IST,

IST,

RBI WPS (DEPR): 07/2016: Inflation-Forecast Targeting For India: An Outline of the Analytical Framework

|

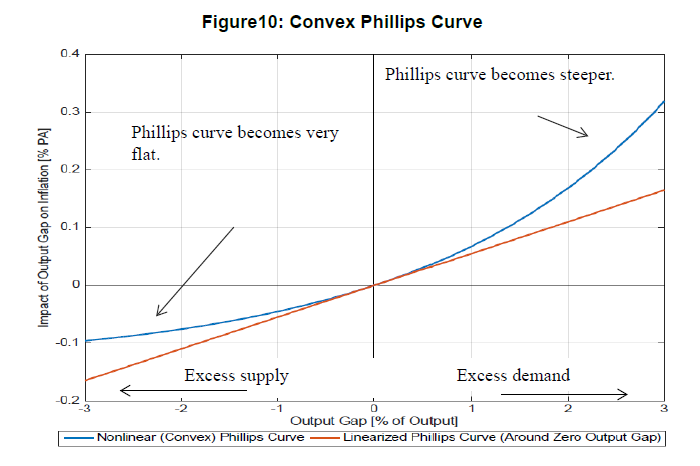

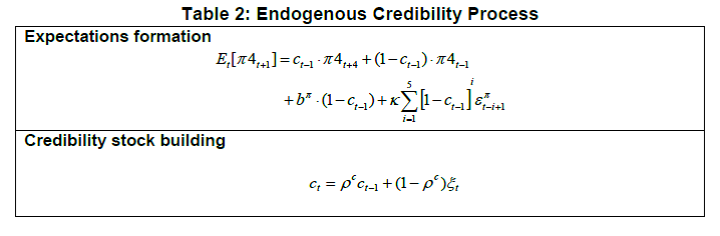

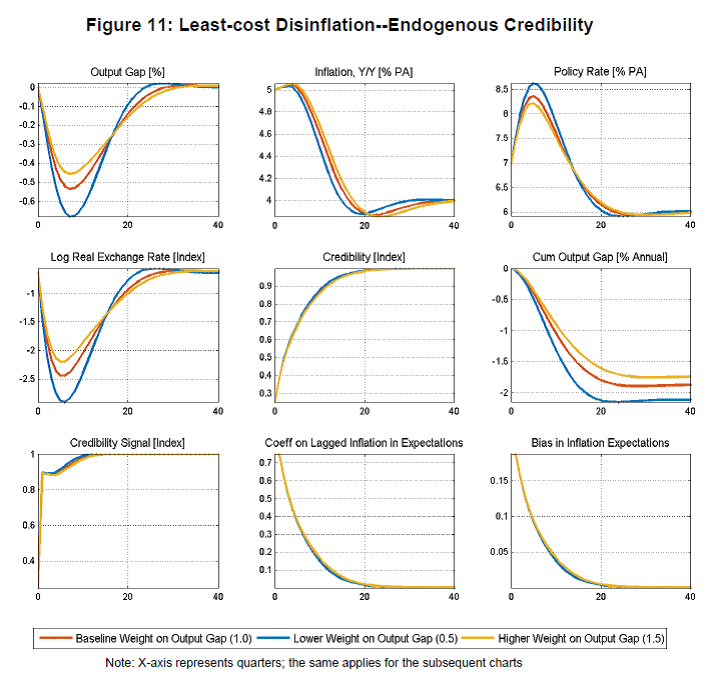

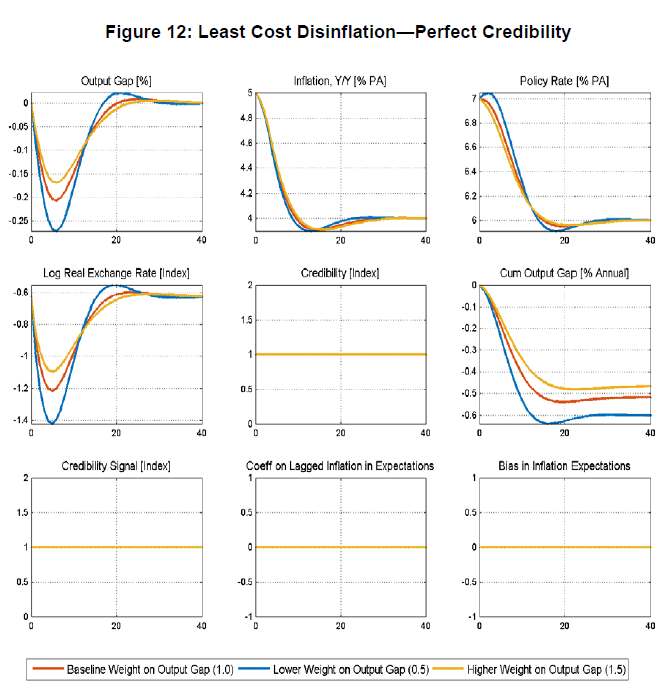

RBI Working Paper Series No. 07 Abstract 1India formally adopted flexible-inflation targeting (FIT) in June 2016 to place price stability, defined in terms of a target CPI inflation, as the primary objective of the monetary policy. In this context, the paper draws on Indian macro-economic developments since 2000 and the experience of other countries that adopted FIT to bring out insights on how credible policy with an emphasis on strong nominal anchor can reduce the impact of supply shocks and improve macroeconomic stability. For illustrating the key issues given the unique structural characteristics of India and the policy options under an FIT framework, the paper describes an analytical framework using the core Quarterly Projection Model (QPM). Simulation of QPM are carried out to illustrate the monetary policy responses under different types of uncertainty and to bring out the importance of gaining credibility for improving monetary policy efficacy. JEL Classification: E5, Z0 Keywords: forecasting, economic projections, macroeconomic models I. Introduction This paper outlines an analytical framework for the implementation of flexible-inflation targeting (FIT) in India. It follows upon the recommendations of the Expert Committee to Revise and Strengthen the Monetary Policy Framework Report (January 2014)2, the subsequent Agreement on Monetary Policy Framework by Government of India and RBI on February 20, 20153 and the amendment of the Reserve Bank of India Act in May 2016 paving the way for the adoption of flexible inflation targeting framework for monetary policy and the constitution of a Monetary Policy Committee4. After providing a broad overview of the FIT framework, the paper provides a brief account of the macroeconomic developments since 2000s to highlight the macro-economic challenges faced by monetary policy at different phases. This is followed by a brief discussion on the international experiences with implementation of the FIT and the insights that could be useful in implementation of the framework in the Indian context. Thereafter, the paper discusses the key challenges in adopting FIT in India, given its unique structural characteristics. The details of core quarterly projection model (QPM) within the FIT are presented thereafter with illustrations on how the core-QPM could be used to think about monetary policy response to various scenarios including supply shocks. The final section provides the conclusions. This paper needs to be read along with the companion paper Benes et al. (2016)5 which implements a full scale production version of the QPM for India. The core QPM described in this paper draws heavily on the production-QPM for its overall structure and calibrations and as such much of the validation of the core-QPM is based on the production-QPM given in Benes et al. (2016). While the production-QPM goes into a high level of depth in term of inflation processes, treatment of shocks and monetary policy transmission of the economy, the focus of core-QPM described in this paper is to have an analytical discussion on optimal monetary policy responses under an FIT framework in an economy faced with considerable uncertainties; both in terms of shocks and in terms of underlying structural factors conditioning the monetary policy transmission. An overview of the FIT regime is discussed in Section II. Section III presents a narrative of the inflation process in India in the past decade and half. Country experiences on FIT are presented in Section IV followed by Section V which describes the key challenges in implementing FIT in India. Section VI presents the core-QPM and Section VII presents some policy simulation based on core-QPM. Section VIII concludes. II. Flexible Inflation Targeting: An Overview Since the central bank’s own forecast contains all the information it possesses relevant to the outlook for inflation—including policymaker’s preferences regarding the short-run trade-off between output and inflation, as well as the estimated effects of shocks working their way through the economy—it depicts an ideal intermediate target for monetary policy over the relevant policy horizon. Therefore, inflation-forecast targeting (IFT) is systematic, operational, flexible inflation targeting6 (Box 1). A successful policy regime provides an anchor to all nominal values, resulting in a significant reduction of uncertainty. The appropriate analytical framework works back from this anchor, and provides monetary policy with feasible medium-term paths consistent with it. In particular, it allows for the derivation of paths for the policy rate which guide the short-term interest rate in a way that the inflation objective is achieved7. In this framework the policy interest rate has to be endogenous, determined ultimately by the goal—otherwise the system has no nominal anchor. Actual inflation at any point of time may not be equal to the target within FIT as there are multiple shocks that affect inflation. There is a clear recognition that it would take time to bring inflation back to the target after a shock, given the lagged effects of monetary policy through the transmission mechanism. As a medium term framework, it is important to recognize that occasional deviations from the glide path should not be interpreted per se as monetary policy errors that require correction. The actual speed at which inflation adjusts to the long-run target would depend on the nature and magnitude of shocks hitting the economy and the response of monetary policy. Box 1: Six Principles of Inflation Targeting 1. The primary role of monetary policy is to provide a nominal anchor (i.e. low, stable long-run inflation expectations) for the economy; the weights given to any other objective must be consistent with this. 2. Effective inflation-targeting has beneficial first-order effects on welfare by reducing uncertainty, anchoring inflation expectations and reducing the incidence and severity of boom-bust cycles. 3. Fiscal and other government policies may make the task of monetary policy easier and more credible, or more difficult and less credible. 4. Because of

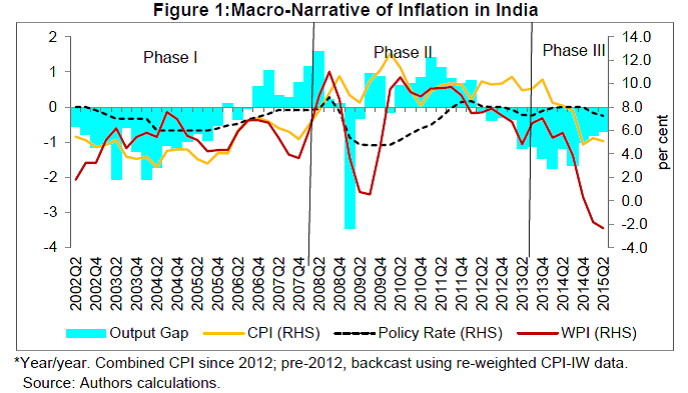

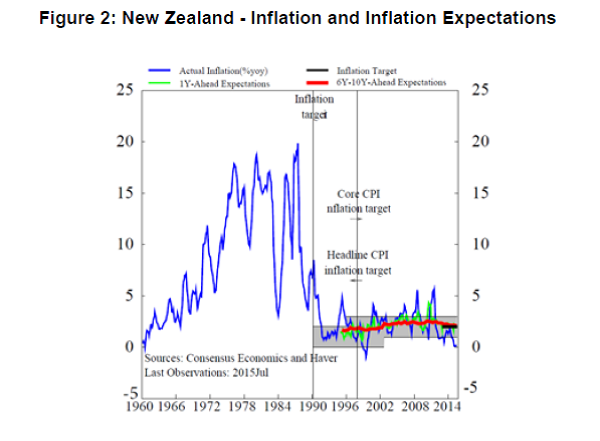

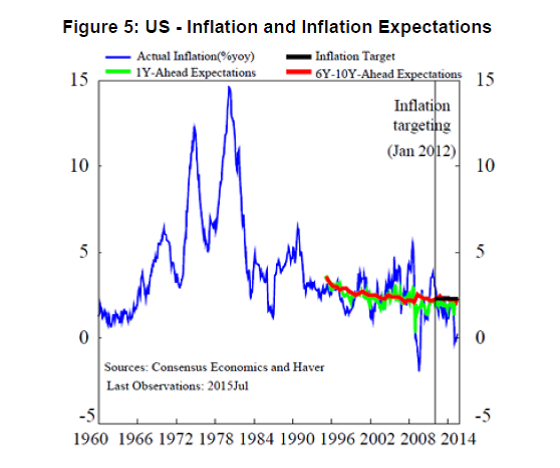

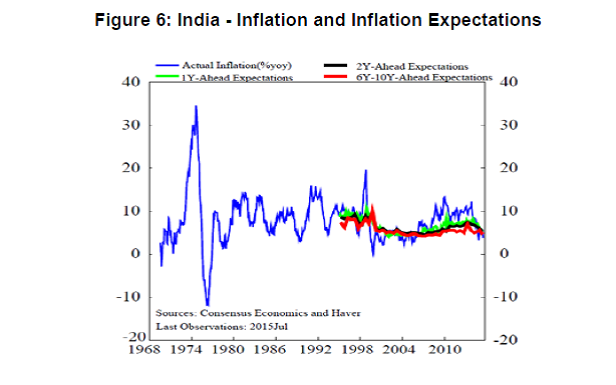

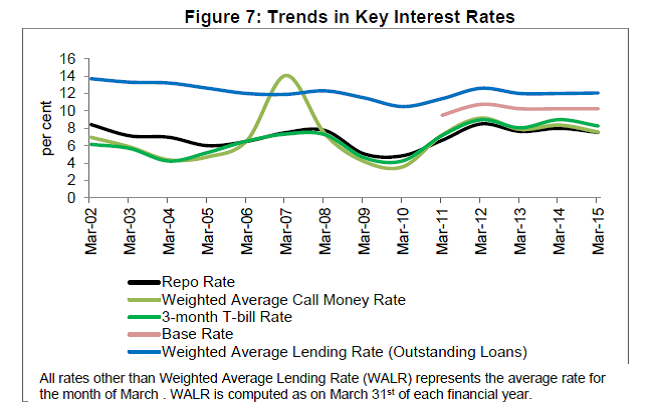

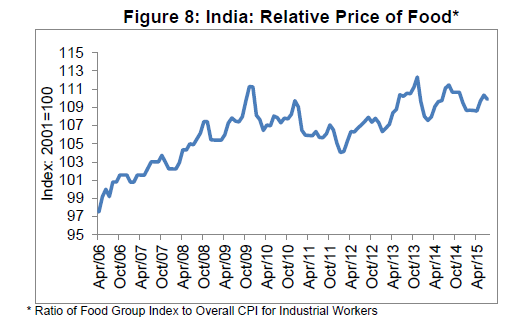

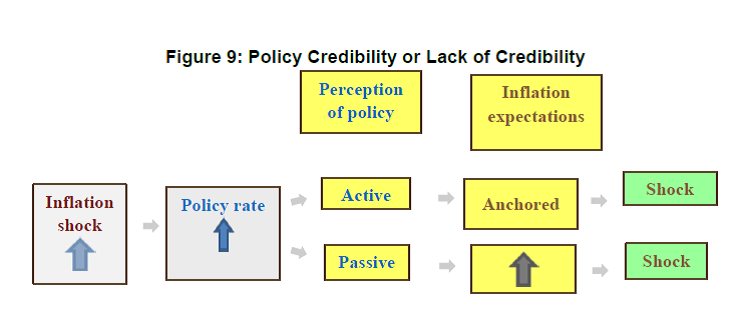

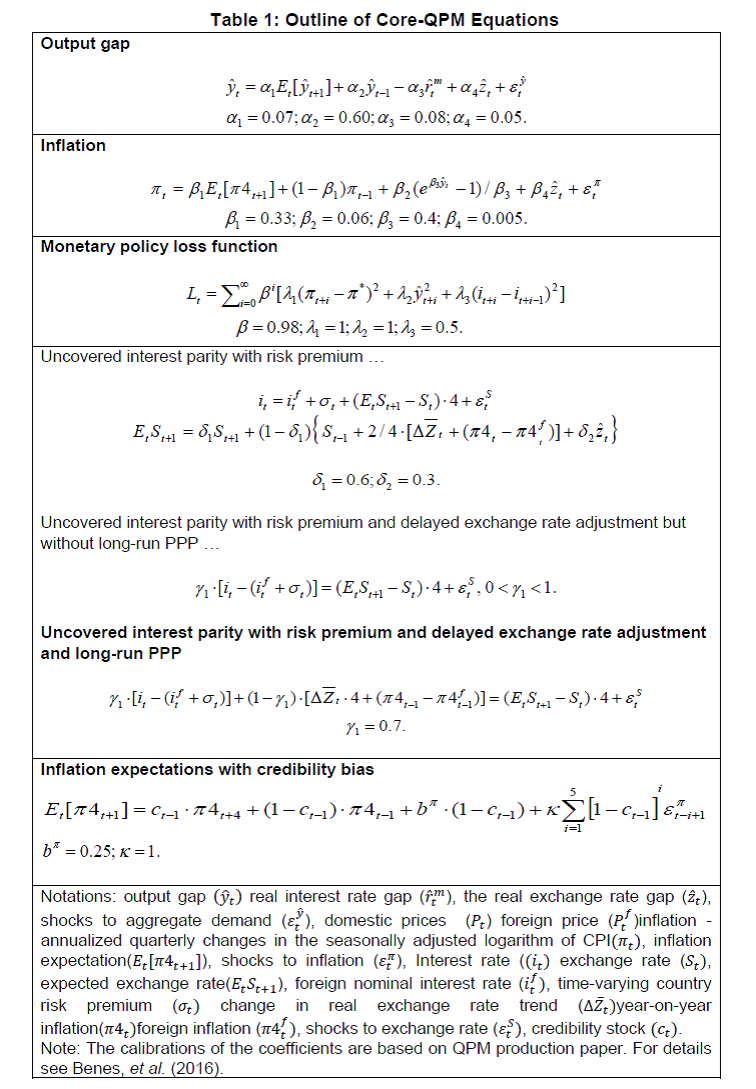

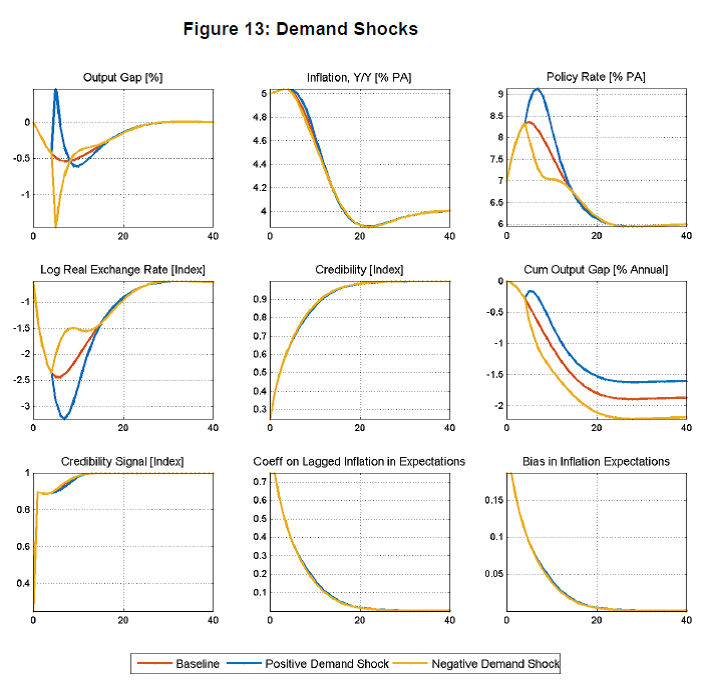

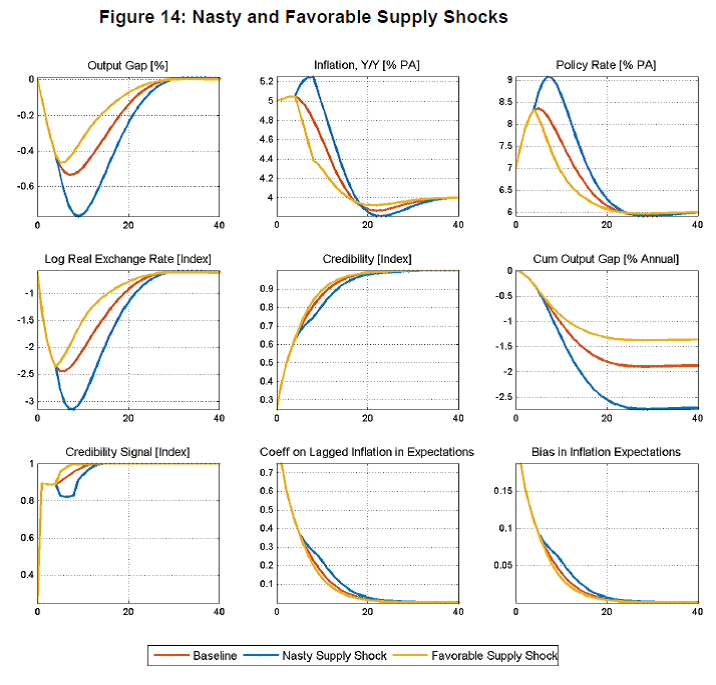

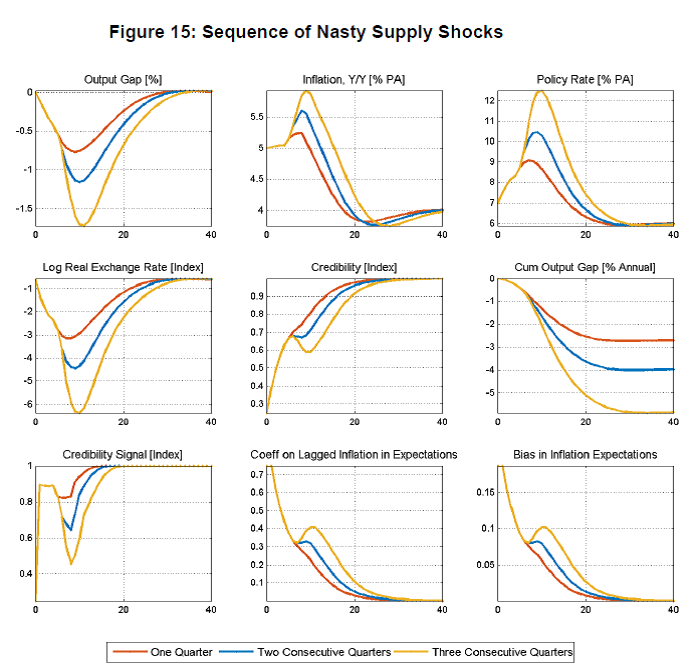

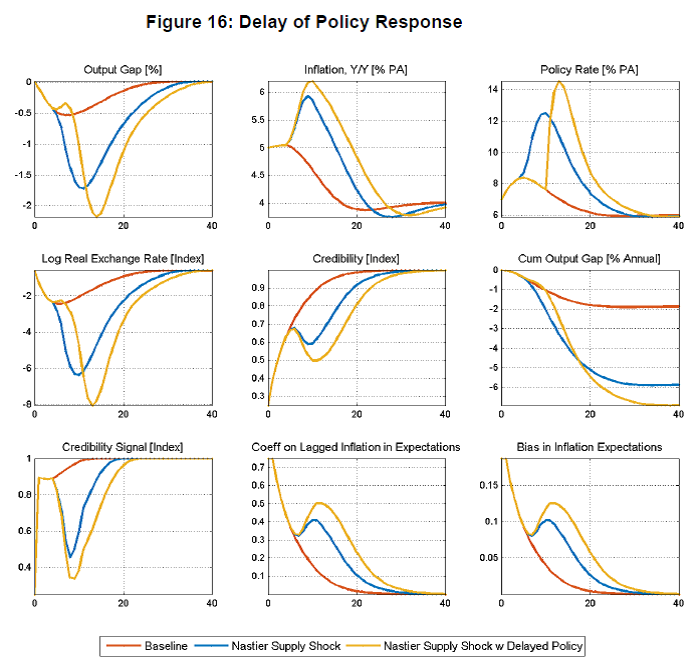

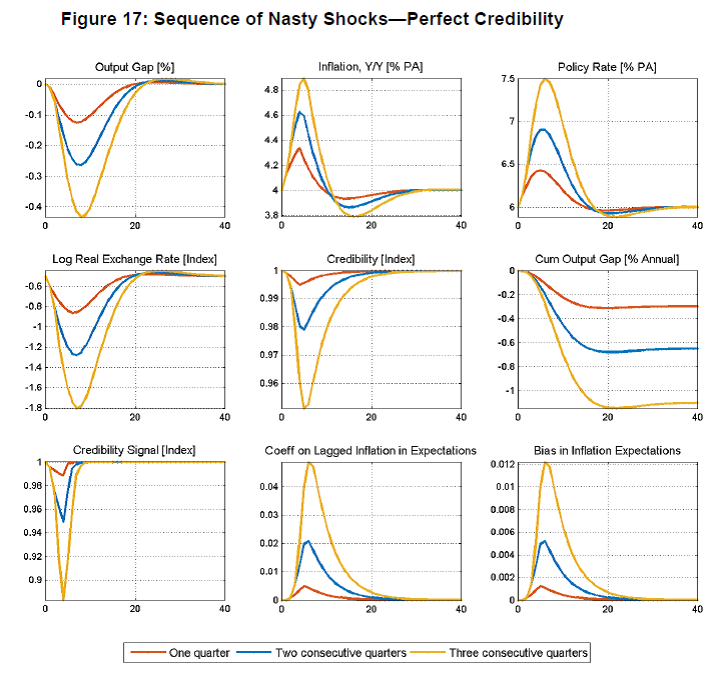

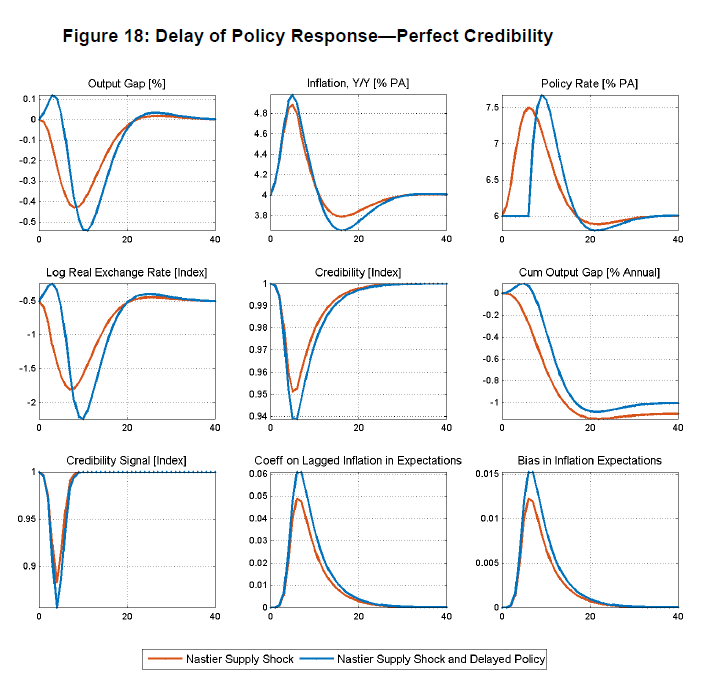

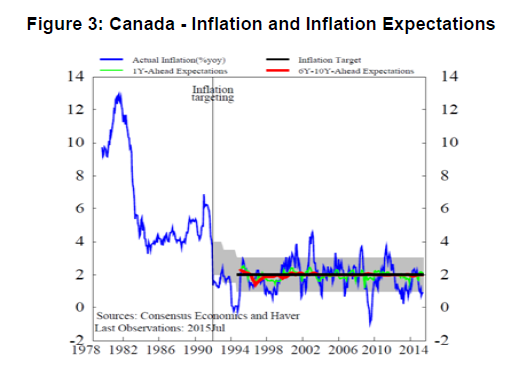

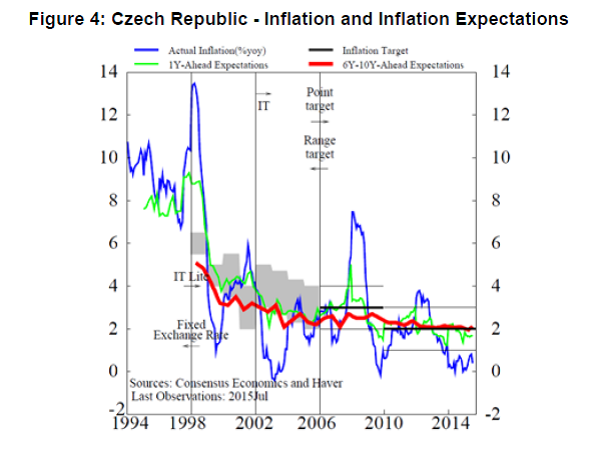

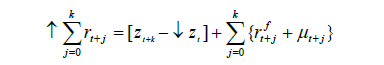

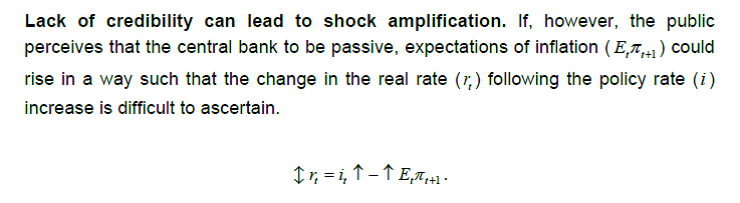

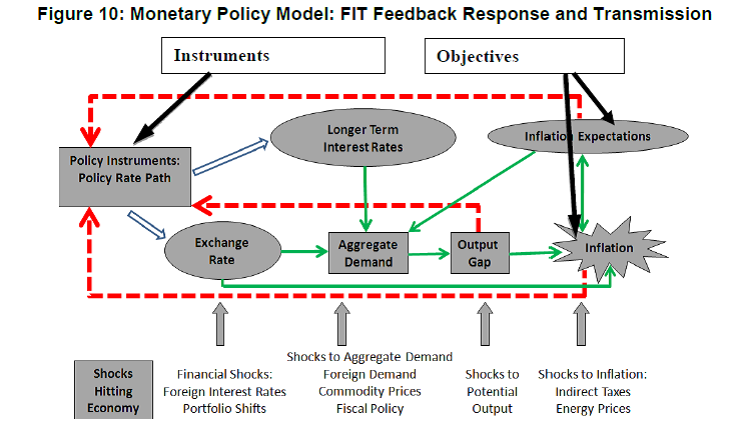

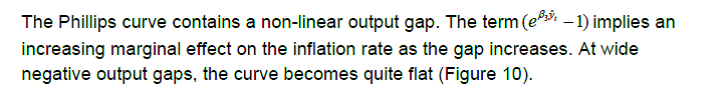

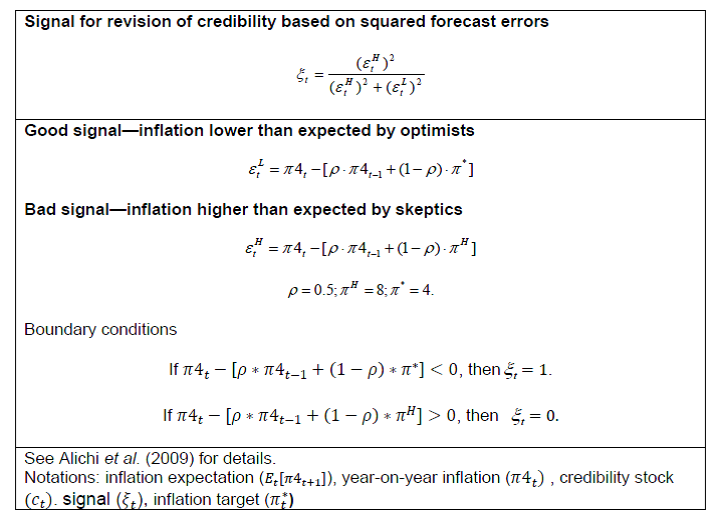

5. In view of possible short-run trade-offs between the inflation targets and other objectives, the conduct of monetary policy must have sufficient independence from the political process to achieve the announced objectives. 6. Effective monitoring and accountability mechanisms are required to ensure that central banks behave in a manner consistent with announced objectives and sound practice.Adapted from Freedman and Laxton (2009). III. Three Recent Phases of Inflation in India: A Macroeconomic View The change in monetary policy framework in India towards FIT has to be seen in the context of macroeconomic developments that preceded this major development. Since 2000, a closer examination of the Indian economy indicates that it underwent three distinct phases with different inflation trajectory and policy response (Figure 1). Phase I: Moderate Inflation and Strong Growth, 2000-2008 In 1998, India adopted a multiple indicator approach8 as the monetary policy framework against an earlier regime of monetary targeting in India. The policy operated without an explicit nominal anchor but with low and stable inflation as one of the prime objectives and using interest rates as the primary source of monetary policy transmission. Though the Reserve Bank used a slew of sectoral Consumer Price Indices (CPIs) and the all India Wholesale Price Index (WPI) to understand price movements, monetary policy communication was predominantly based on an assessment of inflation in terms of WPI. The macro-economic scenario in early 2000s was that of an economy experiencing considerable slowdown in growth resulting from a combination of domestic and external factors. Even though the economy saw two years of deficient monsoons in close succession (2002 and 2004), overall food inflation remained benign. Coupled with weakened demand conditions, overall inflation, therefore, remained well inside the comfort zone. Monetary policy at the start of the decade was expansionary to support the growth recovery, with the key policy rates seeing a reduction by 300 basis points during 2001-2005. With growth firming up, underlying inflation pressures started to emerge in early 2005, prompting a reversal of monetary policy stance to a tightening mode. As a result of the implementation of the Fiscal Responsibility and Budget Management (FRBM) rules in 2004, fiscal deficit of the central government which was at 4.3 per cent in 2003-04 was sequentially brought down to 2.5 per cent in 2007-08 and helped to contain the risk of expansionary fiscal policies engendering aggregate demand pressures. The steady capital inflows induced real appreciation of the currency helped to moderate imported inflationary pressures. Furthermore, even as commodity prices started to edge up since 2005 its immediate pass-through was muted on account of administered pricing of many products, especially fuel9. Though inflation, on an average, was steady at 5-6 percent and in line with policy objectives during this phase, by 2008 inflation as measured by WPI breached single digits to a level much above the comfort zone of the Reserve Bank. CPI inflation also registered a sharp increase. A sustained rise in global commodity prices in general and especially that of crude oil and its lagged pass-through to administered prices shot up fuel inflation and through the input cost channel and second round effects fed into the underlying inflation process. Further, the economy was showing signs of over-heating from growth rates in excess of 9 per cent for three consecutive years. Aggregate demand pressures were further accentuated by unprecedented capital flow induced domestic surplus liquidity conditions, which then fueled high credit growth and asset price increases. This was happening even as the policy rate was raised by a cumulative 300 basis points to a peak of 9 per cent in 2008. However, policy rates in real terms, though positive, witnessed a sharp fall. Monetary policy in this period was undertaken in a challenging environment of unprecedented capital inflows. Other than interest rates, a number of monetary policy instruments were used to modulate domestic liquidity and aggregate demand and maintain macro-stability. The cash reserve ratio (CRR) was increased sharply concomitant with rate hikes to mop up surplus domestic liquidity and strengthen monetary transmission. Outright sterilization through market stabilization scheme was also carried out. Furthermore, to modulate leverage and asset price inflation, macro-prudential measures in the form of higher risk weights and provisioning norms were prescribed for bank lending. Phase II: Persistently High Inflation: 2008-2013 In the immediate aftermath of the Lehman Brothers collapse and the resulting contagion in global financial and commodity markets, which snowballed into the global financial crisis (GFC), GDP growth in India saw a sharp fall as in addition to the sharp contraction in external demand, the freeze in foreign financial markets quickly transmitted to a temporary disruption in short-term lending by banks, adversely impacting trade and domestic activity. However, as calm returned to financial markets, by second half of 2009, growth saw a sharp rebound to touch close to 9 per cent in 2010-11 aided by both expansionary fiscal policy and monetary easing. Hence, the large negative output gap at the start of 2009 turned positive in about two quarters time. Inflation as measured by CPI and WPI initially saw considerable divergence, primarily reflecting the larger share of tradable primary commodity in WPI, prices of which slumped immediately in response to the GFC while CPI inflation remained elevated near double digits. A series of supply side commodity price shocks, pushed WPI inflation up from negative territory in early 2009 to around 10 per cent in 2010 and inflation process quickly became generalised. One of the proximate cause of the upturn was the monsoon shock of 2009 and the resultant rise in food inflation. Food price pressures persisted even after the monsoon shocks faded away possibly reflecting the impact of government interventions in agricultural product and labour market-such as sharp increase in Minimum Support prices (MSPs) and enhanced coverage under the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA). Along with this, changes in food consumption pattern in response to rising incomes led to demand supply mismatches in specific food groups. This resulted in relative prices of food to rise sharply during this period. In a scenario of rapidly increasing world oil prices, its pass-through, though partially offset by administered price mechanism led to higher domestic prices. Consequently, given the post-crisis slowdown in potential output, strong demand pressures along with rising input costs, through wages and raw-material prices, quickly transmitted to output prices of goods and services leading to sharp increases in underlying inflation. Furthermore, persistent food and fuel price shocks in a context of low monetary policy credibility led to drift in inflation expectations contributing further to overall inflation persistence10. Monetary policy during this period was characterized first by a normalisation from crisis driven expansionary policies and subsequently to a series of calibrated tightening measures on concerns of inflation persistence while mindful of being the durability of the growth recovery. The monetary policy response at this time was further challenged by difficulties in assessing the state of the economy both due to the difficulties in assessing the extent of loss of potential output and issues relating to data in a scenario of considerable uncertainty. Furthermore, the continuation of an expansionary fiscal stance right up to 2009-10 in the midst of a strong pick-up in domestic demand added further challenges. Subsequently, entrenched inflationary pressures led monetary policy to shift gears to aggressive tightening. However, on concerns of a sharp slowdown in the economy policy rates and signs of moderation in inflation, key policy rates were eased during 2012 and the first half of 2013. The lack of a credible nominal anchor during this period, and the consequent de-anchoring of inflation expectations, has had deleterious impact on overall macro-environment. As documented in the Expert committee report, persistent and elevated inflation in the post-crisis period led to an erosion of savings in view of negative real interest rates on bank deposits, loss of competitiveness and worsening of trade deficit, inter alia, on account of higher gold demand, which was used as a hedge against rising inflation. These macro vulnerabilities led to several concerns on macro-financial stability which manifested in terms of the turmoil following the taper tantrum in 2013. Towards the latter part of 2013 with the availability of all India CPI (Combined) - although with a short history- monetary policy communication began to be increasingly carried out in terms of CPI than WPI. It was in this context that the need for a review of the monetary policy framework was felt and the Expert committee was formed. Phase III: Disinflation and a New Framework: 2014 – till date Following the recommendations of the Expert committee report, the start of 2014 saw RBI endorsing the glide path of CPI inflation – to reach 8 per cent by January 2015 and 6 per cent by January 2016 and moving towards a flexible inflation targeting framework. Though CPI inflation moderated from double digit levels to single digits, it continued to remain elevated and persistent at the start of 2014, as the pass-through of exchange rate depreciation following the taper tantrum played out through the economy even as aggregate demand started to wane. To break the inflation persistence, key policy rates were increased in January 2014 further reinforcing the earlier hikes in the second half of 2013. By the second half of 2014 underlying inflation started to ease on a more sustained basis. This was further aided by sharp fall in commodity prices especially crude oil and the return of a relatively stable exchange rate. Furthermore, in spite of deficient monsoons, food inflation moderated towards the end of 2014 on a combination of better supply management policies, moderate increase in MSPs leading to a correction in the relative price of food, which had been trending sharply upwards post 2008. As a result, headline inflation saw a rapid decline to 5.2 per cent in January 2015, significantly undershooting the glide path target. Along with it household inflation expectations moderated somewhat and expectations on part of professional forecasters became better anchored to the inflation glide path. Since January 2015 inflation conditions evolved generally in accordance with the disinflation glide path reaching 5.7 per cent in January 2016 (below the disinflation target of 6 per cent set for January 2016). The move towards a flexible inflation targeting framework was formalized through an agreement between the RBI and the government in February 2015. As the economy remained within the path of broad-based disinflation, with a view to support growth, in a scenario of renewed concerns on the strength of recovery of global economy, the policy repo rate was reduced by 150 bps during January 2015 to April 2016.The Finance Act 2016 of May 2016 amended the Reserve Bank of India Act, 1934 to state price stability as the primary objective of the monetary policy, adoption of flexible inflation targeting with CPI as the nominal anchor for monetary policy along with the setting up of a Monetary Policy Committee (MPC) to set the policy rate to achieve the inflation objective (GoI, 2016). The amended RBI Act came into effect in June 2016. In August 2016, the Government notified an inflation target of 4.0 per cent, with 6.0 per cent and 2.0 per cent as the upper and lower tolerance levels respectively, for the period up to March 31, 2021. The Government and the Reserve Bank constituted the six member MPC in September 2016. The narrative of the key features of the inflation process since 2000s pointed to the lack of an explicit nominal anchor as a key factor that led underlying inflation to drift upwards. In the absence of a nominal anchor, relative price shocks to fuel as well as food quickly translated into a persistent generalized inflationary process. The large role of food price shocks, especially, and energy price shocks, in shaping Indian inflation dynamics underscores the need for a strong nominal anchor to anchor inflation and inflation expectations11. IV. International Experience with IFT Often, the arguments against IFT in countries such as India point towards the predominant role of supply shocks in driving inflation conditions. International experiences with IFT in countries that previously had weak price stability history, however, suggest that it may in fact help in reducing the amplitude of such shocks. The experiences of New Zealand, Canada, and the Czech Republic show that all three resorted to inflation targeting to deal with an entrenched problem of high and variable inflation (Clinton et al., 2015; Figures 2-4). In Canada and New Zealand high inflation originated with an inadequate framework for resisting inflation impulses from supply shocks in the 1970s. Long-term inflation expectations ratcheted up. Low levels of inflation, and expectations that these would continue over the long run, were eventually achieved. But this was at the cost of substantial loss of output and employment during the transition to price stability.   The experience in the United States is somewhat different, but with a similar outcome at the end (Figure 5). The US Federal Reserve (Fed) policy—never having really broken down—evolved gradually into its current regime, which looks a lot like FIT, although the Fed does not self-identify as an inflation targeter (Alichi et al., 2015). The behavior of inflation and inflation expectations over the last 3 decades has much in common with that in the 3 economies discussed above. By the turn of the century, most central banks that adopted FIT had also set up a forecast and policy analysis system (FPAS), to assist the implementation of flexible inflation targeting—in essence, as a core component of the FIT architecture. Calibrated monetary policy models played a central role. The overriding justification for model calibration—as opposed to equation-by-equation statistical estimation—is that models for useful policy analysis must embody widely accepted theoretical principles, and yield empirically plausible predictions. Traditionally estimated econometric models may not exhibit desirable properties. Econometric estimation also suffers from its sensitivity to deficiencies in data which made it a non-viable option for countries like New Zealand and the Czech Republic. On a comparative perspective, the inflation in India showed similar pattern as that in the FIT countries discussed above, except in the 1970s, a period which was plagued by oil shocks, droughts and war (Figure 6). There are stark similarities with the nature of problems that countries like New Zealand, Canada, and the Czech Republic experienced at the time they adopted inflation targeting with that faced by India during the years preceding the FIT. Yet, there are a number of challenges that remain peculiar to India, some of which are detailed below. V. Challenges for Implementing FIT in India Transmission Mechanism Weaknesses First and foremost, it is imperative to take into account the key India specific characteristics of the monetary policy transmission mechanism. Monetary policy transmission process is found to be having multiple channels with interest rate emerging as the most important monetary policy transmission channel12. Bank lending channel was also seen to exist and complement the interest rate channel13. Asset price and exchange rate channel of monetary policy transmission, however, were found to be feeble in India14. On the interest rate transmission channel, historically while the transmission of policy rates to money markets and financial market rates has been fairly complete, the transmission to medium term bank lending rates was, however, sluggish (Figure 7). The Expert committee highlighted a number of impediments to the transmission of policy rate to lending rates, with administered interest rates, statutory preemptions, rigidities in deposit rate structure and lack of external benchmarks being the most prominent. Administered interest rates take the form of interest rate on small saving schemes which is administered by Government policy. Small saving interest rates represents in one sense the floor for savings deposit rates and during phases of monetary easing, if time deposit rates of banks fall below the administered small savings rates it could result in a situation wherein the bank deposits migrate to small saving schemes in search of higher returns. This could be alleviated in future as government of India on February 16, 2016 announced measures to align the small saving interest rates with the market rates of the relevant Government securities. Furthermore, a large part of deposits of banks are retail based and the fixed tenure of deposits gives a rigidity to the cost of funds structure of banks. Creation of floating deposit rate products also face the challenge of lack of a transparent external money market benchmark for pricing. High levels of statutory preemptions often lead to crowding out of credit and artificially suppress the long term risk free interest rates, impeding transmission of policy rates to longer rates. Another factor that has a significant bearing on the transmission process is the impact of exogenous capital flows induced bouts of volatility in domestic liquidity conditions. In the face of overwhelming inflows, capital flows that are left unsterilised has a considerable bearing on overall monetary and financial conditions, as was seen in the mid-2000s. At a much broader level, the recourse to informal finance by a considerable section of the population, even as financial inclusion through institutional sources have made tremendous progress over the last decade, undermines the efficacy of monetary policy impulses in influencing aggregate demand. Impediments to transmission can also arise on account of the pricing structure for loans followed by banks in India. This would come about in the form of computation of Base Rate15 based on average cost of funds by banks resulting in lending rate pricing to be less sensitive to changes in policy rate. Since April 2016, the Reserve Bank has made it mandatory for all banks to arrive at the Base Rate using marginal cost of funds. Importance of Food Prices to Changes in the CPI Food group constitutes about 46 per cent of the CPI basket in India and the high share of food in CPI poses a significant challenge in FIT implementation. Food prices are highly susceptible to supply shocks, which often manifest in India in the form of vagaries of rainfall and its impact on agricultural output. Also, the changes in the underlying structure of the economy and shifts in composition of demand could generate trends in relative price of food which may lead to a secular divergence between food and non-food inflation (Figure 8). In such a scenario, the efficacy of FIT could be questioned. Finally, there are a number of interventions of the government in agricultural product markets such as setting of minimum support prices and in labor markets in the form of employment guarantees and minimum wages. In terms of the conceptual framework, monetary policy affects the rate of inflation in the short and medium term through the effect of the output gap on non-food non-fuel prices. This would be typically incorporated into a macro model, wherein the Phillips curve operates through the sticky prices of the core consumption basket. The high weight on food therefore dilutes the medium-term effect of policy rate changes on overall CPI inflation. In addition, the high variance of food prices introduces noise into the inflation rate that makes it difficult for the public and policymakers alike to perceive the influence of monetary policy. While recognizing the importance of swings in food prices in conditioning the medium-term fluctuations in the CPI and the historical dominance of the food component in major cycles of inflation in India, one should not use it as an argument against FIT. Rather, it underscores the major weakness in the erstwhile policy regime: that it did not provide a firm nominal anchor to buck the pass-through of food price shocks to generalized inflation. Under a credible monetary policy regime with stable long-run inflation expectations, the relative price changes, which monetary policy is powerless to affect, could have taken place through one-off changes—without extended pass-through effects—to the overall inflation. In India, some lags in the adjustment of prices to shocks is inevitable, especially in those administered by the government. This, however, merely spreads out the shock but with stable expectations the effect of supply shocks on inflation would be transitory in a credible monetary policy regime. An established FIT program, therefore, provides an effective strategy for dealing with the second round effects of supply shocks. First, a credible long-run inflation target serves as an anchor to expectations. Second, the central bank reinforces the anchor by publishing a forecast that shows a medium-term path back to target along with its assessment of the channels through which the inflation adjusts back to the target taking into account all the intrinsic lags in the adjustment process. As the FIT gains credibility, and wins the public confidence in its ability to ensure price stability even in an economy subject to price level shocks, inflation expectations would remain aligned to the medium-term target, which in itself would ensure that the effects of supply shocks on inflation remain transitory. The strong relative price trend, on the other hand, creates substantive uncertainties, and become a communication problem. Trending relative prices would raise questions on the legitimacy of the use of core inflation in policy formulation as core inflation may turn out to be a systematically downward-biased indicator of headline inflation. The communication becomes challenging following a food price shock, as the authorities cannot point to core inflation to reassure the public that policy is on the right track when the target it expressed is in terms of headline inflation. The challenge to monetary policy communication during a period of trending relative prices, therefore, lies in providing an assessment of the likely size and duration of the relative price trend. No Track Record—the Challenge of Building Credibility Before the introduction of the FIT, the RBI did not have an explicit price stability mandate as its overarching objective. Therefore, the public has no historical record from which it can judge the commitment of the RBI to the announced long-run inflation target, or whether its actions to this end will prove effective. Despite the regime change, the history of high and unstable inflation doubtless weighs heavily in the public mind. Credibility, therefore, can be established earned, over time, by achieving announced objectives, and by effective, transparent communications. On the other side, it can be lost through policy actions inconsistent with stated objectives. Expectations may absorb or amplify an inflation shock, the mechanism of which is illustrated in Figure 9. In the event of an inflationary shock, even if the central bank raises the policy rate, the effect on the economy depends on how the public interprets this action. Credibility results in shock absorption. If the rate hike is perceived as the assertive response by a credible central bank, long-term inflation expectations remain stable, and the policy action raises the real rate. In addition, uncovered interest parity implies a drop in the real price of foreign exchange:  Where: r is domestic real interest rates, z is real exchange rate and μ is shock to interest rates. With the tightened monetary conditions, demand is reduced, a negative output gap is opened, and inflation returns without unusual delay to the long-run target.  In the worst situation, unanchored expectations amplify the initial impact of the shock, and propagate to yield a prolonged inflation spiral. An observer might think that policy rate increases are ineffectual in the fight against inflation, whereas the real problem is that the policy actions are insufficiently aggressive given the shaky confidence in the ability to deliver on the price stability objective. During the initial years of adoption of FIT, the credibility evolves gradually, which helps in keeping the economy in between the two above discussed scenarios. It could also be possible that credibility-building happens at a rate faster or slower than expected, and such dynamics should be clearly accounted for while calibrating the models for policy simulation. VI. Quarterly Projection Model Having discussed the key challenges faced in implementation of FIT, we now turn to the core Quarterly Projection Model (QPM) to illustrate its key properties and how some of these issues are addressed within the overall structure of QPM. Overview The foundation for the QPM family of models is a forward-looking, 4-equation, open-economy model for monetary policy. Endogenous variables are output gap, inflation, interest rate, and exchange rate. This set-up is a standard modern day workhorse for forecasting and monetary policy analysis. Table 1 lists the behavioral equations of the core-QPM. This model omits sectoral details which are explained in detail in the production-QPM16, which encompasses more elaborate dynamics. It also contains a quadratic loss function, which embodies a more realistic view of policymaking under FIT than the linear reaction function in the production model—while small deviations from desired outcomes may be tolerable, very large deviations can lead to dark corners (e.g. inflation spirals or deflation traps) that should be avoided like the plague (Blanchard, 2014). The output gap responds to the real interest rate and the real exchange rate. The expectations-augmented Phillips curve allows for a trade-off between output and inflation in the short run, but not in the long run. The exchange rate is determined via an uncovered interest parity condition that allows for a risk premium. However, this is modified to reduce the sensitivity of exchange rates to interest rate differentials so as to capture frictions relevant to India (e.g., capital controls and developing financial markets). A loss function penalizing deviations of inflation from the target, output gaps, and interest rate variability determines monetary policy—and hence the interest rate. Expectations are a combination of model-consistent (i.e., rational) and backward-looking components. Figure 10 illustrates how the FIT works. A crucial aspect of this is the feedback to the short-term interest rate (policy rate), which is the instrument of monetary policy (the feedback is depicted by dashed red lines in the chart).  The policy interest rate is endogenous consistent with the nominal anchor to the system implying that the interest rate has to follow a path consistent with the long-run inflation target. For any initial deviation from target, however, there are many alternate interest rate paths that would bring inflation back on track over the medium term: for example, large early rate changes may get inflation on target quickly, but with a substantial adverse impact on output; more gradual policy actions will achieve the target more slowly, but with less adverse impact on output. Using this framework, alternate interest rate paths could be generated, which are consistent with inflation target, based on policy makers assessments of underlying macroeconomic situation. Some Specific Features of Core-QPM  In view of the newness of the FIT regime, we assume that it takes time to establish its credibility. Thus expectations formation includes a credibility building process (Table 2). The central bank adds to its credibility stock by demonstrating that it is achieving the policy goal. There are 2 types of expectation building processes. The first type is optimistic yet watchful: it attaches a positive weight (ct) to the central bank’s intermediate target for inflation (i.e., the central bank’s own forecast), but also some weight (1-ct) to actual observed inflation. A good signal for credibility, reinforcing optimism, is when inflation falls towards the long-run target more quickly than the central bank forecast. The second type, conditioned by history, is skeptical. It puts some weight on the high levels of the past17, as well as on actual inflation, but ignores the central bank forecast. A bad signal is when inflation is above the rate expected by the skeptics.  Monetary policy minimizes a quadratic loss-function, which penalizes squared deviations from output and inflation objectives and large short-run interest rate changes. It is common to use a linear (Taylor-type) rule to characterize monetary policy under inflation targeting. Such an approach may be adequate for normal situations, which are not near dark corners—in other words, deflation or high inflation traps. For India the relevant dark corner could be a situation in which expectations of high inflation become so entrenched that their elimination would require huge costs in lost output and employment. Monetary policy would need to put an increasing marginal cost on deviations from target as they grow. Policymakers avoid sharp interest rate changes. The penalty in the loss function for steep policy rate changes reflects the well-known preference of policymakers for gradual rate movements. This has the economic rationale that policymakers uncertain about the source or the duration of a shock will proceed cautiously. In addition, more variable changes in rates are liable to convey less information to the public about the stance of monetary policy. A given policy rate change has more effect on longer-term interest rates and the exchange rate, if there is less noise in its movements. VII. Illustrative Core-QPM Monetary Policy Experiments The most important function of a QPM type of model is to be a tool for policy maker to assess the implications of alternate policy options under periods of uncertainty. We trace out a few plausible scenarios in the Indian context so as to illustrate the policy options and their likely implications using the QPM. Disinflation This experiment derives paths for endogenous variables in a disinflation goal that would take inflation from 5 percent to 4 percent. Minimizing the loss function ensures that the latter is achieved at the lowest cost in terms of loss in output and interest rate variability. We assume an initial equilibrium with 5 percent inflation, and hence a nominal interest rate of 7 percent (or a real rate of 2 percent). With initial credibility not very high, the central bank has to hike the policy rate in the baseline (Figure 11). The uncovered interest parity condition warrants a drop in the exchange rate (i.e. appreciation of the rupee), under no further shocks to the system. The combination of interest rate increase and exchange rate appreciation reduces demand, and opens a negative output gap. Inflation declines first by the impact of the stronger rupee, and then, increasingly over time, by the negative output gap. The cost in terms of cumulative forgone output is 2 percent of annual GDP (i.e. sacrifice ratio of 2). Hawkish policymakers would achieve the long-run target slightly faster than the baseline. But they would raise the policy rate more, triggering a sharper appreciation, a wider medium-term negative output gap, and hence a larger sacrifice ratio. Dovish policymakers, in turn, with a higher weight on the output gap, would tighten monetary conditions less than baseline and hence the sacrifice ratio will be lower. Figure 12 shows a path generated under the assumption that the policy stance is fully credible. The 1-percent reduction in inflation is achieved within a 6 quarter time horizon, at lower cost of lost cumulative output—one-half percent of annual GDP. In the baseline, the tightening of policy is achieved without any increase in the policy interest rate—in effect, the required increase in the real rate is achieved entirely through the reduced expectations of inflation. In the case where policymakers place more weight on deviations of output from long-run equilibrium, the more gradual approach further reduces the output cost. Where policymakers exhibit willingness to tolerate short-term loss of output and employment and accordingly place less weight on the output gap, there is a small policy rate increase, and a slightly higher sacrifice ratio. But clearly, policymakers’ preference on the output gap makes little material difference to outcomes in the prefect credibility situation. Mitigating Demand Shocks—the Divine Coincidence Under optimal policy, the central bank raises (cuts) the policy rate to deal with positive (negative) demand shocks (Figure 13). Dealing with such shocks does not create a conflict between output and inflation objectives—the divine coincidence (Blanchard and Gali, 2007). With the prompt, active response to the shock, inflation is held close to baseline in each case. Given the flat Phillips curve under excess supply conditions, the widening of the output gap has to be somewhat greater for the negative than for the positive shock. Because inflation is well controlled, the demand shocks have no major impact on credibility. Mitigating Supply Shocks—Trade-offs A nasty supply shock requires an increase in interest rates and a larger negative output gap (relative to baseline) to maintain the path to the 4 percent long-run target (Figure 14). The medium-term trade-off is between the speed of the approach to the target, and the size of the output gap. A prompt and aggressive approach prevents long-term inflation expectations from ratcheting upwards, and preserves credibility, but has higher costs in terms of short-run output. By contrast, a favorable supply shock presents an attractive trade-off: inflation moderates relative to baseline, and reaches 4 percent sooner; monetary policy eases; and output gap closes faster. The policy conflict can be seen more starkly in the context of repeated supply shocks (Figure 15). A sequence of nasty supply shocks requires a more aggressive tightening in monetary conditions, and a steep widening of the output gap. Even so, in the medium term inflation increases considerably—the short-run policy trade-off (“stagflation”) looks bad. Monetary policy credibility takes a hit. Policy would, however, be successful in preventing long-term inflation expectations from ratcheting up—even with bad luck, a committed central bank can still successfully anchor long-term inflation expectations. Importance of Prompt Action versus Delay in Policy Response In the previous experiments prompt effective action helped reduce the losses to output and monetary policy credibility following supply shocks. The importance of timely policy action can be shown with an experiment in which policymakers wait before responding to a big nasty supply shock. If the policy action is delayed the interest rate hike has to be much greater than under a baseline response, and the cumulative output gap is larger, albeit with higher inflation (Figure 16). Thus a delay in policy response causes a substantial deterioration in the medium-term output-inflation trade-off. Importance of Credibility Even when policy is perfectly credible, a sequence of nasty shocks poses a dilemma—and the longer the sequence the greater could be the deterioration in the policy trade-off. In the medium term, the interest rate goes up, a negative output gap widens, but inflation rises (Figure 17). There is a loss of policy credibility. Policy does succeed eventually in getting inflation back on target, and restoring reputation, but the costs in terms of lost output are substantial. The credibility factor may not fully eliminate the costs of dealing with supply shocks, but it does allow policymaker some leeway in terms of timing. Figure 18 compares prompt action with delayed action under perfect credibility which indicates that delay does little damage. However, repeated delays could, undermine the credibility. This paper attempts to provide a broad overview of the analytical underpinnings of FIT implementation. Historical experiences of countries which have adopted inflation targeting have shown that having a credible policy with an emphasis on strong nominal anchor can reduce the impact of supply shocks to inflation and improve macroeconomic stability. The core-QPM outlined in the paper traces out the India specific features and provides a flavor of how a QPM can be useful in FIT implementation. Illustrative experiments highlight the challenges confronting monetary policy under different types of uncertainty and show that if credibility is earned and preserved, monetary policy efficacy improves substantially. @ The paper is the outcome of the technical collaboration between RBI and IMF to develop a quarterly projection model for India. The authors would like to express their sincere thanks to B.K Bhoi, Sitikantha Pattanaik, Muneesh Kapur, Rajesh Singh, Rudrani Bhattacharya and anonymous referees for valuable comments on the paper. The authors would also like to express their gratitude for the comments received from the participants of the Department of Economic and Policy Research (DEPR) study circle presentation series. 1 The views expressed in the paper are attributable to the authors only and do not necessarily represent those of the institutions to which they belong. All other usual disclaimers apply. Corresponding author: Email 5 Benes et al., 2016, “Quarterly Projection Model for India: Key Elements and Properties”, Reserve Bank of India Working Paper WPS 08/2016. 6 The term inflation forecast targeting is due to Svensson (1997). 7 This paper assumes that the central bank sets policy rate with the objective of keeping short-term market rate of interest at any desired level. Central banks normally have close control only over a very short-term interest rate, typically an overnight rate (e.g. the federal funds rate in the United States). In advanced economies this has an overriding influence on money market interest rates in general—and hence a significant influence over the longer-term rates affecting households and firms. These linkages are weaker in developing economies such as India—one of the challenges discussed below. 8 Under the multiple indicator approach, interest rates or rates of return in different markets along with movements in currency, credit, fiscal position, trade, capital flows, inflation rate, exchange rate, refinancing and transactions in foreign exchange – available on a high frequency basis – were juxtaposed with output data for drawing policy perspectives. 10 A list of studies on inflation process in this period include Patra and Ray (2010), Basu (2011), Gokran (2011), Darbha and Patel (2012), Nadhanael (2012), Patra et al. (2014), Gulati et al. (2013), Sonna. et al. (2014), Mohanty and John (2015) , Bhattacharya and Gupta (2015). 11 See Rajan R. (2014), Anand et al. (2014). 12 See RBI (2005), Mohan, R. (2008), Patra and Kapur (2010), Aleem (2010), Bhattacharya et al. (2011), Khundrakpam and Jain (2012), Kapur and Behera (2012), Mohanty (2012),Kletzer ((2012), RBI (2014), Das (2015). 13 See Pandit, et al. (2006), Bhaumik et al. (2011), Bhatt and Kishor (2013) 14 See Singh and Pattanaik (2012), Khundrakpam. (2007), Bhattacharya et al. (2008), Khundrakpam and Jain (2012). 15 Base rate for loans by commercial banks refers to rates based on those elements of the lending rates that are common across all categories of borrowers, and as such it represents the ‘floor’ for bank lending rates to which spread components are added to arrive at the lending rate for a particular borrower. References Aleem, A. (2010), “Transmission Mechanism of Monetary Policy in India”, Journal of Asian Economics, 21, 186-197. Alichi, A., H. Chen, K. Clinton, C. Freedman, M. Johnson, O. Kamenik, T. Kışınbay, and D. Laxton (2009), “Inflation Targeting Under Imperfect Policy Credibility,” IMF Working Paper 09/94. Alichi, A., Clinton, K., Freedman, C., Kamenik, O., Juillard, M., Laxton, D., Turunen, J. and Wang, H. (2015), “Avoiding Dark Corners: A Robust Monetary Policy Framework for the United States”, IMF Working Paper 15/134. Anand, R., D. Ding, and V. Tulin (2014), “Food Inflation in India: The Role for Monetary Policy,” IMF Working Paper 14/178. Basu, K.(2011), “Understanding Inflation and Controlling It”, Economic and Political Weekly, Vol.46, No.41, Oct 8-14, 2011. 50-64. Benes et al.(2016), “Quarterly Projection Model for India: Key Elements and Properties”, Reserve Bank of India Working Paper WPS 08/2016. Bhatt, V. and K. N. K. Kishor (2013),“Bank Lending Channel in India: Evidence from State-Level Analysis”, Empirical Economics, Vol. 45, No.3. Bhattacharya, R., I. Patnaik, and A. Shah (2008), “Exchange Rate Pass-through in India”, Macro/Finance Group at NIPFP,[Online]. Available at: http://macrofinance.nipfp.org.in/PDF/BPS2008_erpt.pdf. Bhattacharya, R., I. Patnaik and A. Shah (2011), “Monetary Policy Transmission in an Emerging Market Setting”, IMF Working Paper 11/5. Bhattacharya, R. and A. S. Gupta (2015), “Food Inflation in India: Causes and Consequences”, NIPFP Working Paper No. 2015-151, June Bhaumik, S. K. ,V. Dang, and A. M. Kutan (2011), “Implications of Bank Ownership for the Credit Channel of Monetary Policy Transmission: Evidence from India”, Journal of Banking & Finance, Vol. 35, No. 9, pp. 2418 – 2428. Blanchard, O., and J. Gali (2007), “Real Wage Rigidities and the New Keynesian Model,” Journal of Money, Credit, and Banking, Vol. 39, No. 1, Supplement, pp. 35-65. Blanchard, O.(2014), “Where Danger Lurks,” Finance & Development, Vol. 51, No. 3, September. Clinton, K., Freedman, C., Juillard, M., Kamenik, O., Laxton, M. D., & Wang, H.(2015), “Inflation-Forecast Targeting: Applying the Principle of Transparency”, IMF Working Paper 15/132. Darbha, G. and U. R. Patel (2012), “Dynamics of Inflation ‘Herding’: Decoding India's Inflationary Process”, Working Paper 48, Global Economy and Development, Brookings. Das, S. (2015), “Monetary Policy in India: Transmission to Bank Interest Rates”,IMF Working Paper 15/129. Freedman, C., and D. Laxton (2009), "Why Inflation Targeting?" IMF Working Papers 09/86. Gokarn, S. (2011), “The Price of Protein”. Macroeconomics and Finance in Emerging Market Economies, 4(2); 327–335. Government of India (2013), “Report of the Financial Sector Legislative Reforms Commission, Volume I: Analysis and Recommendations”, March. Government of India (2015), “Agreement on Monetary Policy Framework between the Government of India and the Reserve Bank of India”, February. Available at http://finmin.nic.in/reports/MPFAgreement28022015.pdf Government of India (2016), “Amendments to The Reserve Bank Of India Act, 1934,Chapter XII, Miscellaneous, Part I, The Finance Act 2016”, pp. 82-87, May. Available at www.cbec.gov.in/htdocs-cbec/fin-act2016.pdf Gulati, A., S. Jain, and S.Nidhi (2013). “Rising Farm Wages in India: The ‘Pull’ and ‘Push’ Factors”. Commission for Agricultural Costs and Prices Discussion Paper No. 5. Kapur, M. and H. Behera (2012), “Monetary Transmission Mechanism in India: A Quarterly Model”, RBI Working Paper 9/2012. Khundrakpam, J. K. (2007), “Economic Reforms and Exchange Rate Pass-Through to Domestic Prices in India”, BIS Working Papers 225, Bank for International Settlements. Khundrakpam, J.K.(2008), “How Persistent is Indian Inflationary Process, Has it Changed?,” Reserve Bank of India Occasional Papers Vol. 29, Monsoon 2008. Khundrakpam, J. K. and R. Jain (2012), “Monetary Policy Transmission in India: A Peep Inside the Black Box”, RBI Working Paper 11/2012. Kletzer, K.(2012), “Financial Friction and Monetary Policy Transmission in India,” in Chetan Ghate, ed., the Oxford Handbook of the Indian Economy, Oxford/New Delhi: Oxford University Press. Mohan, R.(2008), “Monetary Policy Transmission in India,” in Transmission Mechanisms For Monetary Policy In Emerging Market Economies, Bank for International Settlements 2008, Vol. 35, pp 259-307. Mohanty, D.(2012), “Evidence on Interest Rate Channel of Monetary Policy Transmission in India”, RBI Working Paper 6/2012. Mohanty, D. and J. John, 2015, “Determinants of inflation in India”, Journal of Asian Economics, Vol. 36, pp. 86 - 96 Nadhanael, G.V. (2012), “Recent Trends in Rural Wages: An Analysis of Inflationary Implications”, Reserve Bank of India Occasional Papers, Vol. 33, No. 1 & 2: Pandit, B.L, A. Mittal, M. Roy and S.Ghosh (2006), “Transmission of monetary policy and the bank lending channel: analysis and evidence for India”, DRG Study No.25, Reserve Bank of India. Patra, M. D., and P. Ray (2010), “Inflation Expectations and Monetary Policy in India: An Empirical Exploration”, IMF Working Paper 10/84. Patra, M.D., and M. Kapur (2010), “A Monetary Policy Model without Money for India”, IMF Working Paper No.10/183. Patra, M. D, J. K. Khundrakpam, and A. T. George (2014), “Post-Global Crisis Inflation Dynamics in India: What has Changed?”, in Shah S., B. Bosworth and A.Panagariya eds. India Policy Forum 2013-14, Volume 10, Sage Publications, July. Rajan, R.(2014), “Fighting Inflation,” speech delivered at FIMMDA-PDAI Annual Conference, February 26. Reserve Bank of India (2005), Report on Currency and Finance, 2003-04. Reserve Bank of India (2014), “Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework”, January. Singh, B. and S. Pattanaik (2012), “Monetary Policy and Asset Price Interactions in India: Should Financial Stability Concerns from Asset Prices be Addressed Through Monetary Policy?”, Journal of Economic Integration, Vol. 27,167-194. Sonna, T., H. Joshi, A. Sebastian and U. Sharma (2014), “Analytics of Food Inflation in India”, RBI Working Paper Series 10/2014. Svensson, L. E.(1997), “Inflation forecast targeting: Implementing and monitoring inflation targets”, European Economic Review, 41(6), 1111-1146. |

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: