IST,

IST,

Policy and Evidence

Dr. Raghuram G. Rajan, Governor, Reserve Bank of India

delivered-on ਜੁਲਾ 26, 2016

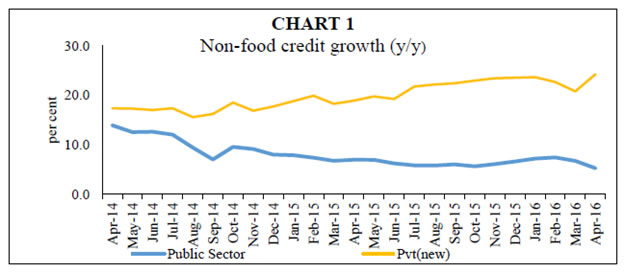

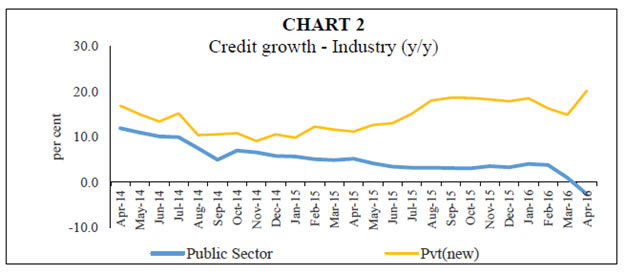

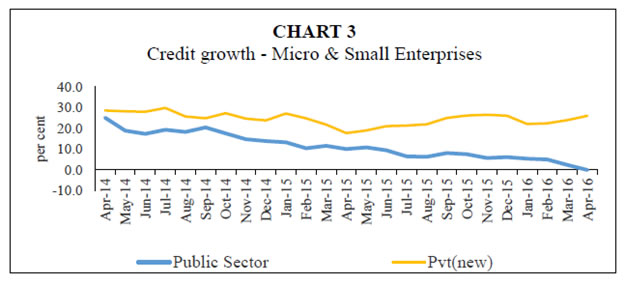

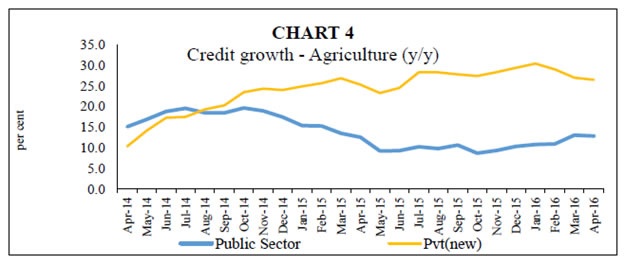

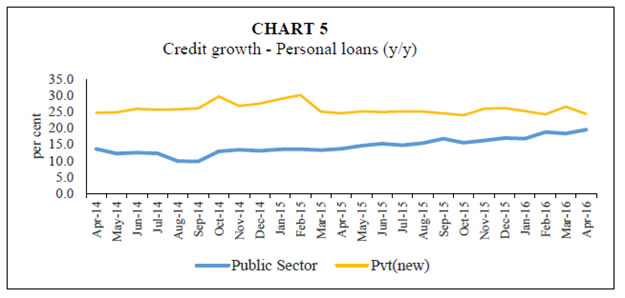

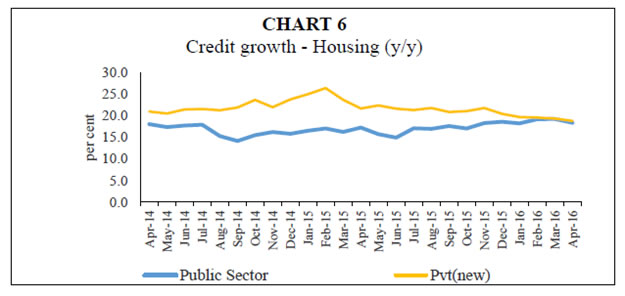

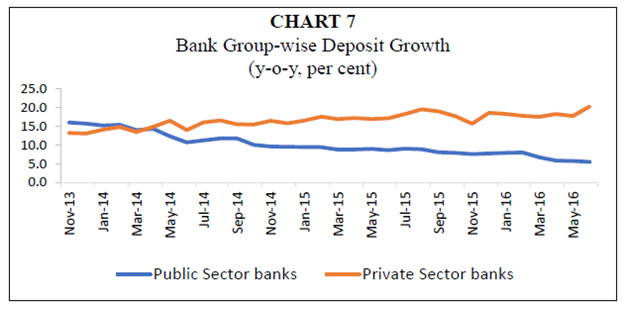

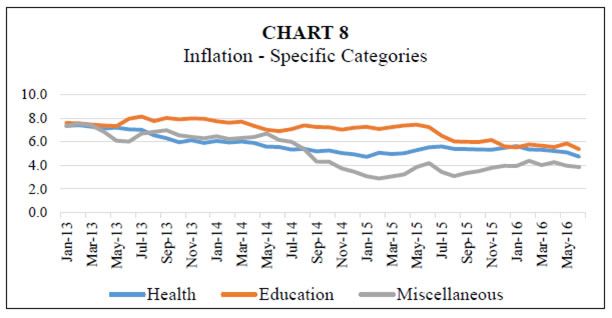

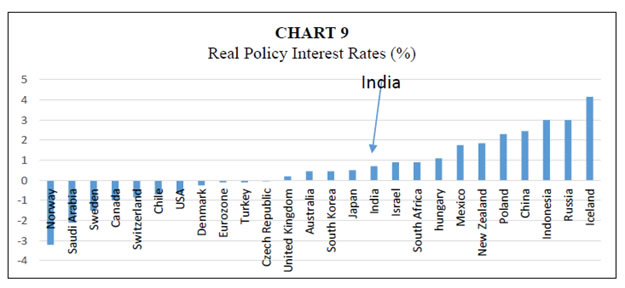

Good morning. It is a pleasure to welcome learned statisticians and economists from across the world to this Statistics Day celebration at the RBI. I am sure you will spend the day discussing advances in the fields of economics and statistics. These discussions will be very valuable. We certainly need to improve the quality and timeliness of our statistics, and big data can be very helpful. What I want to talk about this morning is, however, not the quality or timeliness of the data but the use of evidence in the policy dialogue. Some may believe that all it takes to convince the body politic of the necessity to choose one policy over another is to present the evidence, complete with careful, well identified tests. Confronted with the evidence, the advocates of misguided policies will simply bow to the superiority of the other side’s arguments and withdraw gracefully. Unfortunately, as many of you who advise policymakers know, this is not how the real world works. Let me make the point using a current debate in India. There is a belief in some quarters that the Reserve Bank has hurt economic growth by keeping interest rates and borrowing costs too high, that those high rates have reduced credit and spending but had little effect on inflation. Inflation has come down only because of good luck stemming from low energy prices. Furthermore, the RBI has compounded the growth slowdown by urging banks to clean up their balance sheets. The RBI, of course, stands by its policies. Nevertheless, this debate is very important because it could shape policy directions in India over the medium term. Now what does the evidence say? I am going to offer some simple charts only, not detailed econometric tests, but they should indicate the rationale for our actions. Specifically, monetary policy has not been too tight. Instead, I will argue that the slowdown in credit growth has been largely because of stress in the public sector banks, stemming from past mistakes in lending. This will not be fixed just by a cut in policy rates. Instead, what is required is a clean-up of the balance sheets of public sector banks, which is underway and needs to be taken to its logical conclusion. I will then speculate why economic evidence finds it so hard to prevail in the public debate, not just in India but elsewhere in the world. Public Sector Lending vs Private Sector Lending Let us start by looking at public sector bank credit growth compared with the growth in credit by the new private banks. As the trend in non-food credit growth shows (Chart 1), public sector bank non-food credit growth has been falling relative to credit growth from the new private sector banks (Axis, HDFC, ICICI, and IndusInd) since early 2014. This is reflected not only in credit to industry (Chart 2), but also in micro and small enterprise credit (Chart 3).2 The relative slowdown in credit growth, albeit not so dramatic, is also seen in agriculture (Chart 4), though public sector bank credit growth is picking up once again. Whenever one sees a slowdown in lending, one could conclude there is no demand for credit – firms are not investing. But what we see here is a slowdown in lending by public sector banks vis a vis private sector banks. Why is that? Such a simple identification test suggests that the problem is not that aggregate demand for credit is low because interest rates are too high. That would have implied a slowdown in credit across the board. Yet the real rates of credit growth from private sector banks to different sectors are extremely high, and private banks typically do not charge lower interest rates than public sector banks. This suggests strong demand for loans from them at prevailing interest rates. The obvious conclusion one should draw, therefore, is that the slowdown is because something is affecting credit supply from the public sector banks specifically. Could it be the lack of public sector bank capital? If we look at personal loan growth (Chart 5), and specifically housing loans (Chart 6), public sector bank loan growth approaches private sector bank growth. The lack of capital therefore cannot be the primary culprit. Rather than an across-the-board shrinkage of public sector lending, there seems to be a shrinkage in certain areas of past high credit exposure, specifically in loans to industry and to small enterprises. Additionally, the fact that the credit slowdown dates from early 2014 suggests that the bank cleanup, which started in earnest in the second half of fiscal year 2015, was not the cause. Indeed, the slowdown is best attributed to over-burdened public sector bank balance sheets and growing risk aversion in public sector bankers. Their aversion to increasing their activity can be seen in the rapid slowdown of their deposit growth also, relative to private sector banks (see Chart 7). After all, why would public sector banks raise deposits aggressively if they are unwilling to lend? In sum, the Indian evidence, supported by the narrative of experiences from other parts of the world such as Europe and Japan, suggests that what we are seeing is classic behavior by a banking system with balance sheet problems. We are able to identify the effects because parts of our banking system do not suffer from such problems. The obvious remedy to anyone with an open mind would be to tackle the source of the problem – to clean the balance sheets of public sector banks, a remedy that has worked well in other countries where it has been implemented. Clean up is part of the solution, not the problem, and that is what we are doing. Another take on whether rates are too high Let me now turn back to inflation. No doubt, the RBI has emphasized the fight against inflation, and a key element of any disinflationary process is to curtail aggregate demand. At the same time, because past excess investment and low global demand created overcapacity in certain sectors, the RBI could afford to be less aggressive in curtailing demand than in different circumstances. This is why we chose a gentle glide path to bringing down inflation, first down to 8 percent in 2015, then 6 percent in 2016, and now 5 percent in 2017. We have cut interest rates by 150 basis points since January 2015. With CPI inflation currently close to the upper bound of our inflation target, few could sensibly argue that we have not been adequately accommodative. Of course, our last policy statement indicated we expect it to come down to around 5 percent by March 2017. Critics offer two contradictory arguments on inflation. On the one hand, they argue that we have killed demand and growth through high rates – though this itself seems at odds with the received wisdom that we are the fastest growing large economy in the world. On the other, they argue that our policy has had little effect on curbing inflation, that disinflation has been a result of the fall in oil and other commodity prices. It is worth pointing out that the disinflation process started in late 2013, long before oil prices collapsed. Moreover, a significant part of the fall in oil prices globally has not been passed on domestically, as the government has hiked excise on petrol and diesel, and refinery margins have also waxed and waned. For instance, even as the price of the Indian crude basket fell 72 per cent between August 2014 and Jan 2016, the pump price of petrol fell only 17 per cent. Therefore, while I do want to acknowledge the benign international price environment in bringing down inflation, it is not the entire story. To see this, we plot inflation in non-traded education and health care services in Chart 8, as well as the broader miscellaneous component of the CPI index. Here too, inflation has come down. How could the Reserve Bank have brought down inflation without killing demand? By bringing down the public’s expectations of inflation and by not giving in to the clamor to slash interest rates! Interestingly, the clamor builds up whenever year-on-year inflation is low relative to the policy rate, no matter whether low year-on-year inflation is because of mechanical base effects, and regardless of whether inflation is projected to go up in the future. No serious central bank determines policy on such a basis, but it sometimes is the focal point for the media debate here. As a final piece of evidence on whether our policy is too tight, consider Chart 9 plotting real policy rates around the world. Given our real growth is amongst the highest in the world, while our inflation is in the upper tier, one would expect our real policy rate to be high. Instead, it is right in the middle of the pack of large countries, and significantly lower than China, a country we often like to compare ourselves with. Once again, evidence seems contradictory to the views of the critics of our policy. Finally, some legitimate concerns have been raised about whether our inflation target should include volatile components of inflation like vegetables and other foods. In reality, the RBI has typically looked through such volatility in setting policy rates. Even in the new inflation framework, the inflation target has to be breached three quarters in a row for the MPC to have to explain its failure. Volatile components like vegetables tend to be smoothed over three quarters. At the same time, it is not reasonable to drop food entirely from the target index. It is the single most important consumption category for most Indians still. Moreover, as Indians get richer, there are some structural shifts in consumption patterns that are reflected in higher prices for favored items. It would not be appropriate to ignore these structural shifts and the need for associated supply responses. It is heartening that after years of high pulse inflation, we are seeing a strong attempt by the Government to encourage pulse cultivation, and early sowing patterns suggest possible significant increases in pulse production. Why do arguments persist despite contrary evidence? Why is the debate uninfluenced by the data? Why is it that as we seem to be bringing inflation under control, public voices to abandon the fight are loud? I don’t know for sure but let me hazard a guess; Is it possible the political economy of inflation is different from the received wisdom we were taught in class as students? And are there parallels to the political economy of bank cleanup? Specifically, despite all the public commentary against inflation and its pernicious effect on the weaker sections of society, there seems to be surprisingly little anxiety in public commentary about inflation so long as it stays in the high single digits. Industrialists welcome negative real rates of interest for obvious reasons. Many middle class savers value the high nominal interest rates on their fixed deposits, not realizing that their principal is eroding significantly every year. The Keynesian economist is happy because monetary policy is extremely accommodative. The analysts cheer every cut in interest rates because markets are assumed to have a Pavlovian positive response to them. Even the poor are inured to their fate of seeing real incomes erode, and are only aggrieved when the price of some food staple sky-rockets. Interestingly, short term spikes in food staples are not really controllable by monetary policy, which then leads to the incorrect generalization that since monetary cannot control the politically most important aspects of inflation, it cannot control inflation in general. With no powerful and vocal political constituency getting agitated about generalized inflation so long as it is only moderately high, opponents of disinflationary policies are free to frame the debate as they wish. The persuasive way is to claim that interest rates are hurting growth. The argument is hard to refute because there is always some sympathetic borrower who is paying seemingly excessive rates. The high prevailing borrowing rate of some small borrower – say 15 percent today -- is held out as Exhibit A of the central bank’s inconsiderate policies, never mind that the rate charged includes the policy rate of 6.5 percent plus an additional spread of 8.5 percent, consisting of a default risk premium, a term premium, an inflation risk premium, and the commercial bank’s compensation for costs, none of which are directly affected by the policy rate. The press is constantly urged to frame the debate as inflation versus growth, and with inflation still moderate, only the excessively conservative central bank could be against growth! Never mind that overly accommodative policy today will set up inflation for the future; Never mind that the last forty years of economic theory and practice suggests that the best way central banks can support growth over the medium term is by keeping inflation low and stable. The reality, of course, is that high inflation is not stable. As we have seen in India’s own past, and in other emerging markets, moderately high inflation tends quickly to become very high inflation. The currency then becomes volatile, leading occasionally to external stress. After all, one of the reasons we were termed the Fragile Five in the summer of 2013 was because of our high inflation. Moreover, the saver eventually recognizes that high inflation erodes the value of his financial savings and switches to real assets like gold. Since we do not mine gold in the country, this also puts pressure on the current account. In sum, the fragilities associated with high inflation accumulate, and eventually could lead to crisis. However, the belief that there is a strong powerful domestic constituency against inflation in India, which was drummed into our heads as students, may be a myth, certainly at moderately high levels of inflation. Without any political push back as inflation rises, what is to ensure macroeconomic stability? Unlike more authoritarian Asian economies that used severe administrative measures to deal with bouts of high inflation during their growth phase, our democratic structure rightly does not permit such measures. So it is better that we tackle inflation up front by building the necessary institutions. Perhaps this is why successive governments, in their wisdom, have given the RBI a measure of independence. Certainly, such concerns would support the current government’s decision to enshrine its commitment to low inflation through a formal inflation target and the creation of a monetary policy committee. Interestingly, a similar public dynamic seems to be at work in attitudes towards cleaning up the public sector banks. Clearly, over-levered promoters have no incentive to see the banks tighten screws and demand repayment. Some public sector bank CEOs with a short remaining tenure would prefer not taking stern action and recognizing NPAs. They might indeed prefer transferring any problems to their successor. Investors in bank shares, at least initially, do not welcome disclosures of loan losses. And depositors, knowing the government stands fully behind public sector banks, are rightly unperturbed by the quality of bank balance sheets. So it is easy to ignore the problem of loan losses and hope it somehow goes away, much as it is easy to ignore moderately high inflation. But as with inflation, loan losses have a tendency to increase. The lesson from other countries is that by the time losses get too big to ignore, they are too late to manage, and the system is in crisis. As with inflation, it is the task of the central bank to press for bank clean up earlier, when few amongst the public support the central bank’s activism. Fortunately, after an initial reluctance, banks have entered the spirit of the cleanup and some have gone beyond what was demanded of them. The stock market, after reacting negatively initially early this year, has been more supportive of public sector bank stock prices, probably reflecting the belief the cleanup is good over the medium term. Promoters are selling assets and paying up, and new asset reconstruction companies are being started to buy assets. To restore bank balance sheets to health, it is important this process be taken to its logical conclusion. Criticism of the central bank using arguments unsupported by evidence is not just an Indian phenomenon. The Bank of England was criticized for laying out the economic costs of Brexit, the ECB has been criticized for doing too much to restore health to troubled peripheral economy financial sectors, and the Fed is under fire for departing from the Taylor Rule. Criticism comes with the territory, and central banks need to make the case for their policies. At the same time, it is important that governments around the world look beyond sometimes uninformed and motivated public criticism and protect the independence of their central bank to act. That is essential for stable sustainable growth. 1 Inaugural Address by Dr. Raghuram Rajan, Governor, Reserve Bank of India at the 10th Statistics Day Conference 2016, Reserve Bank of India on July 26, 2016, Mumbai 2 In Chart 2, the latest negative growth April number may be an aberration because of UDAY bonds being transferred from bank loan books to investments |

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: