0 | 2 | 2 | 1 | 62 | 45 | 27 | 34 | 8 | 4 | 14 | 6 | 0 | 222 | | 10-<11 | 134 | 0 | 0 | 1 | 0 | 9 | 2 | 6 | 18 | 10 | 230 | 36 | 127 | 39 | 19 | 250 | 276 | 2 | 1159 | | 11-<12 | 4 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 11 | 12 | 5 | 5 | 13 | 8 | 0 | 60 | | 12-<13 | 12 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 3 | 0 | 28 | 4 | 10 | 27 | 25 | 0 | 109 | | 13-<14 | 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 11 | 3 | 10 | 9 | 0 | 36 | | 14-<15 | 5 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 1 | 8 | 6 | 15 | 0 | 37 | | 15-<16 | 20 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 6 | 0 | 2 | 3 | 0 | 58 | 190 | 1 | 280 | | >=16 | 199 | 0 | 0 | 0 | 0 | 4 | 0 | 1 | 0 | 0 | 13 | 0 | 0 | 1 | 1 | 19 | 1196 | 7 | 1441 | | Total | 727 | 11 | 42 | 69 | 100 | 306 | 206 | 299 | 370 | 245 | 773 | 116 | 286 | 86 | 70 | 464 | 1778 | 10 | 5958 | | Note: Figures are based on sample observations |

|  IST,

IST,