IST,

IST,

Monetary Policy Statement, 2022-23 Resolution of the Monetary Policy Committee (MPC) September 28-30, 2022

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (September 30, 2022) decided to:

Consequently, the standing deposit facility (SDF) rate stands adjusted to 5.65 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 6.15 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 2. Global economic activity is weakening under the impact of the protracted conflict in Ukraine and aggressive monetary policy actions and stances across the world. As financial conditions tighten, global financial markets are experiencing surges of volatility, with sporadic sell-offs in equity and bond markets, and the US dollar strengthening to a 20-year high. Emerging market economies (EMEs) are facing intensified pressures from retrenchment of portfolio flows, currency depreciations, reserve losses and financial stability risks, besides the global inflation shock. As external demand deteriorates, their macroeconomic outlook is becoming increasingly adverse. Domestic Economy 3. Real gross domestic product (GDP) grew year-on-year (y-o-y) by 13.5 per cent in Q1:2022-23. While all constituents of domestic aggregate demand expanded y-o-y and exceeded their pre-pandemic levels, the drag from net exports provided an offset. On the supply side, gross value added (GVA) rose by 12.7 per cent in Q1:2022-23, with all constituents recording y-o-y growth and most notably, services. 4. Aggregate supply conditions are improving. With the south-west monsoon rainfall 7 per cent above the long period average (LPA) as on September 29 and its spatial distribution spreading to some deficit areas, kharif sowing has been catching up. Acreage was 1.7 per cent above the normal sown area as on September 23 and only 1.2 per cent below last year’s coverage. The production of kharif foodgrains as per first advance estimates (FAE) was 3.9 per cent below last year’s fourth advance estimates (only 0.4 per cent below last year’s FAE). Activity in industry and services sectors remains in expansion, especially the latter, as reflected in purchasing managers indices (PMIs) and other high frequency indicators. The index of industrial production growth, however, slowed to 2.4 per cent (y-o-y) in July. 5. On the demand side, urban consumption is being lifted by discretionary spending ahead of the festival season and rural demand is gradually improving. Investment demand is also gaining traction, as reflected in rising imports and domestic production of capital goods, steel consumption and cement production. Merchandise exports posted a modest expansion in August. Non-oil non-gold imports remained buoyant. 6. CPI inflation rose to 7.0 per cent (y-o-y) in August 2022 from 6.7 per cent in July as food inflation moved higher, driven by prices of cereals, vegetables, pulses, spices and milk. Fuel inflation moderated with reduction in kerosene (PDS) prices, though it remained in double digits. Core CPI (i.e., CPI excluding food and fuel) inflation remained sticky at heightened levels, with upside pressures across various constituent goods and services. 7. Overall system liquidity remained in surplus, with the average daily absorption under the liquidity adjustment facility (LAF) easing to ₹2.3 lakh crore during August-September (up to September 28, 2022) from ₹3.8 lakh crore in June-July. Money supply (M3) expanded y-o-y by 8.9 per cent, with aggregate deposits of commercial banks growing by 9.5 per cent and bank credit by 16.2 per cent as on September 9, 2022. India’s foreign exchange reserves were placed at US$ 537.5 billion as on September 23, 2022. Outlook 8. High and protracted uncertainty surrounding the course of geopolitical conditions weighs heavily on the inflation outlook. Commodity prices, however, have softened and recession risks in advanced economies (AEs) are rising. On the domestic front, the late recovery in sowing augurs well for kharif output. The prospects for the rabi crop are buffered by comfortable reservoir levels. The risk of crop damage from excessive/unseasonal rains, however, remains. These factors have implications for the food price outlook. Elevated imported inflation pressures remain an upside risk for the future trajectory of inflation, amplified by the continuing appreciation of the US dollar. The outlook for crude oil prices is highly uncertain and tethered to geopolitical developments, with attendant concerns relating to both supply and demand. The Reserve Bank’s enterprise surveys point to some easing of input cost and output price pressures across manufacturing, services and infrastructure firms; however, the pass-through of input costs to prices remains incomplete. Taking into account these factors and an average crude oil price (Indian basket) of US$ 100 per barrel, inflation is projected at 6.7 per cent in 2022-23, with Q2 at 7.1 per cent; Q3 at 6.5 per cent; and Q4 at 5.8 per cent, and risks are evenly balanced. CPI inflation for Q1:2023-24 is projected at 5.0 per cent (Chart 1). 9. On growth, the improving outlook for agriculture and allied activities and rebound in services are boosting the prospects for aggregate supply. The Government’s continued thrust on capex, improvement in capacity utilisation in manufacturing and pick-up in non-food credit should sustain the expansion in industrial activity that stalled in July. The outlook for aggregate demand is positive, with rural demand catching up and urban demand expected to strengthen further with the typical upturn in the second half of the year. According to the RBI’s surveys, consumer outlook remains stable and firms in manufacturing, services and infrastructure sectors are optimistic about demand conditions and sales prospects. On the other hand, headwinds from geopolitical tensions, tightening global financial conditions and the slowing external demand pose downside risks to net exports and hence to India’s GDP outlook. Taking all these factors into consideration, real GDP growth for 2022-23 is projected at 7.0 per cent with Q2 at 6.3 per cent; Q3 at 4.6 per cent; and Q4 at 4.6 per cent, and risks broadly balanced. For Q1:2023-24, it is projected at 7.2 per cent (Chart 2).  10. In the MPC’s view, inflation is likely to be above the upper tolerance level of 6 per cent through the first three quarters of 2022-23, with core inflation remaining high. The outlook is fraught with considerable uncertainty, given the volatile geopolitical situation, global financial market volatility and supply disruptions. Meanwhile, domestic economic activity is holding up well and is expected to be buoyant in H2:2022-23, supported by festive season demand amidst consumer and business optimism. The MPC is of the view that further calibrated monetary policy action is warranted to keep inflation expectations anchored, restrain the broadening of price pressures and pre-empt second round effects. The MPC feels that this action will support medium-term growth prospects. Accordingly, the MPC decided to increase the policy repo rate by 50 basis points to 5.90 per cent. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. 11. Dr. Shashanka Bhide, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to increase the policy repo rate by 50 basis points. Dr. Ashima Goyal voted to increase the repo rate by 35 basis points. 12. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. Prof. Jayanth R. Varma voted against this part of the resolution. 13. The minutes of the MPC’s meeting will be published on October 14, 2022. 14. The next meeting of the MPC is scheduled during December 5-7, 2022. (Yogesh Dayal) Press Release: 2022-2023/967 |

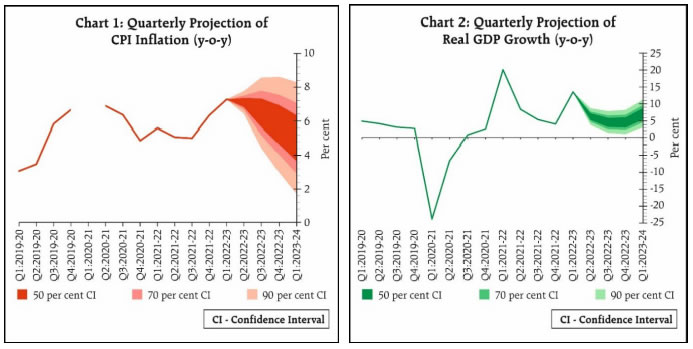

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: