IST,

IST,

Half Yearly Report on Management of Foreign Exchange Reserves: April - September 2024

|

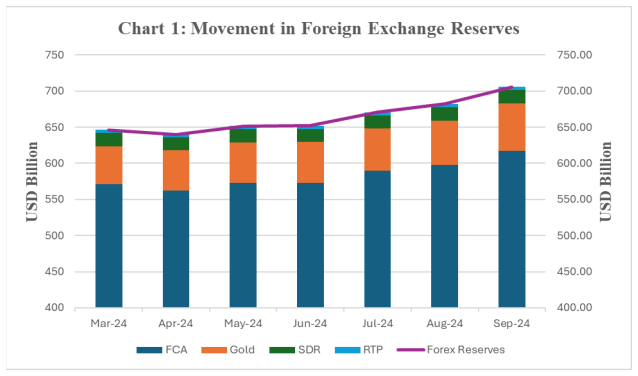

Contents Developments during the Half Year ended September 2024 The Reserve Bank of India publishes half-yearly reports on management of foreign exchange reserves as part of its efforts towards enhanced transparency and levels of disclosure. These reports are prepared half yearly with reference to the position as at end-March and end-September each year. The present report (43rd in the series) is with reference to the position as at end-September 2024. The report is divided into two parts: Part I contains the developments regarding movement of foreign exchange reserves, information on the external liabilities vis-à-vis the reserves, adequacy of reserves, etc., during the half-year under review. Objectives of reserve management, statutory provisions, risk management practices, information on transparency and disclosure practices followed by the RBI with regard to reserve management are covered in Part II. I.2 Movement of Foreign Exchange Reserves I.2.1 Review of Growth of Foreign Exchange Reserves During the half-year period under review, reserves increased from USD 646.42 billion as at end- March 2024 to USD 705.78 billion as at end-September 2024 (Table 1 and Chart 1). Although both US dollar and Euro are intervention currencies and the Foreign Currency Assets (FCA) are maintained in major currencies, the foreign exchange reserves are denominated and expressed in US dollar terms. Movements in the FCA occur mainly on account of purchase and sale of foreign exchange by the RBI, income arising out of the deployment of the foreign exchange reserves, external aid receipts of the Central Government and changes on account of revaluation of the assets. I.2.2 Sources of Accretion to Foreign Exchange Reserves On a balance of payments basis (i.e., excluding valuation effects), foreign exchange reserves increased by US$ 5.2 billion during April-June 2024 compared to the increase of US$ 24.4 billion during April-June 2023. Foreign exchange reserves in nominal terms (including valuation effects) increased by US$ 5.6 billion during April-June 2024 as compared with an increase of US$ 16.6 billion in the corresponding period of the preceding year. Table 2 provides details of sources of variation in foreign exchange reserves during April-June 2024 vis-à-vis the corresponding period of the previous year. The valuation gain amounted to US$ 0.4 billion during April-June 2024 as against a valuation loss of US$ 7.8 billion during April-June 2023. The net forward asset (payable) of the Reserve Bank stood at USD 14.58 billion as at the end of September 2024. I.4 External Liabilities vis-à-vis Foreign Exchange Reserves India’s International Investment Position (IIP), which is a summary record of the stock of country’s external financial assets and liabilities as at end-June 2024, is furnished in Table 3. During the period between end-June 2023 and end-June 2024, the external assets increased by USD 108.4 billion and external liabilities increased by USD 97.7 billion. The net IIP as at end-June 2024 was negative at USD 368.3 billion as against a negative net IIP of USD 379.0 billion at end-June 2023, implying that the sum of all external liabilities is more than that of the external assets in both periods.1 There has been a decrease in the negative gap on a year-on-year basis. At the end of June 2024, foreign exchange reserves cover of imports (on balance of payments basis) stood at 11.2 months (11.3 months at end-March 2024). The ratio of short-term debt (original maturity) to reserves, which was 19.7 per cent at end-March 2024, increased to 20.3 per cent at end-June 2024. The ratio of volatile capital flows (including cumulative portfolio inflows and outstanding short-term debt) to reserves increased marginally from 69.8 per cent at end-March 2024 to 70.1 per cent at end-June 2024. I.6. Management of Gold Reserves As at end-September 2024, the Reserve Bank held 854.73 metric tonnes of gold, of which 510.46 metric tonnes were held domestically. While 324.01 metric tonnes of gold were kept in safe custody with the Bank of England and the Bank for International Settlements (BIS), 20.26 metric tonnes were held in the form of gold deposits. In value terms (USD), the share of gold in the total foreign exchange reserves increased from 8.15 per cent as at end-March 2024 to about 9.32 per cent as at end-September 2024. I.7 Investment Pattern of the Foreign Currency Assets The foreign currency assets comprise multi-currency assets that are held in multi-asset portfolios as per the existing norms, which conform to the best international practices followed in this regard. As at end-September 2024, out of the total FCA of USD 617.07 billion, USD 515.30 billion was invested in securities, USD 60.11 billion was deposited with other central banks and the BIS and the balance USD 41.66 billion comprised deposits with commercial banks overseas (Table 4). With the objective of exploring new strategies and products in reserve management while diversifying the portfolio, a small portion of the reserves is being managed by external asset managers. The investments made by the external asset managers are governed by the permissible activities as per the RBI Act, 1934. I.8.1 Financial Transaction Plan (FTP) of the IMF During the half year under review, there was one purchase transaction aggregating USD 327.41 million and seven repurchase transactions aggregating USD 707.98 million under the FTP of the IMF. I.8.2 Investments under New Arrangements to Borrow (NAB) and Note Purchase Agreement (NPA) with IMF India’s commitment under the IMF’s New Arrangements to Borrow (NAB) was last raised to SDR 8,881.82 million from January 01, 2021. RBI has NIL subscription under NAB as at end of September 2024. In terms of the Note Purchase Agreement (NPA) 2020, entered into between RBI and IMF, RBI has agreed to invest an amount equivalent to USD 3.90 billion in SDR denominated Notes issued by IMF. The SAARC currency Swap Framework which came into operation on November 15, 2012 was valid till June 30,2024. Subsequently, the Reserve Bank of India with the approval of the Government of India has put in place a framework for Currency swap arrangement for SAARC countries 2024-27. Under this arrangement, RBI will offer seven other SAARC countries swap facilities under two swap windows i.e., USD 2 billion under the USD/EURO swap window and INR 250 billion under the India Rupee Swap window. Under the previous framework, Bhutan availed a swap of ₹ 16, 675.90 million (equivalent to USD 200 million) on May 03, 2024 for three months and fully repaid the same on August 05, 2024. Subsequently, RBI has signed Currency Swap Agreements with the Royal Monetary Authority of Bhutan (RMAB) and the Maldives Monetary Authority (MMA). Bhutan has availed a swap of ₹ 15 billion on August 05, 2024. I.8.4 Investment in bonds issued by IIFC (UK) The Reserve Bank has the mandate to invest up to USD 5 billion in the bonds issued by the India Infrastructure Finance Company (UK) Limited. As at end of September 2024, the amount invested in such bonds stood at USD 720 million. Objectives of Reserve Management, Legal Framework, Risk Management Practices, Transparency and Disclosure II.1. Objectives of Reserve Management The guiding objectives of foreign exchange reserve management in India are similar to those of many central banks in the world. The demands placed on the foreign exchange reserves may vary widely depending upon a variety of factors including the exchange rate regime adopted by the country, the extent of openness of the economy, the size of the external sector in a country's GDP and the nature of markets operating in the country. While safety and liquidity constitute the twin objectives of reserve management in India, return optimization is kept in view within this framework. II.2. Legal Framework and Policies The Reserve Bank of India Act, 1934 provides the overarching legal framework for deployment of reserves in different foreign currency assets and gold within the broad parameters of currencies, instruments, issuers and counterparties. The essential legal framework for reserve management is provided in sub-sections 17(6A), 17(12), 17(12A), 17(13) and 33 (6) of the above Act. In brief, the law broadly permits the following investment categories:

The broad strategy for reserve management including currency composition and investment policy is decided in consultation with the Government of India. The risk management functions are aimed at ensuring development of sound governance structure in line with the best international practices, improved accountability, a culture of risk awareness across all operations, efficient allocation of resources and development of in-house skills and expertise. The risks attendant on deployment of reserves, viz., credit risk, market risk, liquidity risk and operational risk and the systems employed to manage these risks are detailed in the following paragraphs. The Reserve Bank is sensitive to the credit risk it faces on account of the investment of foreign exchange reserves in the international markets. The Reserve Bank's investments in bonds/treasury bills represent debt obligations of highly rated sovereigns, central banks and supranational entities. Further, deposits are placed with central banks, the BIS and commercial banks overseas. RBI has framed requisite guidelines for selection of issuers/ counterparties with a view to enhancing the safety and liquidity aspects of the reserves. The Reserve Bank continues to apply stringent criteria for selection of counterparties. Credit exposure vis-à-vis sanctioned limit in respect of approved counterparties is monitored continuously. Developments regarding counterparties are constantly under watch. The basic objective of such an on-going exercise is to assess whether any counterparty's credit quality is under potential threat. Market risk for a multi-currency portfolio represents the potential change in valuations that result from movements in financial market prices, viz. changes in interest rates, foreign exchange rates, equity prices and commodity prices. The major sources of market risk for central banks are currency risk, interest rate risk and movement in gold prices. These risks are managed using Value-at-Risk (VaR), Conditional Value-at-Risk (CVaR), scenario analysis, stress testing etc. Further, to manage interest rate risk, duration and permitted deviations from the duration are specified as per the prevailing market conditions. Gains/losses on valuation of FCA and gold due to movements in the exchange rates and/or price of gold are booked under a balance sheet head named the Currency and Gold Revaluation Account (CGRA). The balances in CGRA provide a buffer against exchange rate/gold price fluctuations. The dated foreign securities are valued at market prices at the end of each business day and the appreciation/depreciation arising therefrom is transferred to the Investment Revaluation Account (IRA). The balance in IRA is meant to provide cushion against changes in the security prices over the holding period. Currency risk arises due to movements in the exchange rates. Decisions are taken on the long-term exposure to different currencies depending on the likely movements in exchange rates and other considerations over the medium and long-term. The decision-making procedure is supported by reviews of the strategy on a regular basis. The crucial aspect of the management of interest rate risk is to protect the value of the investments as much as possible from adverse impact of interest rate movements. The interest rate sensitivity of the portfolio is identified in terms of the benchmark duration and the permitted deviation from the benchmark. Liquidity risk involves the risk of not being able to sell an instrument or close a position when required without facing significant costs. The reserves need to have a high level of liquidity at all times in order to be able to meet any unforeseen and emergency needs. Any adverse development on the external front would pose a demand on our forex reserves and, hence, the investment strategy needs a highly liquid portfolio. The choice of instruments determines the liquidity of the portfolio. For example, in some markets, treasury securities could be liquidated in large volumes without much distortion of the price in the market and, thus, can be considered as liquid. Except fixed deposits with the BIS/ commercial banks overseas / central banks and securities issued by supranationals, almost all other types of investments are highly liquid instruments which could be converted into cash at short notice. The Reserve Bank closely monitors the portion of the reserves which could be converted into cash at a very short notice to meet any unforeseen/ emergency needs. II.3.4 Operational Risk and Control System In tune with the global trend, close attention is paid to strengthen the operational risk control arrangements. Key operational procedures are documented. Internally, there is total separation of the front office and the back-office functions and the internal control systems ensure several checks at the stages of deal capture, deal processing and settlement. The deal processing and settlement system, including generation of payment instructions, is also subject to internal control guidelines. There is a system of concurrent audit for monitoring compliance in respect of the internal control guidelines. Further, reconciliation of accounts is done regularly. In addition to internal audit and independent monitoring, the financial accounts are audited by external statutory auditors. There is a comprehensive reporting mechanism covering significant areas of activity/ operations relating to reserve management. These are provided to the senior management at frequent intervals, depending on the type and sensitivity of information. The Reserve Bank uses SWIFT as the messaging platform to settle its trades and send financial messages to its counterparties, custodians of securities and other business partners. International best practices with respect to usage and security of SWIFT system are followed. The SWIFT applications are updated to the SWIFT recommended versions, along with strict compliance with all the mandatory security control measures as recommended by SWIFT. The SWIFT connectivity infrastructure was successfully upgraded to the latest version. Further, Reserve Bank of India has successfully migrated to SWIFT ISO 20022 standards (for incoming messages). Its system is now enabled to interact with MX messaging formats having enhanced security features. II.4 Transparency and Disclosures The Reserve Bank has been making available in the public domain data relating to Foreign Exchange Reserves, its operations in foreign exchange market, position of the country’s external assets and liabilities and earnings from deployment of Foreign Currency Assets and gold through periodic press releases of its Weekly Statistical Supplements, Monthly Bulletins, Annual Reports, etc. The Reserve Bank's approach with regard to transparency and disclosure closely follows international best practices in this regard. The Reserve Bank has adopted the Special Data Dissemination Standards (SDDS) template of the IMF for publication of the detailed data on Foreign Exchange Reserves. Such data are made available on monthly basis on the Reserve Bank's website. 1 Partially revised figures and hence may not tally with figures published in the previous reports. |

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: