IST,

IST,

Annex-2 : Methodologies

Banking stability map and indicator The banking stability map and indicator presents an overall assessment of changes in underlying conditions and risk factors that have a bearing on the stability of the banking sector during a period. The ratios used for constructing each composite index are given in Table 1. The five composite indices represent the five dimensions of soundness, asset-quality, profitability, liquidity and efficiency. Each composite index, representing a dimension of bank functioning, takes values between zero (minimum) and 1 (maximum). Each index is a relative measure during the sample period used for its construction, where a high value means the risk in that dimension is high. Therefore, an increase in the value of the index in any particular dimension indicates an increase in risk in that dimension for that period as compared to other periods. For each ratio used for a dimension, a weighted average for the banking sector is derived, where the weights are the ratio of individual bank assets to total banking system assets. Each index is normalised for the sample period as ‘ratio-on-a-given-date minus minimum-value-in-sample-period divided by maximum-valuein- sample-period minus minimum-value-in-sample-period’. A composite index of each dimension is calculated as a weighted average of normalised ratios used for that dimension where the weights are based on the marks assigned for assessment for the CAMELS rating. Based on the individual composite index for each dimension, the banking stability indicator is constructed as a simple average of these five composite indices. Estimation of losses: Expected losses, unexpected losses and expected shortfalls of SCBs The following standard definitions were used for estimating these losses:

The losses, EL, UL and ES, were estimated by using a simulated PD distribution. As a first step an empirical distribution of the PD was estimated using the Kernel Density Estimate; second using the empirically estimated probability density function, 20,000 random numbers were drawn based on the Monte Carlo simulation and finally, EL, UL and ES were calculated by taking PDs as average PD, 99.9 per cent VaR of PD and average PD beyond 99.9 per cent loss region respectively. Macro stress testing

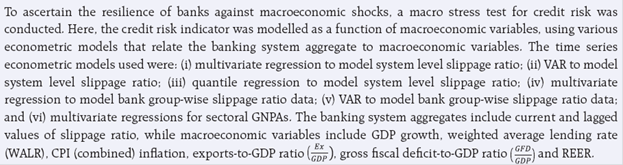

While multivariate regression allows evaluating the impact of selected macroeconomic variables on the banking system’s GNPA and capital, the VAR model reflects the impact of the overall economic stress situation on the banks’ capital and GNPA ratios, which also take into account the feedback effect. In these methods, the conditional mean of slippage1 ratio is estimated and it is assumed that the impact of macro-variables on credit quality will remain the same irrespective of the level of the credit quality, which may not always be true. In order to relax this assumption, quantile regression was adapted to project credit quality, in which, in place of conditional mean the conditional quantile was estimated. The Modelling Framework The following multivariate models were run to estimate the impact of macroeconomic shocks on the GNPA ratio/ slippage ratio (SR): System Level Models The projection of system level GNPAs was done using three different but complementary econometric models: multivariate regression, vector autoregressive (which takes into account the feedback impact of credit quality to macro-variables and interaction effects) and quantile regression (which can deal with tail risks and takes into account the non-linear impact of macroeconomic shocks). The average of projections derived from these models was used for calculating the impact on CRAR.

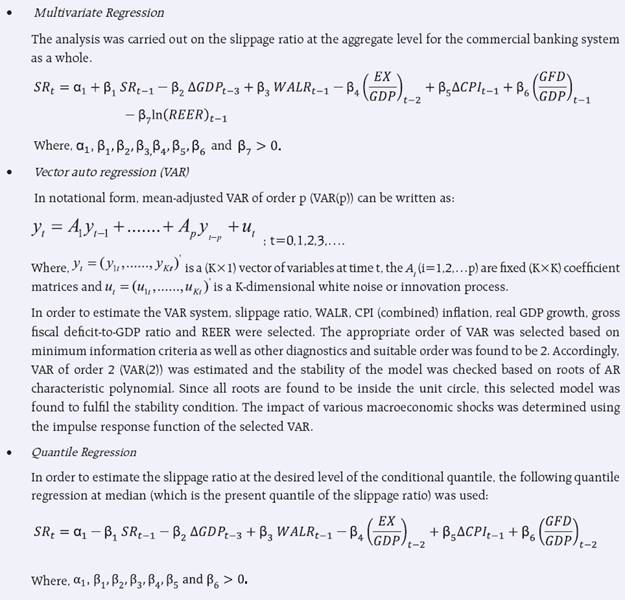

Bank group level models The projection of bank groups-wise GNPA are done using two different but complementary econometric models: multivariate regression and vector autoregressive. The average of projections derived from these models was used to calculate the impact on CRAR.

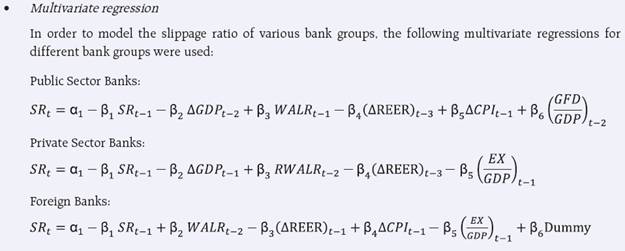

• Vector auto regression In order to model the slippage ratio of various bank groups, different VAR models of different orders were estimated based on the following macro variables: Public Sector Banks: Real GDP growth, CPI (combined)-inflation, WALR and first difference of REER and GFD to GDP ratio of order 2. Private Sector Banks: Real GDP growth, real WALR and first difference of REER of order 1. Foreign Banks: CPI (combined)-inflation, WALR and REER of order 2. Sector level models • Sectoral multivariate regression The impact of macroeconomic shocks on various sectors was assessed by employing multivariate regression models using the aggregate GNPA ratio for each sector separately. The dependent variables consisted of lagged GNPAs, sectoral GDP growth, CPI (combined)-inflation and WALR. Impact of exchange rate movement on asset quality The impact of the exchange rate on the asset quality of SCBs was captured through REER (36 currencies trade based using CPI inflation) which was found to be small. This could be because of merchandise export to GDP ratio and CPI in a way subsumes the effect of REER. Substituting REER with other indicators also did not improve the results. Estimation of GNPAs from slippages Derivation of GNPAs from slippage ratios, which were projected from the earlier mentioned credit risk econometric models, were based on the following assumptions: credit growth of 15 per cent; recovery rate of 9.6 per cent, 6.7 per cent, 5.8 per cent and 5.2 per cent during March, June, September and December quarters respectively; write-off rates of 6.3 per cent, 4.4 per cent, 2.8 per cent and 4.8 per cent during March, June, September and December respectively. Projection of PAT There are various components of profit after tax (PAT) of banks like interest income, other income, operating expenses and provisions. Hence, these components are projected using different time series econometric models (as given later) and finally PAT was estimated using the following identity: PAT = NII + OOI - OE - Provisions - Income Tax where, NII is Net Interest Income, OOI is Other Operating Income and OE is Operating Expenses.

Impact of GNPAs on capital adequacy Finally, impact on CRAR was estimated based on the PAT estimated as mentioned earlier. RWA growth was assumed at 10 per cent under the baseline, 12.5 per cent under medium risk and 15.5 per cent under severe risk scenarios. Regulatory capital growth was assumed to remain at the minimum by assuming minimum mandated transfer of 25 per cent of the profit to the reserves account. The projected values of the ratio of the non-performing advances were translated into capital ratios using the ‘balance sheet approach’, by which capital in the balance sheet is affected via provisions and net profits. Single factor sensitivity analysis – Stress testing As a part of quarterly surveillance, stress tests are conducted covering credit risk, interest rate risk, liquidity risk etc. and the resilience of commercial banks in response to these shocks is studied. The analysis is done on individual SCB as well as on the aggregated-system. Credit risk To ascertain the resilience of banks, the credit portfolio was given a shock by increasing GNPA levels for the entire portfolio as well as for few select sectors. For testing the credit concentration risk, default of the top individual borrower(s) and the largest group borrower was assumed. The analysis was carried out both at the aggregate level as well as at the individual bank lev el. The assumed increase in GNPAs was distributed across sub-standard, doubtful and loss categories in the same proportion as prevailing in the existing stock of NPAs. However, for credit concentration risk the additional GNPAs under the assumed shocks were considered to fall into sub-standard category only. The provisioning norms used for these stress tests were based on existing average prescribed provisioning for different asset categories. The provisioning requirements were taken as 25, 75 and 100 per cent for sub-standard, doubtful and loss advances respectively. These norms were applied on additional GNPAs calculated under a stress scenario. As a result of the assumed increase in GNPAs, loss of income on the additional GNPAs for one quarter was also included in total losses in addition to additional provisioning requirements. The estimated provisioning requirements so derived were deduced from banks’ capital and stressed capital adequacy ratios were derived. Interest rate risk Under assumed shocks of the shifting of the INR yield curve, there could be losses on account of the fall in value of the portfolio or decline in income These estimated losses were reduced from the banks’ capital to arrive at stressed CRAR. For interest rate risk in the trading portfolio (HFT + AFS), a duration analysis approach was considered for computing the valuation impact (portfolio losses). The portfolio losses on these investments were calculated for each time bucket based on the applied shocks. The resultant losses/gains were used to derive the impacted CRAR. In a separate exercise for interest rate shocks in the HTM portfolio, valuation losses were calculated for each time bucket on interest bearing assets using the duration approach. The valuation impact for the tests on the HTM portfolio was calculated under the assumption that the HTM portfolio would be marked-to-market. Evaluation of the impact of interest rate risk on the banking book was done through ‘income approach’. The impact of shocks were assessed by estimating income losses on the exposure gap of rate sensitive assets and liabilities, excluding AFS and HFT portfolios, for one year only for each time bucket separately. This reflects the impact on the current year profit and loss and income statements. Liquidity risk The aim of the liquidity stress tests is to assess the ability of a bank to withstand unexpected liquidity drain without taking recourse to any outside liquidity support. Various scenarios depict different proportions (depending on the type of deposits) of unexpected deposit withdrawals on account of sudden loss of depositors’ confidence and assess the adequacy of liquid assets available to fund them. Another liquidity risk analysis based on the unutilised portion of credit lines which are sanctioned/committed/guaranteed (taking into account the undrawn working capital sanctioned limit, undrawn committed lines of credit and letters of credit and guarantees) was carried out to focus on banks’ ability to fulfil the additional and sudden demand for credit with the help of their liquid assets only. Assumptions in the liquidity stress tests include: • It is assumed that banks will meet stressed withdrawal of deposits or additional demand for credit through sale of liquid assets only. • The sale of investments is done with a haircut of 10 per cent of their market value. • The stress test is done on a static mode. Stress testing of the derivatives portfolios of select banks The stress testing exercise focused on the derivatives portfolios of a representative sample set of the top 20 banks in terms of notional value of the derivatives portfolios. Each bank in the sample was asked to assess the impact of stress conditions on its respective derivatives portfolio. In the case of domestic banks, the derivatives portfolios of both domestic and overseas operations were included. In case of foreign banks, only the domestic (Indian) position was considered for the exercise. For derivatives trade where hedge effectiveness was established it was exempted from stress tests, while all other trades were included. The stress scenarios incorporated four sensitivity tests consisting of the spot USD/INR rate and domestic interest rates as parameters (Table 2).

Scheduled urban co-operative banks Credit risk Stress tests on credit risk were conducted on SUCBs using their asset portfolios as at end September 2014. The tests were based on a single factor sensitivity analysis. The impact on CRAR was studied under four different scenarios. The assumed scenarios were: • Scenario I: 0.5 SD shock on GNPA (classified into sub-standard advances). • Scenario II: 1 SD shock on GNPA (classified into loss advances). • Scenario III: 0.5 SD shock on GNPA (classified into sub-standard advances). • Scenario IV: 1 SD shock on GNPA (classified into loss advances). Liquidity risk A liquidity stress test based on a cash flow basis in the 1-28 days time bucket was also conducted, where mismatch (negative gap [cash inflow less than cash outflow]) exceeding 20 per cent of outflow was considered stressful. • Scenario I: Cash outflows in the 1-28 days time bucket goes up by 50 per cent (no change in cash inflows). • Scenario II: Cash outflows in the 1-28 days time bucket goes up by 100 per cent (no change in cash inflows). Non-banking financial companies Credit risk Stress tests on credit risk were conducted on non-banking financial companies (including both deposit taking and non-deposit taking and systemically important) using their asset portfolios as at end September 2014. The tests were based on a single factor sensitivity analysis. The impact on CRAR was studied under two different scenarios: • Scenario I: GNPA increased by 0.5 SD from the current level. • Scenario II: GNPA increased by 1 SD from the current level. • Scenario III: GNPA increased by 3 SD from the current level. The assumed increase in GNPAs was distributed across sub-standard, doubtful and loss categories in the same proportion as prevailing in the existing stock of GNPAs. The additional provisioning requirement was adjusted from the current capital position. The stress test was conducted at individual NBFCs levels as well as at an aggregate level. Interconnectedness: Network analysis Matrix algebra is at the core of the network analysis, which is essentially an analysis of bilateral exposures between entities in the financial sector. Each institution’s lendings and borrowings with all others in the system are plotted in a square matrix and are then mapped in a network graph. The network model uses various statistical measures to gauge the level of interconnectedness in the system. Some of the most important ones are: Connectivity: This is a statistic that measures the extent of links between the nodes relative to all possible links in a complete graph. Cluster Coefficient: Clustering in networks measures how interconnected each node is. Specifically, there should be an increased probability that two of a node’s neighbours (banks’ counterparties in case of the financial network) are also neighbours themselves. A high clustering coefficient for the network corresponds with high local interconnectedness prevailing in the system. Shortest Path Length: This gives the average number of directed links between a node and each of the other nodes in the network. Those nodes with the shortest path can be identified as hubs in the system. In-betweeness Centrality: This statistic reports how the shortest path lengths pass through a particular node. Eigenvector Measure of Centrality: Eigenvector centrality is a measure of the importance of a node (bank) in a network. It describes how connected a node’s neighbours are and attempts to capture more than just the number of out degrees or direct ‘neighbours’ that a node has. The algorithm assigns relative centrality scores to all nodes in the network and a bank’s centrality score is proportional to the sum of the centrality scores of all nodes to which it is connected. In general, for a NxN matrix there will be N different eigen values, for which an eigenvector solution exists. Each bank has a unique eigen value, which indicates its importance in the system. This measure is used in the network analysis to establish the systemic importance of a bank and by far it is the most crucial indicator. Tiered Network Structures: Typically, financial networks tend to exhibit a tiered structure. A tiered structure is one where different institutions have different degrees or levels of connectivity with others in the network. In the present analysis, the most connected banks (based on their eigenvector measure of centrality) are in the innermost core. Banks are then placed in the mid-core, outer core and the periphery (the respective concentric circles around the centre in the diagrams), based on their level of relative connectivity. The range of connectivity of the banks is defined as a ratio of each bank’s in degree and out degree divided by that of the most connected bank. Banks that are ranked in the top 10 percentile of this ratio constitute the inner core. This is followed by a mid-core of banks ranked between 90 and 70 percentile and a 3rd tier of banks ranked between the 40 and 70 percentile. Banks with a connectivity ratio of less than 40 per cent are categorised as the periphery. Solvency contagion analysis The contagion analysis is basically a stress test where the gross loss to the banking system owing to a domino effect of one or more banks failing is ascertained. We follow the round by round or sequential algorithm for simulating contagion that is now well known from Furfine (2003). Starting with a trigger bank i that fails at time 0, we denote the set of banks that go into distress at each round or iteration by Dq, q= 1,2, …For this analysis, a bank is considered to be in distress when its core CRAR goes below 6 per cent. The net receivables have been considered as loss for the receiving bank. Liquidity contagion analysis While the solvency contagion analysis assesses potential loss to the system owing to failure of a net borrower, liquidity contagion estimates potential loss to the system due to the failure of a net lender. The analysis is conducted on gross exposures between banks. The exposures include fund based and derivatives ones. The basic assumption for the analysis is that a bank will initially dip into its liquidity reserves or buffers to tide over a liquidity stress caused by the failure of a large net lender. The items considered under liquidity reserves are: (a) excess CRR balance; (b) excess SLR balance; (c) available marginal standing facility; and (d) available export credit refinance. If a bank is able to meet the stress with liquidity buffers alone, then there is no further contagion. However, if the liquidity buffers alone are not sufficient, then a bank will call in all loans that are ‘callable’, resulting in a contagion. For the analysis only short-term assets like money lent in the call market and other very short-term loans are taken as callable. Following this, a bank may survive or may be liquidated. In this case there might be instances where a bank may survive by calling in loans, but in turn might propagate a further contagion causing other banks to come under duress. The second assumption used is that when a bank is liquidated, the funds lent by the bank are called in on a gross basis, whereas when a bank calls in a short-term loan without being liquidated, the loan is called in on a net basis (on the assumption that the counterparty is likely to first reduce its short-term lending against the same counterparty). 1 Slippages are fresh accretion to NPAs during a period. Slippage Ratio = Fresh NPAs/Standard Advances at the beginning of the period. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: