IST,

IST,

Monthly Payment System Indicators - March 2023

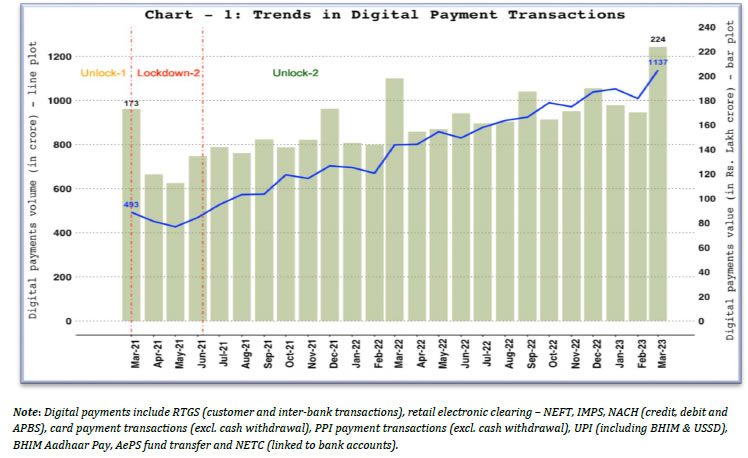

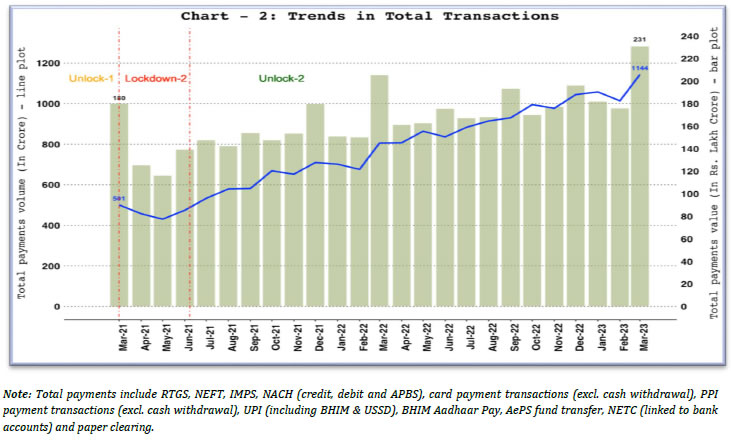

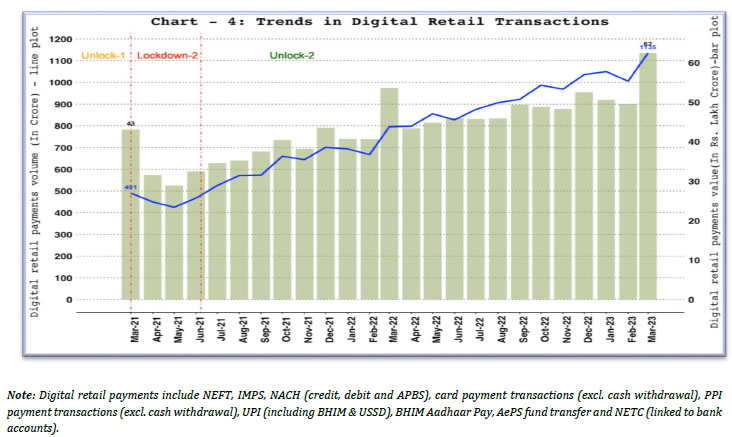

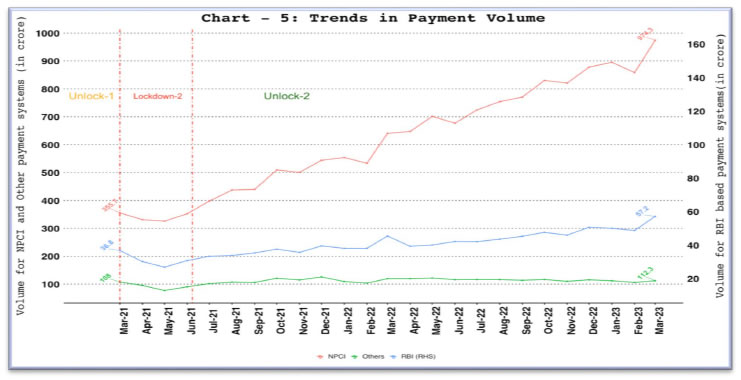

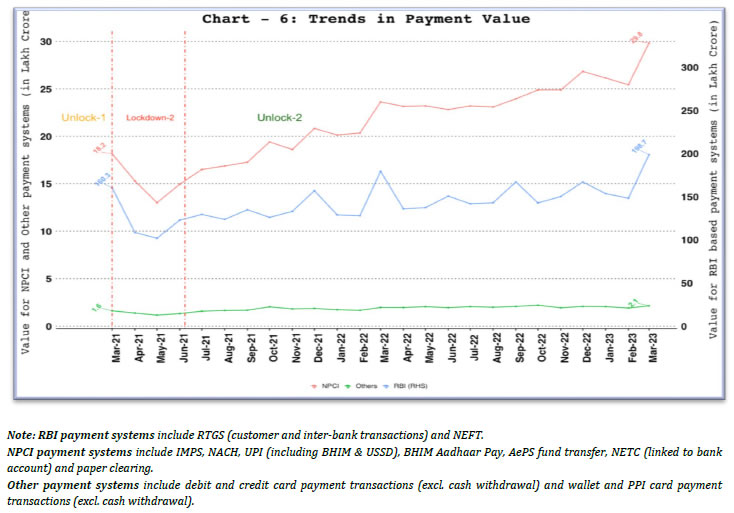

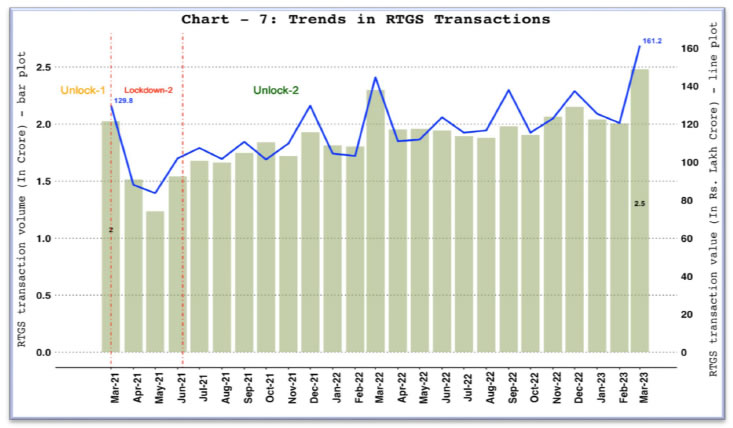

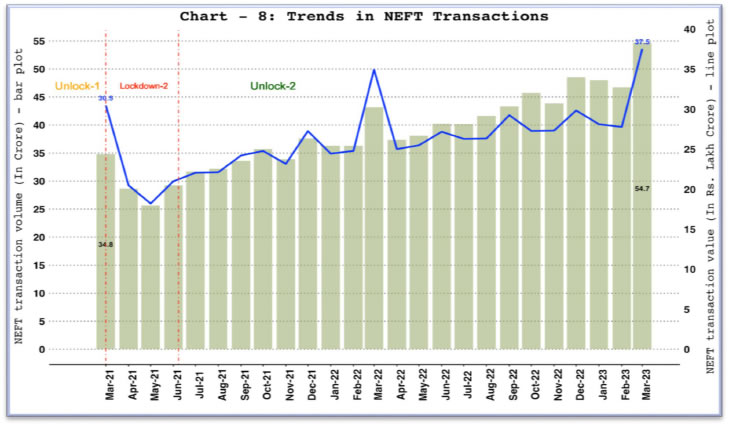

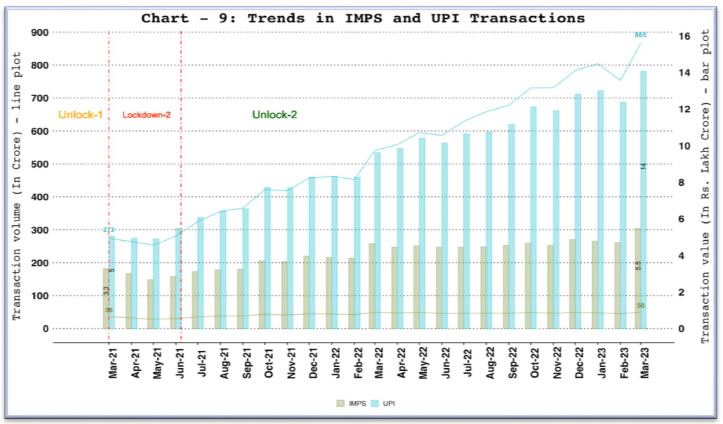

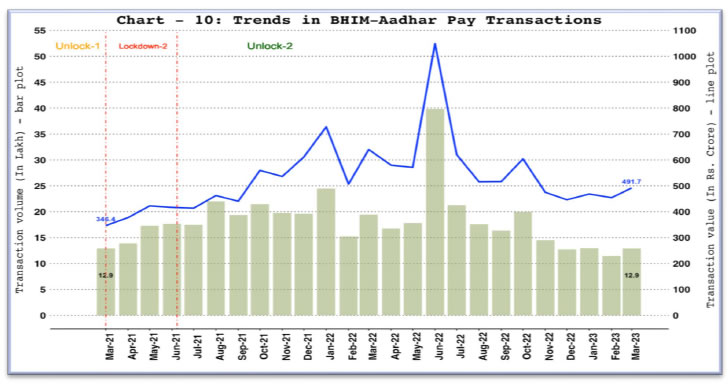

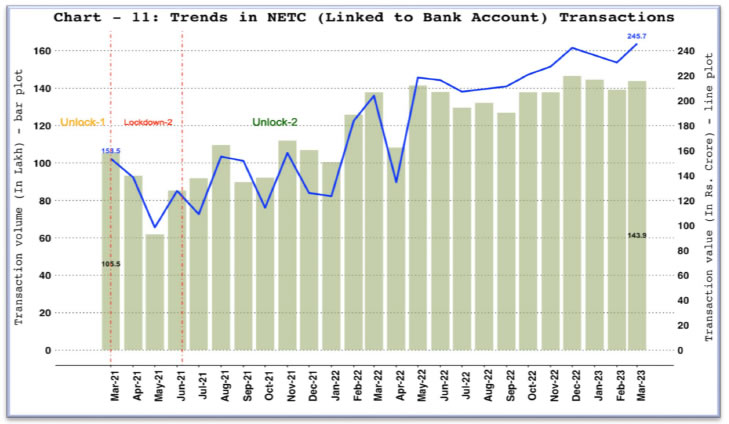

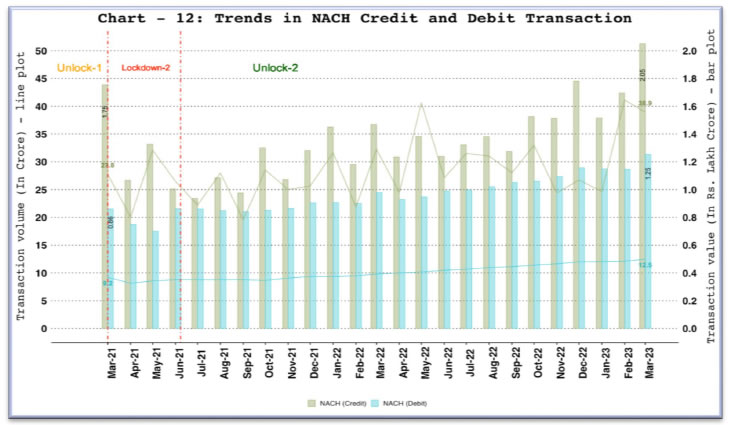

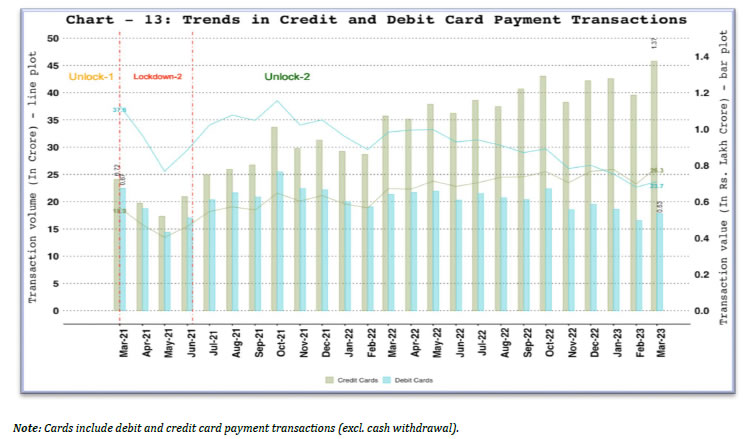

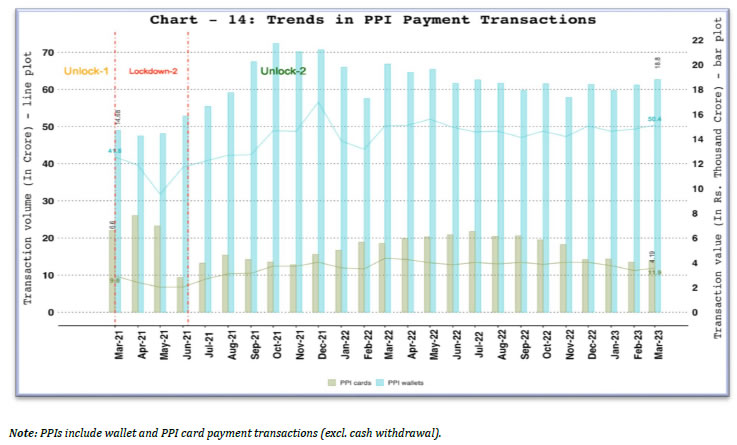

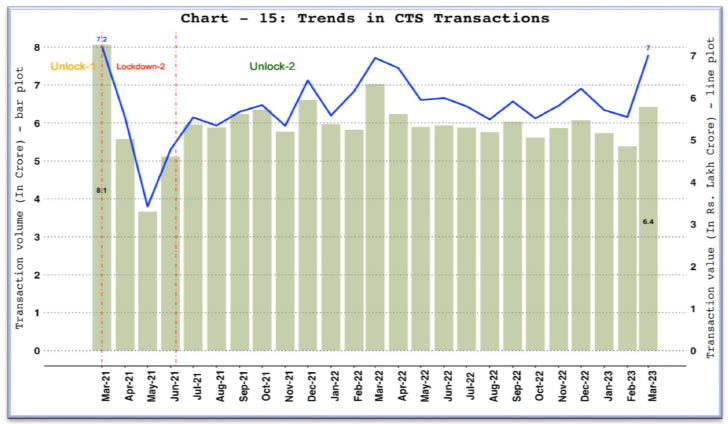

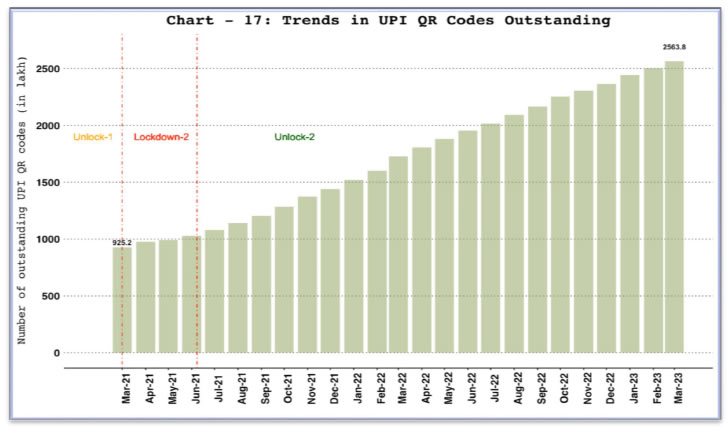

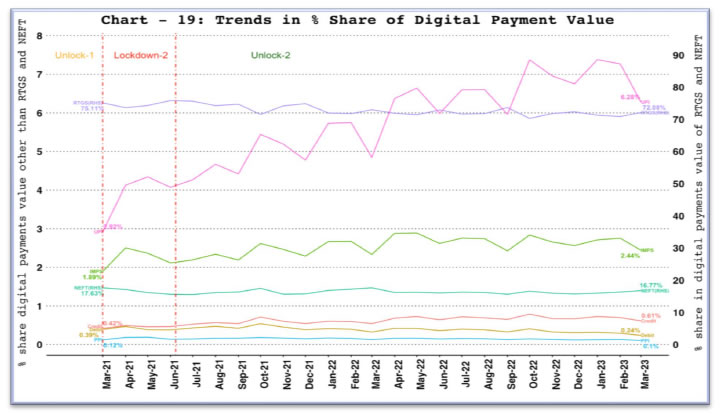

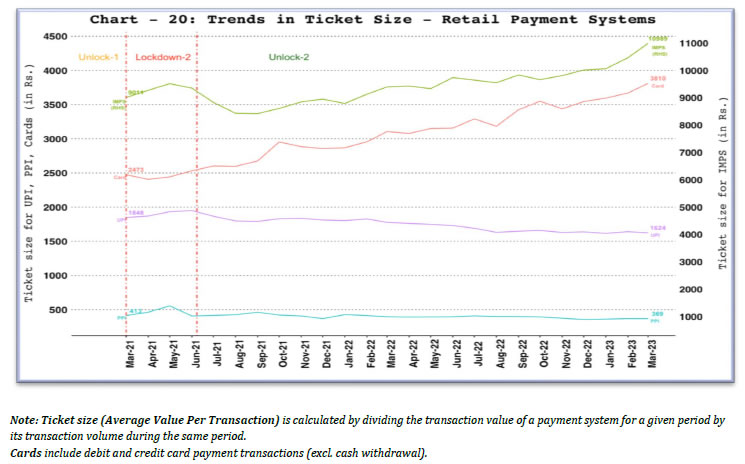

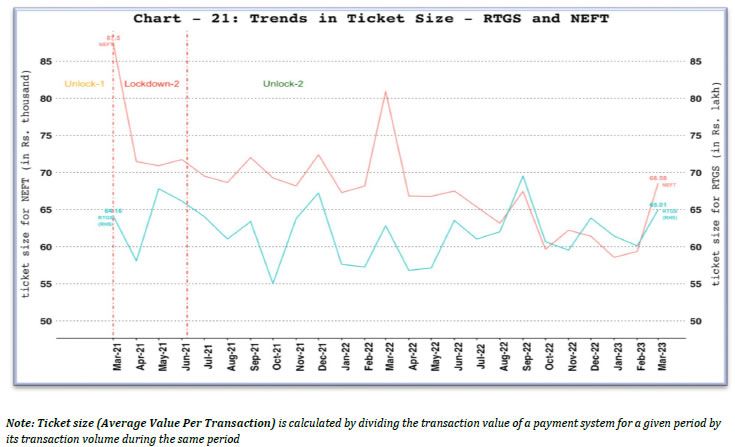

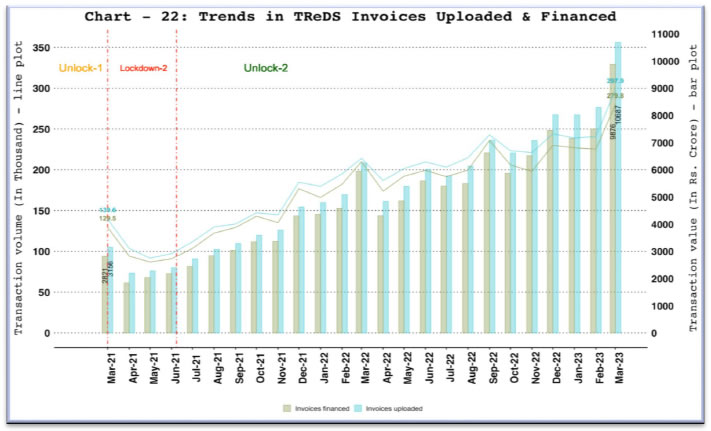

1. DIGITAL PAYMENTS – VOLUME AND VALUE  2. TOTAL PAYMENTS – VOLUME AND VALUE  3. TOTAL RETAIL PAYMENTS – VOLUME AND VALUE  4. DIGITAL RETAIL PAYMENTS – VOLUME AND VALUE  5. COMPARISON OF RBI, NPCI AND OTHER PAYMENT SYSTEMS A. COMPARISON OF PAYMENTS VOLUME  B. COMPARISON OF PAYMENTS VALUE  6. RBI OPERATED PAYMENT SYSTEMS A. REAL TIME GROSS SETTLEMENT (RTGS)  B. NATIONAL ELECTRONIC FUNDS TRANSFER (NEFT)  7. NPCI OPERATED FAST PAYMENT SYSTEMS - UNIFIED PAYMENTS INTERFACE (UPI) AND IMMEDIATE PAYMENT SYSTEM (IMPS)  8. OTHER NPCI OPERATED PAYMENT SYSTEMS A. BHARAT INTERFACE FOR MONEY (BHIM) AADHAR PAY  B. NATIONAL ELECTRONIC TOLL COLLECTION (NETC) (LINKED TO BANK ACCOUNT)  C. NATIONAL AUTOMATED CLEARING HOUSE (NACH) - CREDIT AND DEBIT  9. CARDS AND PREPAID PAYMENT INSTRUMENTS (PPIS) A. DEBIT AND CREDIT CARDS  B. PPI WALLETS AND CARDS USAGE  10. PAPER OPERATED PAYMENT SYSTEM - CHEQUE TRUNCATION SYSTEM (CTS)  11. CARD ACCEPTANCE INFRASTRUCTURE AND QR CODES A. CARD ACCEPTANCE INFRASTRUCTURE  B. UPI QR CODES  12. PAYMENT SYSTEM WISE VOLUME AND VALUE SHARE A. DIGITAL PAYMENT VOLUME SHARE  B. DIGITAL PAYMENT VALUE SHARE  13. TICKET SIZE A. TICKET SIZE OF RETAIL PAYMENT SYSTEMS  B. TICKET SIZE OF NEFT AND RTGS PAYMENT SYSTEMS  14. TRADE RECEIVABLES DISCOUNTING SYSTEM (TREDS) A. TREDS - INVOICES UPLOADED AND FINANCED  B. TREDS - BUYERS AND SELLERS ONBOARDED  |

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: