The Indian economy continued to exhibit robust growth during the second quarter

(July-September) of 2007-08, albeit with some moderation. According to the Central

Statistical Organisation (CSO), real GDP growth moderated to 8.9 per cent during

the second quarter of 2007-08 from 10.2 per cent in the corresponding period of

2006-07. Real GDP growth during the first half of 2007-08 was estimated at 9.1

per cent as compared with 9.9 per cent in the corresponding period of 2006-07

(Table 1 and Chart

1). While agriculture and allied activities recorded higher growth during

the first half of 2007-08 over the corresponding period of the previous year,

the growth in industrial and services sectors was somewhat lower than in the previous

year.

Table 1: Growth Rates of Real GDP (At 1999-2000 prices) |

(Per cent) |

Sector |

2000-01

to 2006-07

(Average) |

2005-06* |

2006-07# |

2006-07 |

2007-08 |

2006-07 |

2007-08 |

|

|

|

|

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

April-September |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

1. |

Agriculture and |

|

|

|

|

|

|

|

|

|

|

|

|

Allied Activities |

2.5 |

6.0 |

2.7 |

2.8 |

2.9 |

1.6 |

3.8 |

3.8 |

3.6 |

2.8 |

3.7 |

|

|

(21.4) |

(19.7) |

(18.5) |

|

|

|

|

|

|

|

|

2. |

Industry |

7.0 |

8.0 |

11.0 |

10.6 |

11.3 |

10.8 |

11.2 |

10.6 |

8.3 |

11.0 |

9.5 |

|

|

(19.6) |

(19.4) |

(19.6) |

|

|

|

|

|

|

|

|

2.1 |

Mining and Quarrying |

4.6 |

3.6 |

5.1 |

3.7 |

3.9 |

5.5 |

7.1 |

3.2 |

7.7 |

3.8 |

5.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2.2 |

Manufacturing |

7.7 |

9.1 |

12.3 |

12.3 |

12.7 |

11.8 |

12.4 |

11.9 |

8.6 |

12.5 |

10.2 |

2.3 |

Electricity, Gas and |

|

|

|

|

|

|

|

|

|

|

|

|

Water Supply |

4.8 |

5.3 |

7.4 |

5.8 |

8.1 |

9.1 |

6.9 |

8.3 |

7.3 |

6.9 |

7.8 |

3. |

Services |

8.6 |

10.3 |

11.0 |

11.6 |

11.7 |

10.9 |

10.0 |

10.6 |

10.3 |

11.6 |

10.5 |

|

|

(59.0) |

(60.9) |

(61.8) |

|

|

|

|

|

|

|

|

3.1 |

Trade, Hotels, |

|

|

|

|

|

|

|

|

|

|

|

|

Restaurants, Transport, |

|

|

|

|

|

|

|

|

|

|

|

|

Storage and |

|

|

|

|

|

|

|

|

|

|

|

|

Communication |

10.3 |

10.4 |

13.0 |

12.4 |

14.2 |

13.1 |

12.4 |

12.0 |

11.4 |

13.3 |

11.7 |

3.2 |

Financing, Insurance, |

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate and |

|

|

|

|

|

|

|

|

|

|

|

|

Business Services |

7.9 |

10.9 |

10.6 |

10.8 |

11.1 |

11.2 |

9.3 |

11.0 |

10.6 |

10.9 |

10.8 |

3.3 |

Community, Social and |

|

|

|

|

|

|

|

|

|

|

|

|

Personal Services |

6.0 |

7.7 |

7.8 |

11.3 |

8.3 |

6.7 |

5.7 |

7.6 |

7.8 |

9.7 |

7.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.4 |

Construction |

9.9 |

14.2 |

10.7 |

10.5 |

11.1 |

10 |

11.2 |

10.7 |

11.1 |

10.8 |

10.9 |

4. |

Real GDP at Factor Cost |

6.9 |

9.0 |

9.4 |

9.6 |

10.2 |

8.7 |

9.1 |

9.3 |

8.9 |

9.9 |

9.1 |

|

|

(100.0) |

(100.0) |

(100.0) |

|

|

|

|

|

|

|

|

Memo: |

(Amount in Rupees crore) |

a)Real GDP at factor cost |

26,04,532 |

28,48,157 |

|

|

|

|

|

|

|

|

b)GDP at current market prices |

35,67,177 |

41,25,725 |

|

|

|

|

|

|

|

|

*: Quick Estimates. #: Revised Estimates

Note : Figures in parentheses denote shares in real GDP.

Source : Central Statistical Organisation (CSO). |

Agricultural Situation

Cumulative rainfall during

the 2007 South-West monsoon season (June 1 to September 30) turned out to be 5

per cent above normal. The seasonal rainfall was well-distributed over time, barring

the short spells of rainfall deficiency during the first week of June, third and

fourth weeks of July and third week of August. At the end of the season (as on

September 27, 2007), water stock in 81 major reservoirs was 79 per cent of the

full reservoir level (FRL), lower than 87 per cent during the corresponding period

of the previous year, but higher than the average of 67 per cent over the last

10 years. Cumulative rainfall during the North-East monsoon (October 1, 2007 to

December 31, 2007) was, however, 32 per cent below normal as compared with 21

per cent below normal during the corresponding period of the previous year. Of

the 36 meteorological sub-divisions, cumulative rainfall was deficient/scanty/no

rain in 27 sub-divisions (same as last year) (Table

2). As on January 17, 2008, the total live water storage was 55 per cent of

the FRL (59 per cent last year).

The sowing of kharif crops improved during

2007-08 on account of satisfactory rainfall during the South-West monsoon and

remunerative market prices. The reported sown area as on October 26, 2007 was

about 2.7 per cent higher than the previous year (Table

3). In contrast, area sown under rabi crops so far (up to January 18, 2008)

has been about 3.7 per cent lower than a year ago. Rabi sowing was lower in case

of rice, wheat, pulses and oilseeds, but higher in case of coarse cereals than

in the previous year.

Table

2: Rainfall during South-West and North-East Monsoon |

(Number

of Meteorological Divisions) |

Year |

South-West

Monsoon |

North-East

Monsoon |

|

Cumulative |

Excess |

Normal |

Deficient |

Scanty/ |

Cumulative |

Excess |

Normal |

Deficient |

Scanty/ |

|

Rainfall: |

Rainfall |

Rainfall |

Rainfall |

No

Rain |

Rainfall: |

Rainfall |

Rainfall |

Rainfall |

No

Rain |

|

Above(+)/

Below (-) Normal

(per cent) |

|

|

|

|

Above(+)/

Below (-) Normal

(per cent) |

|

|

|

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

1998 | 6 | 12 | 21 | 3 | 0 | - | 28 | 6 | 1 | 1 |

1999 | -4 | 3 | 26 | 7 | 0 | - | 20 | 7 | 6 | 3 |

2000 | -8 | 5 | 23 | 8 | 0 | - | 0 | 4 | 13 | 19 |

2001 | -8 | 1 | 30 | 5 | 0 | - | 14 | 10 | 9 | 3 |

2002 | -19 | 1 | 14 | 19 | 2 | -33 | 3 | 7 | 12 | 14 |

2003 | 2 | 7 | 26 | 3 | 0 | 9 | 9 | 9 | 6 | 12 |

2004 | -13 | 0 | 23 | 13 | 0 | -11 | 8 | 10 | 17 | 1 |

2005 | -1 | 9 | 23 | 4 | 0 | 10 | 11 | 6 | 5 | 14 |

2006 | -1 | 6 | 20 | 10 | 0 | -21 | 3 | 6 | 14 | 13 |

2007 | 5 | 13 | 17 | 6 | 0 | -32 | 2 | 7 | 9 | 18 |

Excess:+20 per

cent or more. Normal : +19 per cent to - 19 per cent.

Deficient :- 20 per

cent to -59 per cent.

Scanty : - 60 per cent to -99 per cent. No Rain: -100

per cent.

Source : India Meteorological Department. |

The

First Advance Estimates for 2007-08 have placed the total kharif foodgrains production

at 112.2 million tonnes, which though lower than the target, was about 1.6 per

cent higher than that of the previous year (110.5 million

Table

3: Progress of Area under Crops - 2007-08 |

(Million

hectares) |

Crop | Normal

Area | Area

Coverage | Crop | Normal

Area | Area

Coverage |

|

|

2006 |

2007 |

Variation |

|

|

(As

reported on

January 18, 2008) |

| |

| |

| |

| 2006 | 2007 | Variation |

1 | 2 | 3 | 4 | 5 | 1 | 2 | 3 | 4 | 5 |

Kharif

Crops | Rabi

Crops | Rice | 38.2 | 37.1 | 37.3 | 0.2 | Rice | 3.7 | 0.9 | 0.8 | -0.1 |

Coarse Cereals | 22.9 | 22.1 | 22.0 | -0.1 | Wheat | 26.2 | 28.0 | 27.4 | -0.6 |

of which: |

| |

| | Coarse

Cereals | 6.4 | 6.4 | 6.5 | 0.1 |

Bajra | 9.4 | 9.3 | 8.7 | -0.6 | of

which: | |

| |

| Jowar | 4.4 | 3.8 | 3.6 | -0.2 |

| |

| |

| |

| |

| | Jowar | 5.0 | 4.7 | 4.6 | -0.1 |

Maize | 6.2 | 6.8 | 7.5 | 0.6 |

| |

| |

| |

| |

| | Maize | 0.7 | 0.8 | 0.9 | 0.1 |

Total Pulses | 10.9 | 11.4 | 12.6 | 1.2 |

| |

| |

| |

| |

| | Total

Pulses | 11.4 | 13.7 | 12.9 | -0.8 |

Total Kharif | Oilseeds15.4 | 16.8 | 17.7 | 0.9 |

| |

| |

| |

| |

| | Total

Rabi Oilseeds | 8.8 | 9.5 | 8.5 | -1.0 |

of which: |

| |

| |

| |

| |

| |

| |

| | of

which: | |

| |

| Groundnut | 5.5 | 4.8 | 5.4 | 0.6 |

| |

| |

| |

| |

| | Groundnut | 0.8 | 0.7 | 0.6 | -0.1 |

Soyabean | 6.6 | 8.1 | 8.8 | 0.6 |

| |

| |

| |

| |

| | Rapeseed/Mustard | 5.9 | 6.6 | 5.9 | -0.7 |

Sugarcane | 4.2 | 4.8 | 5.1 | 0.3 |

| |

| |

| Cotton | 8.3 | 9.0 | 9.3 | 0.4 | Sunflower | 1.2 | 1.1 | 0.9 | -0.2 |

All Crops | 100.8 | 102.1 | 104.9 | 2.7 | All

Crops | 56.5 | 58.5 | 56.3 | -2.2 |

Source : Ministry

of Agriculture, Government of India. |

tonnes) (Table

4). The enhanced kharif foodgrains production is expected to be largely on

account of the recovery in the production of pulses and maize. Amongst the non-foodgrains,

while the production of sugarcane, jute and mesta, and cotton are expected to

witness modest growth over the previous year, that of oilseeds is likely to show

a significant increase.

Food Management

Total procurement

of rice and wheat during 2007-08 (up to January 9, 2008) aggregated 30.1 million

tonnes, which was higher by 1.5 per cent than that procured during the corresponding

period of the previous year mainly on account of a 20.6 per cent increase in wheat

procurement at 11.1 million tonnes. Total offtake of rice and wheat during 2007-08

(up to October 31, 2007) at 21.4 million tonnes was marginally lower, by 0.5 per

cent, than the 21.5 million tonnes offtake during the corresponding period of

the previous year. As on November 1, 2007, total stocks of foodgrains with the

Food Corporation of India (FCI) and other Government agencies were at around

Table

4: Agricultural Production | (Million

tonnes) |

Crop |

2003-04 |

2004-05 |

2005-06 |

2006-07* |

2007-08 |

|

|

|

|

|

T |

A@ |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Rice | 88.5 | 83.1 | 91.8 | 92.8 | 93.0 |

| | Kharif | 78.6 | 72.2 | 78.3 | 80.1 | 80.0 | 80.2 |

| Rabi | 9.9 | 10.9 | 13.5 | 12.7 | 13.0 |

| Wheat | 72.2 | 68.6 | 69.4 | 74.9 | 75.5 |

| Coarse

Cereals | 37.6 | 33.5 | 34.1 | 34.3 | 37.5 |

| | Kharif | 32.2 | 26.4 | 26.7 | 25.7 | 28.7 | 26.6 |

| Rabi | 5.4 | 7.1 | 7.3 | 8.6 | 8.8 |

| Pulses | 14.9 | 13.1 | 13.4 | 14.2 | 15.5 |

| | Kharif | 6.2 | 4.7 | 4.9 | 4.7 | 5.5 | 5.5 |

| Rabi | 8.7 | 8.4 | 8.5 | 9.5 | 10.0 |

| Total

Foodgrains | 213.2 | 198.4 | 208.6 | 216.1 | 221.5 |

| | Kharif | 117.0 | 103.3 | 109.9 | 110.5 | 114.2 | 112.2 |

| Rabi | 96.2 | 95.1 | 98.7 | 105.6 | 107.3 |

| Total

Oilseeds | 25.2 | 24.4 | 28.0 | 23.9 | 30.0 |

| | Kharif | 16.7 | 14.1 | 16.8 | 13.9 | 18.5 | 16.1 |

| Rabi | 8.5 | 10.2 | 11.2 | 9.9 | 11.5 |

| Sugarcane | 233.9 | 237.1 | 281.2 | 345.3 | 310.0 | 345.6 |

Cotton # | 13.7 | 16.4 | 18.5 | 22.7 | 22.0 | 22.9 |

Jute and Mesta ## | 11.2 | 10.3 | 10.8 | 11.3 | 11.0 | 11.3 |

T : Target. A :

Achievement.

@ : First Advance Estimate for Kharif

Production (September

19, 2007). * : Fourth Advance Estimates.

# : Million bales of 170 kgs each.

## : Million bales of 180 kgs each.

Source : Ministry of Agriculture, Government

of India. |

19.7 million tonnes, which were higher by 5.7

per cent than a year ago (18.7 million tonnes). Commodity-wise, the stock of rice

(10.7 million tonnes) was lower by 14.9 per cent than that of the previous year

(12.5 million tonnes), while the stock of wheat (9.0 million tonnes) was 50.6

per cent higher than that of the previous year (6.0 million tonnes) (Table

2).

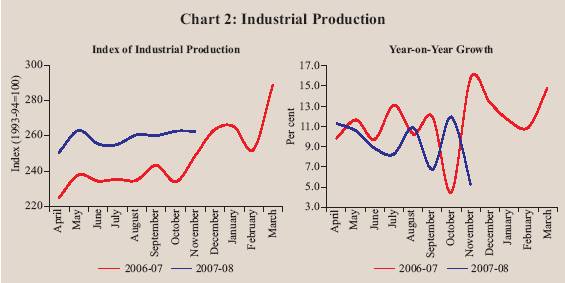

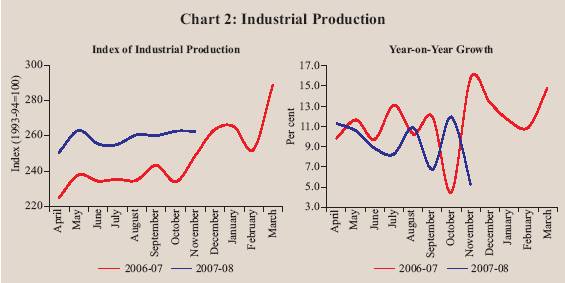

Industrial Performance

Growth in

the index of industrial production (IIP) moderated to 9.2 per cent during April-November

2007 from 10.9 per cent during April-November 2006 (Chart

2).

Table

5: Management of Food Stocks | (Million

tonnes) |

|

Opening

Stock of Foodgrains |

Procurement

of Foodgrains |

Foodgrains

Off-take |

Closing |

Norms |

Month |

Rice |

Wheat |

Total |

Rice |

Wheat |

Total |

PDS |

OWS |

OMS |

Exports-

Domestic |

Total |

Stock |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

14 |

2004-05 | 13.1 | 6.9 | 20.7 | 24.0 | 16.8 | 40.8 | 29.7 | 10.6 | 0.2 | 1.0 | 41.5 | 18.0 |

| 2005-06 | 13.3 | 4.1 | 18.0 | 26.9 | 14.8 | 41.7 | 31.4 | 9.8 | 1.1 | 0.0 | 42.2 | 16.6 |

| 2006-07 | 13.7 | 2.0 | 16.6 | 26.7 | 9.2 | 35.9 | 31.6 | 5.1 | 0.0 | 0.0 | 36.8 | 17.8 |

| 2006-07# | 13.7 | 2.0 | 16.6 | 20.4 | 9.2 | 29.6 | 18.4 | 3.1 | 0.0 | 0.0 | 21.5 |

| |

2007-08# | 13.2 | 4.6 | 17.8 | 18.9 | 11.1 | 30.1 | 19.3 | 2.1 | 0.0 | 0.0 | 21.4 |

| |

2006 |

April | 13.7 | 2.0 | 16.6 | 1.7 | 8.7 | 10.3 | 2.5 | 0.3 | 0.0 | 0.0 | 2.8 | 22.8 | 16.2 |

May | 12.8 | 9.0 | 22.8 | 1.6 | 0.6 | 2.2 | 2.5 | 0.4 | 0.0 | 0.0 | 3.0 | 22.3 |

| June | 12.0 | 9.3 | 22.3 | 1.5 | 0.0 | 1.5 | 2.5 | 0.6 | 0.0 | 0.0 | 3.1 | 20.5 |

| July | 11.1 | 8.2 | 20.5 | 0.8 | 0.0 | 0.8 | 2.7 | 0.4 | 0.0 | 0.0 | 3.1 | 17.1 | 26.9 |

August | 9.5 | 7.3 | 17.1 | 0.5 | 0.0 | 0.5 | 2.7 | 0.4 | 0.0 | 0.0 | 3.1 | 15.5 |

| September | 7.8 | 6.7 | 15.5 | 0.2 | 0.0 | 0.2 | 2.3 | 0.5 | 0.0 | 0.0 | 2.8 | 12.6 |

| October | 6.0 | 6.4 | 12.6 | 8.0 | 0.0 | 8.0 | 2.4 | 0.3 | 0.0 | 0.0 | 2.7 | 18.7 | 16.2 |

November | 12.5 | 6.0 | 18.7 | 2.0 | 0.0 | 2.0 | 2.5 | 0.4 | 0.0 | 0.0 | 2.9 | 17.8 |

| December | 12.1 | 5.6 | 17.8 | 2.6 | 0.0 | 2.6 | 2.6 | 0.3 | 0.0 | 0.0 | 3.0 | 17.5 |

| 2007

| January | 12.0 | 5.4 | 17.5 | 4.3 | 0.0 | 4.3 | 2.7 | 0.4 | 0.0 | 0.0 | 3.1 | 18.1 | 20.0 |

February | 12.6 | 5.4 | 18.1 | 2.4 | 0.0 | 2.4 | 2.7 | 0.5 | 0.0 | 0.0 | 3.1 | 19.1 |

| March | 14.0 | 5.1 | 19.1 | 1.2 | 0.0 | 1.2 | 2.7 | 0.5 | 0.0 | 0.0 | 3.2 | 17.8 |

| April | 13.2 | 4.6 | 17.8 | 0.9 | 7.9 | 8.7 | 2.5 | 0.2 | 0.0 | 0.0 | 2.8 | 25.1 | 16.2 |

May | 13.5 | 11.6 | 25.1 | 1.5 | 2.6 | 4.0 | 2.8 | 0.2 | 0.0 | 0.0 | 3.0 | 25.9 |

| June | 12.6 | 13.3 | 25.9 | 1.3 | 0.7 | 2.0 | 2.7 | 0.4 | 0.0 | 0.0 | 3.1 | 23.9 |

| July | 11.0 | 12.9 | 23.9 | 0.8 | 0.0 | 0.8 | 2.9 | 0.4 | 0.0 | 0.0 | 3.3 | 21.2 | 26.9 |

August | 9.2 | 12.0 | 21.2 | 0.1 | 0.0 | 0.1 | 2.8 | 0.3 | 0.0 | 0.0 | 3.1 | 18.0 |

| September | 6.9 | 11.0 | 18.0 | 0.0 | 0.1 | 0.1 | 2.7 | 0.3 | 0.0 | 0.0 | 3.0 | 15.6 |

| October | 5.5 | 10.1 | 15.6 | 7.4 | 0.0 | 7.4 | 2.7 | 0.3 | 0.0 | 0.0 | 3.0 | 19.7 | 16.2 |

November | 10.7 | 9.0 | 19.7 | 1.8 | 0.0 | 1.8 |

| |

| |

| |

| | _ | _ | _ |

| |

| _ | _ | _ | _ | _ | _ |

| December |

| |

| 3.5 | 0.0 | 3.5 |

| |

| |

| |

| | _ | _ | _ |

| |

| _ | _ | _ | _ | _ | _ |

| January * |

| |

| 1.6 | 0.0 | 1.6 |

| |

| |

| |

| PDS: Public

Distribution System. OWS: Other Welfare Schemes. OMS : Open Market Sales.

_ : Not Available.

# : Procurement up to January 9, and offtake up to October

31.

*: Procurement up to January 9, 2008.

Note : Closing stock figures

may differ from those arrived at by adding the opening stocks and procurement

and deducting offtake, as stocks include coarse grains also.

Source : Ministry

of Consumer Affairs, Food and Public Distribution, Government of India. |

The manufacturing sector recorded a lower growth of 9.8 per cent during April-November

2007 as compared with 11.8 per cent during April-November 2006. Mining sector

recorded a growth of 4.9 per cent as compared with 4.2 per cent, while the electricity

sector moderated to 7.0 per cent as compared with 7.3 per cent during April-November

2006 (Table 6).

Table

6: Index of Industrial Production: Sectoral and Use-Based

Classification of Industries |

(Per

cent) |

Industry

Group |

Weight

in IIP |

Growth

Rate |

Weighted

Contribution# |

|

|

April-March |

April-November |

April-March |

April-November |

|

|

2006-07 |

2006-07 |

2007-08

P |

2006-07 |

2006-07 |

2007-08

P |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

Sectoral |

|

|

|

|

|

|

|

Mining |

10.5 |

5.3 |

4.2 |

4.9 |

3.4 |

2.8 |

3.6 |

Manufacturing |

79.4 |

12.5 |

11.8 |

9.8 |

91.1 |

91.2 |

89.9 |

Electricity |

10.2 |

7.3 |

7.3 |

7.0 |

5.5 |

6.0 |

6.6 |

Use-Based |

|

|

|

|

|

|

|

Basic Goods |

35.6 |

10.3 |

9.4 |

8.4 |

27.2 |

26.8 |

27.6 |

Capital Goods |

9.3 |

18.2 |

17.4 |

20.8 |

17.6 |

17.1 |

25.4 |

Intermediate Goods |

26.5 |

12.0 |

11.1 |

10.1 |

27.0 |

27.2 |

29.3 |

Consumer Goods (a+b) |

28.7 |

10.1 |

9.9 |

5.2 |

28.5 |

29.2 |

18.0 |

a) Consumer Durables |

5.4 |

9.2 |

12.4 |

-1.7 |

6.7 |

9.7 |

-1.6 |

b) Consumer Non-durables |

23.3 |

10.4 |

8.9 |

7.8 |

21.8 |

19.4 |

19.7 |

General |

100.0 |

11.5 |

10.9 |

9.2 |

100.0 |

100.0 |

100.0 |

P : Provisional.

# : Figures may not add up to 100 due to rounding off.

Source: Central Statistical

Organisation. |

The moderation in manufacturing sector

growth was due to decelerated/ negative growth of eleven out of the seventeen

manufacturing industry groups accounting for 49.3 per cent weight in the IIP (Table

7). These, among others, included 'machinery and equipment', 'basic metal

and alloy industries', 'rubber, plastic, petroleum and coal products','cotton

textiles', 'non-metallic mineral products', and 'transport equipment and parts'.

'Metal products and parts' group recorded a decline due to the perfomance of tin

metal containers, welded link chains and razor blades. The 'leather and leather

and fur products' group, however, made a turnaround to register positive growth

during the period.

In terms of use-based classification, the capital and intermediate

goods sectors recorded double digit growth during April-November 2007 (see Table

6).

Table

7: Growth of Manufacturing Groups | (Per

cent) | Industry

Group | Weight

in IIP | Growth

Rate | Weighted

Contribution# |

| |

| April-March | April-November | April-March | April-November |

|

| | 2006-07 | 2006-07 | 2007-08P | 2006-07 | 2006-07 | 2007-08

P | 1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

1. | Food

products | 9.1 | 8.7 | 2.5 | 6.8 | 5.7 | 1.5 | 4.4 |

2. | Machinery

and equipment |

| |

| |

| |

|

| other than transport equipment | 9.6 | 14.2 | 15.0 | 12.2 | 18.2 | 20.0 | 20.3 |

3. | Chemicals

and chemical products |

| |

| |

| |

|

| except products of petroleum

and coal | 14.0 | 9.4 | 9.2 | 9.4 | 15.0 | 16.0 | 19.3 |

4. | Basic

metal and alloy Industries | 7.5 | 22.9 | 20.5 | 15.6 | 16.6 | 15.8 | 15.7 |

5. | Wood

and wood products, |

| |

| |

| |

|

| furniture and fixtures | 2.7 | 29.1 | 2.4 | 72.6 | 2.4 | 0.2 | 7.4 |

6. | Rubber,

plastic, petroleum |

| |

| |

| |

|

| and coal products | 5.7 | 12.9 | 12.0 | 10.8 | 6.4 | 6.4 | 6.9 |

7. | Non-metallic

mineral products | 4.4 | 12.9 | 13.6 | 8.4 | 6.6 | 7.4 | 5.6 |

8. | Beverages,

tobacco and related |

| |

| |

| |

|

| products | 2.4 | 11.1 | 13.1 | 9.5 | 4.5 | 5.7 | 5.1 |

9. | Cotton

textiles | 5.5 | 14.8 | 13.1 | 5.5 | 4.8 | 4.7 | 2.4 |

10. | Transport

equipment and parts | 4.0 | 15.0 | 16.3 | 2.7 | 8.2 | 9.5 | 2.0 |

11. | Textile

products | |

| |

| |

| |

| (including

wearing apparel) | 2.5 | 11.5 | 12.2 | 4.9 | 3.2 | 3.7 | 1.8 |

12. | Leather

and leather and fur products | 1.1 | 0.4 | -3.4 | 12.2 | 0.0 | -0.3 | 1.1 |

13. | Metal

products and parts |

| |

| |

| |

|

| (except machinery and equipment) | 2.8 | 11.4 | 7.0 | -4.4 | 2.3 | 1.5 | -1.1 |

14. | Jute

and other vegetable |

| |

| |

| |

|

| fibre textiles (except

cotton) | 0.6 | -15.8 | 2.3 | 13.3 | -0.4 | 0.1 | 0.4 |

15. | Wool,

silk and man-made |

| |

| |

| |

|

| fibre textiles | 2.3 | 8.1 | 7.6 | 4.5 | 1.9 | 2.0 | 1.4 |

16. | Paper

and paper products |

| |

| |

| |

|

| and printing, publishing

and | |

| |

| |

| |

| allied

activities | 2.7 | 8.4 | 8.9 | 1.6 | 2.3 | 2.5 | 0.5 |

17. | Other

manufacturing industries | 2.6 | 7.7 | 10.8 | 19.1 | 2.4 | 3.4 | 7.2 |

| Manufacturing

- Total | 79.4 | 12.5 | 11.8 | 9.8 | 100.0 | 100.0 | 100.0 |

P : Provisional.

# : Figures may not add up to 100 due to rounding off.

Source: Central Statistical

Organisation. | The sustained high growth in the capital

goods sector was driven by increased capital expenditure undertaken by manufacturing

firms to augment their production capacities. Growth in the intermediate goods

sector was driven by increased production of particle board, plywood commercial,

PVC pipes and tubes and metalise bopp films. Growth of the consumer goods sector

decelerated to 5.2 per cent during April-November 2007 from 9.9 per cent during

April-November 2006 _ largely reflecting the sharp decline in the consumer

durables segment. The negative growth in the consumer durables was on account

of decline in production of telephone instruments, T.V. receiver, motorcycles,

etc. The growth of the basic goods sector moderated to 8.4 per cent during

April-November 2007 from 9.4 per cent during April-November 2006 due to decelerated

growth in the cement sector and some aluminium and steel products.

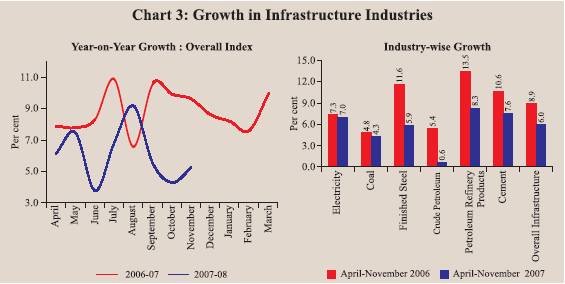

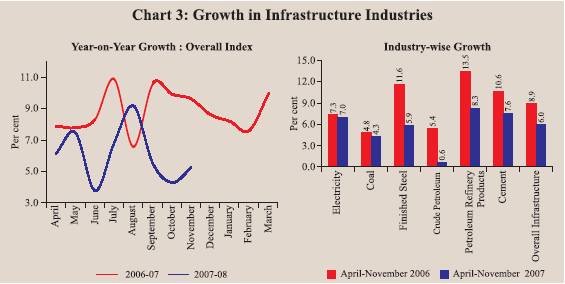

Infrastructure

During April-November 2007, the infrastructure

sector recorded a lower growth of 6.0 per cent than a year ago (8.9 per cent)

reflecting slow down in all the sectors (Chart 3).

High base, decline in refinery output in some public sector refineries and lower

capacity utilisation led to the moderation in growth of petroleum refinery products.

A sharp deceleration in crude oil production was attributable to decline in production

in some of the Oil and Natural Gas Corporation (ONGC) and Oil India Limited wells.

Lower growth in the coal sector was mainly on account of decline in production

in some of the subsidiaries of Coal India Limited. Capacity constraints faced

by major steel producers combined with high base slowed down the growth of the

steel sector. High base coupled with capacity constraints have led to moderation

in cement sector.

Table

8 : Growth in Services Sectors | (Contribution

to real GDP growth; percentage points) |

Year/Quarter |

Construction |

Trade,

Hotels, |

Financing,

Insurance, |

Community,

Social |

Total |

|

|

Transport

and Communication |

Real

Estate and Business Services |

and

Personal Services |

Services |

1 |

2 |

3 |

4 |

5 |

6 |

2000-01 | 0.4 | 1.6 | 0.5 | 0.7 | 3.2 |

2001-02 | 0.2 | 2.0 | 0.9 | 0.6 | 3.8 |

2002-03 | 0.5 | 2.1 | 1.1 | 0.6 | 4.2 |

2003-04 | 0.7 | 2.9 | 0.8 | 0.8 | 5.2 |

2004-05 | 0.9 | 2.7 | 1.2 | 1.1 | 5.9 |

2005-06 | 0.9 | 2.7 | 1.5 | 1.1 | 6.2 |

2006-07 | 0.7 | 3.4 | 1.5 | 1.1 | 6.7 |

2006-07: Q1 | 0.7 | 3.2 | 1.5 | 1.6 | 7.0 |

2006-07: Q2 | 0.8 | 3.7 | 1.6 | 1.3 | 7.4 |

2006-07: Q3 | 0.7 | 3.3 | 1.4 | 0.9 | 6.3 |

2006-07: Q4 | 0.8 | 3.4 | 1.3 | 0.8 | 6.2 |

2007-08: Q1 | 0.7 | 3.1 | 1.6 | 1.1 | 6.5 |

2007-08: Q2 | 0.8 | 3.1 | 1.6 | 1.2 | 6.6 |

Services Sector

During the first half of

2007-08, the services sector continued to record double digit growth of 10.5 per

cent, though lower than that of 11.6 per cent growth during the corresponding

period of the previous year. The services sector continued to be the main driver

of growth of the economy, contributing 72.1 per cent to real GDP growth. Services

sector activity was led by the sub-sector 'trade, hotel, transport and communication'

which contributed nearly 47.5 per cent to growth in services sector during the

first half of 2007-08 (Table 8). The 'construction'

sub-sector grew by 11.1 per cent during the second quarter of 2007-08, thereby

recording double digit growth for eighteen consecutive quarters.

Leading

indicators of service sector activity for April-October 2007 show that growth

rates in revenue earning freight traffic of the railways, commercial vehicles

production, new cell phone connections, passengers handled by civil aviation at

domestic terminals, cement and steel moderated albeit over a high base (Table

9).

Aggregate Demand

Growth of the Indian economy

continued to be driven by domestic demand, particularly gross fixed capital formation

(GFCF). While private final consumption demand contributed 36.3 per cent to the

incremental growth in real GDP during July-September 2007 (34.9 per cent during

July-September 2006), the contribution of real GFCF was 49.4 per cent (34.6 per

cent a year ago). The growth rate of private final consumption expenditure (PFCE)

was estimated at 5.6 per cent in the second quarter of 2007-08 as compared with

6.3 per cent in the

Table

9: Indicators of Service Sector Activity | (Growth

rates in per cent) | Sub-sector | 2005-06 | 2006-07 | April-November |

|

| | 2006 | 2007 |

1 | 2 | 3 | 4 | 5 |

Tourist arrivals | 12.4 | 13.6 | 12.2 | 11.9 |

Commercial vehicles production

# | 10.6 | 33.0 | 29.5

* | 5.3 * |

Railway revenue earning freight

traffic | 10.7 | 9.2 | 10.1 | 8.0 |

New cell phone connections | 89.4 | 85.4 | 121.0 | 44.6 |

Cargo handled at major ports | 10.4 | 9.5 | 8.0 | 13.1 |

Civil aviation |

| |

| |

a) Export cargo handled | 7.3 | 3.6 | 4.6 | 0.2 |

b) Import cargo handled | 15.8 | 19.4 | 19.8 | 22.3 |

c) Passengers handled at international

terminals | 12.8 | 12.1 | 11.7 | 13.4 |

d) Passengers handled at domestic

terminals | 27.1 | 34.0 | 37.4 | 25.9 |

Cement * * | 10.7 | 9.1 | 10.6 | 7.6 |

Steel * * | 10.8 | 8.0 | 11.6 | 5.9 |

Aggregate deposits | 18.1 | 23.7 | 13.2

@ | 14.6 @ |

Non-food credit | 31.8 | 28.4 | 17.5

@ | 11.8 @ |

* : April-October.

@: Up to January 4, 2008.

# : Leading indicator for transportation.

*

* : Leading indicators for construction.

Source: Ministry of Tourism, Ministry

of Commerce and Industry, Ministry of Statistics and Programme Implementation,

Reserve Bank of India and Centre for Monitoring Indian Economy. |

corresponding quarter of 2006-07. The growth rate of real GFCF accelerated

to 15.2 per cent from 13.3 per cent in the corresponding period of 2006-07 (Table

10). The expenditure composition of real GDP indicates a decline in the share

of real PFCE to 55.2 per cent in the second quarter of 2007-08 from 56.9 per cent

in the corresponding period of 2006-07. On the other hand, share of real GFCF,

as per cent to GDP, increased to 30.3 per cent from 28.6 per cent.

Table

10: Disposition of National Income (At 1999-2000 prices) |

(Growth

rates in per cent) | Item | 2005-06 | 2006-07 | 2006-07 | 2007-08 | 2006-07 | 2007-08 |

| QE | RE | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | April-September |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

1. Total Final

Consumption Expenditure | 7.2 | 6.6 | 11.8 | 3.7 | 5.1 | 6.1 | 6.5 | 6.5 | 7.8 | 6.5 |

| a)Private

Final Consumption |

| |

| |

| |

| |

| |

| Expenditure

(PFCE) | 6.7 | 6.2 | 6.5 | 6.3 | 6.0 | 6.0 | 5.6 | 5.6 | 6.4 | 5.6 |

| b)Government

Final Consumption |

| |

| |

| |

| |

| |

| Expenditure | 9.8 | 9.0 | 47.6 | -9.7 | 0.4 | 6.6 | 10.5 | 12.0 | 15.8 | 11.1 |

2. Gross Fixed

Capital Formation (GFCF) | 15.3 | 14.6 | 15.8 | 13.3 | 15.5 | 14.1 | 15.9 | 15.2 | 14.5 | 15.5 |

3. Change in Stocks | 69.0 | 10.2 | 10.2 | 10.6 | 9.7 | 10.3 | 8.4 | 8.6 | 10.4 | 8.5 |

4. Valuables | 0.4 | 38.0 | 38.4 | 47.1 | 29.8 | 37.8 | 10.5 | 19.6 | 42.5 | 15.0 |

5. Exports | 5.9 | 8.6 | 10.3 | 18.9 | -1.9 | 8.7 | 5.5 | 4.4 | 14.4 | 5.0 |

6. Imports | 10.3 | 11.4 | 11.7 | 18.7 | 4.8 | 11.3 | 16.1 | -0.5 | 15.1 | 7.9 |

Memo: |

| |

| |

| |

| |

| |

Real GDP at market

prices | 9.2 | 9.4 | 8.1 | 10.7 | 9.0 | 9.6 | 9.2 | 8.8 | 9.4 | 9.0 |

QE: Quick Estimates.

RE: Revised Estimates.

Source : Central Statistical Organisation. |

Corporate Performance

The performance of non-government

non-financial companies slowed somewhat in the two quarters of 2007-08 (Table

11). Sales during the second quarter of 2007-08 grew by 16.0 per cent as compared

with 29.2 per cent in second quarter of 2006-07. The growth in net profits

moderated sharply to 22.7 per cent from 49.4 per cent a year ago. The growth in

gross profits at 22.1 per cent during the second quarter of 2007-08 was the lowest

in the last six quarters.

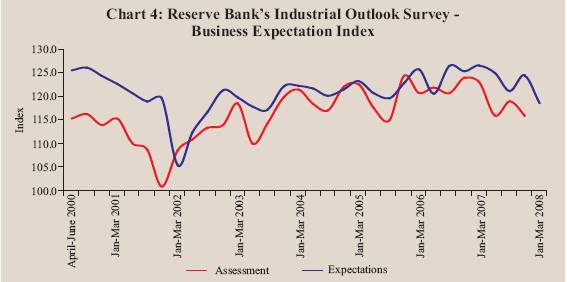

Business Expectation Survey

Despite continued strength in domestic fundamentals, business confidence

indices compiled by various agencies indicate some softening of sentiment against

the backdrop of elevated international crude oil prices and global uncertainties

(Table 12).

According to the latest business

confidence survey conducted by the Federation of Indian Chambers of Commerce and

Industry (FICCI) in December 2007, the overall business confidence index during

October 2007-March 2008 declined both over the previous quarter and over a year

ago, reflecting mainly concerns

Table

11: Corporate Financial Performance | (Growth

rates in per cent) | Item | 2005-06 | 2006-07 | 2006-07 | 2007-08 | 2006-07 | 2007-08 |

|

| | April-September | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

Sales | 16.3 | 26.2 | 27.4 | 17.4 | 25.6 | 29.2 | 30.3 | 22.5 | 19.2 | 16.0 |

Total Expenditure | 16.7 | 23.5 | 25.6 | 16.9 | 24.6 | 26.6 | 26.9 | 19.5 | 19.3 | 15.5 |

Depreciation | 8.1 | 15.4 | 16.1 | 15.1 | 14.9 | 16.4 | 16.8 | 18.1 | 18.1 | 15.8 |

Gross Profits | 24.6 | 41.5 | 39.8 | 28.1 | 33.9 | 45.9 | 51.8 | 39.2 | 28.6 | 22.1 |

Interest Payments | -2.0 | 17.4 | 20.8 | 10.1 | 19.9 | 18.0 | 11.9 | 32.3 | 4.4 | 18.4 |

Profits After Tax | 32.8 | 45.2 | 41.6 | 31.1 | 34.7 | 49.4 | 59.5 | 39.6 | 33.9 | 22.7 |

Select

Ratios | (Per

cent) | Gross Profits

to Sales | 12.2 | 15.6 | 15.6 | 16.9 | 15.6 | 15.9 | 15.8 | 15.3 | 16.7 | 16.6 |

Profits After Tax to Sales | 8.2 | 10.7 | 10.6 | 11.7 | 10.6 | 11.0 | 11.0 | 10.6 | 11.6 | 11.5 |

Interest to Sales | 2.2 | 2.1 | 2.2 | 2.0 | 2.2 | 2.0 | 2.0 | 2.0 | 2.0 | 2.1 |

Interest to Gross Profits | 18.1 | 13.3 | 14.1 | 11.9 | 13.9 | 12.8 | 12.5 | 13.0 | 11.7 | 12.6 |

Interest Coverage(Times) | 5.5 | 7.5 | 7.1 | 8.4 | 7.2 | 7.8 | 8.0 | 7.7 | 8.5 | 7.9 |

Memo: | (Amount

in Rs. crore) | No.

of Companies | 2,730 | 2,388 | 2,053 | 2,082 | 2,228 | 2,263 | 2,258 | 2,356 | 2,342 | 2,228 |

Sales | 7,35,216 | 10,41,894 | 4,24,565 | 5,36,358 | 2,34,610 | 2,51,125 | 2,60,064 | 2,94,223 | 2,80,814 | 2,97,110 |

Expenditure | 6,43,826 | 8,72,168 | 3,53,505 | 4,45,086 | 1,95,556 | 2,09,437 | 2,16,053 | 2,48,740 | 2,34,596 | 2,47,425 |

Depreciation Provision | 28,961 | 37,095 | 15,710 | 19,347 | 8,449 | 8,892 | 9,172 | 10,338 | 10,173 | 10,576 |

Gross Profits | 90,179 | 1,62,017 | 66,265 | 90,472 | 36,567 | 40,041 | 41,169 | 45,108 | 46,925 | 49,228 |

Interest Payments | 16,302 | 21,500 | 9,358 | 10,760 | 5,083 | 5,121 | 5,162 | 5,862 | 5,504 | 6,194 |

Profits After Tax | 60,236 | 1,11,107 | 44,927 | 62,846 | 24,845 | 27,710 | 28,698 | 31,251 | 32,699 | 34,266 |

Notes:

1.

Data for 2005-06 are based on audited balance sheet, while those for 2006-07 and

2007-08 are based on abridged financial results of the select non-Government non-financial

public limited companies.

2. Growth rates are per cent changes in the level

for the period under reference over the corresponding period of the previous year

for common set of companies.

3. The quarterly data may not add up to annual

data due to differences in the number and composition of companies covered in

each period. |

Table

12: Business Expectations Surveys | (Per

cent) |

Agency |

Business

Expectations |

Growth

over a year ago |

Growth

over |

|

Period |

Index |

|

previous

round |

1 |

2 |

3 |

4 |

5 |

NCAER | October

2007-March 2008 | Business

Confidence Index | -4.3 | 5.8 |

FICCI | October

2007-March 2008 | Business

Confidence Index | -15.1 | -10.5 |

RBI | January-March

2008 | Business Expectation

Index | -6.2 | -4.7 |

Dun & Bradstreet | January-March

2008 | Business Optimism Index | -13.2 | -12.6 |

over rupee appreciation, hardening of interest rates, rising cost of

raw materials, particularly oil, and global uncertainties. Fifty-three per cent

of the respondents who participated in the survey indicated the current overall

economic conditions to be 'moderately to substantially better' than in the preceding

six months as against 70 per cent reported in the last survey.

According

to the survey by the National Council of Applied Economic Research (NCAER) conducted

in October 2007, the overall business confidence index (BCI) for the next six

months declined on a year-on-year basis, but improved over the previous round

of the survey. A component-wise analysis shows that while expectation about present

capacity utilisation (being close to or above optimal level) registered a marginal

decline, the other three major components, viz., overall economic conditions,

investment climate, financial position of the firms recorded an improvement over

the previous round. Amongst the various industry sectors, the maximum gain in

business confidence was noticed in the capital goods and services sectors, while

the minimum gain was expected in the consumer non-durable sector.

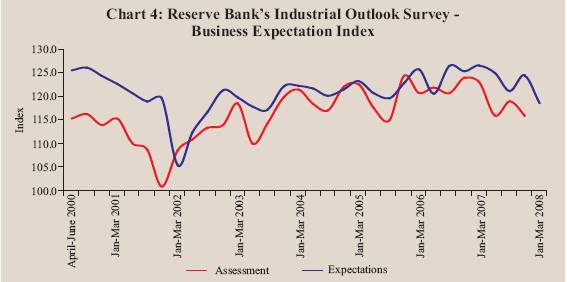

According

to the Reserve Bank's latest Industrial Outlook Survey, the business expectations

indices based on assessment for October-December 2007 and on expectations for

January-March 2008 declined by 2.5 per cent and 4.7 per cent, respectively, over

the previous quarters.

The decline in expectations index for January-March

2008 emanated from lower net responses for major parameters of the survey such

as the overall business situation, availability of finance, production, order

books, capacity utilisation, employment, exports and profit margins over the previous

quarter (Table 13 and Chart

4).

Purchasing Managers’ Index

The ABN-AMRO

Purchasing Managers' Index (PMI), which provides the indicators related to the

performance of the manufacturing sector, however, rose by 1.6 per cent in December

2007 over the preceding month, signalling a marked improvement in the health of

the Indian manufacturing sector. The rise in the PMI was underpinned by sharp

increases in new business volumes and a marked expansion of production. Employment

levels and stocks of purchases also continued to rise. The seasonally adjusted

Output Index increased by 0.6 per cent in

Table

13: Reserve Bank's Survey - Net Response on 'A Quarter Ahead' |

Expectations

About the Industrial Performance | (Per

cent) |

Parameter |

Response |

Oct- |

Jan- |

Apr- |

July- |

Oct- |

Jan- |

|

|

|

Dec. |

March |

June |

Sept |

Dec. |

Mar |

|

|

|

2006 |

2007 |

2007 |

2007 |

2007 |

2008 |

1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

1. | Overall

business situation | Better | 51.8 | 53.7 | 51.7 | 49.5 | 50.2 | 47.7 |

|

| | (41.2) | (40.7) | (43.3) | (41.2) | (42.1) | (42.9) |

2. | Financial

situation | Better | 41.9 | 44.5 | 43.8 | 41.3 | 40.1 | 40.3 |

|

| | (50.6) | (

49.9) | (49.8) | (49.8) | (51.3) | (50.3) |

3. | Working

capital finance requirement | Increase | 35.4 | 36.2 | 35.3 | 34.5 | 32.2 | 34.7 |

|

| | (58.3) | (59.2) | (59.2) | (59.2) | (62.6) | (60.3) |

4. | Availability

of finance | Improve | 33.4 | 36.2 | 35.2 | 32.1 | 33.8 | 31.1 |

|

| | (57.8) | (56.6) | (57.2) | (58.6) | (58.8) | (59.5) |

5. | Production | Increase | 49.7 | 50.7 | 47.8 | 46.6 | 49.0 | 43.9 |

|

| | (39.6) | (40.1) | (41.6) | (41.1) | (40.9) | (42.3) |

6. | Order

books | Increase | 46.3 | 47.3 | 45.7 | 43.6 | 44.1 | 37.1 |

|

| | (42.6) | (43.1) | (45.4) | (46.1) | (46.0) | (48.6) |

7. | Pending

orders, if applicable | Below

normal | -2.1 | -2.7 | -2.2 | 2.2 | -3.5 | 0.4 |

|

| | (81.7) | (82.9) | (82.8) | (82.6) | (82.4) | (80.2) |

8. | Cost

of raw material | Decrease | -49.2 | -41.7 | -42.1 | 46.0 | -42.4 | -44.1 |

|

| | (46.4) | (51.0) | (52.0) | (49.7) | (51.0) | (49.2) |

9. | Inventory

of raw material | Below average | -6.1 | -7.1 | -7.3 | 5.4 | -6.3 | -7.3 |

|

| | (83.5) | (83.8) | (85.0) | (85.0) | (85.0) | (84.8) |

10. | Inventory

of finished goods | Below average | -4.9 | -5.2 | -4.4 | 2.7 | -3.5 | -4.5 |

|

| | (83.5) | (84.5) | (85.2) | (87.1) | (86.4) | (86.1) |

11. | Capacity

utilisation (Main product) | Increase | 33.2 | 33.3 | 29.4 | 27.0 | 28.4 | 24.2 |

|

| | (56.6) | (57.7) | (60.4) | (61.4) | (61.5) | (62.3) |

12. | Level

of capacity utilisation | Above

normal | 10.9 | 12.8 | 11.5 | 9.4 | 10.7 | 6.4 |

| (Compared

to the average in | | (76.6) | (76.4) | (77.1) | (76.5) | (77.2) | (78.3) |

| the

preceding four quarters) |

| |

| |

| |

| 13. | Assessment

of the production capacity | More

than | 5.1 | 4.8 | 4.0 | 3.0 | 4.2 | 4.7 |

| (With

regard to expected demand | adequate | (79.7) | (81.8) | (82.2) | (82.2) | (83.0) | (83.8) |

| in

the next six months) | |

| |

| |

| |

14. | Employment

in the company | Increase | 17.9 | 18.1 | 18.3 | 17.4 | 16.7 | 14.6 |

|

| | (73.3) | (73.7) | (73.3) | (73.5) | (74.1) | (75.6) |

15. | Exports,

if applicable | Increase | 34.2 | 32.6 | 33.4 | 32.6 | 31.4 | 24.3 |

|

| | (57.2) | (57.3) | (56.8) | (55.6) | (55.9) | (58.3) |

16. | Imports,

if any | Increase | 23.4 | 20.8 | 21.6 | 23.7 | 20.8 | 20.1 |

|

| | (68.1) | (68) | (68.4) | (68.2) | (68.6) | (70.5) |

17. | Selling

prices are expected to | Increase | 16.8 | 14.2 | 15.5 | 19.0 | 13.0 | 14.9 |

|

| | (68.0) | (69.2) | (68.9) | (67.1) | (68.5) | (67.1) |

18. | If

increase expected in selling prices | Increase

at | 14.5 | 10.5 | 12.1 | 10.4 | 3.7 | 13.3 |

|

| lower rate | (67.0) | (68.1) | (66.7) | (65.0) | (58.9) | (66.7) |

19. | Profit

margin | Increase | 9.2 | 11.6 | 9.9 | 7.5 | 9.6 | 5.4 |

|

| | (60.6) | (61.7) | (62.5) | (62.6) | (59.6) | (60.0) |

Notes:

1.

'Net response' is measured as the percentage share differential between the companies

reporting 'optimistic' (positive) and 'pessimistic' (negative) responses; responses

indicating status quo (no change) are not reckoned. Higher 'net response' indicates

higher level of confidence and vice versa.

2. Figures in parentheses are the

percentages of respondents with 'no change over the preceding quarter' as responses. |

December 2007 over the preceding month. Reports from the survey panel

suggested favourable market conditions, leading to a sharp rise in volumes of

incoming new business, and inventory build up.

Forecasts by various agencies for real GDP growth in 2007-08 are set out

in Table 14.

Table : 14 : Projections of Real GDP for India by various Agencies - 2007-08 |

(per cent) |

Agency |

Latest Projection |

Earlier Projection |

|

Overall

Growth |

Agriculture |

Industry |

Services |

Month of

Projection |

Overall

Growth |

Month |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

ASSOCHAM |

9.0 |

3.5 |

10.0 |

10.5 |

December 2007 |

8.5-8.7 |

August 2007 |

JP Morgan |

8.6 |

2.6 |

9.8 |

10.0 |

September 2007 |

8.0 |

March 2007 |

Merrill Lynch |

8.8 |

4.0 |

9.5 |

10.0 |

September 2007 |

8.5 |

March 2007 |

ICRA |

9.0 |

- |

- |

- |

September 2007 |

8.5 |

April 2007 |

Citigroup |

9.3 |

3.0 |

10.0 |

11.0 |

September 2007 |

9.3 |

April 2007 |

CRISIL |

8.6 |

3.4 |

9.2 |

10.0 |

December 2007 |

7.9-8.4 |

March/ June 2007 |

Indicus Analytics |

8.4 |

2.7 |

8.5 |

10.1 |

October 2007 |

8.4 |

March 2007 |

CMIE |

9.1 |

3.9 |

9.4 |

10.7 |

January 2008 |

9.1 |

December 2007 |

NCAER |

8.9 |

3.8 |

9.0 |

10.6 |

October 2007 |

8.5 |

August 2007 |

Economic Advisory |

|

|

|

|

|

|

|

Council |

8.9 |

3.6 |

9.7 |

10.3 |

January 2008 |

9.0 |

July 2007 |

UNCTAD |

8.5 |

- |

- |

- |

September 2007 |

- |

- |

IMF |

8.9* |

- |

- |

- |

October 2007 |

9.0 * |

July 2007 |

ADB |

8.5 |

- |

- |

- |

September 2007 |

8.0 |

March 2007 |

RBI |

Around 8.5 |

- |

- |

- |

October 2007 |

Around 8.5 |

July 2007 |

- : Not Available.

* : Calendar year. |

|

IST,

IST,