Today, the Reserve Bank released the results of the 98th round of the Industrial Outlook Survey (IOS) conducted during April-June 2022. The survey encapsulates qualitative assessment of the business climate by Indian manufacturing companies for Q1:2022-23 and their expectations for Q2:2022-231. In all, 1,239 companies responded in this round of the survey. The additional response block for assessing the outlook on key parameters for two more quarters, which was introduced in the wake of uncertainties since the onset of the COVID-19 pandemic, was continued in this round of survey. Highlights: A. Assessment for Q1: 2022-23 -

Respondents were optimistic about demand conditions in Q1:2022-23, as revealed in their positive assessment on production, order books, capacity utilisation, employment and foreign trade (Table A). -

Manufacturers assessed a rise in costs of raw material as well as in salary outgo during Q1:2022-23; they also perceived a rise in cost of funds. -

Sentiments on selling prices hardened in consonance with input cost pressures; respondents’ perception on profit margin turned marginally positive during the quarter. -

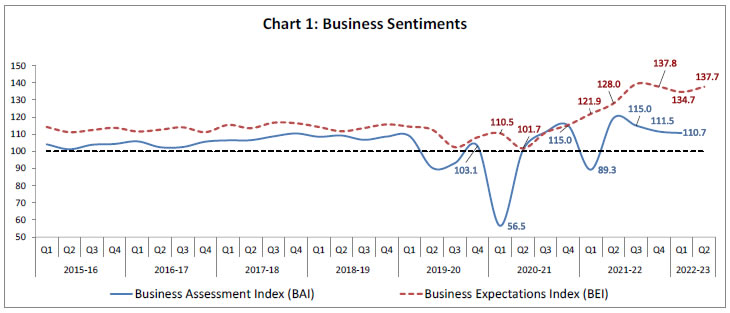

Overall, business sentiments in the manufacturing sector remained positive; the business assessment index (BAI)2 stood at 110.7 in Q1:2022-23 as compared with 111.5 a quarter ago (Chart 1). B. Expectations for Q2: 2022-23 -

Respondents retained their optimistic outlook on demand conditions, as reflected in their expectations on production, order book, and employment for Q2:2022-23. -

Pressures from purchase of raw materials, staff cost and cost of financing are likely to continue in Q2:2022-23 and to adjust for the cost escalation, the respondents expected improvement in pricing power and profit margin. -

The business expectations index (BEI) improved to 137.7 in Q2:2022-23 from 134.7 in the previous quarter (Chart 1). C. Expectations for Q3:2022-23 and Q4:2022-23 -

Manufacturers perceive sequential improvement in demand conditions and overall business situation till Q4:2022-23 (Table B). -

Respondents expect marginal easing of input cost pressures in later part of the year; selling prices are expected to rise. | Table A: Summary of Net responses3 on Survey Parameters | | (per cent) | | Parameters | Assessment period | Expectation period | | Q4:2021-22 | Q1:2022-23 | Q1:2022-23 | Q2:2022-23 | | Production | 23.8 | 22.2 | 65.6 | 67.4 | | Order Books | 21.3 | 21.7 | 66.1 | 68.1 | | Pending Orders | 3.9 | 7.5 | 1.8 | 2.6 | | Capacity Utilisation | 17.2 | 16.8 | 59.0 | 60.6 | | Inventory of Raw Materials | -7.8 | -9.8 | -38.8 | -41.5 | | Inventory of Finished Goods | -6.5 | -9.0 | -39.5 | -41.3 | | Exports | 12.7 | 14.3 | 58.0 | 60.8 | | Imports | 11.3 | 14.9 | 56.4 | 61.3 | | Employment | 11.4 | 15.3 | 50.2 | 54.9 | | Financial Situation (Overall) | 20.7 | 20.6 | 65.4 | 67.1 | | Availability of Finance (from internal accruals) | 18.1 | 18.1 | 59.9 | 61.9 | | Availability of Finance (from banks & other sources) | 16.1 | 17.2 | 57.8 | 60.4 | | Availability of Finance (from overseas, if applicable) | 9.1 | 14.4 | 59.2 | 64.6 | | Cost of Finance | -12.6 | -23.6 | -54.9 | -64.0 | | Cost of Raw Material | -49.5 | -84.4 | -77.0 | -79.0 | | Salary/ Other Remuneration | -18.2 | -34.8 | -65.6 | -60.8 | | Selling Price | 20.3 | 25.0 | 55.7 | 60.3 | | Profit Margin | -1.2 | 1.8 | 43.2 | 47.4 | | Overall Business Situation | 24.1 | 22.3 | 68.0 | 70.7 |

| Table B: Business Expectations of Select Parameters for extended period – Net response | | (per cent) | | Parameters | Round 97 | Round 98 | | Q1:2022-23 | Q2:2022-23 | Q3:2022-23 | Q4:2022-23 | | Overall Business Situation | 68.0 | 70.7 | 70.8 | 72.2 | | Production | 65.6 | 67.4 | 70.9 | 71.9 | | Order Books | 66.1 | 68.1 | 70.6 | 71.7 | | Capacity Utilisation | 59.0 | 60.6 | 68.3 | 68.3 | | Employment | 50.2 | 54.9 | 63.1 | 59.8 | | Cost of Raw Materials | -77.0 | -79.0 | -76.3 | -75.0 | | Selling Prices | 55.7 | 60.3 | 65.6 | 61.1 | | Note: Please see the excel file for time series data. |

| Table 1: Assessment and Expectations for Production | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net response | Increase | Decrease | No change | Net response | | Q1:2021-22 | 1,281 | 16.5 | 42.3 | 41.2 | -25.9 | 53.3 | 9.7 | 37.0 | 43.7 | | Q2:2021-22 | 1,414 | 44.5 | 10.7 | 44.8 | 33.8 | 58.8 | 6.8 | 34.3 | 52.0 | | Q3:2021-22 | 1,082 | 42.5 | 11.6 | 45.9 | 30.9 | 75.3 | 3.8 | 20.9 | 71.5 | | Q4:2021-22 | 1,283 | 38.0 | 14.2 | 47.8 | 23.8 | 66.5 | 5.3 | 28.3 | 61.2 | | Q1:2022-23 | 1,239 | 36.6 | 14.4 | 48.9 | 22.2 | 70.4 | 4.9 | 24.7 | 65.6 | | Q2:2022-23 | | | | | | 72.4 | 5.0 | 22.6 | 67.4 | ‘Increase’ in production is optimistic.

Note: The sum of components may not add up to total due to rounding off (This is applicable for all tables). |

| Table 2: Assessment and Expectations for Order Books | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net response | Increase | Decrease | No change | Net response | | Q1:2021-22 | 1,281 | 20.0 | 36.5 | 43.5 | -16.4 | 51.0 | 7.8 | 41.1 | 43.2 | | Q2:2021-22 | 1,414 | 44.9 | 10.1 | 45.0 | 34.7 | 56.9 | 6.5 | 36.7 | 50.4 | | Q3:2021-22 | 1,082 | 39.0 | 9.5 | 51.5 | 29.5 | 73.9 | 3.6 | 22.4 | 70.3 | | Q4:2021-22 | 1,283 | 34.7 | 13.4 | 51.9 | 21.3 | 66.2 | 4.7 | 29.1 | 61.5 | | Q1:2022-23 | 1,239 | 34.1 | 12.5 | 53.4 | 21.7 | 70.4 | 4.2 | 25.4 | 66.1 | | Q2:2022-23 | | | | | | 72.7 | 4.6 | 22.6 | 68.1 | | ‘Increase’ in order books is optimistic. |

| Table 3: Assessment and Expectations for Pending Orders | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Above Normal | Below Normal | Normal | Net response | Above Normal | Below Normal | Normal | Net

response | | Q1:2021-22 | 1,281 | 7.4 | 17.5 | 75.1 | 10.0 | 11.6 | 9.2 | 79.3 | -2.4 | | Q2:2021-22 | 1,414 | 9.6 | 8.1 | 82.3 | -1.6 | 10.8 | 7.2 | 82.0 | -3.7 | | Q3:2021-22 | 1,082 | 7.2 | 10.9 | 81.9 | 3.6 | 8.8 | 4.8 | 86.4 | -4.1 | | Q4:2021-22 | 1,283 | 9.8 | 13.7 | 76.5 | 3.9 | 8.5 | 7.9 | 83.6 | -0.5 | | Q1:2022-23 | 1,239 | 6.7 | 14.2 | 79.1 | 7.5 | 8.8 | 10.6 | 80.6 | 1.8 | | Q2:2022-23 | | | | | | 7.7 | 10.3 | 82.1 | 2.6 | | Pending orders ‘Below Normal’ is optimistic. |

| Table 4: Assessment and Expectations for Capacity Utilisation (Main Product) | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net response | Increase | Decrease | No change | Net

response | | Q1:2021-22 | 1,281 | 13.4 | 39.5 | 47.1 | -26.1 | 45.2 | 7.3 | 47.5 | 38.0 | | Q2:2021-22 | 1,414 | 39.2 | 10.4 | 50.4 | 28.8 | 51.6 | 6.2 | 42.2 | 45.4 | | Q3:2021-22 | 1,082 | 31.2 | 9.0 | 59.8 | 22.2 | 68.3 | 3.1 | 28.5 | 65.2 | | Q4:2021-22 | 1,283 | 30.2 | 13.0 | 56.9 | 17.2 | 57.0 | 4.5 | 38.5 | 52.6 | | Q1:2022-23 | 1,239 | 29.5 | 12.8 | 57.7 | 16.8 | 63.5 | 4.5 | 32.0 | 59.0 | | Q2:2022-23 | | | | | | 65.6 | 5.0 | 29.4 | 60.6 | | ‘Increase’ in capacity utilisation is optimistic. |

| Table 5: Assessment and Expectations for Level of CU (compared to the average in last 4 quarters) | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Above Normal | Below Normal | Normal | Net response | Above Normal | Below Normal | Normal | Net response | | Q1:2021-22 | 1,281 | 5.2 | 18.4 | 76.3 | -13.2 | 25.3 | 8.4 | 66.2 | 16.9 | | Q2:2021-22 | 1,414 | 15.4 | 7.7 | 76.9 | 7.8 | 15.6 | 7.9 | 76.5 | 7.7 | | Q3:2021-22 | 1,082 | 12.6 | 8.4 | 78.9 | 4.2 | 30.4 | 3.7 | 65.9 | 26.7 | | Q4:2021-22 | 1,283 | 12.6 | 10.8 | 76.6 | 1.9 | 30.1 | 5.8 | 64.2 | 24.3 | | Q1:2022-23 | 1,239 | 19.6 | 10.4 | 70.0 | 9.2 | 39.3 | 5.4 | 55.4 | 33.9 | | Q2:2022-23 | | | | | | 50.2 | 6.3 | 43.5 | 43.9 | | ‘Above Normal’ in Level of capacity utilisation is optimistic. |

| Table 6: Assessment and Expectations for Assessment of Production Capacity (with regard to expected demand in next 6 months) | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | More than adequate | Less than adequate | Adequate | Net response | More than adequate | Less than adequate | Adequate | Net response | | Q1:2021-22 | 1,281 | 10.8 | 13.0 | 76.2 | -2.2 | 20.2 | 7.3 | 72.5 | 12.9 | | Q2:2021-22 | 1,414 | 17.3 | 7.6 | 75.1 | 9.7 | 28.4 | 5.8 | 65.8 | 22.6 | | Q3:2021-22 | 1,082 | 13.2 | 6.1 | 80.6 | 7.1 | 31.0 | 4.0 | 65.1 | 27.0 | | Q4:2021-22 | 1,283 | 14.1 | 7.1 | 78.8 | 7.1 | 30.7 | 4.0 | 65.3 | 26.7 | | Q1:2022-23 | 1,239 | 25.2 | 7.2 | 67.6 | 18.0 | 42.7 | 3.9 | 53.5 | 38.8 | | Q2:2022-23 | | | | | | 51.5 | 5.4 | 43.0 | 46.1 | | ‘More than adequate’ in Assessment of Production Capacity is optimistic. |

| Table 7: Assessment and Expectations for Exports | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net response | Increase | Decrease | No change | Net response | | Q1:2021-22 | 1,281 | 18.3 | 26.1 | 55.6 | -7.8 | 38.7 | 9.0 | 52.3 | 29.6 | | Q2:2021-22 | 1,414 | 39.2 | 7.7 | 53.0 | 31.5 | 49.8 | 6.2 | 44.0 | 43.6 | | Q3:2021-22 | 1,082 | 29.8 | 9.7 | 60.5 | 20.0 | 67.3 | 3.1 | 29.6 | 64.3 | | Q4:2021-22 | 1,283 | 25.3 | 12.6 | 62.1 | 12.7 | 59.2 | 4.5 | 36.4 | 54.7 | | Q1:2022-23 | 1,239 | 25.5 | 11.2 | 63.4 | 14.3 | 62.4 | 4.4 | 33.2 | 58.0 | | Q2:2022-23 | | | | | | 65.2 | 4.4 | 30.4 | 60.8 | | ‘Increase’ in exports is optimistic. |

| Table 8: Assessment and Expectations for Imports | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net response | Increase | Decrease | No change | Net response | | Q1:2021-22 | 1,281 | 18.9 | 17.1 | 64.0 | 1.7 | 32.6 | 6.6 | 60.8 | 26.1 | | Q2:2021-22 | 1,414 | 36.0 | 5.8 | 58.2 | 30.2 | 47.3 | 4.5 | 48.3 | 42.8 | | Q3:2021-22 | 1,082 | 26.8 | 6.9 | 66.3 | 19.9 | 63.4 | 2.9 | 33.7 | 60.4 | | Q4:2021-22 | 1,283 | 22.9 | 11.6 | 65.4 | 11.3 | 55.6 | 3.8 | 40.6 | 51.8 | | Q1:2022-23 | 1,239 | 23.9 | 9.0 | 67.0 | 14.9 | 59.7 | 3.4 | 36.9 | 56.4 | | Q2:2022-23 | | | | | | 64.5 | 3.2 | 32.3 | 61.3 | | ‘Increase’ in imports is optimistic. |

| Table 9: Assessment and Expectations for level of Raw Materials Inventory | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Above average | Below average | Average | Net response | Above average | Below average | Average | Net response | | Q1:2021-22 | 1,281 | 11.5 | 11.2 | 77.3 | -0.3 | 17.2 | 5.4 | 77.4 | -11.8 | | Q2:2021-22 | 1,414 | 20.2 | 5.5 | 74.4 | -14.7 | 23.7 | 6.2 | 70.0 | -17.5 | | Q3:2021-22 | 1,082 | 16.5 | 5.1 | 78.4 | -11.4 | 33.7 | 4.4 | 61.9 | -29.4 | | Q4:2021-22 | 1,283 | 14.7 | 6.9 | 78.4 | -7.8 | 32.7 | 3.7 | 63.5 | -29.0 | | Q1:2022-23 | 1,239 | 16.8 | 7.0 | 76.1 | -9.8 | 42.4 | 3.6 | 54.0 | -38.8 | | Q2:2022-23 | | | | | | 46.1 | 4.6 | 49.3 | -41.5 | | ‘Below average’ Inventory of raw materials is optimistic. |

| Table 10: Assessment and Expectations for level of Finished Goods Inventory | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Above average | Below average | Average | Net response | Above average | Below average | Average | Net response | | Q1:2021-22 | 1,281 | 14.4 | 10.2 | 75.4 | -4.2 | 16.4 | 5.5 | 78.1 | -10.9 | | Q2:2021-22 | 1,414 | 20.0 | 5.2 | 74.8 | -14.9 | 25.0 | 5.6 | 69.4 | -19.4 | | Q3:2021-22 | 1,082 | 15.3 | 5.5 | 79.2 | -9.8 | 34.4 | 3.8 | 61.8 | -30.7 | | Q4:2021-22 | 1,283 | 13.7 | 7.2 | 79.0 | -6.5 | 31.1 | 3.9 | 64.9 | -27.2 | | Q1:2022-23 | 1,239 | 16.4 | 7.4 | 76.2 | -9.0 | 42.4 | 3.0 | 54.6 | -39.5 | | Q2:2022-23 | | | | | | 45.6 | 4.3 | 50.1 | -41.3 | | ‘Below average’ Inventory of finished goods is optimistic. |

| Table 11: Assessment and Expectations for Employment | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net response | Increase | Decrease | No change | Net response | | Q1:2021-22 | 1,281 | 9.1 | 12.7 | 78.2 | -3.5 | 23.5 | 5.5 | 71.0 | 17.9 | | Q2:2021-22 | 1,414 | 29.5 | 4.6 | 65.9 | 24.9 | 28.6 | 2.5 | 69.0 | 26.1 | | Q3:2021-22 | 1,082 | 25.3 | 5.4 | 69.3 | 19.8 | 52.2 | 1.3 | 46.5 | 50.9 | | Q4:2021-22 | 1,283 | 20.3 | 8.9 | 70.8 | 11.4 | 49.2 | 2.0 | 48.8 | 47.2 | | Q1:2022-23 | 1,239 | 23.4 | 8.1 | 68.4 | 15.3 | 52.7 | 2.5 | 44.7 | 50.2 | | Q2:2022-23 | | | | | | 57.1 | 2.1 | 40.8 | 54.9 | | ‘Increase’ in employment is optimistic. |

| Table 12: Assessment and Expectations for Overall Financial Situation | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Better | Worsen | No change | Net response | Better | Worsen | No change | Net response | | Q1:2021-22 | 1,281 | 17.8 | 30.6 | 51.6 | -12.7 | 53.4 | 6.1 | 40.5 | 47.3 | | Q2:2021-22 | 1,414 | 41.7 | 8.9 | 49.4 | 32.8 | 54.0 | 5.8 | 40.2 | 48.2 | | Q3:2021-22 | 1,082 | 38.1 | 9.8 | 52.0 | 28.3 | 71.5 | 2.9 | 25.7 | 68.6 | | Q4:2021-22 | 1,283 | 33.9 | 13.2 | 53.0 | 20.7 | 64.0 | 4.7 | 31.3 | 59.3 | | Q1:2022-23 | 1,239 | 33.0 | 12.3 | 54.7 | 20.6 | 69.3 | 3.9 | 26.7 | 65.4 | | Q2:2022-23 | | | | | | 70.4 | 3.4 | 26.2 | 67.1 | | ‘Better’ overall financial situation is optimistic. |

| Table 13: Assessment and Expectations for Working Capital Finance Requirement | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net response | Increase | Decrease | No change | Net response | | Q1:2021-22 | 1,281 | 24.4 | 14.0 | 61.7 | 10.4 | 37.6 | 5.2 | 57.3 | 32.4 | | Q2:2021-22 | 1,414 | 39.6 | 4.7 | 55.7 | 34.9 | 44.7 | 3.0 | 52.2 | 41.7 | | Q3:2021-22 | 1,082 | 31.6 | 4.5 | 63.9 | 27.1 | 63.3 | 2.2 | 34.4 | 61.1 | | Q4:2021-22 | 1,283 | 31.4 | 8.1 | 60.5 | 23.3 | 54.7 | 2.9 | 42.4 | 51.7 | | Q1:2022-23 | 1,239 | 33.4 | 7.9 | 58.7 | 25.5 | 62.8 | 1.4 | 35.7 | 61.4 | | Q2:2022-23 | | | | | | 65.0 | 2.6 | 32.5 | 62.4 | | ‘Increase’ in working capital finance is optimistic. |

| Table 14: Assessment and Expectations for Availability of Finance (from Internal Accruals) | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Improve | Worsen | No change | Net response | Improve | Worsen | No change | Net response | | Q1:2021-22 | 1,281 | 13.3 | 17.6 | 69.1 | -4.3 | 39.7 | 5.1 | 55.2 | 34.7 | | Q2:2021-22 | 1,414 | 35.3 | 6.8 | 57.9 | 28.5 | 42.4 | 3.8 | 53.7 | 38.6 | | Q3:2021-22 | 1,082 | 30.6 | 5.8 | 63.6 | 24.8 | 64.1 | 2.1 | 33.8 | 61.9 | | Q4:2021-22 | 1,283 | 27.7 | 9.6 | 62.7 | 18.1 | 55.7 | 2.8 | 41.5 | 52.9 | | Q1:2022-23 | 1,239 | 27.8 | 9.7 | 62.4 | 18.1 | 62.4 | 2.5 | 35.2 | 59.9 | | Q2:2022-23 | | | | | | 64.2 | 2.4 | 33.4 | 61.9 | | ‘Improvement’ in availability of finance is optimistic. |

| Table 15: Assessment and Expectations for Availability of Finance (from banks and other sources) | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Improve | Worsen | No change | Net response | Improve | Worsen | No change | Net response | | Q1:2021-22 | 1,281 | 10.7 | 13.1 | 76.1 | -2.4 | 30.0 | 4.4 | 65.6 | 25.6 | | Q2:2021-22 | 1,414 | 33.2 | 4.9 | 61.8 | 28.3 | 38.4 | 2.9 | 58.8 | 35.5 | | Q3:2021-22 | 1,082 | 26.2 | 3.9 | 69.9 | 22.4 | 60.6 | 1.9 | 37.5 | 58.7 | | Q4:2021-22 | 1,283 | 24.1 | 8.0 | 68.0 | 16.1 | 52.0 | 2.1 | 45.9 | 49.8 | | Q1:2022-23 | 1,239 | 24.8 | 7.6 | 67.5 | 17.2 | 59.3 | 1.5 | 39.2 | 57.8 | | Q2:2022-23 | | | | | | 62.2 | 1.8 | 36.1 | 60.4 | | ‘Improvement’ in availability of finance is optimistic. |

| Table 16: Assessment and Expectations for Availability of Finance (from overseas, if applicable) | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Improve | Worsen | No change | Net response | Improve | Worsen | No change | Net response | | Q1:2021-22 | 1,281 | 13.6 | 12.0 | 74.5 | 1.6 | 16.5 | 3.1 | 80.3 | 13.4 | | Q2:2021-22 | 1,414 | 33.8 | 2.3 | 63.9 | 31.5 | 44.0 | 1.3 | 54.7 | 42.7 | | Q3:2021-22 | 1,082 | 22.4 | 3.4 | 74.1 | 19.0 | 66.5 | 0.6 | 32.8 | 65.9 | | Q4:2021-22 | 1,283 | 17.9 | 8.7 | 73.4 | 9.1 | 52.5 | 1.5 | 46.0 | 50.9 | | Q1:2022-23 | 1,239 | 21.9 | 7.5 | 70.6 | 14.4 | 60.2 | 0.9 | 38.9 | 59.2 | | Q2:2022-23 | | | | | | 65.8 | 1.2 | 33.0 | 64.6 | | ‘Improvement’ in availability of finance is optimistic. |

| Table 17: Assessment and Expectations for Cost of Finance | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net

response | Increase | Decrease | No change | Net response | | Q1:2021-22 | 1,281 | 15.7 | 11.3 | 73.0 | -4.5 | 22.2 | 8.2 | 69.6 | -13.9 | | Q2:2021-22 | 1,414 | 32.5 | 4.0 | 63.5 | -28.6 | 34.9 | 3.3 | 61.8 | -31.5 | | Q3:2021-22 | 1,082 | 24.9 | 5.5 | 69.5 | -19.4 | 58.3 | 2.5 | 39.3 | -55.8 | | Q4:2021-22 | 1,283 | 22.1 | 9.6 | 68.3 | -12.6 | 50.7 | 2.1 | 47.2 | -48.6 | | Q1:2022-23 | 1,239 | 30.5 | 6.9 | 62.6 | -23.6 | 57.0 | 2.1 | 40.9 | -54.9 | | Q2:2022-23 | | | | | | 65.6 | 1.6 | 32.8 | -64.0 | | ‘Decrease’ in cost of finance is optimistic. |

| Table 18: Assessment and Expectations for Cost of Raw Materials | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net

response | Increase | Decrease | No change | Net response | | Q1:2021-22 | 1,281 | 58.1 | 5.8 | 36.1 | -52.3 | 64.9 | 2.5 | 32.6 | -62.4 | | Q2:2021-22 | 1,414 | 62.5 | 1.4 | 36.1 | -61.0 | 56.8 | 2.0 | 41.2 | -54.9 | | Q3:2021-22 | 1,082 | 62.0 | 3.2 | 34.8 | -58.8 | 76.6 | 1.4 | 22.1 | -75.2 | | Q4:2021-22 | 1,283 | 55.0 | 5.5 | 39.4 | -49.5 | 75.1 | 1.5 | 23.3 | -73.6 | | Q1:2022-23 | 1,239 | 85.5 | 1.1 | 13.3 | -84.4 | 78.2 | 1.2 | 20.6 | -77.0 | | Q2:2022-23 | | | | | | 80.6 | 1.6 | 17.9 | -79.0 | | ‘Decrease’ in cost of raw materials is optimistic. |

| Table 19: Assessment and Expectations for Salary/Other Remuneration | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net response | Increase | Decrease | No change | Net response | | Q1:2021-22 | 1,281 | 26.4 | 6.5 | 67.1 | -19.9 | 42.7 | 1.2 | 56.1 | -41.6 | | Q2:2021-22 | 1,414 | 33.1 | 1.8 | 65.2 | -31.3 | 32.5 | 0.9 | 66.6 | -31.6 | | Q3:2021-22 | 1,082 | 29.3 | 2.4 | 68.3 | -26.9 | 51.2 | 0.9 | 47.9 | -50.4 | | Q4:2021-22 | 1,283 | 24.6 | 6.4 | 69.0 | -18.2 | 50.9 | 1.0 | 48.2 | -49.9 | | Q1:2022-23 | 1,239 | 39.6 | 4.8 | 55.5 | -34.8 | 66.3 | 0.7 | 33.0 | -65.6 | | Q2:2022-23 | | | | | | 61.3 | 0.4 | 38.3 | -60.8 | | ‘Decrease’ in Salary / other remuneration is optimistic. |

| Table 20: Assessment and Expectations for Selling Price | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net response | Increase | Decrease | No change | Net response | | Q1:2021-22 | 1,281 | 26.9 | 7.3 | 65.8 | 19.6 | 35.0 | 5.8 | 59.1 | 29.2 | | Q2:2021-22 | 1,414 | 42.0 | 3.9 | 54.1 | 38.2 | 31.1 | 2.9 | 66.0 | 28.2 | | Q3:2021-22 | 1,082 | 34.5 | 6.3 | 59.2 | 28.2 | 59.7 | 2.3 | 38.0 | 57.4 | | Q4:2021-22 | 1,283 | 30.0 | 9.7 | 60.2 | 20.3 | 54.0 | 3.7 | 42.3 | 50.3 | | Q1:2022-23 | 1,239 | 33.3 | 8.3 | 58.4 | 25.0 | 59.5 | 3.8 | 36.7 | 55.7 | | Q2:2022-23 | | | | | | 63.4 | 3.2 | 33.4 | 60.3 | | ‘Increase’ in selling price is optimistic. |

| Table 21: Assessment and Expectations for Profit Margin | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Increase | Decrease | No change | Net response | Increase | Decrease | No change | Net response | | Q1:2021-22 | 1,281 | 11.8 | 44.0 | 44.2 | -32.2 | 28.8 | 17.8 | 53.4 | 11.0 | | Q2:2021-22 | 1,414 | 30.0 | 20.6 | 49.5 | 9.4 | 43.7 | 11.0 | 45.3 | 32.7 | | Q3:2021-22 | 1,082 | 22.8 | 19.0 | 58.2 | 3.8 | 59.9 | 8.2 | 31.9 | 51.7 | | Q4:2021-22 | 1,283 | 20.6 | 21.8 | 57.6 | -1.2 | 49.5 | 9.7 | 40.8 | 39.8 | | Q1:2022-23 | 1,239 | 22.5 | 20.7 | 56.7 | 1.8 | 53.6 | 10.4 | 35.9 | 43.2 | | Q2:2022-23 | | | | | | 57.6 | 10.1 | 32.3 | 47.4 | | ‘Increase’ in profit margin is optimistic. |

| Table 22: Assessment and Expectations for Overall Business Situation | | (Percentage responses) | | Quarter | Total response | Assessment | Expectations | | Better | Worsen | No change | Net response | Better | Worsen | No change | Net response | | Q1:2021-22 | 1,281 | 18.6 | 39.2 | 42.3 | -20.6 | 57.7 | 5.1 | 37.2 | 52.5 | | Q2:2021-22 | 1,414 | 43.5 | 9.5 | 47.0 | 34.0 | 59.9 | 7.5 | 32.5 | 52.4 | | Q3:2021-22 | 1,082 | 42.3 | 9.8 | 47.9 | 32.5 | 73.1 | 2.8 | 24.1 | 70.3 | | Q4:2021-22 | 1,283 | 37.7 | 13.6 | 48.8 | 24.1 | 67.6 | 4.2 | 28.2 | 63.4 | | Q1:2022-23 | 1,239 | 36.0 | 13.8 | 50.2 | 22.3 | 71.8 | 3.8 | 24.4 | 68.0 | | Q2:2022-23 | | | | | | 73.9 | 3.2 | 22.9 | 70.7 | | ‘Better’ Overall Business Situation is optimistic. |

| Table 23: Business Sentiments | | Quarter | Business Assessment Index (BAI) | Business Expectations Index (BEI) | | Q1:2021-22 | 89.3 | 121.9 | | Q2:2021-22 | 119.4 | 128.0 | | Q3:2021-22 | 115.0 | 139.3 | | Q4:2021-22 | 111.5 | 137.8 | | Q1:2022-23 | 110.7 | 134.7 | | Q2:2022-23 | | 137.7 |

|

IST,

IST,