IST,

IST,

Households’ Inflation Expectations Survey

|

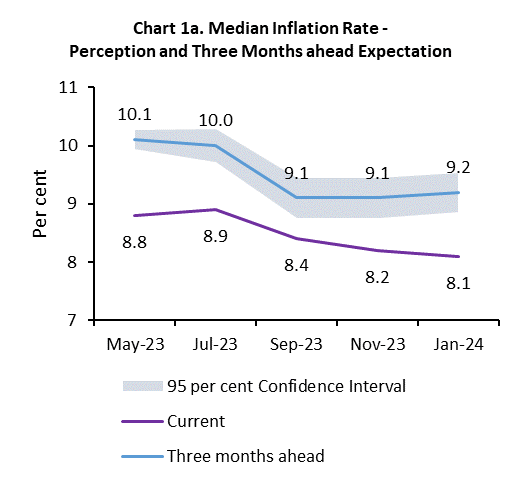

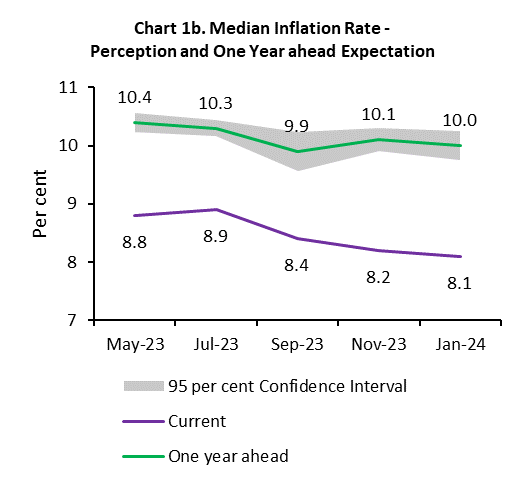

Today, the Reserve Bank released the results of January 2024 round of its bi-monthly inflation expectations survey of households (IESH)[1] 2. The survey was conducted during January 2-11, 2024 in 19 major cities, with responses from 6,062 urban households. Female respondents accounted for 52.3 per cent of this sample.

Highlights:

Note:Please see the excel file for time series data3

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ਪੇਜ ਅੰਤਿਮ ਅੱਪਡੇਟ ਦੀ ਤਾਰੀਖ: