IST,

IST,

Monetary Policy Statement, 2024-25 Resolution of the Monetary Policy Committee (MPC) December 4 to 6, 2024

|

Monetary Policy Decisions

Consequently, the standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

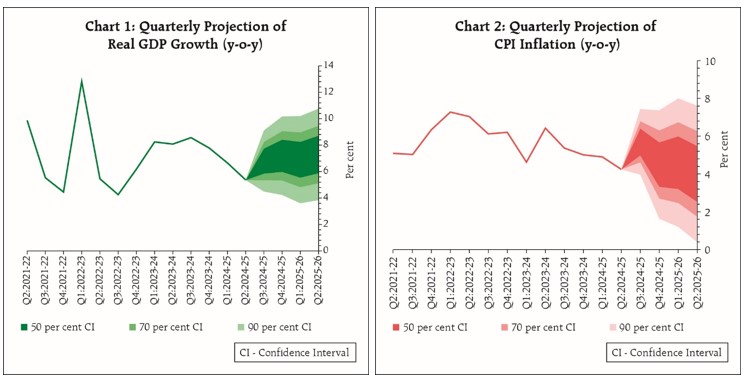

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. Growth and Inflation Outlook 2. The global economy remains stable with growth holding up amidst waning inflation, albeit at a slow pace. Geopolitical risks and policy uncertainty, especially with respect to trade policies, have imparted heightened volatility to global financial markets. 3. On the domestic front, real gross domestic product (GDP) registered a lower than expected growth of 5.4 per cent in Q2:2024-25 as private consumption and investment decelerated even while government spending recovered from a contraction in the previous quarter. On the supply side, the growth in gross value added (GVA) during Q2 was aided by resilient services and improving agriculture sector, but weakness in industrial activity – manufacturing, electricity and mining – tempered overall growth. Looking ahead, robust kharif foodgrain production and good rabi prospects, coupled with an expected pickup in industrial activity and sustained buoyancy in services augur well for private consumption. Investment activity is expected to pick up. Resilient world trade prospects should provide support to external demand and exports. Headwinds from geo-political uncertainties, volatility in international commodity prices, and geo-economic fragmentation continue to pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 6.6 per cent with Q3 at 6.8 per cent; and Q4 at 7.2 per cent. Real GDP growth for Q1:2025-26 is projected at 6.9 per cent; and Q2 at 7.3 per cent(Chart 1). The risks are evenly balanced. 4. Headline CPI inflation surged above the upper tolerance level to 6.2 per cent in October from 5.5 per cent in September and sub-4.0 per cent prints in July-August, propelled by a sharp pick-up in food inflation and an uptick in core (CPI excluding food and fuel) inflation. Going forward, food inflation is likely to soften in Q4 with seasonal easing of vegetables prices and kharif harvest arrivals; and good soil moisture conditions along with comfortable reservoir levels auguring well for rabi production. Adverse weather events and rise in international agricultural commodity prices, however, pose upside risks to food inflation. Even though energy prices have softened in the recent past, its sustenance needs to be monitored. Businesses expect pressures from input costs to remain elevated and growth in selling prices to accelerate from Q41 . Taking all these factors into consideration, CPI inflation for 2024-25 is projected at 4.8 per cent with Q3 at 5.7 per cent; and Q4 at 4.5 per cent. CPI inflation for Q1:2025-26 is projected at 4.6 per cent; and Q2 at 4.0 per cent (Chart 2). The risks are evenly balanced. Rationale for Monetary Policy Decisions 5. The MPC noted that the near-term inflation and growth outcomes in India have turned somewhat adverse since the October policy. Going forward, however, economic activity is set to improve along with rising business and consumer sentiments, as reflected in the Reserve Bank’s surveys.The recent spike in inflation highlights the continuing risks of multiple and overlapping shocks to the inflation outlook and expectations. Heightened geo-political uncertainties and financial market volatility add further upside risks to inflation. High inflation reduces the purchasing power of both rural and urban consumers and may adversely impact private consumption. The MPC emphasises that strong foundations for high growth can be secured only with durable price stability. The MPC remains committed to restoring the balance between inflation and growth in the overall interest of the economy. Accordingly, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting. The MPC also decided to continue with the neutral stance of monetary policy as it provides flexibility to monitor the progress and outlook on disinflation and growth and to act appropriately. The MPC remains unambiguously focused on a durable alignment of inflation with the target, while supporting growth. 6. Shri Saugata Bhattacharya, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to keep the policy repo rate unchanged at 6.50 per cent. Dr. Nagesh Kumar and Professor Ram Singh voted to reduce the policy repo rate by 25 basis points. 7. Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Professor Ram Singh, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted for continuing with the neutral stance of monetary policy and to remain unambiguously focused on a durable alignment of inflation with the target, while supporting growth. 8. The minutes of the MPC’s meeting will be published on December 20, 2024. 9. The next meeting of the MPC is scheduled during February 5 to 7, 2025.

(Puneet Pancholy) Press Release: 2024-2025/1646 |

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: