|

PREFACE

Department of Regulation (DoR) serves as the primary regulatory authority within the Reserve Bank of India overseeing a diverse range of financial entities, including Commercial Banks, Cooperative Banks, Non-Banking Financial Companies (NBFCs), Asset Reconstruction Companies, All India Financial Institutions, and Credit Information Companies. With a dual focus on depositor protection and the promotion of a robust financial system, the Department strives to ensure the orderly development and conduct of banking operations, ultimately fostering a healthy, stable, and inclusive financial ecosystem that offers cost-effective intermediation services while upholding responsible conduct. To achieve these objectives, the Department operates through a twin-peak regulatory architecture, divided into two specialized Divisions—the Prudential Regulation Division and the Conduct and Operations Division.

As the Indian financial system has evolved, many regulatory instructions have been issued over the years. To enhance the ease of accessibility and compliance, it has become essential to institutionalize a regular, periodic review of regulatory developments and processes. This proactive approach will enable DoR to streamline its framework, ensuring it remains effective, efficient, and supportive of the financial system’s continued growth and development.

With this objective, the Reserve Bank constituted the Regulations Review Authority 2.0 (RRA 2.0) in 2021 to review the regulatory prescriptions internally as well as by seeking suggestions from the RBI regulated entities and other stakeholders with a view to their simplification and ease of implementation. Based on detailed deliberation, RRA 2.0 finalized its report on June 10, 2022. One of the key recommendations of the report was to create a Regulatory Handbook, consolidating the regulations applicable to regulated entities as a quick reference guide.

Accordingly, DoR has compiled its regulatory instructions in an easily accessible handbook titled “Regulations at a Glance”. The handbook provides tabular summary of all major regulations issued by the Reserve Bank and has been organized in six different chapters; namely, I—Introduction; II— Licensing of New Institutions; III— Governance and Ownership Framework; IV—Prudential Norms and Capital Regulations; V—Conduct Related Regulations; and VI—Resolution of Regulated Entities.

This handbook is designed to provide a high-level overview of the regulatory landscape, serving as a broad point of reference for general understanding. For specific compliance requirements, regulated entities are advised to consult and adhere to the respective, detailed regulations issued through Circulars/ Master Circulars/ Master Directions and as amended from time to time. Please note that this handbook will undergo updates at regular intervals to reflect changes in the regulatory environment. Users are encouraged to check for the latest version to ensure accuracy.

CHAPTER I - LEGISLATIVE FRAMEWORK

| Sl. No. |

Categories |

Relevant Legisltaive Frameworks (indicative list only) |

| 01. |

Regulation of Banks |

• Reserve Bank of India Act, 1934

• Banking Regulation Act, 1949

• The Recovery Of Debts And Bankruptcy (RDB) Act, 1993

• Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002

• The Prevention of Money Laundering (PML) Act, 2002

• Companies Act, 2013 |

| 02. |

Regulation of NBFCs, ARC and Credit Information Companies |

• Reserve Bank of India Act, 1934 (for all NBFCs)

• National Housing Bank Act (NHB Act), 1987 (for HFCs)

• SARFAESI Act, 2002 (for ARCs)

• The Prevention of Money Laundering (PML) Act, 2002

• Credit Information Companies (Regulation) Act, 2005 (for Credit Information Companies),

• Factoring Regulation Act, 2011 (for NBFC-Factors and NBFC-ICCs licensed to undertaking factoring business) |

| 03. |

Regulation of Cooperative Banks |

• Reserve Bank of India Act, 1934

• Banking Regulation Act, 1949

• Multi-State Co-operative Act, 2002

• The Prevention of Money Laundering (PML) Act, 2002

• Various State Co-operative Acts |

| 04. |

Regulation of All India Financial Institutions (AIFIs) |

• Reserve Bank of India Act, 1934

• Relevant Acts for the concerned AIFIs like NABARD Act, 1981, NHB Act, 1987, NaBFID Act, 2021.

• The Recovery Of Debts And Bankruptcy (RDB) Act, 1993

• SARFAESI Act, 2002

• The Prevention of Money Laundering (PML) Act, 2002 |

CHAPTER II - LICENSING OF NEW INSTITUTIONS

II.1 LICENSING OF BANKS

| Category |

Commercial Banks |

Cooperative Banks |

| Universal Banks |

Small Finance Banks |

Urban Cooperative Banks |

Rural Cooperative Banks [State Cooperative Banks (StCBs), Central Cooperative Banks (CCBs)] |

| 1. Paid-up/ Net worth (or other important conditions) |

₹1,000 crore |

₹300 crore |

₹12.5 lakh - ₹4 crore (depending upon category of centre, and population size)

[RBI has stopped accepting fresh application for granting banking license to new UCBs since 2004] |

• State Govt. declares a particular society as StCB/ CCB

• RBI to ensure adequate capital/Governance structure and earning prospects

• RBI grants banking license based on recommendation of NABARD and its internal analyses |

| 2. Condition for Promoters/ Promoter groups |

Fit and Proper Crieria |

Fit and Proper Crieria |

Focus on promoters' educational background, professional competence, means and standing, ability to mobilise requisite capital and membership |

|

Resident Individuals with > 10 years of experience in banking and finance at a senior level; Record of sound credentials and integrity; successful track record > 10 years.

Resident entities with > 10 years of successful track record (if total assets > ₹5000 crore then non-financial business to be ≤ 40% in terms of assets/ income)

Record of sound credentials and integrity; successful track record > for at least 10 years |

Resident Indian Citizens with > 10 years of experience in banking and finance at a senior level; Companies and Societies having successful track record > 5 years, |

| 3. Transition from other financial institutions |

Existing NBFCs controlled by residents with >10 years of successful track record can set up |

Existing NBFCs, LABs, MFIs controlled by residents with >5 years of successful track record can set up |

– |

– |

| Listed scheduled SFBs can be converted into UBs if satisfactory track record > 5 years; Net Worth > ₹1000 crore; meeting prescribed CRAR; net profit in last 2 FY; GNPA ≤ 3% and NNPA ≤ 1%. |

UCBs with NW ≥ ₹150 crore and maintaining CRAR ≥ 9% can convert;

Existing Payments Banks (PBs) who have completed five years of operations |

– |

– |

II.2 NBFC REGISTRATION

| NBFC category |

Defining conditions |

Current Net Owned Fund |

| NBFC-ICC: Type I NBFC - ND |

NBFC-ICC (financial assets >50% of its total assets and income from these financial assets>50% of its gross income), which does not accept/intend to accept public funds and does not have/intend to have customer interface |

₹2 crore |

| NBFC-ICC: Type II NBFC - ND |

NBFC-ICC (financial assets >50% of its total assets and income from these financial assets>50% of its gross income), which accepts/ intends to accept public funds and/or have/ intends to have customer interface in future |

₹10 crore |

| NBFC-P2P |

NBFC which carries on the business of peer-to-peer lending platform |

₹2 crore |

| NBFC-AA |

NBFC which carries on the business of account aggregator |

₹2 crore |

| NBFC-MFI |

Non-deposit taking NBFC with ≥ 75% of its total assets deployed towards micro-finance loans |

₹10 crore |

| NBFC-FACTOR |

NBFC with ≥ 50% of its total assets and ≥ 50% of its gross income derived from factoring business |

₹10 crore |

| NBFC-HFC |

NBFC with ≥ 60% of its total assets (netted off by intangible assets) in housing finance; ≥ 50% of its total assets (netted off by intangible assets) in housing finance for individuals |

₹20 crore |

| MGC |

A company which primarily transacts the business of providing mortgage guarantee (≥ 90% of business turnover; or ≥ 90% of gross income is from mortgage guarantee business) |

₹100 crore |

| IDF-NBFC |

Non-deposit taking NBFC permitted to refinance post commencement operations date (COD) infrastructure projects with ≥ 01 year of satisfactory commercial operations; finance toll operate transfer (TOT) projects as the direct lender |

₹300 crore |

| NBFC-IFC |

Non-deposit taking NBFC with ≥ 75% of its total assets deployed towards infrastructure lending |

₹300 crore |

| ARC |

A company registered with Reserve Bank for the purposes of carrying on the business of asset reconstruction and/or securitisation under the aegis of SARFAESI Act, 2002 |

₹300 crore |

| NBFC-CIC |

Core Investment company ≥ ₹100 crore of total assets either individually or in aggregate along with other CICs in the Group, which raises or holds public funds; and 90% of its net assets is in the form of investment/loans in group companies, out of which 60% is in form of equity shares. |

Adjusted Net Worth (ANW) should be ≥ 30% of its aggregate RWA on B/S and risk adjusted value of off-B/s items as on the date of the last audited balance sheet as at the end of FY |

II.3 BRANCH LICENSING

| Scheduled Commercial Banks |

Cooperative banks |

NBFCs |

| SCBs other than RRBs |

RRBs |

UCBs |

Rural Cooperative Banks |

| StCBs |

DCCBs |

| Permitted to open outlets in tier-1 to 6 centers without specific approval from RBI (except for Payment Banks) with certain conditions such as opening 25% of branches in unbanked rural centres during a financial year |

General permission to open outelts in tier-5 and 6 centers without specific approval;

Prior approval required for opening branches in tier-1 to 4 centres |

Automatic route: UCBs meeting Financially Sound and Well Managed (FSWM) criteria permitted for opening new branches up to 10% of the no. of branches (at the end of previous FY) in a FY, s.t. opening minimum 1 branch and a maximum 5 branches branch, in the approved area of operation

Approval route: Board approved annual business plan (ABP) for next FY sent from FSWM UCBs to RBI-RO for approval by 15th December. |

Approval from NABARD and RBI s.t. meeting certain conditions:

CRAR ≥ 9%; No default in maintenance of CRR/SLR during last FY; NNPA ≤ 5%; a track record of regulatory compliance and no monetary penalty during last 2 FYs |

Conditions specified for StCBs plus some additional conditions: licensed DCCB having operation ≥ 3 years; Net profit in last 2 FYs; Not under directions from RBI |

NBFCs lending against gold jewellery: Required to seek prior approval of the Bank to open new branches if the existing number of branches exceed 1,000; no branches to be opened w/o storage and security facilities

Deposit taking NBFCs:

(i) NOF > ₹50 crore and credit rating of AA or above – allowed to open branches anywhere in India.

(ii) NOF upto ₹50 crore – allowed to open branches only in the state where its registered office is situated.

Other NBFCs: Prior approval not required |

CHAPTER III - GOVERNANCE AND OWNERSHIP FRAMEWORK

III.1 GOVERNANCE FRAMEWORK

| Commercial Banks |

NBFCs |

ARCs |

Cooperatives |

• The BR Act prescribes certain qualifications for Directors of the banking company

• Enhanced requirements includes expertise in additional fields like IT, risk management, etc.

• Roles of Chairman and CEO/ MD separated in PvSBs (2007) and PSBs excluding SBI (2014), requiring the Chairman to be part-time (non-executive)

• Prior approval required from RBI for appointment / reappointment/ termination of WTDs and Part-Time Chairman

• Private sector banks are required to have a minimum of two WTDs, including the MD&CEO, on their Boards

• Fit and proper criteria for elected directors on Board of PSBs

• Guidelines for compensation of WTDs/CEOs/MRTs and Control Function Staff for PvSBs and FBs |

• The Companies Act, 2013 has provisions, inter alia, on constitution of the Board and Board committees, and qualification of directors

• RBI can remove the directors of NBFCs (except government owned NBFCs) and supersede their board of directors (except the board of Government Company)

• Scale-based guidelines in the areas of Committees of the Board, restrictions on Directorship, appointment of CRO, etc (details given in table below).

• ‘Fit and proper’ criteria for directors in NBFCs, and prior approval of RBI for any change in management with >30% change in director (excluding independent directors) |

• ARCs are also companies and are governed by the provisions of the Companies Act, 2013

• Besides, the SARFAESI Act requires ARCs to obtain prior approval of RBI for appointment of any director including the MD or CEO

• RBI can remove chairman or any director of the ARC and appoint additional director on their board

• ‘Fit and proper’ criteria for directors and CEO, maximum age limit and max continuous tenure of MD/CEO/WTD

• Board of ARCs shall be chaired by an independent director and at least half of the directors in every board meeting shall be independent directors. |

• Governed by the provisions of the respective state/central co-operative society laws

• Management-related provisions of the BR Act, 1949 have also been made applicable to them since 2020

• RBI guidelines for directors of UCBs, including constitution of Audit Committee of the Board in UCBs

• Criteria for appointment of majority of the directors, MD/ CEO/WTD, max continuous tenure of the directors, supersession of the board, etc. in the BR Act, 1949.

• Larger UCBs to have independent CRO with no additional responsibility

• NABARD’s guidelines for rural cooperatives |

III.2 SCALE-BASED GOVERNANCE FRAMEWORK FOR NBFC

| No. |

Governance regulation |

NBFC-BL |

NBFC-ML |

NBFC-UL |

| 1 |

Atleast one director should have worked in a bank/ NBFC |

Applicable |

Applicable |

Applicable |

| 2 |

Risk Management Committee at Board or Executive level |

Applicable |

Applicable |

Applicable |

| 3 |

Board approved policy for loans to directors, relative of directors and senior officers of the NBFCs |

Applicable |

Applicable |

Applicable |

| 4 |

Constitution of Audit Committee of the Board |

NA |

Applicable |

Applicable |

| 5 |

Constitution of Nomination & Remuneration Committee |

NA |

Applicable |

Applicable |

| 6 |

KMPs to not hold any office (including directorship) in any other NBFC-ML or NBFC-UL (except for directorship in a subsidiary) |

NA |

Applicable |

Applicable |

| 7 |

Restriction on independent director to hold directorships in more than 3 NBFC- ML or NBFC-UL |

NA |

Applicable |

Applicable |

| 8 |

Board approved policy on compensation to KMP and senior management |

NA |

Applicable |

Applicable |

| 9 |

Framing of internal guidelines on corporate governance and publish on website |

NA |

Applicable |

Applicable |

| 10 |

Appointment of Chief Risk Officer (CRO). |

NA |

Applicable to NBFCs with asset size of more than ₹5,000 Cr |

| 11 |

Qualification of Board members – specific expertise is a prerequisite depending on type of business of NBFC |

NA |

NA |

Applicable |

| 12 |

Listing & disclosures as applicable for listed company |

NA |

NA |

Mandatory |

III.3 OWNERSHIP GUIDELINES

| Banking Companies |

NBFCs/ HFCs |

ARCs |

• Prior approval of RBI is required for acquisition of major shareholding in a banking company (≥ 5% of paid-up share capital or voting rights).

• Major shareholders of banks to be ‘fit and proper’ on a continuous basis.

• The persons from FATF non-compliant jurisdictions (including those through which funds are routed) are not allowed to be major shareholders in the banking company. |

• Prior approval of RBI is required for any acquisition/ transfer of ≥ 26% of the shareholding of NBFCs and ≥26 % of the paid-up equity capital of HFCs.

• In case of deposit accepting/taking HFCs, the prior approval is required for acquisition of 10% or more by a foreign investor.

• Further approval required for takeover or acquisition of control which may or may not lead to change of management of NBFCs/HFCs.

• Investors from FATF non-compliant jurisdictions are not permitted to acquire significant influence in NBFCs/HFCs. |

• Prior approval of RBI is required for

- any transfer or fresh issuance of shares resulting in induction of a new sponsor

- any transfer or fresh issuance of shares resulting in cessation of an existing sponsor.

- an aggregate transfer of 10% or more of the total paid up share capital of the ARC by a sponsor during the period of five years commencing from the date of the CoR.

• Sponsors of ARCs to be ‘fit and proper’ on a continuous basis.

- Investors from FATF non-compliant jurisdictions are not permitted to acquire significant influence in ARCs. |

CHAPTER IV - PRUDENTIAL NORMS AND CAPITAL REGULATIONS

IV.1 CAPITAL REGULATIONS PRESCRIBED BY BCBS

| Basel I Framework |

Basel II Framework |

Basel III Framework |

• Definition of regulatory capital - items qualifying as capital were divided into Tier 1 capital and Tier 2 capital;

• Categorization of assets by standard risk-weight categories - all credit risk exposures were risk weighted based on their relative degree of risk; and

• Stipulation of Minimum Capital Adequacy Ratios - relating capital to risk-weighted assets viz., Tier 1 Capital Ratio of 4% and Total Regulatory Capital Ratio of 8% |

• Pillar 1 – stipulating minimum capital requirements which are more comprehensive in their coverage and more risk-sensitive than Basel I. In addition to credit risk and market risk, a specific charge for operational risk was included;

• Pillar 2 – consisting of a Supervisory Review Process for assessing the capital adequacy of individual banks, requiring banks to hold capital for risks that are not captured under Pillar 1; and

• Pillar 3 – or Market Discipline, which introduced disclosure requirements for a better understanding of a bank’s risk profile and its capital position |

• Revised Definition of Capital: The minimum level of Tier 1 capital was raised from 4% to 6%. A new Common Equity Tier 1 (CET1) ratio of 4.5% within the Tier 1 capital was introduced to ensure that at least three-quarters of the Tier 1 ratio is composed of capital of the highest quality (common equity and retained earnings).

• Introducing a leverage ratio to contain the build-up of bank leverage.

• Ensuring that capital requirements contribute to dampening economic and financial shocks, as opposed to amplifying them, through the introduction of capital buffers viz., the Capital Conservation Buffer (CCB) and Countercyclical Capital Buffer (CCyb).

• A framework for identifying the Global Systemically Important Banks (G-SIBs) and the magnitude of additional loss absorbency capital requirements (in the form of CET1 capital) applicable to these G-SIBs. The BCBS further required all member countries to have a regulatory framework to deal with Domestic Systemically Important Banks (D-SIBs) |

IV.2 CAPITAL AND PRUDENTIAL REQUIREMENTS IN INDIA-MARKET AND LIQUIDITY RISK

| Risk Component |

Capital Estimation and/or other prudential requirements |

| Market Risk |

• Market risk means the risk of losses in on and off-balance-sheet positions arising from movements in market prices. The market risk positions subject to capital charge requirement are: (i) The risks pertaining to interest rate related instruments and equities in the trading book; and (ii) Foreign exchange risk (including open position in precious metals) throughout the bank (both banking and trading books).

• The capital requirement for market risk is the simple sum of the capital requirements arising from each of the three risk classes – namely interest rate risk, equity risk and FX risk. |

| Interest Risk |

The capital requirement consists of two components:

• “Specific risk” charge for each security, which is designed to protect against an adverse movement in the price of an individual security owing to factors related to the individual issuer. The specific risk capital charge varies based on, inter alia, the nature of the investment and the residual maturity.

• “General market risk” charge, which is designed to capture the risk of loss arising from changes in market interest rates towards interest rate risk in the portfolio. The capital charge is the sum of four components:

(a) the net short or long position in the whole trading book;

(b) a small proportion of the matched positions in each time-band (the “vertical disallowance”);

(c) a larger proportion of the matched positions across different time-bands (the “horizontal disallowance”), and

(d) a net charge for positions in options, where appropriate. |

| Equity Risk |

The capital requirement consists of two components:

(i) “Specific risk” charge for each security, which will be 11.25 per cent or capital charge in accordance with the risk warranted by external rating (or lack of it) of the counterparty, whichever is higher and specific risk is computed on banks’ gross equity positions.

(ii) “General market risk” charge towards equity risk in the portfolio, which will be 9 per cent on the gross equity positions. |

| Forex Risk |

• To determine the forex risk capital charge, banks shall first determine the net open position in each currency. The net open positions, limits or actual whichever is higher, would attract capital charge at 9 per cent. |

| Market Risk (NBFCs) |

Not applicable |

| Market Risk (Standalone PDs-SPDs) |

• Capital charge to be higher of (i) and (ii)-

(i) Standardised Approach: Fixed income (duration method), Forex (the net open positions, limits or actual whichever is higher, would attract capital charge at 15 per cent) and equity (using Internal Model Approach).

(ii) Internal risk management framework-based approach: daily VaR at 99th percentile, one-tailed confidence level; price shock equivalent to 15 days movement in prices; |

| Counterparty Credit Risk |

• Capital computation through Current Exposure Method (CEM)

=> Exposure = Replacement Cost (RC) + potential furture exposure (PFE),

where PFE = (notional principal amount of each of the contracts) X (relevant add-on factors according to nature and residual maturity). |

| Interest Rate Risk in the Banking Book (IRRBB) |

• Exposure to IRRBB in terms of potential change in-

(i) earnings perspective - measured through ΔNII (Net Interest Income) using Traditional Gap Analysis (TGA) method, and

(ii) economic value perspective - measured through ΔMVE (Market value of Equity i.e. networth) using Duration Gap Analysis (DGA) method |

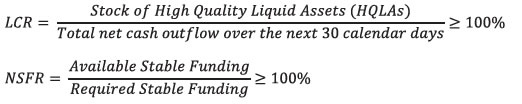

| Liquidity Risk |

• All commercial banks in India (except RRBs, Payments Banks and Local Area Banks) are required to maintain minimum of 100 per cent Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) on an ongoing basis at both standalone and consolidated basis.

• All non-deposit taking NBFCs with asset size of ₹5,000 crore and above (except CICs, Type 1 NBFCs, NOFHCs and SPDs) and all deposit taking NBFCs irrespective of their asset size are also required to maintain a minimum 100 per cent LCR. |

IV.3 CREDIT RISK

IV.3.a Credit Products

IV.3.a.i Lending Against Securities

| Security against which loan is granted |

Limit |

LTV/ Margin |

| Scheduled Commercial Banks (as per applicability) |

| Equity shares and equity mutual funds (in dematerialized form) |

₹20 lakh |

LTV of 75% |

| Bonds and Debentures |

₹20 lakh |

As per bank’s internal policy |

| Debt mutual funds |

As per bank’s internal policy |

As per bank’s internal policy |

| Loan for IPOs |

₹10 lakh |

50% margin |

| Loan for ESOPs |

₹20 lakh |

10% margin |

| Urban Cooperative Banks |

| Shares, bonds and debentures (in dematerialized form) |

₹10 lakh |

LTV of 50% |

| Rural Cooperative Banks |

| Shares, bonds and debentures |

₹5 lakh |

LTV of 50% |

| NBFCs |

| Listed equity shares |

No limit |

LTV of 50% |

| Loans for subscription to IPOs |

₹1 crore |

As per NBFC’s internal policy |

Scheduled Commercial Banks (in further details)

| Item/Subject |

Limit |

| Banks' exposure to capital markets as sensitive sector exposure, imposing a flat RW |

125% |

| Banks' total exposure to capital markets |

40% of net worth |

| Financing NBFCs for further lending to individuals for subscribing to IPOs or purchasing shares in the secondary market |

Prohibited |

IV.3.a.ii Housing Finance

| Entity |

Amt. (₹lakh) |

LTV |

Risk Weight |

| SCBs and HFCs |

Up to 30 |

<=80 |

35 |

| >80 but ≤90 |

50 |

| Above 30 up to 75 |

<=80 |

35 |

| Above 75 |

<=75 |

50 |

| UCBs |

Up to 30 |

<=75 |

50 |

| Above 30 |

<=75 |

75 |

| Other housing loans |

100 |

| RCBs |

Up to 30 |

<=75 |

50 |

| >75 |

100 |

| Other housing loans |

100 |

| LABs and RRBs |

Up to 20 |

90 |

50 |

| Above 20 and up to 75 |

80 |

50 |

| Above 75 |

75 |

75 |

| NBFCs excluding HFCs |

Other secured loans |

100 |

Further, limits on Housing loans have been prescribed for certain categories of REs, which are as under:

| Entity |

Nature of Loan |

Limit |

| UCBs |

Aggregate exposure of a UCB to residential mortgages (housing loans to individuals), other than those eligible to be classified as priority sector |

25% of total loans and advances |

| Aggregate exposure of a UCB to real estate sector, excluding housing loans to individuals |

5% of total loans and advances |

| Housing Loans to individuals (loan amount per dwelling unit, subject to extant single borrower exposure limits) |

₹60 lakh for Tier-1 UCBs

₹1.40 crore for Tier-2 UCBs

₹2 crore for Tier-3 UCBs

₹3 crore for Tier-4 UCBs |

| Supplementary Finance – loans for alterations, additions, repairs to houses / flats |

₹10 lakh in metropolitan centres and up to ₹6 lakh in other centres |

| StCBs/DCCBs having assessed net worth less than ₹100 crore |

Housing Loans |

₹50 lakh |

| StCBs/DCCBs having assessed net worth equal to or more than ₹100 crore |

Housing Loans |

₹75 lakh |

| All StCBs/DCCBs |

Total Exposure to Housing Finance and CRE-Residential Housing |

5% of total assets |

| All StCBs/DCCBs |

Supplementary Finance – loans for alterations, additions, repairs to houses / flats |

₹1 lakh |

IV.3.a.iii Digital Lending

| Item/Subject |

Limit/Details |

| Default Loss Guarantee from Lending Service Provider to Regulated Entities |

5% of the loan portfolio |

| Nature of Default Loss Guarantee |

Cash or lien marked fixed Deposit or a bank guarantee from a scheduled commercial bank |

| Invocation of Default Loss Guarantee |

Within 120 days |

| Period of Default Loss Guarantee cover |

Not less than the longest tenor of the loan in the underlying loan portfolio being guaranteed |

| Prudential norms on income recognition, asset classification and provisioning shall be applicable on the underlying loans in the portfolio, irrespective of availability of DLG cover. In cases where REs act as LSPs and provide DLG cover, the RE shall deduct the amount of DLG cover from its capital. |

|

To improve transparency and disclosure on such arrangements, REs shall ensure that LSPs disclose the number of DLG portfolios along with respective amount of DLG cover on their website.

|

IV.3.a.iv Regulations related to Non-Fund Based Facilities

| Scheduled Commercial Banks |

Urban Co-operative Banks |

• Guarantees should generally not have a maturity of > 10 Yrs

• Banks should generally avoid issuing non-fund based facilities to/ on behalf of customers who do not have credit facility with them

• Bank Guarantee (BG)/ Letter of Credit (LCs) can be issued to clients of co-operative banks with a counter guarantee from the co-operative bank, subject to the specified conditions

• The limit on unsecured exposure was removed in 2004, giving bank boards the freedom to set their own policies

• Guarantees for ₹50,000 and above should be signed by two officials

• Banks should be cautious when co-accepting bills, ensuring they are genuine trade bills and not accommodation bills |

• The maturity period for guarantees should be kept short and should not exceed ten years

• Total volume of outstanding guarantee obligations should not exceed 10% of the total owned resources of the bank comprising paid up capital, reserves and deposits

• Proportion of unsecured guarantees outstanding at any time outstanding at any time may be limited to 25% of the owned funds of the bank or 25% of the total amount of guarantees, whichever is less

• Primarily focus on providing financial guarantees and avoid issuing performance guarantees

• Exercise caution when co-accepting bills

• Avoid undue concentration of unsecured guarantee commitments to particular groups of customers and/or trades |

IV.3.b Credit Risk Management

IV.3.b.i Interest Rate on Advances

| Entity |

Conditions |

| SCBs |

• Banks have the freedom to offer all categories of advances on fixed or floating interest rates. However, for EMI based personal loans, Banks are mandated to offer loans on both fixed and floating rate

• Fixed interest rate on loans of tenor three years and below cannot be less than the corresponding Marginal Cost of Lending Rate (MCLR)

• For floating interest rate loans to other than retail and MSME borrowers, banks can offer loans with reference to either an internally calculated reference rate MCLR or external reference rates published by the Financial Benchmarks India Pvt Ltd (FBIL)

• MCLR: Banks are required to calculate their cost of funds as a marginal cost that includes certain components viz., marginal cost of funds, negative carry-on account of CRR, operating cost and tenor premium. The periodicity of reset shall be one year or lower. The exact periodicity of reset shall form part of the terms of the loan contract

• Banks are required to extend floating rate loans to Retail and MSME borrowers with reference to external benchmark lending rates only. The external benchmarks that may be considered for loans are - Reserve Bank of India policy Repo Rate or Government of India 3-Months and 6-Months Treasury Bill yields published by FBIL or any other benchmark market interest rate published by FBIL. The periodicity of reset of interest shall be atleast once in three months.

• Banks can, at their discretion, extend EBLR loans to other than mandated sector as well |

| RRBs |

• The interest rates charged by RRBs have been deregulated in 1994 wherein it was advised to abolish minimum lending rate for credit limits of over ₹2 lakh |

| NBFCs |

• The interest rates charged by NBFCs have been deregulated wherein the Board shall adopt an interest rate model taking into account relevant factors such as cost of funds, margin and risk premium and determine the rate of interest to be charged. |

IV.3.b.ii Loans and Advances

Statutory Restrictions on SCBs

| Sl. No |

Item/Subject |

Limit/Permissibility |

| 1 |

Advances against bank's own shares |

Prohibited as per BR Act |

| 2 |

Advances to bank's Directors |

Restricted as per BR Act |

| 3 |

Banks holding shares in any company, whether as pledgee, mortgagee or absolute owner (as % of the paid-up share capital of that company or its own paid-up share capital and reserves, whichever is less) |

< 30% |

| 4 |

Employment of any person whose remuneration or part of whose remuneration takes the form of commission or a share in the profits of the company |

Prohibited as per BR Act |

| 5 |

Banks to maintain minimum level of their assets in India at the close of business on the last Friday of every quarter |

≥ 75% of Demand and Time Liabilities in India (DTL) |

Regulatory limits on UCBs:

| Sr. No. |

Area |

Limits for UCBs |

| 1 |

Prudential exposure limits

(Single or Group borrower/ parties) |

15% of Tier-I capital (Single borrower)

25% of Tier-I capital (Group borrower) |

| 2 |

Aggregate exposure of a UCB to residential mortgages (housing loans to individuals), other than those eligible to be classified as priority sector |

25% of total loans and advances |

| Aggregate exposure of a UCB to real estate sector, excluding housing loans to individuals |

5% of total loans and advances |

| 3 |

Housing Loans to individuals (loan amount per dwelling unit, subject to extant single borrower exposure limits) |

₹60 lakh for Tier-1 UCBs

₹1.40 crore for Tier-2 UCBs

₹2 crore for Tier-3 UCBs

₹3 crore for Tier-4 UCBs

(Housing loans may be repayable within a maximum period of 20 years, including moratorium or repayment holiday.) |

| 4 |

Housing Finance – Loans to individual borrower for repairs/ additions/ alterations |

₹10 lakh in metropolitan centres (those centres with population of 10 lakh and above); and, ₹6 lakh in other centres |

| 5 |

Deposit with other banks (Gross) |

20% of its total deposits |

| 6 |

Deposit with other banks (Single bank) |

5% of its total deposits |

| 7 |

Unsecured loans and advances – bank level |

10% of its total assets

(For UCBs having CRAR ≥ 9%, Gross NPAs ≤ 7%; Extra limit upto 15% of total assets for loans sanctioned for productive purposes (upto ₹10,000);

For UCBs with a large PSL portfolio (not less than 90%), CRAR ≥ 9%, Gross NPAs≤ 7; Limit upto 35% of total assets for priority sector loans upto ₹40,000) |

| 8 |

Unsecured loans and advances – Individual borrower |

Limits ranging from ₹25,000 to ₹5 lakh, depending on the size of Demand and Time Liabilities (DTL) and compliance with CRAR |

| 9 |

Lending against shares/debentures (Aggregate limit) |

20% of the Tier-I capital as on March 31st of previous financial year |

| 10 |

Lending against shares/ debentures |

₹5 lakh if the security is in physical form

₹10 lakh if the security is in demat form

(A margin of 50% should be maintained on all such advances. Advances against units of mutual funds can be extended only to individuals as in the case of advances against the security of shares, debentures and bonds) |

| 11 |

Small Value Loans (limit for 50% of aggregate loans and advances)

(Limit will be 40% by March 31, 2025 and 50% by March 31, 2026) |

₹25 lakh or 0.4% of Tier I capital, whichever is higher, subject to a ceiling of

₹3 crore per borrower.

Subject to prudential exposure limits

(Boards of UCBs, however, shall periodically review the portfolio behaviour and quality under different loan-size categories and where necessary, may consider fixing lower ceilings.) |

| 12 |

Gold Loan – Bullet Repayment |

₹2 lakh (₹4 lakh for PSL compliant UCBs)

Subject to following conditions:

(i) UCBs should maintain a LTV ratio of 75% on the outstanding amount of loan including the interest on an ongoing basis, failing which the loan will be treated as Non-Performing Asset (NPA).

(ii) The period of the loan shall not exceed 12 months from the date of sanction. |

| 13 |

Loans to nominal members (for short / temporary period and for purchase of consumer durables) |

₹0.50 lakh for UCBs with deposits upto ₹50 crore

₹1 lakh for other UCBs |

| 14 |

Overall PSL targets |

75% of Adjusted Net Bank Credit (ANBC) or Credit Equivalent Amount of Off-balance Sheet Exposure (CEOBSE) by March 31, 2026 |

| 15 |

PSL sub-target for weaker section |

Higher of 12% of ANBC or CEOBSE by March 31, 2026 |

| 16 |

PSL sub-target for micro enterprises |

Higher of 7.5% of ANBC or CEOBSE |

IV.3.b.iii Gold Loans

| Sl. No |

Item/Subject |

Limit/Permissibility |

| 1 |

LTV Condition |

Regulatory stipulation: 75%

For SCBs, LTV is applicable only on non-agricultural loans.

For StCBs, CCBs and RRBs, LTV is applicable only on loans extended for the purpose of medical expenses and meeting unforeseen liabilities.

For NBFCs and UCBs, LTV is applicable on all loans extended by the RE. |

| 2 |

Other condition |

Co-operative banks and RRBs are not permitted to extend bullet repayment loans against eligible gold collateral of > ₹2 Lakh to a single customer.

For UCBs that have met their PSL obligations, the limit is enhanced to ₹4 Lakh |

IV.3.c Income Recognition, Asset Classification1 and Provisioning Norms2

IV.3.c.i IRACP norms

| Special Mention Accounts (SMA) Sub-categories |

Loans other than revolving facilities:

Basis for classification – Principal or interest payment or any other amount wholly or partly overdue between |

For revolving facilities:

Basis for classification – Outstanding balance remains continuously in excess of the sanctioned limit or drawing power, whichever is lower, for a period of: |

| SMA-0 |

Up to 30 days |

NA |

| SMA-1 |

More than 30 days and up to 60 days |

More than 30 days and up to 60 days |

| SMA-2 |

More than 60 days and up to 90 days |

More than 60 days and up to 90 days |

| NPA |

> 90 days |

• The outstanding balance in the CC/OD account remains continuously in excess of the sanctioned limit/drawing power for 90 days, or

• The outstanding balance in the CC/OD account is less than the sanctioned limit/drawing power but there are no credits continuously for 90 days, or the outstanding balance in the CC/OD account is less than the sanctioned limit/drawing power but credits are not enough to cover the interest debited during the previous 90 days period inclusive of the day for which the day-end process is being run |

| • In the case of Farm Credit extended to agricultural activities, loan granted for short duration crops will be treated as NPAs, if the instalment of principal or interest thereon remains overdue for two crop seasons. |

| • A loan granted for long duration crops will be treated as NPA, if the instalment of principal or interest thereon remains overdue for one crop season. |

IV.3.c.ii Asset Classification

| Categories in NPA |

SCBs/AIFIs |

UCBs |

StCBS/CCBs |

RRBs |

NBFCs |

HFCs |

| Sub Standard Assets |

An asset which has remained NPA for a period less than or equal to 12 months |

An asset which has remained NPA for a period less than or equal to 12 months |

An asset which has remained overdue for a period not exceeding 3 years |

An asset classified as NPA for a period not exceeding one year. |

An asset which has remained NPA for a period less than or equal to 12 months

NBFC-BL-NPA for a period not exceeding 18 months |

An asset which has remained NPA for a period less than or equal to 12 months |

| Doubtful Asset |

An asset which has remained in the substandard category for a period of 12 months. |

An asset which has remained NPA for more than 12 months. |

An asset which has remained overdue for a period exceeding 3 years |

An asset which has remained in the sub-standard category for 12 months |

An asset which remains a sub-standard asset for a period exceeding 12 months.

NBFC-BL-which remains a sub-standard asset for a period exceeding 18 months |

An asset which has remained in the substandard category for a period exceeding 12 months. |

| Loss Assets |

Identification of loss by bank, or internal/external auditor, or RBI

Asset not written off wholly

Asset is considered uncollectible and its continuance as a bankable asset is not warranted but may have some salvage and recovery value |

Identification of loss by Bank, or internal/external auditor, or RBI, or Cooperation Dept.

Asset not written off wholly

Asset is considered uncollectible and its continuance as a bankable asset is not warranted but may have some salvage and recovery value |

Identification of loss by Bank, or internal/external auditor, or RBI, or NABARD

Asset not written off wholly

Asset is considered uncollectible and its continuance as a bankable asset is not warranted but may have some salvage and recovery value |

Identification of loss by NBFC, or internal/external auditor, or RBI

Asset not written-off wholly

Non-recoverability due to either erosion in the value of security or non-availability of security or due to any fraudulent act or omission on the part of the borrower |

Identification of loss by HFC, or internal/external auditor, or RBI, or NHB

Asset not written off wholly

Asset is adversely affected by a potential threat of non-recoverability or due to any fraudulent act or omission on the part of the borrower |

IV.3.c.iii Standard Asset Provisioning Rates

| |

SCBs & AIFIs |

UCBs3 |

NBFC (UL) & HFCs |

RRBs |

RCBs |

NBFCs |

| Farm Credit |

0.25% |

0.25% |

NA |

0.25% |

0.25% |

0.40% (ML)

0.25% (BL) |

| Individual housing loans |

0.25% |

0.40% |

0.25% |

0.40% |

0.40% |

| Small and Micro Enterprises |

0.25% |

0.25% |

0.25%4 |

0.25% |

0.25% |

| Commercial Real Estate (CRE) |

1.00% |

1.00% |

1.00% |

1.00% |

1.00% |

| CRE-Residential Housing (RH) |

0.75% |

0.75% |

0.75% |

0.40% |

0.40% |

| Housing loans at teaser rates |

2.00% |

0.40% |

2.00% |

0.40% |

0.40% |

| All others |

0.40% |

0.40% |

0.40% |

0.40% |

0.40% |

IV.3.c.iv Specific loan loss provisioning

| For sub-standard assets |

For doubtful assets |

For Loss Assets |

• For SCBs and AIFIs, provisioning for sub-standard assets shall be on the basis of security coverage i.e., secured advances shall be provided at 15% and un-secured advances at 25%.

• For HFCs, a general provision of 15% shall be made.

• For all other REs, it shall be at 10% irrespective of security availability. |

• For SCBs, AIFIs and HFCs, provisioning for doubtful assets shall be 25%/40%/100% for the secured portion, based on ageing profile.

• For NBFCs it shall be 20%/30%/50% for the secured portion, based on ageing profile.

• For other REs it shall be 20%/30%/100% respectively for the secured portion, based on ageing profile. For unsecured portion, it shall be 100% |

100% |

Provisioning (for NBFC-MFIs)

| Asset Classification |

Provisioning |

| Standard Asset |

NBFC-BL: 0.25% of outstanding

NBFC-ML: 0.40% of outstanding |

| Non-performing Assets |

The aggregate loan provision to be maintained by NBFC-MFIs at any point of time shall not be less than the higher of:

(a) 1% of the outstanding loan portfolio, or

(b) 50% of the aggregate loan instalments which are overdue for more than 90 days and less than 180 days and 100 percent of the aggregate loan instalments which are overdue for 180 days or more. |

IV.3.c.v Provisions on Project Accounts as long as these are classified as standard assets

| Entity |

Particulars |

Provisioning requirement |

| Commercial Banks |

If the revised Date of Commencement of Commercial Operations (DCCO) is within two years/one year from the original DCCO prescribed at the time of financial closure for infrastructure and non-infrastructure projects (including commerical real estate projects) respectively |

0.40% |

| |

If the DCCO is extended:

i) Beyond two years and upto four years or three years from the original DCCO, as the case may be, for infrastructure projects depending upon the reasons for such delay;

ii) Beyond one year and upto two years from the original DCCO, for non-infrastructure projects (including real estate projects) |

5.00% – From the date of such restructuring till the revised DCCO or 2 years from the date of restructuring, whichever is later |

| UCBs |

Project Loans for Infrastructure Sector

i) Until two years from the original DCCO

ii) During the third and the fourth years after the original DCCO |

i) 0.40%

ii) 1.00% |

| |

Project Loans for Non-Infrastructure Sector

i) Until the first six months from the original DCCO

ii) During the next six months |

i) 0.40%

ii) 1.00% |

| NBFCs |

If the revised DCCO is within two years from the original DCCO prescribed at the time of financial closure |

0.25% |

| |

If the DCCO is extended beyond two years and upto four years or three years from the original DCCO, as the case may be, depending upon the reasons for such delay |

Project loans restructured with effect from January 24, 2014:

5.00% - From the date of such restructuring till the revised DCCO or 2 years from the-date of restructuring, whichever is later. |

IV.3.d Resolution of Stressed Assets

IV.3.d.i Guidelines

| Restructuring Guidelines applicable to different REs |

| SCBs, SCBs (excluding RRBs), AIFIs, SFBs, non-deposit taking NBFCs of asset size of ₹500 crore and above and all NBFC-D |

UCBs |

Non-deposit taking NBFCs with asset size less than ₹500 crore |

HFCs |

LABs, RRBs |

Prudential Framework on Resolution of Stressed Assets dated June 07, 2019

Framework for Revival and Rehabilitation of Micro, Small and Medium Enterprises (MSMEs) dated March 17, 2016 (for MSME borrowers whose aggregate exposure with all commercial banks is ₹25 crore or less) |

Prudential Guidelines on Restructuring of Advances by UCBs dated March 6, 2009 |

Master Direction – Reserve Bank of India (Non-Banking Financial Company – Scale Based Regulation) Directions, 2023 |

Non-Banking Financial Company – Housing Finance Company (Reserve Bank) Directions, 2021 |

Debt Restructuring Mechanism for Small and Medium Enterprises (SMEs) dated September 08, 2005 |

IV.3.d.ii Prudential Framework on Resolution of Stressed Assets

| Item/Subject |

Details |

| Applicability |

SCBs (excluding RRBs), All India Financial Institutions (AIFIs) and non-deposit taking NBFCs of asset size of ₹500 crore and above and all Deposit-taking NBFCs |

| Other important features |

• Trigger of Review Period: Lenders to complete prima facie review of borrower account within 30 days of default

• If RP is not implemented within 180 days from the end of the Review Period, then additional provisions of 20% for borrowers with aggregate exposure to the banking system is >=₹1500 cr. If the resolution plan is not successfully implemented within 365 days from occurrence of default, additional 15% provision shall be made, making the total provisioning to be at 35%

• Borrowers with aggregate exposure of ≥₹100 Cr, resolution plans involving restructuring/change in ownership shall mandatorily require one independent credit evaluation (ICE) rating of RP4 or higher from a CRA for residual debt; two such ICE ratings if exposure ≥₹500 Cr

• Asset classification of borrower accounts to be downgraded to NPA upon restructuring

• Monitoring period: longer of period for repayment of ≥10% of dues as part of RP, or 1 year from the beginning of first repayment

• Review period: Triggered if unsatisfactory performance during the monitoring period

• Specified period: period from the date of implementation of RP up to the date by which at least 20% of outstanding principal and interest sanctioned as per plan of RP. Fresh RP required in case of default during the specified period. In such a case, additional provision of 15% required

• If borrower exits specified period, any new default will be treated as new credit event

• Compromise settlement where repayment period >3 months shall be treated as restructuring |

IV.3.e Credit Risk Transfer and Distribution

IV.3.e.i Securitisation of Standard Assets

| Item/Subject |

Limit/Criteria (for SCBs, AIFIs, SFBs and NBFCs) |

| Applicability |

SCBs, AIFIs, and NBFCs including HFCs; (RRBs and Cooperative banks are not permitted for securitisation under MD-SSA; SFBs also need to follow their operating guidelines) |

| Assets not eligible for securitisation: |

a. Re-securitisation exposures;

b. Structures in which short term instruments such as commercial paper, which are periodically rolled over, are issued against long term assets held by a Special Purpose Entity (SPE)

c. Synthetic securitisation;

d. Securitisation with the following assets as underlying:

i) revolving credit facilities as underlying

ii) Restructured loans and advances which are in the specified period;

iii) Exposures to other lending institutions;

iv) Refinance exposures of AIFIs;

v) Loans with bullet payments of both principal and interest as underlying; and,

vi) Loans with residual maturity of less than 365 days |

Minimum Retention Requirement (MRR) for underlying loans of maturity – 24 months or less;

MRR for 24 months and more and loans with bullet repayments |

5% of the book value of the loans being securitised

10% of the book value of the loans being securitised |

| Limit on total exposure of an originator to the securitisation exposures belonging to a securitisation structure or scheme |

20% |

| Requirements for Simple Transparent and Comparable (STC) criteria |

Homogenous, non-default, sufficient information history on asset performance and payment details, consistency in underwriting, transparent enforcement rights |

Capital Treatment

| |

Long Term |

Short Term |

| STC |

Non-STC |

STC |

Non-STC |

Applicable Risk Weight

(Actual weight will be dependent upon maturity, seniority, and tranche thickness) |

10% - 1250% (Senior tranche)

15% - 1250% (Non-senior tranche)

[based on rating and tranche maturity] |

15% - 1250% [based on rating and tranche maturity] |

10% - 1250% [based on rating] |

15% - 1250% [based on rating] |

IV.3.e.ii Transfer of Loan Exposures

| Sl. No |

Item/Subject |

Limit/Criteria |

| A |

Non-Default Loans |

|

| 1 |

Permitted modes |

Assignment, novation or loan participation |

| 2 |

Permitted transferors/transferees |

SCBs (including SFBs5, excluding RRBs), AIFIs, NBFCs including HFCs |

| 3 |

Minimum Holding Period (MHP) requirements

- for loans with original maturity less than two years;

for loans with original maturity more than two years |

3 months

6 months |

| 4 |

Minimum retention Requirement

Where the acquiring lender performs due diligence at the individual loan level for less than one third of the portfolio |

10% of economic interest in the transferred loans |

| B |

Stressed Loans6 |

|

| 1 |

Permitted mode |

Through assignment or novation

Loan Participation not permitted |

| 2 |

Permitted transferors |

SCBs, Primary (Urban) Co-operative Banks/State Co-operative Banks/Central Co-operative Banks, SFBs7, NBFCs including HFCs, and AIFIs |

| 3 |

Permitted transferees

- General permission

- Under a resolution plan implemented under the Prudential Framework dated June 7, 2019 |

SCBs (excluding RRBs), AIFIs, SFBs, NBFCs (incl HFCs), ARCs

Apart from the above, a company, as defined in sub-section (20) of Section 2 of the Companies Act, 2013 other than a financial service provider as defined in sub-section (17) of Section 3 of the Insolvency and Bankruptcy Code, 2016.

[Other class of entities permitted to hold loan exposures under the regulations issued by a financial sector regulator may be added, based on a framework put in place by the financial regulator concerned for this purpose, in consultation with the Reserve Bank.] |

| 4 |

Cooling period in respect of:

- Fresh exposure by the transferor to the borrower

- Fresh exposure by any RBI-regulated entity to the acquirer for the purpose of deploying in the borrower, except for working capital facilities (which are not in the nature of term loans) to the borrower whose loan is transferred |

- 1 year, if transferee is RBI-regulated entity

- 3 years, if transferee is non-RBI regulated entity

- 3 years |

| 5 |

Mandatory Swiss Challenge |

If the aggregate exposure (including investment exposure) of lenders to the borrower/s whose loan is being transferred is ₹100 crore or more |

| 6 |

Minimum Holding Period (in case of loans acquired from other entities) for lenders to hold the exposures on their books, before transferring |

6 months |

| C |

Transfer of stressed asset to ARCs |

|

| 1 |

Periodic Valuation of Security Receipts (SRs) by transferors, in respect of assets transferred by them

If the investment by the transferor in SRs issued against loans transferred by it is more than 10% of all SRs issued against the transferred asset |

Lower of (A):

- Redemption value of SRs arrived based on the NAV declared by the ARC

- NBV of the transferred stressed loan at the time of transfer.

Lower of (B):

- A above

- face value of the SRs reduced by the notional provisioning rate applicable if the loans had continued on the books of the transferor. |

IV.3.f Concentration Risk Management

IV.3.f.i Exposure/Concentration Norms- SCBs

| Items |

Limits |

| Large Exposure Framework (LEF) norms for SCBs |

| Single counterparty |

20% of Tier 1 capital (extendable to 25% with Board approval) |

| Group of connected counterparties |

25% of Tier 1 capital |

| Single counterparty (Exposure to Bank) |

25% of Tier 1 capital

(15% for G-SIB exposure to G-SIB)

(20% for non G-SIB exposure to G-SIB) |

| Single counterparty (Exposure to NBFC) |

20% of Tier 1 (gold loan NBFC - 7.5% of capital funds) |

| Capital Market Exposures |

40% of net worth |

| Sectoral exposures, including real estate |

To be decided by the bank's Board |

| Consumer credit, including unsecured loans |

To be decided by the bank's Board |

| Exposure norms for SFBs |

| Single counterparty |

10% of capital funds |

| Group of connected counterparties |

15% of capital funds |

| Other exposure norms |

At least 50% of the loan portfolio should constitute loans and advances of up to ₹25 lakh |

| Intragroup exposures for SCBs |

| Single exposure |

|

| Non-financial companies and unregulated financial services companies |

5% of Paid-up capital and reserves |

| Regulated financial services companies |

10% of Paid-up capital and reserves |

| Aggregate exposure |

|

| All non-financial companies and unregulated financial services companies taken together |

10% of Paid-up capital and reserves |

| All group companies taken together |

20% of Paid-up capital and reserves |

| Country Risk Exposure limits for SCBs |

| Limits on exposure to any country |

Regulatory capital (Tier 1 and 2) , except in the case of insignificant risk category |

| Inter Bank Liabilities (Commercial Banks excluding RRBs) |

| Limit |

• Shall not exceed 200 % of its net worth as on 31st March of the previous year

• 300% of net worth for banks whose CRAR is at least 11.25% as on 31st March of the previous year |

| Inclusions |

Only fund based limits within India |

| Exclusions |

IBL outside India

TREPS borrowing, refinance from NABARD, SIDBI |

| Inter Bank Liabilities (UCBs) |

| Inter-UCB Deposits |

The total inter-UCB deposits accepted by a UCB shall not exceed 10% of its total deposits as on 31st March of the previous financial year subject to specified conditions. |

IV.3.f.ii Exposure/Concentration Norms- NBFCs

| LEF for NBFC- Upper Layer (UL) (other than IFC) |

Limits |

| Single |

20% of Tier 1 capital (+5% Board discretion, +5% for infrastructure - Ceiling 25% of tier 1 capital) |

| Group |

25% of Tier 1 capital (+10% for infrastructure) |

| LEF for NBFC-UL (IFC) |

|

| Single |

25% of Tier 1 capital (+5% Board discretion) |

| Group |

35% of Tier 1 capital |

| Concentration norms for NBFC-Middle Layer (ML) (other than IFC) |

|

| Single |

25% of Tier 1 capital (+5% infrastructure) |

| Group |

40% of Tier 1 capital (+10% for infrastructure) |

| Concentration norms for NBFC-ML (IFC) |

|

| Single |

30% of Tier 1 capital |

| Group |

50% of Tier 1 capital |

| NBFC- Base Layer (BL) |

As per NBFC's Board approved policy. |

IV.4 OPERATIONAL RISK CAPITAL REQUIREMENTS FOR SCBs

| Current approach |

Basic Indicator Approach as per Master Circular – Basel III Capital Regulations, 2024

• Operational risk capital (ORC) = fixed percentage (denoted as alpha (α) which is presently 15%) of positive annual gross income (GI) averaged over the previous three years

• RWA = ORC * 12.5 |

Proposed Approach

(Implementation date to be communicated later) |

Master Direction (MD) on Minimum Capital Requirements for Operational Risk- Standardised Approach

| Bucket Category |

ORC Calculation |

Bucket 1 banks

Buckets 2 & 3 banks (with < 5 years of high-quality loss data) |

ORC = BIC |

| Buckets 2 & 3 banks (with 5>= years of high-quality loss data) |

ORC = BIC x ILM |

| RWA |

= ORC *12.5 |

| Details regarding Buckets, BIC and ILM are given below in separate table |

|

| Component |

Description |

Formula |

| Estimation of BIC and ILM |

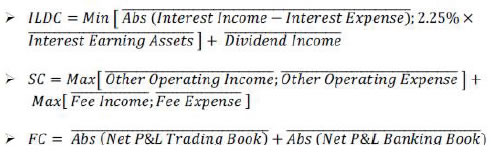

| Business Indicator (BI) |

A financial-statement-based proxy for operational risk comprising (i) interest, lease, and dividend component (ILDC), (ii) service component (SC), and financial component (FC). |

BI = ILDC + SC + FC

|

| Business Indicator Component (BIC) |

Calculated by multiplying BI by specific coefficients (αi) based on BI size. |

BIC = BI x αi |

| Estimation of BIC and ILM |

| |

|

The value of marginal co-efficient is based on the bucket category of the banks.

| Bucket |

BI Range (₹ Crore) |

BI Marginal Coefficients (αi) |

| Bucket 1 |

≤ 8000 |

12% |

| Bucket 2 |

8000 < BI ≤ 240000 |

15% |

| Bucket 3 |

> 240000 |

18% |

|

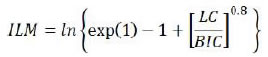

| Internal Loss Multiplier (ILM) |

A scaling factor reflecting historical losses, used to adjust operational risk capital. |

Loss Component (LC) is equal to 15 times average annual operational risk losses based on high-quality operational risk annual loss data for 10 years. However, banks that do not have 10 years of high-quality loss data but have five years and above of high-quality loss data shall make use of such available high-quality loss data to calculate the LC. |

IV.5 OPERATIONAL RISK MANAGEMENT AND RESILIENCE: KEY PRINCIPLES

PILLAR-1

[Prepare and Protect] |

PILLAR-2

[Build Resilience] |

PILLAR-3

[Learn and Adapt] |

Principle 1: Establishing a strong risk management culture.

Principle 2: Implementing and maintaining an Operational Risk Management Framework (ORMF) and operational resilience approach, integrated into overall risk management processes.

Principle 3: Approval and periodic review of ORMF by the Board.

Principle 4: Approval and periodic review of risk appetite, tolerance statement, criteria for identification of critical operations and impact tolerances for them.

Principle 5: Implementation of policies by Senior management by establishing robust governance structure with segregation of responsibilities.

Principle 6: Identification, assessment and management of the operational risk in all material products, activities, processes and systems.

Principle 7: Comprehensive, appropriately resourced and adequately articulated change management process.

Principle 8: Monitoring of operational risk profiles and exposures and establishing reporting mechanisms.

Principle 9: Implementation of strong control environment, internal controls and risk mitigation strategies. |

Principle 10: Mapping of the internal and external interconnections and interdependencies for critical operations.

Principle 11: Management of third dependencies (including intra-group) for delivery of critical operations.

Principle 12: Implementation and testing of business continuity plans.

Principle 13: Development and implementation of incident response and recovery plans.

Principle 14: Robust Information and Communication Technology (ICT) risk management programs which are tested regularly. |

Principle 15: Transparent and appropriate disclosures on operational risk management approach and operational risk exposure.

Principle 16: Conduct of lessons learned exercise after a disruption to enhance capability to adapt and respond in future.

Principle 17: Establishing effective feedback systems for continuous learning and improvement. |

IV.6 GUIDELINES ON MANAGING RISKS AND CODE OF CONDUCT IN OUTSOURCING OF FINANCIAL SERVICES

| Underlying principle |

• Outsourcing of any activity by an RE neither diminishes its ability to fulfil its obligations to customers and RBI nor impedes effective supervision by RBI.

• The ultimate responsibility for the outsourced activity vests with the outsourcing RE. |

| Activities that should not be outsourced |

• Core management functions including Internal Audit, Compliance function and decision-making functions like determining compliance with KYC norms for opening deposit accounts, according sanction for loans (including retail loans) and management of investment portfolio. |

IV.6.a Roles and responsibilities of the Board and Senior Management

| Board |

Senior Management |

• Approve a risk and materiality evaluation framework and policies for outsourcing.

• Set approval authorities based on risk and materiality of service.

• Review outsourcing strategies regularly. |

• Assess risks and materiality of outsourcing using Board-approved framework.

• Develop and enforce outsourcing policies and procedures and periodically review policy effectiveness.

• Inform the Board about material outsourcing risks.

• Ensure that tested contingency plans are put in place. |

IV.6.b Other important considerations

| Evaluation and due diligence of Service Provider |

Outsourcing Agreement |

Confidentiality and Security |

Business Continuity and Contingency Planning |

• REs should consider qualitative and quantitative, financial, operational and reputational factors including compatibility with RE’s systems, performance and customer service standards.

• Due diligence should include all the aspects including but not limited to evaluation of experience, financial soundness, reputation and culture, compliance, complaints including potential litigations, security, internal controls, auditing and monitoring and external factors like political, economic, social and legal environment. |

• The outsourcing contract should be clear and enforceable, covering key aspects, including but not limited to service standards and access to relevant records, monitoring and termination provisions, data confidentiality audit rights for the RE, right of RBI to access documents and conduct inspections of service provider, preservation of documents and data by the service provider in accordance with the legal/regulatory provisions, etc. |

• REs should ensure that service provider safeguards customer information, with access granted only on a “need-to-know” basis, security breaches are disclosed by service provider to the RE and the same are reported to the Bank immediately and enough safeguards are implemented by service provider to prevent comingling of documents and data of RE and other entities.

• While REs may share premises, certain services, back-offices, hardware and software applications, etc., with group entities or may outsource financial services to a group entity, REs should maintain arm’s length relationship in such dealings and ensure clear identification of the entity and appropriate disclosure on the nature of such arrangements to all customers in all communications. |

• REs must ensure that service providers establish and test a robust business continuity plan and documents and data of the RE are isolated by service provider for easy retrieval and transfer back to RE in emergencies.

• REs should retain controls to implement appropriate measures including options to transferring the service to alternative service providers or back to in-house infrastructure. |

IV.6.c Monitoring, Control and Audit

| Monitoring Mechanism |

Strategy to be implemented by REs |

| Central Record of Agreements |

Maintain centralized records of all material outsourcing arrangements and ensure that half yearly reviews are placed before the Board. |

| Regular Audits and Review |

(a) Internal and External auditors to assess the adequacy of the risk management practices for overseeing and managing the outsourcing arrangement.

(b) Banks to undertake annual assessments of provider’s financial stability, operational condition, and compliance and highlight areas of concern. |

| Termination Announcement |

Publicize terminations of agreement with service providers to prevent continued customer interactions and inform IBA (for banks) with reasons for termination. |

IV.7 LEVERAGE RATIO REQUIREMENTS APPLICABLE TO REs

| Regulated Entity |

Leverage Ratio Definition |

Leverage Ratio Requirement |

SCBs

(excluding SFBs, PBs, and RRBs) |

Tier 1 capital divided by Exposure Measure |

The minimum Leverage Ratio shall be 4% for D-SIBs and 3.5% for other banks. |

| AIFIs |

Tier 1 capital divided by Exposure Measure |

The minimum Leverage Ratio shall be 4%. |

| SFBs |

Tier 1 capital divided by Total Exposure |

The minimum Leverage Ratio shall be 4.5%. |

| PBs |

Net worth (paid-up capital and reserves) divided by outside liabilities |

The minimum Leverage Ratio shall be 3%. |

| NBFC-BL |

Total Outside Liabilities divided by Owned Fund |

The Leverage Ratio should not exceed 7. |

| NBFC-AA |

Outside Liabilities (excluding borrowings/ loans from the group entities) divided by Owned Funds |

The Leverage Ratio should not exceed 7. |

| NBFC-P2P |

Total Outside Liabilities divided by Owned Funds |

The Leverage ratio should not exceed 2. |

| NBFC-CIC |

Outside Liabilities divided by Adjusted Net Worth |

The Leverage ratio should not exceed 2.5. |

IV.8 CAPITAL ADEQUACY AND PROVISIONING REQUIREMENTS FOR RBI REGULATED ENTITIES

IV.8.a Banks and All-India Financial Institutions (AIFIs)

| No. |

Regulated Entity |

Applicable Basel Framework |

Minimum requirements (%) |

CCB and CCyB |

| CET1 |

Tier 1 |

CRAR |

| 1 |

Scheduled Commercial Banks (SCBs) excluding SFBs, PBs, LABs, RRBs |

Basel III |

5.58 |

7 |

9 |

CCB - 2.5%

CCyB – Not Activated |

| 2 |

Small Finance Banks (SFBs) |

Basel II norms generally applicable |

6 |

7.5 |

15 |

NA |

| 3 |

Payments Banks (PBs) |

Basel II norms generally applicable |

6 |

7.5 |

15 |

NA |

| 4 |

Local Area Banks (LABs) |

Basel I |

- |

4.5 |

9 |

NA |

| 5 |

Regional Rural Banks (RRBs) |

Basel I |

5.5 |

7 |

9 |

NA |

| 6 |

Urban Coperative Banks |

|

|

|

|

|

| 6.1 UCBs: Tier 2 to Tier 4 |

Basel I |

- |

6 |

12 |

NA |

| 6.2 UCBs: Tier 1 UCBs |

- |

4.5 |

9 |

| 7 |

Rural Co-operative Banks (RCBs) |

Basel I |

- |

4.5 |

9 |

| 8 |

All India Financial Institutions (AIFIs) |

Basel III |

5.5 |

7 |

9 |

NA |

IV.8.b NBFCs

| No. |

Regulated Entity |

Minimum requirements (%) |

| CET1 |

Tier 1 |

CRAR |

| 1 |

NBFC-BL9 |

No risk-based capital requirement except as specified at 5.2 and 5.6 below; (Leverage Ratio of 7 times) |

| 2 |

NBFC-ML |

- |

10 |

15 |

| 3 |

NBFC-UL |

9 |

10 |

15 |

| 4 |

NBFC-TL |

Shall be subject to higher capital charge which will be communicated separately upon classification. |

| 5 |

NBFC categories by activity |

|

|

|

| 5.1 Housing Finance Company |

- |

10 |

15 |

| 5.2 Micro Finance Institutions |

- |

7.5 |

15 |

| 5.3 Mortgage Guarantee Companies |

- |

6 |

10 |

| 5.4 Standalone Primary Dealer |

- |

7.5 |

15 |

| 5.5 Core Investment Company |

Modified risk-based capital requirement

(CICs must maintain Adjusted Net Worth (ANW) of at least 30% of RWAs.) |

| 5.6 NBFCs engaged in lending against gold |

- |

12 |

15 |

| 5.7 Peer to Peer Lending Platform (P2P) and Account Aggregator (AA) |

No risk-based capital requirement |

IV.8.c Risk weight related regulations covering all forms of risk

| Sl. No |

Item/Subject |

Risk Weights (RWs) |

| Capital charge for credit risk for Scheduled Commercial Banks (SCBs) |

| General Framework - For SCBs (except RRBs), the Standardized Approach for credit risk under Basel framework has been prescribed by the Reserve Bank with certain modifications to align with domestic conditions. Under the Standardised Approach, the rating assigned by the eligible external credit rating agencies (ECRAs) largely support the measure of credit risk. Concurrently, RWs for certain exposures do not depend on ratings provided by ECRAs, but on some other criteria or as prescribed by the Reserve Bank from time to time considering macroprudential risks. The Reserve Bank has identified certain ECRAs that meet the eligibility criteria for providing credit ratings to banks’ exposure/counterparties and has prescribed risk weights (RWs) corresponding to such ratings. |

| 1 |

Domestic sovereign exposures (direct claims) |

0% |

| 2 |

Exposures to foreign sovereigns |

0% to 150% (depending on their external credit ratings) |

| 3 |

Claims on domestic bank

• Other than investment in equity and capital instruments of scheduled banks

• Investment in equity and capital instruments issued by scheduled banks (that are outside the scope of regulatory consolidation) |

20% to 625% (based on their CET1 and CCB levels)

125% to full deduction (based on their CET1 and CCB levels) |

| 4 |

Claims on banks in foreign jurisdiction - based on the external ratings assigned by international rating agencies. |

20% to 150% |

| 5 |

Claims on Corporate/ NBFCs/ Primary Dealers/ Public Sector entities

For NBFCs exposure that attracts RW of less than 100% as per the external rating |

20% to 150% (based on their ratings)

Additional RW of 25% shall be applied over and above the RW indicated by external rating. The requirement for additional RW shall cease to exist from April 01, 2025. |

| 6 |

Claims on Commercial Real Estate (CRE) |

100% |

| 7 |

Claims on Commercial Real Estate-Residential Housing (CRE-RH) |

75% |

| 8 |

Retail loans:

• Loans to small businesses included under regulatory retail

• Consumer credit, including personal loans but excluding housing loans, education loans, vehicle loans, loans secured by gold and gold jewellery, and microfinance loans

• Credit Cards

• Individual housing loans

• Other Consumer credit exposure |

75%

125%

150%

35%/50% (based on loan amount and LTV)

100% |

| 9 |

Past-due loans - based on the specific provisions and collateral. |

50 to 150% |

| Capital charge for credit risk for NBFCs |

| 10 |

Domestic sovereign exposures (direct exposures) |

0% |

| 11 |

Exposures guaranteed by sovereign

• Central Government guaranteed claims

• State Government guaranteed claims

• State Government guaranteed claims (which have remained in default for a period of more than 90 days |

0%

20%

100% |

| 12 |

Cash and bank balances including fixed deposits and certificates of deposits with banks |

0% |

| 13 |

Bonds of public sector banks |

20% |

| 14 |

Loans and advances fully secured against deposits held and loans to staff |

0% |

| 15 |

All assets covering PPP and post commercial operations date infrastructure projects in existence over a year of commercial operation |

50% |

| 16 |

Credit card exposures

Consumer credit exposures categorised as retail loans, excluding housing loans, educational loans, vehicle loans, loans against gold jewellery and microfinance/SHG loans |

125% |

| 17 |

Other exposures (except credit card and certain retail loans) |

100% |

| 18 |

For Housing Finance Companies (HFCs), risk weight on residential mortgages secured by property are based on the LTV ratio and loan amount.

• Individual housing loans – based on the LTV ratio and loan amount

• CRE

• CRE-RH |

35% or 50%

100%

75% |

| Capital charge for credit risk for UCBs/ StCBs /DCCBs /LABs/RRBs |

| 19 |

• Loans guaranteed by central/state governments.

• Loans guaranteed by state governments which has become NPA |

0%

100% |

| 20 |

Loans to PSUs |

100% |

| 21 |

Cash / balances with RBI and Loan against term deposits / Life policies / NSCs and KVPs |

0% |

| 22 |

Balances in co-operative banks and other banks |

20% |

| 23 |

• Individual housing loans - risk weight on residential mortgages depend on LTV

• CRE10

• CRE-RH |

50% to 100% (for LABs – 50% to 75%)

100%

75% |

| 24 |

Retail loans and advances

• Consumer credit including personal loan for UCB/ DCCB/ StCB

• Credit card and consumer credit including personal loans, but excluding housing loans, education loans, vehicle loans, loans secured by gold and gold jewellery, and microfinance loans – LAB/ RRBs (excluding credit card)

• Loans up to ₹1 lakh against gold and silver ornaments

• Loans extended against primary / collateral security of shares / debentures

o UCB

o StCB/ DCCB/RRBs

o LAB (capital market exposure)

• All other loans and advances including educational loan are generally risk weighted at- |

125%

125%

50%

127.50%

125%

125%

100% |

| For all Regulated Entities (REs) |

| 25 |

Off-balance sheet exposures across REs are converted to credit-equivalent amounts using specified Credit Conversion Factors (CCFs) given for REs. These credit-equivalent amounts are then assigned RWs based on the counterparty or type of exposure (whichever is higher) as discussed above, ensuring a consistent risk assessment. |

Based on RW assigned as per counterparty or type of exposure (whichever is higher) |

IV.9 STATUTORY AND REGULATORY LIMITS ON DEPOSITS FOR DEPOSIT TAKING NBFCs (INCLUDING HFCs)

| No. |

Statutory and regulatory restrictions of deposits |

| 1 |

Deposit taking NBFCs shall maintain liquid assets of 15% of public deposit outstanding as at the close of business on last working day of second preceding quarter |

| 2 |