IST,

IST,

Monthly Payment System Indicators - February 2024

|

Monthly Payment System Indicators - February 2024

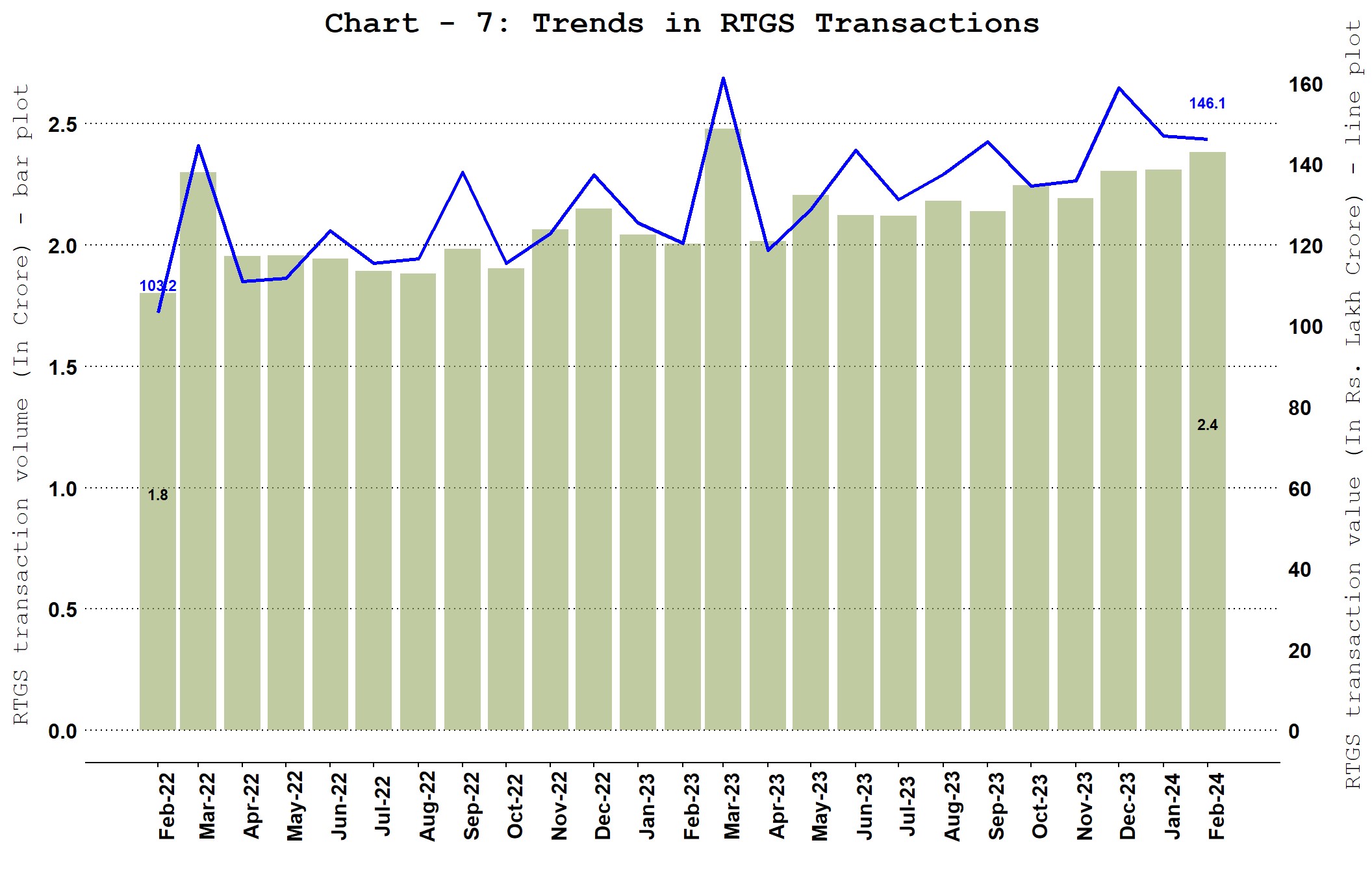

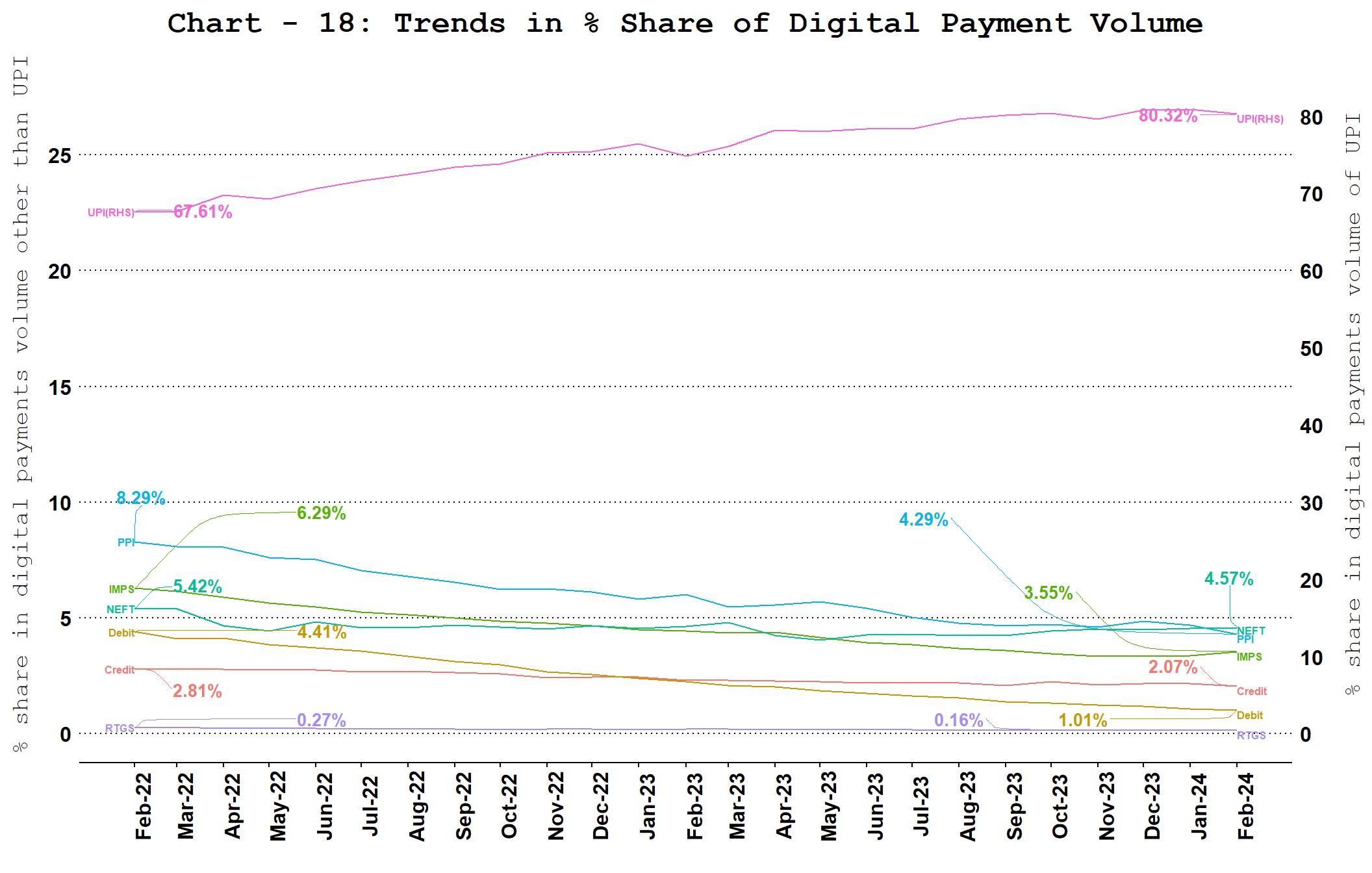

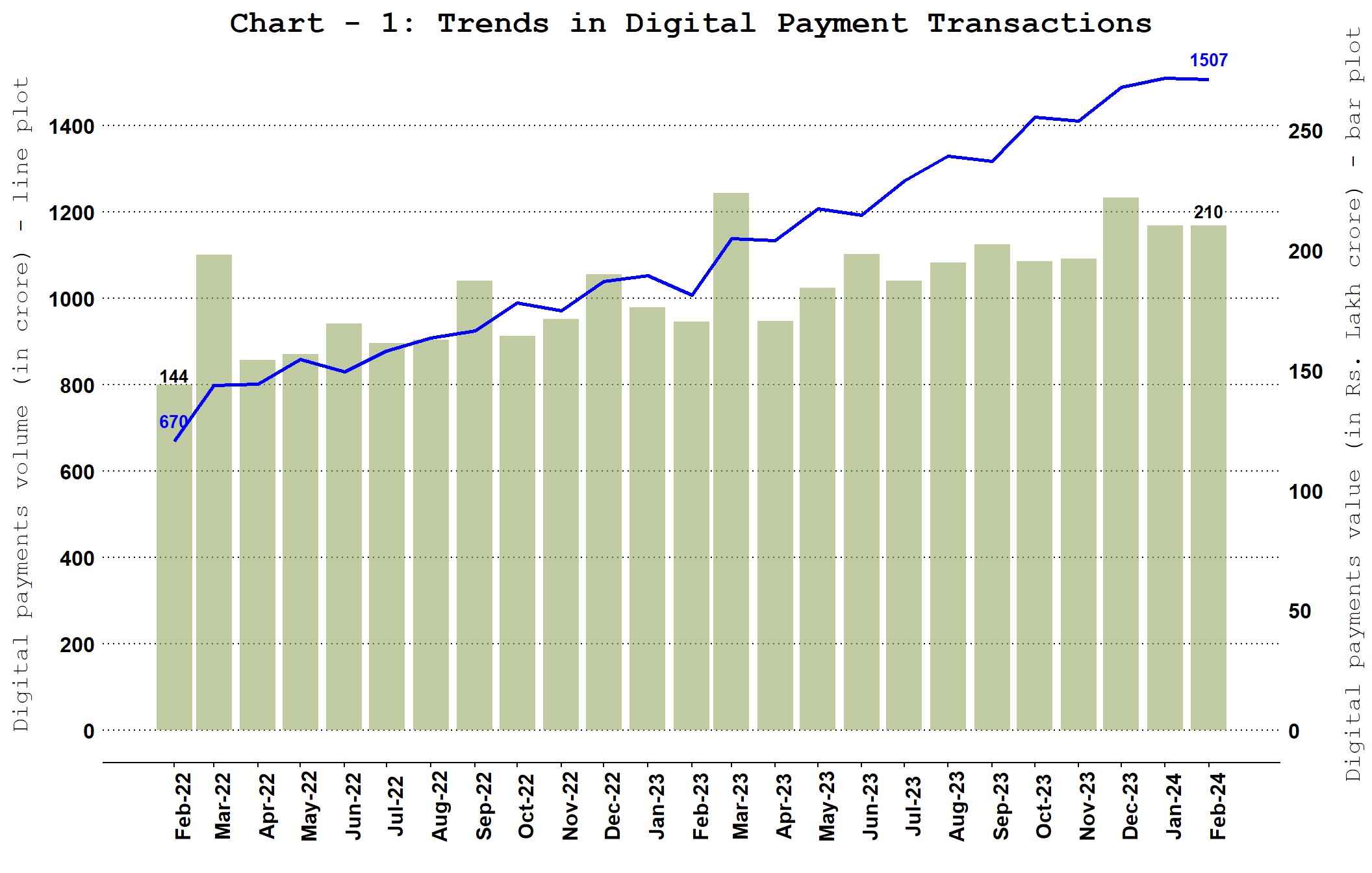

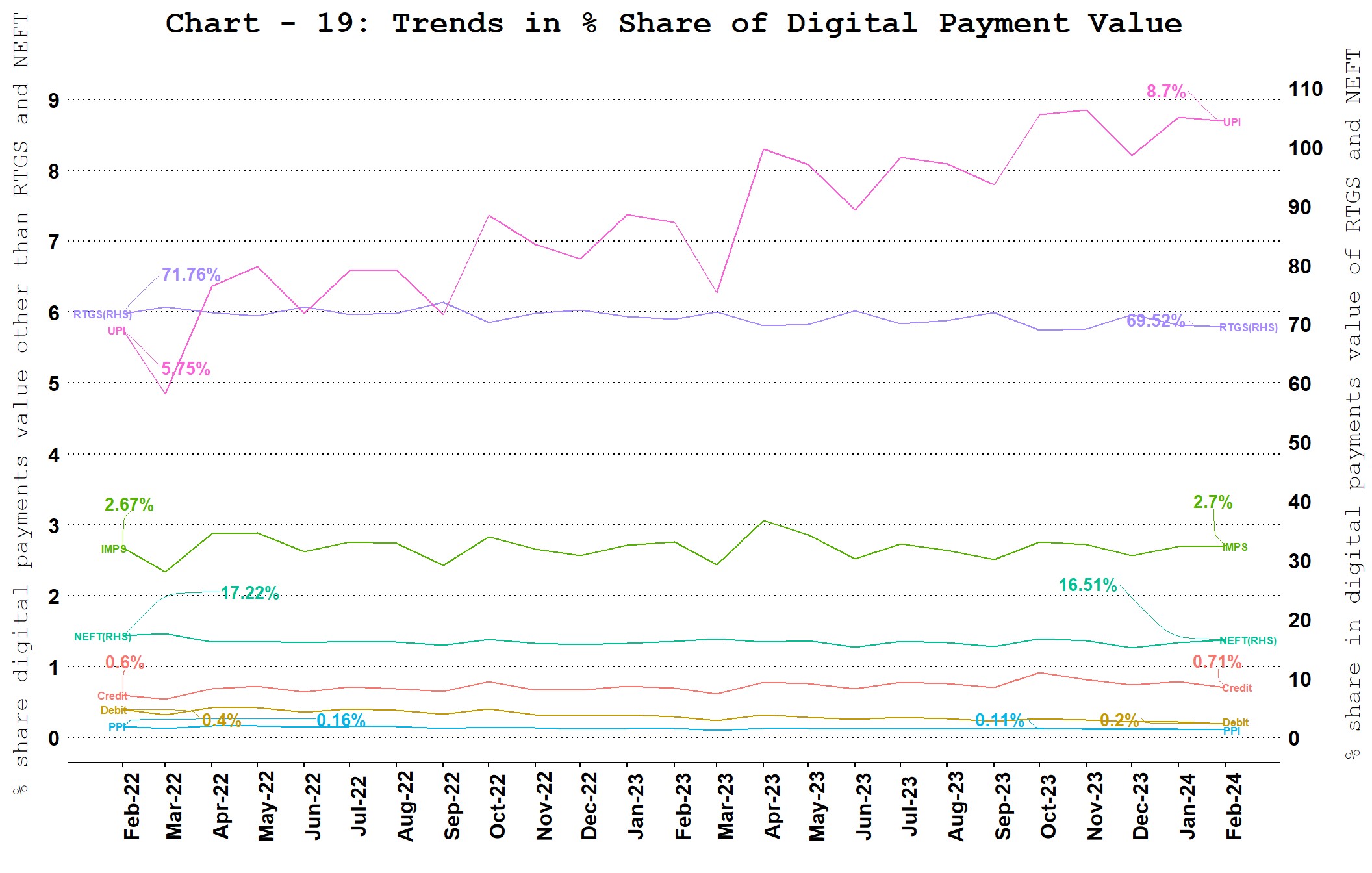

Note: Digital payments include RTGS (customer and inter-bank transactions), retail electronic clearing – NEFT, IMPS, NACH (credit, debit and APBS), card payment transactions (excl. cash withdrawal), PPI payment transactions (excl. cash withdrawal), UPI (including BHIM & USSD), BHIM Aadhaar Pay, AePS fund transfer and NETC (linked to bank accounts).

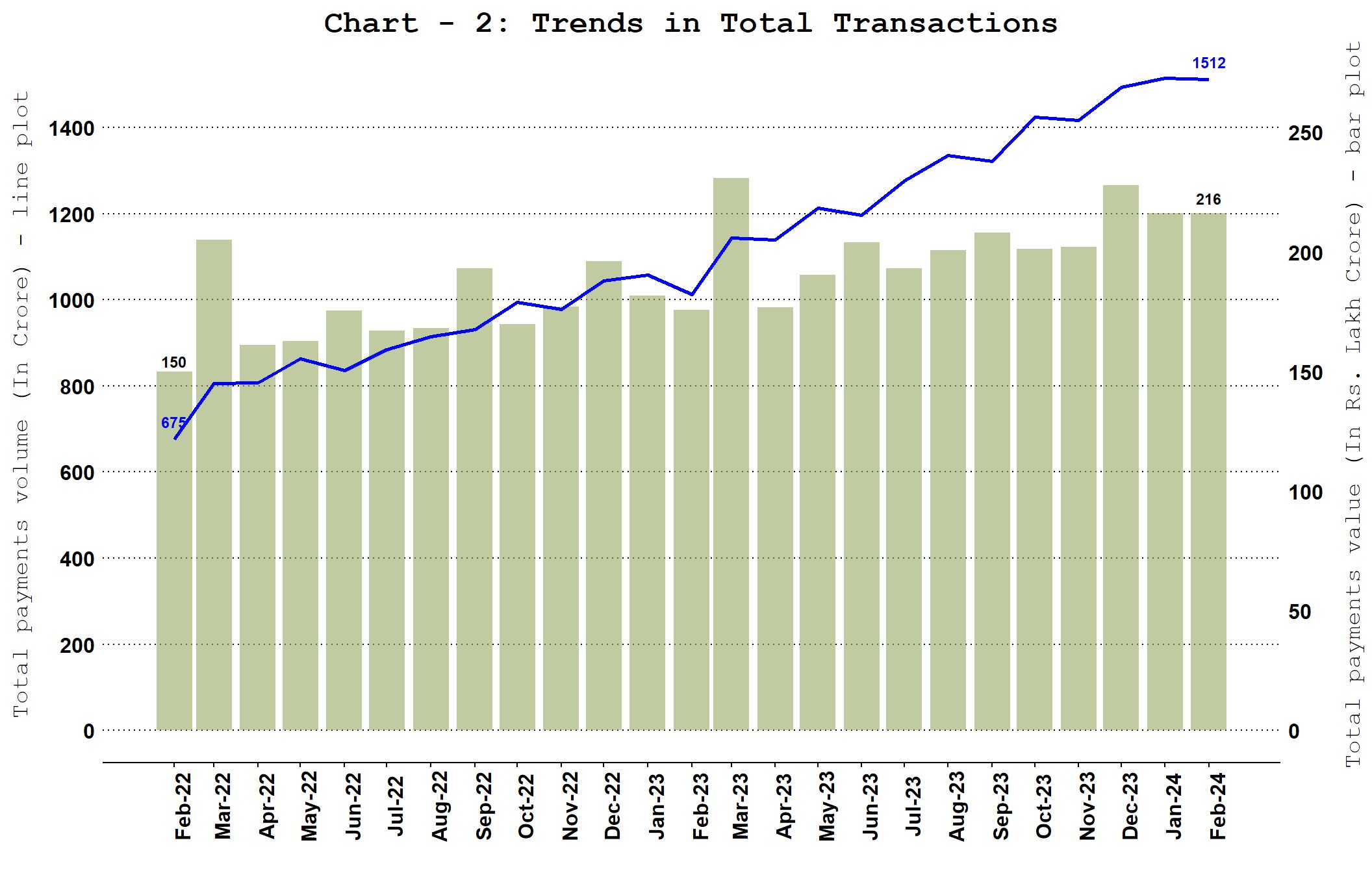

Note: Total payments include RTGS, NEFT, IMPS, NACH (credit, debit and APBS), card payment transactions (excl. cash withdrawal), PPI payment transactions (excl. cash withdrawal), UPI (including BHIM & USSD), BHIM Aadhaar Pay, AePS fund transfer, NETC (linked to bank accounts) and paper clearing.

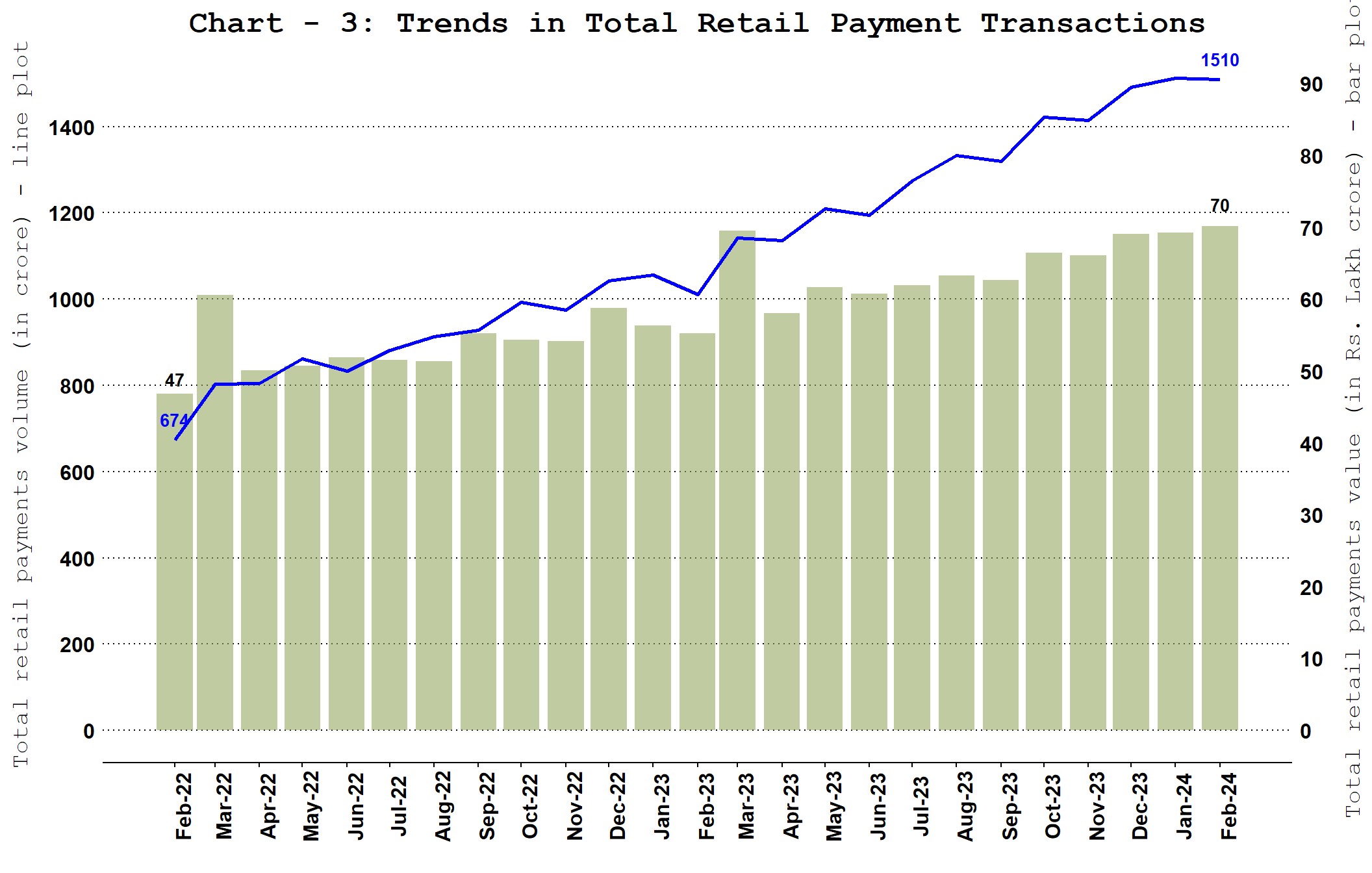

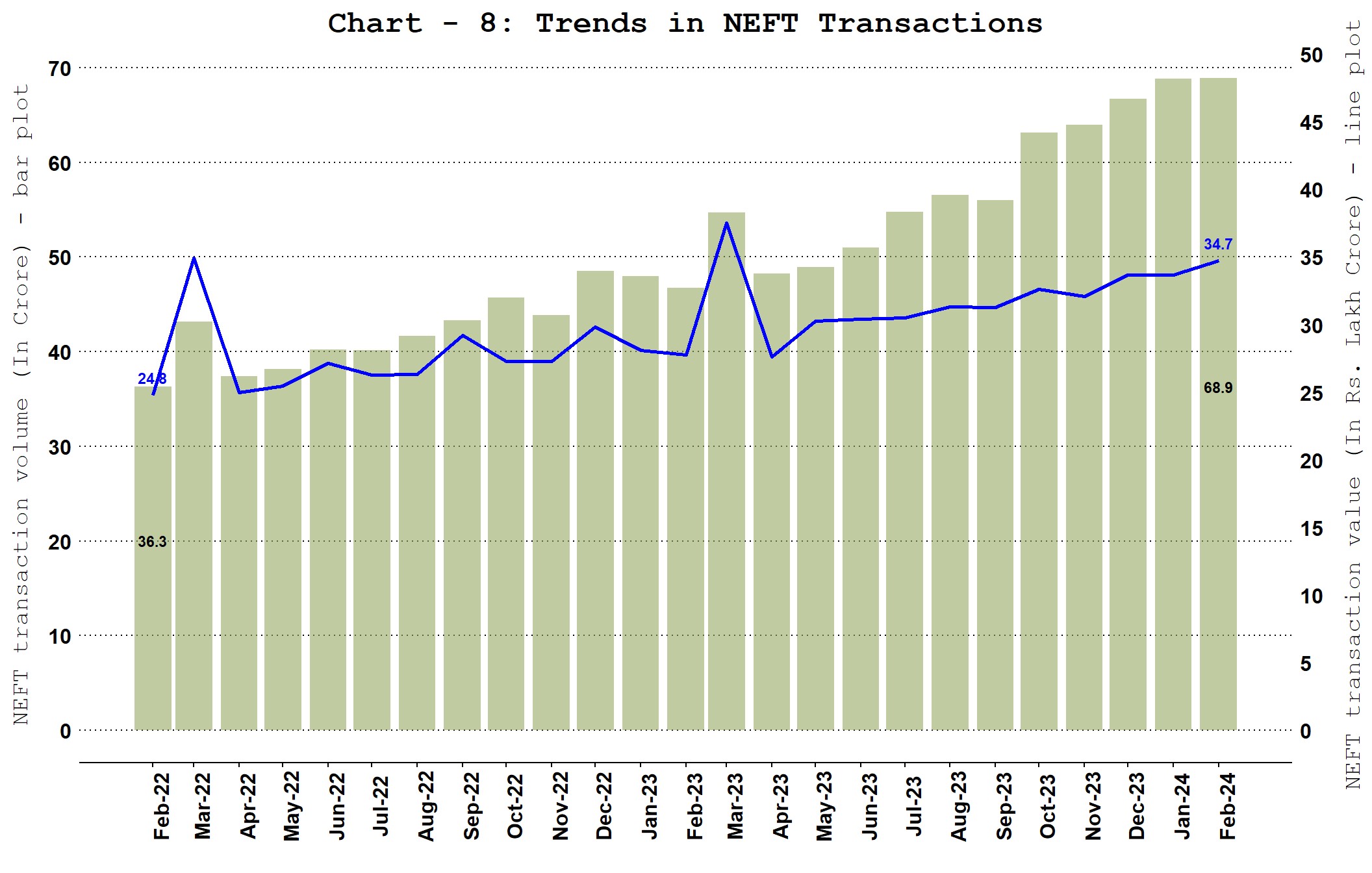

Note: Total retail payments include NEFT, IMPS, NACH (credit, debit and APBS), card payment transactions (excl. cash withdrawal), PPI payment transactions (excl. cash withdrawal), UPI (including BHIM & USSD), BHIM Aadhaar Pay, AePS fund transfer, NETC (linked to bank accounts) and paper clearing.

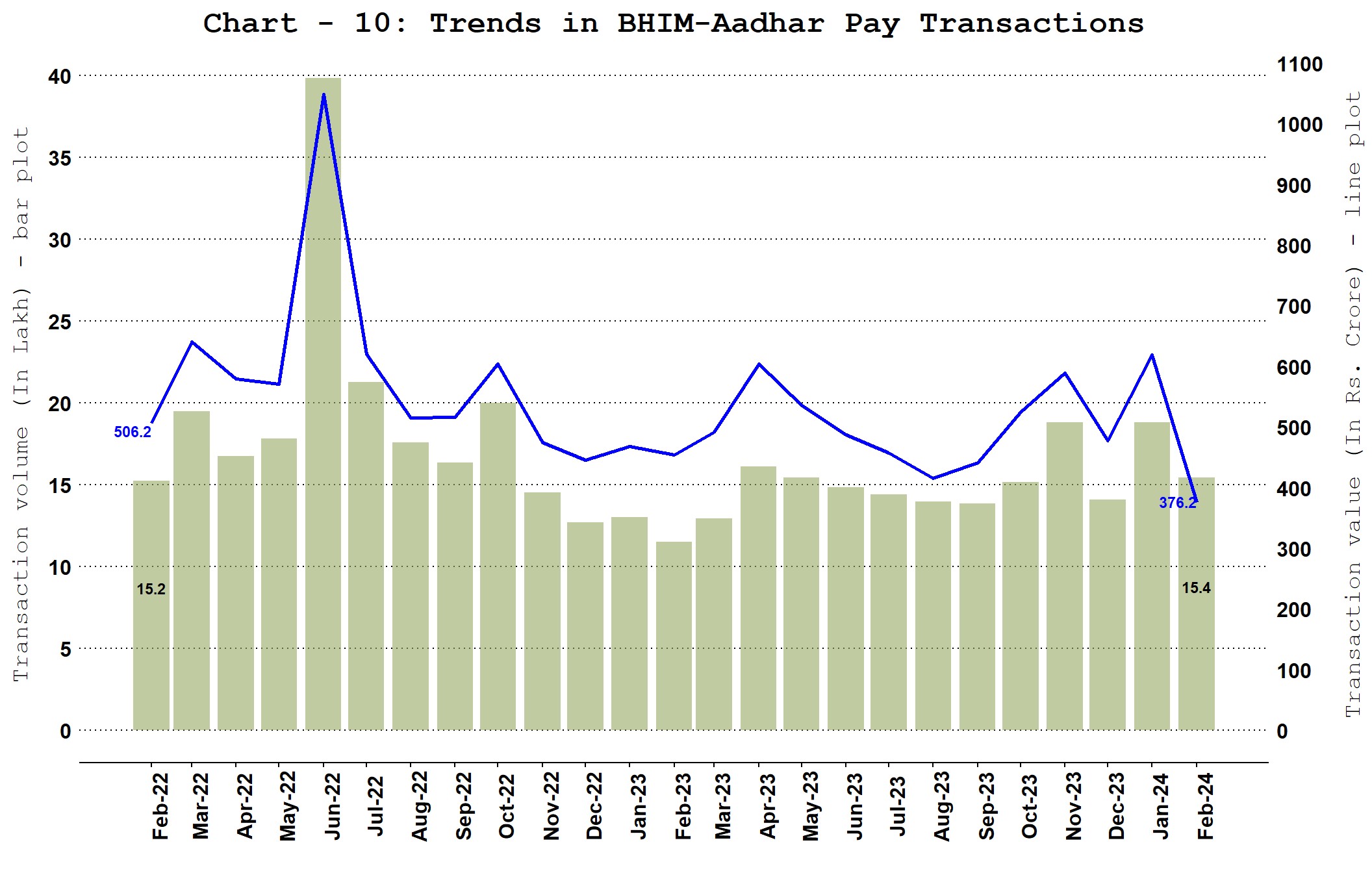

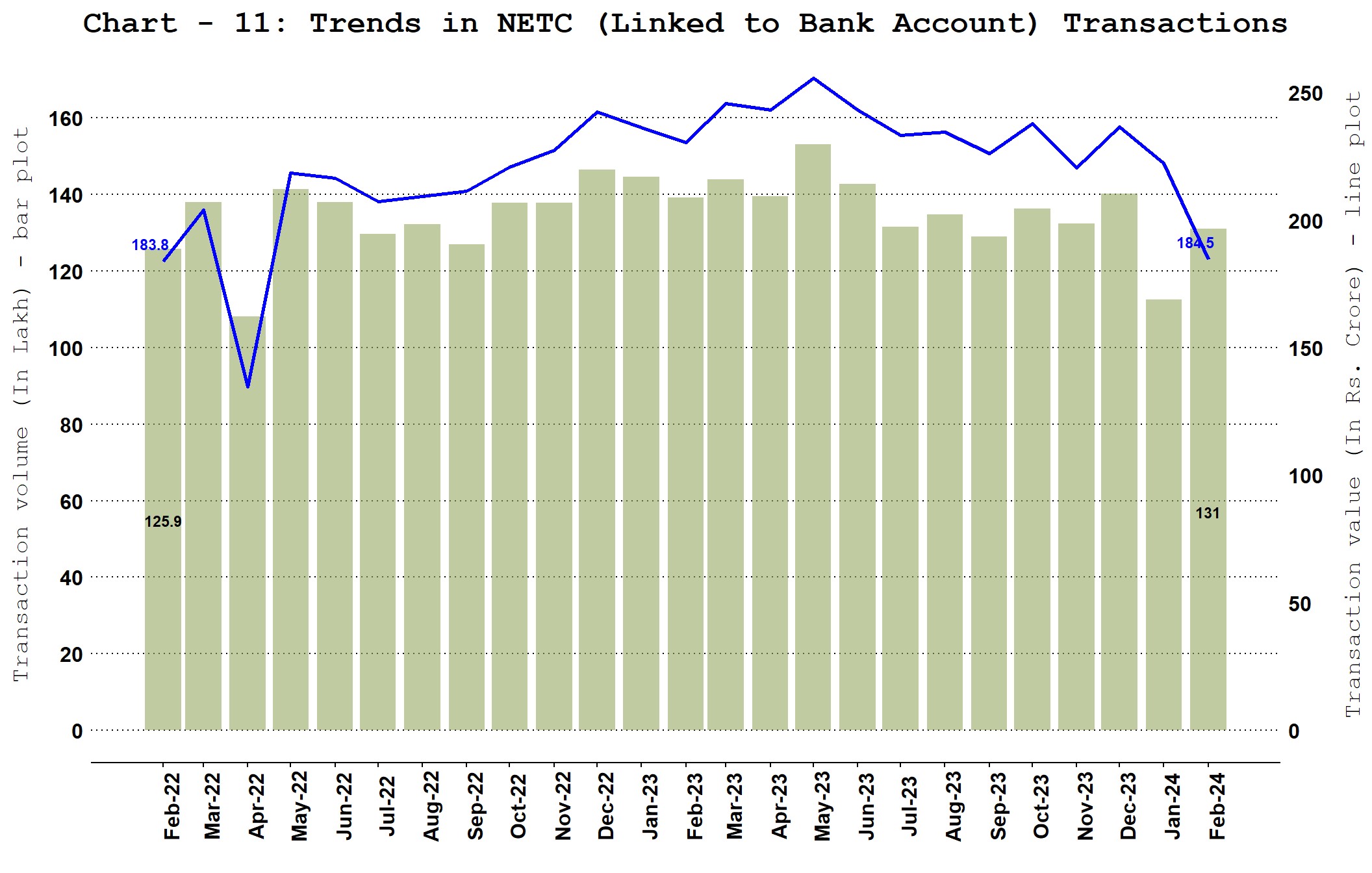

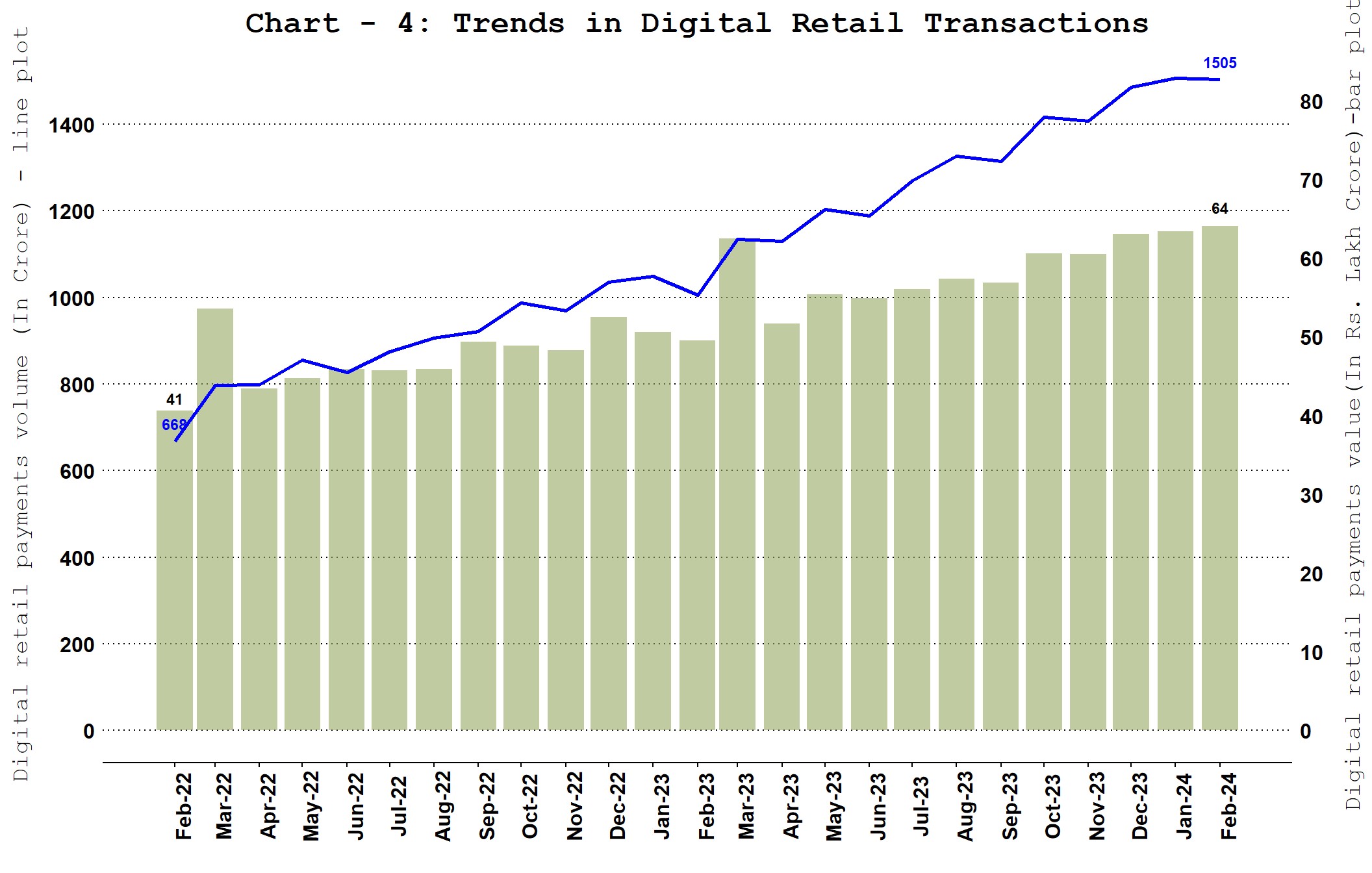

Note: Digital retail payments include NEFT, IMPS, NACH (credit, debit and APBS), card payment transactions (excl. cash withdrawal), PPI payment transactions (excl. cash withdrawal), UPI (including BHIM & USSD), BHIM Aadhaar Pay, AePS fund transfer and NETC (linked to bank accounts).

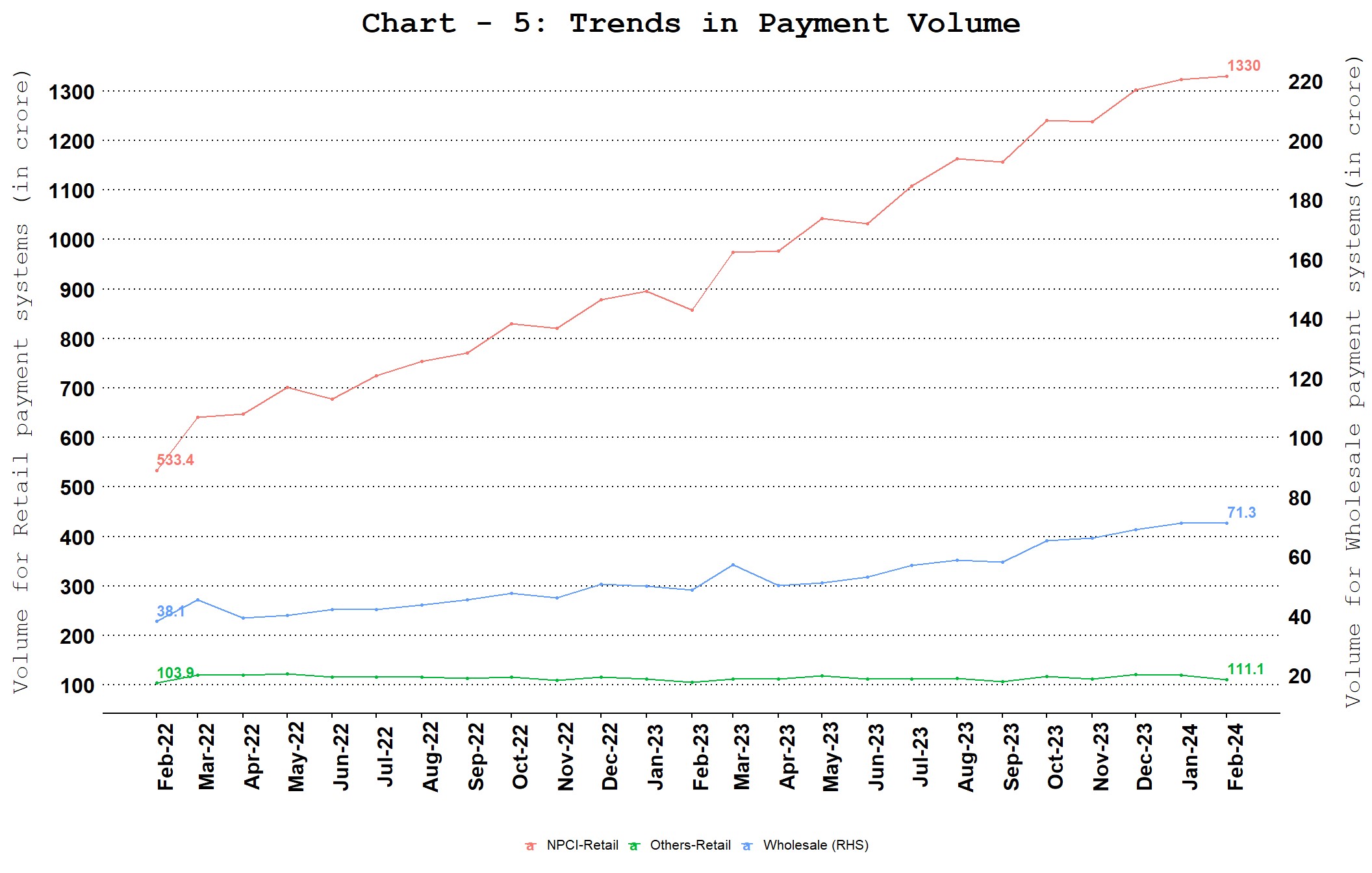

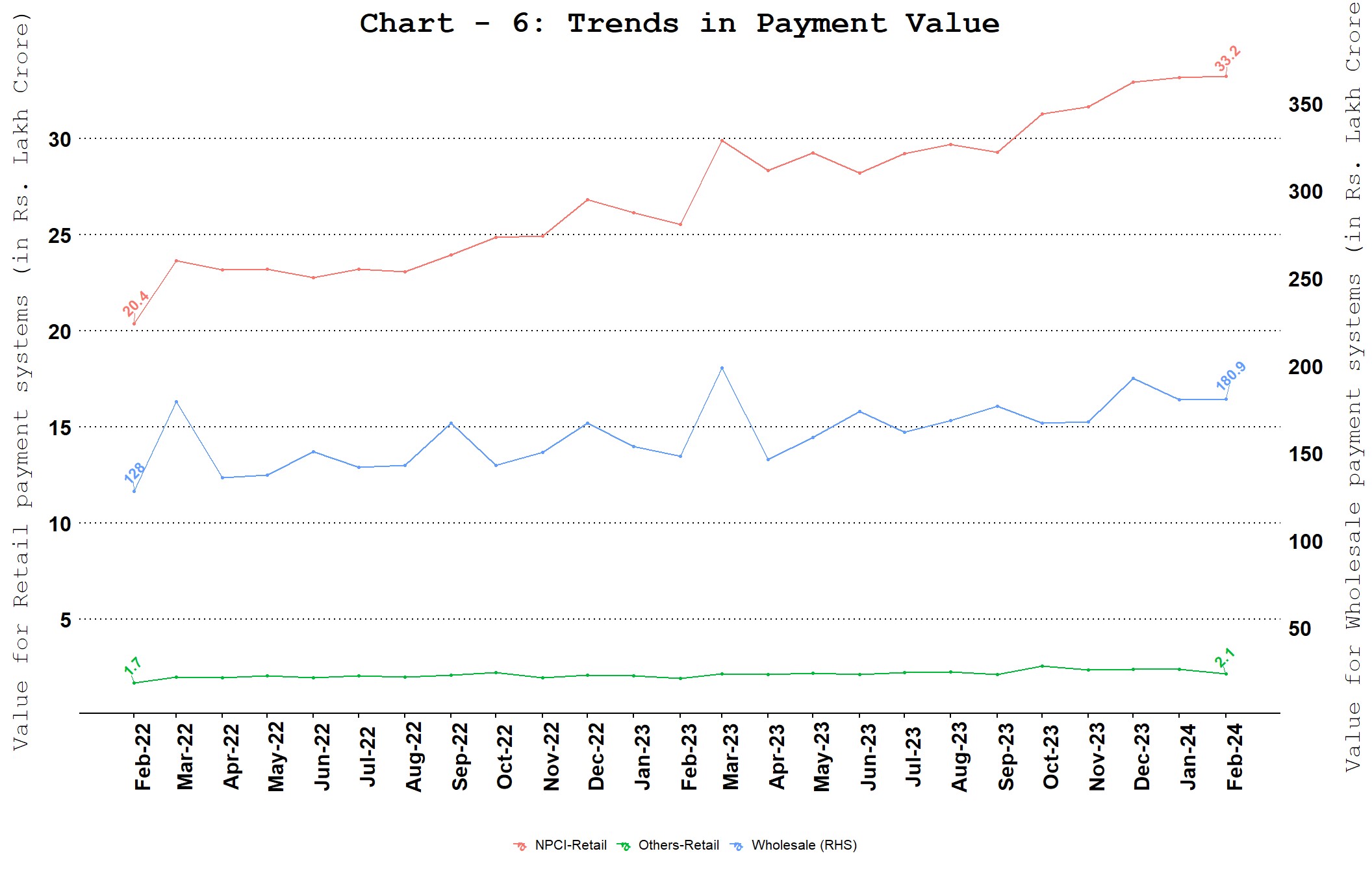

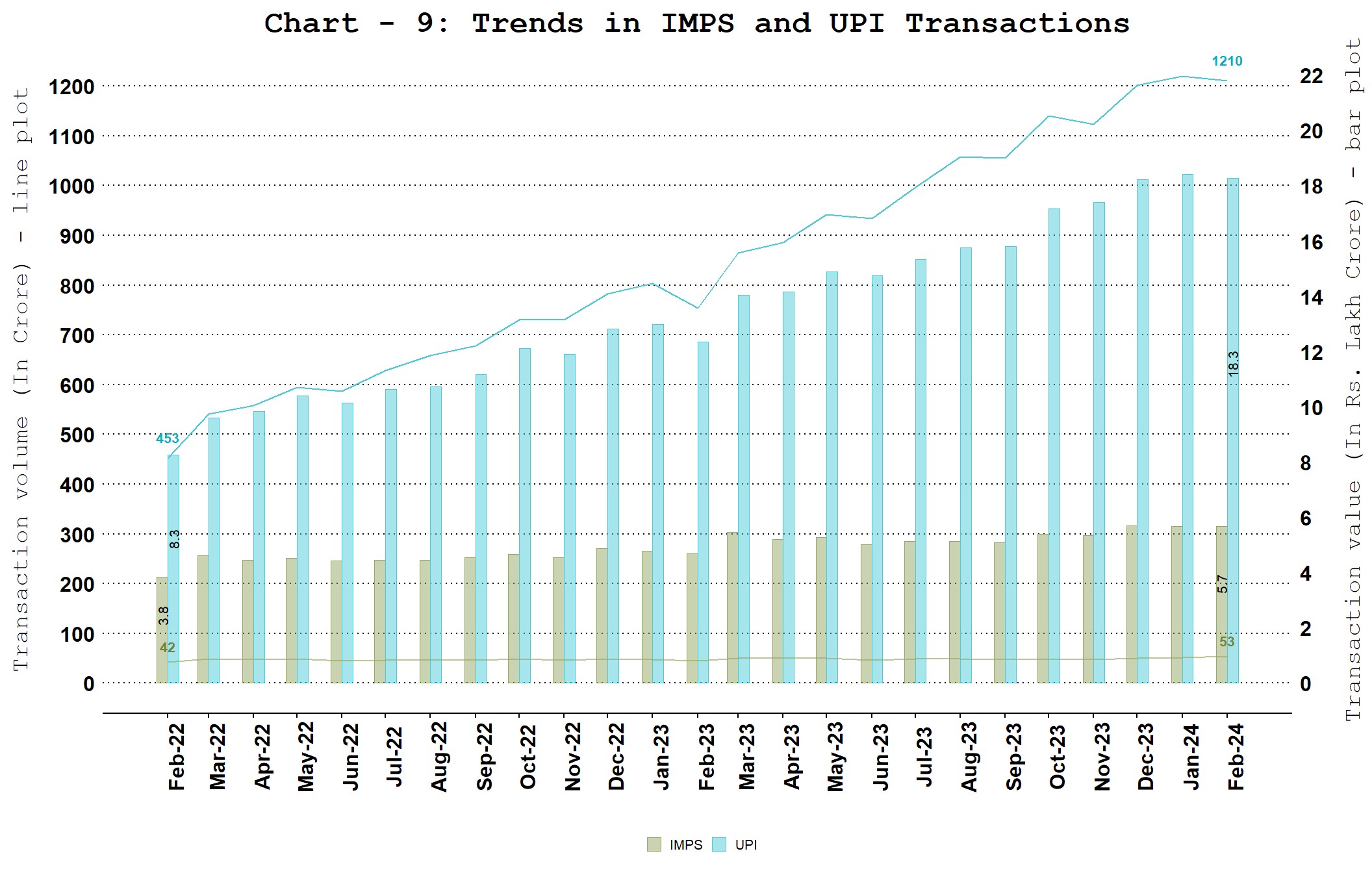

Note: Wholesale payment systems include RTGS (customer and inter-bank transactions) and NEFT. NPCI-retail payment systems include IMPS, NACH, UPI (including BHIM & USSD), BHIM Aadhaar Pay, AePS fund transfer, NETC (linked to bank account) and paper clearing. Other-retail payment systems include debit and credit card payment transactions (excl. cash withdrawal) and wallet and PPI card payment transactions (excl. cash withdrawal).

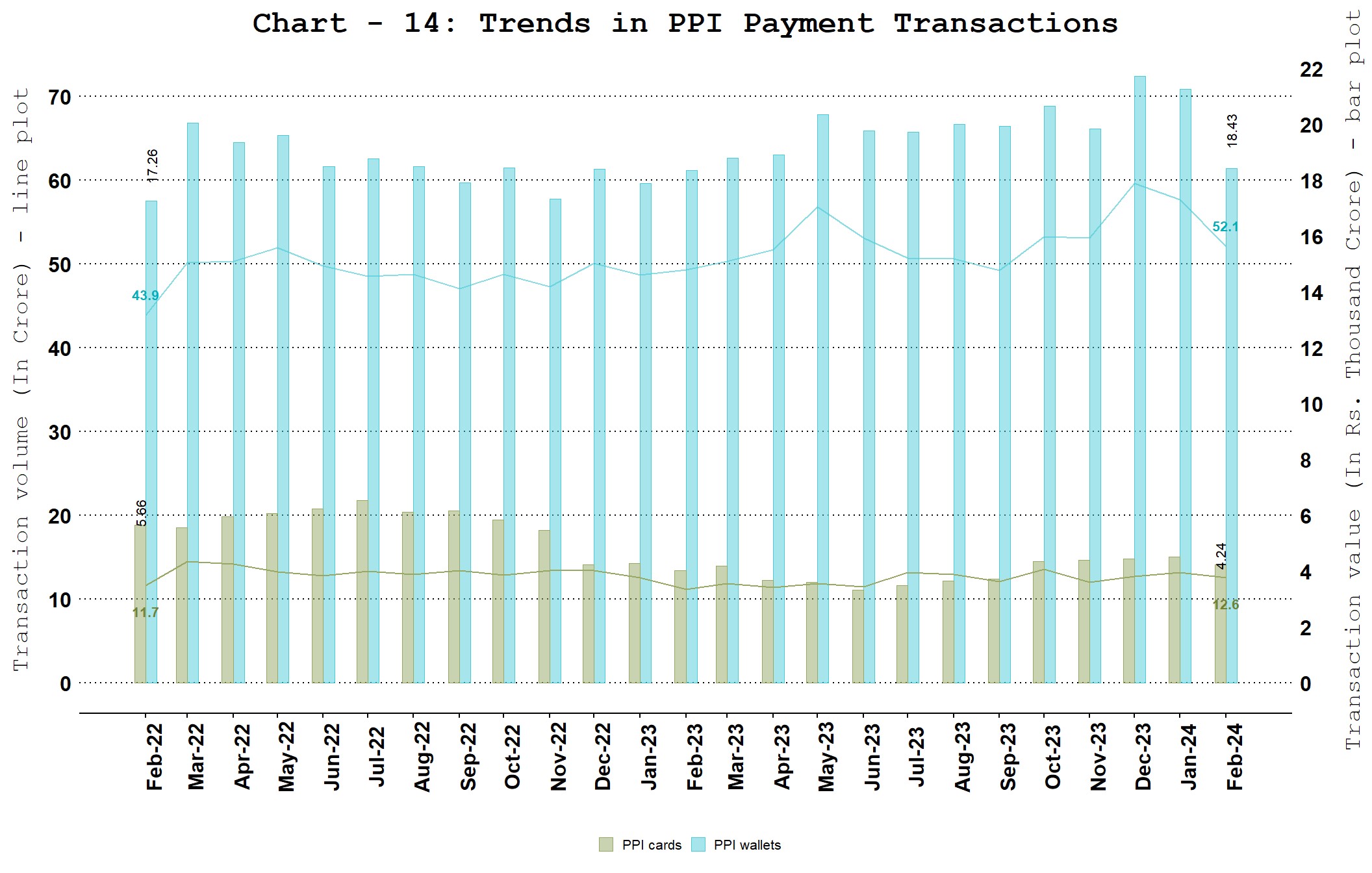

Note: PPIs include wallet and PPI card payment transactions (excl. cash withdrawal).

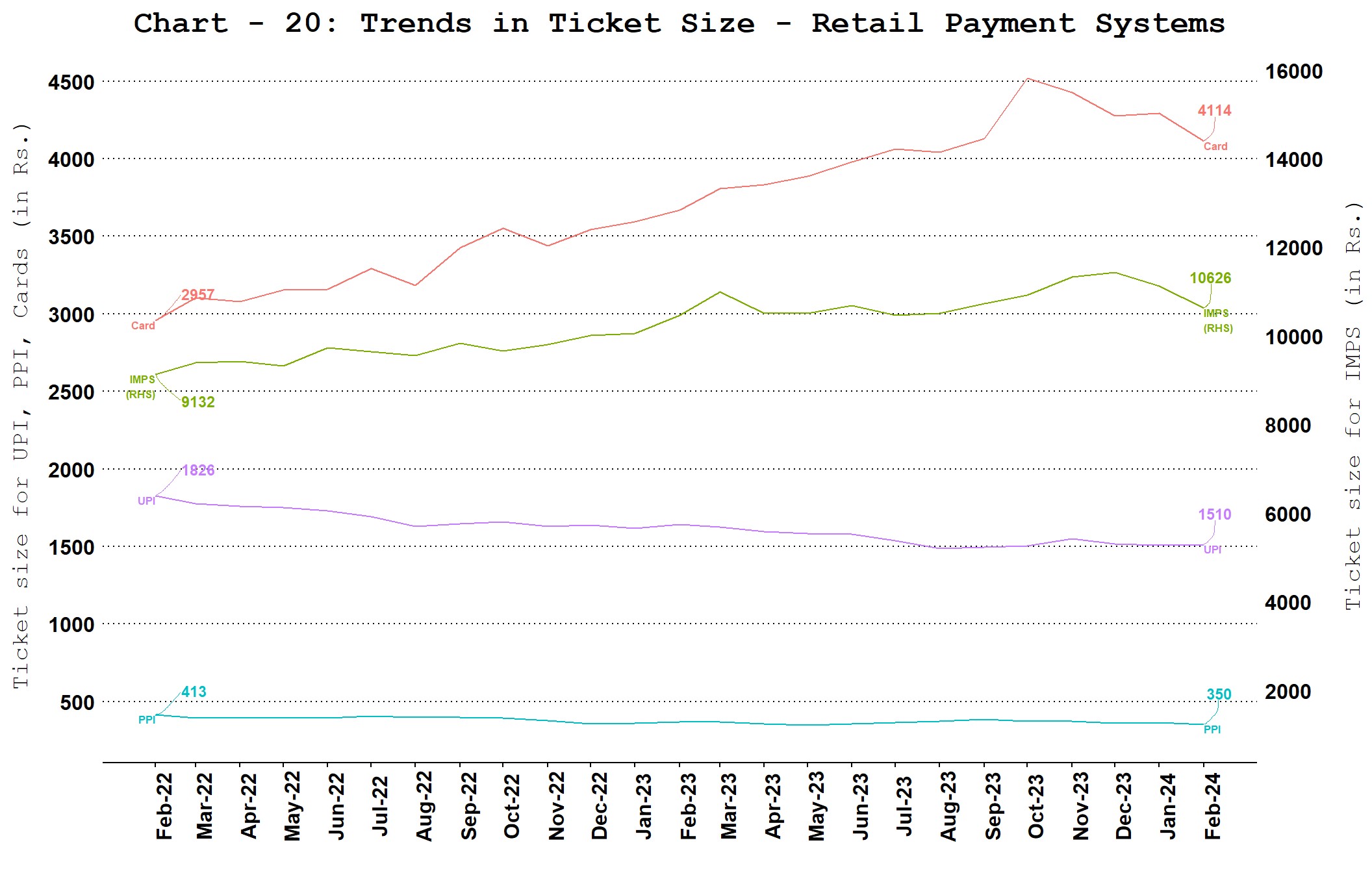

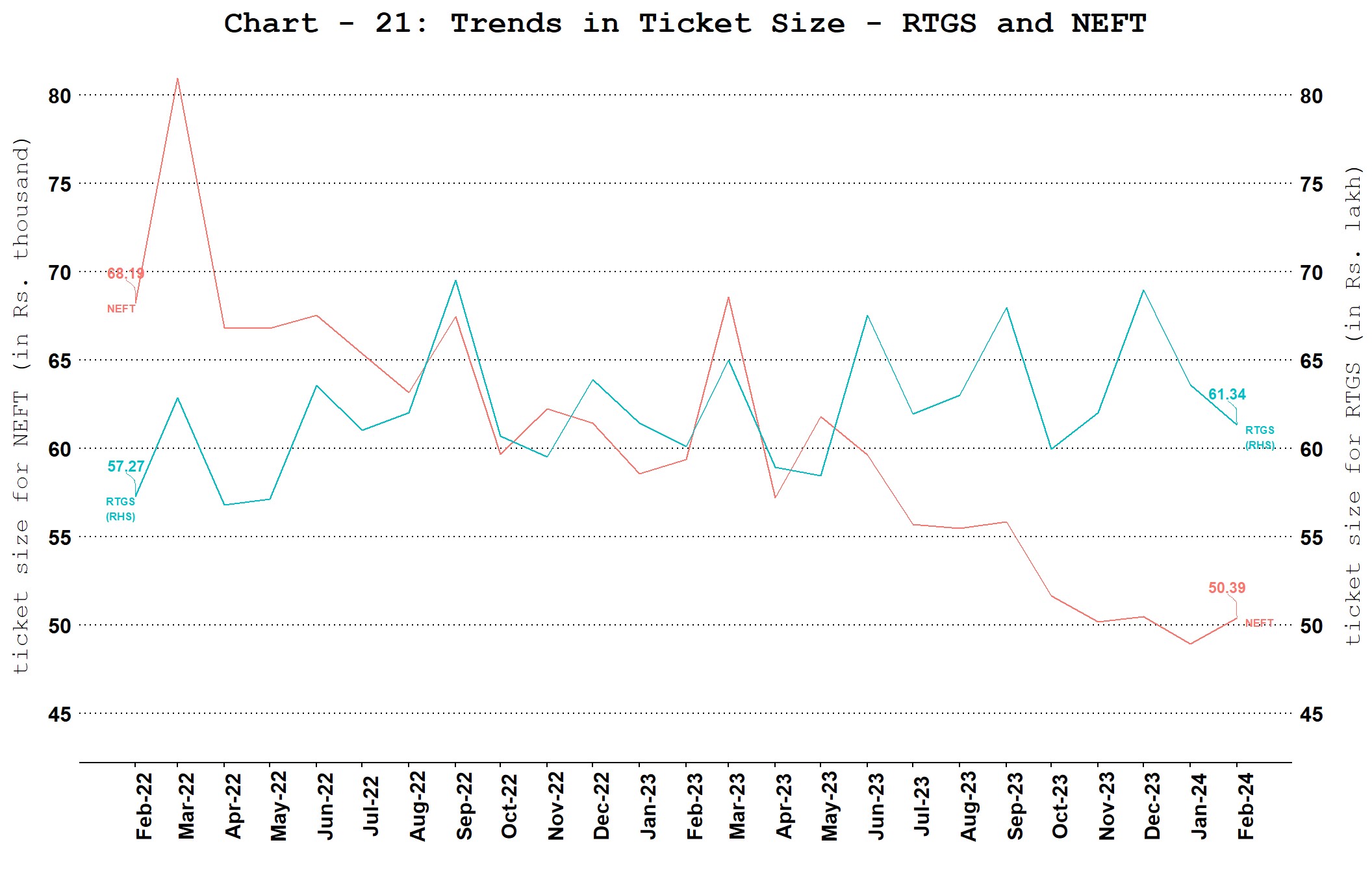

Note: Ticket size (Average Value Per Transaction) is calculated by dividing the transaction value of a payment system for a given period by its transaction volume during the same period

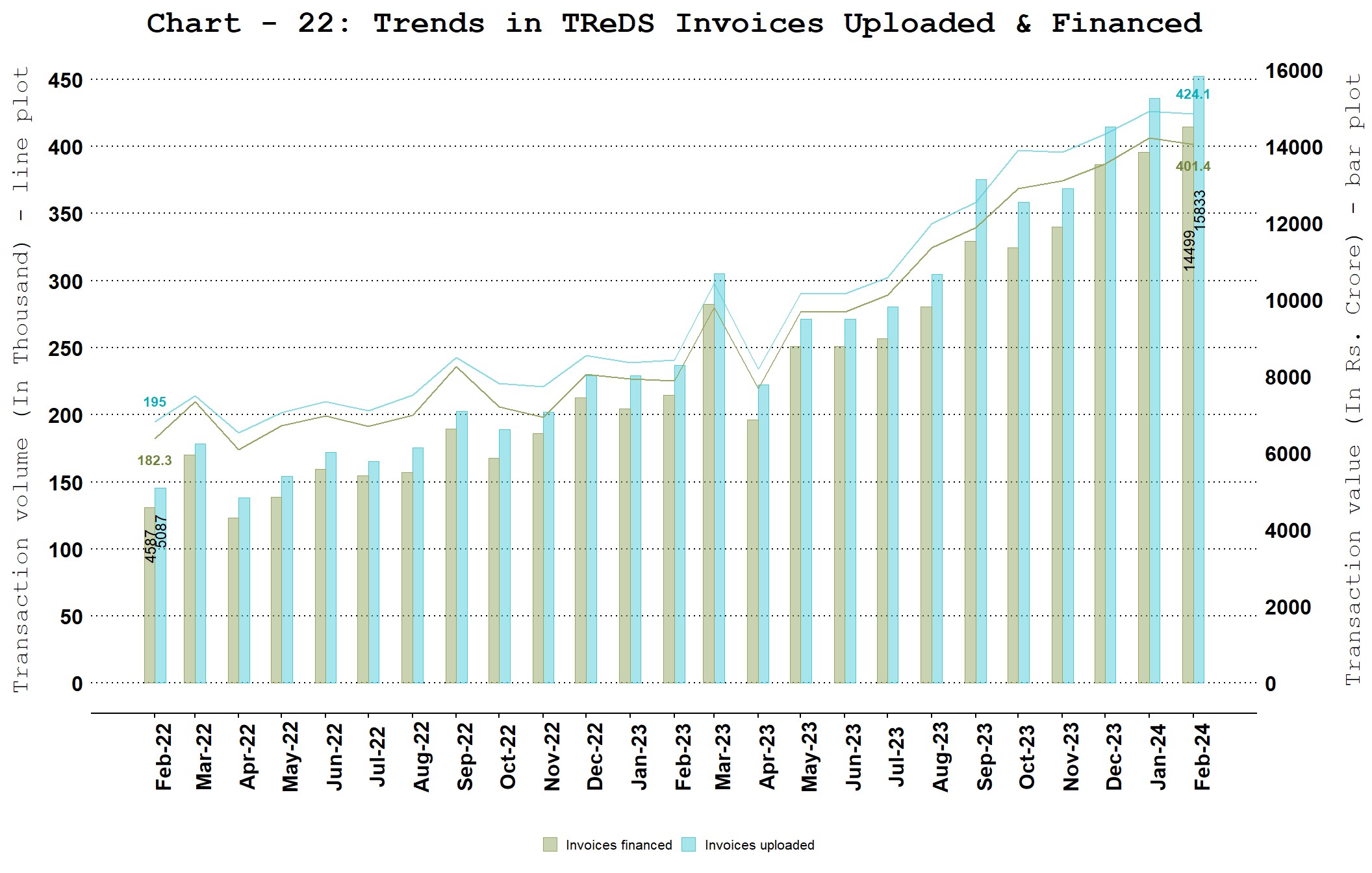

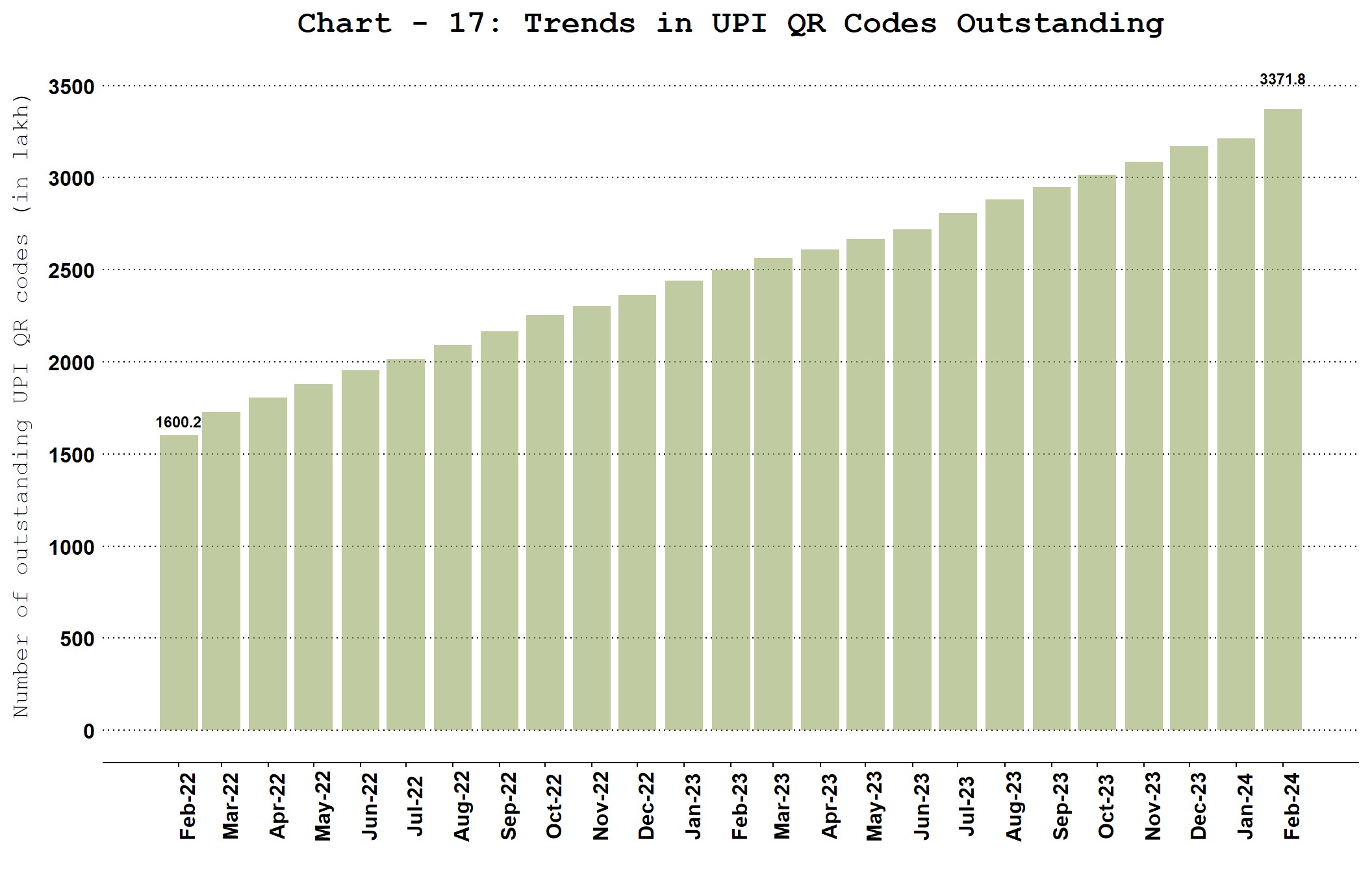

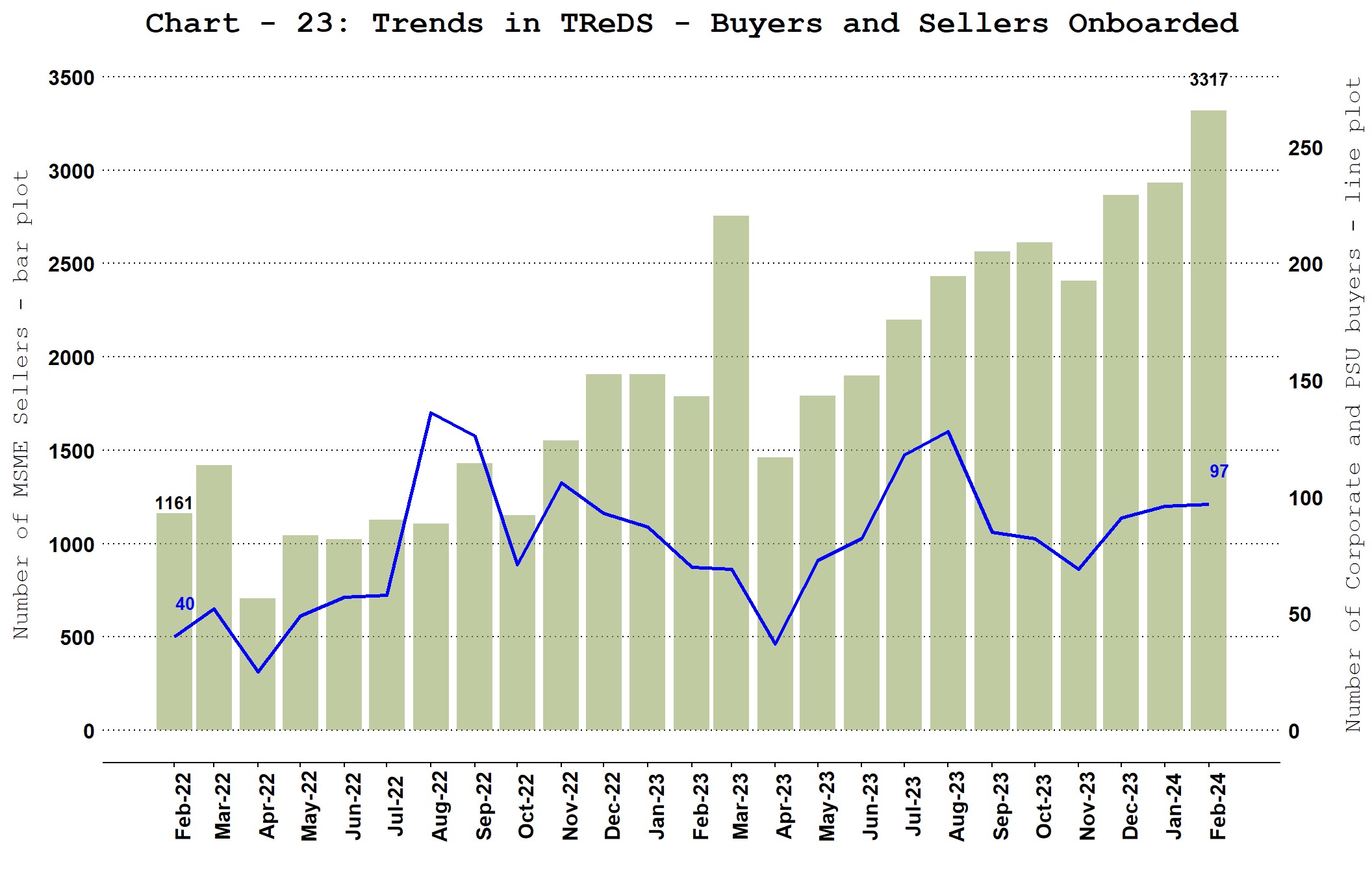

Note: Number of Buyers and Sellers are figures as onboarded during month

|

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: