|

Today, the Reserve Bank released the results of 107th round of its quarterly industrial outlook survey (IOS). The survey1 encapsulates qualitative assessment of the business climate by Indian manufacturing companies for Q2:2024-25 and their expectations for Q3:2024-25 as well as outlook on select parameters for the subsequent two quarters. In all, 1,300 companies responded in this round of the survey2, which was conducted during July-September 2024.

Highlights:

- Assessment for Q2:2024-25

- Manufacturing companies reported some moderation in demand expansion during Q2:2024-25 as reflected in their assessment on production, order books, capacity utilisation, employment and overall business situation (Table A).

- Pressures from cost of raw material, financing cost and salary outgo were assessed to have tempered and, in accordance, sentiments on growth in selling prices and profit margins also moderated.

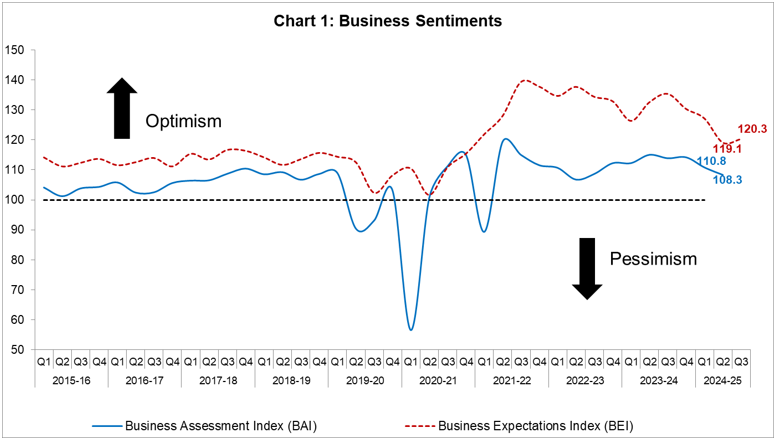

- The business assessment index (BAI) remained in expansion zone but moderated to 108.3 in Q2:2024-25 from 110.8 in the previous quarter (Chart 1).

- Expectations for Q3:2024-25

- Manufacturers maintained their optimism on demand conditions during Q3:2024-25.

- Cost of financing and salary outgo are likely to rise. Pressures from raw material cost are expected to ease, and selling price growth momentum may continue.

- The business expectations index (BEI) improved to 120.3 in Q3:2024-25 from 119.1 in the previous quarter (Chart 1).

- Expectations for Q4:2024-25 and Q1:2025-26

- Manufacturers polled for better expectations on production, order books, employment, capacity utilisation and overall business situation during Q4:2024-25 and Q1:2025-26 (Table B).

- Input cost pressures are likely to continue for manufacturers, who expect to retain pricing power and increase in selling prices on the back of robust demand conditions.

|

Table A: Summary of Net responses3 on Survey Parameters

|

|

(per cent)

|

Parameters |

Assessment period

|

Expectation period

|

|

Q1:2024-25

|

Q2:2024-25

|

Q2:2024-25

|

Q3:2024-25

|

|

Production

|

27.9

|

22.9

|

36.3

|

36.3

|

|

Order Books

|

25.6

|

19.5

|

35.2

|

33.3

|

|

Pending Orders

|

5.9

|

8.0

|

1.8

|

1.8

|

|

Capacity Utilisation

|

18.7

|

15.1

|

29.2

|

29.5

|

|

Inventory of Raw Materials

|

-5.9

|

-2.7

|

-8.3

|

-9.6

|

|

Inventory of Finished Goods

|

-5.5

|

-3.0

|

-7.7

|

-9.9

|

|

Exports

|

10.9

|

5.3

|

24.8

|

26.2

|

|

Imports

|

13.9

|

9.1

|

22.8

|

24.3

|

|

Employment

|

11.2

|

9.7

|

15.6

|

17.6

|

|

Financial Situation (Overall)

|

28.5

|

25.6

|

42.2

|

46.4

|

|

Availability of Finance

(from internal accruals)

|

23.0

|

18.1

|

31.8

|

32.1

|

|

Availability of Finance

(from banks & other sources)

|

20.0

|

14.4

|

27.2

|

26.7

|

|

Availability of Finance

(from overseas, if applicable)

|

9.8

|

5.1

|

16.9

|

20.2

|

|

Cost of Raw Material

|

-49.3

|

-38.7

|

-51.0

|

-47.6

|

|

Cost of Finance

|

-16.6

|

-10.2

|

-19.2

|

-20.2

|

|

Salary/ Other Remuneration

|

-41.7

|

-17.4

|

-26.1

|

-27.4

|

|

Selling Price

|

8.0

|

0.2

|

17.2

|

17.1

|

|

Profit Margin

|

-12.3

|

-10.2

|

9.9

|

13.6

|

|

Overall Business Situation

|

29.6

|

26.3

|

45.0

|

47.4

|

|

Table B: Business Expectations on Select Parameters for extended period – Net response

|

|

(per cent)

|

Parameters |

Round 106

|

Round 107

|

|

Q2:2024-25

|

Q3:2024-25

|

Q4:2024-25

|

Q1:2025-26

|

|

Overall Business Situation

|

45.0

|

47.4

|

53.6

|

53.0

|

|

Production

|

36.3

|

36.3

|

50.7

|

49.9

|

|

Order Books

|

35.2

|

33.3

|

47.2

|

48.5

|

|

Capacity Utilisation

|

29.2

|

29.5

|

47.2

|

46.0

|

|

Employment

|

15.6

|

17.6

|

28.1

|

29.7

|

|

Cost of Raw Materials

|

-51.0

|

-47.6

|

-46.2

|

-46.2

|

|

Selling Prices

|

17.2

|

17.1

|

28.9

|

29.5

|

Note: Please see the excel file for time series data

|

Table 1: Assessment and Expectations for Production

|

|

(Percentage responses)@

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

45.2

|

11.2

|

43.6

|

34

|

63

|

5

|

31.9

|

58

|

|

Q3:2023-24

|

1,040

|

41.2

|

12.2

|

46.7

|

29

|

70.9

|

5.7

|

23.4

|

65.1

|

|

Q4:2023-24

|

1,354

|

46.6

|

12.3

|

41.1

|

34.4

|

62.3

|

4.2

|

33.6

|

58.1

|

|

Q1:2024-25

|

1,351

|

41.4

|

13.6

|

45

|

27.9

|

60

|

6

|

34

|

54

|

|

Q2:2024-25

|

1,300

|

37.6

|

14.7

|

47.7

|

22.9

|

40.7

|

4.3

|

55

|

36.3

|

|

Q3:2024-25

|

|

|

|

|

|

40.5

|

4.3

|

55.2

|

36.3

|

|

‘Increase’ in production is optimistic.

|

|

@:Due to rounding off Percentage may not add up to 100.

|

|

Table 2: Assessment and Expectations for Order Books

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

41.1

|

10.4

|

48.5

|

30.7

|

63

|

4.8

|

32.2

|

58.1

|

|

Q3:2023-24

|

1,040

|

38.3

|

12

|

49.7

|

26.3

|

68.5

|

6.1

|

25.4

|

62.3

|

|

Q4:2023-24

|

1,354

|

43.4

|

11.6

|

44.9

|

31.8

|

61.8

|

6

|

32.1

|

55.8

|

|

Q1:2024-25

|

1,351

|

39.9

|

14.3

|

45.9

|

25.6

|

57.1

|

6

|

36.9

|

51.1

|

|

Q2:2024-25

|

1,300

|

35.3

|

15.8

|

48.9

|

19.5

|

39.4

|

4.2

|

56.3

|

35.2

|

|

Q3:2024-25

|

|

|

|

|

|

38.1

|

4.8

|

57

|

33.3

|

|

‘Increase’ in order books is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 3: Assessment and Expectations for Pending Orders

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Above Normal

|

Below Normal

|

Normal

|

Net response

|

Above Normal

|

Below Normal

|

Normal

|

Net response

|

|

Q2:2023-24

|

1,223

|

8.6

|

11.6

|

79.8

|

3.1

|

10.9

|

9.2

|

79.9

|

-1.7

|

|

Q3:2023-24

|

1,040

|

8.6

|

11.9

|

79.4

|

3.3

|

9.7

|

8.5

|

81.8

|

-1.1

|

|

Q4:2023-24

|

1,354

|

5.5

|

11.7

|

82.8

|

6.2

|

8.2

|

9.3

|

82.5

|

1.1

|

|

Q1:2024-25

|

1,351

|

5.7

|

11.6

|

82.7

|

5.9

|

6.4

|

8.1

|

85.5

|

1.8

|

|

Q2:2024-25

|

1,300

|

3.1

|

11.1

|

85.8

|

8

|

4.2

|

6

|

89.8

|

1.8

|

|

Q3:2024-25

|

|

|

|

|

|

3.8

|

5.6

|

90.5

|

1.8

|

|

Pending orders ‘Below Normal’ is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 4: Assessment and Expectations for Capacity Utilisation (Main Product)

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

38.2

|

8.7

|

53

|

29.5

|

51.8

|

5.2

|

42.9

|

46.6

|

|

Q3:2023-24

|

1,040

|

30.1

|

10.6

|

59.3

|

19.6

|

62.1

|

4.6

|

33.3

|

57.5

|

|

Q4:2023-24

|

1,354

|

34.9

|

9.9

|

55.2

|

24.9

|

51.2

|

4.6

|

44.2

|

46.7

|

|

Q1:2024-25

|

1,351

|

30.1

|

11.4

|

58.6

|

18.7

|

48.4

|

4.8

|

46.8

|

43.6

|

|

Q2:2024-25

|

1,300

|

25.1

|

10

|

65

|

15.1

|

33.2

|

4

|

62.9

|

29.2

|

|

Q3:2024-25

|

|

|

|

|

|

33.4

|

3.9

|

62.6

|

29.5

|

|

‘Increase’ in capacity utilisation is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 5: Level of capacity utilisation (compared to the average in preceding 4 quarters)

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Above Normal

|

Below Normal

|

Normal

|

Net response

|

Above Normal

|

Below Normal

|

Normal

|

Net response

|

|

Q2:2023-24

|

1,223

|

30.5

|

9

|

60.6

|

21.5

|

39

|

6

|

55.1

|

33

|

|

Q3:2023-24

|

1,040

|

26.2

|

9.4

|

64.4

|

16.7

|

36.1

|

6.1

|

57.8

|

30.1

|

|

Q4:2023-24

|

1,354

|

20

|

10.4

|

69.6

|

9.6

|

33.3

|

5.7

|

61.1

|

27.6

|

|

Q1:2024-25

|

1,351

|

16.2

|

11.7

|

72.1

|

4.6

|

22.5

|

7.1

|

70.4

|

15.4

|

|

Q2:2024-25

|

1,300

|

14.9

|

8.1

|

77

|

6.8

|

13.1

|

4.7

|

82.2

|

8.4

|

|

Q3:2024-25

|

|

|

|

|

|

14.4

|

3.8

|

81.8

|

10.5

|

|

‘Above Normal’ in Level of capacity utilisation is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 6: Assessment and Expectations for Assessment of Production Capacity (with regard to expected demand in next 6 months)

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

More than adequate

|

Less than adequate

|

Adequate

|

Net response

|

More than adequate

|

Less than adequate

|

Adequate

|

Net response

|

|

Q2:2023-24

|

1,223

|

23.3

|

4

|

72.7

|

19.3

|

43.4

|

3.9

|

52.7

|

39.5

|

|

Q3:2023-24

|

1,040

|

25.1

|

4.7

|

70.2

|

20.4

|

42.7

|

3.2

|

54.1

|

39.5

|

|

Q4:2023-24

|

1,354

|

17.7

|

5.6

|

76.7

|

12.1

|

38.5

|

3.6

|

57.9

|

34.9

|

|

Q1:2024-25

|

1,351

|

9.8

|

3.2

|

87

|

6.6

|

27.2

|

4.7

|

68.1

|

22.5

|

|

Q2:2024-25

|

1,300

|

6.9

|

2.1

|

90.9

|

4.8

|

14.7

|

2.5

|

82.8

|

12.3

|

|

Q3:2024-25

|

|

|

|

|

|

12.8

|

1.5

|

85.7

|

11.3

|

|

‘More than adequate’ in Assessment of Production Capacity is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 7: Assessment and Expectations for Exports

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

27.7

|

10

|

62.3

|

17.7

|

57.9

|

4.4

|

37.7

|

53.5

|

|

Q3:2023-24

|

1,040

|

25.1

|

13.5

|

61.3

|

11.6

|

58.1

|

5

|

36.9

|

53.1

|

|

Q4:2023-24

|

1,354

|

26.4

|

10.7

|

62.9

|

15.7

|

50.3

|

6.7

|

43

|

43.6

|

|

Q1:2024-25

|

1,351

|

23.7

|

12.8

|

63.4

|

10.9

|

41.6

|

5.5

|

52.9

|

36.1

|

|

Q2:2024-25

|

1,300

|

18.4

|

13.2

|

68.4

|

5.3

|

29.2

|

4.4

|

66.4

|

24.8

|

|

Q3:2024-25

|

|

|

|

|

|

31.2

|

5

|

63.9

|

26.2

|

|

‘Increase’ in exports is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 8: Assessment and Expectations for Imports

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

25.5

|

8.2

|

66.3

|

17.2

|

55.8

|

3.2

|

41

|

52.6

|

|

Q3:2023-24

|

1,040

|

23.2

|

8.7

|

68

|

14.5

|

54.8

|

3.9

|

41.3

|

51

|

|

Q4:2023-24

|

1,354

|

21.6

|

7.8

|

70.6

|

13.8

|

45.2

|

4.2

|

50.6

|

41

|

|

Q1:2024-25

|

1,351

|

21.6

|

7.7

|

70.7

|

13.9

|

35.2

|

4.1

|

60.7

|

31.1

|

|

Q2:2024-25

|

1,300

|

17.6

|

8.5

|

73.8

|

9.1

|

25.7

|

3

|

71.3

|

22.8

|

|

Q3:2024-25

|

|

|

|

|

|

28

|

3.6

|

68.4

|

24.3

|

|

‘Increase’ in imports is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 9: Assessment and Expectations for level of Raw Materials Inventory

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Above average

|

Below average

|

average

|

Net response

|

Above average

|

Below average

|

average

|

Net response

|

|

Q2:2023-24

|

1,223

|

11.5

|

5.3

|

83.2

|

-6.1

|

33

|

4

|

63.1

|

-29

|

|

Q3:2023-24

|

1,040

|

12.9

|

4.1

|

83

|

-8.9

|

30.9

|

3.6

|

65.6

|

-27.3

|

|

Q4:2023-24

|

1,354

|

13.3

|

6

|

80.7

|

-7.3

|

27.4

|

1.7

|

70.9

|

-25.7

|

|

Q1:2024-25

|

1,351

|

11.9

|

6

|

82.1

|

-5.9

|

20.2

|

3.9

|

75.9

|

-16.3

|

|

Q2:2024-25

|

1,300

|

8.8

|

6.1

|

85.1

|

-2.7

|

10.7

|

2.3

|

87

|

-8.3

|

|

Q3:2024-25

|

|

|

|

|

|

11.9

|

2.3

|

85.8

|

-9.6

|

|

‘Below average’ Inventory of raw materials is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 10: Assessment and Expectations for level of Finished Goods Inventory

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Above average

|

Below average

|

average

|

Net response

|

Above average

|

Below average

|

average

|

Net response

|

|

Q2:2023-24

|

1,223

|

11.7

|

4.5

|

83.7

|

-7.2

|

33.2

|

4.4

|

62.4

|

-28.8

|

|

Q3:2023-24

|

1,040

|

14

|

4.5

|

81.5

|

-9.5

|

31.4

|

3.3

|

65.3

|

-28.2

|

|

Q4:2023-24

|

1,354

|

12.4

|

6

|

81.7

|

-6.4

|

27.3

|

2

|

70.7

|

-25.3

|

|

Q1:2024-25

|

1,351

|

11.9

|

6.4

|

81.7

|

-5.5

|

20.1

|

3.9

|

75.9

|

-16.2

|

|

Q2:2024-25

|

1,300

|

9.5

|

6.5

|

84

|

-3

|

10.3

|

2.6

|

87.1

|

-7.7

|

|

Q3:2024-25

|

|

|

|

|

|

12.1

|

2.2

|

85.8

|

-9.9

|

|

‘Below average’ Inventory of finished goods is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 11: Assessment and Expectations for Employment Outlook

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

25.1

|

7.1

|

67.7

|

18

|

43.5

|

3

|

53.5

|

40.5

|

|

Q3:2023-24

|

1,040

|

25.1

|

6.9

|

67.9

|

18.2

|

42.5

|

3.7

|

53.8

|

38.8

|

|

Q4:2023-24

|

1,354

|

21.7

|

4.9

|

73.4

|

16.8

|

41.7

|

2.2

|

56.1

|

39.5

|

|

Q1:2024-25

|

1,351

|

18.5

|

7.3

|

74.1

|

11.2

|

31.3

|

2.2

|

66.5

|

29.1

|

|

Q2:2024-25

|

1,300

|

15.9

|

6.2

|

77.9

|

9.7

|

17.7

|

2.1

|

80.2

|

15.6

|

|

Q3:2024-25

|

|

|

|

|

|

19.3

|

1.6

|

79.1

|

17.6

|

|

‘Increase’ in employment is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 12: Assessment and Expectations for Overall Financial Situation

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Better

|

Worsen

|

No change

|

Net response

|

Better

|

Worsen

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

41.6

|

10.7

|

47.7

|

30.9

|

60.2

|

3.9

|

35.9

|

56.3

|

|

Q3:2023-24

|

1,040

|

36.8

|

11.2

|

52

|

25.6

|

68.7

|

5.1

|

26.2

|

63.5

|

|

Q4:2023-24

|

1,354

|

45

|

10.1

|

44.9

|

34.8

|

58.2

|

4

|

37.8

|

54.2

|

|

Q1:2024-25

|

1,351

|

40.9

|

12.4

|

46.7

|

28.5

|

59.2

|

5.2

|

35.6

|

54

|

|

Q2:2024-25

|

1,300

|

37.5

|

11.9

|

50.6

|

25.6

|

44.7

|

2.5

|

52.8

|

42.2

|

|

Q3:2024-25

|

|

|

|

|

|

49.1

|

2.7

|

48.1

|

46.4

|

|

‘Better’ overall financial situation is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 13: Assessment and Expectations for Working Capital Finance Requirement

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

38.4

|

5.1

|

56.6

|

33.3

|

53.3

|

2.2

|

44.4

|

51.1

|

|

Q3:2023-24

|

1,040

|

32.8

|

6.9

|

60.3

|

26

|

60.2

|

2.6

|

37.3

|

57.6

|

|

Q4:2023-24

|

1,354

|

37.5

|

4.7

|

57.8

|

32.8

|

49.6

|

2.9

|

47.6

|

46.7

|

|

Q1:2024-25

|

1,351

|

31.6

|

6.5

|

61.9

|

25.1

|

46.6

|

3

|

50.4

|

43.6

|

|

Q2:2024-25

|

1,300

|

24.1

|

4.7

|

71.2

|

19.4

|

32

|

2.1

|

66

|

29.9

|

|

Q3:2024-25

|

|

|

|

|

|

32.4

|

1.2

|

66.5

|

31.2

|

|

‘Increase’ in working capital finance is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 14: Assessment and Expectations for Availability of Finance (from Internal Accruals)

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Improve

|

Worsen

|

No change

|

Net response

|

Improve

|

Worsen

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

37.1

|

6.3

|

56.6

|

30.8

|

54.4

|

2.1

|

43.5

|

52.3

|

|

Q3:2023-24

|

1,040

|

30.6

|

6.9

|

62.5

|

23.7

|

61.6

|

2.5

|

35.9

|

59.1

|

|

Q4:2023-24

|

1,354

|

35.9

|

6

|

58

|

29.9

|

49.3

|

2

|

48.7

|

47.4

|

|

Q1:2024-25

|

1,351

|

29.5

|

6.5

|

64

|

23

|

47.7

|

2.9

|

49.4

|

44.8

|

|

Q2:2024-25

|

1,300

|

23.5

|

5.4

|

71.1

|

18.1

|

33

|

1.2

|

65.9

|

31.8

|

|

Q3:2024-25

|

|

|

|

|

|

32.9

|

0.8

|

66.3

|

32.1

|

|

‘Improvement’ in availability of finance is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 15: Assessment and Expectations for Availability of Finance (from banks and other sources)

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Improve

|

Worsen

|

No change

|

Net response

|

Improve

|

Worsen

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

34.9

|

5.7

|

59.4

|

29.1

|

50.5

|

1.5

|

47.9

|

49

|

|

Q3:2023-24

|

1,040

|

28.8

|

5.6

|

65.5

|

23.2

|

58.2

|

2.5

|

39.3

|

55.8

|

|

Q4:2023-24

|

1,354

|

31.2

|

5.1

|

63.6

|

26.1

|

46.5

|

2.1

|

51.4

|

44.5

|

|

Q1:2024-25

|

1,351

|

25.9

|

5.9

|

68.3

|

20

|

43.2

|

2.8

|

54

|

40.5

|

|

Q2:2024-25

|

1,300

|

18.7

|

4.3

|

77

|

14.4

|

28.7

|

1.4

|

69.9

|

27.2

|

|

Q3:2024-25

|

|

|

|

|

|

27.4

|

0.7

|

72

|

26.7

|

|

‘Improvement’ in availability of finance is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 16: Assessment and Expectations for Availability of Finance (from overseas, if applicable)

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Improve

|

Worsen

|

No change

|

Net response

|

Improve

|

Worsen

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

24.3

|

5.7

|

69.9

|

18.6

|

52.4

|

2

|

45.7

|

50.4

|

|

Q3:2023-24

|

1,040

|

20.2

|

6

|

73.9

|

14.2

|

56.4

|

2.9

|

40.7

|

53.5

|

|

Q4:2023-24

|

1,354

|

21.2

|

5.2

|

73.6

|

15.9

|

45.3

|

1.4

|

53.4

|

43.9

|

|

Q1:2024-25

|

1,351

|

16.2

|

6.5

|

77.3

|

9.8

|

35.9

|

2.7

|

61.5

|

33.2

|

|

Q2:2024-25

|

1,300

|

9.4

|

4.3

|

86.4

|

5.1

|

18.1

|

1.2

|

80.7

|

16.9

|

|

Q3:2024-25

|

|

|

|

|

|

20.6

|

0.4

|

79

|

20.2

|

|

‘Improvement’ in availability of finance is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 17: Assessment and Expectations for Cost of Finance

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

33

|

6.6

|

60.4

|

-26.4

|

56.4

|

2.2

|

41.5

|

-54.2

|

|

Q3:2023-24

|

1,040

|

29.2

|

6.8

|

64

|

-22.5

|

58.5

|

3.6

|

37.9

|

-54.9

|

|

Q4:2023-24

|

1,354

|

31.3

|

6.5

|

62.3

|

-24.8

|

48.8

|

2.9

|

48.3

|

-45.9

|

|

Q1:2024-25

|

1,351

|

23.3

|

6.7

|

70

|

-16.6

|

40.3

|

4.1

|

55.6

|

-36.3

|

|

Q2:2024-25

|

1,300

|

14.3

|

4.1

|

81.6

|

-10.2

|

22.1

|

2.9

|

75

|

-19.2

|

|

Q3:2024-25

|

|

|

|

|

|

22.2

|

2

|

75.8

|

-20.2

|

|

‘Decrease’ in cost of finance is optimistic. Footnote ‘@’ given in Table 1 is applicable here. The column heads, namely ‘Increase’ and ‘Decrease’ in data releases for rounds 82-87 were interchanged and should be read as above.

|

|

Table 18: Assessment and Expectations for Cost of Raw Materials

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

49.3

|

5.5

|

45.3

|

-43.8

|

60.6

|

2.4

|

37

|

-58.3

|

|

Q3:2023-24

|

1,040

|

41.8

|

8.4

|

49.7

|

-33.4

|

67.8

|

2.8

|

29.3

|

-65

|

|

Q4:2023-24

|

1,354

|

50.2

|

6.3

|

43.5

|

-43.8

|

57

|

2.9

|

40.1

|

-54.2

|

|

Q1:2024-25

|

1,351

|

53.9

|

4.6

|

41.5

|

-49.3

|

55.9

|

3.1

|

40.9

|

-52.8

|

|

Q2:2024-25

|

1,300

|

44.5

|

5.8

|

49.8

|

-38.7

|

52.1

|

1.1

|

46.9

|

-51

|

|

Q3:2024-25

|

|

|

|

|

|

49.2

|

1.6

|

49.3

|

-47.6

|

|

‘Decrease’ in cost of raw materials is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 19: Assessment and Expectations for Salary/Other Remuneration

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

32.3

|

3.5

|

64.2

|

-28.8

|

49.8

|

0.5

|

49.7

|

-49.3

|

|

Q3:2023-24

|

1,040

|

30.3

|

4.1

|

65.7

|

-26.2

|

47.3

|

1.7

|

51

|

-45.6

|

|

Q4:2023-24

|

1,354

|

26.1

|

1.8

|

72.1

|

-24.3

|

42.9

|

0.9

|

56.2

|

-42

|

|

Q1:2024-25

|

1,351

|

42.9

|

1.2

|

55.9

|

-41.7

|

52.9

|

0.9

|

46.2

|

-51.9

|

|

Q2:2024-25

|

1,300

|

18.8

|

1.4

|

79.8

|

-17.4

|

26.7

|

0.6

|

72.7

|

-26.1

|

|

Q3:2024-25

|

|

|

|

|

|

27.8

|

0.3

|

71.9

|

-27.4

|

|

‘Decrease’ in Salary / other remuneration is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 20: Assessment and Expectations for Selling Price

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

22.3

|

10.6

|

67.1

|

11.7

|

46.9

|

5.4

|

47.7

|

41.4

|

|

Q3:2023-24

|

1,040

|

22

|

11.9

|

66.1

|

10.2

|

45.2

|

5.2

|

49.6

|

40.1

|

|

Q4:2023-24

|

1,354

|

18.9

|

10.8

|

70.3

|

8.1

|

40.4

|

5.6

|

54

|

34.8

|

|

Q1:2024-25

|

1,351

|

18.5

|

10.5

|

71

|

8

|

30.5

|

5.7

|

63.8

|

24.7

|

|

Q2:2024-25

|

1,300

|

10.9

|

10.7

|

78.4

|

0.2

|

20.3

|

3.1

|

76.5

|

17.2

|

|

Q3:2024-25

|

|

|

|

|

|

19.3

|

2.2

|

78.5

|

17.1

|

|

‘Increase’ in selling price is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 21: Assessment and Expectations for Profit Margin

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Increase

|

Decrease

|

No change

|

Net response

|

Increase

|

Decrease

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

21.9

|

17.4

|

60.7

|

4.5

|

43.8

|

8.1

|

48.1

|

35.7

|

|

Q3:2023-24

|

1,040

|

20.5

|

19.1

|

60.4

|

1.4

|

45.5

|

9.7

|

44.8

|

35.8

|

|

Q4:2023-24

|

1,354

|

17.2

|

20.6

|

62.1

|

-3.4

|

40.3

|

9.5

|

50.2

|

30.8

|

|

Q1:2024-25

|

1,351

|

13

|

25.3

|

61.7

|

-12.3

|

30.4

|

10.4

|

59.2

|

20

|

|

Q2:2024-25

|

1,300

|

12.2

|

22.4

|

65.4

|

-10.2

|

16.7

|

6.8

|

76.4

|

9.9

|

|

Q3:2024-25

|

|

|

|

|

|

19.4

|

5.8

|

74.9

|

13.6

|

|

‘Increase’ in profit margin is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 22: Assessment and Expectations for Overall Business Situation

|

|

(Percentage responses)

|

|

Quarter

|

Total response

|

Assessment

|

Expectations

|

|

Better

|

Worsen

|

No change

|

Net response

|

Better

|

Worsen

|

No change

|

Net response

|

|

Q2:2023-24

|

1,223

|

46

|

11.8

|

42.2

|

34.3

|

65

|

4.3

|

30.7

|

60.7

|

|

Q3:2023-24

|

1,040

|

40.6

|

12

|

47.4

|

28.6

|

73.1

|

5.2

|

21.7

|

67.9

|

|

Q4:2023-24

|

1,354

|

47.2

|

11.3

|

41.4

|

35.9

|

62.5

|

4.2

|

33.3

|

58.3

|

|

Q1:2024-25

|

1,351

|

42.7

|

13.1

|

44.2

|

29.6

|

62

|

5.5

|

32.5

|

56.5

|

|

Q2:2024-25

|

1,300

|

39.7

|

13.3

|

47

|

26.3

|

47.4

|

2.5

|

50.1

|

45

|

|

Q3:2024-25

|

|

|

|

|

|

51.2

|

3.9

|

44.9

|

47.4

|

|

‘Better’ Overall Business Situation is optimistic. Footnote ‘@’ given in Table 1 is applicable here.

|

|

Table 23: Business Sentiments4

|

|

Quarter

|

Business Assessment Index (BAI)

|

Business Expectations Index (BEI)

|

|

Q2:2023-24

|

115.0

|

132.5

|

|

Q3:2023-24

|

113.9

|

135.4

|

|

Q4:2023-24

|

114.2

|

130.3

|

|

Q1:2024-25

|

110.8

|

127.2

|

|

Q2:2024-25

|

108.3

|

119.1

|

|

Q3:2024-25

|

|

120.3

|

[1] The survey results reflect the respondents’ views, which are not necessarily shared by the Reserve Bank.

[2] Results of the previous survey round were released on the Bank’s website on August 08, 2024.

[3] Net Response (NR) is the difference between the percentage of respondents reporting optimism and those reporting pessimism. It ranges between -100 to 100. Any value greater than zero indicates expansion/optimism and any value less than zero indicates contraction/pessimism. In other words, NR = (I – D), where, I is the percentage response of ‘Increase/optimism’, and D is the percentage response of ‘Decrease/pessimism’ and E is the percentage response as ‘no change/equal’ (i.e., I+D+E=100). For example, increase in production is optimism whereas decrease in cost of raw material is optimism.

[4] For each survey round, two summary indices are computed – one based on assessment [viz., Business Assessment Index (BAI)] and another based on expectations [viz., Business Expectations Index (BEI)]. Each index is a composite indicator calculated as a simple average of nine business parameters, where each parameter is derived as a weighted net response, weights being the share of industry groups in gross value added (GVA). The nine parameters considered are: (1) overall business situation; (2) production; (3) order books; (4) inventory of raw material; (5) inventory of finished goods; (6) profit margins; (7) employment; (8) exports; and (9) capacity utilisation. BAI/BEI gives a snapshot of the business outlook in every quarter and takes values between 0 and 200, with 100 being the threshold separating expansion from contraction.

|

IST,

IST,