Combined Government Finances: 2006-07

Combined

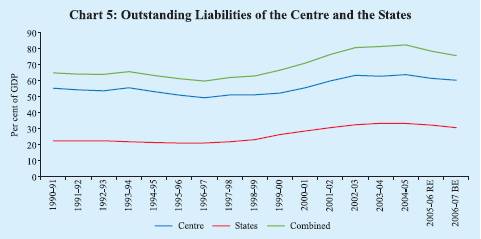

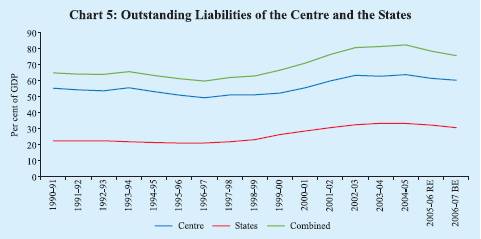

Government finances were budgeted to improve in 2006-07, with key fiscal ratios

placed 0.8-1.0 percentage points of GDP lower than in 2005-06, reflecting the

improvement in the finances of both the Central and State Governments (Table

14). This was envisaged to be achieved through a reduction in expenditure

(as percentage of GDP), particularly in the revenue account. The combined debt-GDP

ratio was budgeted to decline from 78.5 per cent at end-March 2006 to 75.7 per

cent at end-March 2007

(Chart 5).

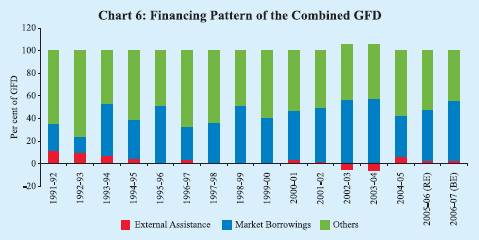

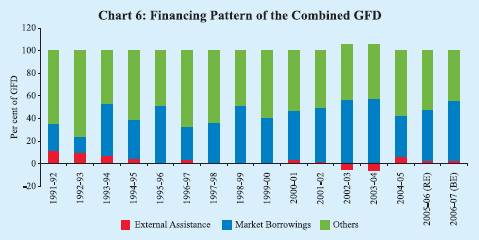

The combined fiscal

deficit during 2006-07 was budgeted to be financed primarily from domestic resources.

Market borrowings were budgeted to finance 52.4 per cent of the gross fiscal deficit

(GFD) during 2006-07 (45.5 per cent a year ago) while other liabilities (small

savings, provident funds, reserve funds and deposits and advances) were budgeted

to finance 44.9 per cent (43.7 per cent in 2005-06). External assistance was budgeted

to finance 3.2 per cent of the combined fiscal deficit during 2006-07 as compared

with 2.9 per cent in 2005-06 (Chart 6).

Table

14: Key Fiscal Indicators | (Per

cent to GDP) | Year | Revenue

Deficit | Gross Fiscal Deficit | Primary

Deficit | 1 | 2 | 3 | 4 |

Centre |

2003-04 | 3.6 | 4.5 | -0.03 |

2004-05 | 2.5 | 4.0 | -0.04 |

2005-06 | 2.6 | 4.1 | 0.4 |

2006-07 BE | 2.1 | 3.8 | 0.2 |

2006-07 RE | 2.0 | 3.7 | 0.1 |

2007-08 BE | 1.5 | 3.3 | -0.2 |

States |

2002-03 | 2.2 | 4.2 | 1.3 |

2003-04 | 2.2 | 4.5 | 1.5 |

2004-05 | 1.2 | 3.5 | 0.7 |

2005-06 RE | 0.5 | 3.2 | 0.7 |

2006-07 BE | 0.1 | 2.7 | 0.2 |

Combined

| 2002-03 | 6.6 | 9.6 | 3.1 |

2003-04 | 5.8 | 8.5 | 2.1 |

2004-05 | 3.7 | 7.5 | 1.4 |

2005-06 RE | 3.1 | 7.4 | 1.6 |

2006-07 BE | 2.2 | 6.4 | 0.8 |

RE: Revised Estimates. BE: Budget Estimates.

Note:

The fiscal ratios for finances of the Centre are from

the Union Budget 2007-08.

The fiscal ratios in respect of States and Combined

finances for 2005-06 RE and 2006-07 BE are based on CSO’s Quick Estimates

and Advance Estimates, respectively. |

Centre’s

Fiscal Situation: 2006-07

According to the revised estimates

for 2006-07, the key deficit indicators of the Union Government, viz.,

revenue deficit, gross fiscal deficit and primary deficit, relative to GDP, were

placed lower than the budgeted levels. This mainly reflected buoyancy in revenue

receipts, which more than offset the increased expenditures, particularly, in

respect of interest payments, fertiliser and interest subsidies, and non-defence

capital outlay. The Government could, therefore, effect reduction of 0.1 percentage

point of GDP in each of the three key fiscal indicators vis-à-vis

the budgeted levels. The reductions in GFD and revenue deficit (RD), relative

to GDP,

of

0.4 percentage points and 0.6 percentage points, respectively, during 2006-07

(RE) over 2005-06 were also more than the minimum thresholds of 0.3 percentage

points and 0.5 percentage points of GDP, respectively, stipulated under the Fiscal

Responsibility and Budget Management (FRBM) Rules, 2004. The fiscal consolidation

process was, thus, resumed during 2006-07 after a pause in 2005-06.

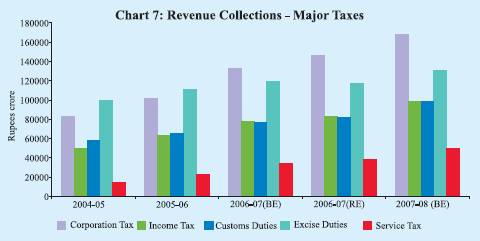

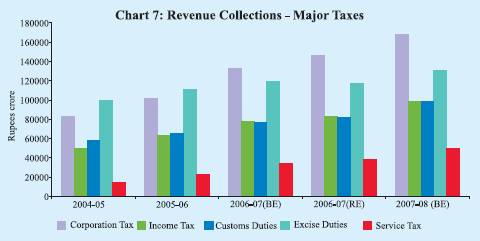

Revenue

receipts in the revised estimates showed an increase of 4.9 per cent over the

budgeted levels and were placed at 10.3 per cent of GDP. This was mainly on account

of higher net tax revenue (5.7 per cent higher than budgeted) (Table

15), in turn, due to higher than budgeted collections in respect of personal

income tax, corporation tax, customs duties and new taxes. However, collections

under excise duties in the revised estimates were lower than the budget estimates

(Chart 7). The collections under non-tax revenues were also

better than the budget estimates on account of higher dividends and profits (10.7

per cent) and interest receipts (4.5 per cent). Among the capital receipts, recoveries

of loans and advances were lower than budgeted, reflecting the impact of the debt

waiver to the State Governments under the Twelfth Finance Commission (TFC) award.

The aggregate expenditure in the revised estimates for 2006-07 was 3.1 per

cent higher than the budget estimates on account of higher revenue expenditure,

particularly in interest payments, subsidies and grants to States (Table

16).

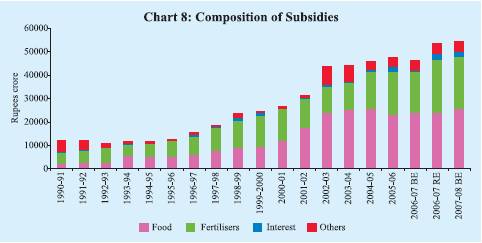

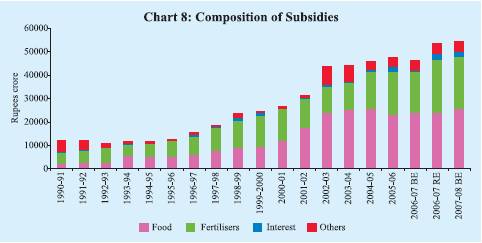

The total expenditure on subsidies at Rs.53,463 crore (1.3 per

cent of GDP) in the revised estimates for 2006-07 was 15.7 per cent higher than

the budgeted amount mainly on account of fertiliser and interest subsidies exceeding

Table

15: Receipts of the Centre | (Amount

in Rupees crore) | Item | | 2005-06 | 2006-07 | 2006-07 | Variation

(4 over 3) | | | | (Accounts) | (BE) | (RE) | | |

| | | | | | Amount | Per

cent | 1 | | | 2 | 3 | 4 | 5 | 6 |

1. | Total

Receipts (2+3) | 5,06,123 | 5,63,991 | 5,81,637 | 17,646 | 3.1 |

| | | (14.2) | (14.3) | (14.2) | | |

2. | Revenue

Receipts (i+ii) | 3,47,462 | 4,03,465 | 4,23,331 | 19,866 | 4.9 |

| | | (9.7) | (10.2) | (10.3) | | |

| i) | Tax

Revenue (Net) | 2,70,264 | 3,27,205 | 3,45,971 | 18,766 | 5.7 |

| | | (7.6) | (8.3) | (8.4) | | |

| ii) | Non-Tax

Revenue | 77,198 | 76,260 | 77,360 | 1,100 | 1.4 |

| | | (2.2) | (1.9) | (1.9) | | |

3. | Capital

Receipts | 1,58,661 | 1,60,526 | 1,58,306 | -2,220 | -1.4 |

| | | (4.4) | (4.1) | (3.9) | | |

| of

which: | | | | | |

| Market

Borrowings | 1,06,241 | 1,13,778 | 1,10,500 | -3,278 | -2.9 |

| Recoveries

of Loans | 10,645 | 8,000 | 5,450 | -2,550 | -31.9 |

| Disinvestment

Proceeds | 1,581 | 3,840 | 528* | -3,312 | -86.3 |

RE: Revised Estimates. BE: Budget

Estimates.

* Represents bonus shares issued by Oil and Natural Gas Corporation

(ONGC) Ltd.

Note : Figures in parentheses are percentages

to GDP. |

the

budget estimates by Rs.5,199 crore (30.1 per cent) and Rs.2,320 crore (478.4 per

cent), respectively (Chart 8). While fertilisers subsidies

increased from Rs.17,253 crore in the budget estimates to Rs.22,452 crore in the

revised estimates, interest subsidies increased from Rs.485 crore to Rs.2,805

crore. Fertiliser subsidies were higher than the budget estimates on account of

increase in input costs and cost of imported fertiliser. Interest relief to debt

stressed farmers

Table

16: Aggregate Expenditure of the Centre | (Amount

in Rupees crore) | Item | 2005-06

(Accounts) | 2006-07(BE) | 2006-07(RE) | Variation

(4 over 3) | | | | | | Amount | Per

cent | 1 | | 2 | 3 | 4 | 5 | 6 |

1. | Total

Expenditure (2+3 = 4+5) | 5,06,123 | 5,63,991 | 5,81,637 | 17,646 | 3.1 |

| | (14.2) | (14.3) | (14.2) | | |

2. | Non-Plan

Expenditure | 3,65,485 | 3,91,263 | 4,08,907 | 17,644 | 4.5 |

| | (10.2) | (9.9) | (10.0) | | |

| of

which: | | | | | |

| Interest

Payments | 1,32,630 | 1,39,823 | 1,46,192 | 6,369 | 4.6 |

| | (3.7) | (3.5) | (3.6) | | |

| Defence

Expenditure | 80,549 | 89,000 | 86,000 | -3,000 | -3.4 |

| | (2.3) | (2.3) | (2.1) | | |

| Subsidies | 47,520 | 46,213 | 53,463 | 7,250 | 15.7 |

| | (1.3) | (1.2) | (1.3) | | |

3. | Plan

Expenditure | 1,40,638 | 1,72,728 | 1,72,730 | 2 | 0.0 |

| | (3.9) | (4.4) | (4.2) | | |

4. | Revenue

Expenditure | 4,39,761 | 4,88,192 | 5,06,767 | 18,575 | 3.8 |

| | (12.3) | (12.4) | (12.4) | | |

5. | Capital

Expenditure | 66,362 | 75,799 | 74,870 | -929 | -1.2 |

| | (1.9) | (1.9) | (1.8) | | |

RE : Revised Estimates. BE :

Budget Estimates.

Note : Figures in parentheses are percentages

to GDP. |

and

provision of interest subvention on short-term credit to farmers led to higher

than budgeted interest subsidies.

Financing of the Union Budget

Gross and net market

borrowings (dated securities and 364-day Treasury Bills excluding allocations

under the Market Stabilisation Scheme) of the Centre for 2006-07 were budgeted

at Rs.1,79,716 crore and Rs.1,13,778 crore, respectively. In the revised estimates,

net market borrowings were placed lower at Rs.1,10,500 crore, thus, financing

72.5 per cent of GFD. Apart from market borrowings, drawdown of cash balances

financed 7.2 per cent of GFD in the revised estimates as compared to nil percentage

in the budget estimates. In the public account, deposits and advances, state provident

funds and reserve funds financed 7.6 per cent, 3.3 per cent and 2.8 per cent,

respectively, of GFD.

According to the Reserve Bank records, actual gross

market borrowings by the Central Government through dated securities and 364-day

Treasury Bills amounted to Rs.1,79,373 crore (net Rs.1,11,270 crore) during 2006-07.

Gross market borrowings through dated securities by the Central Government amounted

to Rs.1,46,000 crore (net Rs.1,06,916 crore) during 2006-07 as compared with Rs.1,31,000

crore (net Rs.98,370 crore) during the previous year (Table 17).

Gross market borrowings through dated securities during 2006-07 were 94 per cent

of the budget estimates, the same as that in the previous year. Of the 33 auctions

held during 2006-07, 30 auctions were in respect of reissuance of existing securities.

Three new securities of 10-year, 15-year and 30-year were issued to provide a

benchmark in the secondary market. The total devolvement on the primary dealers

(PDs) was Rs.5,604 crore.

Table

17: Central Government Securities Issued during 2006-07 |

(Amount in Rupees

crore/Maturity in years) | | Borrowings

as per Issuance Auction Calendar | Actual

Borrowings | |

Sr. No. | Date

of

Auction | Amount | Residual

Maturity | Date of

Auction | Amount | Residual

Maturity | Yield

(Per

cent) | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

1. | April

3-12, 2006 | 5,000 | 10

-14 | April 10, 2006 | 5,000 | 10.00 | 7.59 |

| | 3,000 | 20

and above | April 10, 2006 | 3,000 | 28.30 | 7.97 |

2. | April

18-25, 2006 | 6,000 | 5-9 | April

25, 2006 | 6,000 | 6.02 | 7.06 |

| | 4,000 | 20

and above | April 25, 2006 | 4,000 | 26.34 | 8.00 |

3. | May

2-9,2006 | 6,000 | 10-14 | May

4, 2006 | 6,000 | 9.94 | 7.55 |

| | 4,000 | 20

and above | May 4, 2006 | 4,000 | 28.26 | 8.14 |

4. | May

16-24, 2006 | 5,000 | 15

-19 | May 23, 2006 | 5,000 | 15.00 | 7.94 |

5. | June

1- 8, 2006 | 6,000 | 5-9 | June

6, 2006 | 6,000 | 5.07 | 7.39 |

| | 4,000 | 20

and above | June 6, 2006 | 4,000 | 30.00 | 8.33 |

6. | June

15-24, 2006 | 5,000 | 15-19 | June

22, 2006 | 5,000 | 7.81 | 7.92 |

| | | | June

22, 2006# | 4,000 | 14.92 | 8.46 |

7. | July

3-11, 2006 | 6,000 | 10-14 | July

11, 2006 | 5,000 | 9.75 | 8.29 |

| | 4,000 | 20

and above | July 11, 2006 | 2,000 | 28.08 | 8.75 |

8. | July

17-25, 2006 | 5,000 | 15-19 | July

27, 2006 | 4,000 | 3.79 | 7.69 |

9. | August

1-8, 2006 | 6,000 | 5-9 | August

8, 2006 | 6,000 | 4.90 | 7.94 |

| | 3,000 | 20

and above | August 8, 2006 | 3,000 | 9.68 | 8.27 |

10. | August

14-22, 2006 | 5,000 | 10-14 | August

18, 2006 | 5,000 | 10.40 | 8.12 |

| | 3,000 | 20

and above | August 18, 2006 | 3,000 | 29.79 | 8.72 |

11. | September

4-12, 2006 | 6,000 | 10-14 | September

8, 2006 | 6,000 | 9.59 | 7.76 |

| | 3,000 | 20

and above | September 8, 2006 | 3,000 | 27.91 | 8.45 |

12. | October

6-13, 2006 | 6,000 | 10

-14 | October 13, 2006 | 6,000 | 9.49 | 7.63 |

| | 3,000 | 20

and above | October 13, 2006 | 3,000 | 29.64 | 8.10 |

13. | November

3-10, 2006 | 6,000 | 5-9 | November

3, 2006 | 6,000 | 5.49 | 7.50 |

| | 3,000 | 20

and above | November 3, 2006 | 3,000 | 27.76 | 8.02 |

14. | November

17-24, 2006 | 5,000 | 10-14 | November

24, 2006 | 5,000 | 10.13 | 7.43 |

15. | December

1-8, 2006 | 6,000 | 5-9 | December

8, 2006 | 5,000 | 7.35 | 7.31 |

| | 3,000 | 20

and above | December 8, 2006 | 4,000 | 29.49 | 7.63 |

16. | January

5-12, 2007 | 5,000 | 10-14 | Not

issued | – | – | – |

| | 4,000 | 20

and above | January 12, 2007 | 4,000 | 29.39 | 8.24 |

17. | January

18-25, 2007 | 5,000 | 15-20 | January

25, 2007 | 5,000 | 14.32 | 8.20 |

18. | February

2-9, 2007 | 6,000 | 5-9 | February

9, 2007 | 6,000 | 7.18 | 7.88 |

| | 3,000 | 20

and above | February 9, 2007 | 3,000 | 29.32 | 8.19 |

19. | March

2-9, 2007 | 5,000 | 10-14 | March

9, 2007 | 4,000 | 9.84 | 8.06 |

| | 3,000 | 20

and above | March 9, 2007 | 3,000 | 29.24 | 8.40 |

# : Not scheduled. |

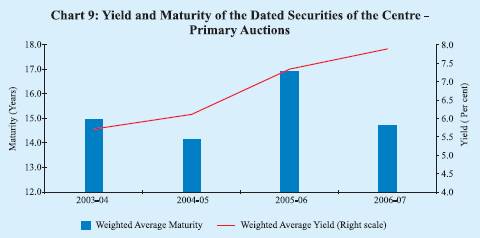

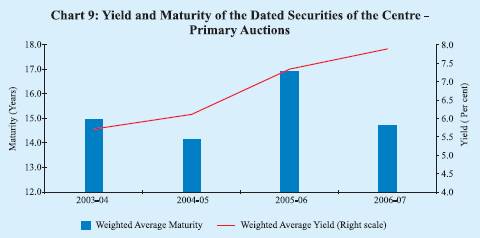

The weighted average yield of the dated securities

issued during 2006-07 increased to 7.89 per cent from 7.34 per cent during the

previous year. The weighted average maturity of the dated securities issued during

the year, on the other hand, fell to 14.72 years from 16.90 years during 2005-06

(Chart 9).

With the Reserve Bank withdrawing from

participation in the primary issuance of the Central Government securities with

effect from April 1, 2006 in accordance with the FRBM Act, 2003, the Ways and

Means Advances (WMA) arrangements were revised from 2006-07 in consultation with

the Government. Under the previous arrangements, the limits of WMA were fixed

on a half-yearly basis. For 2005-06, the limits were Rs.10,000 crore for the first

half of the fiscal

year

(April-September) and Rs.6,000 crore for the second half of the fiscal year (October-March).

In order to facilitate the transition necessitated by the new FRBM provisions,

under the revised arrangements, the limits for 2006-07 were fixed on a quarterly

basis instead of half-yearly basis. Accordingly, the WMA limits for 2006-07 were

placed at Rs.20,000 crore and Rs.10,000 crore for the first and second quarters,

respectively, and Rs.6,000 crore each for the third and fourth quarters of the

year. The Reserve Bank retained the flexibility to revise the limits in consultation

with the Government of India taking into consideration the transitional issues

and prevailing circumstances. Furthermore, interest rates on WMA and overdraft

have been linked to the repo rate as against the Bank Rate hitherto, following

emergence of the repo rate as the short-term reference rate. Accordingly, the

interest rate on WMA is at the repo rate and that on overdraft is at repo rate

plus two percentage points.

The Central Government took recourse

to WMA on 39 days during 2006-07 as compared with only two days during 2005-06.

The average WMA utilisation during 2006-07 was Rs.402 crore as compared with Rs.3

crore in the previous year. The peak WMA availed amounted to Rs.11,754 crore on

June 6, 2006. The Central Government did not resort to overdraft during the year.

The surplus cash balances of the Centre which amounted to Rs.48,928 crore

at end-March 2006 dwindled rapidly during April-May 2006. The Centre has, however,

been maintaining surplus cash balance from August 8, 2006, mainly reflecting parking

of surplus cash by the State Governments in the 14-day Intermediate Treasury Bills

during the greater part of the year. The surplus balance rose to an intra-year

high of Rs.77,473 crore on March 21, 2007, reflecting buoyancy in advance

tax collections. As on March 31, 2007, the surplus balance amounted to Rs.50,092

crore. The daily surplus balance of the Central Government averaged Rs.28,022

crore during 2006-07 as compared with Rs.25,296 crore a year ago. State

Finances: 2006-07

Revenue deficit (RD) and gross fiscal deficit

(GFD) of State Governments were budgeted at 0.1 per cent and 2.7 per cent, respectively,

of GDP during 2006-07 -a reduction of 0.4 percentage points and 0.5 percentage

points, respectively, over the previous year (Table 14).

State budgets for 2006-07 reflect the efforts of the State Governments to pursue

the process of fiscal correction and consolidation through the progressive enactment

of Fiscal Responsibility Legislations (FRLs). The State Governments were aided

in their effort by larger devolution and transfer through shareable Central taxes

and grants under the TFC award. Furthermore, all States, barring Uttar Pradesh,

have implemented value added tax (VAT) in lieu of sales tax, which is

expected to provide buoyancy to the States’ own tax revenue. Recognising

that sustained fiscal correction lies in revenue augmentation, the State Governments

in their budgets for 2006-07 laid stress on improvement in tax administration

and streamlining and strengthening of tax and non-tax collections. For improving

accountability of budget proposals, some States proposed to introduce ‘Outcome

Budget’. Several States announced introduction of new pension scheme based

on defined contribution to restrict their rising pension obligations. The States

also proposed to improve spending on education and health sector and implement

the centrally sponsored scheme of rural employment guarantee scheme.

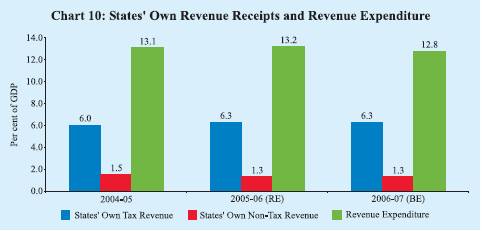

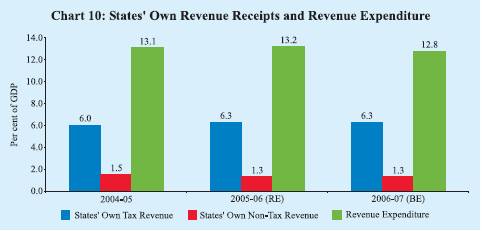

The fiscal correction in the revenue account during 2006-07 was proposed to be

achieved primarily through containment of growth in revenue expenditure to 11.3

per cent in 2006-07 from 15.4 per cent in the previous year. As a proportion to

GDP, revenue expenditure was envisaged to decline to 12.8 per cent during 2006-07

(BE) from 13.2 per cent in the previous year (Chart 10).

Revenue receipts were budgeted to be maintained at the level of 12.7 per cent

of GDP in 2006-07 (BE). States’ own tax as well as own non-tax revenues,

as percentage to GDP, at 6.3 per cent and 1.3 per cent, respectively, during 2006-07

(BE) would remain the same as

a year ago. Higher grants coupled with the incentives

provided by the TFC towards restructuring of State finances aided the States in

their endeavour for fiscal correction and consolidation.

The decomposition

of GFD of the State Governments reveals an improvement in the quality of fiscal

consolidation, with the share of revenue deficit budgeted to decline substantially

to 4.1 per cent in 2006-07 from 15.1 per cent in the previous year. Correspondingly,

the share of capital outlay would move up from 74.9 per cent in 2005-06 (RE) to

88.0 per cent in 2006-07 (BE). As regards financing of GFD, securities issued

to the National Small Savings Fund (NSSF) would continue to be the major source

of financing, although its share would decline from 65.4 per cent to 53.1 per

cent. Market borrowings with their share at 20.8 per cent (16.4 per cent during

the previous year) would finance a larger share of GFD during 2006-07 (Table

18).

Table

18: Decomposition and Financing Pattern of GFD of States |

(Per cent) |

Item | 1990-95 | 1995-2000 | 2000-04 | 2004-05 | 2005-06 | 2006-07 |

| | (Average) | (Average) | (Average) | | (RE) | (BE) |

1 | | | 2 | 3 | 4 | 5 | 6 | 7 |

Decomposition (1 to 4) | | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

1. | Revenue Deficit | | 24.7 | 44.8 | 56.3 | 33.3 | 15.1 | 4.1 |

2. | Capital Outlay | | 55.3 | 43.3 | 36.7 | 56.3 | 74.9 | 88.0 |

3. | Net Lending | | 20.0 | 12.2 | 7.0 | 10.3 | 10.0 | 8.8 |

4. | Disinvestment | | – | -0.2 | – | – | – | -0.9 |

| | | | | | | | |

Financing (1 to 11) | | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

1. | Market Borrowings | | 16.0 | 16.1 | 24.6 | 31.6 | 16.4 | 20.8 |

2. | Loans from Centre | | 49.0 | 40.6 | 7.8 | -10.8 | 1.9 | 4.4 |

3. | Special Securities issued

to NSSF/Small Savings | | – | 28.9* | 35.4 | 62.2 | 65.4 | 53.1 |

4. | Loans from

LIC, NABARD, NCDC, SBI and | | | | | | |

| other banks | | 1.8 | 2.8 | 4.9 | –** | 4.9 | 6.9 |

5. | State Provident Fund | | 14.3 | 13.4 | 8.3 | 7.2 | 7.9 | 8.0 |

6. | Reserve Funds | | 6.8 | 5.5 | 4.5 | 6.5 | 2.9 | 4.0 |

7. | Deposits and Advances | | 9.8 | 9.8 | 3.4 | 7.4 | -0.6 | -1.1 |

8. | Suspense and

Miscellaneous | 4.3 | 2.7 | -0.4 | -2.4 | 3.3 | 3.3 |

9. | Remittances | | -1.4 | -3.6 | 0.6 | 1.1 | 0.8 | 1.8 |

10. | Overall Surplus(+)/Deficit(-) | 4.4 | -2.6 | 1.1 | 9.6 | 4.9 | 3.6 |

11. | Others | | -5.0 | 9.5 | 9.8 | -12.4

$ | -7.9 | -4.7 |

BE: Budget Estimates. RE: Revised Estimates.

– : Negligible/Not applicable.

* : Pertains to 1999-2000 as the scheme

was introduced from that year only. The sum of items will

not be equal to 100

for 1995-2000 (Average).

** : Tamil Nadu has shown a negative figure of Rs.1,376

crore under Loans from National Co operative Development Corporation (NCDC) on

account of adjustment of

Tamil Nadu Industrial Development Corporation (TIDCO)

bonds.

$ : On account of Land Compensation and other bonds ( Rs.1,962 crore)

issued by Government of Tamil Nadu.

Notes :

1. ‘Others’

is a residual item and includes, inter alia, Contingency Funds, Appropriation

to

Contingency Funds, Miscellaneous Capital Receipts, Inter-State Settlement,

Land Compensation and Other Bonds and Loans from Financial Institutions other

than those mentioned in the Table.

2. Due to the change in the accounting

procedure from 1999-2000, Loans from the Centre exclude States’ share in

small saving collections which are shown under Securities issued to the NSSF under

internal debt.

Accordingly, repayments of small saving collections included

in under repayments of Loans to the Centre are now shown under discharge of Internal

Debt to have consistent accounting for receipts and expenditure.

3. Figures

for 2004-05 (Accounts) in respect of Jammu & Kashmir and Jharkhand relate

to Revised Estimates.

4. All financing items are on net basis.

Source

: Budget Documents of State Governments. | Market

Borrowings

The provisional net allocation of market borrowings for

all State Governments during 2006-07 was placed at Rs.17,243 crore. The gross

allocation of market borrowings amounted to Rs.26,597 crore, including the additional

allocation of Rs.2,803 crore and repayments of Rs.6,551 crore. During 2006-07,

the States raised market loans amounting to Rs.20,825 crore (or 78.3 per cent

of gross allocation) through auctions, with cut-off rates in the range 7.65-8.66

per cent (Table 19). The

Table

19: Market Borrowings of State Governments during 2006-07 |

Item | | Date | Cut-off

Rate | Tenor | Amount

Raised | | | | | (Per

cent) | (Years) | (Rupees

crore) | 1 | | | 2 | 3 | 4 | 5 |

A. | Tap

Issues | – | – | – | – |

B. | Auctions

(i to xii) | | | | 20,825 |

| i. | First | April

27, 2006 | 7.65 | 10 | 300 |

| ii. | Second | May

11, 2006 | 7.89 | 10 | 500 |

| | | | 8.00 | 10 | 1,646 |

| | | | 7.95 | 10 | 881 |

| | | | 8.04 | 10 | 150 |

| | | | 7.96 | 10 | 130 |

| | | | 7.87 | 10 | 400 |

| | | | 7.91 | 10 | 500 |

| | | | 7.98 | 10 | 57 |

| | | | 8.05 | 10 | 15 |

| | | | 7.93 | 10 | 1,307 |

| iii. | Third | July

13, 2006 | 8.65 | 10 | 933 |

| | | | 8.66 | 10 | 300 |

| | | | 8.62 | 10 | 225 |

| iv. | Fourth | August

25, 2006 | 8.11 | 10 | 1,050 |

| v. | Fifth | October

17, 2006 | 7.99 | 10 | 153 |

| | | | 8.04 | 10 | 48 |

| vi. | Sixth | November

16, 2006 | 7.74 | 10 | 2,184 |

| | | | 7.80 | 10 | 91 |

| | | | 7.82 | 10 | 156 |

| vii. | Seventh | December

14, 2006 | 7.81 | 10 | 340 |

| | | | 7.89 | 10 | 166 |

| | | | 7.93 | 10 | 809 |

| | | | 7.94 | 10 | 455 |

| | | | 7.99 | 10 | 193 |

| viii.Eighth | January

18, 2007 | 7.99 | 10 | 300 |

| | | | 7.99 | 10 | 100 |

| | | | 7.99 | 10 | 315 |

| | | | 7.96 | 10 | 500 |

| ix. | Ninth | February

2, 2007 | 7.95 | 10 | 200 |

| x. | Tenth | February

22, 2007 | 8.17 | 10 | 375 |

| | | | 8.10 | 10 | 47 |

| | | | 8.20 | 10 | 213 |

| | | | 8.19 | 10 | 300 |

| | | | 8.20 | 10 | 350 |

| | | | 8.19 | 10 | 500 |

| | | | 8.45 | 10 | 1,615 |

| xi. | Eleventh | March

13, 2007 | 8.38 | 10 | 212 |

| | | | 8.45 | 10 | 250 |

| | | | 8.40 | 10 | 470 |

| | | | 8.39 | 10 | 67 |

| | | | 8.39 | 10 | 70 |

| | | | 8.39 | 10 | 90 |

| | | | 8.32 | 10 | 300 |

| | | | 8.25 | 10 | 200 |

| | | | 8.32 | 10 | 414 |

| | | | 8.38 | 10 | 211 |

xii. | Twelfth | March

23, 2007 | 8.35 | 10 | 738 |

| | | | | | |

Grand Total (A+B) | | | | 20,825 |

Source : Reserve Bank of

India. |

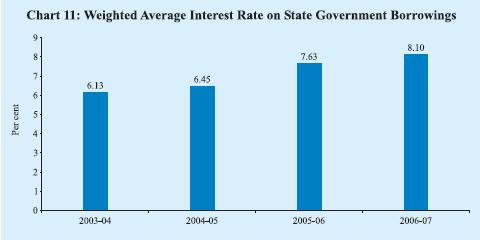

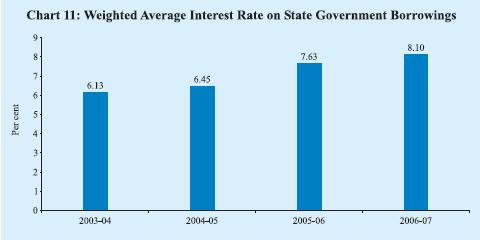

weighted

average interest rate of market loans increased to 8.10 per cent during 2006-07

from 7.63 per cent during the previous year (Chart 11).

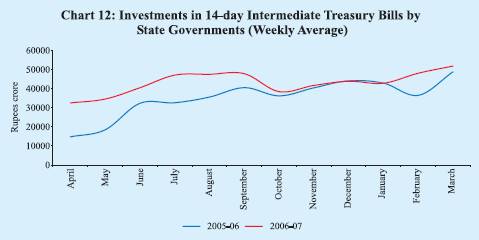

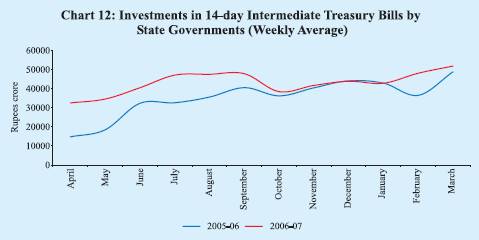

The liquidity position of the States remained comfortable during 2006-07.

This was reflected in the weekly average investment by the States in the 14-day

Treasury Bills which increased further during 2006-07 to Rs.43,075 crore from

Rs.35,278 crore in the previous year (Chart 12).

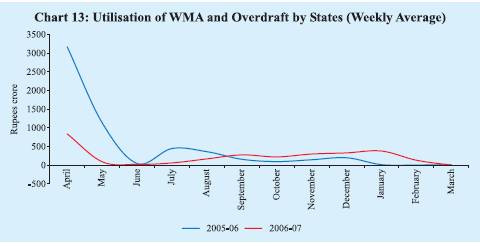

The surplus cash balances of the State Governments are automatically invested

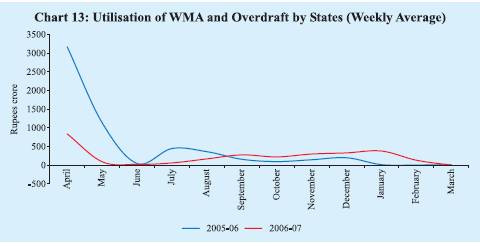

in 14-day Treasury Bills. The weekly average utilisation of WMA and overdraft

by the States at Rs.234 crore in 2006-07 was lower than that of Rs.482 crore in

2005-06 (Chart 13).

Two States resorted to overdraft during 2006-07

as compared with eight States during the previous year.

Fiscal

Outlook: 2007-08

The Union Budget for 2007-08 proposes to continue

the fiscal consolidation process, with the key deficit indicators, viz.,

gross fiscal deficit (GFD), revenue deficit (RD) and primary deficit (PD), budgeted

to be lower by 0.3-0.5 percentage points of GDP in 2007-08 than the previous year

(Table 20). The Budget envisages a revenue-led fiscal consolidation

along with reprioritisation of expenditure to augment allocations for improvement

in the social and physical infrastructure, particularly in the rural areas so

as to achieve a ‘faster and more inclusive’ growth process. The revenue

deficit relative to GDP is budgeted to be reduced in 2007-08 by 0.5 percentage

points, which is the minimum stipulated threshold limit under the FRBM Rule, 2004;

therefore, a substantial correction in the revenue deficit of 1.5 percentage points

would be required in 2008-09, the terminal year for meeting the FRBM target.

The gross tax-GDP ratio, which has been rising since 2002-03, is budgeted

to improve from 11.4 per cent in 2006-07 (RE) to 11.8 per cent in 2007-08 (BE).

This reflects expectations of high growth as well as the impact of measures taken

to widen the tax base, rationalise exemptions and improve tax compliance (Table

21). The budget estimates of total expenditure in the Union Budget 2007-08

include a sum of Rs.40,000 crore allocated for acquiring the Reserve Bank’s

equity holding in the State Bank of India (SBI). As thistransaction is matched

by the non-debt capital receipt of an equal amount, there would be no impact on

the

Table

20: Union Budget 2007-08 at a Glance | (Amount

in Rupees crore) | Item | | 2006-07 | 2007-08 | Growth

rate

( per cent ) | | | | (RE) | (BE) | | |

| | | | | 2006-07 | 2007-08 |

1 | | | 2 | 3 | 4 | 5 |

1, | Revenue Receipts

(i+ii) | 4,23,331 | 4,86,422 | 21.8 | 14.9 |

| | | (10.3) | (10.5) | | |

| i) | Tax

Revenue (Net) | 3,45,971 | 4,03,872 | 28.0 | 16.7 |

| | | (8.4) | (8.7) | | |

| ii) | Non-Tax

Revenue | 77,360 | 82,550 | 0.2 | 6.7 |

| | | (1.9) | (1.8) | | |

2. | Non-Plan Expenditure | 4,08,907 | 4,35,421* | 11.9 | 6.5 |

| | | (10.0) | (9.4) | | |

| of which: | | | | |

| i) | Interest

Payments | 1,46,192 | 1,58,995 | 10.2 | 8.8 |

| | | (3.6) | (3.4) | | |

| ii) | Defence

Expenditure | 86,000 | 96,000 | 6.8 | 11.6 |

| | | (2.1) | (2.1) | | |

| iii) | Subsidies | 53,463 | 54,330 | 12.5 | 1.6 |

| | | (1.3) | (1.2) | | |

3. | Plan Expenditure | 1,72,730 | 2,05,100 | 22.8 | 18.7 |

| | | (4.2) | (4.4) | | |

4. | Revenue Expenditure | 5,06,767 | 5,57,900 | 15.2 | 10.1 |

| | | (12.4) | (12.0) | | |

5. | Capital Expenditure | 74,870 | 82,621* | 12.8 | 10.4 |

| | | (1.8) | (1.8) | | |

6. | Total Expenditure | 5,81,637 | 6,40,521* | 14.9 | 10.1 |

| | | (14.2) | (13.8) | | |

7. | Revenue Deficit | 83,436 | 71,478 | -9.6 | -14.3 |

| | | (2.0) | (1.5) | | |

8. | Gross Fiscal

Deficit | 1,52,328 | 1,50,948 | 4.0 | -0.9 |

| | | (3.7) | (3.3) | | |

9. | Gross Primary

Deficit | 6,136 | -8,047 | -55.6 | -231.1 |

| | | (0.1) | (-0.2) | | |

* : Adjusted for an amount of Rs.40,000 crore

on account of transactions relating to transfer of RBI’s stake in SBI to

the Government.

Note : Figures in parentheses are percentages

to GDP. | deficit indicators. Aggregate expenditure, after

adjusting for this transaction, is budgeted to increase by 10.1 per cent in 2007-08.

Growth in the revenue expenditure in 2007-08 is budgeted to decelerate to 10.1

per cent from 15.2 per cent in 2006-07 on account of containment of subsidies

and deceleration in the growth of interest payments. The capital outlay (adjusted

for transactions for purchasing stake in the SBI) is budgeted to increase by 15.3

per cent as compared with an increase of 18.4 per cent in 2006-07.

During

2007-08, net market borrowings (net of MSS) are budgeted to increase marginally

from Rs.1,10,500 crore in 2006-07 (RE) to Rs.1,10,827 crore. Inclusive of repayments

of Rs.76,942 crore, gross market borrowings, net of MSS, are

placed at Rs.1,87,769 crore in 2007-08. Net market borrowings would finance

Table

21: Gross Tax Revenues of the Centre | (Per

cent to GDP) | Year | Direct | Indirect | Total |

1 | 2 | 3 | 4 |

1990-91 | 1.9 | 8.2 | 10.1 |

1991-92 | 2.3 | 8.0 | 10.3 |

1992-93 | 2.4 | 7.5 | 10.0 |

1993-94 | 2.4 | 6.5 | 8.8 |

1994-95 | 2.7 | 6.5 | 9.1 |

1995-96 | 2.8 | 6.5 | 9.4 |

1996-97 | 2.8 | 6.6 | 9.4 |

1997-98 | 3.2 | 6.0 | 9.1 |

1998-99 | 2.7 | 5.6 | 8.3 |

1999-00 | 3.0 | 5.8 | 8.8 |

2000-01 | 3.2 | 5.7 | 9.0 |

2001-02 | 3.0 | 5.2 | 8.2 |

2002-03 | 3.4 | 5.4 | 8.8 |

2003-04 | 3.8 | 5.4 | 9.2 |

2004-05 | 4.2 | 5.5 | 9.8 |

2005-06 | 4.6 | 5.6 | 10.3 |

2006-07 RE | 5.6 | 5.8 | 11.4 |

2007-08 BE | 5.8 | 6.1 | 11.8 |

73.4 per cent of GFD in 2007-08 as compared with 72.5 per cent in the

revised estimates for 2006-07. Investments by the National Small Savings Fund

(NSSF) in the special Central Government securities are budgeted to finance 7.0

per cent of GFD as against 2.0 per cent in the previous year. This reflects

the reinvestment of redemption proceeds as well as investment from small savings

collections in Central Government special securities following the policy decision

to reduce the minimum obligation of the State Governments to borrow from the NSSF

to 80 per cent of net collections from 100 per cent. External assistance is budgeted

to finance 6.0 per cent of GFD as compared with 5.2 per cent of GFD in 2006-07. |

IST,

IST,