IST,

IST,

Bank Lending Survey- Recent Trends

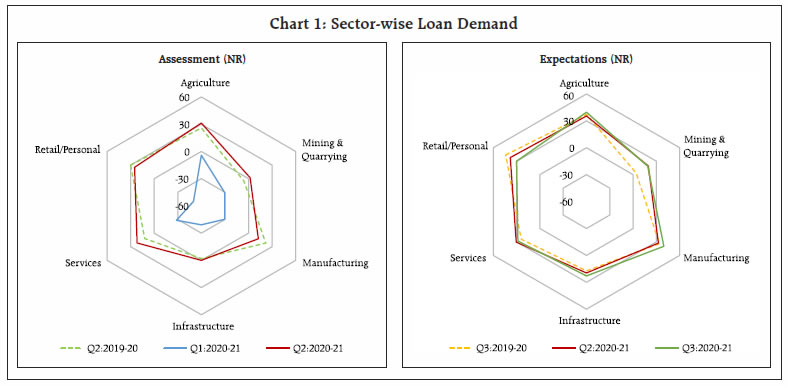

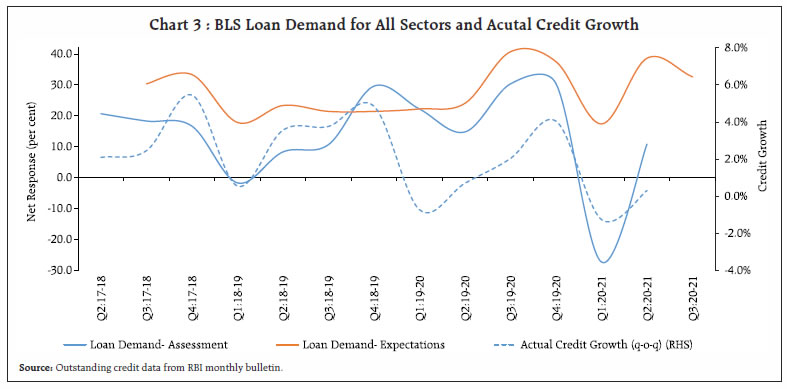

Initiated in 2017 by the Reserve Bank, the Bank Lending Survey in India provides perceptions of banks on loan demand and loan terms and their outlook in near term across major sectors. The details of the survey and its summary results since the first round (Q2:2017-18) are presented in this article. A broad corroboration is observed in the borrowers’ perceptions and lenders’ sentiments on the manufacturing sector. Bankers’ sentiments on lending conditions have consistently improved after the adverse situation witnessed during April-June 2020 due to the COVID-19 pandemic. Introduction In a bank dominated economy like India, credit is an essential lubricant to the engine of economic growth and its prognosis may be a useful input in policy formulation. Information on credit is often supplemented with the bankers’ perceptions about its demand and financing conditions, which are collected through the dedicated Bank Lending Survey (BLS), also known internationally as senior loan officers’ survey or credit condition survey. Lending choices of banks depend on various factors like macroeconomic outlook, liquidity conditions, borrowers’ creditworthiness, uncertainty associated with the concerned sector, expected return including risk premium, portfolio mix and risk management abilities, among others. In this context, BLS provides lender’s qualitative perspective on credit market conditions, especially the impact of changing economic or financial conditions on loan demand and loan terms of banks for different economic sectors. Following the recommendations of the Internal Working Group on Surveys (2009), the Reserve Bank launched the Credit Conditions Survey (CrCS) in 2010. Its questionnaire underwent few revisions based on users’ requirements as well as feedback from technical experts and responding banks, before it was rechristened as Bank Lending Survey (BLS) in 2017. The present article lays out broad contours of its methodology, trends in its results and compares it with official statistics and other surveys. The remainder of the article is structured in six sections. Section II presents the cross-country practices on BLS. Section III gives an overview of the methodology of quarterly BLS conducted by the Reserve Bank; Section IV highlights the results of survey and Section V discusses its relationship with other select economic series. Section VI concludes. Bank lending surveys are conducted regularly by central banks in major developed economies (e.g., the USA, the UK, Japan, Canada, New Zealand and the euro area countries) and some other developing and emerging market economies such as Jamaica, Nigeria and Thailand, which generally release their aggregate results in public domain. The European Investment Bank (EIB) manages the half-yearly BLS to monitor banking sector trends and challenges in the Central, Eastern and South-Eastern Europe (CESEE) region. BLS is conducted among banks and often also covers other lending institutions and respondents are given time upto a month to provide their feedback. Its respondents are usually senior loan officers / heads of credit department and other senior officers in comparable positions, who give their qualitative assessment on prevailing credit market situation and their perceptions and intentions for the immediate future, through structured questionnaire on either 3 or 5-point scale. Many central banks conduct these surveys on a quarterly basis while some (e.g., Reserve Bank of New Zealand) approach lenders every six months. The survey questions generally pertain to loan demand, loan standards and terms/conditions and factors impacting loans to different sectors (e.g., businesses, households, non-financial corporations). They are backward looking (e.g. developments during past three months) and/or forward looking (e.g., expected changes in next three months). Some central banks surveys (e.g., Bank of Japan and European Central Bank (ECB)) specifically request respondents to ignore usual seasonal variations while expressing their opinion about demand for loan. Responses are generally aggregated in the form of a single statistic, namely, net percentage balance or diffusion index – both are computed for the ECB survey (Table 1). The analysis on ECB’s BLS data suggest that since the results were consistent with other statistics, the survey could add to policymakers’ understanding of economic and financial trends (Berg et al., 2005). The survey provides useful information on Gross Domestic Product (GDP) projection and survey results on specific sectors are relevant for predicting real activity in those sectors (Cunningham, 2006). Apart from analysing responses to the standard BLS questionnaire another study evaluated the ad hoc questions introduced to gauge effectiveness of the ECB’s standard and non-standard measures during the financial crisis. It was found that the survey was useful in understanding granular nuances about whether banks had access to sufficient funds in the wholesale and retail markets; impact of the sovereign debt tensions on bank funding and bank lending; and how the ECB’s negative deposit facility rate affected banks’ net interest income and bank lending (Köhler-Ulbrich et al., 2016). Using survey results in Global Vector Autoregressive (GVAR) framework, a study found that expansionary monetary policies in general resulted in lower credit standards, which in turn reinforced the thrust of monetary policy. However, the expansionary impact was muted at the time of announcements about unconventional monetary policies, likely owing to the signaling effect read as a downgrading of underlying economic prospects (Filardo and Siklos, 2020). III. Reserve Bank’s Lending Survey The Reserve Bank’s BLS is broadly in line with similar surveys conducted by other central banks. It provides practitioners’ feedback on prevailing credit market conditions and gives indications on future demand for bank loans as well as alterations in their terms and conditions, well before actual data are available. Methodology, Sample Size and Response Rate The survey sample covers a panel of top 30 Scheduled Commercial Banks (SCBs) in India covering over 90 per cent of the total outstanding credit. A fixed panel of respondents is canvassed during a financial year and the panel is updated (factoring in banking business / mergers) based on credit outstanding in the latest financial year. The target respondents are heads of the credit department or senior credit officers of banks, who are generally given two-week’s time to respond to the survey questionnaire. Participation in BLS is voluntary and the response rate is over 85 per cent. The survey seeks a bank’s qualitative outlook for two-time points - assessment of the current quarter vis-a-vis the previous quarter and expectations for the ensuing quarter vis-a-vis the current quarter. The multiple-choice questionnaire used in the survey covers broad economic sectors. In case of loan demand, responses are solicited on changes for the current quarter and expectations for the next quarter on a 5-point scale (viz., substantial increase, moderate increase, similar (no change), moderate decrease and substantial decline) for the following sectors: i. All sectors ii. Agriculture iii. Mining and quarrying (including coal) iv. Manufacturing v. Infrastructure vi. Services vii. Retail / Personal Similar questions are asked on loan terms and conditions on a 5-point scale (viz., considerable easing, somewhat easing, similar (no change), somewhat tightening, considerable tightening). The loan terms and conditions are specific to an approved loan, terms agreed between lender and borrower and laid down in the loan contract. The loan terms and conditions cover both price and non-price aspects and include agreed spread over the relevant reference/interest rate, the size of the loan and other non-interest charges (e.g. fee, collateral or guarantee requirement, loan covenants, agreed loan maturity). The loan terms are conditional on borrower’s characteristics and may also change with bank’s loan approval criteria. Aggregation of Survey Responses Responses collected in the BLS are on a 5-point scale and they are summarised into a single number called the Net Response (NR)1, {also known as balance statistics (BS) score}, which is weighted difference between the proportions of positive and negative responses, where ‘no change/similar’ responses are assigned zero weight. NR can take values ranging from –100 to +100: positive values of NR indicate optimism for the parameter/sector (e.g., bank experiencing increase in loan demand or easing of loan terms and conditions) whereas a value below zero reflects pessimism (e.g., lower loan demand or tightening of loan terms and conditions). Thus the net response helps in quantifying qualitative responses that indicates the direction of the change in sentiments; however, it does not strictly estimate the magnitude of change. After its initiation in 2017, thirteen rounds of BLS surveys have been completed. The broad movements in bankers’ perceptions on loan demand and loan terms and conditions are presented in this section (Statements 1 to 4).2 Loan Demand The Covid-19 pandemic and related lockdown resulted in significant contraction in loan demand across all sectors during April-June 2020, which severely dampened sentiments among Indian banks (Statement 1). During July-September 2020, however, the loan officers’ sentiments recovered quickly, and the improvement was broad based. Infrastructure, mining and quarrying sectors recorded lower optimism than other sectors. Retail/personal loan demand was assessed to have posted maximum recovery after recording sharpest fall during the lockdown quarter (Q1:2020-21). In the eleventh round of the BLS conducted during January-March 2020, senior loan officers expressed lower optimism for credit demand for all sectors but did not anticipate the contraction in advance as they could not foresee full impact, due to the severe and sudden nature of the Covid-19 pandemic witnessed later (Statement 2). The subsequent two survey rounds indicated improved quarter-on-quarter loan demand expectations. Among major sectors, bankers have been generally expecting higher demand for retail/personal loans and agriculture segments in the recent times, followed by manufacturing and services sectors. A comparison of the sector-specific NRs indicates banks’ optimism on loan demand across sectors in July-September 2020, reviving from the low assessment reported in April-June 2020 (Chart 1). Banks also expect improvement in loan demand during Q3:2020-21. Loan Terms and Conditions Bankers do not foresee sudden quarter-on-quarter change in loan terms and conditions; these are more dependent on performance of loans across sectors, macroeconomic conditions and opportunities for growth across sectors. NRs for agriculture and personal loan segments have always been in the positive terrain indicating better loan terms and conditions in these sectors (Statement 3). The sentiments on loan terms and conditions for services sector too indicated easing, barring the assessment during the lockdown quarter. For infrastructure, mining and quarrying sector, however, more banks reported some tightening of loan terms.  A comparison of the sector-specific NRs indicates bankers polled better loan terms and conditions across the board in July-September 2020, reviving from low assessment in the previous quarter. They also expect further easing of ‘loan terms and conditions’ during Q3:2020-21 (Statement 4 and Chart 2). V. Survey Results Relationship with Official Statistics and Other Surveys In this section a comparison of survey results is made with trends in actual credit as well as other surveys to gain insights on whether they can be used as effective policy inputs. BLS and Actual Bank Credit Bankers’ assessment of changes in loan demand conditions are fairly close to the growth in actual credit by SCBs, the data which are released subsequently. Their expectations on loan demand have generally been more optimistic but broadly capture turning points in credit growth cycle (Chart 3). Assessment of Credit Conditions for Manufacturing Sector by Borrowers and Lenders BLS provides a supply side view (i.e., lender’s perspective) whereas RBI’s quarterly Industrial Outlook Survey (IOS)3 seeks demand side assessment and outlook on availability of finance (from banks and other domestic sources)4 from manufacturers, who are an important segment of borrowers. IOS collects opinion on availability of finance on a 3-point scale (improve / worsen / no change) and results are presented in the form of net responses5.

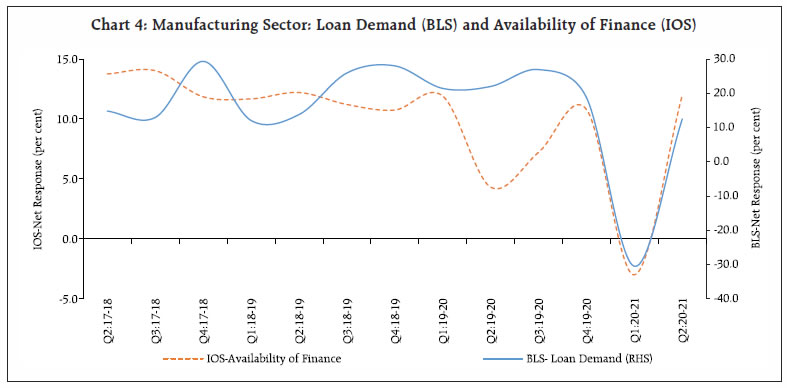

Bankers’ assessment on ‘loan demand from manufacturing sector’ from the BLS and manufacturers’ sentiments on availability of finance (from banks and other sources) from the IOS indicate similar directional changes at a few time points but the perceptions/turning points do not match in other cases possibly because similar assessment from non-bank sources, which may be accounting for a substantial portion of finance, is not available (Chart 4).   Bankers’ perception of easing of loan terms for manufacturing sector is generally in similar direction as manufacturers’ improved sentiments on availability of finance (Chart 5). Co-movement of balance of opinions emanating from the two surveys corroborate the information on credit conditions for manufacturing sector. The survey results reveal that there has been broad-based improvement in bankers’ sentiments on lending conditions, after severe impact of the pandemic during April-June 2020. Responses suggest that perceptions on retail/personal loans, which were most severely hit during the period, have bounced back. The respondents expressed lower optimism for the infrastructure, mining and quarrying sectors when compared to other major sectors. Taking a longer term view, BLS mimics the actual credit growth quite well and since the survey results are available in advance, it may prove to be a useful tool for policymakers to gauge the underlying trends. A broad corroboration is also observed in the borrowers’ perceptions from the IOS and lenders’ sentiments reflected in the BLS. Going forward, regular availability of BLS results is likely to provide useful prognosis of credit market conditions. References Berg, Jesper., van Rixtel, Adrian A.R.J.M., Ferrando, Annalisa., de Bondt, Gabe and Scopel, Silvia., (2005), “The Bank Lending Survey for the Euro Area”. ECB Occasional Paper No. 23, February 2005, https://ssrn.com/abstract=752072. Bank of England (2007), “Bank of England Credit Conditions Survey”, Quarterly Bulletin, Q3. European Central Bank (2018), “User guide to the euro area bank lending survey”, https://www.ecb.europa.eu/stats/pdf/bls_user_guide_201811.en.pdf. Filardo, Andrew J. and Siklos, Pierre L., (2020), “The cross-border credit channel and lending standards surveys”, Journal of International Financial Markets, Institutions and Money, Vol.67. Köhler-Ulbrich, Petra., Hempell, Hannah S., Scopel, Silvia., (2016), “The euro area bank lending survey: Role, development and use in monetary policy preparation”, European Central Bank Occasional Paper Series, No.179, September. Faruqui, Umar, Paul Gilbert, and Wendy Kei., (2008), “Bank of Canada’s Senior Loan Officer Survey”, Bank of Canada Review, Autumn, https://www.bankofcanada.ca/wp-content/uploads/2010/06/faruqui.pdf. Bank of Japan, “Senior Loan Officer Opinion Survey on Bank Lending Practices at Large Japanese Banks”, https://www.boj.or.jp/en/statistics/dl/loan/loos/index.htm. Board of Governors of the Federal Reserve System, “Senior Loan Officer Opinion Survey on Bank Lending Practices”, https://www.federalreserve.gov/data/sloos/about.htm. Reserve Bank of India, Database on Indian Economy, https://dbie.rbi.org.in. Reserve Bank of India (2009), “Report of the Working Group on Surveys”, Reserve Bank of India Bulletin, September. Cunningham, Thomas J., (2006), “The Predictive Power of the Senior Loan Officer Survey: Do Lending Officers Know Anything Special?”, Federal Reserve Bank of Atlanta Working Paper, November. * Prepared by Vijaya Gangadaran and Supriya Majumdar of the Division of Enterprise Surveys, Department of Statistics and Information Management. The views expressed in this article are those of the authors and do not represent the views of the Reserve Bank of India. 1 Net Response (NR) = {1*P2 + 0.5*P1 + 0*P0 + (-0.5)*P(-1) + (-1)*P(-2)}, where, Pi = per cent of responses for ith category viz., P2 = per cent of banks reporting loan demand as ‘Substantial increase’ or loan terms and conditions as ‘Considerable easing’, P1 = per cent of banks reporting loan demand as ‘Moderate Increase’ or loan terms and conditions as ‘Somewhat easing’, P0 = per cent of banks reporting loan demand or loan terms and conditions to remain ‘Same/No Change’, P(-1) = per cent of banks reporting loan demand as ‘Moderate decrease’ or loan terms and conditions as ‘Somewhat tightening’ and P(-2) = per cent of banks reporting loan demand as ‘Substantial decrease’ or loan terms and conditions as ‘Considerable tightening’. 2 The survey results present respondents’ collective views. Detailed BLS data for the 14th survey round (October-December 2020) onwards will be released on the Reserve Bank’s website on the lines of other monetary policy surveys {e.g., Industrial Outlook Survey (IOS), Order Book, Inventory and Capacity Utilisation Survey (OBICUS)}, after the resolution of the Monetary Policy Committee (MPC) is placed in the public domain. 3 The IOS data are released on the RBI website on a quarterly basis (see web-link /en/web/rbi/-/publications/industrial-outlook-survey-of-the-manufacturing-sector-for-q2-2020-21-19984 for the latest web release dated October 9, 2020). 4 Parameters canvassed among manufacturers in the IOS are ‘Availability of finance (from banks and other domestic sources viz., financial institutions, capital markets etc.)’, ‘Availability of Finance (from internal accruals)’ and ‘Availability of Finance (from overseas, if applicable)’. 5 NR for IOS parameters is calculated as percentage of positive (optimistic) responses minus percentage of negative (pessimistic) responses. |

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: