IST,

IST,

Minutes of the Monetary Policy Committee Meeting, June 6 to 8, 2022

[Under Section 45ZL of the Reserve Bank of India Act, 1934] The thirty sixth meeting of the Monetary Policy Committee (MPC), constituted under section 45ZB of the Reserve Bank of India Act, 1934, was held during June 6 to 8, 2022. 2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor. 3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below. Resolution 5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (June 8, 2022) decided to:

Consequently, the standing deposit facility (SDF) rate stands adjusted to 4.65 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 5.15 per cent.

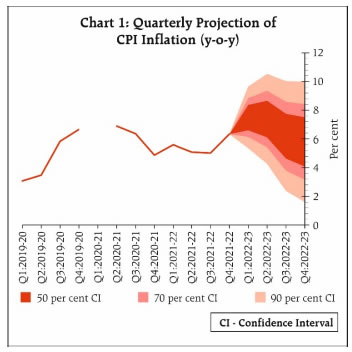

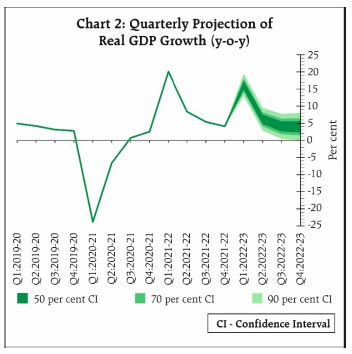

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth. The main considerations underlying the decision are set out in the statement below: Assessment Global Economy 6. Since the MPC’s meeting in May 2022, the global economy continues to grapple with multi-decadal high inflation and slowing growth, persisting geopolitical tensions and sanctions, elevated prices of crude oil and other commodities and lingering COVID-19 related supply chain bottlenecks. Global financial markets have been roiled by turbulence amidst growing stagflation concerns, leading to a tightening of global financial conditions and risks to the growth outlook and financial stability. Domestic Economy 7. According to the provisional estimates released by the National Statistical Office (NSO) on May 31, 2022, India’s real gross domestic product (GDP) growth in 2021-22 was 8.7 per cent. This works out to 1.5 per cent above the pre-pandemic level (2019-20). In Q4:2021-22, real GDP growth decelerated to 4.1 per cent from 5.4 per cent in Q3, dragged down mainly by weakness in private consumption on the back of the Omicron wave. 8. Available information for April-May 2022 indicates a broadening of the recovery in economic activity. Urban demand is recovering and rural demand is gradually improving. Merchandise exports posted robust double-digit growth for the fifteenth month in a row during May while non-oil non-gold imports continued to expand at a healthy pace, pointing to recovery of domestic demand. 9. Overall system liquidity remains in large surplus, with the average daily absorption under the LAF moderating to ₹5.5 lakh crore during May 4 - May 31 from ₹7.4 lakh crore during April 8 - May 3, 2022 in consonance with the policy of gradual withdrawal of accommodation. Money supply (M3) and bank credit from commercial banks rose (y-o-y) by 8.8 per cent and 12.1 per cent, respectively, as on May 20, 2022. India’s foreign exchange reserves were placed at US$ 601.4 billion as on May 27, 2022. 10. CPI headline inflation rose further from 7.0 per cent in March 2022 to 7.8 per cent in April 2022, reflecting broad-based increase in all its major constituents. Food inflation pressures accentuated, led by cereals, milk, fruits, vegetables, spices and prepared meals. Fuel inflation was driven up by a rise in LPG and kerosene prices. Core inflation (i.e., CPI excluding food and fuel) hardened across almost all components, dominated by the transport and communication sub-group. Outlook 11. The tense global geopolitical situation and the consequent elevated commodity prices impart considerable uncertainty to the domestic inflation outlook. The restrictions on wheat exports should improve the domestic supplies but the shortfall in the rabi production due to the heat wave could be an offsetting risk. The forecast of a normal south-west monsoon augurs well for the kharif agricultural production and the food price outlook. Edible oil prices remain under pressure on adverse global supply conditions, notwithstanding some recent correction due to the lifting of export ban by a major supplier. Consequent to the recent reduction in excise duties, domestic retail prices of petroleum products have moderated. International crude oil prices, however, remain elevated, with risks of further pass-through to domestic pump prices. There are also upside risks from revisions in the prices of electricity. Early results from manufacturing, services and infrastructure sector firms polled in the Reserve Bank’s surveys expect further input and output price pressures going forward. Taking into account these factors, and on the assumption of a normal monsoon in 2022 and average crude oil price (Indian basket) of US$ 105 per barrel, inflation is now projected at 6.7 per cent in 2022-23, with Q1 at 7.5 per cent; Q2 at 7.4 per cent; Q3 at 6.2 per cent; and Q4 at 5.8 per cent, with risks evenly balanced (Chart 1). 12. The recovery in domestic economic activity is gathering strength. Rural consumption should benefit from the likely normal south-west monsoon and the expected improvement in agricultural prospects. A rebound in contact-intensive services is likely to bolster urban consumption, going forward. Investment activity is expected to be supported by improving capacity utilisation, the government’s capex push, and strengthening bank credit. Growth of merchandise and services exports is set to sustain the recent buoyancy. Spillovers from prolonged geopolitical tensions, elevated commodity prices, continued supply bottlenecks and tightening global financial conditions nevertheless weigh on the outlook. Taking all these factors into consideration, the real GDP growth projection for 2022-23 is retained at 7.2 per cent, with Q1 at 16.2 per cent; Q2 at 6.2 per cent; Q3 at 4.1 per cent; and Q4 at 4.0 per cent, with risks broadly balanced (Chart 2).   13. Inflation risks flagged in the April and May resolutions of the MPC have materialised. The projections indicate that inflation is likely to remain above the upper tolerance level of 6 per cent through the first three quarters of 2022-23. Considerable uncertainty surrounds the inflation trajectory due to global growth risks and geopolitical tensions. The supply side measures taken by the government would help to alleviate some cost-push pressures. At the same time, however, the MPC notes that continuing shocks to food inflation could sustain pressures on headline inflation. Persisting inflationary pressures could set in motion second round effects on headline CPI. Hence, there is a need for calibrated monetary policy action to keep inflation expectations anchored and restrain the broadening of price pressures. Accordingly, the MPC decided to increase the policy repo rate by 50 basis points to 4.90 per cent. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. 14. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to increase the policy repo rate by 50 basis points to 4.90 per cent. 15. All members, namely, Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das unanimously voted to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. 16. The minutes of the MPC’s meeting will be published on June 22, 2022. 17. The next meeting of the MPC is scheduled during August 2-4, 2022. Voting on the Resolution to increase the policy repo rate to 4.90 per cent

Statement by Dr. Shashanka Bhide 18. The inflationary pressures have increased significantly since the MPC meetings of April 2022 and May 2022. The headline CPI inflation rose to 7.0 per cent in March and 7.8 per cent in April, YOY basis. The inflation rate was also at or above the upper level of the tolerance band of inflation target in January and February. The CPI headline increased by 0.96% in March and 1.4% in April, MOM basis, reversing the moderate increase or declining pattern seen in the previous three months of December 2021- February 2022, reflecting the increased price pressures, particularly in March and April. The broadening of the inflationary pressure is also seen in the rising rates of the three major components of CPI- food, fuel and miscellaneous. In the case of food, the MOM increase in CPI in March and April were 1.3 and 1.4 per cent, respectively, reversing the declining pattern during December 2021- February 2022. The CPI-Fuel & Light group rose by 3.1 per cent in April (MOM), the highest pace since July 2011. While the inflation rate has been rising since October 2021, in the period since March 2022 its trajectory has been significantly steeper from the previous months. 19. As the supply side of the economy began to return to some normalcy after the successive waves of the COVID-19 Pandemic, the rising commodity prices in the international markets have remained a major cause of rising input costs in 2021. The sharp increase in the momentum of prices since March is mainly due to the global supply disruptions caused by the Russia-Ukraine war and its aftermath leading to spikes in international commodity prices. In the case of food inflation, the supply interruptions in the international markets on account of both production shortfalls and war induced supply restrictions of edible oils and wheat have exacerbated the emerging supply-demand imbalance. The impact on fertiliser and other input supplies add to the cost of supply across the agricultural sector. Energy prices in general have been affected by supply disruptions and continued demand. 20. While the domestic monetary and economic policies remained supportive of growth through the pandemic period, achieving sustained growth momentum has been a challenging goal both as a result of the repeated waves of the pandemic and its global impact. At the global level the uncertainty over the timing of the end of the pandemic continues as sudden increase in infections has been reported in a number of countries. The provisional estimates (PE) of estimates GDP released by the National Statistical Office place the GDP growth for 2021-22 at 8.7 per cent reflecting catch-up of private final consumption expenditure, gross fixed capital formation and overall GDP, all measured in constant prices, with the pre-pandemic year 2019-20. The YOY growth of GDP in Q4:FY2021-22 is 4.1 per cent, 6.7 per cent over the previous quarter. In terms of GVA, all the major segments of the economy, agriculture, industry, and services inclusive of construction in 2021-22 exceeded the 2019-20 levels. In the services sector, only segment that includes the contact intensive ‘trade, hotels and transport’ subsectors, the GVA is yet to reach the pre-pandemic level. 21. More recent data on the economy remains positive on the whole, with broad based indicators such as non-food bank credit, GST collections and toll collections showing significant growth YOY basis up to May 2022. In the case of petrol and diesel consumption, for which data are available up to April 2022, YOY growth rate is higher than in the previous month. PMI for manufacturing in May 2022 has remained marginally lower compared to April and in the case of services, PMI has improved in May. The RBI’s enterprise surveys reflect business expectations of higher output/ turnover over the quarters in FY2022-23 particularly in the second half of the year. Merchandise exports in US$ value for April and May 2022 more than doubled compared to the same period 2020-21 and also exceeded the values in the same period in 2019-20. Imports have also increased sharply reflecting growing domestic economic activity. However, there are clearly uncertainties regarding the growth prospects, particularly in view of the emerging adverse global demand conditions with the global output and trade volume growth now expected to be lower in 2022 than in 2021. Sharp tightening of monetary policy in several major advanced economies has also adverse implications for capital flows, financial markets and exchange rate for India. The RBI’s Consumer Confidence Survey conducted during May 2-May 11, 2022 in the major urban areas shows weaker optimism in the general economic conditions for one-year ahead, with overall household spending expected to increase due to higher ‘essential expenditure’, also for one-year ahead. 22. Taking into account the present trends and projections of major indicators, the real GDP growth YOY basis for FY2022-23 has been retained at 7.2 per cent as projected in April 2022 meeting. As noted above, there are clearly uncertainties, particularly relating to the global macroeconomic conditions. The RBI’s Survey of Professional Forecasters conducted during May 2022 has the median forecast of 7.2 per cent for real GDP growth in FY2022-23, YOY basis, declining from 7.5 per cent obtained in March 2022. 23. Continued growth momentum in Q4:FY2021-22, and the positive trends in the broader indicators of economic activities in the first one or two months of Q1:FY2022-23 suggest that demand conditions are supportive of economic growth in the face of the cost push inflationary pressures that have developed. 24. The projected headline inflation rate for FY2022-23, YOY basis, has now been revised upwards to 6.7 per cent from 5.7 per cent projected in the April meeting. One of the factors that has led to the upward revision is the increase in average crude oil price for the year also affecting trade balance. The projected quarterly headline inflation rates in FY2022-23 are provided in the MPC resolution for June 2022. Besides the petroleum prices, headline inflation is also significantly affected by food inflation. For the major food commodities, a normal rainfall would moderate the prices, although the international supply conditions for food commodities would be a factor that would affect the course of food price inflation. 25. In sum, the inflationary pressures that have intensified since March 2022 are expected to remain a concern in FY2022-23 unless the international supply conditions improve quickly. Changing the course of inflation trajectory to reach targeted level is a priority at this stage for monetary policy although the growth momentum remains modest one. Monetary policy tightening has begun in a number of economies globally to rein in inflationary pressures. Fiscal measures to contain the impact of international price spikes to the domestic consumer and measures to improve supply expansion would moderate price pressures. The RBI moved to streamline the LAF corridor in April 2022, with SDF as the floor and restoring the width of the corridor at the pre-pandemic level. The MPC raised the policy Repo rate by 40 basis points in its meeting held in May and RBI also announced an increase in CRR by 50 basis points. In view of the elevated levels of inflation rates which may persist given the disruptions international supply chains are experiencing, there is a need to ensure that policy rates are consistent with the requirements of moderating inflation expectations and liquidity conditions are consistent with the requirements of economic growth in an environment less constrained by the COVID pandemic. While the impact of these measures is likely to have some adverse impact on aggregate demand in the short term, moderating inflation pressures now is crucial to ensure a stable macroeconomic environment. 26. Accordingly, I vote to increase the policy repo rate by 50 basis points to 4.90 per cent. I also vote to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. Statement by Dr. Ashima Goyal 27. There is worry about US inflation generalizing to the rest of the world, but we must remember Indian inflation differs. We did have much higher inflation than the US but that was in the past. The danger is Indian inflation is more susceptible to crude oil and food inflation triggered by the Ukraine war. Inflation is becoming broad-based but that is because rising transport and communication costs affect almost every product. But cost pass through is one-time. True second round effects require wages to rise. And since in India the majority still lives in rural areas, rural wages must rise. In India’s high inflation episode over 2007-2011 real rural wage growth became sharply positive. A rise in raw material input prices raises food prices but input prices do not rise again because food prices have risen. But if a rise in rural wages raises food prices, the later raises wages further. 28. There are a number of links in the chain from wages to prices. Wages rise with expected inflation and the tightness of the labour market. In India they are especially sensitive to food inflation. But the continuation of the free food programme blunts the sensitivity of rural wages to food prices. Moreover, the rise in minimum support prices is moderate. Other special factors that were relevant in 2011 are not active now1. 29. The second big difference today is that we are in an inflation targeting regime. To the extent price expectations are anchored they will not raise wages. In a country with volatile inflation and thin news sources a lot of attention is paid to central bank communication. The inflation target can get internalized faster. In every country household inflation expectations exceed actual inflation but the impact of hierarchy shows up in extreme sensitivity to government action. Both times petrol and diesel excise was cut there was a steep fall in household inflation expectations. Countercyclical taxes may not raise the fiscal deficit because of buoyancy of taxes under high nominal output growth. 30. Third, if the labour market is not tight there would not be much impact of wages on prices despite expected inflation. Rising employment does not put pressure on wages, if there are many willing to work without higher wages. We know unemployment is high in India, especially for youth. Many are looking to shift to more productive jobs. Wages are rising in sectors like information technology where there is a shortage of skills, but it is not yet a general phenomenon. Contrast this with the US where acute shortages are pushing up wages. During the pandemic many firms have economized on labour cost and the share of wages has gone down. Moreover, the aggregate supply curve is estimated to be flat so that prices do not rise much even if employment rises. 31. Fourth, firms set prices as a mark-up on wages and other costs. But if demand is slack, they tend to reduce mark-ups or make other adjustments rather than pass on rising input prices to consumers. Corporate surveys show that input price indices have risen more than output price indices and yet mark-ups have remained constant. It is wage share that has fallen. This is the classic low demand response. India did not have excess stimulus like in the US, and excess demand is not adding to inflation pressures here. 32. Fifth, credit growth is moderate and has just reached double digits. Excess durable liquidity cannot create inflation if broad money supply growth is low and asset prices are falling because of foreign outflows. A key figure to note is that broad money growth at 8.8% was much lower than nominal income growth. Financial conditions are not loose. 33. Finally, since inflation largely stayed within the target band in the Covid-19 period the real interest rate was around -2%, compared to -6% in the US. Deviation from equilibrium real rates and the persistent distortions they can create were not large. 34. Global growth is wavering with the continuing Ukraine war and problems in China. Inflation and widespread monetary tightening are further threats to it. 35. Indian growth, however, seems quite resilient to these shocks as yet. The digital boom and supply chain diversification led export demand may outlast softening of global growth. There is pent-up demand for services, despite Covid-19 resurfacing, but it may not sustain. Other consumption is still soft. Investment is yet to take off broadly. However, an important difference policy has to keep in mind is that today the country is coming out of a pandemic-induced slump. In 2011 it was coming out of a boom with clear signs of over-heating. So policy also has to pay attention to the recovery. 36. RBI inflation projection for CPI headline in 2022-23 is 6.7% (up from 5.7% in the April policy), but the Q4 figure is expected to soften to 5.8%. Firms’ price expectations from the IIM Ahmedabad survey also show some slight moderation with one year ahead expectations at less than 6%. RBI surveys show cost pressures are expected to ease in the second half of the year. There are some signs of softening in prices of global commodities apart from crude oil. 37. At the current stage of recovery, however, the one-year ahead real rate must not be more negative than -1%. A fifty or sixty basis point hike would achieve this, while looking through part of the spike in 2022 even as further supply-side movement and clarity on global developments are awaited. Such a real interest rate, while not dampening the recovery much, will prevent a possibly inflationary further rise in demand and unsustainable current account deficit. Markets benefit from recovery and so are better able to absorb rate hikes that are in step with the latter. 38. Given the above considerations I vote for a 50 bps rise in the repo rate. Further changes will depend on growth and inflation outcomes. Since future moves will either be a pause or a rise it is also useful to change the guidance to withdrawal of accommodation. I therefore vote to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. While the real repo rate is a useful guide to actions, and has theoretical clarity, it is difficult to estimate the neutral rate precisely. The stance therefore can be more clearly defined in terms of action on liquidity, which started in 2021. 39. Under the external benchmark system, as it works currently, banks may not need to raise deposit rates commensurately until excess liquidity is sufficiently absorbed so that they have to borrow at the repo. If excess liquidity persists, yet policy rates rise, the ECB multi-tier excess reserve system2 is an option. Higher rates paid on a part of reserves held at the central bank could be conditional on banks passing on a share of this to depositors. Statement by Prof. Jayanth R. Varma 40. In my statement during the May meeting, I called for more than 100 basis points of rate increases to be carried out very soon. Taking into account the 40 basis points hike in May, my preference would have been for an increase of 60 basis points in this meeting. However, I have decided to go along with the majority view of 50 basis points for the same reason as in May: a difference of opinion of 10 basis points is not material enough to be elevated to a dissent. Hence, I vote in favour of raising the policy repo rate to 4.90%. 41. I stated in May that the MPC has a lot of catching up to do, and that remains true today. Between April and now, the MPC has raised the policy rate by 90 basis points, but during the same period the RBI’s projection of inflation for the year 2022-23 has risen by 100 basis points from 5.7% to 6.7%. The real policy rate, therefore, remains more or less where it was in April. This reminds me of Lewis Carroll’s adage that we must run as fast as we can, just to stay in place, and to go anywhere we must run even faster. Clearly, more needs to be done in future meetings to bring the real policy rate to a modestly positive level consistent with the emerging inflation and growth dynamics. 42. I am therefore happy that the second resolution is clearer than the May resolution that I had described then as pedantically correct but falling short in communicative efficacy. The resolution no longer talks about remaining accommodative, and confines itself to remaining focused on withdrawal of accommodation. I therefore vote in favour of this resolution. 43. It appears to me however that as the MPC navigates this process of withdrawal, there is merit in signalling the likely pace of this tightening in more quantitative terms. Many leading central banks currently provide forecasts of the future path of the policy rate several quarters ahead. The MPC has now accumulated several years of experience, and the RBI has evolved into a mature inflation targeting central bank. I believe that the time is therefore ripe for MPC members to start moving towards providing projections of the future path of the policy rate. This would help stabilize long term bond markets and also anchor inflation expectations. Statement by Dr. Rajiv Ranjan 44. The ongoing war in Europe and the consequent sanctions have taken a heavy toll on the global economy by aggravating supply chain disruptions and heightening uncertainty about the post-pandemic recovery. With inflation scaling multi-decadal peaks across several countries and remaining stubborn, risks of long-term inflation expectations getting unhinged have increased manifold leaving monetary authorities with little room to manoeuvre. Several Asian economies, who abstained from policy tightening last year despite mounting inflation pressures, have joined the bandwagon of their advanced economy counterparts in the battle against inflation. The pace and extent of tightening, however, are tailored to country-specific macroeconomic developments and requirements. 45. In the Indian context, domestic economic activity is progressing on the expected trajectory in 2022-23 so far as evident from the available high-frequency indicators (HFIs) during April-May 2022. Notably, 51 HFIs out of more than 70 that are monitored to track real economic activity (both from demand and supply side) have crossed their pre-pandemic (2019-20) levels. While 37 HFIs have exceeded their pre-pandemic levels by more than 10 per cent, 30 HFIs have surpassed it by over 20 per cent. Overall, growth drivers seem to be holding up despite higher inflation and tightening monetary conditions. 46. The surge in inflation by 84 basis points in April to 7.8 per cent was accompanied by broad-based momentum effects (month-on-month price increase) covering food, fuel and core categories. Six out of 12 food sub-groups and 8 out of 10 groups/sub-groups in core registered a pick-up in inflation. Overall, around 78 per cent of the CPI basket recorded a rise in inflation in April. CPI diffusion indices – for positive price increases and those for price increases at or above a seasonally adjusted annualised rate (SAAR) of 6 per cent – edged up sharply in April, indicating widening price pressures. Reflecting these, all core inflation measures – exclusion-based and trimmed mean measures – exceeded 6 per cent in April and were in the range of 6.4 per cent to 7.5 per cent. The weighted median (inflation relating to the 50th percentile by weight) also increased further by 40 bps to 6.5 per cent in April. 47. Given the severity and extent of generalisation of inflation as mentioned in the preceding paragraph, average CPI inflation during 2022-23 is now projected at 6.7 per cent, an increase of one percentage point (100 bps) from 5.7 per cent indicated in the April 2022 policy. About three-fourths of the revision in inflation projections is on account of food as adverse global price spillovers are expected to be more than transient. Even though aggregate demand conditions have remained subdued during the past few years, repeated supply shocks seem to be primarily leading to higher inflation gap persistence3 causing inflation to remain at elevated levels above the target. Such large and persistent supply shocks have the potential to un-anchor inflation expectations. 48. With protracted geopolitical tensions and no early resolution of the conflict in sight, considerable uncertainty clouds the evolving inflation trajectory. While the supply side measures taken by the government would undeniably alleviate some cost-push pressures, it needs to be complemented by calibrated monetary policy actions to anchor inflation expectations and contain the broadening price pressures. Given inflation expectations in India are largely adaptive or backward looking, persistent supply disruptions and the resulting price pressures could get entrenched in higher inflation expectations. Since the short-term trade-off between inflation and output worsens under high inflation expectations (the upward shift of the Phillips curve), this would call for front-loaded policy action to rein in inflation expectations. It is worthwhile to note that central bank credibility plays an important role in minimising the sacrifice ratio – the loss of growth due to policy tightening. Thus, more than the direct impact, it is the second-round effects that central banks seek to address through the anchoring of long-run inflation expectations which, in turn, can deliver low and stable inflation over the medium-term. 49. In view of the above and given the MPC’s projection that inflation is likely to remain above the upper tolerance level of 6 per cent through the first three quarters of 2022-23 with persistent shocks to food inflation sustaining pressures on the headline, I vote for a 50 basis points increase in the policy repo rate. I also vote for withdrawal of accommodation to align inflation with the target going forward, while remaining growth supportive. On the MPC’s decision of rephrasing the stance by abjuring the words “to remain accommodative” and focusing on withdrawal of accommodation, it is consistent with the recent monetary policy actions to withdraw the extraordinary pandemic measures-infused liquidity. The measures taken so far have ensured that liquidity conditions evolve in alignment with the monetary policy stance and liquidity overhang does not pose additional risks to inflation. 50. While frontloading policy measures, one needs to be aware that the pace of policy transmission has quickened after the introduction of the external benchmark-based lending rates (EBLR) in October 2019. With more than 40 per cent of the total floating rate outstanding loans linked to external benchmarks, the degree of pass-through to actual lending rates has increased and this would strengthen monetary transmission in the current cycle. The inherent framework of the EBLR regime which enables quicker and larger transmission to lending rates coupled with banks’ propensity to pass-through policy rate changes to lending rates rather quickly, particularly during tightening cycles, may have to be factored to achieve the desired outcome during the current tightening phase. Of course, the trajectory of inflation going ahead will be an important determining factor. 51. More importantly, when the monetary-fiscal coordination is at its best, fighting inflation becomes a joint responsibility which is crucial for engineering a successful disinflation. In this context, with monetary policy prioritising price stability and fiscal policy emphasising on quality of expenditure through capex, the economy becomes the net beneficiary. Thus, it may be important for the government – both centre and states – to successfully complete their budgeted capex plans and work through their counter-cyclical policy levers to ensure a soft-landing for the economy amidst monetary tightening to rein in inflation. Statement by Dr. Michael Debabrata Patra 52. “Globalisation is finished” seems to be the theme of discussions in business and financial fora the world over. Geopolitics has become front and centre of all investment decisions. Near shoring, on shoring and reshoring echo through investor conferences, adding to the influential call for friend shoring or relocation of supply chains to friendly countries. The age of globalisation based on outsourcing is over. Decades of productivity gains from opening up are being reversed and this is showing up in inflation. 53. Terms that are being used to describe the global outlook are now being drawn from extreme weather conditions. Bond yields and consumer surveys are flashing red. Google searches for “recession” are soaring. In fact, the narrative is shifting from whether there will be a recession to what will be the shape of the recession as monetary policy goes on to the front foot. 54. With inflation at multi-decadal highs across advanced economies and emerging and developing economies, the inflation crisis is global. In response, the most widespread monetary policy tightening in decades is underway. It is the most coordinated tightening cycle in many years, and the actions are appearing synchronised because imported inflation pressures are being exacerbated by country-specific factors acting at the same time. Yet, for monetary policy, rather than materially compressing demand, managing expectations is the key. 55. The global inflation crisis is just the face of one of the most severe food and energy crises in recent history that now threatens the most vulnerable across the globe. Across the developing world, food shortages will likely last through this year and the early part of next year, exacerbating the pain of soaring food prices. Even in the world’s richest nations, higher food prices are causing food poverty for the first time in a generation. 56. At the receiving end are emerging market equities and bonds. In terms of widely used indices, emerging market bonds are suffering their worst losses in three decades, hit by rising global interest rates. Surges of volatility in the foreign exchange markets have become a function of supply chain pressures, soaring shipping costs and the position of the host country on the path of monetary policy normalisation. 57. India is being impacted by the global inflation crisis as recent outcomes have shown. Two thirds of the change in the CPI since the war is reflecting the materialising of geopolitical risk. Although the ongoing inflation surge is a supply phenomenon everywhere, mending supply always takes time. Admirable efforts have been made in this direction at the cost of strains on fiscal discipline, demonstrating that price stability is a shared responsibility – the government sets the inflation target and the central bank implements it. 58. To gain time for supply to respond, the blunt instrument of monetary policy has to be deployed – there is no other recourse at this juncture. What will monetary policy do? The fact that inflation remains elevated and is broadening indicates that there is some demand that is able to afford these high prices, perhaps due to revenge spending in a pandemic stressed response. In fact, core core inflation – the most sluggish part of the index – CPI excluding food, fuel, petrol, diesel, gold and silver (44 per cent versus 47 per cent of the CPI in the standard core) – and the weighted median are both showing generalisation and momentum. High frequency indicators for May point to expansion in demand. This warrants some monetary policy front load to modulate it so that even though it is not at full strength, it does not exceed the available supply. In the process, spending will slow down, so will demand and so will the economy. The objective should be to take the repo rate to a height that is at least above the four quarters ahead forecast of inflation, knowing that monetary policy works with lags. Concomitantly, it is important to condition public perceptions and expectations that growth will be closer to 6 per cent than to 7 per cent in 2023-24 as a result of monetary tightening. 59. If this inflation is allowed to go out of hand, it could (i) corrode the foundations of the recovery that is gradually gaining traction – empirical evidence shows that inflation above 6 per cent in India is unambiguously harmful for growth; (ii) deter investment decisions because businesses will worry about demand for their products getting postponed at these elevated levels of prices; (iii) cause depositors to worry about negative returns to their deposits and hence shift to time tested holders of value like gold which translates to capital flight in the case of India – the world’s second largest importer of the yellow metal produces only 1 per cent of consumption domestically; (v) cause exchange rate depreciation which will increase imported inflation, discourage capital inflows and trigger large capital outflows. 60. So, the die is cast. On one side are the nihilists – they lick their lips and obsess that the RBI, like a lamb to the slaughter, is about to fail in its monetary policy mandate. They fail to differentiate between a procedural issue and sensationalism. 61. The accountability mechanism enhances credibility in the monetary policy framework and that is of paramount importance. The wide public sensitivity to accountability works in the same direction as monetary policy in the pursuit of ensuring price stability. It shows that inflation expectations are anchored around the conviction that monetary policy will not tolerate persistent deviations from target because it is enjoined by legislation (not) to do so. On the other side are the facts, the immutables, which suggest that inflation may be peaking. In June, the excise duty cuts on petrol and diesel will have kicked in strongly and knocked off 20 bps from headline inflation. After that second order effects will take effect. Other measures will work like second order effects to soften core inflation at the margin. As monetary policy works through its lags, demand will inevitably get restrained and become compressed to the level of supply. Inflation will fall back to below 6 per cent by the fourth quarter of 2022-23. In 2023-24, it should moderate to 4 per cent. This is the most pragmatic result that can be hoped for under the prevailing extraordinary circumstances. 62. Headline inflation levels will remain high across the world for some time; hence, the thing to watch is the direction of inflation, not its level, which will remain elevated for some time in view of the overwhelming shocks. If headline inflation starts moving down in the second half of the year, the objective of taking the policy rate above the level of future inflation will be achieved sooner than later, providing space to pause and reconfigure. 63. If the early arrival of the monsoon and the removal of the ban on edible oil exports by Indonesia foretell of a more benign outlook on food prices than currently envisaged, India would have tamed the inflation crisis even earlier and decoupled from the rest of the world. Without a doubt, the impact of the war in the form of generalising price pressures will cause a very grudging decline in inflation and a possible breach of the accountability criteria. The battle would be lost but the war would have been won if India is able to bend down the future trajectory of inflation. This is attributable no less to the supply side measures undertaken by the Government; the tightening of the LAF corridor and introduction of the standing deposit facility in April 2022 as its floor at a rate 40 basis points higher than the fixed rate reverse repo; the 40 basis points raising of the policy rate in May along with the 50 basis points increase in the cash reserve ratio requirement; and the proposed increase in the policy repo rate in today’s meeting. 64. To reiterate, given the extraordinary circumstances driving up inflation the world over, our endeavour should be to bring down inflation into the tolerance band by the last quarter of 2022-23 or the first quarter of 2023-24 and progressively align it to the target during the course of 2023-24. This should minimise the loss of output. If real GDP growth averages between 6-7 percent of GDP in 2022-23 and 2023-24, the recovery that is increasingly solidifying gets a fair chance of reaching the sunlight. 65. If all that happens, the RBI will have fulfilled its mandate of prioritising price stability while being mindful of growth. 66. Accordingly, I vote to raise the policy repo rate by 50 basis points and to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. Statement by Shri Shaktikanta Das 67. The war in Europe is lingering. The end of war and sanctions are nowhere in sight. The uncertainty continues. Global growth and trade are steadily decelerating, global commodity prices remain firm and financial markets worldwide are turning more volatile. Monetary policy normalisation has become the order of the day across most central banks. The war has globalised inflationary pressures across geographies, and there are increasing risks of long-term inflation expectations getting unanchored. While prices of a few commodities – such as metals and fertilisers – have seen some softening, most food and all energy prices remain elevated. 68. Against this background, the domestic CPI inflation for April 2022 surged to 7.8 per cent – the fourth consecutive month of inflation being above the upper tolerance level of 6.0 per cent. Adverse spillovers from high global commodity prices continue to impinge on domestic prices in April and thereafter. Domestic factors also played a role, with a strong heat wave and consequent loss of production resulting in significant pick-up in prices of several food items. According to our latest assessment, the average annual inflation in the current year (2022-23) is expected to be 6.7 per cent, with the first three quarters remaining above six per cent. 69. Growth impulses, on the other hand, are broadly evolving in line with expectations as borne out by the available high-frequency indicators during April-May 2022. The forecast of a normal southwest monsoon, the improvement in employment conditions as reflected in the rates of labour force participation (LFP) and employment, the early results from RBI surveys indicating steady rise in capacity utilisation and improving non-food credit growth augur well for the growth outlook. Together, these developments can be expected to support private consumption and investment. Net household financial savings (HFS) in 2021-22, although moderating from the preceding year, remained above pre-pandemic levels and along with healthy balance sheets of banks and corporates, can support private consumption and investment. Merchandise exports clocked double-digit growth for the fifteenth successive month in May 2022, despite heightened global uncertainty. In the wake of all these developments, the projection of growth for 2022-23 has been retained at 7.2 per cent, the same as in the April MPC resolution. 70. Thus, while high inflation continues to be the major concern, revival of economic activity remains steady and is gaining traction. The time is appropriate to go for a further increase in the policy rate to effectively deal with inflation and inflation expectations. Accordingly, I vote for a 50 bps increase in the repo rate which would be in line with the evolving inflation-growth dynamics and will help in mitigating the second round effects of adverse supply shocks. This action will reinforce our commitment to price stability – our primary mandate and a pre-requisite for sustainable growth over the medium term. 71. I also vote for a change in the stance to provide greater clarity on our policy intent by focussing wholly on withdrawal of accommodation. It is important in this context to note that the repo rate is still below the pre-pandemic level and the liquidity surplus is still higher than what it was prior to the pandemic. As our policy in recent months has been unambiguously focussed on withdrawal of accommodation, both in terms of liquidity and rates, the change in wording of stance should be seen as a continuation and fine-tuning of our recent approach. The withdrawal of accommodation, as I see it, would be non-disruptive to the process of recovery and would strengthen our ongoing efforts to combat inflation and anchor inflation expectations. (Yogesh Dayal) Press Release: 2022-2023/406 1 See Goyal, A. and A. K. Baikar, ‘Psychology or Cyclicality: Rural wage and inflation dynamics in India’, Economic and Political Weekly, pp. 116-125. Vol. L No. 23. June 6, 2015. 2 See https://www.ecb.europa.eu/press/pr/date/2019/html/ecb.pr190912_2~a0b47cd62a.en.html 3 Inflation gap persistence (Cogley et al., 2010) is measured by the time varying persistence in the deviation of inflation from its long-term trend. Recent estimates with Indian inflation data suggest that it increased from 0.10 to 0.30. Ref: Cogley, T., Primiceri, G. E., & Sargent, T. J. (2010). Inflation-gap persistence in the US. American Economic Journal: Macroeconomics, 2(1), 43-69. |

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: