IST,

IST,

Consumer Confidence Survey

|

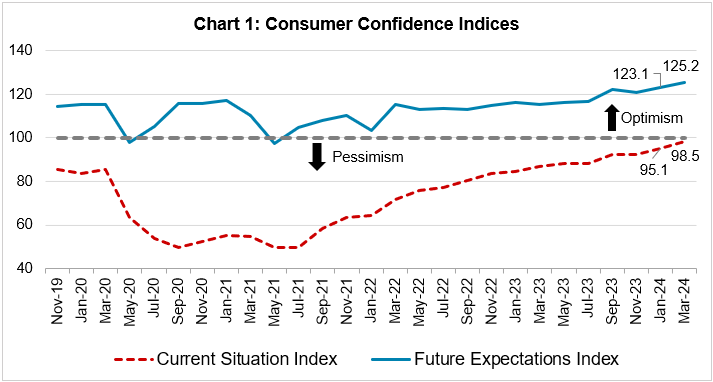

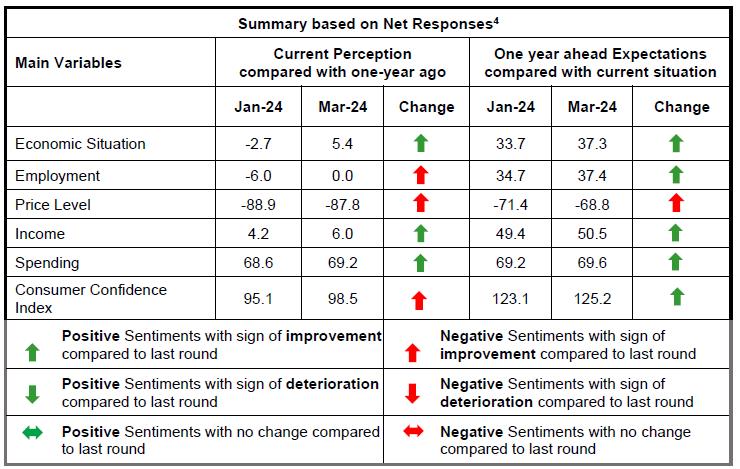

Today, the Reserve Bank released the results of March 2024 round of its bi-monthly consumer confidence survey (CCS)1. The survey collects current perceptions (vis-à-vis a year ago) and one year ahead expectations of households on general economic situation, employment scenario, overall price situation, own income and spending across 19 major cities. The latest round of the survey was conducted during March 2-11, 2024, covering 6,083 respondents. Female respondents accounted for 50.8 per cent of this sample. Highlights:

Note: Please see the excel file for time series data.3  1 The survey results reflect the respondents’ views, which are not necessarily shared by the Reserve Bank. Results of the previous survey round were released on the Bank’s website on February 08, 2024. 2 CSI and FEI are compiled on the basis of net responses on the economic situation, income, spending, employment and the price level for the current period (as compared with one year ago) and a year ahead, respectively. CSI and FEI = 100 + Average of Net Responses of the above parameters. 3 Unit-level data for previous rounds of the survey are available on the Bank’s ‘Database on Indian Economy’ (DBIE) portal (weblink: https://dbie.rbi.org.in/#/dbie/home) under the head ‘Unit-level Data’. 4 ‘Net response’ is the difference between the percentage of respondents reporting optimism and those reporting pessimisms. It ranges between -100 and 100. Any value greater than zero indicates expansion/ optimism and values less than zero indicate contraction/ pessimism. |

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: