IST,

IST,

Minutes of the Monetary Policy Committee Meeting December 6-7, 2016

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The second meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the amended Reserve Bank of India Act, 1934, was held on December 6 and 7, 2016 at the Reserve Bank of India, Mumbai. 2. The meeting was attended by all the members - Dr. Chetan Ghate, Professor, Indian Statistical Institute; Dr. Pami Dua, Director, Delhi School of Economics; and Dr. Ravindra H. Dholakia, Professor, Indian Institute of Management, Ahmedabad; Dr. Michael Debabrata Patra, Executive Director (the officer of the Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Shri R. Gandhi, Deputy Governor in charge of monetary policy - and was chaired by Dr. Urjit R. Patel, Governor. 3. According to Section 45ZL of the amended Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:– (a) the resolution adopted at the meeting of the Monetary Policy Committee; (b) the vote of each member of the Monetary Policy Committee, ascribed to such member, on resolutions adopted in the said meeting; and (c) the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting. 4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The Committee reviewed in detail staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation at its meeting today, the Monetary Policy Committee (MPC) decided to:

6. Consequently, the reverse repo rate under the LAF remains unchanged at 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. 7. The decision of the MPC is consistent with an accommodative stance of monetary policy in consonance with the objective of achieving consumer price index (CPI) inflation at 5 per cent by Q4 of 2016-17 and the medium-term target of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment 8. Global growth picked up modestly in the second half of 2016, after weakening in the first half. Activity in advanced economies (AEs) improved hesitantly, led by a rebound in the US. In the emerging market economies (EMEs), growth has moderated, but policy stimulus in China and some easing of stress in the larger commodity exporters shored up momentum. World trade is beginning to emerge out of a trough that bottomed out in July-August and shows signs of stabilising. Inflation has ticked up in some AEs, though well below target, and is easing in several EMEs. Expectations of reflationary fiscal policies in the US, Japan and China, and the waning of downward pressures on EMEs in recession are tempered by still-prevalent political risks in the euro area and the UK, emerging geo-political risks and the spectre of financial market volatility. 9. International financial markets were strongly impacted by the result of the US presidential election and incoming data that raised the probability of the Federal Reserve tightening monetary policy. As bouts of volatility fuelled a risk-off surge into US equities and out of fixed income markets, a risk-on stampede pulled out capital flows from EMEs, plunging their currencies and equity markets to recent lows even as bond yields hardened in tandem with US yields. The surge of the US dollar from late October intensified after the election results and triggered sizable depreciations in currencies around the world. Commodity prices firmed up across the board from mid-November on an improvement in the outlook for demand following the US election results, barring gold which lost its safe haven glitter to the ascendant US dollar. Crude prices have firmed after the OPEC’s decision to cut output. 10. On the domestic front, the growth of real gross value added (GVA) in Q2 of 2016-17 turned out to be lower than projected on account of a deeper than expected slowdown in industrial activity. Manufacturing slowed down both sequentially and on an annual basis, with weak demand conditions and the firming up of input costs dragging down the profitability of corporations. Gross fixed capital formation contracted for the third consecutive quarter. Although government final consumption expenditure slowed sequentially, it supported private final consumption expenditure, the mainstay of aggregate demand. The contribution of net exports to aggregate demand remained positive, but on account of a sharper contraction in imports relative to exports. 11. Turning to Q3, the Committee felt that the assessment is clouded by the still unfolding effects of the withdrawal of specified bank notes (SBNs). The steady expansion in acreage under rabi sowing across major crops compared to a year ago should build on the robust performance of agriculture in Q2. By contrast, industrial activity remains weak. Among the core industries in the index of industrial production (IIP), the output of coal contracted in October due to subdued demand, while the production of crude oil and natural gas shrank under the binding constraint of structural impediments. The production of cement, fertilisers and electricity continued to decelerate, reflecting the sluggishness in underlying economic activity. On the other hand, steel output has recorded sustained expansion following the application of countervailing duties. Refinery output accelerated on the back of a pick-up in exports and capacity additions. The withdrawal of SBNs could transiently interrupt some part of industrial activity in November-December due to delays in payments of wages and purchases of inputs, although a fuller assessment is awaited. In the services sector, the outlook is mixed with construction, trade, transport, hotels and communication impacted by temporary SBN effects, while public administration, defence and other services would continue to be buoyed by the 7th Central Pay Commission (CPC) award and one rank one pension (OROP). GVA by financial services is expected to receive a short-term boost from the large inflow of low-cost deposits. 12. Retail inflation measured by the headline consumer price index (CPI) eased more than expected for the third consecutive month in October, driven down by a sharper than anticipated deflation in the prices of vegetables. Underlying this softer reading, however, was an upturn in momentum as prices rose month-on-month across the board. Still elevated prices of sugar and protein-rich items, coupled with a turning up of prices of cereals, pulses and processed foods pushed up the momentum of food prices, which partly offset the moderation in food inflation brought about by a strong favourable base effect. In the fuel category, inflation eased with the decline in LPG prices on an annual basis and a fall in electricity prices from a month ago. Inflation excluding food and fuel continues to show strong persistence. Although housing and personal care inflation softened marginally, the steady rise in inflation in respect of education, medical and health services, and transport and communication has imparted stickiness to inflation in this category. 13. Liquidity conditions have undergone large shifts in Q3 so far. Surplus conditions in October and early November were overwhelmed by the impact of the withdrawal of SBNs from November 9. Currency in circulation plunged by ₹7.4 trillion up to December 2; consequently, net of replacements, deposits surged into the banking system, leading to a massive increase in its excess reserves. The Reserve Bank scaled up its liquidity operations through variable rate reverse repo auctions of a wide range of tenors from overnight to 91 days, absorbing liquidity (net) of ₹5.2 trillion. The Reserve Bank allowed oil bonds issued by the Government as eligible securities under the LAF. From the fortnight beginning November 26, an incremental CRR of 100 per cent was applied on the increase in net demand and time liabilities (NDTL) between September 16, 2016 and November 11, 2016 as a temporary measure to drain excess liquidity from the system. From November 28, liquidity absorption fell back and the Reserve Bank undertook variable rate repo auctions of ₹3.3 trillion on November 28. As expected, money market conditions tightened thereafter and the weighted average call rate (WACR) traded near the upper bound of the LAF corridor on that day before dropping back to the policy repo rate on November 30. All other rates in the system firmed up in sympathy, with term premia getting restored gradually. Through this episode, active liquidity management prevented the WACR from falling even to the fixed rate reverse repo rate, the lower bound of the LAF corridor. Liquidity management was bolstered by an increase in the limit on securities under the market stabilisation scheme (MSS) from ₹0.3 trillion to ₹6 trillion on November 29. There have been three issuances of cash management bills under MSS for ₹1.4 trillion by December 6, 2016. 14. In the external sector, India’s merchandise exports rebounded in September and October. The return to positive territory was supported by a pick-up in both POL and non-POL exports. After a prolonged fall for 22 months, imports rose in October on the back of a sharp rise in the volume of gold imports and higher payments for POL imports. Non-oil non-gold import growth also turned positive after a gap of seven months. For the period April-October, the merchandise trade deficit was lower by US $ 25 billion from its level a year ago. Accordingly, the current account deficit is likely to remain muted, notwithstanding some loss of remittances and software exports under invisibles. Net foreign direct investment has remained reasonably robust, with more than half going to manufacturing, communication and financial services. By contrast, portfolio investment outflows of the order of US $ 7.3 billion occurred in October-November from both debt and equity markets – as in peer EMEs across the board – reflecting a strong home bias triggered by the outcome of the US presidential election and the near-certainty of monetary policy tightening in the US. The level of foreign exchange reserves was US$ 364 billion on December 2, 2016. Outlook 15. The Committee took note of the upturn in the prices of several items that is masked by the easing of inflation on base effects during October. Despite some supply disruptions, the abrupt compression of demand in November due to the withdrawal of SBNs could push down the prices of perishables in the reading that becomes available in December. On the other hand, prices of wheat, gram and sugar have been firming up. While discretionary spending on goods and services in the CPI excluding food and fuel – constituting 16 per cent of the CPI basket – could have been affected by restricted access to cash, the prices of these items may weather these transitory effects as they are normally revised according to pre-set cycles. Prices of housing, fuel and light, health, transport and communication, pan, tobacco and intoxicants, and education – together accounting for 38 per cent of the CPI basket – may remain largely unaffected. Going forward, base effects are expected to reverse and turn unfavourable in December and February. If the usual winter moderation in food prices does not materialise due to the disruptions, food inflation pressures could re-emerge. Furthermore, CPI inflation excluding food and fuel has been resistant to downward impulses and could set a floor to headline inflation. With the OPEC’s agreement to cut production, crude prices may firm up in the coming months. Global developments, especially as financial markets factor in the future stance of US monetary and fiscal policy, could impart volatility to the exchange rate thereby feeding into inflation. The withdrawal of SBNs could result in a possible temporary reduction in inflation of the order of 10-15 basis points in Q3. Taking these factors into account, headline inflation is projected at 5 per cent in Q4 of 2016-17 with risks tilted to the upside but lower than in the October policy review. The fuller effects of the house rent allowances under the 7th CPC award are yet to be assessed, pending implementation, and have not been reckoned in this baseline inflation path (Chart 1). 16. The outlook for GVA growth for 2016-17 has turned uncertain after the unexpected loss of momentum by 50 basis points in Q2 and the effects of the withdrawal of SBNs which are still playing out. Downside risks in the near term could travel through two major channels: (a) short-run disruptions in economic activity in cash-intensive sectors such as retail trade, hotels & restaurants and transportation, and in the unorganised sector; (b) aggregate demand compression associated with adverse wealth effects. The impact of the first channel should, however, ebb with the progressive increase in the circulation of new currency notes and greater usage of non-cash based payment instruments in the economy, while the impact of the second channel is likely to be limited. In October 2016, GVA growth in H2 was projected at 7.7 per cent and for the full year at 7.6 per cent. Incorporating the expected loss of growth momentum in Q3 and waning effects in Q4 alongside the boost to consumption demand from higher agricultural output and the implementation of the 7th CPC award, GVA growth for 2016-17 is revised down from 7.6 per cent to 7.1 per cent, with evenly balanced risks (Chart 2). 17. The liquidity management framework was refined in April with the objective of meeting short-term liquidity needs through regular facilities, frictional and seasonal mismatches through fine-tuning operations and more durable liquidity needs for facilitating growth by modulating net foreign assets and net domestic assets. The Reserve Bank has conducted liquidity management consistent with this framework, progressively moving the system level ex ante liquidity conditions to close to neutrality. In Q3 up to early November, liquidity conditions remained in mild surplus mode. The Reserve Bank injected liquidity of ₹1.1 trillion through OMO purchases during the fiscal year so far, including an OMO purchase auction of ₹100 billion in October. Although the replacement of SBNs has engendered large surplus liquidity warranting exceptional operations, this needs to be seen as transitory. The Reserve Bank is committed to conducting liquidity operations in pursuit of the objectives of the revised framework put in place in April to restore system level liquidity to a position of neutrality as the surplus liquidity pressures abate. 18. In the view of the Committee, this bi-monthly review is set against the backdrop of heightened uncertainty. Globally, the imminent tightening of monetary policy in the US is triggering bouts of high volatility in financial markets, with the possibility of large spillovers that could have macroeconomic implications for EMEs. In India, while supply disruptions in the backwash of currency replacement may drag down growth this year, it is important to analyse more information and experience before judging their full effects and their persistence – short-term developments that influence the outlook disproportionately warrant caution with respect to setting the monetary policy stance. If the impact is transient as widely expected, growth should rebound strongly. Turning to inflation, food prices other than vegetables are exhibiting sustained firmness and a pick-up in momentum. Another disconcerting feature of recent developments is the downward inflexibility in inflation excluding food and fuel which could set a resistance level for future downward movements in the headline. Moreover, volatility in crude prices and the surge in financial market turbulence could put the inflation target for Q4 of 2016-17 at some risk. Given these indicators of underlying inflation, it is appropriate to look through the transitory but unclear effects of the withdrawal of SBNs while setting the monetary policy stance. On balance, therefore, it is prudent to wait and watch how these factors play out and impinge upon the outlook. Accordingly, the policy repo rate has been kept on hold in this review, while retaining an accommodative policy stance. 19. Six members voted in favour of the monetary policy decision. The minutes of the MPC’s meeting will be published on December 21, 2016. The next meeting of the MPC is scheduled on February 7 & 8, 2017 and its resolution will be placed on the Reserve Bank’s website on February 8, 2017. Voting on the Resolution to keep the policy repo rate unchanged at 6.25 per cent

Statement by Dr. Chetan Ghate 20. Because of the increased uncertainty due to the withdrawal of SBNs, and virtually no hard data for November, it would be prudent to ‘wait-and-watch’. 21. While a negative demand shock because of the withdrawal of SBNs will lead to a decline in consumption demand, the risks that such a reduction will have longer term effects by impinging on overall investment sentiment and investment activity are low. The risks that weakening aggregate demand could exacerbate a current type of “credit cycle” where a weakening of the real economy leads to a reduction in bank profits, leading to credit restrictions which further weaken the real economy, are also low. What counters the adverse effects of the withdrawal of SBNs is the aggressive pace of digitisation, and the fast restoration of the transaction demand for money from the re-tendering process. I therefore expect the demand and supply effects from the withdrawal of SBNs to be transient with the accompanying increase in the output gap likely to be temporary. This makes it inappropriate to respond with a rate cut. 22. My paramount concern at this juncture has to do with the stickiness of inflation excluding food and fuel. While headline inflation declined in October, inflation excluding food and fuel increased to 4.9 per cent in October, and remains sticky despite favourable base effects. It may be that a decline in core only comes after there is a substantial decline in inflationary expectations. Since the last review, there has also been a reversal of the non-food commodity cycle (e.g., metals, oil). Having said this, food inflation declined sharply in October although cereal inflation has been increasing gradually, and pulses and products continue to be major contributors of food inflation. While cereal prices may be constrained by buffer stocks, vegetable inflation is transient in nature, with possible reversals in trend. What is comforting though is that fewer commodities are driving inflation now compared to last month, which means that inflation is less generalised. Some disinflation will also come about because of the withdrawal of SBNs, although with a lag. 23. Despite a 175 basis points cut in the policy rate between January 2015 and November 2016, the reduction in the weighted average lending rate (WALR) on outstanding rupee loans for data up to September 2016 was only 71 basis points. Because of imperfect interest-rate pass through so far, an additional cut at this juncture may not yield any further transmission from banks. 24. Once the union budget is announced in the first week of February, there will be one more data point. 25. Taking into account these considerations, I vote for keeping the policy repo rate unchanged at 6.25 per cent at today’s meeting of the Monetary Policy Committee. I also believe that the Committee should now focus on the mid-point of the medium-term inflation target of 4 +/- 2 per cent given the lags associated with the transmission of monetary policy. Statement by Dr. Pami Dua 26. On the basis of the Indian leading indices produced by the Economic Cycle Research Institute (ECRI), it can be inferred that the Indian economy was in a resilient state ahead of the decision to withdraw SBNs. It may be noted that a leading index predicts changes in economic activity and thus, cyclical turns in the economy. Specifically, with the Indian Leading Index growth in a clear cyclical upswing and rising to a two-year high before the withdrawal of SBNs, the economic growth outlook going into the autumn months had become increasingly optimistic, underscoring the economy’s resilience to potential negative shocks. Thus, from a business cycle perspective, at the time, the Indian economy was not vulnerable. Moreover, growth in ECRI’s Indian Leading Exports Index, a harbinger of India's exports growth, was also in a decisive cyclical upturn. This indicates that improved exports growth may provide additional support to growth in economic activity, particularly in the context of the brighter global growth prospects suggested by ECRI’s global leading indices. In this backdrop, the withdrawal of SBNs is expected to have only a transitory impact on economic activity. 27. Moreover, with a cumulative reduction in the policy rate by 175 basis points since January 2015, conditions are conducive for further transmission to lending rates by banks. Meanwhile, in the light of higher international bond yields and a strong upturn in ECRI's U.S. Future Inflation Gauge (that anticipates U.S. inflation), the U.S. Federal Reserve is expected to raise its policy rate this month. 28. Keeping in view the above, I fully endorse the resolution to keep the policy repo rate unchanged at 6.25 per cent. Statement by Dr. Ravindra H. Dholakia 29. After carefully considering all arguments for and against holding the policy rate constant in the December review, I find the following reasons convincing for my vote: 30. The Reserve Bank’s forecast of the CPI headline inflation rate obtained by assessment of commodity groups in the CPI basket for the end of March 2017 is about 5 per cent with some upside risks. While my own point forecast based on a more aggregative econometric model is lower, the range estimates of the same indicate a significant chance of the inflation rate exceeding the threshold in March 2017 and in June 2017. 31. Stickiness in the core inflation (other than food and fuel) at close to 5 per cent over the past several months is observed. This coupled with marginally declining but still very high inflationary expectations revealed by the RBI surveys need to be considered seriously. 32. Given the recent developments on SBNs and related policies, the banking sector is likely to be flooded with liquidity for some time to come that on its own may exert a greater influence on the lending rates of banks than the repo rate. 33. Transmission out of the cumulative reduction of 175 basis points in the repo rate since January 2015 has so far been substantially less than 50 per cent in the weighted average lending rate (WALR) for the outstanding Rupee loans and around 60 per cent in the WALR for the fresh rupee loans, whereas it is above 70 per cent in the deposit rates. Thus, there exists enough space for further transmission in the lending rates by the banks. 34. Both external and domestic economic environments are currently impacted by some unique uncertainties as pointed out in the resolution of the Committee. The magnitude of individual and net impact is not very clear at this juncture. In such an environment characterised by uncertainties, any policy intervention in terms of repo rate with acknowledged longer outside lags is likely to add to the uncertainties, which will not be good for the economy. 35. While the recent developments on SBNs can be considered as an exogenous shock to the economy that results in downward revision of the GDP growth forecast, it is widely perceived to be a transitory or temporary phenomenon. If it is so, it is not advisable to respond with a policy intervention that involves longer distributive lags, because otherwise it can destabilise the system or create avoidable uncertainty in policy stance and action in future. Statement by Dr. Michael Debabrata Patra 36. As the resolution of the Monetary Policy Committee (MPC) sets out, an exceptional configuration of factors is obscuring a clear assessment of the outlook. While domestic supply disruptions and demand compression appear to be transient, global developments, including the morphing of political changes into macroeconomic risks, could likely be longer-lived and more challenging. Under these conditions, precaution warrants careful monitoring of the manner in which these forces play out and influence the near- to medium-term. In particular, it is critical to stay focused on the inflation target of 5 per cent for Q4 of 2016-17 amidst subsiding but still-present upside risks in the form of firmness in prices of several food items barring vegetables, hardening international commodity prices – especially of crude oil – and the downward inflexibility in inflation excluding food and fuel. Achieving 5 per cent will imbue credibility into the commitment of monetary policy to the inflation target of 4 per cent, i.e., the centre of the target band. Accordingly, I vote for keeping the policy rate unchanged, while allowing the transmission of policy rate reductions of 175 basis points effected from January 2015 to maintain accommodation in the monetary policy stance. Statement by Shri R. Gandhi 37. I fully concur with the assessment set out in the monetary policy resolution of the MPC and vote in favour of no change in the repo rate because of the following reasons: 38. There is uncertainty about the short-term impact of the decision to withdraw the legal tender status of ₹500 and ₹1000 denomination bank notes on the macro-economy, although the impact is likely to be transitory. I, however, don’t see any significant downside risks to the medium-term growth prospects of the economy. However, there are other uncertainties as well, especially the oil price situation and geo-political situation. For a forward looking monetary policy framework, given the lags in monetary policy transmission, a policy rate action amidst heightened uncertainty will only implicitly allow short-term developments and expectations to impact the medium-term outlook, which needs to be avoided. 39. In an environment characterised by uncertainty, it is more important to create or reinforce enabling conditions for monetary policy actions to work more effectively, going ahead. Hence, my vote for maintaining the policy rate at current level. Statement by Dr. Urjit R. Patel 40. Inflation excluding food and fuel remains sticky. International crude oil prices have firmed up. Global financial conditions pose a threat to macroeconomic and financial stability, with large fluctuations in capital flows and asset prices imparting volatility which gets transmitted into inflation. This uncertainty shows no sign of subsiding, and is likely to get accentuated in the coming year as US macroeconomic and trade policies realign. Even as growing credibility in the disinflation process in India has lowered households’ inflation expectations from double digits prevailing until December 2015, they remain elevated and feed into the services component of inflation. More recently, the steady easing of food inflation has brought about a decline in inflation expectations in the latest round of the survey. 41. The impact of the withdrawal of SBNs on growth and inflation, while uncertain, is transitory. Against this backdrop, it is important for monetary policy to stay focused on the medium-term and strive to achieve, on a durable basis, the middle of the notified inflation target range i.e., 4 per cent. There are other risks to this objective. The full cost-push effects of higher allowances under the 7th CPC’s award will impact inflation outcomes and inflation expectations in 2017-19. Also, the implementation of the goods and services tax could produce a one-off step-up, albeit modest, in inflation. The decision of the Organisation of Petroleum Exporting Countries (OPEC) to cut production, supported by key non-OPEC members, will harden crude prices further as demand and supply get balanced out. Recent movements in other commodity prices also suggest that the global commodity price cycle could be turning. Inflation in advanced economies is turning up incipiently and is expected to rise significantly in 2017 from 2016 levels. Achieving the inflation target of 5 per cent for Q4 of 2016-17 and securing 4 per cent – the central point of the notified target range – remains the primary objective. Ajit Prasad Press Release : 2016-2017/1606 |

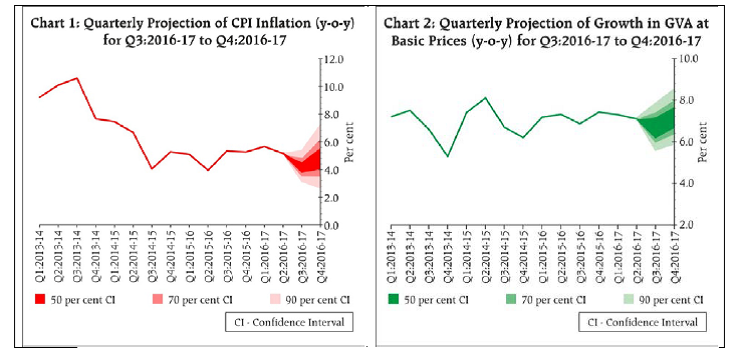

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: