IST,

IST,

Global Liquidity and Financial Contagion

Shri Deepak Mohanty, Executive Director, Reserve Bank of India

delivered-on ਜਨ 15, 2014

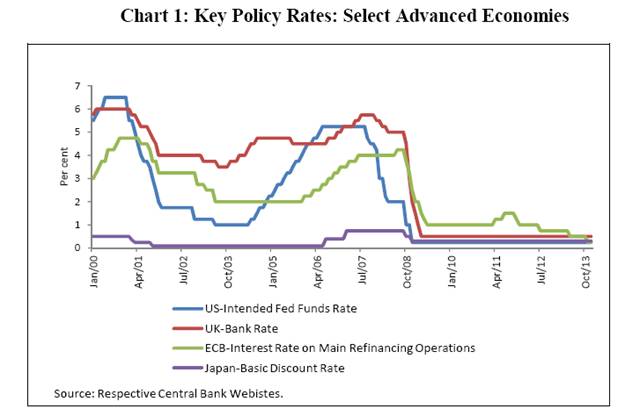

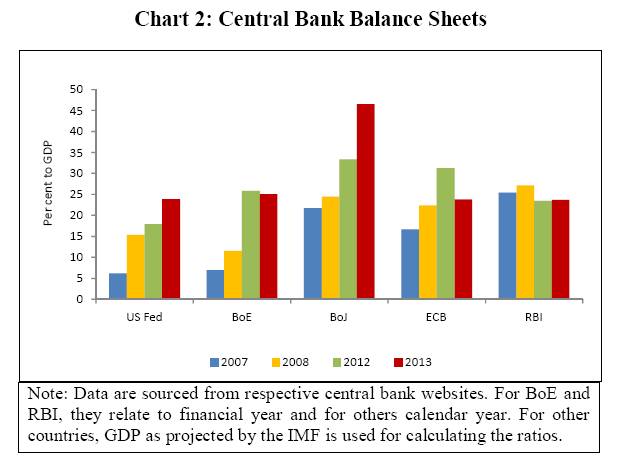

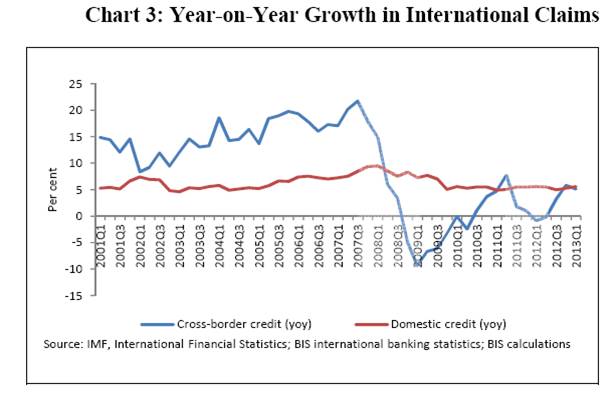

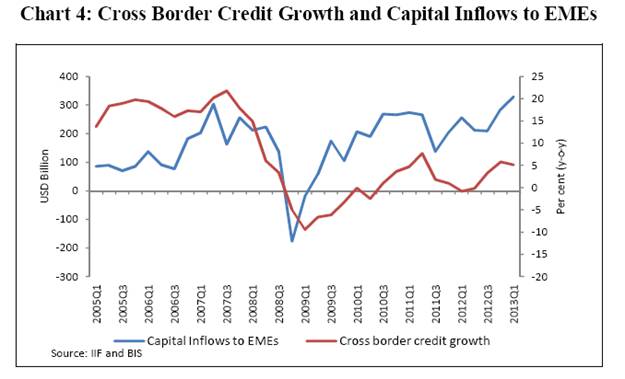

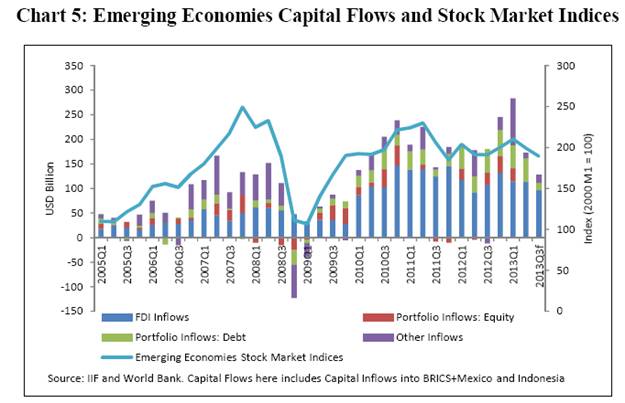

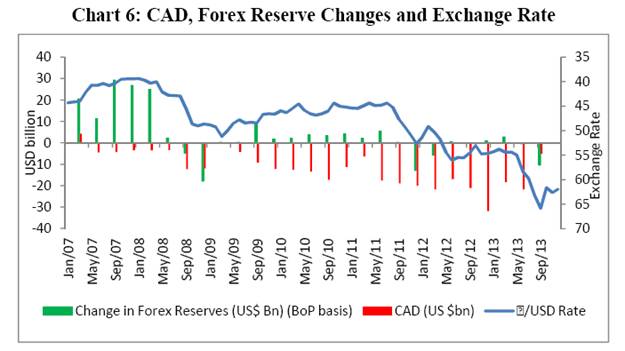

I thank Mrs. Usha Thorat, Director, Centre for Advanced Financial Research and Learning (CAFRAL) for the opportunity of being a part of this very distinguished panel. With the “great moderation” of high growth and low inflation, consideration of liquidity almost fell off from the lexicon of central banks. Arguably, with central banks targeting interest rates, liquidity becomes endogenous. Of course, liquidity is the flip side of the same coin. If one were to target a very low interest rate, one would have to let go of liquidity. While monetary policy is conducted by countries keeping in view their domestic objectives, liquidity cannot be confined to sovereign boundaries. The bigger and more systemic a country is, the greater is the spillover, particularly if it is a reserve currency country. The events leading up to the “great recession” made us cognisant of the role played by excessive global liquidity in the financial crisis. As the global economy pulled out of the great recession, liquidity played an even greater role in terms of unconventional monetary policy. As recovery takes hold in advanced economies and central banks exit from their excessively accommodative monetary policy, liquidity for sure will play an important role, some glimpse of which we had in the May 2013 announcement of taper by the US Fed. Though market reaction was muted in the subsequent December 2013 Fed announcement of calibrated reduction of its bond purchase programme, how the situation will evolve is uncertain. But certainly, consideration of liquidity has come to occupy centre stage in policy analysis. The ebb and flow of global liquidity is of greater concern for emerging market economies (EMEs) like ours. Against this backdrop, I will begin by reviewing the concept and the trend in global liquidity. I then highlight the impact of global liquidity on asset markets and EMEs before turning to our experience in managing the spillover. Concept and Trend Traditionally, liquidity is seen in terms of the balance sheet of the central bank or more broadly the balance sheet of the banking sector. It could be some measure of narrow money or broad money. However, financial innovation and technology has made it possible to generate substantial financial liquidity outside the monetary sector. The global financial crisis has prompted the Bank for International Settlements (BIS) and the International Monetary Fund (IMF) to come up with a much wider concept of global liquidity. The BIS-IMF definition of the global liquidity emphasises on the “ease of financing” as a key attribute. It depends upon the existing macroeconomic environment, monetary policy stance, financial regulation and a host of other factors such as the pace of financial innovation and risk appetite that guide the actions of market participants. Indicators of global liquidity can broadly be classified into two categories: price based indicators and quantity based indicators. Price based indicators tend to provide information about the conditions at which liquidity is provided, while quantity measures capture how far such conditions translate into the build-up of potential risks1. Policy rates, short-term interest rates, long-term interest rates, term spreads, deviations of levels from trends, and deviations of term spreads from trends are all regarded as important indicators of global liquidity conditions. On the other hand, quantity-based indicators of global liquidity measure both assets and liabilities of globally active financial intermediaries. Generally, it is the asset-side approach, which is considered more appropriate as it represents the actual extension of international credit. These two approaches represent the same underlying phenomenon and complement each other2. Let me now turn to the recent trend in global liquidity. Immediate rise in global liquidity in the post-crisis period was the result of unusual policy accommodation in the advanced economies.In an effort to prop up their financial systems, monetary authorities in the advanced economies resorted to aggressive monetary easing by reducing policy rates to near zero (Chart 1). However, the key channels of conventional monetary policy were impaired once policy rates approached the zero lower bound. Recognising the limitations of conventional policy tools and the severity of the economic downturn, major central banks turned to substantial liquidity injection by expanding their balance sheets in various unconventional ways (Chart 2). In the run up to the crisis, there was a buildup of international cross-border credit which was followed by a large decline immediately following the crisis (Chart 3). Let me now turn to the impact of such ebb and flow of global liquidity on asset markets and the EMEs. Impact on EMEs An environment of excessive global liquidity has been associated with high capital inflows to EMEs. During the phase of excess liquidity, global investors seeking higher yields shift their portfolios towards emerging markets exhibiting higher interest rates and better economic prospects. This is reflected in strong capital flows to EMEs, which may not always be consistent with their domestic fundamentals (Chart 4). This has implications for exchange rates, domestic monetary and liquidity conditions and overall macroeconomic and financial stability. While high and unstable capital flows can lead to macro and financial stability concerns, managing capital flows to minimise such concerns has costs. Global liquidity could potentially lead to over-heating through augmenting domestic liquidity; loss of competitiveness through exchange rate appreciation; and increased vulnerability to crisis through spillover to various segments of financial sector. Furthermore, fluctuations in global liquidity make capital flows to EMEs more unstable. This in turn makes it difficult for policymakers to assess and distinguish between the durable and transitory components of capital flows, constraining their ability to effectively pursue domestic policy objectives. In short, capital flows inconsistent with domestic absorptive capacities in EMEs complicate macroeconomic management. It is also argued that major central banks engaging in ultra-accommodative monetary policies at the same time give a large positive shock to global liquidity that feeds into commodity and food price inflation.3 Easy access to wholesale funding markets saw increasing participation of major investment banks in the commodity market leading up to 2008 crisis4. Correlation between cross-border credit and international commodity prices suggests a possible link between global liquidity and financialisation of commodity markets. In 2008, global capital inflows retreated from the EMEs. The resumption of capital flows to countries in 2009 with a strong growth outlook or appreciation expectations brought back pressures on the exchange rate and rising asset valuations, including equities (Chart 5). Many emerging markets met these challenges with a mix of macroeconomic policies as well as macro-prudential and other capital flow management measures. Let me now turn to the Indian experience in managing the spillover from volatility in capital flows. Indian Experience We have a deficit in the current account of our balance of payments (BoP). Hence, we are dependent on global financial markets to finance our current account deficit (CAD). The impact of capital flow volatility on our economy can best be captured in a snapshot by looking at the movement in our foreign exchange reserves and the exchange rate (Chart 6). We experienced a phase of high growth and low inflation prior to the crisis. Financing the current account was not an issue for two reasons: first, the CAD was small and second, capital inflows were far in excess of the absorptive capacity of the economy. Hence, capital inflows resulted in both the appreciation of the Rupee and accretion to foreign exchange reserves. In the context of intervention in the foreign exchange market, the issue of cost of sterilisation invariably comes up for discussion. But the issue is a complex one: should one look purely at the financial cost measured largely in terms of interest rate differential between foreign and domestic interest rates? Should one look at the cost of non-intervention in terms of its implications for financial stability, which is of course difficult to quantify but perhaps easy to understand? In any case, the financial cost of sterilisation is in the nature of a quasi-fiscal cost: if it is borne by the central bank, profit transfer to the government reduces to that extent; if it is directly borne by the government, it is reflected in the budget. In addition, if sterilisation is done through raising unremunerated cash reserve ratio (CRR), the cost is borne by commercial banks, though they may benefit from easy liquidity. In its intervention operations, the Reserve Bank followed a cost sharing approach with the financial costs shared by the RBI, government and commercial banks. With the hindsight I could venture to say that the liquidity buffers that were built up earlier helped during the crisis. Deleveraging during the crisis led to reversal of capital flows. India’s balance of payments came under pressure in Q3 of 2008-09 due to capital outflows. It became necessary to draw down reserves to finance the shortfall and maintain orderly conditions in the foreign exchange market. This led to a corresponding contraction in the base (reserve) money. The Reserve Bank, therefore, ensured the necessary expansion in net domestic assets (NDA) through conventional open market operations (OMO) involving outright purchase of government securities in the secondary market as well as provision of liquidity through repos under its daily liquidity adjustment facility (LAF). Another instrument, which allowed the Reserve Bank to expand liquidity, was the unwinding of the market stabilisation scheme (MSS) securities5. The unwinding of MSS balances not only created the scope for adequate liquidity expansion by the Reserve Bank without expanding its balance sheet in any significant measure, but the timing of the unwinding could also be modulated in such a way that the large borrowing programme of the government was managed smoothly without exerting undue market stress. In addition, the reduction in cash reserve ratio (CRR) of banks from 9 per cent to 5 per cent released `1.6 trillion of primary liquidity. Liquidity expansion achieved through unwinding of MSS and reduction in CRR ensured that the Reserve Bank’s balance sheet did not expand significantly, unlike in several other central banks. Thus the liquidity buffer built up in the pre-crisis period helped to ease both foreign exchange and rupee liquidity. Since India witnessed stronger growth ahead of the global recovery, capital inflow revived during 2009-10 and 2010-11 and was reflected in significant appreciation of the Rupee. It was also supported by ample global liquidity conditions emanating from quantitative easing (QE). However, during the euro area crisis, deleveraging in European banking system again adversely affected capital flows to India towards the later part of 2011-12. In response, several policy measures were taken to encourage capital inflows, particularly giving greater access to international investors to domestic currency debt market. Again, volatility in the financial market returned following the announcement in May 2013 of the US Fed’s intention of likely tapering of QE. Portfolio outflows, particularly from the domestic currency debt segment, were substantial. This prompted the Reserve Bank to resort to somewhat unconventional monetary policy measures besides drawing down of foreign exchange reserves to meet the immediate shortfall. Let me give you the essence of the key measures.

As portfolio capital outflows waned and BoP improved, stability returned to the foreign exchange market. This prompted the Reserve Bank to unwind the bulk of the exceptional measures and normalise monetary policy by restoring the policy interest rate corridor to its original configuration and the repo rate to its signaling role of policy. Conclusion Let me conclude. Excess global liquidity emanating from accommodative monetary policy stance in advanced economies has raised asset prices and imparted greater volatility to capital flows to EMEs. In episodes of liquidity stress, capital account and exchange rate management seem to override the domestic monetary policy objectives of growth-inflation considerations. As aptly observed by Hélène Rey (2013), “independent monetary policies are possible if and only if the capital account is managed”.6 In India, we experienced two episodes of severe stress on our balance of payments emanating from volatile capital flows which were managed with a combination of polity tools. Given that the central bank balance sheets in advanced countries are still bloated and the actual taper starting now, considerable uncertainties remain for global financial markets and capital flows to the EMEs. Thank you. *Remarks by Shri Deepak Mohanty, Executive Director at the Conference on Capital Account Management and Macro-Prudential Regulation for Financial Stability and Growth organised by the Centre for Advanced Financial Research and Learning (CAFRAL) and Initiative for Policy Dialogue (iPD), New Delhi, January 14, 2014. The assistance provided by Rajan Goyal, Rajeev Jain and Somnath Sharma is acknowledged. 1 BIS (2011), “Global liquidity - concept, measurement and policy implications”, CGFS Publications No 45, November 2011. 2 IMF (2013), ‘‘Global Liquidity-Credit and Funding Indicators’’, IMF Policy Paper, July 16, 2013. 3 Belke, Ansgar, Ingo Bordon and Ulrich Volz (2012), “Effects of Global Liquidity on Commodity and Food Prices”, DIW Working Paper No.1199, Deutsches Institutfür Wirtschaftsforschung, Berlin. 4 Lane, Timothy (2012), “Financing commodities markets”, Remarks at the CFA Society of Calgary, Calgary, Alberta, 25 September 2012. 5 MSS securities are essentially short-term government securities, introduced in April 2004, as an instrument of sterilisation to partly neutralise the expansionary effects of surges in capital inflows. The amount sterilised through MSS remained immobilised in the Central Government’s account with the Reserve Bank of India. As at end-September 2008, MSS amount stood over `1.7 trillion. 6 Rey, Hélène (2013), “Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence”, paper presented in 2013 Jackson Hole Economic Policy Symposium, Federal Reserve Bank of Kansas City. |

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: