IST,

IST,

National Strategy for Financial Education: 2020-2025

Strengthening Financial Inclusion in the country has been one of the important developmental agendas of both the Government of India and the four Financial Sector Regulators (viz. RBI, SEBI, IRDAI and PFRDA). Financial literacy supports the pursuit of financial inclusion by empowering the customers to make informed choices leading to their financial well-being. 2. Subsequent to completion of the period of the first National Strategy for Financial Education (NSFE: 2013-2018), a review of the progress made was undertaken by the Technical Group on Financial Inclusion and Financial Literacy (TGFIFL- Chair: Deputy Governor, RBI) under the Financial Stability and Development Council (FSDC-Chair: Hon’ble Union Finance Minister). Based on the review of progress made under the Strategy and keeping in view the various developments that have taken place over the last 5 years1, notably the Pradhan Mantri Jan Dhan Yojana (PMJDY)2, the National Centre for Financial Education (NCFE) in consultation with the four Financial Sector Regulators and other relevant stakeholders has prepared the revised NSFE (2020-2025). 3. The NSFE document intends to support the Vision of the Government of India and Financial Sector Regulators by empowering various sections of the population to develop adequate knowledge, skills, attitude and behaviour which are needed to manage their money better and plan for their future. The Strategy recommends adoption of a Multi-Stakeholder Approach to achieve financial well-being of all Indians. 4. To achieve the vision of creating a financially aware and empowered India, the following Strategic Objectives have been laid down:

5. In order to achieve the Strategic Objectives laid down, the document recommends adoption of a ‘5 C’ approach for dissemination of financial education through emphasis on development of relevant Content (including Curriculum in schools, colleges and training establishments), developing Capacity among the intermediaries involved in providing financial services, leveraging on the positive effect of Community led model for financial literacy through appropriate Communication Strategy, and lastly, enhancing Collaboration among various stakeholders. 6. The recommendations laid down in the Strategy under each of the ‘5 Cs’ are as under: Content

Capacity

Community

Communication

Collaboration

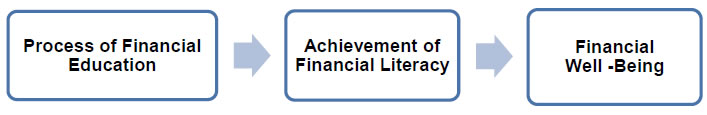

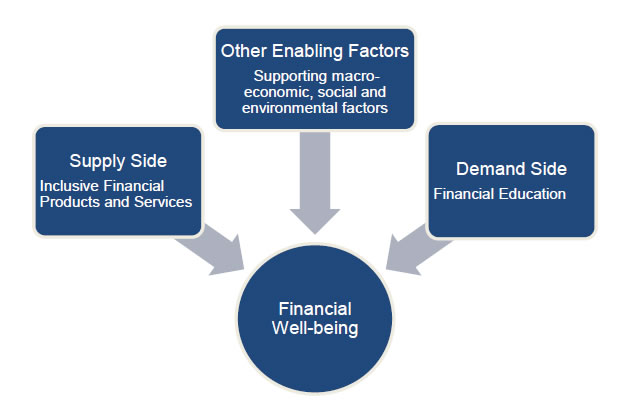

The Strategy also suggests adoption of a robust ‘Monitoring and Evaluation Framework’ to assess the progress made under the Strategy. 1.1 The Organization for Economic Co-operation & Development (OECD) defines Financial Literacy and Financial Education. Financial Literacy is defined as a combination of financial awareness, knowledge, skills, attitude and behaviour necessary to make sound financial decisions and ultimately achieve individual financial well-being (OECD, 2012). Financial Education, on the other hand is defined as the process by which financial consumers/investors improve their understanding of financial products, concepts and risks and through information, instruction and/or objective advice, develop the skills and confidence to become more aware of financial risks and opportunities, to make informed choices, to know where to go for help and to take other effective actions to improve their financial well-being” (OECD, 2005). 1.2 As can be seen, the term Financial Education and Financial Literacy are not the same, these are related concepts. People achieve Financial Literacy through the process of Financial Education. The achievement of Financial Literacy empowers the users to make sound financial decisions which result in financial well-being of the individual.  1.3 The financial service sector in India has undergone significant changes in the last 5 years and the sector has been ever widening. There is a need to increase the size of banking as well as other financial sectors to ensure that the benefits of these developments reach the common masses. Financial inclusion is a National priority of Government of India and the Financial Sector Regulators (RBI, SEBI, IRDAI and PFRDA) as it is an enabler for inclusive growth. In the Indian context, financial inclusion is the process of ensuring access to appropriate financial products and services needed by vulnerable groups such as weaker sections and low income groups at an affordable cost in a fair and transparent manner by mainstream institutional players. Financial inclusion provides an avenue to the poor for integrating with the formal financial system. While financial inclusion is essentially a supply-side intervention, financial education is a demand side intervention. Apart from these forces operating on the demand side and supply side, there are also other enabling factors on the ground. Achievement of financial well-being of citizens of any country depends on how well these factors and forces are integrated and the extent to which these work in cohesion.  1.4 Financial education plays a vital role in creating demand side response to the initiatives of the supply side interventions. Financial education initiatives by concerned stakeholders will help people achieve financial well-being by accessing appropriate financial products and services through regulated entities. These efforts will be guided by the National Strategy for Financial Education (NSFE). Incidentally, financial education also supports achievement of Sustainable Development Goal (SDG) No. 4 on Education which aims to ensure inclusive and equitable quality education and promote life-long learning opportunities for all (SDG Target 4.6 on Literacy and SDG Target 4.4 on Life Skills under SDG 4 on Education). 1.5 India has made tremendous progress in bringing its citizens into the formal financial system over the last many years. Since India’s first NSFE was released in 2013, there have been many developments in the financial inclusion scenario of the country. During this period, important financial inclusion initiatives by Government of India such as Pradhan Mantri Jan-Dhan Yojana (PMJDY), social security schemes viz. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Pradhan Mantri Kisan Maan Dhan Yojana (PM-KMY), Pradhan Mantri Shram Yogi Maan Dhan Yojana (PM-SYM) and Pradhan Mantri Mudra Yojana (PMMY) have changed the financial inclusion landscape. These initiatives are not only bringing the excluded sections into the financial mainstream but also ensuring access to various financial services such as Basic Savings Bank Deposit Account (BSBDA), need based credit, remittance facility, insurance and pension to the excluded sections. 1.6 The latest available World Bank’s Findex 2017 Report had brought out that the proportion of adults with a formal account in the country has risen from 35% in 2011, to 53% in 2014, to 80% in 2017. India has also made extraordinary progress in reducing the country’s gender gap in account ownership, from nearly 20% in 2014 to 6% in 2017 (World Bank Group, 2018). Much of this improvement can be attributed to the flagship initiative of the Government of India towards financial inclusion, namely the PMJDY3, supported by the conducive ecosystem created by the financial sector regulators. In order to take forward the benefits achieved through the financial inclusion efforts, financial literacy will have to play a central role in ensuring that people use appropriate formal financial services to ensure their financial well-being (Department of Financial Services, Ministry of Finance, Government of India, 2019). Background and Rationale of NSFE 1.7 India has a large population of adults4. This demographic advantage can be leveraged to ensure that India becomes one of the fastest growing economies, with emphasis on inclusive growth through a vibrant and stable financial system. Since a large number of stakeholders, including the Central and State governments, Financial Sector Regulators, financial institutions, civil society, academia, educational institutions in public and private sector and others are involved in spreading financial literacy, a broad National Strategy for Financial Education (NSFE) is a pre-requisite to ensure that they work in tandem and their work is aligned to the overall Strategy on financial education and not at cross purposes. In recent years, it is increasingly being recognized that Nation-wide financial literacy can be achieved only through a multi-stakeholder approach wherein different stakeholders viz. Government, Financial Sector Regulators, Financial Service providers, civil society, academia (both in public and private sector), etc. have a role to play. 1.8 National Strategy for Financial Education is defined as “a nationally co-ordinated approach to financial education that consists of an adapted framework or programme” (OECD, 2019). The NSFE document intends to support the vision of the Government of India and Financial Sector Regulators by enabling various sections of the population to develop knowledge, skills, attitude and behaviour which are needed to manage their money better and to plan for their future. The document also takes stock of the current work done by various stakeholders and adopts a multi-stakeholder approach to achieve financial well-being of Indians. 1.9 Towards this objective, the National Centre for Financial Education (NCFE) has been set up by all the Financial Sector Regulators as a Section (8) company under Companies Act, 2013 to undertake basic financial education and to develop suitable content for increasing financial literacy among the masses in the country. 1.10 Over the last few years, there has been rapid progress towards digitalization which has brought newer opportunities to the forefront like never before. This Digital revolution has been supported by initiatives like Digital India Campaign, Digital Saksharta Abhiyan, etc. There is a paradigm shift in digital transactions and Payment Infrastructure in the country (Goal of Less Cash Economy). Due to all these developments, it has become imperative to revise the existing National Strategy for Financial Education (NSFE) and to adopt innovative measures to implement the same. The National Strategy for Financial Education (2020-2025) inter-alia focuses on advancement of skills of financial service providers and other intermediaries involved in dissemination of financial literacy. 1.11 It is envisaged that implementing the Strategy would go a long way in furthering financial literacy across the country and result in positive behavioural outcomes among the population emanating from the Strategic Objectives laid down in the document. Chapter 2: Overview of Progress under 1st NSFE (2013-2018) 2.1 Since the launch of the first National Strategy for Financial Education (NSFE) in 2013, different stakeholders have undertaken several measures to improve financial literacy of the cross-section of population in the country. A snapshot of the initiatives undertaken by the various stakeholders is summarized in Annex. The key learnings from the programmes of financial literacy implemented during the 1st NSFE (2013-2018) are summarized below:

The key learnings, as detailed above, have been incorporated in the Strategic Objectives (Chapter 4), Policy Design (Chapter 5), and Action Plan (Chapter 6).

Chapter 3: Assessment of the Needs and Critical Gaps 3.1 To prepare a comprehensive Strategy based on people’s needs and the country’s available resources, the following process has been adopted in the Indian context:

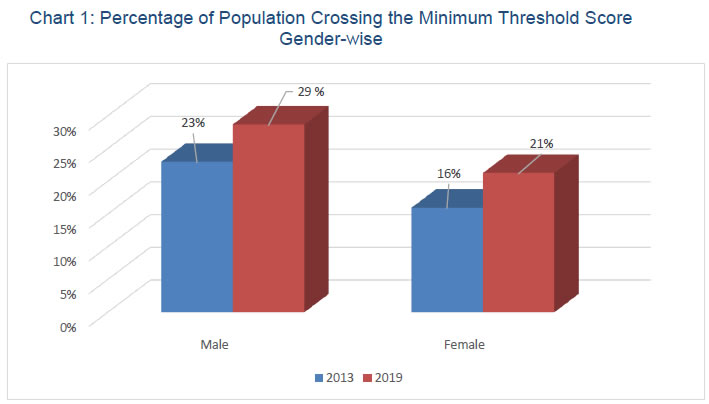

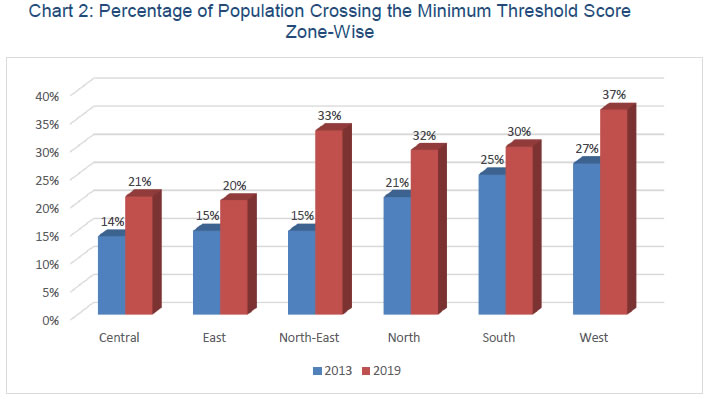

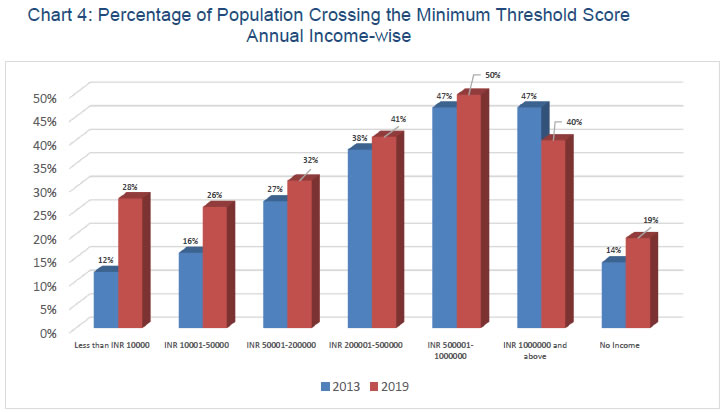

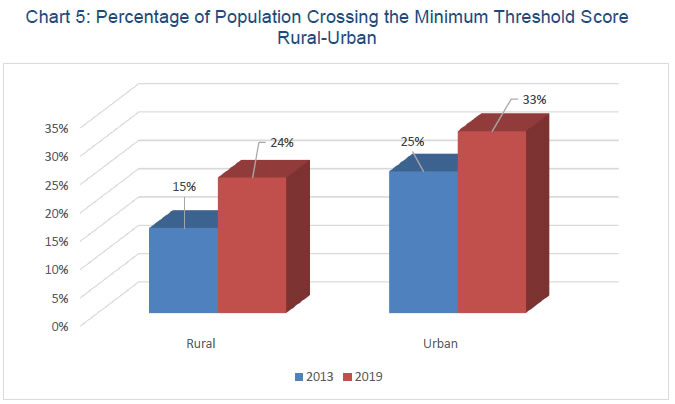

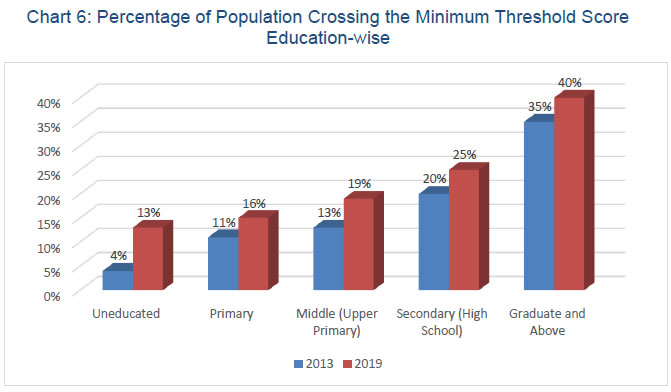

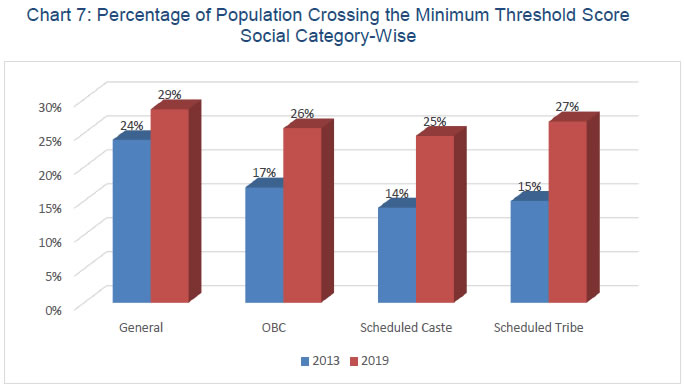

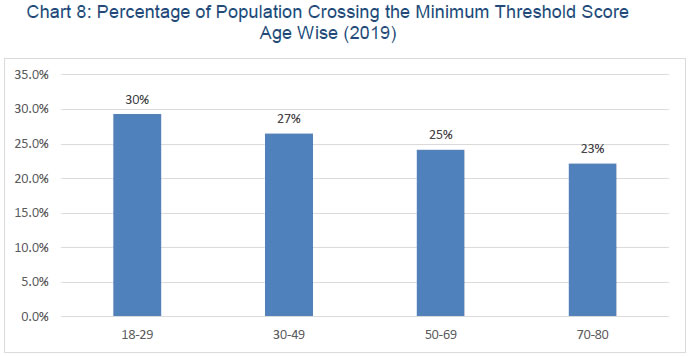

A. Assessment and Evaluation of Critical Gaps in Financial Literacy 3.2 NCFE has carried out an All India Financial Inclusion and Financial Literacy Survey in 2019 with the help of an external surveying agency to find out the status of financial literacy in India. It may be mentioned that a similar Survey was undertaken in 2013 on the lines of OECD-INFE toolkit. A sample of 75000 adults aged 18 to 79 were interviewed in 14 national/regional languages using a set of household questionnaire. A multi-stage sampling technique has been adopted for selection of districts, block/wards, villages, households, respondents during the Survey. 3.3 The Survey conducted in 2019 revealed that 27.18% of the respondents have achieved minimum target score/minimum threshold score in each of the components of financial literacy prescribed by OECD-INFE [i.e. a minimum of 3 in Financial Attitude (out of 5), 6 in Financial Behaviour (out of 9) and 6 in Financial Knowledge (out of 9)] as compared to 20% in 2013. 3.4 Some of the major findings of the Survey are illustrated in the charts below:         3.5 Based on the above illustrative Charts, the following thrust areas have been arrived at for improving financial education efforts:

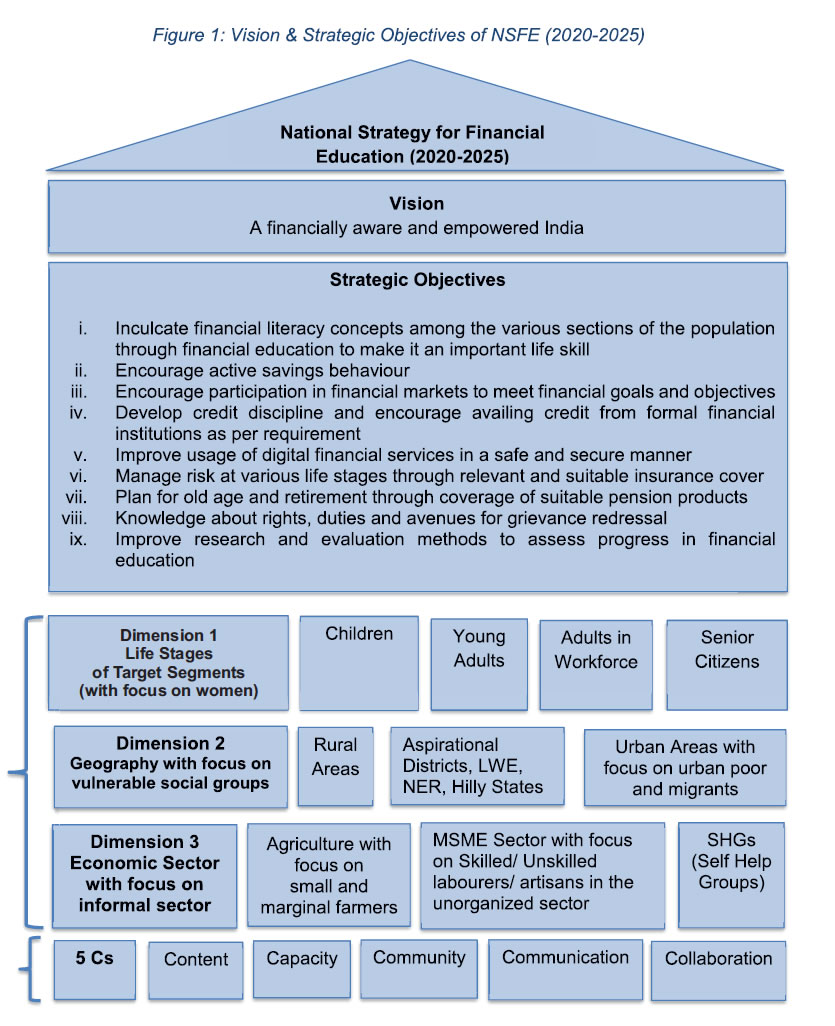

B. Comparison of NSFE with the OECD-INFE Policy Handbook on National Strategies for Financial Education 3.6 The OECD-INFE Policy Handbook on National Strategies for Financial Education (OECD, 2015) lays down important broad guidelines for Nations to develop their National Strategies for Financial Education. Based on the Handbook, the following steps have been undertaken by adopting them in the Indian context to develop the country’s Strategy: I. Identification of Policy Priorities of the National Strategy through the Tools of Assessment a) Mapping exercise of existing initiatives: Keeping in view the developments over the last five years since the launch of the first National Strategy for Financial Education (2013-2018) and the emerging aspirations of the country, NCFE had undertaken a mapping exercise of existing initiatives through consultation with Department of Financial Services, Ministry of Finance, Government of India; Financial Sector Regulators; Banks; Development Financial Institutions; Indian Banks’ Association; Self-Regulatory Organizations (SROs) (FIDC, M-Fin and Sa-Dhan); and other stakeholders (such as NPCI). The key initiatives taken by NCFE, the Financial Sector Regulators, Development Financial Institutions, NPCI, etc. are summarized in Annex. The key learnings from these initiatives along with a study of global best practices on financial education have been used in formulating the strategic objectives and developing the action plans. b) Measurement of Level of Financial Literacy and Inclusion through Nation-wide Survey: A Pan India Financial Inclusion and Financial Literacy Survey in line with the standards prescribed by OECD-INFE toolkit was undertaken in 2013-2014 to assess the level of financial literacy in the country. Subsequent to the completion of the period of the 1st NSFE, a survey has been undertaken in 2019 to empirically review the progress made during the last five years (2013-2018). II. Establishing Institutional and Governing Arrangements Keeping in view the existing institutional arrangement for guiding, monitoring and evaluating the Strategy, a well-defined institutional arrangement has been developed and laid down in Chapter 6. III. Evaluation Plan of National Strategy for Financial Education A standardized method to monitor and evaluate the progress made by various stakeholders under the period of the Strategy has been laid down in Chapter 7. Chapter 4: Vision and Strategic Objectives of NSFE (2020-2025) 4.1 As mentioned in the document titled - Advancing National Strategies for Financial Education, (jointly published by OECD and Russia’s G20 Presidency in 2003), it is essential to establish clear financial education mandates, objectives and resources to be deployed by relevant public institutions for advancing National Strategy for Financial Education. 4.2 This Strategy document has been developed as a revised version of its precursor, NSFE (2013-2018) by including data-driven findings, new policy measures, evaluation tools, interventions and technological improvements. Since this Strategy is a revision of the earlier Strategy, it has been decided to retain the Vision and merge the Mission with the following Strategic Objectives. Vision – A financially aware and empowered India 4.3 As there have been several developments in the financial inclusion landscape and the economy, in general, the Strategic Objectives have been revised to reflect the changes in the vast economic landscape and provide renewed impetus to promote financial education in the vast expanse of the diverse country. The Strategic Objectives are as under:

4.4 Keeping in view the importance of granularity and our learning that a one-size-fits-all approach to financial education does not yield the desired results, the Strategic Objectives are envisaged to be achieved through the following dimensions:

4.5 A ‘5 C’ approach would be adopted for dissemination of financial education through emphasis on development of relevant Content (including Curriculum in schools, colleges and training establishments), developing Capacity among the intermediaries involved in providing financial services, leveraging on the positive effect of Community led model for financial literacy through appropriate Communication Strategy, and lastly, enhancing Collaboration among various stakeholders.  5.1 Components of Financial Education 5.1.1 Basic Financial Education The basic financial education consists of fundamental tenets of financial well-being6. With the introduction of Government’s PMJDY scheme along with APY, PMJJBY & PMSBY besides MUDRA Yojana, many people have already been included. They also require financial education so that they can take full benefits from these schemes. These basic concepts need to be communicated to everyone by adopting different modes of delivery, suitable to the target audience. Special emphasis shall be laid on the financially excluded and those newly included but not operating their accounts. The basic financial education acts as a foundation for sector-specific and process education. 5.1.2 Sector Specific Financial Education Sector specific financial education is being imparted by the Financial Sector Regulators and focuses on “What” of the financial services and the contents cover awareness on ‘Dos & Don’ts’, ‘Rights & Responsibilities’, ‘Safe usage of digital financial services’ and approaching ‘Grievance Redressal’ Authority. Basic and Sector specific education will empower a person to be more prudent and make informed decisions while choosing appropriate financial products as per his/ her requirements from the available alternatives. 5.1.3 Process Education Process education is crucial to ensure that the knowledge translates into behavior. As an illustration, some of the aspects to be covered include:

These contents are to be developed in the form of easy to understand Audio/ Video, Animated Posters to help the consumers understand the processes to be adopted for various transactions. (For example, a short video on how to use the ATM displayed in the ATM machine would be helpful for a customer to avail the service) 5.2 Delivery Channels for Financial Education Besides the already existing delivery channels for disseminating financial education messages, newer modes of delivery channels such as social media platforms, community radios, technology kiosks, chatbots etc. shall be effectively deployed. Chapter 6: Action Plan to Achieve the Strategic Objectives 6.1 The 5-Core Actions / 5-C Approach shall be adopted through emphasis on development of relevant Content, developing Capacity of the various intermediaries involved in providing financial services, leveraging on the facilitating role of Community led model for financial literacy through appropriate Communication strategy by enhancing Collaboration among various stakeholders. A brief about each of the following core actions is given below. 6.1.1 Content

6.1.2 Capacity

6.1.3 Community

6.1.4 Communication

6.1.5 Collaboration

6.2 The Strategic Goals along with detailed implementation plan and milestones are detailed in the following pages. Action Plan for NSFE (2020-2025)

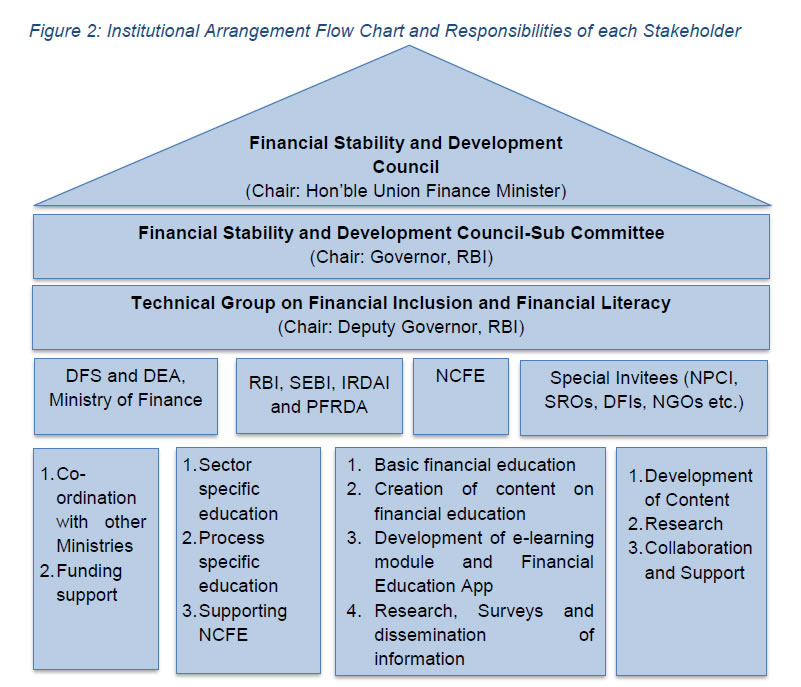

The intervention of Department of Financial Services (DFS), Ministry of Finance, Government of India would be sought for implementation of the above Action Plans, as and when necessary.  6.3 In line with the previous Strategy, the entire National Strategy for Financial Education (2020-2025) is sought to be implemented through the institutional mechanism, as illustrated above. Besides the oversight of the FSDC (Chair: Hon’ble Union Finance Minister), the implementation of the Strategy would be directly monitored by the Technical Group on Financial Inclusion and Financial Literacy (TGFIFL) (Chair: Deputy Governor, RBI). 6.4 Since the implementation of the National Strategy for Financial Education would entail large allocation and deployment of financial resources and manpower, adequate planning needs to be done at the Apex as well as at the level of Sector Specific Financial Regulators to ensure smooth implementation. All the Financial Sector Regulators, their respective Regulated Entities and other stakeholders should make necessary provisions for the same. 6.5 Identification of Key Stakeholders in the National Strategy: The following stakeholders have been identified for implementation of the strategic goals. The list is illustrative and not exhaustive.

Chapter 7: Monitoring and Evaluation 7.1 It is well known that any Strategy is as good as its implementation. Keeping in view the vast and rapid changes taking place in the financial sector, all the stakeholders need to appreciate the dynamic nature of evolution of financial services and the concomitant changes that are required towards financial literacy. Having in place, a robust and scientific assessment method, would go a long way in helping Policy makers identify priorities and assess the impact of their interventions. 7.2 Some of the broad issues that need to be considered in this regard are as under:

7.3 The OECD-INFE Issue Note on the Evaluation of National Strategies for Financial Education suggests that evaluation of National Strategy is essential from an accountability perspective, to provide valuable evidence to improve financial education policies and contribute to their sustainability, on the long term besides being a powerful source of evidence for the impact on the financial literacy and financial behaviour of citizens. The document also distinguishes between monitoring (A process of regular tracking of the implementation process) and Evaluation (The comprehensive process of understanding how the National Strategy has advanced towards its objectives) (OECD, 2019). Monitoring Mechanism 7.4 The Technical Group on Financial Inclusion and Financial Literacy (TGFIFL)(Chair: DG, RBI) shall be responsible for periodic monitoring and implementation of National Strategy for Financial Education. There would be periodic monitoring of the activities undertaken by various stakeholders for dissemination of basic, sector specific and process literacy. A Digital Repository to collect information on various financial literacy activities undertaken by the stakeholders shall be prepared. To begin with, the Digital Repository can collect data of NCFE’s financial literacy initiatives, the Financial Sector Regulators and over time, gather data from Development Financial Institutions (NABARD and SIDBI), financial service providers and other stakeholders. Based on analyses and feedback from the participants, this Digital Repository would help in identifying those areas/geographies where more financial education interventions would be needed and at the same time, prevent duplication of efforts by stakeholders. Evaluation Mechanism 7.5 Evaluation of the Strategy refers to a process that is seeking to assess if, and How, the National Strategy is adding value, Whether it is meeting its objectives and What impact it is having on the stated aims (OECD, 2019). Proper evaluation provides feedback as to whether the Strategy is leading to a change that is desirable and a change which would not have occurred, otherwise. The OECD-INFE Issue Note on the Evaluation of National Strategies for Financial Education Monitoring highlights the importance of integrating the evaluation process in the Strategy document and ensuring that the co-ordinators actively engage with evaluation across short-term, medium-term and long-term time horizon and using the data collected through monitoring process and undertaking analysis of the same. 7.6 Keeping this in view, a Mid-term Evaluation shall be undertaken at the end of three years of Strategy implementation (2022-2023). A comprehensive National Survey at the end of the Strategy implementation period shall be undertaken in 2025. 1. (2003). Advancing National Strategies for Financial Education. OECD and Russia’s G20 Presidency joint publication. 2. Department of Financial Services, Ministry of Finance, Government of India. (2019, October 24). Progress Report-PMJDY. Retrieved from Pradhan Mantri Jan Dhan Yojana: https://www.pmjdy.gov.in/account 3. NCFE-NISM. (2013). Financial Literacy and Inclusion in India - Final Survey Report 2013. Mumbai: NCFE-NISM. 4. OECD. (2005). Improving Financial Literacy: Analysis of Issues and Policies, OECD Publishing. 5. OECD. (2005). Recommendation of Principles and Good Practices for Financial Education and Awareness. Paris: OECD. 6. OECD. (2012). High-level Principles on National Strategy for Financial Education. 7. OECD. (2015). National Strategies for Financial Education-OECD/INFE Policy Handbook. Paris: OECD. 8. OECD. (2016). OECD/INFE International Survey of adult financial literacy competencies. Paris: OECD. 9. OECD. (2019). Evaluation of National Strategies for Financial Education. Paris: OECD-INFE. 10. Rangarajan, D. C. (2008). Committee on Financial Inclusion. Mumbai: RBI. 11. World Bank Group. (2018). The Global Findex Database. Washington DC: International Bank for Reconstruction and Development/The World Bank. Annex - Financial Literacy Initiatives by Stakeholders A. NCFE NCFE creates financial awareness and empowerment through financial education campaigns across the country for all sections of the population through seminars, workshops, conclaves, trainings, programs, campaigns, discussion forums by itself or with help of institutions, organizations and provide training in financial education. It creates workbooks, worksheets, literature, pamphlets, booklets, fliers, technical aids. NCFE prepares appropriate financial literature for target-based audience on financial markets and financial digital modes for improving financial literacy so as to improve their knowledge, understanding, skills and competence in finance. Basic Financial Education: NCFE is conducting financial education campaign through financial education programs like MSSP (for schools), Financial Education Training Programme (FETP) for school teachers, FACT (for undergraduate and postgraduate students) and FEPA (financial education program for adults).

B. RBI Basic Financial Education: RBI has prescribed the following content for basic financial education:

Sector Focused Financial Education: The content covers relevant topics in the banking sector such as ATMs, payment systems such as NEFT, UPI, USSD, awareness about sachet portal, keeping away from Ponzi schemes, fictitious emails/calls, KYC, Exercising Credit Discipline, Business Correspondents etc. A Financial Awareness Messages (FAME) booklet comprising of 20 messages for the general public and five Posters on financial literacy for the Financial Literacy Week have been made available on the Financial Education webpage of RBI’s website. Public Awareness Campaign

C. SEBI Basic Financial Education: SEBI has undertaken the following initiatives for basic financial education:

Sector Specific Financial Education: SEBI has the following initiatives for sector focused financial education:

In addition to the above, SEBI has also undertaken the following initiatives: • Participation in World Investor Week in association with International Organization of Securities Commissions (IOSCO): With the objective of highlighting the initiatives taken by various financial market regulators in the direction of conducting investor protection and education awareness activities, IOSCO has been organizing every year a weeklong global campaign referred to as World Investor Week (WIW). SEBI participated in IOSCO WIW by organising various financial literacy and investor awareness programmes during this week across the country. • Dedicated Investor Website: A dedicated website http://investor.sebi.gov.in is maintained for the benefit of investors. The website provides relevant educational/awareness material and other useful information. Further, schedules of various investor and financial education programmes are also displayed on the website for the information of investors. • Mass Media Campaign: In order to reach out to people, SEBI has embarked on a mass media campaign giving relevant messages to investors through popular media. Since year 2012, SEBI has carried out various awareness campaigns in multi mass media (TV/Radio/Print/bulk SMS) on topics as mentioned below:

Additionally, posters on cautionary messages listed above were printed in various languages and distributed to district collectors, panchayat offices, etc. in various languages. • Investor Grievance Redressal: SEBI has been taking various regulatory measures to expedite the redressal of investors grievances. The grievances lodged by investors are taken up with the respective listed company or intermediary and continuously monitored. SEBI Complaints Redressal System (SCORES) has helped the investors in real time knowledge of status of their grievances since investors can log onto SCORES at any time and from anywhere and check the status of the grievances with the help of user-name and password provided to them at the time of lodging grievances. • SEBI Toll Free Helpline: SEBI had launched toll free helpline service numbers 1800 22 7575/1800 266 7575 on December 30, 2011. The helpline service is available every day from 9:00 a.m. to 6:00 p.m. (except on declared public holidays in Maharashtra) to investors from all over India. The helpline service is available in English, Hindi and various regional languages. D. IRDAI Since its inception, IRDAI has taken various initiatives in the area of financial literacy. Awareness programmes have been conducted on television and radio and simple messages about the rights and duties of policyholders, channels available for dispute redressal etc. have been disseminated through television and radio as well as the print media through sustained campaigns in English, Hindi and 11 other Indian languages. IRDAI has got a pan India survey on awareness levels about insurance carried out through the NCAER in a bid to improve on its strategy of creating insurance awareness. A post launch survey was also done to gauge the efficacy of the campaigns of IRDAI in increasing insurance penetration and awareness. IRDAI has also brought out publications of ‘Policyholder Handbooks’ as well as a comic book series on insurance. A dedicated website for consumer education in insurance was launched to reach out to the policyholders more effectively. IRDAI’s Integrated Grievance Management System (IGMS) creates a central repository of grievances across the country and provides for various analyses of data indicative of areas of concern to the insurance policyholder. Some of the major initiatives carried out by IRDAI are listed below:

E. PFRDA PFRDA has launched a dedicated website called “Pension Sanchay” in 2018. Through this website, PFRDA aims towards addressing the need of financial literacy from the perspective of retirement planning. The content of the website has been designed keeping into view the four most important concepts in financial decision making-knowledge of interest rates, interest compounding, inflation and risk diversification. The website has separate blog segment where blogs written by the professionals in the financial sectors and the officers of the Authority are made available which provides meaningful insight regarding the fundamentals of finance, banking and investments. PFRDA conducts subscriber awareness programs through its central record keeping agencies at different places across India. Further, PFRDA also has empaneled a dedicated training agency for creating subscriber awareness and capacity building regarding the NPS and APY. In addition to the above, PFRDA also conducts Annuity Literacy Program in co-ordination with NPS Trust and Annuity Service Providers for making subscribers aware about the different annuities available to them. F. NABARD

NABARD has advised banks (scheduled commercial banks, RCBs, RRBs) to draw up state-wise quarterly plans for support from FIF towards financial and digital literacy camps by their branches and FLCs. These plans would have to cover target groups such as SHGs, students; senior citizen; farmers; small entrepreneurs etc. giving special attention to excluded blocks, areas based on FIPs of Banks and discussions in SLBC Sub Committee on FI and State Government priorities. NABARD RO would also be holding quarterly review with banks for projects funded out of FIF and the progress would also be reviewed in FI Sub Committee of SLBCs. G. SIDBI

H. NPCI

1 Increased penetration of mobile phones, retail digital transactions, growing adult population in the country, entry of Payments and Small Finance Banks, Fin-Tech players and awareness on the need to manage one’s finances. 2 PMJDY also known as the National Mission for Financial Inclusion, was launched by Hon’ble Prime Minister of India in August 2014. For further details please see explanation for Foot note No. 3 in page 6 (Chapter-01). 3 Pradhan Mantri Jan Dhan Yojana (PMJDY) launched in August 2014 is a National Mission on Financial Inclusion encompassing an integrated approach to bring about comprehensive financial inclusion of all the households in the country. The plan envisaged universal access to banking facilities with at least one basic banking account for every household, financial literacy, access to credit, insurance and pension facility. The plan also envisages channelling all Government benefits (from Centre / State / Local Body) to the beneficiaries’ accounts and pushing the Direct Benefits Transfer (DBT) scheme of the Union Government. Subsequently, the Government decided to continue National Mission for Financial Inclusion (PMJDY) beyond August 2018 with focus of opening account from every household to every adult. So far 37.70 Crore bank account have been opened under PMJDY (as on December 18, 2019). For more details see http://www.pmjdy.gov.in/ 4 The population of India is 1,370,862,591 as of October 29, 2019, based on Worldometers elaboration of the latest United Nations data. The age group (15-64) constitutes 67.27% of the total population and the median age is 27.1 (https://www.worldometers.info/world-population/india-population/) 5 In the survey undertaken in 2013, North East Zone was subsumed under East Zone. Hence the data for North East between 2013 and 2019 may not be comparable. 6 The concepts include: (a) importance and advantages of savings, (b) staying out of unproductive loans, (c) borrowing from formal financial sector as per need and capacity, (d) interest rate and the power of compounding, (e) time value of money, (f) inflation, (g) the need to insure, (h) the need to plan for old age income, (i) role of major financial sector related institutions such as Ministries, Financial Sector Regulators, banks, stock exchanges and insurance companies and (j) basic concept regarding relation between risks versus returns, (k) grievance redressal. |

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: