X. Human Resources Development and Organisational Matters - ਆਰਬੀਆਈ - Reserve Bank of India

X. Human Resources Development and Organisational Matters

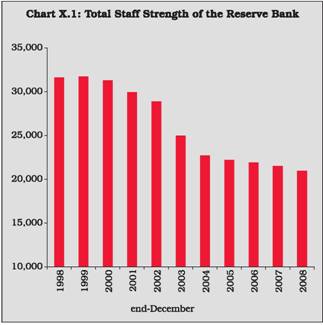

X. HUMAN RESOURCES DEVELOPMENT AND ORGANISATIONAL MATTERS As a knowledge driven public institution, the Reserve Bank assigns significant importance to the management of human resources. The Reserve Bank constantly strives to enhance the professional skills of the staff through appropriate training as well as providing scope for learning in every important area relevant to central banking for the staff at all levels. The two-way interactions through various collaborative efforts with different external institutions and agencies, both within the country and outside, provide opportunities for acquiring relevant feedback and gaining important insights from the experience and practices of others. The interactions of the Reserve Bank with the public through its various education as well as customer service delivery mechanisms aim at greater information dissemination about the Reserve Bank’s role and functions in the economy. Various modes of communication have also been effectively utilised to improve the flow of information, with better clarity. The improvements in internal functioning of the various departments have been ensured through appropriate checks and balances and internal auditing policy. The contribution of the Reserve Bank to economic research activities in India has been significant, which range from research by its own staff members to supporting academic research initiatives outside. X.1 The range of complex issues and policy challenges that emerged from the global financial crisis clearly highlight the importance of the quality of human resources available in the central banks to ensure financial stability in a market economy. The global crisis brought the role of central banks to the centre stage of crisis management, testing the resolve and competence of the available human resources to face the challenges. The Reserve Bank, as the central bank of one of the fastest growing emerging economies in the world with an expanding and liberalised financial system, recognises the critical significance of ensuring quality human resources to be able to discharge all the responsibilities effectively and efficiently. In its continued concerted efforts to strengthen the human resources, as a public institution, it faces stiff competition from the market in search of right talent. Moreover, in view of the increasing importance of coordination and cooperation among central banks in a globalised world on the one hand, and the need for continuous interactions with the market entities on the other, to enhance the understanding of issues and to maintain the flow of information through relevant feedback, existing human resources need to be exposed on a regular basis to other central banks and markets. Empowering the existing staff with adequate training in leading universities and research organisations is another important task of human resources management in central banks. The Reserve Bank has a multi-pronged approach to strengthen its human resources, using alternative available avenues in relation to the Bank’s identified needs. This Chapter documents the specific aspects of Reserve Bank’s various human resource development initiatives. HUMAN RESOURCE INITIATIVES Training and Skills Enhancement X.2 The two training establishments of the Reserve Bank, viz., the Reserve Bank Staff College (RBSC), Chennai and the College of Agricultural Banking (CAB), Pune cater to the training needs of the officers of the Reserve Bank and the banking industry. The four Zonal Training Centres (ZTCs) focus on training of Class III and IV staff of the Reserve Bank (Table 10.1). Reserve Bank Staff College (RBSC), Chennai X.3 The RBSC was established to impart training to the Reserve Bank’s own officers in junior and middle management cadres and specialised development of officers in the senior management cadre. It continues to contribute to the skill-upgradation of officers across all cadres of the Bank. It has been consistently modernising the techniques for imparting training as well as revamping the course content in response to the evolving challenges for the central banks and the changing needs for training. X.4 A number of topical programmes covering a host of areas were organised by the College during the year (Table 10.2). An interactive training programme was organised by the college with Police Officers from Sardar Vallabhbhai Patel National Police Academy, Hyderabad on various issues about the training structure, training modules and activities conducted at RBSC. The College hosted the second meeting of the High Level Group (HLG) on Systems and Procedures for Currency Distribution. The HLG comprised top executives from banks and renowned institutions. The college also conducted a study on ‘central bank balance sheet’, which was relevant in the context of the global economic crisis as central banks use their balance sheets as an instrument for aggressive quantitative easing. The College also developed an animation CD, ‘Mani loses Money’ for creating awareness amongst the common man regarding NBFCs in English, Hindi and Tamil. The delegates attending International Training Programme on Training Methods and Skills for Managers (TMSM) organised by the National Institute for Micro, Small and Medium Enterprises (NIMSME), Hyderabad visited the College and had an interactive session on the Reserve Bank, its functions and role in the economy. College of Agricultural Banking (CAB), Pune X.5 The CAB, originally set up with a focus on training the senior and middle level officers of rural and co-operative credit sectors, has, in recent years, diversified and expanded the training coverage into areas relating to non-banking financial companies, human resource management and information technology. Keeping in view the emerging training needs, the College organised several training programmes during the year (Table 10.2). The College conducted a workshop for State Level Bankers’ Committee (SLBC) convenor banks on the ways and means to accelerate flow of credit to priority sector for overall rural development. A customised programme for the Directors of State Co-operative Banks and District Central Cooperative Banks in Bihar was conducted by the College to create comprehensive awareness about developments in the financial sector, including regulatory and supervisory guidelines, particularly relating to the co-operative sector. Deputation of Officers for Training in India and Abroad X.6 The Reserve Bank deputes its officers to various external training institutes, conferences, seminars and workshops with a view to upgrading their skills and providing exposure to international perspective on topical issues. During 2008-09, 718 officers were deputed by the Bank to participate in training programmes, seminars and conferences organised by external management/banking institutions in India. The areas of training included human resources management, risk management, security, labour laws and micro finance. The Reserve Bank also deputed 426 officers to attend training courses, seminars, conferences and workshops conducted by banking and financial institutions and multilateral institutions in more than 30 countries (Table 10.3). The areas of training covered, inter alia, banking supervision, derivatives, risk management, financial programming and policies, central bank accounting, monetary policy and operations, finance for agriculture, rural development and macroeconomic management, human resources (HR), debt, reserve management, extensible business reporting language (XBLR), payment systems, women empowerment, deposit insurance, financial markets, microfinance and IT audit. One officer has been sponsored by the Bank to pursue two-year Post Graduate Programme in Banking and Finance (PGPBF) for the year 2009-2011 conducted by National Institute of Bank Management (NIBM), Pune. X.7 In order to enhance adequate familiarity with new developments in the field of economics, finance and quantitative techniques of analysis and sharpen executive skills, the Reserve Bank has decided from the year 2007-08 to depute senior officers in Grade ‘F’ for advanced management/ executive education programmes of about 2 to 3 weeks’ duration conducted at leading international business schools. Four senior officers in Grade ‘F’ were deputed to pursue such courses in 2008-09 at internationally renowned business schools, viz., the J.K. Kellog School of Management, North Western University, US and MIT Sloan School of Management, Cambridge, US. X.8 With a view to acquiring a global mindset through relevant exposure, two Advanced Management Programmes for senior officers (Grades ‘E’ and ‘F’) of the Bank and major public sector banks were conducted in collaboration with MDI, Gurgaon during the year. The first one titled “March Towards World Class Banking”, was conducted during September–October 2008 and the second one titled “Leading Change: Organisational Issues and Challenges” was conducted in April 2009. Both the programmes involved one week module at MDI, Gurgaon and two weeks module at London, Paris and Basel. X.9 Two programmes captioned as ‘Advanced Management Programme’ were conducted during October 2008 and March 2009 in collaboration with IIM, Lucknow. The programme had two components: the domestic learning component of one week at IIM, Lucknow followed by the overseas component at Malaysia and Singapore for one week. 60 officers in Grade ‘C’ and ‘D’ and one observer have been deputed so far for the programme. Joint India-IMF Training Programme (ITP)-Pune X.10 The joint India-IMF Training Programme (ITP) was established at the NIBM campus in Pune to impart policy-oriented training to nominees of Governments and central banks of the participating SAARC and East African countries, apart from India, in economics and related operational fields. During the year, seven programmes were conducted under the joint training programme (Table 10.4). Developments in the Short-term Secondment Scheme X.11 Effective collaboration and coordination between central banks has become critical for dealing with the challenges in a globalised world. Working in other central banks for a short period could provide direct exposure to the Bank’s officers to the approach adopted in other central banks in performing more or less similar broad functions. In pursuance of the Short-term Secondment Scheme that the Reserve Bank has worked out with select central banks, i.e., the Bank of England, Reserve Bank of Australia and Banque de France, two officers from the Reserve Bank were seconded to Bank of England in their Monetary and Financial Statistics Division and International Economic Analysis Division, respectively. One more official from the Reserve Bank was also seconded to the Financial Markets Group in the Reserve Bank of Australia during the period. Under the arrangement other central banks have with the Reserve Bank, while one official from Banque de France took up his secondment in the Department of Banking Supervision and Department of Banking Operations and Development, another official from the Reserve Bank of Australia undertook her secondment work in the Department of Economic Analysis and Policy. International Seminar X.12 As part of inter-institutional synergy initiatives, the Reserve Bank and Banque de France had decided in the year 2007 to organise joint seminars on topics of contemporary and mutual relevance. Taking these initiatives forward, a collaborative seminar was organised on a broad theme- “Issues in Capital Account Convertibility and Lessons from the Current Financial Crisis” on April 02 and 03, 2009 at the CAB, Pune. While the resource persons for the seminar covered a combination of Senior Executives of the Reserve Bank, Banque de France and the IMF, the participants comprised select officers from the Reserve Bank, French Consulate in India and various French credit institutions located in India. The Reserve Bank and the Bank of England co-hosted a G-20 Workshop on the “The Causes of the Crisis: Key Lessons” in Mumbai on May 24-26, 2009. The focus of the Workshop was on the role played by macroeconomic factors in the crisis and its propagation around the world. The workshop deliberated on the role and possible reforms of the international monetary system and the international financial institutions. Senior executives from the governments and central banks of the G-20 member countries participated in the Workshop. X.13 Five officers were selected during 2008-09 under the Golden Jubilee Scholarship Scheme for higher studies abroad. In all, 95 officers have been selected under this scheme since its inception in 1986. Under this scheme, officers of the Bank get the opportunity to pursue academic excellence in the leading international universities. Two officers availed study leave under different schemes for pursuing higher studies during the year. Zonal Training Centres (ZTCs) X.14 ZTCs of the Reserve Bank organised training programmes on functional areas of the Bank, information technology and behavioural areas for Class III and IV employees of the Reserve Bank. Apart from conducting regular programmes at their premises, ZTCs also conduct off-site programmes on personnel effectiveness, functions and working of the Reserve Bank for Class III staff and developmental programme for Class IV staff. X.15 In addition to the regular training initiatives, ZTC Belapur (Mumbai) and ZTC, Kolkata had introduced Integrated Officers Development Programmes (IODP) during 2007-08. Observing the success of these programmes at ZTCs, a total of 17 such programmes were conducted during 2008-09 at ZTC, Belapur and ZTC Kolkata. For 2009-10, 20 Integrated Officers Development Programmes (IODP), now renamed as Basic Management Programme (BMP), at ZTC, Belapur and 15 BMPs at ZTC, Kolkata have been scheduled. Deputation of Class III and IV Staff to External Institutions in India X.16 Under the scheme for deputation of Class III and IV staff for training in external institutions in India, 92 Class III employees and 79 Class IV employees were deputed for external training institutions during July 2008-June 2009. In addition, 817 Class III employees and 397 Class IV employees have been deputed for in-house programmes within the Bank. OTHER INITIATIVES 360-Degree Appraisal for Officers in Grade ‘F’ in the Bank X.17 The Bank has constituted a panel of HR consultants to assist the Bank in framing, implementing and delivering integrated HR solutions in the areas of HR policies, processes and systems, etc., as and when the need arises. Subsequent to a Quality and Cost Based Selection (QCBS), M/s Ernst and Young have been awarded the contract by the Bank for conduct of a 360-degree feedback exercise for Grade ‘F’ Officers of the Bank. The exercise, which is being co-ordinated by Central Office, Human Resources Development Department, is purely developmental in nature. RBI Young Scholars Scheme 2008-09 X.18 The Reserve Bank launched the Reserve Bank Young Scholars Scheme for students in the age group of 18 and 23 years, studying in undergraduate classes in various institutions across the country in 2007. Under the scheme for 2009, a country-wide selection test was conducted in all scheduled languages for the purpose and 150 Young Scholars were selected for being located at various Reserve Bank offices spread across India. This marks a significant effort on the part of the Bank, especially in view of its uniqueness of being perhaps the first such exercise, which was conducted in all major Indian languages. The underlying purpose of taking this innovative initiative has, in a sense, been quite well served as this has been a major awareness and sensitisation exercise on the role of the Reserve Bank and the banking system across the country. Committee of Executive Directors on Regional Offices X.19 A Committee of Executive Directors was set up by the Bank in April 2007 for identifying major focus areas for its Regional Offices and making better use of human resources deployed therein. Human Resources Development Department provided the Secretariat for the Committee. The mandate and terms of reference of the Committee required it to identify redefined roles for the Regional Offices of the Reserve Bank and situating them in the overall context of the evolving challenges for the central bank and policy concerns. The Report of this Committee of Executive Directors, which was submitted to the Bank in July 2008, focused on 4 major areas, namely: (i) Organisational Issues; (ii) Customer Service; (iii) Communication Strategies and (iv) Financial Education and Inclusion Initiatives. The broad thrust of the recommendations made in this Report has since been considered and given in-principle approval by the Bank and currently the Bank’s Department of Administration and Personnel management is co-ordinating the follow-up exercise to implement the said recommendations across the Bank’s offices/departments. Senior Management Conference 2008 X.20 The Senior Management Conference 2008 of the Bank was held in Mumbai from November 20 to 23, 2008. The broad theme of the Conference was “Financial Sector Development in India: Agenda for the Reserve Bank in the Next 5 years”. Besides individual sessions by the Top Executives of the Bank and diverse functional presentations, 4 eminent guest speakers addressed the Conference on emerging issues of contemporary relevance. These varied lectures focused on issues like the need to move beyond growth alone to an expansive view of India’s future, building of a new financial architecture, the need for putting in place proper Information System Controls in modern organisations and the usage and possibilities of the Right to Information (RTI) Act. The Guest Speakers at the Senior Management Conference 2008 were: (i) Sir Mark Tully, former Chief of BBC India Bureau; (ii) Smt. Ela Bhatt, Chairperson of the Self-Employed Women’s Association (SEWA), Ahmedabad; (iii) Shri K. Natarajan, Chief Executive Officer, Mindtree Ltd., Bangalore; and (iv) Shri Arvind Kejriwal, leading RTI Activist and Ramon Magsaysay Award Winner. Human Resources Audit X.21 The Reserve Bank has several HR systems and policies designed to enhance and harness the potential of its human capital. The Bank has decided to undertake an HR audit in order to further improve the HR processes and evolve the HR function accordingly. This audit, while analysing the existing HR processes, will help identify areas for further improvement. The HR audit will be employed in some critical HR areas like Performance Appraisal, Recruitment Policies and Practices, Transfers and Rotations, Promotions, Training and Development and Compensation Policy. SAARCFINANCE Study on HR X.22 In pursuance of the deliberations at the 17th SAARCFINANCE Governors’ meeting held in Washington DC on April 12, 2008, a paper was prepared with a broad theme of “Loss of central bank’s human capital to commercial organisations and the appropriate ways and means to retain the best talent keeping in view the predefined roles and functions of the central bank”. While attempting a brief scan of human resources in central banks in general and analysing the broad trends in the evolving manpower turnover scenario therein, the paper delved into the Indian context and the challenges faced in this regard by the Reserve Bank, and the strategies that the Bank has adopted or needs to consider as appropriate response. With a view to having more definitive insights from the internal and external stakeholders, along with a comparative analysis of talent processes in the Reserve Bank vis-à-vis those in select Indian banks and a couple of leading central banks in Asia for making the present exercise more comprehensive, the Bank has also taken relevant research inputs from M/s Hewitt Associates, India, which is in the Bank’s approved panel of HR Consultants. Knowledge Sharing Series X.23 The Bank has initiated a regular interface mechanism in the form of a knowledge-sharing lecture series, wherein leaders from the financial and corporate world are invited to share their knowledge and experiences with the Bank’s officials on a wide range of critical issues. Several interactive lectures have been organised by the Bank under the ambit of this series, which include interfaces with renowned nutritionist and dietician, cardiologist, gynecologist, and lectures on the art of storytelling, positive thinking and counseling, music therapy for stress relieving etc. Incentive Scheme for Distance Learning/Part-time Courses X.24 During 2008-09 (July-June), 468 employees availed the benefits under the incentive scheme for pursuing select categories of part time and distance education courses. The major areas of the study are management, information technology, financial analysis, commerce and economics. Awards for Without Reserve X.25 The Bank’s in-house journal “Without Reserve” received an award for overall excellence and a citation of encomium in the XIth All India Journal Competition instituted by the Mayaram Surjan Foundation, Raipur. “Without Reserve” also bagged the National Award for House Magazine (First Prize) 2007 for the fourth consecutive year for being the best National in-house magazine in a contest organised by the Press Club, Thiruvananthapuram. The Association of Business Communicators of India (ABCI), at the 48th annual awards competition, awarded “Magazine of the Year” award along with 8 other prizes in various categories covering internal magazines, bilingual publication, magazine design, features (English), features (language), special column (language), illustration and wall calendar. Visits/Attachments X.26 With a view to strengthening the scope for acquiring relevant knowledge from other institutions on a sustained basis as also to spread better awareness outside about the critical role played by the Reserve Bank in the economy, an External Services and Technical Co-operation Cell was constituted in the Human Resources Development Department. The Department coordinates training/ exposure purpose visits by external visitors/ delegations to the Bank from foreign central banks, overseas universities and other institutions from India and abroad. During the year 2008-09, the department arranged interface/training sessions for a total of 73 international visitors from foreign central banks and reputed international educational institutions. Interface sessions were also arranged for 148 domestic visitors, mainly from the Foreign Service Institute, National Defense College and participants of the Higher Command Courses from the armed forces. Grants to various Institutions X.27 Apart from its own training colleges mentioned earlier, the Reserve Bank has also catalysed the creation of four more research and training institutions in India, viz., (i) Indira Gandhi Institute of Development Research (IGIDR), Mumbai; (ii) National Institute of Bank Management (NIBM), Pune; (iii) Indian Institute of Bank Management (IIBM), Guwahati; and (iv) Institute for Development and Research in Banking Technology (IDRBT), Hyderabad. The Reserve Bank extended financial support of Rs.11.52 crore, Rs.83.10 lakh and Rs.39.59 lakh to IGIDR, NIBM and IIBM, respectively, during 2008-09. Summer Placement X.28 The Reserve Bank has a Summer Placement Scheme, which provides an opportunity to domestic and foreign students to expose themselves to the working environment in a central bank and apply their knowledge to various operational issues while pursuing their internship. During the year 2009, the Bank has selected 79 Summer Trainees for taking up projects in various central office departments in Mumbai as well as at Regional Offices of the Bank located at the Metro centres. In addition, 11 Summer Trainees have been selected from amongst the desirous candidates studying in reputed institutes abroad. Industrial Relations X.29 Industrial relations in the Bank remained, by and large, peaceful during 2008-09. The Bank continues to hold periodical meetings with the recognised Associations/Federations of workman/ employees/officers on various matters related to service conditions and welfare measures. Recruitment X.30 During 2008 (January-December), the Reserve Bank recruited 174 employees. Of this, 22 belonged to Scheduled Castes (SCs) and Scheduled Tribes (STs) categories, constituting 12.6 per cent of total recruitment (Table 10.5) Staff Strength X.31 The total staff strength of the Reserve Bank as on December 31, 2008 was 20,952 as compared with 21,494 a year ago (Chart X.1). Of the total staff, 21.2 per cent belonged to Scheduled Castes and 8.9 per cent belonged to Scheduled Tribes (Table 10.6).

X.32 During the year 2008 (January-December), meetings between the Management and the representatives of the All India Reserve Bank Scheduled Castes/Scheduled Tribes and the Buddhist Federation were held on four occasions to discuss issues relating to the implementation of reservation policy in the Reserve Bank. In accordance with the Central Government’s policy, the Reserve Bank provided reservation to Other Backward Classes (OBCs) effective from September 8, 1993. The number of OBCs (recruited after September 1993) in the Reserve Bank as on December 31, 2008 stood at 874. Of these, 293 were in Class I, 82 in Class III and 499 in Class IV. Two meetings were held with the All India Reserve Bank OBC Employees’ Welfare Association to discuss issues relating to implementation of reservation policy in the Reserve Bank. X.33 The total strength of ex-servicemen in the Reserve Bank as on December 31, 2008 stood at 198 in Class I, 178 in Class III and 777 in Class IV. The total number of physically handicapped employees in Class I, Class III and Class IV cadres in the Reserve Bank stood at 191, 138 and 130, respectively, as on December 31, 2008. X.34 Of the total staff, 41.8 per cent was in Class I, 23.4 per cent in Class III and the remaining 34.8 per cent in Class IV (Table 10.7). X.35 Almost one-fourth of the total staff is involved in work related to currency management (Table 10.8). X.36 Mumbai centre (including the Central Office Departments) continued to have the maximum number of staff (29.2 per cent) followed by Kolkata (9.8 per cent), Chennai (7.4 per cent) and Delhi (7.1 per cent) (Table 10.9). X.37 The Reserve Bank has come a long way. The year 2009 marks a momentous milestone in the history of the Bank as it entered into its 75th year of its establishment. In order to commemorate the Platinum Jubilee of the Reserve Bank of India, the year 2009 has been earmarked for launching a series of initiatives and events for making the Reserve Bank a more useful and effective public entity so as to enable it to serve the country and its public in general better (Box X.1).

Promotion of Hindi X.38 The Reserve Bank continued with its efforts to promote the use of Hindi in its working during 2008-09. In pursuance of the statutory requirements of Rajbhasha Policy involving implementation of the provisions of the Official Languages Act, 1963, the Official Language Rules, 1976 and the Annual Programme issued by the Government of India, the Reserve Bank conducted various Hindi training programmes and other promotional activities such as publication of reference material, shield competitions, inter-bank Hindi essay competition and inter-bank/financial institutions and Hindi/ bilingual in-house journal competitions. Many programmes were conducted during Hindi fortnight observed from September 14, 2008. As a part of promotional activity, the Reserve Bank continued to bring out its various publications in bilingual form, i.e., both in Hindi and English. X.39 A quarterly journal ‘Rajbhasha Samachar’ is being published regularly by the Rajbhasha Department. The journal is focused on the latest developments in the area of implementation of Official Language Policy and other activities. Understanding and dissemination of new banking concepts also forms a part of this publication. A quarterly Hindi magazine "Banking Chintan Anuchintan" is also published by the department containing useful articles in Hindi on banking and HR subjects. Besides a bilingual in-house journal "Without Reserve" is published by Bank's Central Office. The regional offices also made attempts to publish regular magazines in Hindi during the year. X.40 Translation workshops were conducted for Rajbhasha Officers of the Reserve Bank so as to encourage the adaptation of translation work. A few workshops were also conducted for senior officers to familiarise themselves with the Official Language policy and instructions thereon. An annual conference of Rajbhasha Officers of the Bank was also held to discuss various issues pertaining to the use and promotion of Hindi language. X.41 The Reserve Bank through its Rajbhasha Department further strengthened the use of Hindi in computerisation. A reporting package is being developed so that all the Departments/Offices of the Bank and head offices of the public sector banks will be able to submit Hindi data by using ‘on line’ facility. On guidelines received from the Government of India, the Bank has adopted use of Unicode Hindi fonts for all its Hindi requirements. Revised edition of ‘Prashasanik Shabdavali’ containing administrative terms, names of departments and designations was released in electronic form for the use of the Reserve Bank staff. Preparation of banking terminology in Hindi ‘Paribhashik Kosh’ is at an advanced stage.

X.42 The Committee of Parliament on Official Language visited Regional Office of the Reserve Bank at New Delhi in September 2008 and expressed satisfaction over the use of Hindi in the Bank. Complaints Redressal Mechanism – Prevention of Sexual Harassment of Women at Workplace X.43 Pursuant to the guidelines laid down in the Supreme Court Judgment [Vishaka and Others vs. State of Rajasthan (1997) SCC 241], a Complaints Redressal Mechanism for prevention of incidence of sexual harassment of women at workplaces was put in place in the Reserve Bank in 1998. Under the system, a Central Complaints Committee (CCC) headed by a lady officer in Grade ‘F’ is functional at the Central Office level. In order to provide an easy access to the complaints redressal mechanism for the lady staff working in offices located at various other places, additional complaints committees have been formed at six locations in the Reserve Bank’s offices in Mumbai and 20 Regional Offices. These committees are also headed by senior woman officers. The CCC and Regional Complaints Committees (RCCs), besides having a member from NGOs, have more than 50 per cent women members. The CCC acts as the focal point for matters relating to prevention of sexual harassment of women at work place and receives references related to sexual harassment from the RCCs. The CCC and RCCs both, apart from providing a complaint redressal mechanism, have also generated better awareness of sexual harassment issues. They are also providing counselling to aggrieved persons. During 2008-09 (July-April), only one complaint of the sexual harassment was received, investigations in respect of which revealed that the matter related to dispute over allocation of their duties rather than sexual harassment. A complaint received prior to this period is at the final stage of disposal. Customer Service and Grievance Redressal System in the Reserve Bank X.44 The Reserve Bank renders services to members of the public, banks, Central and State Governments and financial institutions in areas covering currency management, Government receipts and payments, public debt management, clearing and remittance of funds and foreign exchange, etc. In order to further improve the delivery of customer service, a Customer Service Department was set up in July 2006 by bringing in various customer service activities handled by different Departments of the bank under a single roof. The aim of the Customer Service Department is to work towards fair and responsible banking and to ensure cost effective and credible system of dispute resolution for common persons utilising the banking services. Towards this vision, the Department focused on several important activities during the year, viz., to ensure redressal of grievances of users of banking services in an inexpensive, expeditious, fair and reasonable manner so as to provide impetus to improved customer services in the banking sector on a continuous basis; to provide valuable feedback/ suggestions to the Reserve Bank towards framing appropriate and timely guidelines to banks to improve the level of customer service and to strengthen their internal grievance redressal systems; to enhance the awareness of the Banking Ombudsman Scheme; and to facilitate quick and fair (non-discriminatory) redressal of grievances through use of IT systems, comprehensive and easily accessible database and enhanced capabilities of staff through training. Box X. 1 The Reserve Bank, which commenced its operations on April 1, 1935, has entered into its 75th year of establishment. Not only does this Platinum Jubilee year mark a momentous milestone in the history of the Bank in terms of past numerous achievements in serving the nation, it also provides an occasion for introspection, an occasion to reflect on the evolution of the institution and to reinvent as to how the institution could fulfill its objectives even better so that the Reserve Bank continues to make a positive difference in the life of every Indian. Keeping this in view, a series of initiatives and events has been planned to coincide with the Platinum Jubilee year of the Reserve Bank. Besides various events of celebration, a number of initiatives and activities have been proposed for making the Reserve Bank a more useful, relevant, professional and effective public institution that can serve the country better. The broad components of these celebrations will be three-fold: (i) learning events such as seminars, memorial lectures, etc. ; (ii) functions and events like the Down the Memory Lane events, bringing out special issue of “Without Reserve”, the annual Senior Management Conference, release of commemorative stamp and coin, cultural and sports events, etc. and (iii) Outreach programmes. The Bank plans to make use of this to more effectively reach out to the users of its services by seeking to associate them proactively in the dissemination and deliberation process. For this, seminars and panel discussions on key issues and themes are being organised at select Regional Offices of the Reserve Bank inviting various constituents of the Bank. It is expected that such an initiative will form an important part of the Reserve Bank’s efforts, especially through its Regional Offices, to seize and create potential for newer and wider engagement in the local development processes so as to be able to look after the soundness of the financial system. This will also seek to ensure that the broad economic concerns of all sections of the population of these areas, with the vulnerable and marginalised groups at the core of the agenda, are adequately addressed. Keeping in mind that these Platinum Jubilee Year celebrations of the central bank need to reflect the Bank’s past and also manifest its current and future approach, the Governor, in his broadcast to the members of the Bank’s staff on April 1, 2009, has elucidated the significance of the occasion and set forth the Bank’s broad agenda for the near/medium term.X.45 The Complaints Redressal Cell (CRC) of the Customer Service Department coordinates with different Departments of the Bank, which have direct dealings with the public for prompt disposal of complaints against the services rendered by the Reserve Bank to the satisfaction of members of the public. Complaints by the members of public/Bank’s constituents pointing out deficiencies in the services rendered by the various Departments of the Bank at different centres, including Central Office Departments, fall within the ambit of the CRC. CRC covers all service-oriented Departments of the Bank and in particular, the Banking Department [Public Accounts Department (PAD), Deposits Accounts Department (DAD), and Public Debt Office (PDO)], Foreign Exchange Department and Issue Department. X.46 CRCs have been established at all Offices/ Central Office Departments. Advertisements, giving wide publicity about the functioning of the CRC at various Centres and also at the Central Office are simultaneously published on a half-yearly basis, on first Sunday of January and July every year. The advertisements are published in the leading English and regional dailies. Citizens’ Charter specifying the timeframe for each of the customer related activities of the Banking Department is prominently displayed in the Banking Hall for the benefit of the customers/members of the public visiting the Reserve Bank for availing of various kinds of services. Due publicity to the Citizens’ Charter is also given through the Reserve Bank’s website and hard copies of the same are made available to the customers/members of public over the counter. CRC obtains Monthly Status Reports on the receipt and disposal of complaints from all offices/Departments. CRC also receives Quarterly Reports based on the feedback received in writing from the Bank’s customers on Citizens’ Charter. The Regional Offices are required to assess the level of customer service every quarter. CRC analyses these reports to assess the level of customer service. The issues relating to the customer service and redressal of complaints are discussed at the Branch Level Management Committee meetings that are held at periodic intervals. Offices also arrange periodic meetings with the customers, viz., commercial banks, urban co-operative banks, Government agencies/ departments and members of public and submit reports thereon to the CRC. Customer service complaints/grievances, both against the Reserve Bank and commercial banks were brought within the purview of Local Boards. X.47 The Complaint Tracking System (CTS) is being periodically updated to deal with the rising number of complaints and also to get quick response from the banks. The upgraded version of the CTS envisages paperless office at Banking Ombudsmen (BO) offices. The upgradation would provide alert facility to Nodal Officers of the respective banks under each BO’s jurisdiction as soon as the complaint against the concerned bank is received by the BO office for the purpose of monitoring at the bank level. It also provides for comprehensive reports of the complaints received by BO offices under different categories, reasons and bank-wise classification. X.48 Customer Service Department plans to publish four booklets during 2009-10 on the rights and obligations of customers related to credit cards, service charges, housing loans and collection of cheques. The booklets on housing loans and collection of cheques have already been finalised and are in the process of being printed. Furthermore, Microsoft excel based programme has been developed by the Customer Service Department, which would be put up on the Bank’s website so as to enable the customers to calculate EMIs and loan amounts and compare the same across banks for different maturities and interest rates. Also a massive publicity campaign on the Banking Ombudsman Scheme is being launched covering both print and electronic media (Jago Grahak Jago campaign) in collaboration with the Government of India. X.49 Customers, particularly in rural and semi-urban areas, find it difficult to switch their accounts from one bank to another because of lack of geographic coverage. Hence, there is a need for regulatory oversight as also creating customer awareness. Banking Ombudsmen (BO) have undertaken face to face interaction with the stakeholders at fora like farmer’s associations, consumer societies, chambers of commerce, trade associations, etc. BOs have been advised to hold quarterly meetings with the lead banks at district levels to explain the policies of the Reserve Bank. BOs were also advised to take particular interest in dissemination of knowledge on the recent changes in the BO Scheme and the rationale for the same. BOs have been encouraged to spread awareness about the Scheme in the interior parts of the country to empower the customers and also to sensitise bankers to deal with the customers fairly. Management of the Bank’s Premises X.50 Premises Department is responsible for framing policies for creation, maintenance, renovation and consolidation of the Bank’s physical infrastructure (office/residential buildings) by adopting modern technologies and materials, etc. The Department, in coordination with Estate Office at Regional Offices, is focusing on providing modern infrastructural facilities in office buildings as well as residential quarters in a planned manner so as to inculcate a sense of pride and belongingness amongst officers/staff. X.51 Keeping in view the importance attached to scarce resources, the Premises Department has initiated energy/water saving measures, as a part of its responsibility to address ecological and environmental concerns. The Department has taken up the national objective of reduction in energy consumption and implementation of environment friendly measures. The initiatives taken by the Bank in upgrading energy efficiency in all its office buildings and detailed monitoring of energy use have been recognised by Bureau of Energy Efficiency (BEE), Ministry of Power, Government of India. BEE has developed norms for the ‘Building Energy Star Rating Programme’ and all the buildings of the Bank have been rated as the most energy efficient buildings in the country. BEE, on the occasion of launching of the star rating program for the buildings at New Delhi on February 25, 2009 recognised the Reserve Bank’s commitment to enhancing energy efficiency and awarded the first star rating labels to the Bank’s building at Bhubaneswar and New Delhi. The four buildings located at Bhubaneswar, Chennai, Kochi, Kolkata are recognised as 5-star building under the rating system. Nine buildings at Bhopal, Chandigarh, Hyderabad, Jaipur, Kanpur, Mumbai, Nagpur, New Delhi and Thiruvananthapuram have been given 4-star rating by BEE. Keeping in view the phasing out dates declared by Ministry of Environment and Forests for the Ozone Depleting Substances (ODS), the Premises Department reviewed the air-conditioning plant working on these refrigerants in the Bank’s buildings and an action plan has been prepared for replacement of these plants by 2010. Replacement of air-conditioning plants was taken up at Belapur, Mumbai Regional Office, Kolkata and Thiruvananthapuram during the year 2008-09 and is at various stages of implementation/ processing. X.52 Water conservation and water audit have been initiated and all the Regional Offices have been advised to conduct Water Audit. The action points have been identified for immediate implementation and advised to all the Regional Offices accordingly. The Bank is exploring the feasibility of implementing ‘Green Building Projects’ to rationalise the use of natural resources. Steps have also been initiated to enhance the greenery and to maintain the ecological balance in our surroundings by undertaking tree planting in Bank’s properties. X.53 The Department has initiated the process of construction of Officers’ residential flats at New Delhi, Mumbai, Chennai, Jammu and Hyderabad under Design – Build mode of Construction in which a single entity, i.e., DB Developers assumes complete responsibility of executing the project. The project is likely to be completed in the next 2 years and will address the Officers’ residential requirement at these centres. The Department has taken up major structural rehabilitation work in the Central Office Building, which is likely to be completed by the close of 2009. X.54 In the light of the experience gained over the years, a need was felt to revisit and revise the policy and practices relating to dead stock management and also to computerise the maintenance of dead stock accounts in order to reduce the administrative and operational costs. Accordingly, a revised Fixed Asset Policy was put in place with the approval of the Committee of the Central Board. The policy was designed to be in line with the best global accounting practices and in conformity with AS 10 of the Institute of Chartered Accountants of India (ICAI). The Department developed a computerised Inventory Management System for implementation with effect from 1st July 2009. The system is web-based, accessed from Nagpur Data Centre and will address the functions of Estate Department at Regional Offices.Inspection of Offices/Departments in the Reserve Bank X.55 The Management Audit and Systems Inspection (MASI), Information Systems Audit, Concurrent Audit (CA) and Control Self-Assessment Audit (CSAA) of the Offices/ departments of the Reserve Bank are undertaken at prescribed intervals. The MASI evaluates the adequacy and reliability of existing systems and procedures to ensure that laws, regulations, internal policy guidelines and instructions are meticulously followed. Aspects relating to organisational goals, delegation of power and customer service in the department/Office and management efficacy are also looked into under Management Audit. During the year 2008-09, Systems Inspections, including Information Systems Audits of eleven Regional Offices (ROs), fifteen Central Office Departments (CODs), one Training Establishment (TE) and one Associate Institute were completed. In addition, Risk Based Inspection/Audit of New Delhi Office was also taken up and completed. X.56 The monitoring of the efficacy of the Concurrent Audit and Control Self Assessment Audit prevailing at various ROs/CODs continued to be undertaken through an off-site Audit Monitoring Arrangement and on-site snap audits of offices (ROs/ CODs/ TEs). During the year 2008-09, snap audits of 21 Regional Offices, 24 Central Office Departments and two Training Establishments were conducted. X.57 Technology audits of critical and important IT applications/ systems were undertaken by involving external experts in the field of Information Systems Audit. During the year, technology audits of National Electronic Clearing Systems (NECS), Centralised PAD Systems (CPAD), Clearing Corporation of India Limited (CCIL) Transactions and Integrated Accounting Systems (IAS) were conducted. Technology Audits of e-Treasury application and Liquidity Adjustment Facility (LAF) module covering functionality and security review are underway. The project for obtaining ISO 9001-2000 Certification in select work areas/Departments was taken up in the Bank, in phases (Box X.2).Information Systems (IS) Audit Policy X.58 In order to address the changing business environment and needs ushered in by increased usage of technology in the Reserve Bank as also to map Bank’s IS Audit Policy to international best practices and standards, a comprehensive review of the existing Policy was undertaken in consultation with the Institute of Internal Auditors (IIA). The revised IS Audit Policy has been approved in March 2009. An IS Audit strategic plan document prepared to facilitate achievement of Policy objectives has also been approved (Box X.3). Risk Based Internal Audit (RBIA) X.59 Implementation of the project for introduction of Risk Based Internal Audit (RBIA) in the Reserve Bank has been taken forward during the year by taking up live run of RBIA at New Delhi RO. Based on the experience gained during this Audit and some more such live runs to follow, methodology for conducting such audits is being evolved in order to facilitate transition from the existing Systems of Inspection to RBIA in a year’s time. Communication X.60 The Reserve Bank recognises the critical significance of a sound communication policy. The goals of its communication policy are intimately interlinked to its objectives. Transparency, clarity, managing expectations and promoting two-way flow of information along with dissemination of information, statistics and research at various frequencies continued to remain the principal goals of the Reserve Bank’s communication policy. X.61 In keeping with its communication policy, the Reserve Bank continued to disseminate information through various channels, such as, press releases, notifications, speeches, publications, frequently asked questions (FAQs), advertisements in print and electronic media and the website. Press and video conferences with the participation of national and regional media following the announcement of annual, quarterly and half yearly monetary policy statements continued to play a significant role in reaching out to the public at large. Occasional interviews of the Top Management with national and international media helped in covering the Reserve Bank’s assessment of the economy and the financial system conveying to the wider audience.Box X.2 As a part of the Reserve Bank’s continuing initiatives to adopt and adhere to the international best practices and standards, the project of obtaining Quality Management System (QMS) certification (ISO 9001) and Information Security Management System (ISMS) certification (ISO 27001) in select work areas was undertaken in phases. ISO 9001-2000 is a generic management standard providing an internationally accepted framework for establishing quality management systems with customer focus and continual improvement as the key elements. Quality Management System (QMS) enables the organisation to identify, measure, control and improve various business processes for better achievement of its business objectives. The ISO 9001 Standards are flexible enough to be implemented in any kind and size of organization and have ‘Plan, Do, Check, Act’ cycle as operating principle. Information Security Management System (ISMS) is a systematic approach to managing sensitive information. It encompasses people, processes and Information Management systems. The Standard provides a framework for selection of adequate security controls proportionate to the criticality of the information processed/ stored and business process risks in a particular work area/ domain by alignment of business processes and information security needs. It is implemented through the process of information system asset inventorisation, risk identification and documentation of management and information security policies as well as control procedures for effective risk mitigation. Status of ISO 9001 Certification in the Bank During the first phase, ISO 9001 certification was obtained for DCM, DGBA, and Issue and Banking Departments at Kolkata and Hyderabad ROs. It completed first cycle of 3 years in April 2009 and recertification at these locations was successfully accomplished through external certifying agency. During second phase of certification, Issue and Banking Departments at New Delhi, Jaipur, Bangalore and Chennai ROs were certified. These locations successfullyfaced second surveillance (sustenance) audit during the year. The certified Departments have benefited from implementation of standards by way of continual improvement through measurable quality objectives, particularly in the areas of house-keeping, record management and customer service; re-emphasised calibration system of measuring/processing devices, especially Currency Verification and Processing Systems (CVPS), among others. Currently, third phase of certification covering DEAP, DAPM, HRDD and Issue and Banking Departments at Ahmedabad, Bhopal, Nagpur and Thiruvananthapuram ROs is underway. Fourth phase of certification at Issue and Banking Departments in 8 of the remaining ROs has been initiated. As a part of extending ISO certification to other work areas, FED is also planned for implementing these Standards. Status of ISO 27001 Certification in the Bank ISO 27001 Standards are implemented in select work areas of the Reserve Bank, in phases, with assistance from external experts/consultants. During the first phase, such certification was obtained for Departments such as DEIO and IDMD. First cycle of 3 years was completed at these locations in April 2009 and recertification was successfully accomplished through external certifying agency. During the second phase of certification, two more Departments, viz. DBS and DBOD were covered. DBS successfully faced 1st surveillance (sustenance) audit during the year. Implementation of ISO 27001 has been taken-up Department-wise, in view of the diverse functionality, multiple information processing systems and varying levels of criticality of information across Departments. The certified Departments have benefitted from implementation of Standards by way of increased security awareness at all levels, documented incident reporting system, dynamic IS risk assessment and treatment. Currently, third phase of ISO 27001 certification covering Central Accounts Section (CAS), Nagpur and Financial Market Department (FMD) is underway.X.62 During the year ended June 30, 2009, the Reserve Bank issued 2,119 press releases, 79 master circulars and 517 notifications. It organised meetings, workshops and seminars to interact with special audiences. Queries relating to banking, foreign exchange, economy, customer service were received through e-mail in the helpdesk email boxes set up in the various Departments and Regional Offices. These queries were over and above the queries received under the Right to Information Act, 2005. X.63 With accent on transparency and accountability, the Reserve Bank has been making increasing use of its website (URL:http://www.rbi.org.in) for communicating with the external audiences. The site is used not only to disseminate information emanating from the Reserve Bank but also to seek feedback on reports and recommendations as well as on draft regulatory guidelines. During 2008-09, eight draft guidelines, one draft report and two approach papers were placed on the website for feedback. The number of users who registered themselves for receiving information available on the Reserve Bank’s website through email increased twofold during the year. As many as 19,096 users registered themselves during the year taking the total number of registered users to 34,104. Information Systems Audit (ISA) function was formalised in the Reserve Bank, with the necessary responsibilities entrusted to the Inspection Department in 2001, in the wake of increasing computerisation and growing usage of IT in work processes. An IS Audit Policy, with provision for periodical review was also formulated. Considering the emerging business environment characterised by increased technology usage as also enhanced complexity of technologies being deployed, risks and resultant assurance needs have grown over the years. The IS Audit policy was, therefore, revised in order to refocus the approach to IS Audit in the Bank, in tandem with international best practices. The objective of the revised IS Audit Policy is to assess and provide independent, objective assessment of the state of affairs and make audit recommendations regarding IT and IS in terms of Functionality, Security and Performance. The policy, prepared in consultation with Institute of Internal Auditors (IIA) also refers to guidelines provided by the Information Systems Audit and Control Association (ISACA) and other best practices followed internationally. The key changes in the revised IS Audit Policy apart from relevance and business need perspective include: (i) issues related to functionality and performance aspect of the IT systems delivering the business objectives along with risk assessment, (ii) consulting role in IS Audit function at various stages of IT projects and applications and (iii) provision for effective deployment and appropriate and adequate resources, internal as well as external, with necessary flexibility. During 2008-2009, a strategic plan for aligning IS Audit function to the organisational requirements in the wake of increasing use of technology in business processes was approved. It included taking up periodical third party IS Audits. The components of strategic plan include: (i) risk orientation of audit function, (ii) changing the audit report structure, (iii) skill up-gradation and knowledge dissemination/sharing, (iv) availing external assistance wherever required, (v) audit resource augmentation and (vi) introducing a system or regular third party audits in IT/IS aspects thereby achieving the attributes such as valued assurance, scalable model and sustainable effort in IS Audit function. Various steps were taken to operationalise the strategic plan such as: (i) the major IT systems were classified based on the importance (criticality, important or normal) based on the availability factor along with complexity of rating, (ii) audit activities pertaining to periodical review with respect to the major IT systems were categorised into three levels and (iii) the broad scope of periodic audit was formalised for these audit activities. The audit guidelines are being prepared for generic/application specific scopes against key components defined in live run of Risk Based Internal Audit. X.65 Under the outreach programme, the staff of the Reserve Bank also visited schools, colleges, professional and other academic/vocational institutions in both, Mumbai and various other regional centres for an interactive session. The interaction was mainly on subjects, such as, role and functions of the Reserve Bank, Indian economy, evolution of money, salient security features of currency notes, the Reserve Bank’s financial literacy project, understanding of payment system and general banking. X.66 The Reserve Bank arranged an interactive workshop for communicators of central banks of SAARC countries and other regulators of financial sector in India in February 2009. Hosted by the College of Agricultural Banking, Pune, the objective of the three-day workshop was to facilitate exchange of ideas and networking. Topics, such, as communication policy, internal communication, role and tools of communication and challenges of communication were discussed at the workshop. The workshop was organised under the SAARCFINANCE forum. X.67 Regional Directors of select offices interacted with the representatives of local print and electronic media to disseminate information on financial literacy initiatives taken up by the Reserve Bank, coin and note distribution measures of the regional offices and other matters pertaining to currency management. Participation in radio and television programmes by senior officers also helped in spreading awareness and sensitising the public about the role of the central bank and the importance of financial literacy. Customer Service X.68 During the year under review, Regional Offices undertook various measures including the evaluation of customer satisfaction for further improving customer service in the areas of banking, currency management, foreign exchange management and clearing mechanism. The efforts included training programmes/workshops/ meetings to educate officials of various banking and non-banking organisations, such as, State and Central Government undertakings, authorised foreign exchange dealers, rural and urban money lenders, representatives of major NGOs, professors and farmers’ organisations. X.69 Officers in some regional centres made incognito visits to bank branches to assess customer service in areas, such as, exchange of defective notes, display of service charges and interest rate on various deposits, cheque drop box facility, conduct of foreign exchange business, the Banking Ombudsman Scheme, etc. Several Regional Offices organised melas for exchange of soiled/mutilated notes and coin distribution as well as camps on weekly market days for supply of new notes and coins.X.70 Workshops/seminars/meetings were held with banks, micro finance institutions, rural insurance agencies, officials of Department of Posts and other field level functionaries to familiarise them with the Reserve Bank’s instructions on financial inclusion and also to discuss issues, such as, opening of no-frills accounts, IT-enabled financial inclusion, formation of self-help groups, etc. X.71 Advertising campaigns were undertaken to highlight investor friendly features of the Government Securities Act, 2006 and to caution the public against fictitious offers of remitting cheap funds from abroad. Financial Education and Literacy X.72 In an effort to enhance and promote financial education and literacy, a few more comic books were released under Raju and Money Kumar series. These included ‘Raju and the Sky Ladder’, ‘Raju and the Magical Goat’ and ‘Money Kumar and Caring for Currency’. A few Regional Offices of the Bank collaborated with the state level bankers’ committees and district level government officials in dissemination of financial education material in the local language. X.73 Regional Offices also participated in fairs/ exhibitions of local and national reach to disseminate information on the Reserve Bank’s role as a central bank, besides currency management, clean note policy, security features of new series of notes issued in 2005, star series notes, detection of forged notes, foreign exchange facilities to residents, investment in non-banking financial companies and Banking Ombudsman Scheme, etc. Dissemination of useful information emanating from the Reserve Bank in local language, besides English and Hindi, was the objective of participating in exhibitions and melas.X.74 Students were encouraged to take up short projects for spreading financial literacy and disseminating information to various target groups, viz., students, women, rural and urban poor, defence personnel and senior citizens, especially in the rural/ semi-urban areas. Select Regional Offices conducted quiz competition/inter-school debate, essay competition on banking, currency notes and financial inclusion related topics for school students. X.75 As a part of village level awareness programmes, some Regional Offices visited select villages and met agricultural labourers, farmers, members of self help groups and primary agricultural credit societies, workers from nonGovernment organisations and other community based organisations to discuss issues relating to financial planning, accessing banking services, availing loans under differential rate of interest (DRI) Scheme and other Government sponsored schemes, simplification of lending procedures for crop loans, advantages of kisan credit cards, etc.The Right to Information (RTI) Act, 2005 X.76 The Right to Information Act, 2005 was enacted on June 15, 2005 and came into effect from October 12, 2005. The Reserve Bank has a centralised system for providing information under the Act. Shri V.S. Das, Executive Director, has been designated as the Central Public Information Officer (CPIO) and Shri H.R. Khan, Executive Director as the Alternate Central Public Information Officer. Smt. Usha Thorat, Deputy Governor is the Appellate Authority (AA) and Dr. K.C. Chakrabarty, Deputy Governor, took over the responsibility of the Alternate Appellate Authority. With a view to assisting members of public to submit requests for information, senior officers have been designated as Central Assistant Public Information Officers at each office/Central Office Departments of the Bank. X.77 Increased awareness of the RTI Act resulted in a rise in the number of requests for information from 2,455 during 2007-08 to 3,333 in 2008-09 (Table 10.10). Almost 98 per cent of the requests had been responded to. The requests, in respect of which the information could be fully disclosed and hence disclosed, rose from 68 per cent as at the end of June 30, 2008 to 75 per cent as on June 30, 2009. Also, against the decision of CPIO /non-disclosure of information, 493 appeals in 2007-08 and 550 appeals during 2008-09 were received. Central Information Commission (CIC) has so far dealt with 125 appeals (including decisions on cases pertaining to earlier period). The Commission upheld the decisions of the CPIO/ first Appellate Authority of the Bank in 87 cases and provided minor directions in 38 cases. Some of the important decisions of the CIC have been summarised in the Box X.4X.78 Majority of the requests for information that were received during the year pertained to the Reserve Bank’s regulatory and supervisory functions. Besides, there were also several requests pertaining to other areas, such as currency management, foreign exchange facilities, customer service and personnel management. Certain requests seeking opinions, views, reasons, interpretations or grievance redressal were outside the scope of the Act and dealt with accordingly. Information, which is exempted from disclosure under the provisions of the RTI Act was not furnished. A ‘Disclosure Log’ summarising disclosures of general interest has also been placed on the Reserve Bank’s website. Box X.4