Report on Trend and Progress of Banking in India, 2007-08

Issues in Fraud Monitoring

2.133 Banks often take the help of third parties to conduct the due diligence exercise for their credit decisions. Some such parties that banks solicit expert opinion, attestation, confirmation and credit information from include lawyers, valuers, chartered accountants, statutory auditors, real estate agents, builders, warehouse owners, motor vehicle dealers, agricultural equipment dealers and third party service providers. It has been observed that sometimes these third parties provide inaccurate or misleading information/confirmation/opinion to the banks resulting in the weakening of the due diligence processes. This kind of negligent/ malafide/criminal action on the part of unscrupulous third parties is found to have caused or facilitated frauds in banks. This trend, which is a matter of concern for banks and the Reserve Bank, is being examined for shaping an appropriate regulatory response.

2.134 Banks are required to report fraud cases of Rs.1 lakh and above to the Reserve Bank, following which they are advised to report the cases to the Central Bureau of Investigation (CBI) or the police, examine staff accountability and expedite proceedings against the erring staff, recover the amounts involved in frauds through the various options available to them, remove the names of suspect advocates/valuers from their approved panels and claim insurance, wherever applicable. Public sector banks and private sector/foreign banks are required to report frauds involving Rs.1 crore and above to the Economic Offences Wing of the CBI and Serious Frauds Investigation Office, respectively. Public sector banks should report frauds involving less than Rs.1 crore to the local police, while private sector banks should do the same when the sum involved is between Rs.10,000 and Rs.1 crore. Besides, the Reserve Bank has taken a series of steps for checking/preventing frauds by cautioning the banks about common fraud prone areas, their modus operandi and the measures that could be taken to prevent/reduce their incidence. The Reserve Bank has been issuing, in confidence, ‘caution advices’ containing details of borrowers involved in frauds of Rs.25 lakh and above to banks so that they could exercise due care while considering advancing of credit to such entities.

Supervisory Initiatives Pertaining to Modification of Off-Site Surveillance System

2.135 As part of a new supervisory strategy which was suggested by the Narasimham Committee in 1991, an off-site monitoring system for surveillance over banks was introduced by the Reserve Bank in November 1995 which became fully operational by March 1997. The scope and coverage of the off-site monitoring and surveillance system (OSMOS) returns are periodically revised to incorporate new regulatory changes and other data requirements. The last revision of the OSMOS returns was done in December 2004. Since then, several new regulatory prescriptions have been announced which are required to be captured in the off-site returns for monitoring compliance and analysis. Changes in supervisory focus and additional reporting requirements and improvements in existing reporting/data processing at the end of reporting banks also necessitated a revision of the OSMOS returns. After obtaining suggestions from various users of the system, a comprehensive review of the coverage and scope of the system has been proposed. The changes so identified have been documented and the process of software development is currently underway.

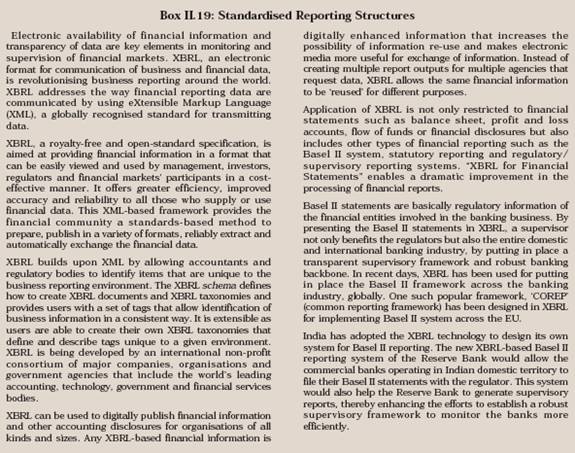

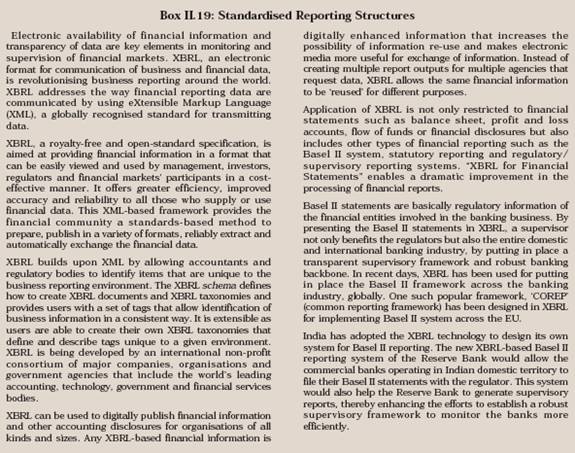

2.136 In view of the application of the Revised Framework, in phases, with effect from March 31, 2008 a new capital adequacy return under the off-site reporting framework was devised thus increasing the total number of off-site returns or DSB Returns (when off-site prudential supervisory returns were first introduced, these returns were christened ‘DSB’ returns and the nomenclature has been retained) from 22 to 23. An Internal Group has recommended a suitable reporting framework using eXtensible Business Reporting Language (XBRL) technology to capture data as per the final guidelines issued in April 2007 and subsequent amendments issued on March 31, 2008.

2.137 Banks have so far been submitting DSB returns to the Reserve Bank via e-mail using the OSMOS software. It was decided that online returns filing system (ORFS) would be the single-window data receptacle for receiving all data from external entities and thus all the existing DSB returns were to migrate to the ORFS. The system requirement specification has been completed for all the 22 existing DSB returns and they are in different stages of being implemented. The new Basel II return, mentioned above, would also be implemented on ORFS. Simultaneously, the work related to back-end changes to the databases and the reporting tools has commenced. The revised structural liquidity statement was made active from February 2008. Consolidated prudential report return has also been hosted on the live environment. Furthermore, it is envisaged that all the reporting tools would also be web-enabled.

7. Regional Rural Banks

2.138 With a view to making RRBs important vehicles of credit delivery in rural and backward areas, the Reserve Bank has been taking measures from time to time for strengthening them and improving their performance. Considering the critical role of sponsor banks in positioning the RRBs as partners in development of the rural sector and in order to encourage synergies between the parent bank and RRBs, the Reserve Bank advised all sponsor banks to take steps on issues pertaining to human resources (HR), information technology (IT) and operations of the RRBs sponsored by them. In recent years, the RRBs have been strengthened through amalgamation and recapitalisation (refer Chapter III).

2.139 Based on the recommendation of the Internal Working Group on RRBs (Chairman : Shri A.V. Sardesai) and pursuant to the announcement made in the Mid-term Review for 2007-08, the Reserve Bank, in December 2007, announced the roadmap for bringing the RRBs within the CRAR framework. To assess the capital structure of the RRBs, it was proposed that they disclose the level of their CRAR as on March 31, 2008 in their balance sheets and thereafter every year as ‘notes on accounts’ to their balance sheets.

Technology Upgradation of RRBs

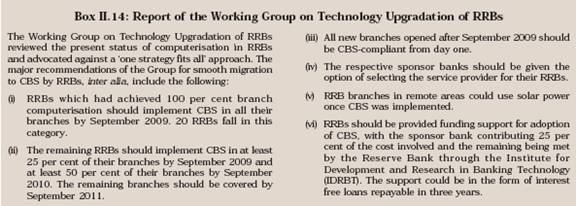

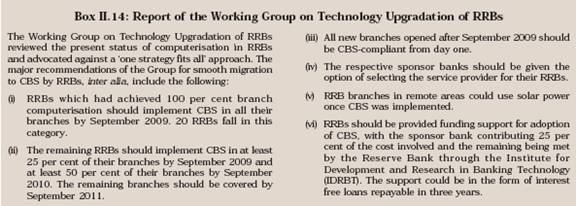

2.140 Consequent upon the announcement made in the Mid-term Review for 2007-08, and in order to prepare RRBs to adopt appropriate technology and migrate to core banking solutions (CBS) for better customer service, a Working Group (Chairman: Shri G. Srinivasan) was constituted with representatives from NABARD, sponsor banks and RRBs, to prepare a road-map for migration to CBS by RRBs (Box II.14).

Financial Assistance to RRBs for Implementing ICT-based Solutions

2.141 The Mid-term Review for 2007-08 announced that financial assistance would be provided to RRBs to defray a part of their initial cost in implementing ICT-based solutions, including installation of solar power generating devices for powering ICT equipment in remote and under-served areas. In order to work out the modalities of assistance to be provided to RRBs, a Working Group (Chairman: Shri G. Padmanadbhan) was constituted to explore affordable ICT-based solutions suitable for RRBs and to identify the cost elements and recommend the manner and criteria for funding such ICT solutions. The Group’s Report, submitted in April 2008, is under examination. The Group delved into the existing financial and infrastructural constraints that RRBs faced in initiating financial inclusion initiatives. It also explored the various technology options available for RRBs to achieve financial inclusion. The Report recommended that the funding of the ICT requirements of RRBs could be done through “Technology Upgradation Interest Free Loans” to be routed through the IDRBT. It was proposed that such loans should have a moratorium period of three years and the repayments should not exceed 5 per cent of the profits of the borrowing bank. For RRBs that continuously incurred losses, an extension of the moratorium period by another two years (total of five years) could be considered. Eligibility criteria for banks to avail the technology upgradation loans as well as caps on funding were also prescribed.

Human Resources Issues in RRBs

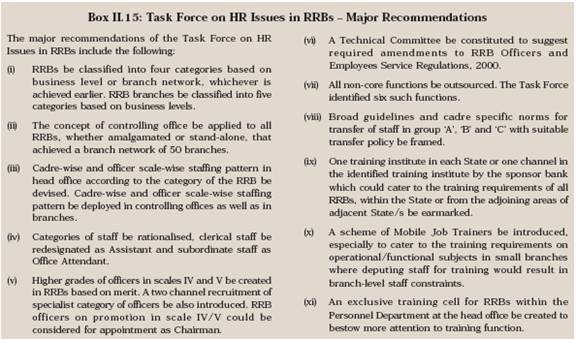

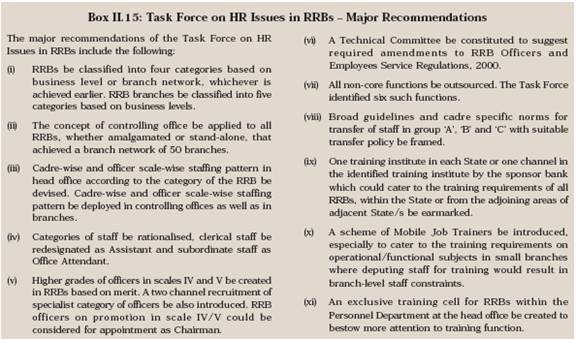

2.142 The Task Force constituted to formulate a comprehensive HR Policy for RRBs (Chairman: Dr. Y.S.P. Thorat) submitted its Report to the Government of India in October 2007 (Box II.15). The report is being examined by the Government in the light of views/ comments of the Reserve Bank.

8. Financial Markets

2.143 The Reserve Bank continued with its endeavour to develop broad-based, deep and liquid financial markets during 2007-08. The Technical Advisory Committee (TAC) on Money, Foreign Exchange and Government Securities Markets continued to provide valuable guidance to the Reserve Bank on issues relating to the development and regulation of financial markets. In 2008-09, beginning September 2008, the international financial crisis has had indirect knock-on effects on domestic financial markets. Money markets experienced unusual tightening of liquidity as a result of global developments which were amplified by transient local factors. The foreign exchange market experienced pressure on account of portfolio outflows by FIIs and enhanced foreign exchange requirements of oil and fertiliser companies. Constraints in access to external financing as also re-pricing of risks and higher spreads resulted in additional demand from corporates for domestic bank credit with attendant hardening of interest rates across the spectrum. Given the uncertain global financial situation, it has been recognised that monitoring and maintenance of domestic financial stability warrants continuous attention. The Reserve Bank is maintaining a close vigil on the entire financial system to prevent pressures from building up in the financial markets.

Developments in the Money Market

2.144 The broad policy focus in the money market was to ensure stability, minimise default risk and achieve balanced development of its various segments. With a view to widening the collateral base, necessary changes were made in the Public Debt Office-Negotiated Dealing System (PDO-NDS) to enable the acceptance of the SDLs as eligible securities under the LAF repos with effect from April 3, 2007. A margin of 10 per cent was applied in respect of SDLs.

2.145 The Reserve Bank issued comprehensive guidelines in respect of derivatives in April 2007. Subsequently, the CCIL was advised to start a trade reporting platform for OTC derivative transactions to address the need for a mechanism to capture and disseminate trade information and provide post-trade processing infrastructure in respect of these transactions. The reporting platform for OTC rupee interest rate swaps (IRS) and forward rate agreements (FRA) was made operational by the CCIL on August 30, 2007 whereby banks and PDs report the IRS and FRA to the platform on a daily basis.

2.146 Exchange-traded interest rate futures (IRF) contracts were introduced on the NSE in 2003. These contracts, however, failed to attract a critical mass of participants and transactions. With a view to develop a robust IRF market, the Reserve Bank, in August 2007, constituted a Working Group on IRF (Chairman: Shri V.K. Sharma) following the recommendation made by the TAC on Money, Foreign Exchange and Government Securities Markets. The Group submitted its Report in March 2008 and based on the feedback received from the public, experts, banks, market participants and the Government, the Report was finalised on August 8, 2008. The major recommendations of the Report, inter alia, included: (a) banks could be allowed to take trading positions in IRF, subject to prudential regulations, and the extant practice of banks’ participation in IRF for hedging risk in their underlying investment portfolio of Government securities classified under the AFS and the HFT categories, should be extended to the interest rate risk inherent in their entire balance sheet (both on and off-balance sheet items); (b) the extant norm of holding the entire SLR portfolio in HTM category should be reviewed; (c) the time limit on short selling to be extended so that the term/tenure/maturity of the short sale was co-terminus with that of the futures contract; (d) a system of transparent and rule-based pecuniary penalty for subsidiary general ledger (SGL) bouncing should replace the current regulatory penalty; and (e) the broader policy on IRF, including that relating to the product and participants, should be the responsibility of the Reserve Bank, while the micro-structure details should be left to respective exchanges.

Developments in the Government Securities Market

2.147 With the implementation of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 and withdrawal of the Reserve Bank from the primary segment, development of the Government securities market has assumed vital importance. The Government Securities Act, 2006 empowered the Reserve Bank to continue with efforts to broaden and deepen the market in terms of participants, instruments and processes.

2.148 With a view to providing flexibility to participants and encouraging wider market participation, the Mid-term Review for 2007-08 announced that the short sale and ‘when issued’ transactions, that were permitted to be undertaken only on Negotiated Dealing System-Order Matching (NDS-OM) since introduction in February and May 2006, respectively, would be allowed to be covered outside the NDS-OM system. The cover transactions of short sales and ‘when issued’ were permitted to be undertaken through the telephone market or through purchases in primary market with effect from January 1, 2008.

2.149 The medium-term objective of the Reserve Bank is to allow current account facility only to banks and PDs. Many non-bank and non-PD entities, however, held current accounts as a pre-requisite for settlement of Government security transactions by Negotiated Dealing System (NDS) members. The Annual Policy Statement for 2008-09 announced that a system of ‘Multi Modal Settlements’ would facilitate the settlement of Government security transactions undertaken by non-bank and non-PD NDS members. Accordingly, the settlement system under the NDS was modified for entities that did not maintain current accounts with the Reserve Bank (refer Chapter VI, Box VI.3).

2.150 Consequent to the announcement in the Annual Policy Statement for 2008-09, development of the system for separate trading for registered interest and principal of securities (STRIPS) has been taken up. The activity of stripping/reconstitution would be carried out in the NDS system of the Reserve Bank. To begin with, securities with coupon dates as January 2 and July 2, were identified as eligible for stripping/reconstitution on the basis of cash flow concentration among current coupon dates. The processing of requests for stripping/reconstitution would be carried out by PDs. The STRIPS system is proposed to be introduced during 2008-09.

2.151 Most of the recommendations of the High Level Committee on Corporate Bonds and Securitisation (Chairman: Dr. R.H. Patil) have been taken up for implementation. The Union Budget for 2008-09 abolished tax deduction at source on corporate bonds. Reporting platforms for corporate bonds were set up by the NSE and the BSE in July 2007 and the Fixed Income Money Market and Derivatives Association of India (FIMMDA) in September 2007. The Reserve Bank issued guidelines to its regulated entities to report their OTC trades on the FIMMDA platform. The Annual Policy Statement for the year 2008-09 announced that repos in corporate bonds would be introduced once the prerequisites, viz., efficient price discovery through greater public issuances and secondary market trading, and an efficient and safe settlement system based on delivery versus payment (DvP) III and straight through processing (STP) were met.

Developments in the Foreign Exchange Market

2.152 In line with the recommendations of the Committee on Fuller Capital Account Convertibility, a number of measures were taken during 2007-08 to further liberalise the foreign exchange transactions and simplify/ rationalise the associated procedures to facilitate prompt and efficient customer service. The RBI (Amendment) Act, 2006 empowered the Reserve Bank to regulate interest rate, foreign currency and credit derivatives. Accordingly, the Reserve Bank initiated several measures to further develop the derivatives market in the country.

2.153 The Reserve Bank permitted authorised dealers (ADs) to allow refund of export proceeds for goods re-imported into India on account of poor quality, subject to certain conditions. Import rules were liberalised for business process outsourcing companies, schedule air transport service companies and importers of rough diamonds/precious/semi-precious stones. There was liberalisation of remittance schemes in respect of certain entities. The limits under Liberalised Remittance Scheme were further enhanced to US$ 200,000 in September 2007. In February 2008, guidelines for maintaining Vostro accounts abroad by foreign exchange houses under the rupee drawing arrangements were liberalised. In September 2008, the limit for advance remittance for all admissible current account transactions for import of services without bank guarantee was raised to US$ 500,000 from US$ 100,000.

2.154 AD category–I banks8 were allowed to grant rupee loans to non-resident Indian (NRI) employees of Indian companies for availing employees stock option plan schemes, subject to certain conditions.

2.155 On September 23, 2008, the Reserve Bank operationalised the ‘Issue of Foreign Currency Exchangeable Bonds (FCEB) Scheme’ that was notified by the Government on February 15, 2008. A FCEB is a bond denominated in foreign currency, issued by an issuing company9 and subscribed to by persons resident outside India. It is exchangeable into equity share of another company, to be called the offered company10, in any manner, either wholly, or partly or on the basis of any equity related warrants attached to debt instruments.

2.156 The guidelines for ECBs were liberalised during the course of the year through various measures. In August 2007, ECBs of more than US$ 20 million per borrower per financial year were permitted only for foreign currency expenditure for permissible end-uses and those up to US$ 20 million were permitted under the automatic route. The ECB proceeds in both the cases, however, needed to be parked overseas and not remitted to India. In September 2007, corporates were allowed to pre-pay ECB up to US$ 500 million, as against the earlier limit of US$ 400 million, subject to certain conditions. In May 2008, the limit for rupee expenditure for permissible end-uses under the approval route was enhanced to US$ 100 million for borrowers from the infrastructure sector (and further raised to US$ 500 million in September 2008, subject to conditions) while for other borrowers, it was set at US$ 50 million. In October 2008, the limit was raised to US$500 million for all borrowers and the requirement of minimum average maturity period of seven years for ECBs of more than US$ 100 million for rupee capital expenditure by the borrowers in the infrastructure sector was dispensed with. In June 2008, hotels, hospitals and software companies were allowed to avail ECBs up to US$ 100 million per financial year, for the purpose of import of capital goods under the approval route. With effect from July 11, 2008, AD category-I banks could convey ‘no objection’, without prior approval from the Reserve Bank, for procedures to secure the ECB to be raised by the borrower, subject to certain conditions. In October 2008, the definition of infrastructure for the purpose of availing ECB was expanded to include mining, exploration and refining while payment for obtaining license/permit for 3G spectrum by telecom companies was classified as eligible end-use for the purpose of ECB. Furthermore, borrowers were granted the flexibility to keep their ECB proceeds offshore or keep it with the overseas branches/ subsidiaries of Indian banks abroad or to remit these funds to India for credit to their rupee accounts with AD category-I banks in India, pending utilisation for permissible end-uses. During the course of the year, the all-in-cost ceiling for ECBs of various maturities was revised upwards. As at end-October 2008, the all-in-cost ceiling over 6-month LIBOR for ECBs with average maturity period between three to five years was 300 basis points and those with maturity period more than five years was 500 basis points. The all-in-cost ceiling for trade credit less than three years was enhanced to 6-month LIBOR plus 200 basis points.

2.157 Measures taken to facilitate foreign exchange hedging included increase in the eligible limit for booking of forward contracts by importers/exporters and resident individuals. The Reserve Bank increased the number of entities that AD banks could permit to hedge price risk based on specifications such as their underlying economic exposures, domestic purchases, imports and inventory volumes.

2.158 Pursuant to the announcement made in the Annual Policy Statement for 2007-08, an Internal Working Group on Currency Futures (Chairman: Shri Salim Gangadharan) was set up that studied the experiences of some emerging market economies where currency futures exchanges were functioning with capital controls. The draft Report of the Group incorporating the views expressed by the TAC for Money, Foreign Exchange and Government Securities Markets was placed on the Reserve Bank's website in November 2007 for wider dissemination and feedback. Based on the feedback/comments received from the public, banks, market participants, academicians and the Government of India, the final Report was posted on the Reserve Bank's website on April 28, 2008. A Reserve Bank-SEBI Standing Technical Committee on Exchange Traded Currency Futures was constituted to formulate operational aspects of currency futures trading. The Technical Committee submitted its Report on May 29, 2008.

2.159 On August 6, 2008, after consultation with the SEBI and representatives of various market participants, the Reserve Bank issued directives covering the framework for trading of currency futures in recognised exchanges and the prudential parameters for the participation of banks in the currency futures market. While members trading in currency futures required balance sheet net worth of Rs.1 crore, the clearing members required balance sheet net worth of Rs.10 crore. At the initial stage, currency futures contracts on dollar-rupee were permitted with a minimum contract size of US$ 1,000 and a maximum maturity of 12 months. The Report of the Working Group indicated that introduction of contracts on other currency pairs would be considered subsequently. The contracts could be settled in cash in rupees on the last working day of the month and the initial margin was stipulated at a minimum of 1.75 per cent on the first day of trading and 1.0 per cent thereafter. The gross open position limits could not exceed 6.0 per cent of the total open interest or US$ 5 million, whichever was higher, for clients and 15.0 per cent or US$ 25 million, whichever was higher, for trading members. No separate position limits were prescribed at the clearing member level. The Reserve Bank and SEBI Committee would hold periodic meetings to sort out any issue arising out of the overlap in jurisdiction of the currency futures market.

2.160 Exchange traded currency futures on US$-INR were launched on August 29, 2008 on the NSE and on October 1, 2008 on the BSE. Trading of currency futures commenced on the Multi Commodity Exchange of India on October 7, 2008.

2.161 The AML guidelines are revised from time to time on the basis of feedback received from authorised money changers. The limit for payment of cash towards encashment by foreign visitors/NRIs was raised from US$ 2,000 to US$ 3,000 in October 2007.

Furthermore, the Reserve Bank advised that in addition to the documents in support of the name, address and business activity, permanent account number (PAN) card would also be accepted as a suitable document for establishing the relationship with the company/firm.

9. Customer Service in Banks

2.162 The Reserve Bank has been taking various initiatives for fair treatment and empowerment of customers. Banks have been sensitised to provide focussed attention to good and efficient customer service. To give adequate attention to customer service, a fourfold structure is in place in commercial banks, viz., board-level Customer Service Committee for policy formulation, Standing Committee to review customer service, nodal department/ nodal officer for liaisoning with the Reserve Bank and the bank and branch level Customer Committee. Periodic meetings with nodal officers of banks by Banking Ombudsmen and the Reserve Bank’s Customer Service Department are also held to communicate the importance of customer service. During the year 2007-08, several initiatives were taken by the Reserve Bank in the area of customer service in banks such as guidelines on engagement of recovery agents, strengthening of grievance redressal mechanism in banks, branch level committee on customer service, furnishing a copy of loan agreement to borrowers, settlement of claims in the case of missing persons, permission for appointed guardian of disabled persons (those afflicted by autism, cerebral palsy, mental retardation and multiple disabilities) to open and operate bank accounts and spread of banking facilities to the visually challenged.

2.163 The Reserve Bank has taken a number of steps to disseminate instructions relating to customer service and grievance redressal by banks through its multi-lingual website by placing all customer related notifications and press releases in a specific page titled ‘For Common Person’. Customers of commercial banks can also approach the Reserve Bank with their grievances and queries through ‘Contact Us’ icon on the home page of the website. A complaint form for sending complaints to the Banking Ombudsman has also been made functional. The Banking Ombudsman Scheme 2006 has been made more customer-friendly by increasing the areas covered under the scheme, by allowing complainants to use e-mail or any other means including post cards for submitting their complaints and by permitting complainants to appeal against the decisions of the Banking Ombudsman.

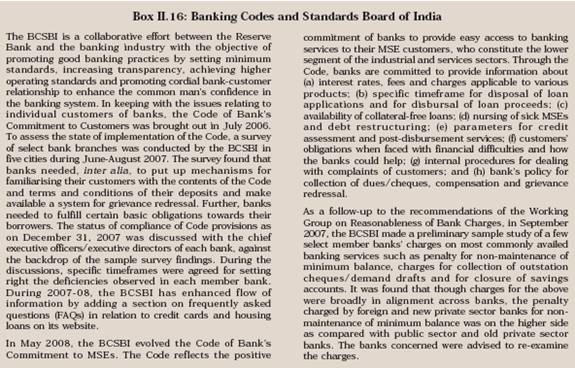

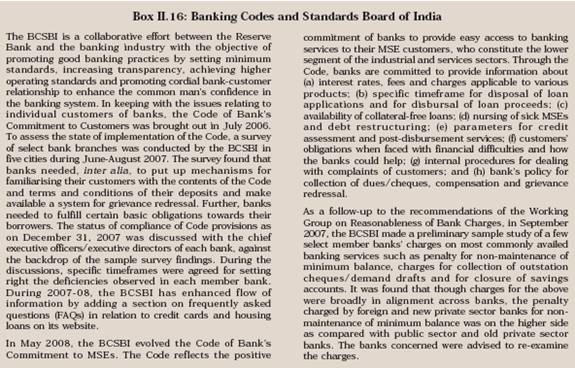

Code of Bank’s Commitment to MSEs

2.164 The BCSBI was set up in 2006 with the active support of the Reserve Bank and SCBs. The BCSBI, which has 60 SCBs as its members, continued its efforts to improve customer service in banks (Box II.16).

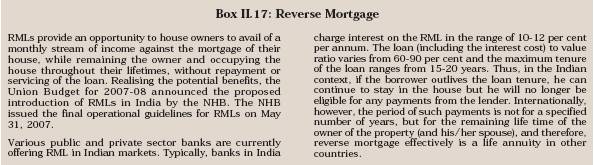

Reverse Mortgage Loans

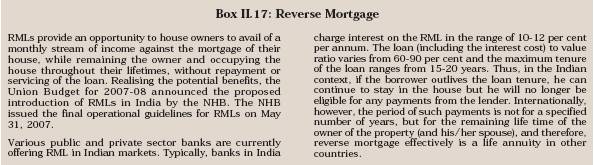

2.165 It is recognised that senior citizens need a regular cash flow for supplementing their pension/other income. For most senior citizens, the house is often the largest component of their wealth and the secular increase in residential house prices has created considerable ‘home equity’ wealth. Reverse mortgage is a financial product that allows them to unlock the value of their most valuable asset, their home, by mortgaging it to a credit intermediary, thereby, enjoying the use of an assured cash flow during their lifetime while continuing to live in the house for as long as they wish (Box II.17). The reverse mortgage loan (RML) was introduced in the Indian financial market, following the announcement in the Union Budget for 2007-08.

2.166 It is believed that the lack of product awareness and Indian societal norms work against the scheme. India still has a strong joint family culture with the younger generation supporting the elderly, which to an extent, obviates the need for the elderly to opt for such schemes. Further, in India, borrowing, till some time ago, was generally not considered a very desirable option, more so for people in the older age bracket. Another reason for the slow offtake of the scheme in India has been the relatively low monthly payments due to the prevailing high interest rate scenario as also because banks keep higher margins (as reflected in the LTV ratio11). However, with gradual changes in the social fabric, this product could see greater acceptance. Banks would also need to create necessary safeguards to ensure that there is no mis-selling of the product to senior citizens.Besides, the norms pertaining to property valuation, maintenance and repossession need to be well-established.

Customer Service Meetings

2.167 In 2007, the Reserve Bank institutionalised the process of examining the feedback emanating out of the complaints received at the Banking Ombudsman offices. Customer Service Meetings are held on a quarterly basis to examine systemic issues reported by the Banking Ombudsmen and it also focuses on other customer service issues, including the Code of Bank’s Commitment to its Customers and the Banking Ombudsman Scheme. The meetings have members at the senior level representing regulatory and supervisory departments of the Reserve Bank, Banking Ombudsmen, the IBA and the BCSBI. It adopts an integrated approach to ensure that appropriate corrective action is taken through self-regulation or regulations prescribed by the Reserve Bank in a time bound manner. The meetings have taken up important customer service related issues such as engagement of recovery agents by banks and setting up an internal grievance redressal mechanism within banks.

Guidelines on Recovery Agents Engaged by Banks

2.168 The Mid-term Review for 2007-08 had warned of the reputational risk to the banking sector on account of the increased number of complaints against the recovery agents engaged by banks. The policy and procedure involved in the engagement of recovery agents by banks was reviewed and draft guidelines in this regard were placed on the Reserve Bank’s website for comments. Based on the feedback received from a wide spectrum of banks/ individuals/organisations, final guidelines on recovery agents covering various aspects such as engagement, methods, training, complaints redressal and penalty were issued to banks in April 2008.

2.169 Banks have been advised to exercise due diligence while engaging recovery agents. They should provide the borrower details of the recovery agency/firms/companies while forwarding default cases to the agency. Banks are not to forward cases to recovery agencies when a grievance/complaint lodged by the particular borrower is pending. This shall, however, not apply in cases where the borrower is continuously making frivolous/ vexatious complaints. Banks are required to devise a mechanism to address borrowers’ grievances with regard to the recovery process.

2.170 Banks have been asked to desist from offering incentives that make recovery agents resort to uncivilised, unlawful and questionable behaviour/recovery process. Furthermore, banks have been advised to strictly adhere to the various guidelines issued by the Reserve Bank (such as Fair Practices Code for Lenders, Guidelines on Credit Card Operations) and Code of Banks’ Commitment to Customers (formulated by the BCSBI) during the loan recovery process. Recognising the need for proper training of recovery agents, the Reserve Bank has requested the IBA to formulate, in consultation with the Indian Institute of Banking and Finance (IIBF), a certificate course for direct recovery agents. Pursuant to the introduction of the course, banks should ensure that all their recovery agents undergo the above training over a period of one year.

2.171 Banks have been advised that when relying on the re-possession clause in a contract for enforcing their rights, they should ensure that the said clause is legally valid and complies with the provisions of the Indian Contract Act. Furthermore, banks have been encouraged to use the forum of Lok Adalats for recovery of personal loans, credit card loans or housing loans of less than Rs.10 lakh, as suggested by the Hon’ble Supreme Court. Complaints regarding violation of the guidelines by a bank or its recovery agents would be taken seriously and the Reserve Bank may consider imposing a ban on such a bank from engaging recovery agents, in a particular area, either jurisdictional or functional, for a limited period. Similar supervisory action could be attracted when the High Courts or the Supreme Court pass strictures or impose penalties against any bank or its directors/officers/agents with regard to policy, practice and procedure related to the recovery process.

Grievance Redressal Mechanism in Banks

2.172 In May 2008, the Reserve Bank asked banks to ensure a suitable mechanism for fair and expeditious resolution of complaints from customers/constituents. It was advised that the mode of registering complaints and details of the person to register the complaint with, should be prominently displayed in bank branches. Complaints received through letters/forms should be acknowledged while timeframes for resolving the complaints received at different levels should be fixed. Complaints emanating from rural areas and those relating to financial assistance to the priority sector and the Government’s poverty alleviation programmes should be covered under the grievance redressal mechanism. Banks have been offered an incentive for speedy redressal of complaints as they can exclude grievances that were redressed within the next working day from the statement of complaints that is disclosed along with banks’ financial results. Banks were also advised that where the complaints were not redressed within one month, the concerned branch/ controlling office should forward a copy of the same to the nodal officer concerned under the Banking Ombudsman Scheme and keep him/ her updated regarding the status of the complaint. Further, the bank should also advise the customer about his/her rights to approach the Banking Ombudsman in case he/she is not satisfied with the bank’s response.

Branch Level Customer Committees

2.173 Banks have been advised, from time to time, to constitute the branch level customer service committees. It was, however, understood that such committees were either non-existent or in a dormant state. With a view to giving shape to a formal channel of communication between customers and bank branches, in September 2007, the Reserve Bank advised banks to initiate steps for strengthening the branch level customer service committees with the involvement of their customers. Taking cognisance of the fact that senior citizens usually form an important customer segment of banks, it was advised that these committees should preferably include senior citizens. The committees may meet at least once a month to study complaints/suggestions, cases of delay, difficulties faced/reported by customers/members of the committee and evolve ways and means of improving customer service. They are required to submit quarterly reports giving inputs/suggestions to the Standing Committee on Customer Service.

Furnishing Copy of Loan Agreement to Borrowers

2.174 In May 2003, the Reserve Bank had issued the Fair Practices Code for Lenders which required banks and FIs to provide a copy of the loan agreement, along with a copy of all enclosures quoted in the loan agreement, to borrowers. It was reported that some banks were furnishing a copy of the loan agreement only when such a request was made by the borrower. The Reserve Bank, therefore, reiterated in August 2007 that banks/FIs should invariably furnish a copy of the loan agreement (and copies of all enclosures mentioned in the loan agreement) to all borrowers at the time of sanction/ disbursement of loans.

Settlement of Claims in Respect of Missing Persons

2.175 The issue of settlement of claims in respect of missing persons was examined based on a query received and banks were advised in May 2008 that the settlement of claims for missing persons would be governed by the provisions of Section 107/108 of the Indian Evidence Act, 1872. The nominee/legal heir was required to raise an express presumption of death of the customer, under the said rules, before a competent court. If the court presumed that he/she was dead, then the claim in respect of a missing person could be settled on the basis of the same. Banks were also advised to formulate a policy which would enable them to settle the claims for a missing person after considering legal opinion and taking into account the facts and circumstances of each case. Further, keeping in view the imperative need to avoid inconvenience and undue hardship to the common person, banks were advised that with due consideration of their risk management systems, they could fix a threshold limit, up to which claims in respect of missing persons could be settled without insisting on production of any documentation other than: (i) the first information report and the non-traceable report issued by police authorities; and (ii) the letter of indemnity.

2.176 In respect of inoperative accounts, banks were advised in August 2008 to consider launching a special drive for finding the whereabouts of the customers/legal heirs.

Facilitating Account Opening/Operating by Appointed Guardians of Disabled Persons

2.177 Banks were advised in November 2007 that legal guardians appointed by the district court under the Mental Health Act, 1987 or by the local level committees set up under the National Trust for the Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities Act, 1999 could open and operate the bank accounts of persons with disabilities covered under the Act. Banks were also advised to ensure that their branches gave proper guidance to the parents/relatives of the disabled persons so that they did not face any difficulties in that regard.

Banking Facilities to the Visually Challenged

2.178 It was brought to the notice of the Reserve Bank that visually challenged persons were facing problems in availing banking facilities. Banking facilities cannot be denied to the visually challenged as they are legally competent to contract. Furthermore, the Honourable Court of Chief Commissioner for Persons with Disabilities had observed that visually impaired persons cannot be denied the facility of cheque book, locker and ATM on account of the possibility of risk in operating/ using the said facility, as the element of risk is involved in case of other customers as well. Banks were, therefore, advised in June 2008 to ensure that all facilities such as cheque book including third party cheques, ATM, net banking, locker, retail loans, credit cards, etc., were invariably offered to the visually challenged persons without any discrimination. Banks were also advised to instruct their branches to render all possible assistance to the visually challenged persons for availing their services.

Credit Card Operations of Banks

2.179 A study on the credit card operations of banks was undertaken, based on the complaints received by the Reserve Bank as also the offices of the Banking Ombudsman. Based on the recommendations made in the study, detailed guidelines were issued to banks on their credit card operations in July 2008. These included the gist of the recommendations of the study report, together with the existing instructions of the Reserve Bank on the subject and the action required to be taken by banks in this regard. Recommendations relating to recovery of credit card dues through recovery agents were covered in the guidelines issued earlier in April 2008.

2.180 On the issue of unsolicited cards, banks were advised that the person in whose name the card was issued could approach the Banking Ombudsman who would determine the amount of compensation payable by the bank to the recipient of the unsolicited credit card as per the provisions of the Banking Ombudsman Scheme, 2006, i.e., for loss of complainant’s time, expenses incurred, harassment and mental anguish suffered by him. Furthermore, it was clarified that any loss arising out of misuse of such unsolicited cards would be the responsibility of the card issuing bank only and the card recipient could not be held responsible for the same. Banks were also advised that in cases where they offered insurance cover to their credit card holders, through tie-ups with insurance companies, they should obtain from the credit card holder the details of nominee/s for the insurance cover in respect of accidental death and disablement benefits. Banks were also advised to ensure that the relevant nomination details were recorded by the insurance company. They should also consider issuing a letter to the credit card holder indicating the details regarding the name, address and telephone number of the insurance company that would handle the claims relating to the insurance cover.

Deposit Schemes with Lock-in Period

2.181 It was noted that some banks were offering special term deposit products with a duration of 300 days to five years, with lock-in periods ranging from 6-12 months. Rates of interest offered on these deposits were not in tune with rates on normal deposits, and premature withdrawal during the lock-in period was either not allowed or, if allowed, was not paid any interest. In October 2007, the Reserve Bank asked the banks offering such deposit schemes to discontinue them with immediate effect. Banks were also advised that before launching new domestic deposit mobilisation schemes, they should ensure that the provisions of the Reserve Bank’s directives on interest rates on deposits, premature withdrawal of term deposits, among others, issued from time to time, were strictly adhered to. There should not be any discrimination in the matter of interest paid on deposits, accepted on the same date and for the same maturity. However, fixed deposit schemes specifically for resident Indian senior citizens offering higher and fixed rates of interest as compared to normal deposits of any size and single term deposits of Rs.15 lakh and above continue to be exempted from the above directive.

National Do Not Call Registry

2.182 With a view to reducing the number of unsolicited marketing calls received by customers, the Reserve Bank, through circulars issued in July 2007 and September 2008, advised banks that all telemarketers, viz., direct selling agents/direct marketing agents engaged by them should be registered with the Department of Telecommunications (DoT). Telemarketers are not supposed to make any selling/marketing calls without scrubbing their calling list with the National Do Not Call Registry, as envisaged in the Unsolicited Commercial Communications Regulations, 2007. Banks are required to furnish the list of all telemarketers engaged by them along with the registered numbers used for making the telemarketing calls to the IBA, which in turn, could be forwarded to the Telecom Regulatory Authority of India.

Acceptance of Cash Over the Counter

2.183 It was observed that some banks had introduced certain products whereby the customers were not allowed to deposit cash over the counter. In August 2008, the Reserve Bank advised banks to ensure that their branches invariably accepted cash over the counters from all their customers who desired to deposit cash at the counters. Further they were also advised to refrain from incorporating clauses in the terms and conditions which restrict deposit of cash over the counters.

Comprehensive Display Board

2.184 In August 2008, commercial banks were advised to categorise the instructions on their display boards under ‘customer service information’, ‘service charges’, ‘grievance redressal’ and ‘others’. Only the important aspects or mandatory instructions relating to the above four categories were required to be placed in a comprehensive display, with detailed information made available in a booklet form. Furthermore, banks were required to display aspects such as ‘working days, working hours and weekly off-days’ outside the branch premises. In September 2008, banks were advised to display information relating to interest rates and service charges to enable customers to obtain the desired information at a quick glance.

10. Payment and Settlement Systems

2.185 A safe and efficient payment and settlement system is sine qua non for the proper functioning of the financial system. Payment systems also play an important role in the implementation of monetary policy as they provide the conduit through which policy signals are transmitted. The Reserve Bank, like other central banks, has been endeavouring to develop the payment and settlement systems in India on a safe, sound, secure and efficient basis. With these objectives in view, the Reserve Bank took several initiatives during 2007-08. The branch coverage both for national electronic funds transfer (NEFT) system as also the real time gross settlement (RTGS) system expanded during the year as a result of the combined efforts of the Reserve Bank and the banks.

Payment and Settlement Systems Act, 2007

2.186 A sound legal framework is an important requirement for the safe and efficient functioning of the payment and settlement systems. The Payment and Settlement Systems Act, 2007 was notified on December 20, 2007. The Act came into effect on August 12, 2008. The regulations framed under the Act i.e., Board for Regulation and Supervision of Payment and Settlement Systems Regulations, 2008 and the Payment and Settlement Systems Regulations, 2008, were also notified on August 12, 200812.

2.187 The Payment and Settlement Systems Act, 2007 has designated the Reserve Bank as the authority to regulate and supervise the payment systems in the country, including those operated by non-banks such as the CCIL, card companies, other payment system providers and all prospective organisations for payments. The netting procedure and settlement finality, earlier governed by contractual agreement/s, have been accorded legal recognition under the Act. The entities that want to operate or continue to operate a payment system would need to apply to the Reserve Bank for authorisation. The other powers vested with the Reserve Bank under the Act include laying down operational and technical standards for the various payment systems, calling for information and returns/ documents from the service providers and imposing fines on failure to do so or on providing false information. The Reserve Bank is empowered to issue directions and guidelines to the system providers, prescribe the duties to be performed by them and audit and inspect their systems/premises.

2.188 The Payment and Settlement Systems Regulations, 2008 cover: (a) authorisation of payment systems including the form and manner of submission of application for authorisation of commencement/ continuation of a payment system and grant of authorisation certificate; (b) payment instructions and determination of standards; (c) furnishing of returns, documents and other information; and (d) furnishing of accounts and balance sheets.

Board for Regulation and Supervision of Payment and Settlement Systems (BPSS)

2.189 The BPSS, which was earlier constituted under the RBI Act, 1934, has since been reconstituted under the Payment and Settlement Systems Act, 2007. The BPSS Regulations 2008, cover: (a) composition of the Board; (b) functions and powers of the Board; (c) powers to be exercised on behalf of the Board; and (d) constitution of sub-committees and advisory committees. The BPSS meets regularly and gives directions for bringing in efficiency, safety and customer convenience in the payment and settlement systems. Some of the areas in which the Board has provided direction include preparation of a framework for payments through mobile phones, extension of the jurisdiction of magnetic ink character recognition (MICR) clearing houses and computerisation of non-MICR clearing houses, launching the Indo-Nepal remittance system, making use of electronic mode of payment mandatory for large value transactions, making all RTGS branches NEFT-enabled while upgrading the NEFT system into a round-the-clock type remittance system, exploring the feasibility of developing a domestic card to inject competition in the market in a non-discriminatory manner, facilitating optimum use of ATMs by rationalising cash withdrawal/balance enquiry charges and disseminating information on major payment services offered by banks including the service charges and quantum of compensation to be paid by banks for deficiency in those services.

Retail Payment Systems

2.190 Paper-based payment system, electronic clearing services (ECS), NEFT and card payment system constitute the retail payment systems. The Reserve Bank has been emphasising migration of the paper-based transaction to electronic mode. However, as cheques still play an important role in the retail payment system, steps are regularly taken to sustain efficiency in the cheque clearing system. A new MICR cheque processing centre (CPC) was set up at Cuttack during the year, increasing the number of total MICR CPCs to 60. With a view to improving efficiency and safety, the Reserve Bank has encouraged the use of Magnetic Media Based Clearing System (MMBCS) technology in smaller clearing houses whose low volumes make the use of MICR technology unviable. The implementation of MMBCS in the smaller clearing houses has led to computerisation of their operations and increased the efficiency in the settlement process. As a result of implementation of the MMBCS system, the total number of computerised clearing houses has reached 993 (out of a total of 1094). The target is to computerise all the clearing houses by end-2008.

2.191 The Cheque Truncation System (CTS) implemented in February 2008 in the National Capital Region is another step taken for bringing in efficiency in paper-based clearing system. The CTS, which started with the participation of ten banks, now has all the members of the New Delhi Bankers’ Clearing House as participants. The physical movement of cheques to all payee bank branches has been truncated. The choice of the point of truncation, whether at the collecting branch or at its service branch, has been left to the individual banks to decide. Clearing takes place based on the validation of cheque images.

Speed Clearing

2.192 Speed clearing leverages the CBS infrastructure in banks for faster clearing of outstation cheques. ‘Speed-clearing’ functions as follows: (a) member banks designate a local CBS-enabled branch (akin to commercial branch for payment of demand drafts) for accepting the cheques from other banks drawn on their own outstation CBS-enabled branches; (b) all cheques drawn on CBS branches are suitably branded for easy identification; and (c) the designated local branch use the CBS solution to take the pay/ no pay decision on cheques drawn on their outstation CBS-enabled branches.

Retail Electronic Payment System

2.193 Electronic payment systems like the ECS (debit and credit), NEFT, card based payment (debit and credit) are becoming increasingly popular. The availability of ECS at 70 centres as against 67 centres in the previous year and the National Electronic Clearing Services (NECS) that was operationalised for credit clearing on September 29, 2008 are efforts for ushering in further development of the retail electronic payment system. To encourage the use of electronic mode of payments, the Reserve Bank waived the processing charges for all electronic payment systems operated by it till March 2009. As the NEFT system, introduced in November 2005, has stabilised, the earlier electronic funds transfer system has been discontinued except for Government payments. NEFT offers 6 settlements on weekdays and 3 settlements on Saturdays13. A total of 87 banks through more than 50,000 branches offer this facility. The NEFT system has now been enabled for three new transaction codes – cash remittance up to Rs.50,000 by walk-in customers not having accounts with the originating banks, Indo–Nepal remittance and card payments.

Mandatory Use of Electronic Mode

2.194 Banks were advised in March 2008 that all large value payments of Rs.1 crore and above, by the Reserve Bank-regulated entities and the markets regulated by it, should be mandatorily routed through the electronic payment systems with effect from April 1, 2008. It was observed in a review that such payments had more or less migrated to the electronic mode. Hence the Reserve Bank brought down the threshold limit to Rs.10 lakh with effect from August 1, 2008.

2.195 The Central Board of Direct Taxes, Government of India made electronic payment of tax mandatory for certain categories of taxpayers, viz., companies and persons (other than a company) to whom provisions of Section 44AB were applicable, with effect from April 1, 2008. Accordingly, banks were advised by the Reserve Bank that the status of all corporate taxpayers could be identified from the name itself. Also, the fourth digit of the PAN of all corporate assesses would necessarily be “C”. Physical challans from such assessees should not be accepted across the counter. The bank concerned would need to acknowledge the e-payment immediately with the relevant transaction identity reflected in the bank’s statement. Banks should prominently display on their e-payment gateway page, the official/s to be contacted in case of difficulties encountered in the electronic payment process. They should also provide the Income Tax Department and the National Securities Depository Limited the contact particulars of officials to be contacted if the department/institution faced any problem.

Mobile Payment

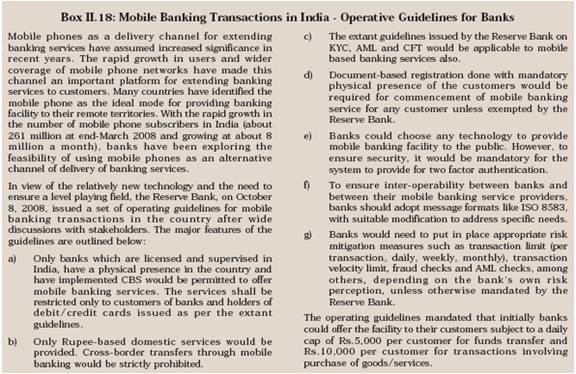

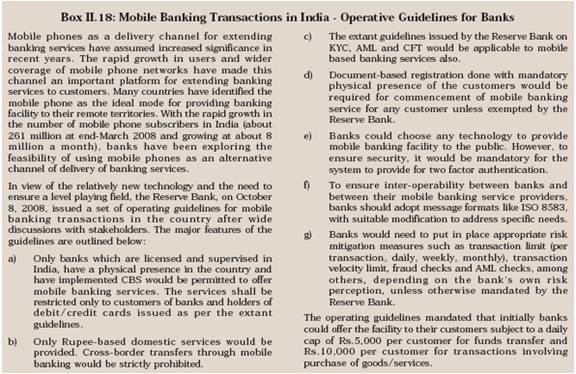

2.196 With the rapid growth in the usage of mobile phones and their wider geographical coverage, banks have been exploring the feasibility of using mobile phones as an alternative channel of delivery of banking services. Keeping this in view, the Reserve Bank placed on its website the guidelines for ‘mobile payments’ for public comments (Box II.18).

Automated Teller Machines

2.197 The number of ATMs is steadily increasing and the usage of ATMs has gone up substantially during the last few years. ATMs are primarily used for cash withdrawal and balance enquiry. It was observed that the service charges levied for use of ATMs were not uniform and transparent. Accordingly, the Reserve Bank, in March 2008, set guidelines for service charges. As per the guidelines, from April 1, 2008, customers would not pay any charge for use of their own bank’s ATMs. Use of other banks’ ATMs would also not attract any fee except when used for cash withdrawal for which the maximum charge levied should be brought down to Rs.20 per withdrawal by March 31, 2008. All cash withdrawals from all ATMs would be free with effect from April 1, 2009.

2.198 The National Financial Switch (NFS), established by the IDRBT, acts as the apex level switch and facilitates connectivity among ATM switches of all member banks. The NFS network connected 28,773 ATMs of 31 participating banks as on June 30, 2008.

Indo-Nepal Remittance

2.199 India has a large Nepalese migrant workforce. To facilitate these workers in sending money to their families/relatives in Nepal, need was felt for a remittance arrangement using the banking channel. The Indo-Nepal remittance system commenced operations with effect from May 15, 2008. With due consideration of the target group (poor workers from Nepal), a concessional charge structure was devised for the facility. The salient features of the remittance system are: (i) it facilitates only one way remittances from India to Nepal using the banking system with a ceiling of Rs.50,000 per remittance with a maximum of 12 remittances in a year; (ii) the remittance facility is extended to both customers and non-customers of banks; (iii) all NEFT-enabled bank branches in India participate in this cross-border remittance initiative; (iv) remittances will be distributed to the beneficiaries in Nepal through the branches of Nepal State Bank and its approved agents.

Large Value Payment Systems

2.200 The large value payment systems include the RTGS, Government securities clearing and foreign exchange clearing. Recognising the importance of safety and efficiency in payment systems, the Reserve Bank has mandated the use of electronic mode of payment between entities regulated by it.

2.201 The RTGS system is in operation since March 2004. Apart from settling inter-bank transactions and time-critical transactions on behalf of customers, it facilitates settlement of all retail paper-based and electronic clearings taking place in Mumbai, and CCIL operated clearings including that related to the NFS in multilateral net settlement batch mode. RTGS is open till 4.30 p.m. for customer transactions and up to 6.00 p.m. for inter-bank transactions on week days. On Saturdays, the RTGS functions till 12.30 p.m. for customer transactions and till 2.00 p.m. for inter-bank transactions. The integration of the RTGS system with the Reserve Bank’s internal accounting system (IAS) has enabled STP. The integration of RTGS-IAS and the securities settlement system has made automatic intra-day liquidity available.

2.202 The CCIL, set up by banks and FIs at the initiative of the Reserve Bank, clears and settles inter-bank trades in Government securities and foreign exchange as well as a money market product, i.e., collateralised borrowing and lending obligations. The clearing and settlement of all secondary market outright sales and Repo transactions in Government securities is carried out through the CCIL. All OTC trades in this segment, which are reported on the Reserve Bank’s NDS platform and trades which are contracted on the online anonymous, trading platform NDS–OM, are accepted by the CCIL for settlement. These trades are settled on a DvP III basis, i.e., the funds leg as well as the securities leg are settled on a net basis. The CCIL also provides guaranteed settlement facility for all dollar-rupee, inter-bank cash, Tom, Spot and Forward transactions14 by becoming the central counterparty to every trade accepted for settlement, through the process of novation. The rupee legs of the transactions are settled through the members’ current accounts with the Reserve Bank and the dollar leg through the CCIL’s account with the Settlement Bank at New York. The CCIL also provides continuous linked settlement services for banks in India by availing third party services of a settlement bank. Currently, 13 banks are availing of this facility to settle cross currency trades.

2.203 The Reserve Bank implemented the Centralised Funds Management System (CFMS) which enables banks to ascertain their balances in accounts maintained with various offices of the Reserve Bank as also transfer funds from one office to another. This system has been functioning smoothly. The facility is now available at all the 16 offices of the Reserve Bank. At present, 71 member banks are using the facility.

Oversight of Payment Systems

2.204 To have a structured approach for conducting oversight of payment systems, the Minimum Standards for Operational Efficiency for paper-based systems (MICR CPCs and MMBCS operated clearing houses) were issued. The “Standards for Operational Efficiency in ECS Operation” and “Standards for Operational Efficiency in NEFT Operation”, incorporating benchmark indicators, were also issued.

2.205 The Reserve Bank constituted an Internal Working Group to suggest norms for permitting various entities in accessing different payment systems available in the country. The Report on “Access Criteria for Payment Systems” was placed in the public domain for comments. On the basis of the recommendations and the feedback received, criteria for participation as a member in the clearing houses at MICR centres were finalised in November 2007 and were made effective from January 1, 2008. Furthermore, the criteria for participation in the national payment systems (RTGS and NEFT) were finalised in September 2008. The financial strength of an institution would be the guiding parameter for participation in the national payment system.

11. Technological and Other Developments

2.206 IT has played a significant role in transforming the functioning of the financial sector in the country. Banks in India have not only used IT to improve their own internal processes but have also deployed it successfully to offer a range of services to customers. As IT’s role has become pervasive, it provides a competitive advantage to organisations in attracting/servicing customers. Furthermore, with the large scale increase in the number of transactions handled by banks, IT has become a crucial factor in efficient handling of transaction processing.

2.207 The latest technological developments in the banking sector include the use of mobile phone technology to access banking-related products and services and the use of internet for banking transactions. These new modes of transactions require a safe and secure environment so that customers could be provided with a variety of options to choose, depending on their own specific requirements. The thrust areas during 2007-08 included the continued coverage of banks under core banking so as to provide the customer with facilities such as ‘anywhere and anytime banking’ and other efforts to enhance the availability of common inter-bank systems, for the benefit of banks as well as their clientele.

Technology in Banks and the Role of the Reserve Bank

2.208 The Financial Sector Technology (FST) Vision, issued in 2005, guides banks in taking their own IT initiatives based on the broad approaches planned by the Reserve Bank. The FST vision document was reviewed during 2007-08, and a draft revised document was made available for public comments. Based on the feedback received and after further examination by IT experts, the FST vision document was finalised and issued in February 2008. The FST vision document outlined technology related aspects with due emphasis on consolidation of IT systems and the increasing importance of data centres. After reviewing the achievements vis-à-vis the targets for the period 2005-08, the document outlined related factors such as attitudinal and other HR-related issues. Other aspects covered in detail include technology obsolescence, outsourcing related challenges, vision for the period 2008-10 and

perspectives for the future.

2.209 An important development during the year was the commencement of operations from three state-of-the-art data centres of the Reserve Bank, which conformed to the Tier-IV Standard of the Uptime Institute15, and provided for redundancy of all components. The critical payment system applications used by banks for their own transactions as well as those processed on behalf of their constituents such as the RTGS and the NDS now operate from these data centres. Furthermore, there was migration of the network based connectivity to the multi protocol label switching technology which is aimed at reducing costs for the users as well as ease of use and better availability.

Technology-based Services of Reserve Bank for Banks

2.210 The Reserve Bank continued to function as a business facilitator for deployment of new products and critical payment and settlement system services by banks. Some of the systems that it provides include the NDS for Government Securities, the RTGS and the CFMS, apart from the Structured Financial Messaging System over the INFINET (Indian Financial Network).

2.211 The secured website of the Reserve Bank disseminates information through electronic means to the Government Departments as well as other commercial banks. During 2007-08, the transmission of clearing data, both for cheque clearing and for ECS, was done through the secured website in many centres. In addition, collation of inputs from the 4,500 currency chests in the country, as part of the Integrated Currency Chest Operations and Management System, was done using the website. This system also operates from the data centres now.

2.212 These initiatives have helped banks, FIs and the Government in using technology to the maximum extent aimed at better e-governance. With large scale dependence on IT, the need to ensure uninterrupted availability of such systems assumes significance for which the business continuity management is ascribed due importance by the Reserve Bank. While the Reserve Bank conducted periodical disaster recovery (DR) drills for the critical systems hosted by it, banks were also required to participate in these drills from their primary sites as well as using their DR systems. The existing IT system to process the requirements of the State and Central Governments for the accounting requirements was replaced by the Centralised Public Accounts Department System, which is more robust and user friendly than the earlier system. Specific guidelines on information systems/security policy to be followed by all the IT users in the Reserve Bank were issued and circulated amongst the employees, IT vendors and other stakeholders. The IAS, aimed at replacing the existing system at the Deposit Accounts Department of the Reserve Bank was made fully operational during 2007-08 at Mumbai.

2.213 The Reserve Bank implemented the ORFS for submission of certain important returns by commercial banks. As part of this, the Reserve Bank aims to adopt the international standards for data sharing among business entities through the XBRL in due course (Box II.19). The move towards the XBRL standards is taking place under a high level Steering Committee (Chairman: Shri V. Leeladhar). As part of the XBRL implementation, an exercise for rationalisation of returns has been initiated. By August 2008, the number of returns to be submitted by the SCBs (excluding RRBs) was reduced from 291 to 223. On August 14, 2008, the Reserve Bank placed on its website the list of returns to be submitted by banks and those that need not be submitted.

Challenges in IT Adoption

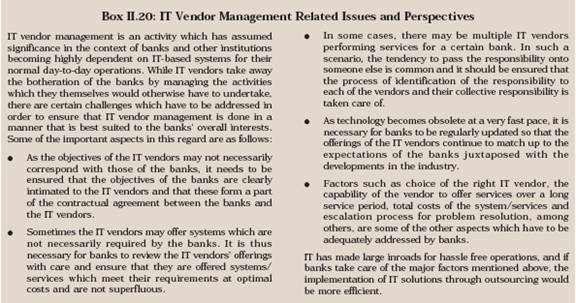

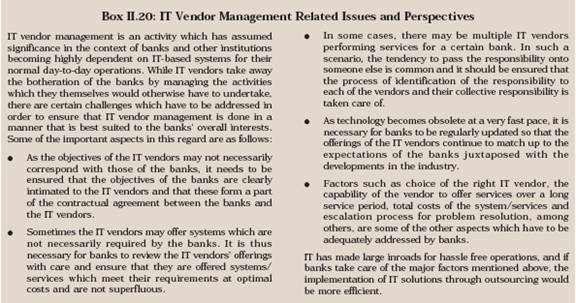

2.214 The adoption of IT provides competitive advantage to banks in their operations. However, banks, have to depend on outsourcing for most of their IT applications and infrastructure as this does not relate to the domain of banking operations. They, therefore, need to exercise caution and put in place mechanisms for vendor management to reap the advantages that adoption of IT can bring in their day-to-day operations (Box II.20).

12. Legal Reforms

2.215 In the light of the developments taking place in the financial sector in recent years, several legislative changes were undertaken during 2007-08 covering Government securities market, payment and settlement system and micro-finance, among others.

2.216 The Government Securities Act, 2006 (GS Act) replaced the Public Debt Act, 1944 and repealed the Indian Securities Act, 1920 in August 2006. The Government Securities Regulations, 2007 (GS Regulations) were framed by the Reserve Bank in terms of Section 32(1) of the GS Act. The main features of the Act and the regulations which came into force on December 1, 2007, include: (i) investor friendly automatic redemption facility, i.e., no physical discharge was required if the investors submitted bank account details for receiving redemption proceeds of Government security held in the form of bond ledger account (BLA), SGL or stock certificate; (ii) facility of pledge or hypothecation or lien of Government security; (iii) legal recognition of beneficial ownership of constituents in respect of Government securities held in the constituents’ subsidiary general ledger account; (iv) simplified procedure/documentation for recognition of title to a Government security of a deceased holder; (v) nomination facility for Government securities held in the form of stock certificate and BLAs; (vi) stripping of a Government security separately for principal and interest and reconstitution thereof; (vii) simplified procedure for issue of duplicate Government securities; (viii) simplified procedure for making vesting order; and (ix) debarring holders of SGL account from trading in case of misuse of SGL account. The GS Act has empowered the Reserve Bank to seek information, inspect and issue directions in relation to Government securities as also to impose penalty up to Rs.5 lakh in case of contravention of the GS Act and a further penalty of Rs.5,000 for every day after the first day during which the contravention continues.

2.217 The Payment and Settlement Systems Act, 2007 received the assent of the President on December 20, 2007. The Act has given wide regulatory and supervisory powers to the Reserve Bank in respect of payment systems in the country (refer paras 2.186-2.189).

2.218 To enable the Reserve Bank to transfer its shareholding in SBI in favour of the Central Government, certain amendments were effected in the State Bank of India Act, 1955 through State Bank of India (Amendment) Ordinance, 2007, which came into force on June 29, 2007. The Ordinance was later replaced by the State Bank of India (Amendment) Act, 2007, which by a deeming provision also came into force on June 29, 2007.

2.219 The Micro Financial Sector (Development and Regulations) Bill, 2007 has been referred to the Standing Committee on Finance after introduction in the Lok Sabha on March 20, 2007. The Bill, inter alia, includes provisions for: (i) constitution of Micro Finance Development Council; (ii) registration of micro finance organisations with NABARD; (iii) settlement of disputes through micro finance ombudsman; and (iv) penalties relating to offences.

2.220 The Securities Contracts (Regulation) Amendment Act, 2007, passed in May 2007 by the Parliament, provides a legal framework for trading in securitised debt, including mortgage backed debt. The Act, inter alia, provides for: (a) including securitisation certificates or instruments under the definition of ‘securities’; and (b) obtaining approval from the SEBI for issue of securitisation certificate or instrument and procedure thereof.

2.221 The State Bank of India (Subsidiary Banks Laws) Amendment Act, 2007, came into effect on July 9, 2007. The major provisions of the Act include: (a) increasing the authorised capital of subsidiary banks of the SBI to Rs.500 crore; (b) fixing of their issued capital by the SBI with the approval of the Reserve Bank; (c) raising of such issued capital by issue of equity or preference shares through preferential allotment/private placement/ public issue in accordance with the specified procedure, with the approval of the SBI and the Reserve Bank; (d) issuance of bonus shares to the equity shareholders with the approval of the SBI and the Reserve Bank; and (e) reduction of SBI’s mandatory shareholding from 55 per cent to 51 per cent of the issued capital consisting of equity shares.

8 Banks currently authorised to deal in foreign exchange are categorised as AD category-I banks. They are authorised to deal in all current and capital account transactions, according to the directions issued by the Reserve Bank from time to time.

9 The issuing company should be a part of the promoter group of the offered company and shall hold the equity share/s being offered at the time of issuance of the FCEB.

10The offered company should be a listed company, which is engaged in a sector eligible to receive FDI and to issue/avail foreign currency convertible bond or ECBs.

11 The amount of instalment is sensitive to the interest rate. Protracted legal process of loan recovery causes banks to keep a lower LTV ratio.

12 The Reserve Bank is empowered under the provisions of the Payment and Settlement Systems Act, 2007 to make regulations to operationalise the provisions of the Act. Accordingly, the two sets of regulations were notified.

13 The revised timings of the six settlements on week days are 9.00 a.m., 11.00 a.m., 12.00 noon, 1:00 p.m., 3:00 p.m. and 5.00 p.m. and the timings of the three settlements on Saturdays are 9.00 a.m., 11.00 a.m. and 12.00 noon.

14 Cash delivery means delivery of foreign exchange on the day of transaction. Tom delivery means delivery of foreign exchange on the next working day after the day of transaction. Spot delivery means delivery of foreign exchange on the second working day after the day of transaction. Forward contract means a transaction involving delivery at a future date beyond cash/tom/spot delivery of foreign exchange.

15The Uptime Institute is an internationally recognised institution, headquartered at Santa Fe, USA, that provides, inter alia, standards for classification of data centres. These are termed as Tiers, with Tier IV being the highest level currently available, providing for 99.999 per cent uptime of data centres. |

IST,

IST,