IST,

IST,

What, Why and How of Retail (Mass) Banking: Issues and Challenges

Dr. K.C. Chakrabarty, Deputy Governor, Reserve Bank of India

delivered-on ਅਕਤੂ 07, 2013

Mrs. Usha Thorat, Director, Centre For Advanced Financial Research And Learning (CAFRAL); Mr. B D W A Silva, Deputy Governor , Central Bank of Sri Lanka; CEOs of various commercial banks from across the globe, other fellow Central Bankers ; ladies and gentleman! At the outset, I would like to extend a warm welcome to all the delegates to this roundtable, especially the foreign delegates who have travelled to India to be a part of this event. It is indeed a privilege for me to address this august gathering assembled here in this picturesque lake city of Udaipur to brainstorm on a very topical subject- finding the right model for taking retail banking to the masses. I am sure the CEOs present here, would not have spent a minute in agreeing to be a part of this roundtable as this presents a unique opportunity for them to learn from the experience of fellow CEOs and pick up ideas that could help in their quest for building an optimal delivery model for their respective retail banking products and services. Likewise, I too did not have any second thoughts on accepting Mrs. Thorat’s invitation to interact with this eminent group as I viewed it as an opportunity to learn about various impediments/irritants that they face while pursuing their brand of banking for the masses. As in-charge of the department within RBI looking after financial inclusion initiatives in India, I have always looked forward to joining any erudite bunch of stakeholders who are equally keen about promoting access of banking services to the people. As far as the Indian banks go, I would say that this seminar is very appropriately timed as our banks seek to build on the gains from the first phase of financial inclusion initiatives in India. 2. The very fact that all of you have chosen to take time out of your extremely busy schedules to attend this event on retail banking epitomizes the significance this segment of banking has assumed, especially in the emerging markets. I intend to commence my address by highlighting the context in which retail banking has assumed such significance amongst the commercial bankers and the regulators/supervisors alike. I would follow this up with discussing why the focus on this segment has sharpened now. I would also dwell upon the key characteristics of retail banking and the pre-conditions for its success and would conclude by sharing my perspectives on the challenges faced by retail banking segment and the way forward. Context 3. As you would all agree, the Global Financial Crisis has proved to be landmark event in the history of finance. The scale of the crisis is unprecedented in the sense that it has affected all economies of the world in some form or the other. Of course, the severity of the shock and its after-effects has been of differing magnitude for different pockets of the world. The regulatory reforms unleashed in the wake of the crisis globally have aimed at making the financial sector a more stable arena. The first and foremost of these measures have sought to curb the high-risk activities undertaken by the investment/wholesale banking divisions of the banks through structural measures for controlling systemic risks. The crisis also highlighted a heightened need for inclusive growth as a means to ensure financial stability. There was also massive outcry about imprudent market practices and an utter disregard for consumer protection by the banking/financial system prompting moves by several jurisdictions to establish new regulatory/supervisory authorities for specifically looking at customer protection issues. Over the course of the Roundtable when you discuss the ideal model for the retail mass banking, it would be appropriate to bear these concerns in mind. I must remind you that financial sector continues to be viewed as the ‘least-trusted’ industry by the people and hence as the main stakeholders, it is our bounden duty to aim at restoring the lost credibility of our profession. What is banking? 4. Before we broach the subject of retail banking, let me begin by elucidating what is banking. You must be wondering why I am getting down to the basics. Believe me this has a purpose. We all understand ‘traditional’ banking as the process of financial intermediation wherein the bank acts as an intermediary between the savers and the borrowers. It accepts deposits for the purpose of making loans to the borrowers as also facilitates payments as part of the country’s payment and settlement systems. The banking industry has, however, undergone a lot of transformation over the last three decades. The banks have become a virtual marketplace offering among others, various non-banking financial products and services to the customers. Besides the traditional sense in which banking is understood, I consider banking as an activity of offering other products and services by the banks to their own customers. My emphasis on the word ‘own’ is not incidental. In developed markets, banks do not offer products and services to their customers unless they have conducted due diligence on the customer in terms of KYC/AML framework. While in the emerging markets, we have certain relaxed KYC norms for ensuring financial access to the unbanked population, if we have to give a significant push to retail (mass) banking, we would need to not only know the customers, but also their business and risks associated with their business. Evolution of banking 5. In the developed markets, banking over the years has evolved through following three distinct phases. These three phases broadly coincide with the level of development in the real economy in the respective jurisdictions. a) Initial Phase: During this phase the banks were primarily engaged in offering the basic intermediation service i.e. provision of savings facilities and credit for productive purposes and also facilitate payment services including remittances b) Intermediate Phase: Apart from providing the services offered in the initial phase, the banks additionally moved into lending for consumption purposes. The banks also started offering certain para-banking services like insurance etc. The demand for such services arises primarily on account of a transition of the economy from an investment (production) led growth phase to a consumption led growth phase. At this stage of development of the economy and the society, retail banking becomes relevant. c) Advanced Phase: Apart from providing the services offered in the intermediate phase, the banks have additionally started providing high-end savings & investment products, wealth management products, and structured products to both individuals and corporates. In other words, in this phase, the banking system additionally starts supporting the speculative activities over and above for the production and consumption activities. Private banking, an advanced version of retail banking for ‘classes’, becomes relevant at this stage. What is Retail Banking? 6. Let me pose a fundamental question to you all - What is retail banking? The answer to the question might sound all too obvious, but let me tell you, there would, perhaps, be as many different perceptions about this as the number of participants here. Why only here? I have observed that across the globe also there is no clear understanding about the ambit of retail banking. Therefore, before we head into the issues proper, I would also like to define ‘retail banking’ and draw an outline of its ambit to ensure that all of us share a similar understanding of the subject that we are set to discuss this evening. 7. Retail Banking refers to provision of banking products and services offered to individual customers, typically for non-entrepreneurial purposes. Let me make another point about banking. On the liability side, banking has invariably always been ‘retail’ i.e. the banks have raised resources from a large number of retail depositors. In that sense when we talk about retail banking, our focus is on the asset side i.e. lending to the retail segment. Thus, on the whole, retail banking involves offering of products both sides of the balance sheet eg. fixed, current / savings accounts on the liability side; and mortgages, loans (e.g., personal, housing, auto, and educational) on the asset side. Additionally, retail banking also involves offering of credit cards, depository services and other para-banking products and services viz. insurance products, capital market products etc. to individuals. Thus, retail banking services broadly corresponds to the banking services providing in the intermediate phase of evolution of banking. It is contextual to mention here that real economies in most of the developing countries have matured enough to demand products and services offered not only during the intermediate phase but also during the advanced phase and hence retail banking, embracing all products and services relating to consumption and speculative function of the economy, has become relevant in these jurisdictions. 8. Retail banking is the most visible face of banking for the general public. These services are typically offered at the physical brick-and-mortar branches and at the ubiquitous ATMs. The delivery channel for retail banking is now no longer restricted to branches and ATMs but also spans telephone and the fastest growing channel i.e. internet. In fact, some retail banks in the west operate solely via the internet and do not have facilities to serve customers at physical outlets. Generally, however, the banks that focus purely on retail clientele are relatively few and retail banking activities are generally conducted by separate divisions within banks. 9. Typically, retail banking services begin with a target clientele which is the common masses and it slowly graduates through a stage which can be called as ‘class retail banking.’ The ‘mass retail banking’ is the stage in which the bank provides standardized banking products and services to its customers. In this phase the banks attempt to build a sufficiently broad customer base which can serve as a stable source of funding . The ‘class retail banking’ on the other hand, is the stage in which the bank offers customized products and services targeted at a niche customer segment, the high net worth individuals. Retail banking focused solely at a niche customer segment may also be termed as private banking. 10. A graphical representation of the positioning of mass retail banking vis-à-vis other segments of banking is as under:  11. As I mentioned earlier, there is a lot of confusion around the ambit of retail banking. This is not really confined only to emerging markets but is a global phenomenon. The confusion primary emanates from whether the banking services offered for entrepreneurial purposes should be considered as part of retail banking or not. Many of the banks include the banking services extended to small borrowers and SME clients also as part of mass retail banking. In my view, the retail banking in its most basic form is only about servicing the individuals (mostly the masses) for non-entrepreneurial purposes. The retail banking over a period of time can make a transition to class banking and banking for entrepreneurial purposes for the individuals, for agriculture or for small businesses (SMEs). This is particularly so as many aspects of retail banking in terms of delivery of services (large number of small value transactions) and risk management practices (scoring model, model based capital assessment) are also applicable to small businesses run by individual entrepreneurs. Characteristics of Retail (Mass) Banking 12. Let me now turn to the major characteristics of the retail banking. The products and services under retail banking are supposed to be standardized. In other words, they are “off-the-shelf” products without any customization for individuals. For comparison sake, I would equate them to products offered at a branded retail store. At retail stores, you pay for what you see and what is mentioned on the price tag. There is uniformity, transparency and non-discrimination about the products and services offered. Hence, the products offered by retail banks also should have similar characteristics. Further, retail banking products are offered across multiple channels and at multiple places (branch, internet, ATM, telephone). The banks have to aim at delivering these services in the most efficient manner. As the retail (mass) banking involves reaching out to a group of individuals, the banks also need to have appropriate systems, structure, manpower and processes in place to deal with the group, group characteristics, group behaviour and group dynamics for the target clientele. Pre-conditions for success of retail banking 13. Having outlined the contours of what is retail banking and what are the typical characteristics of retail banking; let me now turn to some of the necessary preconditions for the success of retail banking. To my mind, the most important pre-requisite for retail banking to succeed is the presence of an efficient delivery mechanism. What essentially binds customers to their bank is quality of services offered, the fairness and affordability of pricing and the promptness of service. . While there is not much scope for the banks to differentiate their product and service offerings in so far as the basic products are concerned, it is important for the bank to enhance the customer experience by ensuring that the services are made available whenever and wherever the customer demands them. Further, the banks can bring down their cost of service delivery, if and only if they are able to improve operational efficiency. In a nutshell, the banks should be able to deliver the products and services to the customers in safe, secure, prompt and cost effective manner by leveraging technology. I have analyzed various metrics of operational efficiencies for the banking system across the globe and I can tell you that notwithstanding the inter se disparity between banks in respective jurisdictions, almost all the jurisdictions represented here today need to improve their operational efficiencies by several notches to reach anywhere closer to their counterparts in developed world. The positive factor, however, for our banks is that the downside is limited and hence, the upside potential is tremendous. 14. The second essential pre-condition for the success of retail banking is appropriateness of product and services for the customers. As the banks strive to bring new customers into their fold and also to retain the existing ones, they must invest heavily into data analytics and assess what are the appropriate products and services for the specific groups of their customers. The banks have to be sensitive about the customers’ needs and requirements. Let me give an example. A migrant laborer in a metropolitan centre and a laborer in a village may have similar balances in their bank accounts, but their requirements would be distinct and therefore, the product offerings of banks to these sets of customers would have to be different. In sum, rather than focusing on financial worth of the customers, the banks would have to inculcate a habit of listening to their customers and building analytics based on this interaction. 15. The next set of essential pre-requisites relate to pricing. Our experience in India demonstrates that the pricing of the products and services –both on the liability as well as on the asset side are heavily weighed against the retail customers as a group. In fact, we have evidences of retail customers being paid different interest rates on their deposits for the same tenor within the same bank. Similarly, I have seen one particular bank’s lending rate for automobile loan vary quite widely. I do not know why a standardized loan product like an automobile loan should be priced differently for different customers when it is a secured loan. Banks should in such cases upfront decide on whether the customer can be given a loan or not and once the lending decision has been made I don’t see any reason for discrimination in the pricing of the loan. I do not understand why the banks should be looking to benefit from information arbitrage they hold rather than pricing their products transparently. and. In contrast to the situation in developed economies, such problems are more endemic in the developing world as here not only the level of financial education and literacy is low, but the financial consumer activism is also pretty much dismal. 16. Insofar as the lending decisions in retail banking business goes, I believe the banks would need to start using scoring models for assessing the credit worthiness of borrowers to bring in greater transparency and efficiency. Credit Scoring model is a statistical technique that combines several financial characteristics to predict the behavior of new applicants based on the performance of previous applicants. At least among the Indian banks, except for a couple of foreign banks and new generation private none of the other banks seem to employ them. In fact, in my interactions with the bankers I feel that there is lot of misgivings about the scoring models and generally people mistake it for rating model. My firm belief is that for bringing in uniformity, transparency and fairness in the retail lending process, the banks would need to start employing credit scoring. 17. As I briefly alluded to above, for the retail banking business to thrive in the developing markets, it is essential that an effective consumer protection environment is created quickly. As most of you are aware, across the globe, the regulators and supervisors are turning increasingly intolerant of unfair market practices adopted by the market participants. We have seen large amounts of penalties levied on banks by the regulators mainly for failing to protect consumers’ interests and for unfair practices. In fact, there is a growing feeling that the banking regulators/supervisors have proved ineffective in checking these unfair practices and failed in effectively protecting consumers. This has culminated in creation of separate authorities for enforcing fair market conduct and for protection of financial consumers. This transformation has happened in the Netherlands, in South Africa, in Australia, in the UK and several other jurisdictions. Therefore, unless the banks in the developing countries are firmly committed to treating their customers fairly and put in place appropriate systems and processes to ensure that, they would be well advised to refrain from riding the bandwagon of retail banking. Why the growing interest in retail banking? 18. The growing interest in the retail banking in the developing economies can be explained on account of a few major developments. The first of them I had referred to briefly above and that is transitioning of the economies into the intermediate phase. As I mentioned earlier, in the initial phase of evolution of banking, the policy makers focused on ensuring the flow of bank credit to the productive sectors of the economy. But over time, as the credit demand from the basic industrial and infrastructure sectors have waned somewhat, the regulators have become more accommodating in allowing the banks to lend even for consumption purposes. The second development that has provided a boost to retail banking aspiration of banks is the availability of enabling technology. Since retail banking requires mass production techniques, the advent of technology has enabled the banks to design appropriate technology-based delivery channels. Retail banking has also received a thrust from the regulators/policymakers’ push for inclusive growth in the wake of the global financial crisis. The Governments across the world view banks as the key component in furthering the cause of financial inclusion. We, in India, have also been promoting a bank-led financial inclusion model and view retail mass banking as the stepping stone towards achievement of universal financial inclusion. The last, but not the least of the reasons for the growing interest in retail banking is the banks’ quest for new sources of revenue and new channels for profit. Slowly but surely, the banks have realized that the commerce for the poor anywhere in the world is more viable than the commerce for the rich and hence they view the excluded masses as a potential source of profit in the long-run. Commercial banks cannot ignore the adage that the “Future of Banking is Retail Banking.” Deficiencies in/ Challenges for Retail Banking 19. Having spelt out what I consider essential pre-requisites for the success of retail banking, let me now turn to some of the issues which pose significant challenge for retail banks. To my mind, ensuring customer protection through transparent and appropriate pricing of product and services, curbing mis-selling, understanding KYC in all its manifestations, managing risks, inadequacy of MIS, countering the effects of disruptive new technologies, retaining customer loyalty, managing cost and ensuring growth are some of the challenges that retail banks have to counter simultaneously at the present juncture. I would elaborate on some of these deficiencies/challenges. (a) Consumer Protection & Pricing 20. As you would have noticed by now, consumer protection has been a recurring theme in my address today. To say that the pricing of products and services in the banking system in India is non-transparent would be an understatement. Actually, I have several examples of pricing being discriminatory, arbitrary and to a certain extent illogical. I do not wish to elaborate too much on how innovative the banks have been in fleecing their customers but let me give you a flavour. There are charges for non-maintenance of minimum balance, charges for cheque return and there are charges even where no service has been provided – customers not conducting any transactions. I can understand that you charge the customer once for not maintaining the minimum balance that he was supposed. But, why on second, third and fourth occasions? So much so that eventually his balance becomes negative. Why do you instead not inform him and close his account after the first instance or convert it to a basic savings account? In fact, I find another disquieting feature in the pricing of products and services by banks and that is poor subsidising the rich. I have not seen banks mentioning the yields to the customers of their deposits or the effective borrowing cost for the customers on the lending products. Why can’t the banks advertise their Annual Equivalent Rates/ Annual Percentage Rates on their deposit and credit products respectively? For your retail banking model to be successful, your pricing should be non-discriminatory, risk-based, competitive and value added. 21. As in-charge of customer service department in the Central Bank, everyday, I receive several complaints about mis-selling of products to gullible consumers, some of which are quite outrageous. Believe me, if you wish your retail banking to succeed, you would have to address this deficiency at the earliest. Else, as I hinted earlier, the regulators/supervisors would no longer be as tolerant in imposing penalties and issuing strictures as earlier. (b) Inadequacy of MIS 22. A crucial import for the success of any business is the accurate, consistent and granular information about its various components. I have highlighted this in the past and want to bring this issue up one more time. The information system in the Indian banks continues to be rudimentary which leads to impressionistic decision making rather than information-based decision making. The banks even lack the basic information on how many customers they have and how many products they have. The data on segmental revenues and segments profits are not available with any granularity. Under the circumstances, the banks would find it very difficult to make their pricing risk-based. It is crucial, therefore, that if the retail banking has to be rolled out successfully, the banks would need to build an appropriate MIS. (c) Understanding and tackling KYC/AML issues 23. I mentioned the importance of conducting KYC/AML for banking customers. As you all know the banks in the developed countries have faced significant amount of penalties from the regulators for their failure to conduct adequate due diligence on their customers. Even, we in India, had to impose penalties on some of the banks for their failure to have proper due diligence on their customers. It is important to understand and appreciate KYC requirements in all manifestations- be it for the products on the asset side of the balance sheet or on the liability side. Banks would also need to be mindful about the KYC due diligence for the third party products that they sell from their premises/through their delivery channel. You have to be increasingly vigilant in the coming days as the trend of forex inflows is likely to reverse thereby exposing the banks to more stringent KYC requirements from the host countries in the West. (d) Managing Risk 24. The retail banking business involves dealing with a large number of customers over varied delivery channels thereby creating significant vulnerabilities across banks’ systems. These vulnerabilities could be in the form of inadequacy of internal guidelines or non-adherence by staff, inadequacy in the technology systems supplied by vendors, fraudulent practices employed by customers, hackers etc. While the banks have developed sufficient safeguards to deal with operational risk event associated with traditional delivery channels, it is the emergence of non-traditional delivery channels which are likely to be the pressure points for banks going forward. This is already evident in large number of technology-related frauds that we have witnessed across Indian banks in the past few years. Though from a value view point these frauds are not significant, still from an individual’s stand point they are quite important. The banks would also need to recognize and manage risks arising from mis-selling etc. besides the other business risks like market risk, liquidity risk, interest rate risk etc. Unless, the banks address these issues quickly, even the low-value frauds would have the potential to cause reputational risk and unwarranted litigation for the banks. It is, therefore, absolutely important that the banks improve their risk management systems to address these vulnerabilities. (e) Countering the effects of disruptive new technologies 25. Retail banking has been most impacted by technology, thanks to the proliferation of alternate channels of delivery (ATMs, internet and telephone banking). The pace with which consumers in the developing countries have also adopted digital technologies has been quite amazing. According to available statistics, by the end of 2011, China and India were ranked first and third respective in the global league table for number of Internet users. Also the use of mobile platforms for accessing internet has been staggering: in China, 65 percent of mobile-phone users regularly access the Internet via their phones, while in India, mobile-only web browsers are expected to comprise 55 percent of the total Internet user base by 2015. As a corollary, the use of traditional delivery channels for accessing banking services has seen a perceptible decline. According to a McKinsey Personal Financial Services survey, in 2011, in both the emerging and developed markets in Asia, there was a significant decline (more than 25per cent) in the number of consumers visiting branches for accessing banking services than in earlier years. Likewise, the use of digital-channel for accessing banking services also showed significant increase (in excess of 35 per cent). While the number of bank customers in India and few other developing countries may still be low, but the banks have to be cognizant of this emerging trend and quickly adjust to the new paradigm where more and more of their customers move online for accessing banking services. As the demographic changes take place the “technology acceptors” will soon outnumber the “technology deniers” and banks have to use this short transitory period to adequately equip themselves to manage the disruptions arising out of this alternate delivery channel. Further, since the internet is available on a “24 by 7” basis, the banks would have to substantially invest in appropriate technology and ensure that their service offerings are available round the clock with minimal downtime. While the use of technology-aided delivery channels has grown multifold, so has the scope for fraudulent transactions through impersonations and identity thefts. Banks would also need to quickly put in place lasting technology-based solutions to thwart the efforts of fraudsters and minimize the customer complaints. As the use of new delivery channels gets more popular, the banks would need to ensure that their customers continue to have good experience with their service offerings and remain loyal to them. (f) Continuing Growth 26. I don’t think growth is as much a challenge for the retail banks in developing economies as in the developed economies. Even with our concerted efforts on increasing the banking penetration and bringing more and more adult population under the formal financial system over the last 6-7 years, more than half of the target population remains uncovered. Of the 6 lakh plus villages in India, as on March 2013 only about 2.68 lakh villages, had access to banking service either through a branch mode, a banking correspondent or other channels. Similarly, the credit penetration from the banking system in the country is abysmally low at about 10%. In absence of access to formal sources of finance, the alternate cost of funds for the people is exorbitantly high. As the pricing of loans no longer remains restricted due to any regulatory/ government fiat, the banks are free to reasonably charge their customers. All this means that the retail banks have a huge potential to grow in India over time . I believe that the other jurisdictions represented here also face similar conditions in their respective countries.I would, therefore, argue that the challenge for the retail banks is not finding new customers or new markets; it is more of a mindset issue. The Top Management and the Board of the banks need to get convinced that financial inclusion as a viable and profit-making business proposition and pursue that objective with a missionary zeal. Way Forward 27. As I mentioned a little while back, there is little to differentiate between basic products and services offered by retail banks. Having conceded that, packaging and branding of products and services are going to be the key differentiator between banks. The banks would have to invest quite a lot in innovation, research and product design so as to keep their product and service offerings relevant and contemporaneous to emerging customer needs. They would have to rummage through huge amount of customer data that gets generated every day in course of transactions and use appropriate analytics to develop products in keeping with changing customer preferences. In this context, banks can also think in terms of giving a dedicated platform of their webpage to the customers to solicit their views/ requirements. 28. As competition gradually brings down the spreads and the profitability, the banks have to continuously work towards improving their productivity and efficiency so as to maintain their RoE. Towards this end, technology would be the key enabler. Though, technology has been available and been in use in the banking sector for more than a decade now, my belief is that it has not yet been exploited to its optimum potential. Technology can assist in all spheres of banking activities – right from planning, strategy, MIS, processing, delivery, monitoring and follow up. I feel that the banks that can quickly conjure up a technology based cost-efficient delivery model for their products and services would be the ultimate winners in the long run. 29. I briefly touched upon the need for developing standardized products and services for furthering the retail banking initiatives. Across the globe, retail lending has been a spectacular innovation in the commercial banking sector in recent years. The growth of retail lending, especially, in emerging economies, is attributable to the rapid advances in information technology, the evolving macroeconomic environment, financial market reform, and several micro-level demand and supply side factors. In the context of retail lending, deployment of scoring models would minimize the subjective element and thereby fast track the decision making process. The mass retail banks of today would also have to plan a transit path for the class banking and gradually to entrepreneurial banking. 30. Quality of services offered by the banks is going to be another key differentiator. In ultimate analysis, providing better service to the customers would be the key to generating larger revenue for the banks. Conclusion 31. The retail banking space proved to be an oasis of relative calm amidst the tumult caused by the Financial Tsunami that the world continues to grapple with even today. The customer deposit garnered by retail banking represents an extremely important source of stable funding for most banks. In this context, it is essential for the banks to keep pushing the frontiers of innovation and experimentation in the retail banking space to survive and also to remain relevant. One of the most essential elements of a strong customer bank relationship is the bank’s understanding of customer needs and preferences. However, with the massive increase in their size and their customer base, the banks have slowly drifted away from understanding their customers’ needs and preferences closely. Further, the proliferation of alternate delivery channels has necessitated that banks build their presence across all channels (omni-channel presence) to offer their services to their customers. As the banks can’t probably dictate that their customers chose specific channel, the challenges for the banks is to design products/systems which are channel/segment agnostic. 32. While retail banking offers phenomenal opportunities for growth, the challenges are equally daunting. The exacting regulatory requirements on the consumer protection front, risks from a slowing global economy and increasing customer expectations mean that banks must innovate to grow. How far the mass retail banking of the future would be able to fulfil its socio-economic objectives would in a large measure depend upon the willingness of the banks to innovate and reform their business processes and structures for this cause. It is in the banks’ own interest to be alive to the customers’ interests; else they might have to face stiff regulatory sanctions. Post crisis, several jurisdictions in the developed world have seen public demands for ethical pricing. In this Facebook and Twitter age, the banks cannot remain oblivious to the power of the social media which wields enough clout to forcibly reform the outliers through negative publicity. Only such retail banks, who inculcate ability to churn out innovative and differentiated products by harnessing cutting-edge technology, greatly improve their productivity and efficiency, bring a fair, transparent and non-discriminatory pricing and demonstrate a commitment towards fair treatment to their customers, would be able to survive and add value to the society. 33. I once again thank Ms. Thorat and CAFRAL for inviting me to this roundtable and giving me an opportunity to share my perspectives on a very topical subject for the banks as well as the regulators and policy makers. I hope that over the course of next two days as you deliberate on the nuances of retail banking, you would reflect on some of the issues that I have raised in my address today. I wish the roundtable all success. Thank You! |

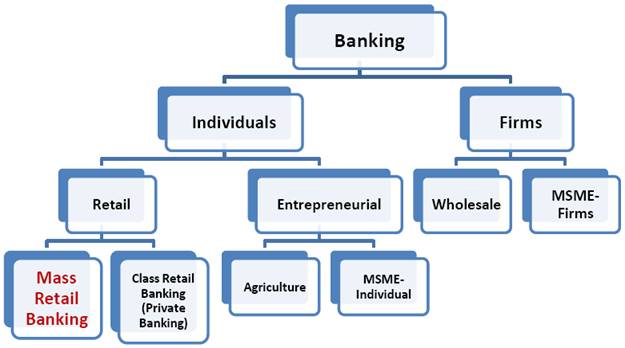

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: