IST,

IST,

FAQs on Non-Banking Financial Companies

Credit Rating

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans: A related party is a person or entity that is related to the entity that is preparing its financial statements (referred to as the ‘reporting entity’).

A person or a close member of that person’s family is related to a reporting entity if that person:

(i) has control or joint control over the reporting entity.

(ii) has significant influence over the reporting entity; or

(iii) is a member of the key management personnel of the reporting entity or of a parent of the reporting entity.

In the definition of a related party, an associate includes subsidiaries of the associate and a joint venture includes subsidiaries of the joint venture. Therefore, for example, an associate’s subsidiary and the investor that has significant influence over the associate are related to each other.

Retail Direct Scheme

Investment and Account holdings related queries

There are two ways to buy Government securities through Retail Direct platform:

-

By placing a bid in the primary auctions of dated G-Sec, T-Bills and SDLs (Non-competitive segment only, i.e., by only entering the desired amount of securities, without entering a price). For Sovereign Gold Bonds (SGBs), you may place a bid during the subscription windows announced by RBI on its website. For step-by-step details on bidding in auctions, you may refer to the User Manual on the Retail Direct Portal.

-

By placing a buy quote in the secondary market portal.

Domestic Deposits

III. Advances

Government Securities Market in India – A Primer

31.1 The Fixed Income Money Market and Derivatives Association of India (FIMMDA), an association of Scheduled Commercial Banks, Public Financial Institutions, Primary Dealers and Insurance Companies was incorporated as a Company under section 25 of the Companies Act,1956 on June 3, 1998. FIMMDA is a voluntary market body for the bond, money and derivatives markets. FIMMDA has members representing all major institutional segments of the market. The membership includes Nationalized Banks such as State Bank of India, its associate banks and other nationalized banks; Private sector banks such as ICICI Bank, HDFC Bank; Foreign Banks such as Bank of America, Citibank, Financial institutions such as IDFC, EXIM Bank, NABARD, Insurance Companies like Life Insurance Corporation of India (LIC), ICICI Prudential Life Insurance Company, Birla Sun Life Insurance Company and all Primary Dealers.

31.2 FIMMDA represents market participants and aids the development of the bond, money and derivatives markets. It acts as an interface with the regulators on various issues that impact the functioning of these markets. FIMMDA also plays a constructive role in the evolution of best market practices by its members so that the market as a whole operates transparently as well as efficiently.

31.3 Financial Benchmarks India Pvt. Ltd (FBIL) was incorporated in 2014 as per the recommendations of the Committee on Financial Benchmarks. FBIL has taken over existing benchmarks such as Mumbai Inter-Bank Outright Rate (MIBOR) and option volatility and introduced new benchmarks such as Market Repo Overnight Rate (MROR), Certificate of Deposits (CDs) and T-Bills yield curves. The development of FBIL as an independent organisation for administration of all financial market benchmarks including valuation benchmarks is important for the credibility of these benchmarks and integrity of financial markets. FBIL has assumed the responsibility for administering valuation of Government securities with effect from March 31, 2018.

FBIL has also assumed the responsibility for computation and dissemination of the daily “Reference Rate” for Spot USD/INR and other major currencies against the Rupee, which was previously being done by the Reserve Bank.

External Commercial Borrowings (ECB) and Trade Credits

H. REFINANCING OF ECB

Foreign Investment in India

Answer: Downstream investment made in accordance with the guidelines in existence prior to February 13, 2009 would not require any modification to conform to these regulations. All other investments, after the said date, would come under the ambit of FEMA 20(R). Downstream investments made between February 13, 2009 and June 21, 2013 which were not in conformity with these regulations should have been intimated to the Reserve Bank by October 3, 2013, for treating such cases as compliant with these regulations.

Indian Currency

D) Soiled, Mutilated and Imperfect Banknotes

(i) A ‘soiled note’ means a note which has become dirty due to normal wear and tear and includes a two-piece note pasted together wherein both the pieces presented belong to the same note and form the entire note with no essential feature missing.

(ii) “Mutilated banknote” is a banknote, of which a portion is missing, or which is composed of more than two pieces.

(iii) “Imperfect banknote” means any banknote, which is wholly or partially, obliterated, shrunk, washed, altered or indecipherable but does not include a mutilated banknote.

All you wanted to know about NBFCs

C. Residuary Non-Banking Companies (RNBCs)

While that there is no ceiling on raising of deposits by RNBCs, it is mandated that every RNBC has to ensure that the amounts deposited with it are fully invested in approved investments. In other words, in order to secure the interests of depositor, such companies are required to invest 100 per cent of their deposit liability into highly liquid and secure instruments, namely, Central/State Government securities, fixed deposits with scheduled commercial banks (SCB), Certificate of Deposits of SCB/FIs, units of Mutual Funds, etc.

Core Investment Companies

D. Miscellaneous:

The number of layers of CICs within a Group (including the parent CIC) shall be restricted to two, irrespective of the extent of direct or indirect holding/ control exercised by a CIC in the other CIC. For instance, if a group consists of a parent CIC namely HCo which is holding 100 per cent equity capital in three other CICs namely A, B and C, the layers in the group shall be as follows.

- HCo shall be considered as first layer of CIC

- A,B and C shall be considered as second layer of CICs.

- Any cross holdings, directly or indirectly through other entities in the group, by CICs in the second layer in any other CIC in the group shall be considered as creation of third layer of CIC/s in the group structure which is a violation of the extant instructions. However, investment by second layer CICs in non-CIC group companies is not a violation to the extant CIC regulations. Further, no restriction is placed on number of CICs in a horizontal layer.

Indian Currency

D) Soiled, Mutilated and Imperfect Banknotes

Reserve Bank of India has been continuously making efforts to make good quality banknotes available to the members of public. To help RBI and the banking system towards this objective, the members of public are requested to ensure the following:

-

Not to staple the banknotes;

-

Not to write/put rubber stamp or any other mark on the banknotes;

-

Not to use banknotes for making garlands/toys, decorating pandals and places of worship or for showering on personalities in social events, etc.

The Reserve Bank of India has issued a press release on March 12, 2008, appealing members of public not to use banknotes for making garlands, decorating pandals and places of worship or for showering on personalities in social events, etc. Press Release issued in this regard is available at the following link:

https://rbi.org.in/web/rbi/-/press-releases/respect-your-banknotes-rbi-appeals-to-public-18026.

FAQs on Non-Banking Financial Companies

Credit Rating

All you wanted to know about NBFCs

C. Residuary Non-Banking Companies (RNBCs)

Retail Direct Scheme

Investment and Account holdings related queries

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Some Useful Definitions

Ans: Any domestic liabilities or assets (even if it is in foreign currency) should not be reported in the FLA return.

Domestic Deposits

III. Advances

Government Securities Market in India – A Primer

32.1. RBI financial market watch - /en/web/rbi/financial-markets/other-links/financial-market-watch

This site provides links to information on prices of G-Secs on NDS-OM, money market and other information on G-Secs like outstanding stock etc.

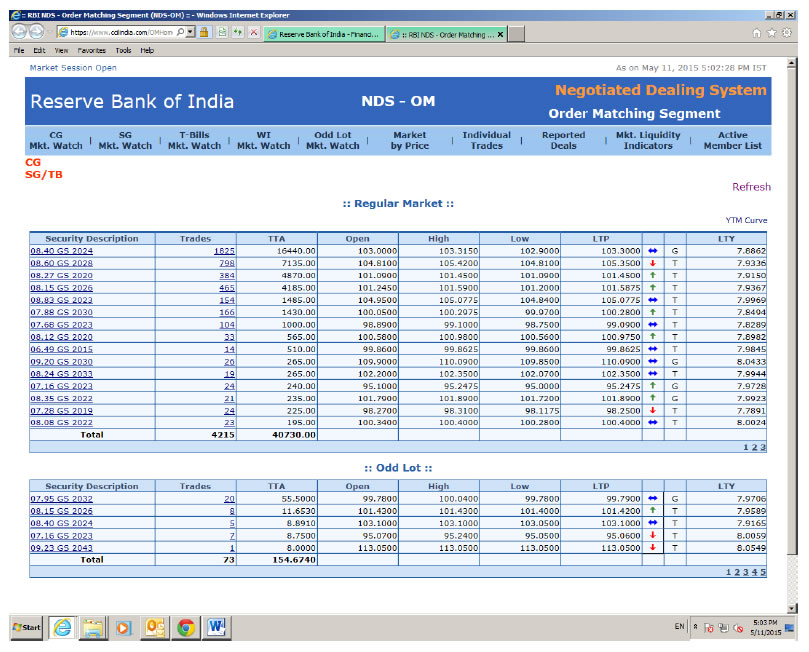

32.2. NDS-OM market watch https://www.ccilindia.com/OMHome.aspx

This site provides real-time information on traded as well as quoted prices of G-Secs, both in Order matching and Reporting segment. In addition, prices of When Issued (WI) (whenever trading takes place) segment are also provided.

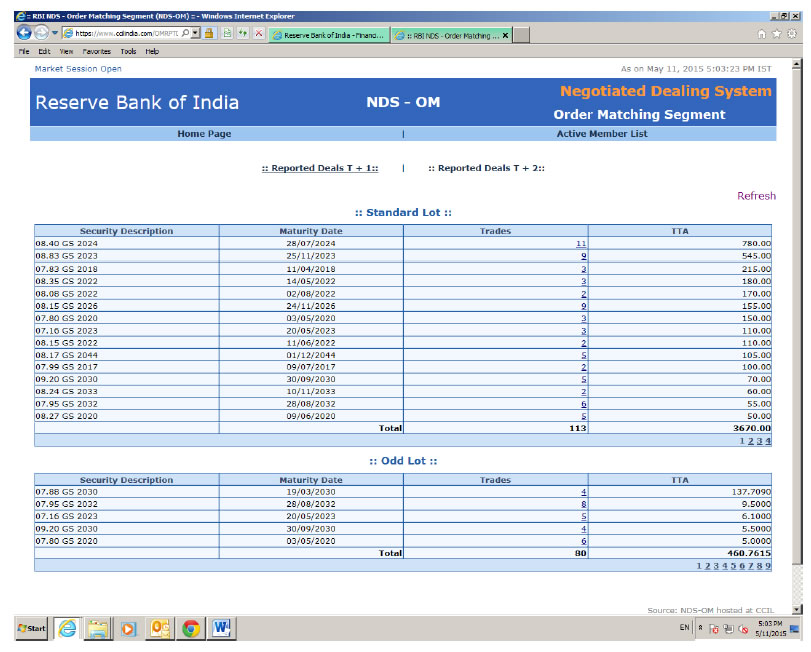

32.3. Reported deals on NDS-OM: https://www.ccilindia.com/OMRPTDeals.aspx

This site provides information on prices of G-Secs in OTC market as reported. One can see chronological traded price levels and quantity in various securities.

32.4 FBIL – www.fbil.org.in

Financial Benchmark India Private Ltd (FBIL) was jointly promoted by Fixed Income Money Market & Derivative Association of India (FIMMDA), Foreign Exchange Dealers’ Association of India (FEDAI) and Indian Banks’ ‘Association (IBA). It was incorporated on 9th December 2014 under the Companies Act 2013. It was recognised by Reserve bank of India as an independent Benchmark administrator on 2nd July 2015.

The company is run by a Board of Directors, assisted by an oversight committee. The main object of the company is to act as the administrators of the Indian interest rate and foreign exchange benchmarks and to introduce and implement policies and procedures to handle the benchmarks. It also will make policies for possible cessation of any benchmark and to follow steps for ensuring orderly transition to the new benchmarks. FBIL will review each benchmark to ensure that the benchmarks accurately represent the economic realities of the interest that it intends to measure. It will take up/consider such other benchmarks as may be required from time to time by periodically assessing the emerging needs of the end -users.

32.5 FIMMDA - http://www.fimmda.org/

This site provides a host of information on market practices for all the fixed income securities including G-Secs. Accessing information from this site requires a valid login and password which are provided by FIMMDA to the eligible entities.

External Commercial Borrowings (ECB) and Trade Credits

H. REFINANCING OF ECB

Foreign Investment in India

ପେଜ୍ ଅନ୍ତିମ ଅପଡେଟ୍ ହୋଇଛି: