IST,

IST,

Non-Banking Financial Institutions

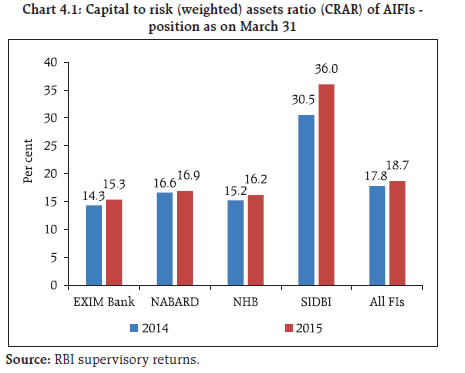

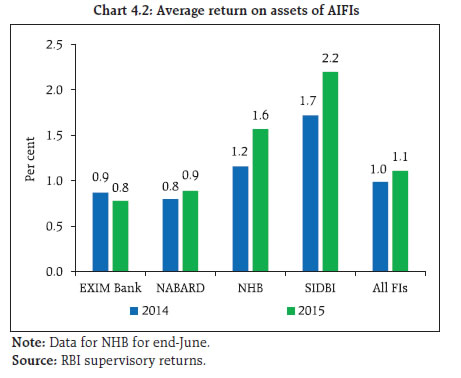

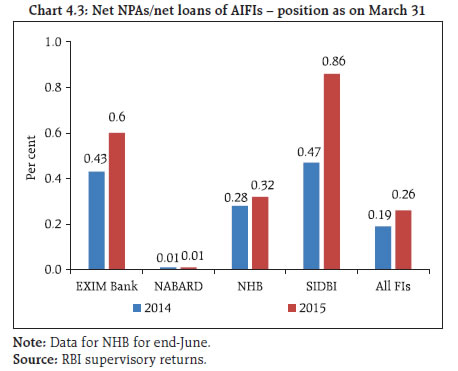

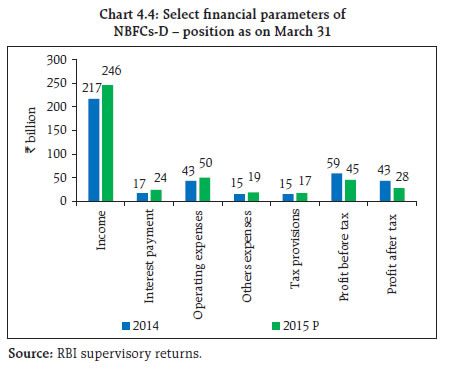

Introduction 4.1 All India Financial Institutions (AIFIs), Non- Banking Financial Companies (NBFCs) and Primary Dealers (PDs) form three important segments of the Non-Banking Financial Institutions (NBFIs) sector in India that are regulated and supervised by the Reserve Bank. AIFIs constitute institutional mechanism entrusted with providing sector-specific long-term financing. NBFCs comprising mostly private sector institutions, provide a variety of financial services including equipment leasing, hire purchase, loans, and investments. Primary dealers (PDs) play a crucial role in fostering both the primary and secondary government securities markets. The operational and financial performance of NBFIs sector is presented in this chapter. All India financial institutions (AIFIs) 4.2 Currently, the four AIFIs regulated and supervised by the Reserve Bank are Export-Import Bank of India (EXIM Bank), National Bank for Agriculture and Rural Development (NABARD), National Housing Bank (NHB) and Small Industries Development Bank of India (SIDBI). They play a salutary role in the financial markets through credit extension and refinancing operation activities and cater to the long-term financing needs of the industrial sector. Financial performance Balance sheet of AIFIs 4.3 The consolidated balance sheet of the AIFIs expanded by 9 per cent during 2014-15 reflecting moderation from double-digit expansion in the previous couple of years (Table 4.1). Loans and advances posted a growth of 11.3 per cent while deposits and borrowings increased by 17 and 9.7 per cent, respectively during 2014-15. AIFIs, during the year, raised short-term funds mainly by floating commercial papers, which are capped under the umbrella limit1. Financial indicators 4.4 AIFIs posted modest growth in income during 2014-15 owing to low growth in interest income and decline in non-interest income even while income from bill discounting/ rediscounting shrunk substantially (Table 4.2). However, AIFIs fared better on the profitability front as both their operating profit and net profit increased significantly during the year. 4.5 AIFIs maintained capital in excess of the stipulated norm and their capital adequacy position comparatively improved during the year (Chart 4.1). 4.6 On the whole, the FIs enjoyed higher returns on their assets during the year barring EXIM Bank whose return on assets was marginally lower (Chart 4.2). 4.7 The asset quality of FIs deteriorated marginally and net non-performing advances (NPAs) as percentage to loans increased from 0.19 per cent in 2013-14 to 0.26 per cent in 2014-15 (Chart 4.3). Nevertheless, the stressed asset position of these four FIs remained comparatively better than that of the commercial banks and other NBFCs. Non-banking financial companies (NBFCs) 4.8 Based on their liability structure, the NBFCs are classified into two broad categories: (a) Deposit taking NBFCs, and (b) Non-deposit taking NBFCs. As on March 31, 2015, there were 11,842 NBFCs registered with the Reserve Bank; out of which 220 were deposit-taking (NBFCs-D) and 11,622 were non-deposit taking (NBFCs-ND) entities. The two existing residual Non-Banking Finance Companies (RNBCs)2 are in the process of winding up their businesses. 4.9 The role of NBFC sector in the Indian financial system has become critical in terms of its size, spread and niche areas of operations. Many of the larger NBFCs have grown bigger and become more connected with other financial entities, necessitating periodical review of the regulatory framework for this sector. During the year, the Reserve Bank, with a view to addressing the regulatory gaps, arbitrage and risks associated with NBFCs, initiated a host of measures to strengthen regulation and supervision of NBFCs and harmonise their regulations with those of the banks in a phased manner as also to foster financial stability. Deposit-taking NBFCs (NBFCs-D) 4.10 The Reserve Bank, as part of deliberate policy, has been discouraging the NBFCs from engaging in deposit mobilisation activities, with a view to protecting depositors’ interests as also fostering financial stability. The regulations for the NBFCs-D have been strengthened so that only the sound and well-functioning entities remain in business. Financial performance Balance sheet of deposit-taking NBFCs 4.11 The balance sheet of NBFCs-D expanded by 2.1 per cent during the year (Table 4.3). Loans and advances, which constituted close to three-fourth of their assets, rose marginally whereas investment activities of NBFCs-D witnessed a sharp rise during the year. On the liability side, the expansion was mainly in terms of public deposits, and bank borrowings. Borrowings from banks still constituted the largest source of funding for NBFCs-D. Mobilisation of funds through debentures, which constituted the second biggest source of funding, declined during the year. Borrowing through commercial papers also declined sharply during the year. Financial indicators 4.12 As compared to the previous year, growth in profitability declined during 2014-15 which inter alia may be attributed to increased interest payment burden and higher operating expenses (Chart 4.4). Asset quality of NBFCs-D 4.13 Asset quality of NBFCs-D deteriorated as both gross and net NPAs increased during 2014-15 (Chart 4.5). Category-wise, deterioration in asset quality was more in respect of the Asset Finance Companies (AFCs) as compared to the Loan Companies (LCs)3. Non-deposit taking systemically important NBFCs (NBFCs-ND-SI) Financial performance 4.14 Non-deposit taking NBFCs with an asset size of ₹1 billion or more were being classified as systemically important NBFCs (NBFCs-ND-SI) till November 2014. Since then, an upward revision in the asset size criterion for classifying NBFCs-ND-SI4 has been effected, which now stands at ₹5 billion. During 2014-15, the balance sheet of NBFCs-ND-SI expanded significantly on the back of marked growth in disbursement of loans and advances on the asset side and sharp rise in borrowings on the liability side (Table 4.4). 4.15 Loans and advances extended by NBFCs-NDSI posted significant growth at 15.5 per cent during 2014-15, in contrast to the slowdown in commercial bank’s non-food credit during the same period (Chart 4.6). Strong growth in credit extended by the NBFC - Infrastructure finance companies (IFCs), microfinance companies and loan companies contributed to sturdy growth in the loan portfolio of NBFCs-ND-SI. Among the sectors, infrastructure, medium and large-scale industries, and the transport sectors contributed to strong growth in credit off-take of the NBFCs-ND-SI. 4.16 During 2014-15, NBFCs-ND-SI raised funds mainly through debentures and commercial papers. Borrowings from banks, which earlier constituted the main source of funding, has been progressively reduced. A notable feature is the rising exposure of mutual funds to the financial instruments floated mainly by the NBFC-IFCs, LCs and NBFC-Micro Finance Institutions (NBFC-MFIs). Financial indicators 4.17 Profitability of the NBFCs-ND-SI improved significantly as at end-March 2015 (Chart 4.7). Net profit as a ratio to total income remained in double-digits and higher than last year’s level. 4.18 Nevertheless, asset quality of systemically important NBFCs continued to deteriorate and the NPA ratio rose marginally compared to the previous year (Chart 4.8). Amongst the NBFCs-ND-SI, LCs accounted for the major chunk of NPAs followed by NBFC-IFCs and AFCs as at end-March 2015. The asset quality of the NBFC-MFIs witnessed some improvement albeit it still remained at an elevated level. 4.19 NPAs of the NBFCs-ND-SI sector were primarily concentrated in infrastructure sector, transport operator segment, and medium and large scale industries. However, the systemically important NBFCs remained well-capitalised. The capital adequacy ratio of these entities remained far above the mandated level of 15 per cent. Primary dealers (PDs) 4.20 As on March 31, 2015, 20 Primary Dealers (PDs) were operating in Indian financial market. Of these, 13 were bank-PDs while seven were standalone PDs. All the PDs achieved a higher success ratio (bids accepted to bidding commitment) than the previous year and this remained way above the mandated ratio of 40 per cent during 2014-15. In the auctions of dated securities, the share of the PDs (bids accepted to the securities issued) increased marginally during 2014-15 to 51.8 per cent. Devolvement pressure on the PDs remained comparatively lower during the year. Partial devolvement on the PDs took place on two instances involving ₹ 52.7 billion during 2014-15 as compared to 12 instances for ₹ 174.5 billion during 2013-14. Financial performance of standalone primary dealers (PDs) 4.21 All the seven standalone PDs posted profit during 2014-15. Profitability increased due to softening of yields during the year. (Chart 4.9). 4.22 Standalone PDs held more risk-weighted assets during the year (Chart 4.10). The capital adequacy position of the PDs declined during the year to 39.6 per cent from 48.7 per cent as at end of March 2014. However, their capital adequacy position was well above the regulatory stipulation of 15 per cent. The PDs were able to meet all their primary and secondary market regulatory requirements during the period. Overall assessment 4.23 The dynamics of the NBFCs sector is reflective of its evolving role in niche areas of specialised services. Operationally, the sector remained relatively stronger vis-à-vis the commercial banks in terms of capital adequacy and profitability. There has also been certain amount of consolidation in the NBFCs space, with some larger-sized NBFCs having grown bigger and becoming well-connected with other financial entities, which has financial stability implications. Asset quality of the entire NBFIs sector also suffered deterioration in recent years. 4.24 In order to address the issue of recovery of bad loans, bigger NBFCs, with an asset size of ₹ 5 billion and above, have been proposed to be brought under the SARFAESI Act, 20025. With a view to address the regulatory gaps and arbitrage owing to differentiated regulation for the NBFCs vis-à-vis commercial banks and risks associated with NBFCs, the Reserve Bank has revised regulatory framework. The revised regulatory framework, put in place in November 2014, aimed at addressing gaps in regulations of NBFCs and harmonising regulation with that of the commercial banks. Some of the important changes inter alia include raising of net owned funds (NOF) for the NBFCs to ₹ 10 million by March 2016 and ₹ 20 million by March 2017, rating requirement for all unrated deposit-taking AFCs by March 31, 2016 for being eligible for acceptance of public deposits, fixing of threshold of ₹ 5 billion for all the NBFCs-ND for being considered systemically important, and harmonisation of the asset classification norms for NBFCs-ND-SI and NBFCs-D in line with that of banks, in a phased manner. The entire regulatory framework was revised with a view to transforming over time to an activity-based regulation of NBFCs while ensuring that NBFCs having low risk profiles would be lightly regulated. 4.25 Notwithstanding such interventions, bringing the credit intermediation activities of a number of small entities, organised and unorganised, which operate as shadow banking entities outside regulatory oversight, within the regulatory jurisdiction remains a challenge. The Reserve Bank has been, from time to time, through its outreach, sensitisation programmes and public notices, sensitising public not to fall prey to such entities. To deal with delinquent and unauthorised entities, State Level Coordination Committee (SLCC) was reconstituted in May 2014 with active state level intervention to facilitate regular sharing of market intelligence and effective coordinated timely action. 1 AIFIs are allowed to mobilise resources within the overall ‘umbrella limit’, which is linked to the net owned funds (NOF) of the FI concerned as per its latest audited balance sheet. The umbrella limit is applicable for five instruments viz., term deposits, term money borrowings, certificates of deposits (CDs), commercial papers (CPs) and inter-corporate deposits. 2 RNBCs in the process of winding up are: Peerless General Finance and Investment Ltd. and Sahara India Financial Corporation Ltd. (SIFCL). 3 Asset finance company (AFC): AFC is a non-bank financial company, carrying on the principal business of financing of physical assets. Investment company. Loan company (LC): LC is non-bank financial company, carrying on the principal business of providing loans or advances for any activity other than its own but does not include AFC. 4 For the sake of comparability, however, in the present analysis, old definition of NBFCs-ND-SI has been considered. 5 Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. |

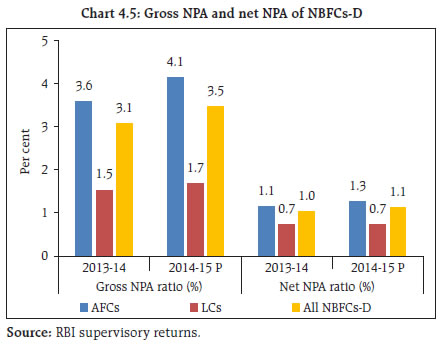

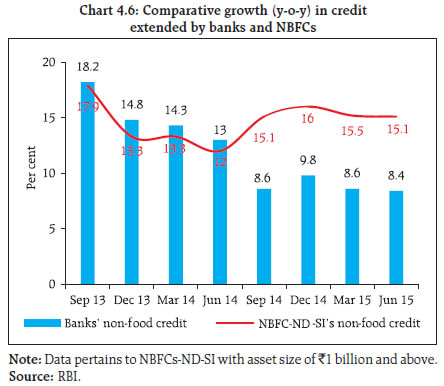

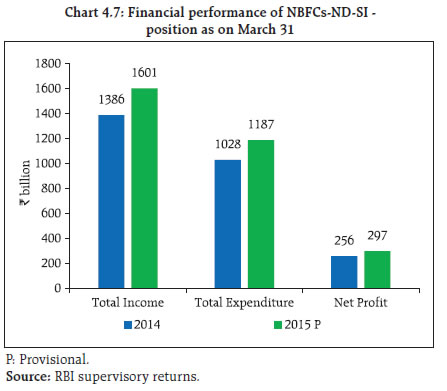

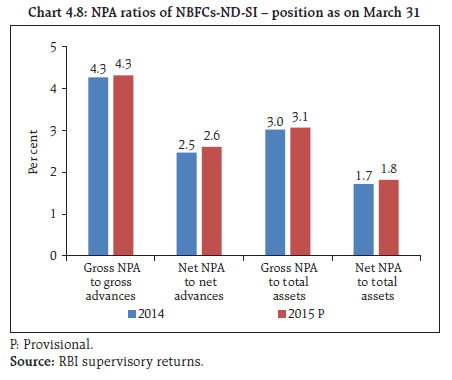

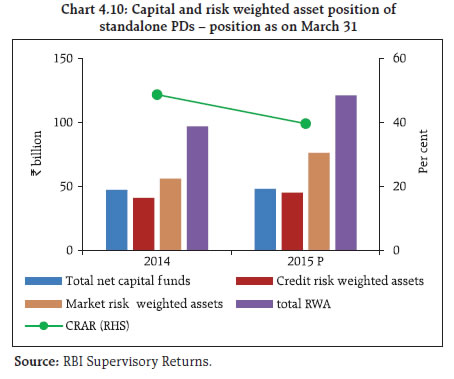

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: