IST,

IST,

Preliminary Estimates of Household Financial Savings - Q1:2020-21

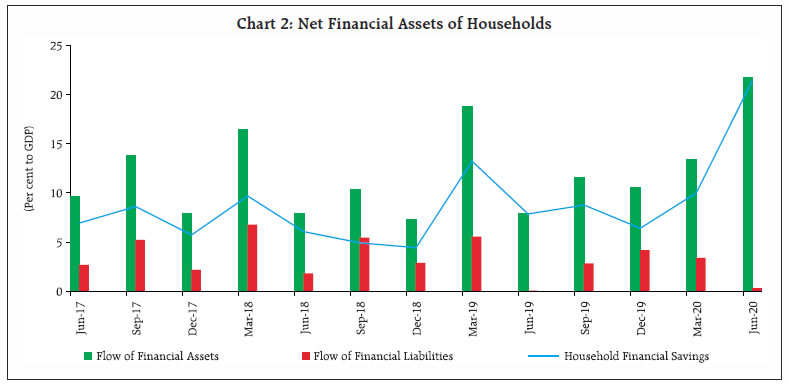

The preliminary estimates of household financial savings show a significant increase in Q1:2020-21, which is in line with the increase in household savings observed in other major economies post-COVID-19. The significant increase in household financial savings in India is counter-seasonal and possibly reflects the impact of COVID-19-led reduction in discretionary spending and the associated forced saving as well as a surge in precautionary saving on concerns relating to income flows in the near-term. The estimated increase in financial savings is consistent with other available official statistics, in particular the decline in private final consumption expenditure and the surplus position in the external current account. Introduction Quarterly data on household financial assets and liabilities (including household financial savings) for the recent three years (2017-18 to 2019-20) were published in the Reserve Bank of India Bulletin, June 2020. Taking into account the large statistical break in the key macroeconomic data resulting from the impact of COVID-19 during Q1:2020-21, which is already evident from the early official estimates of GDP and its key components, this article aims to provide preliminary estimates of household financial savings for Q1:2020-21. During this quarter, India’s GDP contracted by 23.9 per cent year-on-year (y-o-y) and private consumption declined by 26.7 per cent (y-o-y), suggesting possible corresponding large shifts in household savings. The exact magnitude of macroeconomic effects of COVID-19 will take time to unravel fully, as final data are available only with a considerable time lag. While the key determinants of household financial savings, in particular, income (GDP) and interest rate, changed significantly during Q1:2020-21, there were also reportedly shifts in the consumption pattern of non-essential items, precautionary savings and recourse to borrowings/ leverage by households for consumption smoothing. The current information gap on a key macroeconomic variable, viz., household financial savings is the major motivation behind this article. The rest of the article is divided into five sections. Section II discusses the preliminary estimates of the household financial savings at the aggregate level. Section III examines the COVID-19 led increase in household savings in the global context. Section IV shows the domination of banking sector instruments in household financial assets and liabilities. Section V encapsulates major movements on both the asset and liabilities side of households’ balance sheet. Section VI sets out concluding observations. A tabular presentation of the instrument-wise flow of household financial assets and liabilities are given in the Annex. II. Preliminary Estimates: the Headline Numbers Preliminary estimates presented in this article show a jump in household financial savings to 21.4 per cent of GDP in Q1:2020-21, up from 7.9 per cent in Q1 and 10.0 per cent in Q4 of 2019-20 (Table 1). It is likely that the propensity of households to save may have risen markedly during the pandemic on two counts. First, the households would have been forced to save more, being unable to consume up to their normal levels. The household consumption basket would have comprised a limited number of items relative to the pre-COVID period. Second, they may have raised their precautionary savings due to uncertainty about their future incomes, in large part flowing from cautious responses to reports of actual and potential job losses. The preliminary estimates of household financial savings for 2019-20 at 7.7 per cent of GDP (7.6 per cent of GNDI) were published in the Reserve Bank of India Annual Report 2019-20, which now stand revised to 8.3 per cent of GDP1. This article has also updated the series from 2018-19. The data revision is primarily caused by updated information on household share in bank credit, bank deposits and subscription of insurance policies by households. III. COVID-19 Push to Household Savings Globally Globally, owing to the COVID-19 induced lockdown, there has been a tendency on the part of households to increase precautionary savings/ forced savings. The forced savings component was generated as the lockdown measures imposed to contain the virus prohibited households from consuming a large share of their normal expenditure basket. Furthermore, the uncertainty regarding future income, and in particular, the risk of future unemployment, caused by the sudden outbreak of the pandemic led to the rise in precautionary savings (Ercolani, 2020). The sudden increase in household savings got manifested in official data the world over. For instance, in the USA, the personal saving rate2 rose by 20.7 percentage points (to 33.6 per cent of disposable income) in April 2020 from 12.9 per cent in March 20203, and in the UK, household savings ratio4 has increased to 29.1 per cent of disposable income in Q2:2020 from 9.6 per cent in Q1:20205. In the Indian context, it is reportedly observed that while forced savings could be going up in the formal sector on income continuity, a large chunk of labour employed in the informal sector could have increased precautionary savings despite stagnant/ reduced income by lowering consumption6. IV. Banking Instruments Dominate Household Financial Assets/Liabilities The household financial savings in India are significantly affected by their deposits with and borrowing from the banking sector. Bank deposits and bank loans constitute dominant shares of around 56 per cent and 80 per cent of household financial assets and liabilities, respectively7 (Chart 1.a and 1.b).  As per the latest data, aggregate bank deposits in India have touched nearly ₹ 138.7 lakh crore in June 2020, an increase of ₹ 3.0 lakh crore since end-March 2020, while advances are subdued at just over ₹ 102.5 lakh crore, down by ₹ 1.2 lakh crore from end-March 2020. This has widened the gap between credit extended and deposits mobilised during the April-June quarter of 2020. Deposits with banks have picked up by 11 per cent on a y-o-y basis as of June 2020 versus the 7.9 per cent growth registered in 2019-20 and 10 per cent as at end-June 2019. This is despite the weighted average domestic term deposit rates by scheduled commercial banks falling further by around 40 bps over the last three months beyond March 2020. In contrast, credit growth moderated on a y-o-y basis to 6.2 per cent in June 2020 from 12 per cent in June 2019. The divergence between deposit and credit growth in Q1:2020-21 has contributed to the increase in net financial savings of households. V. Preliminary Estimates: An In-Depth Exploration Reflecting the trend in credit and deposit growth, the household financial savings are estimated to have increased sharply in Q1:2020-21 (Chart 2). With the assumption of unchanged share of households in total deposit in Q1:2020-21, the household financial savings work out to 21.4 per cent of GDP in Q1:2020-21. The sharp increase is counter-seasonal and needs to be seen, keeping in view the COVID-19-led reduction in discretionary spending or forced savings by households employed in the formal sector and surge in precautionary savings despite stagnant/reduced income of households working in the informal sector. A significant reduction in nominal GDP has also contributed to the rise in household financial savings-GDP ratio. Furthermore, household financial savings have increased in absolute terms as well (both real and nominal). Household financial savings generally peak in Q4 of the financial year owing to seasonal factors, which are then followed by moderation in Q1 (Prakash, et al., 2020). Accordingly, variations have been observed in the quarterly estimates of household financial savings in the past as well. The recent high of 13.2 per cent of GDP was observed in Q4:2018-19 (Table 1).  The main observations and reasons behind the significant increase in household financial savings in Q1:2020-21 are set out below:

The unprecedented increase in household financial savings in Q1:2020-21 is not unique to India. This spike in household financial savings needs to be seen in the context of COVID-19, which has imparted both demand and supply shocks to the economies affected. Going forward, as the COVID curve flattens and the lockdown gets withdrawn, some of the consumption, particularly, the discretionary component will begin to pick up. High deposits with banks, falling demand for credit and the reluctance of banks to lend have contributed to the elevated savings. On the external front also, the Indian economy, which has traditionally seen a deficit in current account of the balance of payments, witnessed a surplus in Q1:2020-21. As current account balance is usually the mirror image of the savings-investment gap, the surplus in the former suggests domestic savings exceeding the investment during Q1. This also corroborates the subdued domestic demand conditions in the economy, which get mirrored in increased savings of the household sector. The trend of higher than usual household financial savings can persist for some time till the pandemic recedes and consumption levels get normalised. It may also be added that the household financial savings data in this article are preliminary and will get revised in future releases9. The true assessment of the financial savings glut will only be known some years down the line. Meanwhile, a much larger pool of financial surplus can be tapped for intermediation in an innovative way. The unprecedented increase in household financial savings in Q1:2020-21 is expected to taper off in course of time, especially as the COVID curve begins to flatten allowing households to spend and economic activities to revive in the coming quarters. References: Ercolani, Valerio (2020), “Covid-induced Precautionary Saving in the US: The Role of Unemployment Rate”, Analysis of Current Economic Conditions and Policy, Econbrowser, http://econbrowser.com/archives/2020/06/guest-contribution-covid-induced-precautionary-saving-in-the-us-the-role-of-unemployment-rate. Maji, Priyadarshini (2020), “Why Buying Life, Health Insurance has Become a Necessity Today”, Financial Express, April 30, 2020, https://www.financialexpress.com/money/why-buying-life-health-insurance-has-become-a-necessity-today/1944271/ Prakash, Anupam, Anand Prakash Ekka, Kunal Priyadarshi, Chaitali Bhowmick and Ishu Thakur (2020), “Quarterly Estimates of Households’ Financial Assets and Liabilities”, RBI Bulletin, June 2020. RBI (2020), “Annual Report 2019-20”, Reserve Bank of India. The Indian Express, “Sections of Households See Rise in Savings After Lockdown”, July 09, 2020, https://indianexpress.com/article/business/sections-of-households-see-rise-in-savings-after-lockdown-6496812/ * Prepared by Sanjay Kumar Hansda, Anupam Prakash and Anand Prakash Ekka, National Accounts Analysis Division, Department of Economic & Policy Research, Reserve Bank of India. The authors are thankful to Dr. Mridul Kumar Saggar, for insightful discussions on the draft. The views expressed in this article are those of the authors and do not represent the views of the Reserve Bank of India. 1 The National Statistical Office (NSO)’s statistics on household financial savings released in January 2020 stands at 6.5 per cent of GDP for 2018-19. The estimates on household financial savings for 2019-20 and 2020-21 will be released by NSO on January 29, 2021 and January 31, 2022, respectively. 2 “Income left over after people spend money and pay taxes is personal saving. The personal saving rate is the percentage of their disposable income that people save”, Bureau of Economic Analysis, USA. 3 Bureau of Economic Analysis, U.S. Department of Commerce (https://www.bea.gov/data/income-saving/personal-saving-rate). 4 The savings ratio is the per cent of disposable income saved (household saving divided by household disposable income). 5 Office of National Statistics, United Kingdom (https://www.ons.gov.uk/economy/grossdomesticproductgdp/timeseries/dgd8/ukea). 6 The Indian Express, “Sections of Households See Rise in Savings After Lockdown”, July 09, 2020, https://indianexpress.com/article/business/sections-of-households-see-rise-in-savings-after-lockdown-6496812/. 7 The official data regarding household share in deposits are available up to 2019-20 in the Basic Statistical Return published by RBI. 9 As a caveat, it may be added that the preliminary estimates of household financial savings for Q1:2020-21 could be subject to larger than usual revisions, both on the sides of assets and liabilities as for now the pre-pandemic ratios have been applied in the estimation of household shares. |

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: