IST,

IST,

Minutes of the Monetary Policy Committee Meeting, February 6 to 8, 2024 [Under Section 45ZL of the Reserve Bank of India Act, 1934]

|

The forty seventh meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during February 6 to 8, 2024. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (February 8, 2024) decided to:

Consequently, the standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

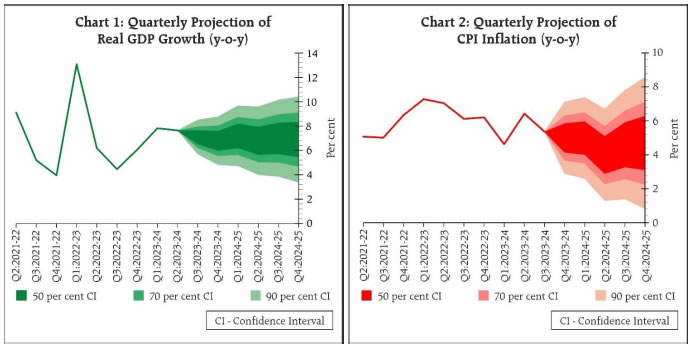

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. Assessment and Outlook 6. Global growth is likely to remain steady in 2024 after a surprisingly resilient performance in a turbulent year gone by. Inflation is edging down from multi-decade highs, with intermittent upticks. Financial market sentiments have been fluctuating with changing views about an early pivot by central banks in advanced economies (AEs). The likelihood of lower interest rates has spurred rallies in equity markets, although uncertainty about the timing of interest rate reduction is reflected in bidirectional movements in the US dollar and sovereign bond yields. Emerging market economies (EMEs) are facing currency fluctuations amidst volatile capital flows. 7. Domestic economic activity is strengthening. As per the first advance estimates (FAE) released by the National Statistical Office (NSO), real gross domestic product (GDP) is expected to grow by 7.3 per cent, year-on-year (y-o-y) in 2023-24, underpinned by strong investment activity. On the supply side, gross value added (GVA) expanded by 6.9 per cent in 2023-24, with manufacturing and services sectors as the key drivers. 8. Looking ahead, recovery in rabi sowing, sustained profitability in manufacturing and underlying resilience of services should support economic activity in 2024-25. Among the key drivers on demand side, household consumption is expected to improve, while prospects of fixed investment remain bright owing to upturn in the private capex cycle, improved business sentiments, healthy balance sheets of banks and corporates; and government’s continued thrust on capital expenditure. Improving outlook for global trade and rising integration in global supply chain will support net external demand. Headwinds from geopolitical tensions, volatility in international financial markets and geoeconomic fragmentation, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 7.0 per cent with Q1 at 7.2 per cent; Q2 at 6.8 per cent; Q3 at 7.0 per cent; and Q4 at 6.9 per cent (Chart 1). The risks are evenly balanced. 9. From its October 2023 trough of 4.9 per cent, CPI inflation increased successively in the next two months to 5.7 per cent by December. Food inflation, primarily y-o-y vegetable price increases, drove the pick-up in headline inflation, even as deflation in fuel deepened. Core inflation (CPI inflation excluding food and fuel) softened to a four-year low of 3.8 per cent in December. 10. Going forward, the inflation trajectory would be shaped by the evolving food inflation outlook. Rabi sowing has surpassed last year’s level. The usual seasonal correction in vegetable prices is continuing, though unevenly. Yet considerable uncertainty prevails on the food price outlook from the possibility of adverse weather events. Effective supply side responses may keep food price pressures under check. The continuing pass-through of monetary policy actions and stance is keeping core inflation muted. Crude oil prices, however, remain volatile. Manufacturing firms covered in the Reserve Bank’s enterprise surveys expect some softening in the growth of input costs and selling prices in Q4:2023-24, while services and infrastructure firms expect higher input cost pressures and growth in selling prices. Taking into account these factors, CPI inflation is projected at 5.4 per cent for 2023-24 with Q4 at 5.0 per cent. Assuming a normal monsoon next year, CPI inflation for 2024-25 is projected at 4.5 per cent with Q1 at 5.0 per cent; Q2 at 4.0 per cent; Q3 at 4.6 per cent; and Q4 at 4.7 per cent (Chart 2). The risks are evenly balanced.  11. The MPC noted that domestic economic activity is holding up well and is expected to be backed by the momentum in investment demand, optimistic business sentiments and rising consumer confidence. On the inflation front, large and repetitive food price shocks are interrupting the pace of disinflation that is led by the moderation of core inflation. Geopolitical events and their impact on supply chains, and volatility in international financial markets and commodity prices are key sources of upside risks to inflation. The cumulative effect of policy repo rate increases is still working its way through the economy. The MPC will carefully monitor any signs of generalisation of food price pressures to non-food prices which can fritter away the gains in the easing of core inflation. As the path of disinflation needs to be sustained, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting. Monetary policy must continue to be actively disinflationary to ensure anchoring of inflation expectations and fuller transmission. The MPC will remain resolute in its commitment to aligning inflation to the target. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. 12. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to keep the policy repo rate unchanged at 6.50 per cent. Prof. Jayanth R. Varma voted to reduce the policy repo rate by 25 basis points. 13. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. Prof. Jayanth R. Varma voted for a change in stance to neutral. 14. The minutes of the MPC’s meeting will be published on February 22, 2024. 15. The next meeting of the MPC is scheduled during April 3 to 5, 2024. Voting on the Resolution to keep the policy repo rate unchanged at 6.50 per cent

Statement by Dr. Shashanka Bhide 16. The First Advance Estimates of GDP for FY 2023-24 released by the National Statistical Office placed year-on-year real GDP growth for FY 2023-24 at 7.3 per cent, exceeding the 7.2 per cent in the previous year. The implicit growth rate of GDP for the second half of 2023-24 at 7 per cent, is well above the projections in the December 2023 MPC meeting. There has been no slow down in growth in FY 2023-24 despite the adverse monsoon conditions affecting agriculture, weak external demand conditions, risks to the global supply chains due to the geopolitical conflicts and elevated policy interest rates during much of the financial year. Moderation in consumer level inflation rate, decline in commodity prices in the international markets impacting input costs for the domestic producers, and increased pace of government capex spending have offset the impact of adverse growth conditions. The recent broader high frequency indicators of economic activity such as non-food credit, PMIs for manufacturing and services, GST collections point to strong demand conditions. 17. While the growth experience has not been evenly shared across output sectors and across sources of demand, broader supportive economic and monetary policies have helped in sustaining the growth drivers. Going forward, revival of growth in consumption demand would be the key factor in sustaining the current growth momentum, which in turn would require improved employment and household income conditions. 18. In the short-term, the RBI’s sample surveys of urban households conducted during Jan 2-11, 2024 show that consumer confidence is improving on the back of consumer’s assessment of general economic situation and household employment, and high household income in comparison to the findings of the previous round of the survey. The consumer optimism is accompanied by caution as the survey indicates that the expectation of increase in overall spending - i.e., the percentage of respondents expecting increased spending - is yet to reach levels of pre-pandemic period. The gap is particularly substantial in the case of discretionary spending. 19. The enterprise surveys of RBI conducted during October-December 2023, point to rise in business optimism over a period from Q4: FY 2023-24 to Q2: FY 2024-25. However, the expectation of improved overall business conditions is across each of the three quarters in the case of services and infrastructure sectors, with manufacturing sector expected to improve significantly only in Q2: FY 2024-25. 20. The growth performance in FY 2023-24 provides a strong base for the prospects for the next financial year. The assessment by international agencies point to significant improvement in the global trade conditions in 2024 and the economic growth is expected to remain stable at the level of the previous year. The international commodity price pressures are expected to remain moderate. In the domestic economy, favourable rainfall during the monsoon would be crucial in achieving both benign inflation and growth scenarios. With a target for reduction in the fiscal deficit in place, the availability of funds to the private investment would be less constrained than otherwise. While each of these conditions would be subject to risks, sustained growth momentum that focuses on domestic sources of demand is also likely. 21. Taking into account the various factors, the real GDP growth for 2024-25 has now been projected at 7% with quarterly growth of 7.2%, 6.8%, 7% and 6.9% in Q1 to Q4, respectively. The forecast is based on a normal monsoon for the year, which would also support rural consumption demand. The RBI Survey of Professional Forecasters conducted in January 2024 provides a median forecast of real GDP growth of 6.5 per cent in 2024-25, revised upward from the forecast of 6.3% in November 2023 round of the survey. 22. The headline consumer price index, YOY basis, increased by 5.6% in November and 5.7% December 2023, following relatively lower rates in the previous two months. The higher inflation rate in November and December was due to food inflation at 8% and 8.7%, respectively. Fuel and light index declined during November and December, YOY basis, and the price index excluding food and fuel (core inflation) rose by 4.1% and 3.8%, respectively. Therefore, in the present conditions, deceleration in food inflation would be key to bringing down the headline inflation to the target on a sustained basis. 23. The elevated food price inflation in December was marked by double digit increase in the prices, on a YOY basis, of pulses, fruits, vegetables and spices; the cereals and products and sugar and confectionary price indices rose by more than 6%. Meat and fish, eggs, milk & products, oils & fats, non-alcoholic beverages, and prepared meals, snacks etc. registered price rise of below 6%. A number of food items, therefore, registered high levels of price rise in December. Going forward, in the short term, deceleration in food prices would require a favourable rabi harvest and an adequate supply response. 24. The Expectations Survey of urban households conducted by RBI during Jan 2-11 indicates decline in the current and one year ahead inflation but an increase in the 3-months ahead horizon, suggesting moderation in price pressures in the medium term. 25. RBI’s enterprise surveys conducted in October-December 2023 point to a mixed picture for price conditions across sectors. In the immediate short-term period of Q4, the survey reveals expectations of declining input cost pressures in manufacturing but rising pattern in services and infrastructure. Consistent with the cost perceptions, larger proportion of firms expect increased selling prices in Q4: 2023-24 and subsequent two quarters in services and infrastructure. 26. The Business Inflation Expectations Survey (BIES) conducted by the Indian Institute of Management, Ahmedabad, during December 2023, reports a significant increase in one-year ahead unit cost based expected inflation as compared to the findings of its survey in November 2023. The survey also reports an increase in the one-year ahead expected headline inflation rate to 4.96% in December 2023 from 4.73% in October 2023. Respondents to the survey were from companies mainly from the manufacturing sector.1 27. The RBI Survey of Professional Forecasters conducted in January 2024 provides estimated median forecast of headline inflation at 5.1% in Q4 2023-24 followed by 5.2%, 3.8%, and 4.9% in Q1 to Q3 2024-25, respectively. The projected CPI inflation rate for 2024-25 is 4.6%. 28. Taking into account the various factors, the CPI inflation rate for 2023-24 is projected at 5.4%, with Q4 at 5%. The CPI inflation rate for 2024-25 is projected at 4.5% with quarterly projections of 5%, 4%, 4.6% and 4.7% for Q1 to Q4, respectively. 29. The present growth and inflation scenarios are nearly the same as we saw them in December: surprisingly strong growth momentum despite the several adverse conditions with prominent uneven patterns across sectors and sources of demand. The uncertainty over global economic conditions due to geopolitical conflicts and weather conditions has also persisted. As far as GDP growth is concerned, the baseline projections for 2024-25, are now revised upward compared to the projections in December. The inflation forecast for the first three quarters of 2024-25 is marginally lower than in the December projections but above 4.5% in Q3 and Q4. 30. Given the implications of current elevated levels of food inflation to the overall inflation pressures, and the prevailing strong overall growth, there is a need to remain focussed on achieving the inflation target in a sustained way. As we had observed in the December 2023 meeting, the transmission of increases in policy rates effected up to February 2023 is still incomplete. Therefore, it is critically important at this juncture to continue with the present policy rates so that the moderation in inflation rate to the target is achieved in a sustained manner. 31. Therefore, I vote:

Statement by Dr. Ashima Goyal 32. Geopolitical risks continue but neither have oil prices risen as much as feared nor has global growth slowed as much as expected. As inflation approaches their target, advanced economy (AE) central banks (CBs) have announced rate cuts in 2024 as they recognize a further rise in real interest rates as inflation falls would be an over-correction and nuanced actions are required for a soft landing. Some emerging market CBs have already cut rates. 33. Indian growth has also exceeded expectations, demonstrating resilience to global shocks. But many high frequency indicators softened in November and December. Even so, imports continue to grow in volume terms and there is no slowing in credit growth. That capacity utilization has not risen despite good growth suggests private investment is taking place. 34. Inflation has also come in below predictions and core inflation continues to soften, again indicating that output remains below capacity. Reforms and structural changes are reducing costs. Profit margins have risen although corporates are preferring volume over price growth. Corporate results show real sales growth continued to outpace nominal growth in Q3. FMCG majors are cutting prices because of local competitors. Oil majors also have room to cut prices. Current perceptions and long-term household inflation expectations have softened. There seems to be overall acceptance that inflation is moving towards the target. This should anchor core inflation around 4%. Faster than expected fiscal consolidation and a continuing better composition of government expenditure, will also lower inflationary pressures. 35. Since growth is still robust and recent headline inflation has been near the upper tolerance band, we can wait a bit longer to ensure that inflation continues movement to the target despite any geopolitics related or other commodity price shocks. The experience of the past year suggests commodity price shocks may now be short-lived and may not raise inflation persistently. Then it would not be necessary to keep rates high just because supply shocks are expected in the future. But we can wait to test this for some more time. So, I vote for status quo on rates though headline inflation FY25 projections of 4.5% gives room to cut. The rise in headline inflation towards 5% expected later in the year is due to base effects and an expected rise in food prices, but the latter are highly uncertain. I also agree to the stance interpreted in terms of policy rates still being disinflationary and vote for status quo on the stance. 36. Further supply-side improvements that could reduce shocks are necessary. Better integrated markets in AEs prevent the kind of food price shocks we have to face. Modern supply chains should use our geographical diversity as well as imports to prevent sharp fluctuations in key vegetable prices. 37. The daily weighted average call rate (WACR) has often exceeded the repo rate in the past few months. Just as the tightening cycle started by withdrawing liquidity to ensure the repo rate would rise above the reverse repo, now after 6 months of tight banking liquidity, and as expected real rates rise, measures to ensure the WACR largely stays at the repo rate are required. These would also bring down short rates and are part of the natural development of the liquidity adjustment framework that supports inflation targeting. 38. Even if the WACR exceeding the repo was due to unprecedented and extended large government cash balances, the toolkit to counter these and the many other shocks to which liquidity in India is subject to, can be expanded and activated. Part of surplus Government cash balances are already considered for VRR auctions, cash management itself can be improved and government borrowing staggered. Moving to the just in time mode would save interest costs. Money market timings can be extended and market microstructure developed to enable banks to lend to each other. 39. Banks are the only conduit of liquidity to the rest of financial system and they tend to hoard liquidity if it is tight. Since nonbank financial intermediaries do not have access to a lender of last resort and penalties for credit default are now high they also tend to hold excess liquidity. As a result large swathes of the credit system do not get serviced. 40. Work on resilience2 suggests CBs should act to reduce risk premiums anywhere in the financial system. An effective example of this is in the Indian foreign exchange (FX) market where rupee volatility and FX forward premiums have declined. This is one reason we have seen large debt inflows coming in at the narrowest interest differentials in the last 2 months3 and again points to the freedoms Indian policy rates have from US rates. 41. Macroprudential tightening also pre-emptively reduces balance sheet (BS) stress as do better macro fundamentals and fiscal consolidation. But adequate liquidity is also important to prevent illiquidity raising costs, turning into insolvency and creating BS stress. A major reason the Silicon Valley Bank collapse was not followed by others was the broad liquidity support the Fed made available to stressed financial institutions even as it continued with quantitative tightening. Statement by Prof. Jayanth R. Varma 42. Inflation is projected to average 4.5% in 2024-25, and, therefore, the current policy rate of 6.5% translates into a real rate of 2%. I do not believe that such a high real rate is required at this stage to drive inflation down to the target of 4%. It is true that economic growth is holding up well, but there is no evidence at all that the economy is overheating. 43. Perhaps, the majority of the MPC worry that the output gap has already closed, and that the projected growth rate of 7% for 2024-25 exceeds the growth potential of the Indian economy. I do not think that such growth pessimism is warranted. During the last few years, we have seen several policy measures including digitalization, tax reforms, and a step up in infrastructure investment that should boost the potential growth rate of the economy. Also, the compound average growth rate of real GDP from the pre-pandemic level is quite low: 4¼% per annum from 2019-20 to 2023-24 (First Advance Estimate). Growth pessimism would require one to assume that the pandemic induced a massive permanent scarring of the economy. To the contrary, all indications are that the economy has been quite resilient, and even sectors that were badly battered by the pandemic are bouncing back. 44. If the potential growth rate of the economy is close to 8%, then the economy is not at risk of overheating in 2024-25. A real interest rate of 1-1.5% would then be sufficient to glide inflation to the target of 4%. A real interest rate of 2% creates the very real risk of turning growth pessimism into a self fulfilling prophecy. 45. It must also be borne in mind that the process of fiscal consolidation is projected to continue in 2024-25. This opens up space for monetary easing without risking an inflationary spiral. In my view, the time has come for the MPC to send a clear signal that it takes its dual mandate of inflation and growth seriously, and that it would not maintain a real interest rate that is significantly more than what is needed to achieve its target. 46. I therefore vote to reduce the repo rate by 25 basis points, and to change the stance to neutral. Statement by Dr. Rajiv Ranjan 47. Let me start from the outlook I had given in my December 2023 minutes, “While a durable growth path backed by consumption and investment is visible from here on, the same cannot be said about disinflation yet. The below 5 per cent print in October 2023 may reverse as early as next month.” Since the last policy, the growth inflation dynamics have evolved largely along these lines. Growth is holding up better than expected, while the inflation prints in November and December crossed 5 per cent. Core inflation has shown marked and durable signs of disinflation that gives us comfort from monetary policy perspective, but upside risks remain from food inflation. 48. Two other comforting developments since the last policy needs attention. The first relates to the global economy that is performing better than expected earlier. Global growth prospects have improved and inflation in advanced economies is slowly inching down, though intermittently deviating from the declining trend. Global commodity prices remain benign and crude oil prices have not risen despite several new flash points in the ongoing conflicts. Second, the central government in its interim budget stayed the course on a fiscal consolidation path. A prudent fiscal policy can reinforce the credibility of the flexible inflation targeting framework and thus help in anchoring the long-term inflation expectations.4 With less budgeted market borrowings and bond inclusion driven flows expected in 2024, the fisc has vacated space for the private sector on the one hand, while on the other hand taken steps to crowd in private investment through its continued focus on capex and other long term sustainable growth initiatives in areas like solar energy, health, innovation and renewables. 49. Against this backdrop, I vote to maintain status quo on rate and stance for the following reasons. 50. First, it may be recalled that we had frontloaded our rate actions by raising the repo rate cumulatively by 250 bps during May 2022 to February 2023 unlike central banks in advanced economies and several emerging market economies where rate hikes were of much higher order. In April 2023, when we paused majority of market participants were still expecting the MPC to hike rates. In other words, we did not raise our interest rates to a very restrictive zone, unlike the 400-500 bps increase seen by western central banks. 51. Second, given the growth-inflation dynamics, and the uncertainty related to the inflation path going ahead, it would be better to continue with status quo to get more clarity on the current rabi crop and upcoming monsoon rains to further reaffirm our conviction of a durable downward trajectory of inflation towards 4 per cent. 52. Third, markets are currently running ahead of policy makers worldwide including India. Any change in policy direction is going to have a multiplier effect. This is particularly tricky considering that transmission has slowed down in the last two months. The weighted average lending rate on fresh loans from commercial bank has fallen by 18 bps during November-December 2023.5 Any change at this stage could be a misstep and an undoing of the gains made so far. 53. Fourth, led by productivity improvement through digitalisation and formalisation of the economy, increased capital formation, favourable demography, and new drivers of growth such as services exports, India’s potential growth is most likely now higher.6 This allows us to move more cautiously on inflation front. Softer core inflation despite strong growth supports this argument. 54. Fifth, successfully managing the final descent of inflation is the most challenging part of the journey and the history of past 100 inflation episodes teaches us that inflation shock, in general, tends to be persistent. What matters for success in defeating inflation is consistency and credibility of policy that helps firmly anchor inflation expectations.7 Avoiding any pre-mature move will help us guard against the biggest challenge to credibility, i.e., having to backpedal later if faced with upside surprises to inflation.8 55. Finally, let me emphasise that today we are in a period of transition, which is a little delicate where neither forward guidance works nor pre-emptive policy actions. Expectations of a change make agents and market participants behave in a way as if the change has already happened, which makes managing the present even tougher. For example, very recently we saw that expectations of rate cuts by major advanced economies have made global markets very exuberant. This makes the job of central banks even more difficult, especially since the last leg of disinflation is still pending. Caution and conservatism are the key during transition times unlike black swan events of the recent past when decisive, aggressive and innovative approaches worked. Staying the full course with determination without getting carried away is the best bet to address these transition challenges. Our strong fundamentals will help us to come out even stronger. Statement by Dr. Michael Debabrata Patra 56. Recent advance estimates of the National Statistical Office (NSO) and subsequently available high frequency indicators point to the momentum of domestic economic activity being sustained. This is underpinned by a shift from consumption to investment. Although a fuller private capex cycle is yet to gather steam, high corporate profitability, the surging housing and real estate market and the strong commitment to fiscal consolidation – now and in the medium-term – should quicken its broader-based onset. Productive capacity of the economy is expanding, mostly financed domestically as evident in the modest current account deficit. Consequently, growth impulses are insulated from the volatility of international financial flows in a highly uncertain and unsettled global environment. On the other hand, private consumption, which accounts for 57 per cent of GDP, is languishing under the strain of still elevated food inflation. This is particularly telling in rural areas. Inflation has to be restrained to its target for growth to be inclusive and sustained. 57. Persisting food supply pressures are holding hostage the disinflation that has been led by the steady easing of core inflation. In the latest CPI print for December 2023, unfavourable base effects snuffed out a decline in the momentum of food inflation. As winter’s seasonal price softening fades, however, demand-supply imbalances in the food category may show up again; they should not be allowed to negate the gains of monetary policy’s restraint on core inflation. Sentiment indicators are conducive. Consumer confidence is steadily improving across rural and urban areas even as inflation expectations of households have dipped over a year ahead, and they are more certain of this outcome in their current perceptions. Business sentiment is also upbeat, particularly among services sector firms. In the manufacturing sector, nominal sales growth is inching up, led by volume expansion. Debt servicing burdens and staff costs are moderating while profitability continues to expand. 58. The optimism generated by these evolving macroeconomic conditions and the recent improvement in financial conditions in response to prudent and growth-stimulating budgetary announcements would come full circle if inflation eases and aligns with the target. The outlook for the Indian economy remains highly sensitive to inflation risks. High inflation erodes purchasing power, especially for those least protected against the higher costs of essentials like food. Restoring price stability is beneficial for all. Accordingly, monetary policy must remain restrictive and maintain downward pressure on inflation while minimising the output costs of disinflation. It is only when inflation subsides and stays close to the target lastingly that policy restraint can be eased. Hence, I vote for keeping the policy rate unchanged and for continuing with the stance of withdrawal of accommodation. Statement by Shri Shaktikanta Das 59. In the current challenging and unsettled global environment, India presents a picture of strength and resilience. Our proactive, multi-pronged and calibrated policies have worked well to maintain and strengthen macroeconomic and financial stability. Our approach can be a good template for the future. Considering that price and financial stability are the foundations for strong, sustainable and inclusive growth, our endeavour all along has been to take a holistic approach to keep the economy in balance. 60. Real GDP in 2023-24 is expected to grow at 7.3 per cent on top of a growth of 7.2 per cent recorded in 2022-23. Inflation is edging down and is expected to soften to 5.4 per cent in 2023-24 from 6.7 per cent in the previous year (average for the year). Consumer confidence is rising, business sentiments remain upbeat and inflation expectations are getting steadily anchored. 61. CPI inflation has fallen decisively from the heightened levels of last summer, led by steady and sustained disinflation in core, though there have been intermittent interruptions caused by adverse food price shocks. This was so recently when food inflation picked-up to 8.7 per cent in December from 6.3 per cent in October. Consequently, headline inflation rose from 4.9 per cent in October to 5.7 per cent in December, even as core inflation (CPI inflation excluding food and fuel) softened to a four-year low of 3.8 per cent. Deflation in fuel has also deepened. 62. Inflation is expected to soften further to an average of 4.5 per cent in 2024-25 with a fleeting trough of 4 per cent in Q2. Food price uncertainty remains a major source of volatility for headline inflation outlook. Growing geo-political tensions and supply chain disruptions due to new flash points also pose further risks to the inflation outlook. 63. GDP growth, going forward, is expected to remain resilient with the momentum of economic activity continuing in 2024-25. Rabi sowing is now better than last year’s, which along with persisting momentum in allied activities, would support rural consumption. Urban demand continues to be strong. Private capex cycle has turned up, supported by government’s infrastructure thrust and twin balance sheets advantage from healthy corporates and banks. In fact, a strong growth in fixed investment validates the turnaround in the investment cycle which I have been emphasising in my previous statements during the year. Net external demand is expected to get an uplift from improving global outlook. On the supply side, manufacturing activity remains upbeat, aided by improving profit margins. Services sector is in a bright spot on the back of strong domestic demand. Accordingly, we expect real GDP to grow by 7.0 per cent in 2024-25. 64. The current setting of monetary policy is moving in the right direction, with growth holding firm and inflation trending down to the target. At this juncture, monetary policy must remain vigilant and not assume that our job on the inflation front is over. We must remain committed to successfully navigating the ‘last mile’ of disinflation which can be sticky. As markets are front-running central banks in anticipation of policy pivots, any premature move may undermine the success achieved so far. Price and financial stability are essential to sustain a long haul of high growth. Policy imperative at the current juncture is to remain focused on achieving the 4 per cent inflation target on a durable basis, keeping in mind the objective of growth. Accordingly, I vote to keep the policy repo rate unchanged and continue with the focus on withdrawal of accommodation. (Shweta Sharma) Press Release: 2023-2024/1916 1 The Business Inflation Expectations Survey (BIES), December 2023. https://www.iima.ac.in/faculty-research/centers/Misra-Centre-for-Financial-Markets-and-Economy/BIESIndian Institute of Management, Ahmedabad. 2 Brunnermeier, M. 2024. 'Microfinance and resilience.' 2024 Presidential address at American Finance Association. Available at: https://www.youtube.com/watch?v=z94l-G5gz4o&list=PL42MdOODnBSvD0p8ervyECxCSfKv2XCRy 3 Rigorous estimations in the papers below show that exchange rate volatility raises EM interest rate spreads. 4 Sims, C. A. (2004). ‘Limits to inflation targeting. The inflation-targeting debate’ (pp. 283-310). University of Chicago Press. 5 The weighted average lending rate (WALR) on fresh rupee loans rose by 181 bps during the current tightening cycle (May 2022 – December 2023). However, during November and December, the WALR on fresh rupee loan declined by 18 bps. 6 I have elaborated on this point in my last minutes. 7 Ari Anil and Lev Ratnovski (2023). ‘History’s Inflation Lessons’. Finance and Development. December. 8 International Monetary Fund, World Economic Outlook update, January 2024. |

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: