IST,

IST,

Report of the Committee on MIBOR Benchmark

|

April 22, 2024 Shri Shaktikanta Das Sir, Report of the Committee on MIBOR Benchmark We are pleased to submit the Report of the Committee on MIBOR Benchmark. The Committee was set up to undertake an in-depth review of existing Rupee interest rate benchmarks in the country, study international experiences, examine the issues related to MIBOR benchmark rate, including the need for transition to an alternate benchmark, and suggest the most appropriate way forward. We thank you for entrusting this responsibility to the Committee and hope that the recommendations of the Committee will help further development of rupee interest rate derivatives market in India.

The Committee would like to thank Shri Shaktikanta Das, Governor, Reserve Bank of India (RBI), for giving the Committee an opportunity to examine the issues pertaining to interest rate derivatives market in India and the MIBOR benchmark. The Committee expresses its sincere gratitude to Dr. Michael Debabrata Patra, Deputy Governor, RBI, for providing continuous encouragement and guidance. The Committee immensely benefitted from the expertise of Shri Muneesh Kapur, who shared his insights on money markets during the deliberations of the Committee. The Committee would like to place on record its deep appreciation for the excellent secretarial support provided by the team from Financial Markets Regulation Department led by Shri Saswat Mahapatra. A special word of appreciation is in order for Ms. Nivedita Banerjee, Shri Arun Kumar and Shri Abhishek Kumar. Meticulous organisation of meetings and other logistic support by Shri Anup Singh, Shri Pratik Yadav, Shri Karan Raibole and Shri Rahul Parmar from the Secretariat team is also acknowledged. The interest rate derivatives (IRD) market in India has shown remarkable development over the last decade. The total outstanding IRD contracts in the market have increased from ₹ 18 lakh crore in 2014 to ₹ 100 lakh crore in 2024. The market is characterized by a high degree of electronic trading and central clearing, not generally seen in other markets. This has ensured price transparency and formation of a significant liquidity pool facilitating efficient execution of large trades. With the participation of non-residents in the onshore market from 2019, the IRD market has further deepened. In India, as well as internationally, there has been a structural change in the funding markets, with the collateralised money markets gaining importance; prompting interest rate benchmarks such as the Secured Overnight Financing Rate (SOFR) in the United States, Swiss Average Rate Overnight (SARON) in Switzerland, among others, gaining prominence in the post-LIBOR world. There have been other developments in the economy, such as banks pricing loans on external benchmarks, which have increased the hedging requirements for interest rate risks. It was announced in the Statement of Development and Regulatory Policies dated August 5, 2022 that a Committee on Mumbai Interbank Outright Rate (MIBOR) benchmark will be set up to review the interest rate benchmarks in India, with a special focus on the MIBOR, and study international experiences in development, usage and transition involving interest rate benchmarks. In accordance with the Terms of Reference (ToR), the Committee has provided recommendations to further develop the IRD market and improve the credibility of interest rate benchmark rates. The first chapter of the report lays down the details of the composition and ToR of the Committee. The second chapter charts the developments underpinning the growth of IRDs in India. Efforts to develop the market had begun in 1999, when over-the-counter (OTC) rupee derivatives in the form of Interest Rate Swaps (IRS) and Forward Rate Agreements (FRAs) were first introduced. Over time, regulatory and developmental initiatives have continued to facilitate market liquidity, transparency, integrity, and participation. Recent years have seen further efforts to improve market infrastructure, facilitate product innovation, widen participant base and encourage participation. Buoyed by the various policy initiatives and efforts of market participants as well as the general development of the financial system and the broader economy, the Rupee IRD market has grown over the years. The third chapter presents an overview of the current state of the IRD market in India, where MIBOR-based overnight indexed swaps (OIS) contract is the predominant instrument, accounting for almost 86 per cent of the ₹ 100 lakh crore of outstanding IRD contracts. Market-making in IRDs is concentrated among foreign banks, private sector banks and standalone primary dealers, with public sector banks playing a relatively small role. Over time, and on the back of regulatory measures, the onshore and offshore rupee IRD markets have become more integrated. The fourth chapter assesses the global landscape of IRDs. According to BIS data in March 2023, IRSs constituted 83 per cent of the US$ 574 trillion outstanding global OTC IRD transactions. Different jurisdictions have favoured IRS instruments tied to specific benchmarks, with a common practice being the concentration of liquidity in one main IRS product. Additionally, the market offers a range of other IRS products catering to specific needs. Market-makers manage the risk arising from multiple benchmarks through basis swaps, which have become crucial, especially during the transition from LIBOR to alternate reference rates. Chapter five discusses the considerable dependence of the domestic market on a single IRD instrument – the MIBOR-based OIS, and its implications. The Committee noted that as the interest rate risk differs across participants, a single IRS instrument is unlikely to fully capture the varied interest rate risks representing the underlying interest rate variables. While different interest rate benchmarks exhibit correlation with each other, hedging of interest rate risk arising from one benchmark using a derivative based on another engenders basis risks. The Committee also noted cases where market-determined benchmarks were not being used for linking of loans, which may lead to further challenges in hedging of interest rate risk. With regard to MIBOR OIS, the Committee noted the risks associated with concentration of activity around a single benchmark under circumstances where it may become less reliable, inaccurate, or unrepresentative of the underlying market it is intended to measure. Chapter six discusses recent developments in the money market along with its implications on MIBOR. The Committee reflected on the paradigm structural change in money markets, which have witnessed a shift towards secured overnight markets comprising banks and non-banks, and away from uncollateralised inter-bank markets; both globally as well as domestically. The Committee observed that the MIBOR which is computed based on call money market transactions, is drawing on a progressively lower number and volume of transactions, and deliberated on possible approaches to make the rate more robust and reliable. Chapter seven examines the case of transitioning from the MIBOR to a potentially more robust alternate benchmark, as the primary underlying for IRDs. The Committee noted that the current overnight benchmarks in the Indian markets are not incorporating transactions from the TREP segment, even though the TREP segment constitutes around 70 per cent of the total money market transactions. The Committee assessed the rates derived from the TREPS / basket repo market vis-à-vis the call money market on the criteria of correlation and volatility, to assess their suitability as an alternate benchmark rate for MIBOR. The Committee noted that transition to an alternate benchmark would entail multiple challenges, such as potential disruption of current market environment, information technology (IT) and system-related challenges at the end of market-makers, potential fragmentation of market liquidity etc. Separately, the Committee also deliberated on the need to develop a range of IRD products along with improvements in associated market infrastructure, with an overall objective of further market development. The Committee’s recommendations are covered in chapter eight of the report. The recommendations have been divided into those related to MIBOR and MIBOR OIS, and those related to IRDs. Recommendations related to MIBOR and MIBOR-based OIS: (a) FBIL may change the methodology for computation of MIBOR to include call transactions based on the first three hours instead of the first hour. (b) FBIL may develop and publish a benchmark based on the secured money market – Secured Overnight Rupee Rate (SORR), computed from trades in first three hours of the basket repo and the TREP segments. (c) FIMMDA may draw up the operational guidelines and market conventions for transactions in IRD based on SORR. CCIL may develop the requisite trading and clearing infrastructure for the instrument. (d) Transition to proposed SORR based IRD, from MIBOR OIS, may be considered only when reasonable liquidity develops in the new IRD. In the interim, market participants may continue using IRDs based on both the benchmarks. Recommendations related to IRDs: (a) The access of non-residents to the onshore IRD markets, beyond MIBOR OIS, for purposes other than hedging may be permitted in a gradual manner based on an assessment of the evolving market conditions and subject to appropriate risk-controls. (b) The sectoral regulations for various financial sector participants (NBFCs, mutual funds, insurance companies, etc.) may be reviewed with a view to providing flexibility to these institutions to manage their interest rate risks with flexibility and efficiency. (c) Banks may review the possibility of pricing of small ticket advances based on market-determined benchmarks, including term benchmarks. (d) FIMMDA may set up a Working Group of market participants to deliberate on the various aspects of developing a market for basis swaps and also finalise market conventions in this regard. (e) FBIL may expand the bouquet of term benchmarks in consultation with market participants. FIMMDA may develop market conventions for such products in consultation with market participants. (f) CCIL may examine offering electronic trading, central clearing, and dissemination of anonymized trade information for a larger bouquet of IRD products. 1.1 It was announced in the Statement of Development and Regulatory Policies dated August 5, 2022, that: The Mumbai Interbank Outright Rate (MIBOR) based overnight indexed swap (OIS) contracts are the most widely used interest rate derivatives (IRDs) in the onshore market. The usage of MIBOR based derivative contracts has increased with steps taken by the Reserve Bank to diversify the participant base and facilitate the introduction of new IRD instruments. At the same time, the MIBOR benchmark rate, calculated based on call money deals executed on the NDS-call platform in the first hour after market opening, is based on a narrow window of transactions. Internationally, there has been a shift to alternate benchmark rates with wider participant bases (beyond banks) and higher liquidity. Amidst these developments, it is proposed to set up a committee to undertake an in-depth examination of the issues, including the need for transition to an alternate benchmark, and suggest the most appropriate way forward. 1.2 Accordingly, a Committee on the MIBOR benchmark was constituted with the following terms of reference: • Review of existing Rupee interest rate benchmarks in the country. • A study of international experiences in developing / use of interest rate benchmarks and issues related to migrating to new benchmarks with a view of drawing lessons relevant to the Indian context. • Review of quality, setting methodology and dissemination time of the MIBOR. • Review of the use of MIBOR for financial contracts and examine the need for transition to new benchmarks, if necessary.

• Any other issue pertinent to the subject. 1.3 The Committee comprises of the following: i. Shri R. Subramanian, Executive Director, RBI – Chairperson ii. Shri Debadatta Chand, Managing Director & CEO, Bank of Baroda - Member iii. Shri. Nand Kishore*, Chairperson, FIMMDA & Deputy Managing Director, Global Markets, SBI - Member iv. Shri Hitendra Dave, CEO, HSBC, India - Member v. Shri Rudra Narayan Kar, Former CEO, FBIL - Member vi. Shri Prasanna Balachander, Group Executive & Head, Global Markets, ICICI Bank - Member vii. Shri Shailendra Jhingan**, Managing Director & CEO, ISEC PD - Member viii. Shri Ashhish Vaidya, Managing Director & Head of Treasury, DBS Bank - Member ix. Dr. Samiran Chakraborty, Chief India Economist, Citibank – Member 2. EVOLUTION OF THE INTEREST RATE DERIVATIVES MARKET IN INDIA 2.1 Derivatives have come to play an important role in the financial markets the world over. These instruments allow users to unbundle risks and allocate them to investors who are the most willing and able to assume them. This has brought substantial benefits to the businesses in facilitating hedging and has enabled financial institutions to offer a progressively wider range of services, achieve greater efficiency in the intermediation process as well as avail of trading opportunities for their own gains. 2.2 Derivative contracts are of two broad types based on how they are traded by market participants. They can be exchange-traded or dealt with over-the-counter (OTC). While exchanges offer standardized contracts which are traded anonymously; the OTC segment provides the option of tailor-made bilateral arrangements and choice of counterparty. OTC derivatives are bilaterally negotiated but are increasingly being traded on electronic traded platforms. Globally, the derivative market is largely OTC. Data from the Bank for International Settlements (BIS) indicates that the notional amount outstanding of OTC derivatives amounted to US$ 717 trillion, as of March 2023, across derivatives on interest rate, foreign exchange, equity, commodity and credit. Of this, interest rate derivatives (IRDs) accounted for 80 per cent of the outstanding OTC derivative contracts. 2.3 In India, interest rate and currency derivatives trade both OTC as well as on exchanges while equity and commodity derivatives trade primarily on exchanges. The market for credit derivatives is yet to substantially evolve in the country though the regulatory framework provides for both OTC and exchange traded credit derivatives. The interest rate derivative market in India is largely an OTC market. The evolution of this market over the last few decades is set out in the rest of this Chapter. Development of the IRD market in India 2.4 In India, efforts to develop the market for IRDs started in 1999, when OTC rupee derivatives in the form of Interest Rate Swaps (IRS) and Forward Rate Agreements (FRAs) were first introduced. Banks/ primary dealers (PDs)/ All-India Financial Institutions (AIFIs) were permitted to undertake different types of plain vanilla FRAs/IRS using any domestic money or debt market rate as the benchmark rate, provided the methodology of computing the rate was objective, transparent and mutually acceptable to both counterparties. These derivatives enabled banks, PDs and AIFIs to hedge interest rate risk for their own balance sheet management and for market-making purposes. 2.5 The market in FRAs/IRS evolved rapidly post introduction. In terms of number of contracts and outstanding notional principal amount, such transactions jumped from about 200 contracts amounting to ₹ 4,000 crore in March 2000 to 6,500 contracts for ₹ 1,50,000 crore in December 2002. The market, however, remained concentrated among select foreign banks, private sector banks and a PD. 2.6 The most prevalent IRD instrument being used was the plain vanilla fixed to floating swaps based on the NSE - Mumbai Interbank Offered Rate (MIBOR). At the same time, swaps based on a few other benchmarks such as the Mumbai Inter-Bank Forward Offered Rate (MIFOR), Mumbai Inter-Bank Offered Currency Swaps (MIOCS), Mumbai Inter-Bank Overnight Index Swaps (MIOIS), Treasury Bill rates, etc. were also used, although the volumes involved were small. Swaps with explicit / implicit optionality features such as caps / floors / collars were not permitted and, hence, most of the innovation was limited to use of alternative benchmarks. 2.7 In November 2002, a Working Group under the Chairmanship of Shri Jaspal Bindra1 was constituted by RBI to review the progress and map further developments in regard to IRDs in India. The Working Group appreciated the healthy growth in the OTC derivatives market in FRAs and IRS in a relatively short period of time, but also felt that it was important to move to the next stage of development by introducing derivative products with optionality. Accordingly, the Group recommended a phased introduction of rupee option products with further product enhancements (caps, floors, collars, swaptions etc.) in stages. The Group also made several recommendations relating the IRD market microstructure including recommendations relating to exchange traded IRDs, central clearing, disclosures, valuations and accounting, accreditation of brokers as well as the need for a legislation on bilateral netting. 2.8 Separately, efforts were undertaken to develop the Exchange Traded Interest Rate Derivatives market. Pursuant to this, Interest Rate Futures (IRF) were introduced in India in June 2003 on the NSE. Three contracts based on a notional 10-year coupon bearing bond, a notional 10-year zero coupon bond and on the 91-day Treasury bill were introduced at the outset. All the contracts were valued using the Zero-Coupon Yield Curve (ZCYC) and were required to be cash-settled. The IRFs, however, failed to gain traction and could attract only a limited set of participants and transactions. In 2008, a Working Group set up under the Chairmanship of Shri V. K. Sharma, then Executive Director, RBI, further examined the issues related to exchange traded interest rate derivatives and made several recommendations for activating the market. However, despite concerted efforts and many changes to the contracts over the years, IRFs have remained thinly traded. 2.9 As volumes in the OTC IRD market continued to grow, the Reserve Bank turned its attention to ensuring market transparency, efficient price discovery, market integrity and ease of transacting. A number of measures were taken to this end. In August 2007, banks and PDs were mandated to report all inter-bank/PD trades in FRAs and IRS to reporting platform developed by CCIL. Post trade transparency was thereafter sought to be achieved for these trades through dissemination of market information, i.e., rate, notional amount, etc. through CCIL’s website. This laid a solid foundation for a robust trade repository for OTC derivatives in the country2, much before the G20 Pittsburg Summit recommended the same. 2.10 In November 2008, CCIL started to offer settlement of IRS trades reported on its reporting platform on a non-guaranteed basis. In 2012, an RBI Working Group on Enhancing Liquidity in the Government Securities and IRD markets (Chair: Shri R. Gandhi, Executive Director, RBI) recommended the standardization of IRS contracts to facilitate centralized clearing and settlement of these contracts given the potential of central clearing for increasing efficiency and managing counterparty risks. CCIL commenced central counterparty (CCP) clearing for IRS trades referenced to the MIBOR and MIOIS benchmarks from 2014, and for MIFOR IRS trades from 2018. 2.11 A framework for accreditation and regulation of brokers in the OTC interest rate derivative market was put in place in August 2011 and the responsibility for the same was delegated to FIMMDA. This provided a fillip to the liquidity in the OTC market for interest rate derivatives as brokers provided the desired pre-trade anonymity to participants who transacted in this market. 2.12 The R Gandhi Working Group, based on experience in the government securities market, recommended the introduction of an electronic trading platform (ETP) facility for IRS. Various ETPs, most notably ICAP’s i-stream (introduced in 2011) and Clearcorp’s ASTROID (2015), started offering transaction services in the IRS market which further enhanced market liquidity. The share of IRS transactions over ETPs has grown over the years. By providing anonymity, certain ETPs have ensured level-playing field for smaller market participants, unlike traditional OTC markets where larger players generally receive more favorable terms-of-trades due to bigger ticket sizes and negotiating power. 2.13 The RBI Working Group on Reporting of OTC Interest Rate and Forex Derivatives, under the chairmanship of Shri P Krishnamurthy, Chief General Manager, RBI, in 2011 suggested the introduction of trade compression for Indian markets with a view to further enhance the efficiency of domestic IRD markets3. Pursuant to that, CCIL started offering portfolio compression services in 2011. The first such exercise, undertaken for MIBOR OIS contracts resulted in a compression of 94.3 per cent of the submitted trades. Till date, 33 cycles of portfolio compression for Rupee IRS derivative trades linked to MIBOR and five cycles for IRS trades linked to MIFOR have been carried out by CCIL. By increasing capital efficiency, these compression exercises have been another important contributor to the increased turnover in IRDs. 2.14 Multiple RBI Committees, including the Bindra Working Group, had noted that in the absence of legal recognition for close-out bilateral netting, banks computed credit exposure on transaction-to-transaction or gross basis. This resulted in large counterparty credit exposures even if the transactions were of offsetting nature with the same counterparty. The Payment and Settlement Systems Act, 2007, recognized multilateral netting of derivative contracts which are centrally cleared. In September 2020, the Bilateral Netting of Qualified Financial Contracts Act was passed, further providing legal recognition to bilateral netting. 2.15 The Bindra Working Group in 2002 had recommended a phased introduction of the rupee option products. In 2016, Rupee Interest Rate Options (IROs) were introduced following the recommendations of a Working Group on Interest Rate Options set up under the chairmanship of Prof P.G. Apte. Only plain vanilla IROs were permitted to begin with. In 2018, in view of feedback from market participants including corporates on the need for swaptions to effectively manage their interest rate risk, Rupee interest rate swaptions were also permitted. FIMMDA was tasked with firming up the operational guidelines on swaptions. Post these developments, swaptions started being traded in domestic markets from 2021. 2.16 To further develop liquidity in the domestic markets, additional measures were undertaken in recent years. Users, other than banks and primary dealers, who were earlier permitted to undertake IRDs only for the purpose of hedging, were permitted to undertake transactions in IRDs for both hedging and otherwise in 2019 in a bid to add to the depth and liquidity of the domestic IRD market. Market participants were also provided with the flexibility to manage their interest rate risks efficiently through product innovation. This led to increasing use of a greater suite of IRD products in the domestic markets for hedging of interest rate risks. In particular, new instruments such as bond FRAs4 and total return swaps (TRS)5, started being offered to meet the evolving needs of users. In a bid to further develop the Rupee IRD market and in response to feedback received from long term investors, RBI, in December 2023, issued draft Directions to permit physically settled bond forwards, thus potentially adding to the suite of interest rate derivative products available in the domestic market. 2.17 While the domestic market for IRDs was growing, an active market for Rupee IRS also developed offshore, in the form of non-deliverable OIS (ND-OIS)/foreign currency settled OIS (FCS-OIS)6 testifying to the growing interest in the Rupee IRD market. However, in the absence of common players, the domestic and offshore markets remained segmented adding to inefficiencies. With a view to removing this segmentation between the two markets, onshoring the offshore IRD market and expanding the participant base in the domestic IRD market, RBI permitted non-residents to access the Rupee IRS market in India in 2019. In 2022, Indian banks and primary dealers were also permitted to transact in the FCS-OIS market. 2.18 The evolution of the Rupee IRD market has been aided by the steps taken to ensure market integrity. The availability of ‘significant’ financial benchmarks administered by Financial Benchmarks India Pvt. Ltd. (FBIL), adhering to the robust governance standards prescribed by the Reserve Bank and accredited brokers functioning in the Rupee IRD market has supported the growth. The requirement for market-makers to assess suitability and appropriateness before offering a product balances the requirement between customer protection and product diversity. Transparency in the market has been ensured by requiring all OTC derivative transactions to be reported to the trade repository and dissemination of the trade information of liquid OTC derivative contracts. 2.19 The G20 recommended, as part of the global agenda to reform the OTC derivatives market, putting in place margining rules for non-centrally cleared derivatives (NCCDs). Well-established margining arrangements for financial contracts contribute to financial stability by enhancing credibility of market mechanism and discouraging excessive risk-taking. The RBI issued a regulatory framework for the exchange of variation margin for NCCDs in 2022. A draft framework for the exchange of initial margin for NCCDs is in the process of being finalized. 2.20 While there has been steady development of the Rupee IRD market through product and conduct regulations, the use of Rupee IRD contracts for hedging has been limited, as seen from the extent of participation of Public Sector Banks (PSBs), who hold a significant portfolio of rupee interest rate sensitive securities. A part of the reason may be the lack of symmetry in the accounting of the derivative and cash position. The revised Directions on Valuation of Investment Portfolio of banks, coming into effect from April 01, 2024 enable banks to comply with the accounting standards prescribed by the Institute of Chartered Accountants of India (ICAI) for accounting of derivatives (including hedge accounting). The alignment between the economic need for a derivative and accounting for a derivative is likely to incentivize the use of derivatives by the market for hedging, going forward. 3. THE INTEREST RATE DERIVATIVES MARKET IN INDIA:

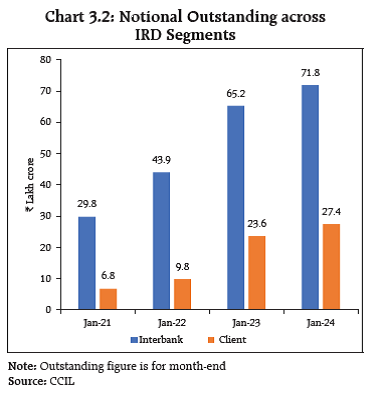

3.1 Buoyed by the various policy initiatives and efforts of market participants as well as the general development of the financial system and the broader economy, the Rupee IRD market has grown over the years primarily to meet the hedging needs of the financial and non-financial sector. In particular, there has been a significant increase in the size of the market in recent years, as measured by the notional value of outstanding contracts which rose from ₹ 37 lakh crore in January 2021 to around ₹ 100 lakh crore in January 2024, with both inter-bank and client transactions increasing in tandem. Of this, MIBOR-based OIS contracts are the predominant instrument accounting for almost 86 per cent of the total notional value of outstanding contracts. The second most transacted derivative product is the MIFOR (now modified MIFOR) based IRS where the notional value of outstanding transactions stood at ₹ 8.1 lakh crore as on January 31, 2024. Other IRD instruments are being transacted in the market as well, each developing in response to successive policy initiatives and different hedging needs of different types of users (Charts 3.1 and 3.2 and Table 3.1).

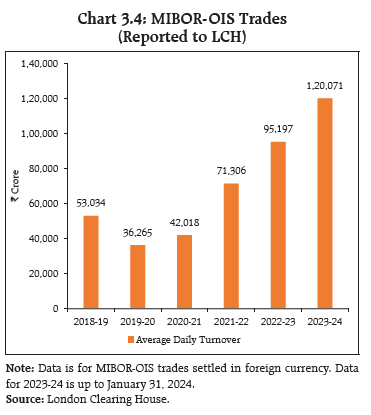

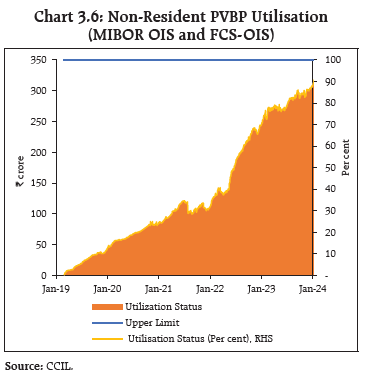

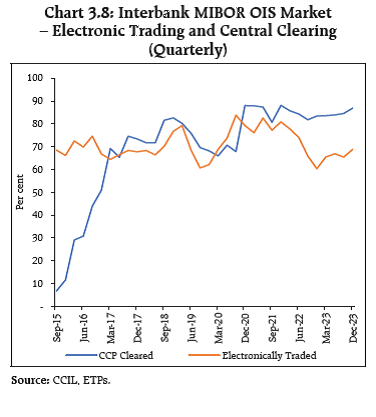

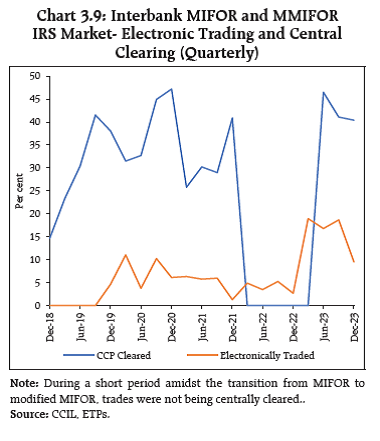

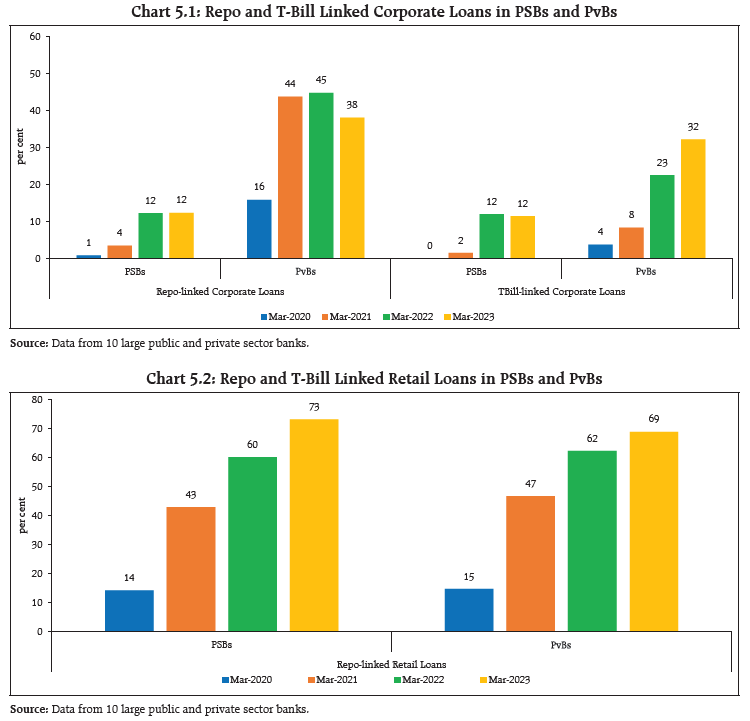

3.2 Market making in the IRD segment in India is dominated by foreign banks though private sector banks and standalone primary dealers have also been playing an increasing role in the market. Public sector banks, in comparison, play a relatively small role in the domestic IRD market (Chart 3.3).  3.3 As the domestic IRD market has been growing in recent years, so also has been the offshore market for Rupee IRDs in response to the growing interest of the global community in the Indian interest rate market. This is evident, for example, from the data on foreign currency settled MIBOR-based OIS trades (FCS-OIS) reported to the London Clearing House (LCH) (Chart 3.4). The two markets had remained segmented with wide variation in the traded OIS rates in the domestic and offshore markets. 3.4 In 2019, RBI opened up access of non-residents to the domestic IRD market. Since then, non-residents have become prominent participants in the onshore MIBOR OIS market, with trading activity surpassing that of resident clients (Chart 3.5). The Price Value of a Basis Point (PVBP)8 utilization of non-residents has also increased over time, on account of rising interest in onshore rupee derivatives (Chart 3.6). In February 2022, RBI permitted banks in India to participate in the offshore markets.    Subsequently, the facility was also extended to standalone primary dealers in August 2022. These policy measures have together narrowed the differential between onshore and offshore MIBOR OIS rates arising from market segmentation (Chart 3.7).  3.5 In parallel with the development of the IRD market, the market infrastructure for the IRD market has also evolved. A significant share of the MIBOR OIS, the most liquid instrument in the market, is traded electronically with price information on transactions being disseminated on a near real-time basis. The bulk of these contracts are centrally cleared. Trades in MIFOR / modified MIFOR are also gradually migrating to electronic trading platforms and about 40 per cent of these trades are centrally cleared. These developments have aided the efficiency of price discovery and made it easier to execute large trades, thereby increasing market depth (Charts 3.8 and 3.9).   4. INTEREST RATE DERIVATIVES – CROSS COUNTRY EXPERIENCE 4.1 Interest rate swaps (IRS) are the most popular IRD instruments globally for management of interest rate risk and/or expressing views on policy rates. As per data available from the BIS, the notional amount of outstanding OTC IRD transactions in March 2023 stood at US$ 574 trillion; out of which 83 per cent was contributed by IRS, 9 per cent by FRAs and remaining 8 per cent by options. 4.2 In most jurisdictions, the IRS market has developed in a manner characterized by concentration of market liquidity in one primary IRS instrument (the “main” IRS). The table below describes the “main” IRSs and the underlying benchmark in a cross section of jurisdictions. 4.3 Conventions also vary across jurisdictions with regard to the tenor of the benchmark underlying the “main” IRS. The benchmark of choice for IRDs in most markets has been the term tenor as they provide a fixed interest rate over a specified term offering predictability for cash flow planning and simplicity in accounting and financial management. This has changed in recent years amid transition from the LIBOR, which was a term rate to alternate reference rates such as the SOFR / SONIA which are primarily overnight rates. Thus, jurisdictions like the US, UK, Singapore and Indonesia where LIBOR-based IRSs were traditionally the “main” IRS have moved to overnight benchmarks serving as the underlying for the “main” IRS. In other jurisdictions, term rates (usually a 3 or 6-month rate) continue to be the preferred benchmarks for IRS. However, even in jurisdictions such as the US which have migrated to overnight rates, efforts are underway to develop credible term rates. For instance, limited use of the Term SOFR rates, a forward-looking interest rate estimate based on SOFR future rates, has been permitted. 4.4 In certain jurisdictions, traditional term rates continue to be used as the benchmark for “main” IRS instrument even after transition to an alternate benchmark post LIBOR cessation. For instance, in Hong Kong, the Hong Kong Interbank Offered Rate (HIBOR), determined daily by the Hong Kong Association of Banks (HKAB) using data submitted by a panel of 20 contributing banks, has been in place for many years. Separately, the Hong Kong Dollar Overnight Index Average (HONIA), based on unsecured overnight Hong Kong dollar interbank transactions, has been introduced by the Hong Kong Monetary Authority (HKMA) in 2020. While the HONIA has been identified as an alternative to HIBOR, there is no plan to discontinue the HIBOR, and market participants are free to choose between them. On account of this, term HIBOR based IRS continues to be the key instrument in Hong Kong. Multiple jurisdictions such as Japan, Europe and South Korea have also adopted a multi-rate approach wherein there is a co-existence of the overnight alternate reference rates (ARR) and the forward-looking term benchmark (Europe: ESTR and EURIBOR; Japan: TONA and JBA TIBOR; South Korea: KOFR and CD rate). 4.5 In a post LIBOR world, certain jurisdictions are also considering rates beyond those determined based on transactions in the open market for their “main” IRS instrument. For instance, Philippines has chosen the Variable Reverse Repo Rate (RRP), the weighted average rate of accepted bids from the daily auctions in the Bangko Sentral ng Pilipinas’ (BSP) RRP operation, as an alternate for the LIBOR-linked Phiref (benchmark for “main” IRS). The plan is to develop an OIS curve based upon the Variable RRP, starting with one-year, two-year and three-year tenors9. 4.6 The Committee noted that while there is a dominant IRS product in most markets, market-makers, nevertheless, offer a range of other IRS products (referred to herein as “non-main” IRS) tailored to specific client needs, which may not exhibit the same level of liquidity as the “main” IRS. These “non-main” IRSs serve a complementary role, contributing to the overall development and depth of the market. For the market-makers, however, the “main” IRS typically serves as a critical risk management tool, underpinned by the typically high correlation between different interest rate benchmarks. Thus, for example, in the US, the “main” IRS is the SOFR-based OIS but there are other products which are also liquid. In particular, the OIS based on the Effective Federal Funds Rate (EFFR) which is primarily used to express views on the direction of monetary policy is also very liquid with volumes comparable to that of SOFR-based IRSs. For example, available data indicates that during the first half of 2023, average trading volumes in SOFR-based OISs were US$ 218 billion while average trading volumes in EFFR-based OISs were US$ 226 billion. Similarly, in China, the 7-Day Repo based IRS is the “main” IRS but comparable liquidity is also available in the market for futures in Chinese Government Bonds and, albeit to a lesser extent, in other “non-main” IRSs (Box 1). In Japan, besides TONA (the benchmark for “main” IRS), TORF and TIBOR rates are also used as underlying benchmarks for IRS, depending on the requirement of market participants. A multiple benchmark approach enables market makers to cater to the requirements of a varied set of stakeholders. 4.7 The availability of a range of derivative contracts referencing different interest rate benchmarks to clients exposes a market maker to interest rate risks arising from multiple benchmarks. A basis swap market has developed in many jurisdictions to enable the management of such risks arising from different benchmarks. A basis swap essentially enables counterparties to the contract to exchange two floating rates referencing different benchmarks. The existence of a basis swap market is key to market makers being able to offer a wider range of IRDs to their clients. During the LIBOR transition, for example, basis swaps were extensively used to manage their LIBOR exposures, i.e., to convert LIBOR exposures to exposures to ARRs. In the post LIBOR world, the use of basis swaps referencing various ARRs has emerged to manage the basis risks arising out of the use of different ARRs.10 5. THE INTEREST RATE DERIVATIVE MARKET IN INDIA: 5.1 The Committee evaluated the growth of the IRD market in India against the backdrop of the evolving macroeconomy, an increasingly complex financial system, diversity in participation and developments in the legal and regulatory landscape. The Committee noted that market in several types of Rupee derivatives has emerged in recent years to cater to different needs of participants. The market for MIBOR-based swaps is very liquid while reasonable liquidity has also developed in the market for MIFOR-based swaps with the transition to modified-MIFOR based swaps having been achieved smoothly. The measure to enable non-residents to access the Rupee OIS market for hedging or otherwise in 2019 and permitting banks and SPDs to access the FCS-OIS market since 2022 have enabled growth in client volumes while at the same time reducing segmentation between the onshore and the offshore markets. The Committee noted that since the Reserve Bank permitted market makers greater flexibility to offer innovative products to meet bespoke requirements of customers, the market for products like bond FRAs has developed primarily to meet the hedging needs of long-term investors in the bond market while products like TRS have developed to meet the needs of issuers of medium to long term corporate bonds. The Committee also noted that the broadening in participant base, especially the growing non-resident participation in the domestic IRD market, has added diversity, liquidity and depth to the market. Significant progress has also been made towards the development of market infrastructure in terms of transparency, electronic trading, central clearing of the more liquid products as well as governance of market-makers and benchmarks. 5.2 The Committee, however, highlighted certain areas where the IRD market in India needed further development. A single IRD product– pros and cons 5.3 The Committee discussed the large concentration of activity around a single IRD product – the MIBOR-based OIS – in the domestic IRD market. MIBOR-based swaps accounted for close to 85 per cent of outstanding IRDs in the domestic market as on January 31, 2024. Together with FCS-OIS (which is the same product save for the currency of settlement), the product accounted for over 88 per cent of outstanding IRDs on the date. Globally, IRDs traded on exchanges also have reasonable liquidity, but, despite concerted efforts to develop the exchange-traded IRD market, IRFs in India have remained thinly traded. 5.4 The Committee deliberated that an interest rate is an economic variable that affects multiple stakeholders in the financial system viz., an investor, a home loan borrower, a corporate borrower, a bank, an entity holding interest rate sensitive securities, an issuer of corporate bond, etc., The nature of the interest rate risk varies based on the nature of the participant and its functions. A single category of interest rate derivative contract is, therefore, unlikely to fully capture the varied interest rate risks representing the underlying interest rate variables viz., the monetary policy rate, the floating rate benchmark or the interest rate risk prevalent in a government security. On the other hand, the presence of multiple rupee IRD contracts with adequate liquidity provides the market with the ability to manage its varied rupee interest rate risks. 5.5 In theory, the market for IRDs in any economy could evolve or develop in such a manner that liquidity is concentrated in a single IRS instrument linked to one benchmark rate, or there could be multiple IRS instruments based on different benchmark rates. The Committee recognized that a single instrument simplifies the financial infrastructure for market participants, reducing complexity in pricing, valuation, and risk management processes. Focusing trading activity on a single instrument based on a single benchmark tends to concentrate liquidity, potentially leading to tighter bid-ask spreads, improved price discovery, and greater market depth. At the same time, multiple IRS instruments based on different benchmarks provide diversity, which allows market participants to select products that best match their needs, hedging strategies, and risk tolerance. Multiple benchmarks also provide a hedge against the risk of a single benchmark becoming less representative. 5.6 A survey of the IRD market in different jurisdictions, as set out in Chapter 4 of this Report, suggests that, in practice, IRD markets across jurisdictions have developed such that market liquidity tends to be predominantly concentrated in one primary instrument. Notwithstanding, market-makers also offer a range of other IRS products tailored to specific client needs, which are reasonably liquid but may not exhibit the same level of liquidity as the primary IRD. 5.7 As the domestic economy has developed, diverse needs for hedging by different market participants have emerged. With the development of the insurance industry alongside the growing penetration of insurance products in the country, the unique need of the insurance sector to hedge their cash flows has emerged. With the development of the corporate bond market and increase in market-based financing, the need to hedge the associated interest rate risks has also commensurately increased. Supervisory scrutiny of interest rate risk in the banking book of commercial banks has led to banks exploring options to hedge the interest rate risks they carry on their balance sheets. The proposed regulatory framework for interest rate risk in the banking book and lessons from the recent banking crisis in a jurisdiction are only likely to accentuate the need for banks to manage their interest rate risks more proactively. 5.8 In recent years, the reliance of the economy and of banks on market-based benchmarks has further increased amid the regulatory mandate for banks to link new floating rate personal and retail loans to an external benchmark. Larger ticket corporate loans are also getting increasingly priced based on an external benchmark with the reliance on the banks’ internal benchmarks, viz., the MCLR, slowly reducing. While the pricing of retail loans is getting linked primarily to the RBI policy repo rate, the pricing of corporate loans is also getting linked to the treasury bills rate, in particular to the 91 and the 182-day treasury bill rates (Charts 5.1 and 5.2).

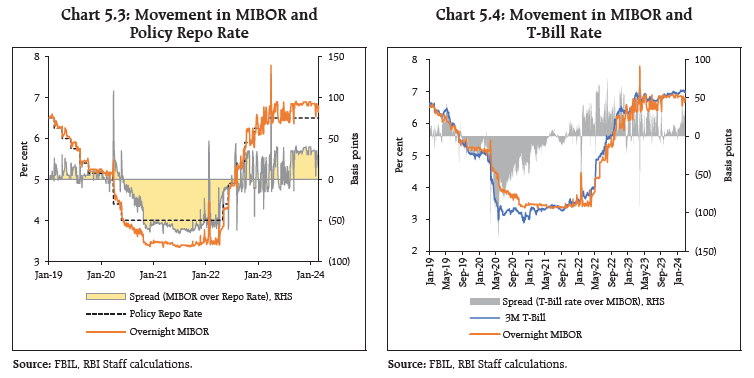

5.9 The Committee discussed the practice being followed by the banks in this regard and felt that in certain cases appropriate instruments for hedging of the underlying interest rate risk may not be available. The Committee noted that the pricing of loans based on policy rates may expose the borrowers as well as banks to interest rate risks especially when interbank rates diverge from the policy rate. Therefore, the Committee felt the need for popularising market-determined benchmarks for linking of loans, including small-ticket advances, to facilitate the hedging of the underlying interest rate risk. 5.10 The above developments have also raised the need for instruments which can be used to efficiently manage the varied interest rate risks encountered by different market participants. The regulatory enablers for product innovation put in place in 2019 have facilitated market participants to use different derivative contracts such as bond FRAs and TRSs, to manage their interest rate risk. However, the liquidity in such contracts is limited and is largely client driven, with a limited inter-bank segment for market-making. 5.11 Anecdotal evidence suggests that globally, especially in emerging markets, there is limited interest amongst stakeholders, especially from the non-financial sector, in hedging of interest rate risk. In the domestic IRD market, there were multiple reasons for limited interest in IRDs. Until recently, the access of non-residents users to the IRD market was limited while resident users were permitted to undertake transactions in permitted products only for hedging. There are also various other product and other regulatory restrictions on different financial entities which constrain their participation in the IRD market. For example, NBFCs are permitted only to participate in exchange traded IRFs to hedge their interest rate risk. There are restrictions applicable on such entities in accessing the domestic IRD market. Similarly, mutual funds can access IRSs only for hedging while insurance companies, which hold a significant amount of fixed income securities on their balance sheet, are also permitted to use a limited set of instruments for hedging. The Committee felt that sectoral regulators may review these frictions and permit the regulated entities to transact in all available IRDs in the market for efficient hedging. Transactions for purpose other than hedging may be specified based on appropriate risk-controls. 5.12 The Committee also discussed the participation of non-residents in the Indian markets, and noted that non-resident participation (for purposes of hedging or otherwise) in the domestic OIS market since 2019 has deepened market liquidity and increased the efficiency of price discovery. In this regard, the members considered if non-residents may be permitted to transact in a wider suite of IRD instruments for purposes other than hedging. The Committee felt that in the long run, allowing non-residents to transact in wider suite of IRD instruments will make Indian markets more global. However, the members observed that Indian IRD markets, apart from MIBOR OIS, may not currently have the size and liquidity to absorb non-resident flows, in the absence of which there are risks of the local market becoming disjointed; as is the likely scenario in products where demand supply factors have larger impact than economic fundamentals. Based on these points, the Committee was of the view that permitting non-residents in all IRD instruments for purpose other than hedging may be done in a gradual manner based on an assessment of the evolving market conditions and subject to appropriate risk-controls. 5.13 Notwithstanding, the Committee felt that the current bouquet of IRDs transacted in Indian markets remains insufficient to meet the hedging requirements of financial and non-financial participants, should such need arise. Accordingly, there is a case for promoting the development of more hedging based on evolving market conditions. 5.14 Against the backdrop of the above developments, the Committee assessed the suitability of the MIBOR-based OIS to meet the diverse hedging needs of different stakeholders and market participants. MIBOR-OIS – a view on the monetary policy changes or an instrument to hedge interest rate risks? 5.15 The Committee discussed that the MIBOR is a benchmark which is economically representative of the daily rates in the call money market, the operating target for monetary policy. The MIBOR therefore, is a fundamental reflection of the RBI policy rate and provides the market an opportunity to take a view on the monetary policy expectations. Accordingly, the MIBOR-based OIS has developed as a tool to enable market participants to express their views on the future movements of the RBI policy rate. As MIBOR-based OIS developed as the primary IRD in the domestic markets, entities needing to hedge their interest rate risks, for example, entities holding a portfolio of government bonds, also tended to use the same contract to hedge their interest rate risk. The MIBOR-based OIS market has therefore emerged as a multi-purpose market and trends in the market reflect both the behavior of market participants for hedging their interest rate risk and to convey their expectations from monetary policy. This is fundamentally different from many other jurisdictions where different benchmarks / instruments exist for different purposes. In the US for example, multiple liquid IRD contracts co-exist – Interest Rate Swaps referencing benchmarks such as SOFR are typically used for the purpose of hedging interest rate risks while market participants typically express their views on policy rates through derivatives based on the EFFR. In Europe, IRSs based on the EURIBOR – a benchmark for longer-term interbank lending rates – are used for a wide range of financial products including managing interest rate risks. On the other hand, OISs based on ESTR – a risk-free rate reflecting overnight borrowing costs – are preferred for expressing views on policy rates. Use of the MIBOR-based swaps to hedge – associated basis risks 5.16 The Committee discussed that the use of MIBOR-based OISs to hedge interest rate risks arising from a government securities portfolio or repo-based loans or loans linked to treasury bill rates, etc. also engender basis risks arising from the spread between the MIBOR and the policy rate or the treasury bill rates, impairing the efficiency of the hedge (Charts 5.3 and 5.4).

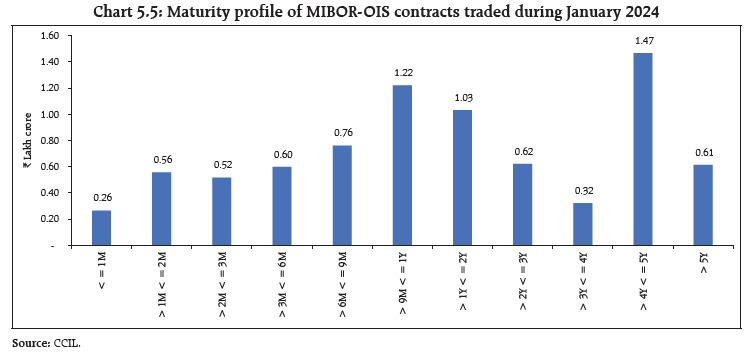

5.17 The Committee noted that the basis risk arising out of the spread between the policy repo rate and MIBOR is expected to be limited given that the weighted average call rate is the operating target of monetary policy and MIBOR is based on call money market transactions. Nonetheless, as the experience of the last few years has demonstrated, the rates in call money market are significantly influenced by prevailing systemic liquidity conditions and can, move around the Liquidity Adjustment Facility (LAF) corridor (and sometimes even beyond the corridor) depending upon liquidity conditions and prevalent demand / supply imbalances. This, however, risks impairing the efficiency of the MIBOR-based derivatives as an instrument for hedging. 5.18 The MIBOR and the treasury bill benchmarks are, on the other hand, fundamentally different benchmarks though both markets are affected by systemic liquidity conditions. One is based on overnight rates while the other is a term rate. Treasury bills being the rates at which the Government borrows are considered risk free rates while call money transactions are unsecured transactions between banks and primary dealers and therefore incorporate an element of credit risk premium. 5.19 The Committee also noted that, notwithstanding the above basis risks, the domestic IRD market has not evidenced transactions in basis swap instruments, which may be encouraged. In many other jurisdictions basis swaps have developed as an instrument to enable market participants to mitigate the risks associated with the spread or basis associated with different variable interest rates. IRDs based on overnight benchmarks versus IRDs based on term benchmarks 5.20 The Committee also deliberated on the need for IRDs based on term benchmark rates. As discussed in Chapter 4 of this report, globally the preferred benchmark for the “main” IRD has been a term benchmark. This is possibly a reflection of the fact that while overnight benchmarks serve the purpose of financial markets, in particular for expressing views on the expected movements of monetary policy rates, they may not be the most appropriate benchmark with regard to meeting the hedging needs of all stakeholders in the financial and non-financial sectors. Overnight rates, anchored as they are to policy rates of the central bank may not also be truly representative of marginal cost of funding for lenders. These aspects are relevant for the MIBOR-based OIS as well. However, the constraint in the domestic market is the lack of an IRS instrument linked to a term benchmark rate, despite the fact that multiple term rates such as CD rates are published by FBIL. Incidentally, the “main” IRS in Korean market is linked to 3M CD rates. MIBOR-based OIS market – development still in progress 5.21 The Committee noted that while the MIBOR-based OIS market is very liquid, there are nonetheless, certain specific issues around the market which limit its usage as a hedging instrument. In particular, the Committee noted that the liquidity in the MIBOR OIS market is concentrated in tenors up to 5 years with liquidity in longer tenors being scarce. Issuers with long term hedging needs such as long-term investors, issuers of longer-term corporate bonds or even long term borrowers of the banking system often find themselves constrained while hedging their interest rate risks and end up with imperfect hedges requiring periodic rollovers (Chart 5.5).

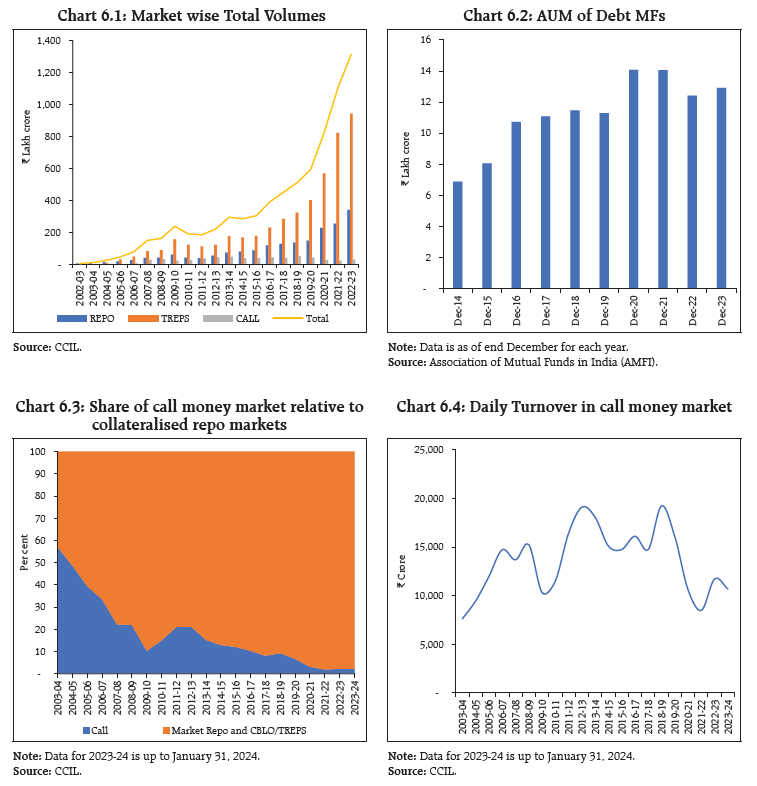

5.22 Over time, the Rupee IRS market has developed into one of the most liquid IRDs. The participant base, however, has not increased commensurately. The participation in MIBOR OIS is concentrated amongst select foreign banks, private sector banks and PDs, while the interest from other banks and clients (corporates, mutual funds, NBFCs etc.) has remained limited. In January 2024, the top six participants accounted for close to half of the total outstanding MIBOR OIS contracts in the interbank segment. While participation by non-residents has increased in the instrument, most of the transactions including in FCS-OIS, are with offshore market-makers rather than with the end users / clients. 5.23 The Committee also noted the risks associated with a large concentration of activity around a single benchmark under circumstances of a benchmark failure, where a financial benchmark becomes unreliable, inaccurate, or unrepresentative of the underlying market it is intended to measure. These issues are discussed in the next chapter. 6. RECENT DEVELOPMENTS IN MONEY MARKETS AND THE MIBOR 6.1 The MIBOR was first introduced by the National Stock Exchange (NSE) in 1998. Two rates were published – the MIBOR and the Mumbai Interbank Bid Rate (MIBID). The rates were computed through a polling process conducted by NSE. In 2002, FIMMDA became a partner in the dissemination of MIBID/MIBOR and the benchmark was rechristened as FIMMDA-NSE MIBID/MIBOR. In 2014, the Committee on Financial Benchmarks (Chair: P. Vijaya Bhaskar) recommended that the methodology of computation of the benchmark be changed from a polling process to one based on actual transactions. The Committee also recommended that a single weighted average traded rate be published instead of separate bid and offer rates. FBIL, which was incorporated in 2014, took over the administration of the benchmark for overnight inter-bank rate in 2015 replacing the “FIMMDA-NSE Overnight MIBID/MIBOR” with “FBIL- Overnight MIBOR”, the current MIBOR. 6.2 Over the past decades, the microstructure of money markets has evolved considerably. There were many contributory factors which shaped the evolution of the domestic money markets in this period. (a) The call money market was the primary market for inter-institutional overnight / short term lending and borrowing with participation from both banks and non-banks. In 1998, the Committee on Banking Sector Reforms (also Narasimham Committee II, Chair: M. Narasimham) recommended that the inter-bank call and notice money market and inter-bank term money market should be restricted to banks. The only exception should be the primary dealers. All the other non-bank participants present in the inter-bank call money market should not be provided access to that market and could be provided access to the money market through different segments. Based on these recommendations, non-banks (except primary dealers) were phased out beginning 2001. Also based on the recommendations of the same Committee, prudential limits on borrowing and lending in the call money market by banks and primary dealers (PDs) were put in place on October 5, 2002. (b) Synchronous with the phasing out of non-banks from the call money market, the access of non-banks to repo markets was widened. In particular, access of major non-banks such as mutual funds and insurance companies to the repo market was facilitated. Mutual funds, buoyed by a robust growth in the Assets under Management (AUM) of debt funds, have continued to be the dominant lender in the money markets in recent years, currently accounting for around 60 per cent of lending in the secured overnight money market and over 70 per cent of the lending in the TREPS segment. (c) At the same time, a slew of initiatives to put in place a robust trading, clearing and settlement infrastructure for the repo markets was undertaken. Repo transactions in government securities are today conducted primarily over two platforms – Clearcorp Repo Order Matching System (CROMS) and Triparty Repo Dealing System (TREPS). These platforms, including the NDS-OM, are operated by Clearcorp Dealing Systems (India) Ltd., a CCIL subsidiary and are governed under the Electronic Trading Platforms (Reserve Bank) Directions, 2018. Repo trades are also settled by the CCIL under the DvP-III process along with outright transactions in government securities to secure liquidity and netting efficiency in settlements. The infrastructure arrangements incorporate near real-time dissemination of trade information. These developments have substantially increased the convenience of executing large deals in secured money markets. (d) Globally, the structure of money markets has witnessed a paradigm shift towards secured overnight markets comprising of banks and non-banks and away from uncollateralised inter-bank markets, especially since the global financial crisis. The concerns associated with the fixing of LIBOR benchmarks as well as the Basel III regulations putting in place, inter alia, a liquidity management framework for banks which penalised uncollateralised borrowing while incentivizing collateralised borrowing, have all played a part in facilitating the change in the structure of money markets. These trends are visible in the domestic money markets as well. 6.3 On the back of the aforesaid developments, the repo markets have witnessed huge growth even as the size of the money market itself has grown. The volumes in the money market grew from ₹ 4.7 lakh crore in 2002-03 to ₹ 237.8 lakh crore in 2009-10 and further to ₹ 1,313 lakh crore in 2022-23. Buoyed by policy initiatives to expand access of non-banks to the repo market and to put in place efficient market infrastructure, the total turnover in the repo markets increased from ₹ 216 lakh crore in 2009-10 to ₹ 1,282 lakh crore in 2022-23. As the activity in the money market shifted to the secured segment, the volumes of call money transaction declined – both relative to repo markets as well as in absolute terms. Call money market volumes have remained largely stagnant even as the overall size of the money market has grown. In 2023-24, average daily volumes in the call money market stood at ₹ 10,600 crore as against daily volumes of ₹ 4.4 lakh crore in the secured segment (TREPS and market repo). The share of call money transactions in overnight money markets has gradually come down from more than 20 per cent in 2011-12 to below 2 per cent in 2022-23 even while the average daily trading volumes remained little changed (Charts 6.1 to 6.4 and Table 6.1).

Assessment of the MIBOR benchmark: Reliability, robustness and representativeness 6.4 The Committee examined the implications of the aforesaid developments in the structure of the money market for the robustness, reliability and representativeness of the MIBOR benchmark. 6.5 The Committee noted that the MIBOR which is computed based on call money market transactions, is drawing on a progressively lower number and volume of transactions. Transaction volumes in similar uncollateralized instruments in certain other jurisdictions, such as the US, have remained broadly stable during the last few years. For example, the average daily turnover in the US Federal Funds market which stood at US$ 67 billion in 2016 remained largely unchanged at US$ 70 billion during 2021. In the UK, the average daily turnover of sterling unsecured money market deposit transactions (underlying the SONIA benchmark) increased from £ 43 billion in 2016 to £ 68 billion in 2023. 6.6 While the overall call money market volumes are declining, the computation of the MIBOR is based on a narrow volume of call transactions, i.e., on trades transacted in the first hour of the trading day (Box II). On an average, such trades accounted for about 40 per cent of daily call money market trades during 2022-23. In other words, the MIBOR was based on transactions amounting to less than ₹ 5,000 crore in recent years, i.e., about 1 per cent of daily money market volumes.

6.7 The call money market also remains heavily concentrated among a few top borrowers, even as the lenders remain diversified. In recent years, more than 90 per cent of borrowing was accounted for by top 10 borrowers. Thin call money market volumes make the MIBOR susceptible to heightened volatility on account of small / idiosyncratic changes in the activities of even one or two participants. A statistical experiment indicates that, for the calendar year 2023, on an average, the MIBOR could be arrived at with 14 highest value transactions in the first hour, thus making the other trades considered in the calculation redundant. This could further exacerbate the susceptibility of the MIBOR as a few transactions of limited market participants could decide the MIBOR for any given day. 6.8 The representativeness of the MIBOR with regard to overnight lending and borrowing costs in the economy has also been impacted by the aforesaid structural changes in the money market. As discussed above, call money market transactions account for just about 2 per cent of money market volumes on any given day. The participant base of the call money market is also skewed wherein cooperative banks accounted for over 50 per cent of the lending in the call money market and primary dealers were borrowers to the tune of over 70 per cent. 6.9 In view of the aforesaid concerns, the Committee undertook an assessment of the computation methodology of the MIBOR benchmark over the last few years. The Committee noted that, unlike the case of the LIBOR benchmarks which were based on polled information, the MIBOR is computed on actual transaction data. The data on the computation of the MIBOR since 2016 indicates that on almost all days, sufficient volume of trades was available in the first hour itself to compute the MIBOR and instances of recourse to fallback mechanisms were rare (Table 6.2).

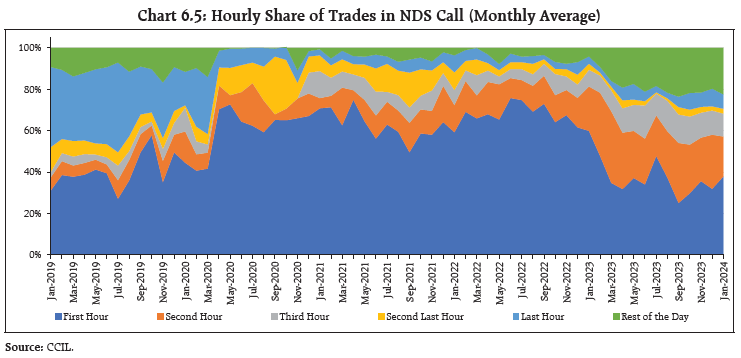

While the Committee drew comfort from the above finding, it deliberated on possible approaches to reduce the potential vulnerabilities associated with the benchmark, with a view to making the MIBOR more robust and reliable. Possible Approaches to reform / improve the MIBOR 6.10 The Committee discussed the possible approaches for increasing the volume in call money market. It was recognized that one of the factors constraining the volume in call money market is limited set of participants – banks and PDs. The largest participants in secured money markets are mutual funds, which are currently not permitted to access the call money market. 6.11 The Committee noted that there are limited examples of countries where non-bank participants like mutual funds transact in call money markets. There are also few instances of non-bank participants being allowed access to central bank liquidity facilities. The one notable exception is the US where money market mutual funds are allowed to deposit surplus funds with the Federal Reserve. These entities are, however, not permitted to borrow from the Federal Reserve. The Committee also observed that the call money rate being the operating target for monetary policy, call money market participants have access to the liquidity facilities of RBI. Fundamentally, the call money market is the only money market segment which trades exclusively in reserves. Therefore, any increase in participation in call money market segment may require commensurate access of such participants to liquidity facilities of RBI, which the Committee felt may not be desirable. 6.12 The Committee also discussed if there is a need to put in place a code of conduct for the participants in the call money market. The low volumes in the call money market means that any individual participant, through alterations in their lending / borrowing behaviour, can influence the call money market rates. A code of conduct could, therefore, act as a deterrent to any potential abuse arising on this count. The Committee, however, noted that the FIMMDA code of fair practice for debt markets already covers call money market. The code requires that “Market participants shall not enter/refrain from entering into transactions with the primary intent of disrupting the market, distorting the prices, or artificially inflating trading volumes”. The Committee also noted that a regulatory framework in the form of the Directions on Market Abuse had also been put in place by the Reserve Bank. In view of the above, the Committee concluded that a separate code of conduct for call money market participants may not be necessary. 6.13 The Committee also reviewed the quality, setting methodology and dissemination time of the MIBOR benchmark methodology with a view to assess any potential modifications to the existing methodology which could improve the robustness of the benchmark and improve its representativeness. The Committee’s assessment in this regard is set out below. Review of the methodology for the computation of the MIBOR 6.14 As discussed above, the computation of the MIBOR is currently based on a subset of call money market trades transacted during a day. On an average during the last five years, about 30 per cent of daily trades in terms of number of transactions and 40 per cent in terms of value are included in the computation of the MIBOR. The Committee considered if increasing the share of daily trades reckoned for the computation of the MIBOR could improve the representativeness of the benchmark and also make it more robust and considered three alternatives to increase the computation window in this regard: (a) Computing MIBOR based on the entire day’s transactions; (b) Computing MIBOR based on the first two hours’ transactions; and (c) Computing MIBOR based on the first three hours’ transactions. The Committee studied the trends in hourly traded data for the last five years. The trends across the five years, filtering out the “noise” of the COVID period when the market hours were truncated, indicates a shift in trading pattern wherein the share of daily trades being transacted in the first two and three hours of the day has increased while the share of trades transacted during the last two hours of the day has substantially reduced (Chart 6.5 and Table 6.3).

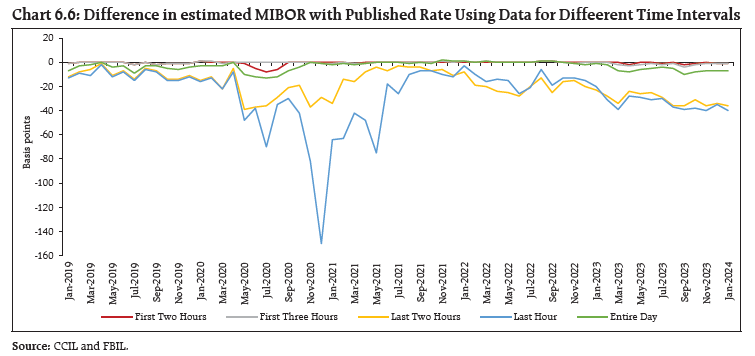

6.15 Based on this, the Committee felt that increasing the computation window of MIBOR rate from extant one hour to three hours will enhance the representativeness of the benchmark, as around 80 per cent of the deals in the call money market are transacted during this window. An increase in computation window, beyond three hours, may not significantly improve the representativeness further, as less than 10 per cent of the deals were transacted during this window in the last two years. Further, the Committee felt that increasing the computation window to full day may delay the publication of benchmark to end of day or the morning of the next day, which may lead to challenges in the settlement of MIBOR OIS on payment day in the extant setup. 6.16 The Committee also studied the impact on the published benchmark rate of a change in the computation window. The empirical evidence indicates that, in the recent period, the deviation of the benchmark rate if the computation window is expanded to the first two to three hours is not significant from the current rate, while there is some impact if it is expanded to the entire day (Chart 6.6 and Table 6.4). Further, the Committee noted that the difference between weighted average rate of call transactions during the last two hours and the extant MIBOR rate is significant. Therefore, inclusion of such deals in the MIBOR computation could invite undue volatility in the benchmark rate.

6.17 The Committee discussed that while increasing the computation window to increase the share of transactions being considered for the computation of the MIBOR could make the MIBOR more representative and enhance its robustness, such a change was not without implications. Changing the computation methodology to include the entire day’s transactions, for example, would result in the publication of the MIBOR after the end of the trading day and this could have implications for the functioning of the market, in particular for the functioning of the market for MIBOR-OIS. The same could also construe a material change in the methodology for the computation of the MIBOR with potential valuation and resultant legal implications for existing contracts based on the MIBOR. 6.18 The Committee was of the opinion that given the benefits of expanding the computation window for the MIBOR while being cognizant of the associated costs / risks, an expanded computation window to include trades in the first three hours could be examined. The Committee also felt that changing the computation of the MIBOR to include the entire day’s call money market transactions may not be desirable. 6.19 The Committee also considered a few other potential methodology changes such as reducing minimum threshold criteria, ignoring reciprocal deals (same counterparties borrowing as well as lending in the market), etc., with a view to assessing if these could enhance the robustness of the benchmark. The Committee was of the opinion that the extant minimum threshold criteria for reckoning transactions for the computation of the MIBOR is important for ensuring reliability of the benchmark rate. With regard to the exclusion of reciprocal deals, the Committee, however, felt that such issues, if prevalent, could be better handled through the code of conduct and fair dealing practices. 7. THE CASE FOR TRANSITION TO ALTERNATE REFERENCE

RATES / 7.1 The Committee recognized that a robust benchmark reference rate needs to be representative of the activities in the underlying market and provide an accurate indication of the market pulse. It also felt that all benchmarks are susceptible to weaknesses, albeit to varying extents, arising from the possibility of errors, bona fide or deliberate. The vulnerability of benchmarks also varies based on the liquidity and diversification of the underlying markets, the robustness of the market microstructure, etc. All of these call for the need for constant vigilance even in the most liquid of markets. The need for vigilance is further enhanced where the underlying markets are shallow, as is the case in the call money market. The Committee also discussed that the robustness and representativeness of any benchmark is enhanced depending on the liquidity in the underlying market and greater use of transaction data. It noted that, internationally, the response to LIBOR-related concerns has been to shift to alternate benchmark rates with wider participant bases (beyond banks) and higher liquidity. The Committee also noted that, globally the preferred benchmark for meeting the hedging needs of economic agents is a term benchmark. 7.2 Against this backdrop and in view of the potential vulnerabilities of the MIBOR, as set out in Chapter 6 of this Report, as well as the challenges posed in hedging of long term interest rate risks and associated basis risks as discussed in Chapter 5 of this Report, the Committee discussed two potential paths to address these issues. (a) The need for transition away from the use of MIBOR to an alternate benchmark rate as the primary benchmark for IRD transactions; (b) The need for developing new IRD products based on term benchmarks to support the hedging needs of various stakeholders; and 7.3 The Committee also discussed the possibility of the co-existence of IRD markets based on overnight and term benchmarks (as is the case in several advanced economies) to support the needs of financial sector participants to express a view on monetary policy and to enable financial and non-financial entities to hedge their interest rate risks, respectively. Transition to an alternate reference rate 7.4 The Committee examined the case of transitioning from the MIBOR to a potentially more robust alternate benchmark, as the primary underlying for interest rate derivatives. To this end, the Committee reviewed the extant interest rate related benchmarks, the methodology of their computation as well as their use in financial markets and by financial institutions.

7.5 The Committee observed that there may be a need to review the existing benchmarks based on the overnight money market. The Committee deliberated that as highlighted in the previous chapter, the microstructure of these markets has evolved considerably with collateralized markets becoming the dominant segment. The Committee noted that so far, there are two benchmark rates available based on overnight money markets – MIBOR and MROR, but none of them incorporate transactions from the TREP segment, even though the TREP segment constitutes around 70 per cent of the total money market transactions. Therefore, it emerged from the discussions that, as benchmarks should be reflective of the current market dynamics, FBIL may develop a benchmark based on the secured money market (both basket repo and TREP), i.e., a Secured Overnight Rupee Rate (SORR). 7.6 Akin to changes suggested for computation window for MIBOR, the proposed SORR benchmark may consider trades in first three hours of basket repo and TREP segments. For calculation of SORR, “special repo” transactions on the CROMS system may be excluded and only “basket repo” transactions may be included. Special repo transactions have the element of “short covering” which may skew the rate calculation. Empirical evidence also suggests that in basket repo and TREPS, transactions in the first three hours account for about 90 per cent and 50 per cent respectively of entire day’s transactions (Tables 7.2 and 7.3). This would also ensure alignment in publication time of all overnight benchmark rates.

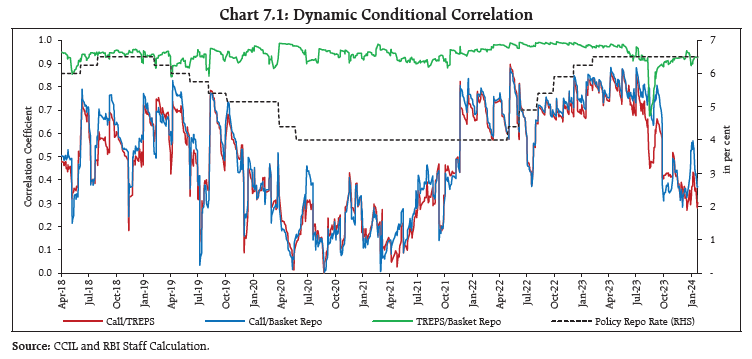

7.7 The Committee also considered the need to develop another benchmark comprising of all transactions –collateralized and uncollateralized, as a single benchmark for entire overnight markets. However, considering the composition of the markets, where repo markets account for 98 per cent of overall transactions, the Committee felt that such a benchmark would practically be very close to the secured benchmark. 7.8 The Committee further discussed that any alternate benchmark considered for potential use as a benchmark for IRDs should be derived from a liquid market with a wider participant base. The Committee felt that such a benchmark should therefore be based on overnight money market where the domestic money market liquidity is concentrated. The Committee was of the opinion that the alternate benchmark will ideally have to be based on the collateralised segment of the overnight money markets (TREPS / basket repo with Government securities as underlying) given the representativeness of these markets which account for 98 per cent of volumes in the overnight money market segment and have a diversified participant base including non-banks such as mutual funds, insurance companies and corporates, in addition to banks and primary dealers. 7.9 The Committee also felt that the transition to such a benchmark, if decided upon, would also be least disruptive given that the liquidity in the IRD market has developed around an overnight benchmark. While the fundamental character of the TREPS / basket repo markets is different from the call money market on which the MIBOR is based, the markets perform essentially the same function of facilitating overnight borrowing and lending and short-term liquidity management. To this end, the Committee assessed the rates derived from the TREPS / basket repo market visà- vis the call money market on the criteria of correlation and volatility, to assess their suitability as benchmark for overnight rates. 7.10 A dynamic conditional correlation among the three segments of money market reflects very high degree of correlation for significant part of the time considered, although the correlation has evolved over time (Chart 7.1).

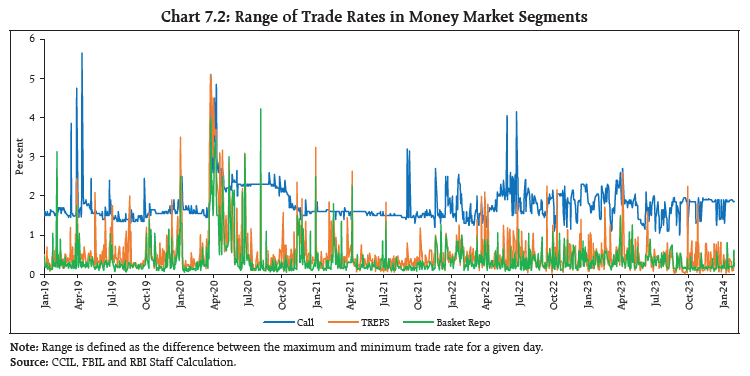

7.11 The Committee noted that the uncollateralised money market segment traded in a wider range of rates when compared to the collateralized segments viz., TREPS and basket repo, where the trading rates moved in a narrower range suggesting that benchmarks based on these rates are likely to be less volatile (Chart 7.2).

7.12 The Committee evaluated several factors which may be pertinent in determining the robustness / resilience of the MIBOR relative to alternate benchmarks based on collateralised overnight market rates. The evaluation is summarized in the Table 7.4.

7.13 Against this backdrop, the Committee discussed three alternate benchmark overnight rates based on the overnight money markets, viz., i. Weighted average rate in the overnight money market segment (viz., NDS-Call, TREPS and basket repo); ii. Weighted average rate in the secured money market segments (viz., TREPS and basket repo); and iii. Weighted average rate in the basket repo segment (the extant Market Repo Overnight Rate (MROR), which is published by FBIL since 2017). 7.14 These benchmarks were also examined for their correlation with MIBOR rate and volatility13 (Tables 7.5 and 7.6). The study indicates that the benchmarks are largely aligned in these aspects. Amongst the benchmarks, the most representative rate is likely to be the benchmark based on all overnight rates ((i) above) followed by the benchmark based on all secured money market transactions (given that the volumes in the basket repo segment are lower than the volumes in the TREPS). A comparison of MIBOR vis-à-vis other money market rates is presented in Annex.

7.15 While the Committee noted that the transition to an alternate benchmark based on collateralized rates will be more representative and robust, it also discussed the challenges associated with such transition: