IST,

IST,

Monetary Policy Statement, 2023-24 Resolution of the Monetary Policy Committee (MPC) June 6-8, 2023

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (June 8, 2023) decided to:

The standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below. Assessment Global Economy 2. In the second quarter of 2023, the global economy is sustaining the momentum gained in the preceding quarter in spite of still elevated though moderating inflation, tighter financial conditions, banking sector stress, and lingering geopolitical conflicts. Sovereign bond yields are trading sideways on expectations of the imminent peaking of the tightening cycle of monetary policy while the US dollar has appreciated. Equity markets have remained range bound since the last MPC meeting. For several emerging market economies (EMEs), weak external demand, elevated debt levels and geoeconomic disintegration amidst tighter external financial conditions pose risks to growth prospects, although capital flows are cautiously returning to them on renewed risk appetite. Domestic Economy 3. According to the provisional estimates released by the National Statistical Office (NSO) on May 31, 2023, India’s real gross domestic product (GDP) growth accelerated from 4.5 per cent (year-on-year, y-o-y) in Q3:2022-23 to 6.1 per cent in Q4, supported by fixed investment and higher net exports. Real GDP growth for 2022-23 was placed at 7.2 per cent, higher than the second advance estimate of 7.0 per cent. 4. Domestic economic activity remains resilient in Q1:2023-24 as reflected in high frequency indicators. Purchasing managers’ indices (PMI) for manufacturing and services indicated sustained expansion, with the manufacturing PMI at a 31-month high in May and services PMI at a 13-year high in April-May. In the services sector, domestic air passenger traffic, e-way bills, toll collections and diesel consumption exhibited buoyancy in April-May, while railway freight and port traffic registered modest growth. 5. On the demand side, urban spending remains robust as reflected in indicators such as passenger vehicle sales and domestic air passenger traffic which recorded double digit growth in April. Rural demand is gradually improving though unevenly – motorcycle sales expanded in April, while tractor sales contracted partly owing to unseasonal rains. Investment activity is picking up as reflected in the healthy expansion in steel consumption and cement output in April. Merchandise exports and non-oil non-gold imports remained in contraction mode in April while services exports sustained a robust expansion. 6. CPI inflation fell sharply to 4.7 per cent in April 2023 from 6.4 per cent in February on the back of large favourable base effects, with softening observed across all the three major groups. Food group inflation eased, with moderation in cereals, eggs, milk, fruits, meat and fish, spices and prepared meals inflation and deepening of deflation in edible oils. In the fuel group, inflation in LPG and firewood and chips prices fell and kerosene prices slipped into deflation. Core inflation (i.e., CPI inflation excluding food and fuel) dipped, driven down by clothing and footwear, household goods and services, health, transport and communication, personal care and effects and recreation and amusement sub-groups. 7. The average daily absorption under the LAF increased to ₹1.7 lakh crore during April-May from ₹1.4 lakh crore in February-March. Money supply (M3) expanded by 10.1 per cent y-o-y and non-food bank credit by 15.6 per cent as on May 19, 2023. India’s foreign exchange reserves were placed at US$ 595.1 billion as on June 2, 2023. Outlook 8. Going forward, the headline inflation trajectory is likely to be shaped by food price dynamics. Wheat prices could see some correction on robust mandi arrivals and procurement. Milk prices, on the other hand, are likely to remain under pressure due to supply shortfalls and high fodder costs. The forecast of a normal south-west monsoon by the India Meteorological Department (IMD) augurs well for kharif crops; however, the spatial and temporal distribution of the monsoon would need to be closely monitored to assess the prospects for agricultural production. Crude oil prices have eased but the outlook remains uncertain. According to the early results from the Reserve Bank’s surveys, manufacturing, services and infrastructure firms polled expect input costs and output prices to harden. A clearer picture will emerge when the final survey results are available. Taking into account these factors and assuming a normal monsoon, CPI inflation is projected at 5.1 per cent for 2023-24, with Q1 at 4.6 per cent, Q2 at 5.2 per cent, Q3 at 5.4 per cent and Q4 at 5.2 per cent. The risks are evenly balanced (Chart 1). 9. The higher rabi crop production in 2022-23, the expected normal monsoon, and the sustained buoyancy in services should support private consumption and overall economic activity in the current year. The government’s thrust on capital expenditure, moderation in commodity prices and robust credit growth are expected to nurture investment activity. Weak external demand, geoeconomic fragmentation, and protracted geopolitical tensions, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.5 per cent with Q1 at 8.0 per cent, Q2 at 6.5 per cent, Q3 at 6.0 per cent, and Q4 at 5.7 per cent, with risks evenly balanced (Chart 2).  10. The MPC took note of the moderation in CPI headline inflation in March-April into the tolerance band, in line with projections, reflecting the combined impact of monetary tightening and supply augmenting measures. Headline inflation is projected to decline in 2023-24 from its level in 2022-23 but would still be above the target, warranting continuous vigil. The progress of the south west monsoon is critical in this regard. Domestic economic activity is holding up well. Consumer confidence is improving and businesses remain optimistic about the future. The cumulative rate hike of 250 basis points undertaken by the MPC is transmitting through the economy and its fuller impact should keep inflationary pressures contained in the coming months. Monetary policy would need to be carefully calibrated for alignment of inflation with the target. Against this backdrop, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent. The MPC resolved to continue keeping a close vigil on the evolving inflation and growth outlook. It will take further monetary actions promptly and appropriately as required to keep inflation expectations firmly anchored and to bring down inflation to the target. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. 11. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50 per cent. 12. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. Prof. Jayanth R. Varma expressed reservations on this part of the resolution. 13. The minutes of the MPC’s meeting will be published on June 22, 2023. 14. The next meeting of the MPC is scheduled during August 8-10, 2023. (Yogesh Dayal) Press Release: 2023-2024/364 |

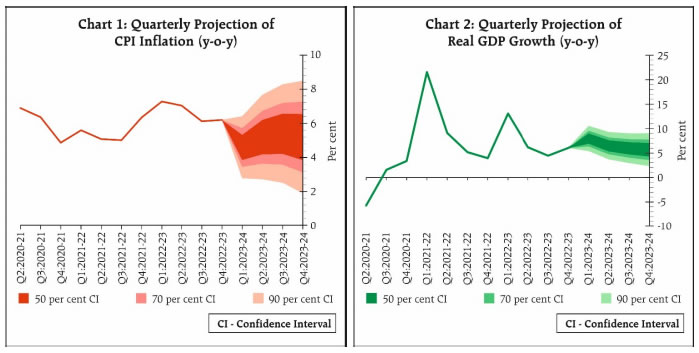

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: