IST,

IST,

Operations and Performance of Commercial Banks (Part 3 of 3)

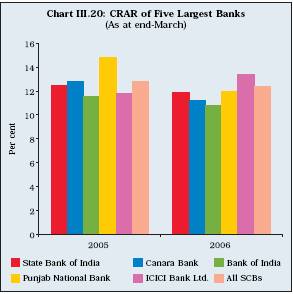

and United Western Bank)5 in the old private sector group, was above the minimum capital requirement of nine per cent. The CRAR of as many as 78 banks was above 10 per cent (Table III.38 and Appendix Table III.30). At this level, commercial banks on the whole should be able to meet the Basel II standards of capital adequacy. 6. Banksí Operations in the Capital Market

3.88 Six public sector banks accessing the capital market were Allahabad Bank, Oriental Bank of Commerce, Syndicate Bank, Andhra Bank, Bank of Baroda and Union Bank of India (Table III.40). Five private sector banks, which raised resources from the capital market during the year were Lakshmi Vilas Bank Ltd., Yes Bank Ltd., ICICI Bank Ltd., the South Indian Bank Ltd. and the United Western Bank Ltd.

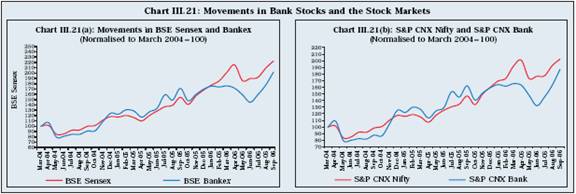

Performance of Banking Stocks in the Secondary Market 3.90 Continuing the trend of the previous year, the stock markets in India witnessed buoyant conditions during 2005-06 on the back of strong FIIs inflows, driven mainly by robust macroeconomic fundamentals and strong corporate profitability. The BSE Sensex closed at an all-time high level of 12,612.38 on May 10, 2006. However, immediately thereafter, the domestic stock markets witnessed a sharp correction in line with major international equity markets, especially emerging markets, mainly due to sharp decline in base metal prices on London Metal Exchange (LME) and fears of further rise in US interest rates. Heavy net sales by FIIs in the Indian equity market, concerns over sharp rise in global crude oil prices and depreciation of rupee vis-‡-vis major currencies also dampened the market sentiment. The BSE Sensex touched 8,929 on June 14, 2006, registering a decline of 20.8 per cent over end-March 2006. Stock markets, however, recouped the losses as the BSE sensex reached a new high of 13,131 on November 3, 2006, reflecting fresh buying by FIIs, strong macroeconomic fundamentals, robust corporate performance and recovery in major international stock markets.

3.91 In line with the general uptrend, banking sector stocks also remained firm up to December 2005 [Chart III.21(a) and 21(b)]. Apart from favourable macroeconomic fundamentals, bank stocks were driven by some sector-specific developments. The progress of the banking sector reforms along with improvement in bankís balance sheets resulted in an increased interest in bank stocks. Banking sector scrips also gained due to several other factors such as, permission to banks to issue perpetual bonds and other hybrid instruments, favourable proposals in the Union Budget, 2006-07 relating to the banking sector such as conversion of non-tradable special securities into tradable SLR Government of India dated securities and inclusion of fixed deposits of scheduled banks of term not less than five years in Section 80C of the Income Tax Act. 3.92 Beginning January 2006, however, market participants revised downward their expectations of future earnings by banks on account of several factors such as uncertainty of interest rates, hikes in the US Fed Rate, lower than expected financial results of some major banks, concerns over rise in cost of funds of banks and squeeze in banksí profits due to increased loan provisioning and depreciation of investments. Reflecting this, the banking sector stocks underperformed the market during January to June 2006. However, performance of bank stocks improved begining July 2006 due to strong expectations of higher earnings and overall recovery in the stock market. The banking stocks, which underperformed in comparison with the general market and important sectoral indices during 2005-06, outperformed both the market and sectoral indices during 2006-07 (April-September) (Table III.42). 3.93 The returns generated by the banking stocks during 2005-06 at 36.8 per cent were higher than those in the previous year (28.6 per cent). The increase in returns during 2005-06 was particularly significant when viewed along with low volatility (measured in terms of co-efficient of variation) of banking stocks (Table III.43).

3.94 At an individual bank level, the scrips of most of public and private sector banks witnessed gains during 2005-06, except Oriental Bank of Commerce, Karur Vysya Bank Ltd. and Bank of Punjab Ltd. Among the public sector banks, the major gainers during 2005-06 were: State Bank of Mysore (90.3 per cent), Bank of India (72.8 per cent), Syndicate Bank (71.3 per cent), Allahabad Bank (65.8 per cent), Indian Overseas Bank (57.7 per cent), Andhra Bank (53.3 per cent), State Bank of Travancore (52.2 per cent) and State Bank of India (49.6 per cent). Among the private sector banks, the major gainers during 2005-06 included Kotak Mahindra Bank Ltd. (115.6 per cent), Karnataka Bank Ltd. (94.1 per cent), Centurion Bank of Punjab Ltd. (73.6 per cent), UTI Bank Ltd. (70.6 per cent), ICICI Bank Ltd. (63.5 per cent) and HDFC Bank Ltd. (50.5 per cent). The price/earning ratio of both public and private sector banks ranged widely. At end-March 2006, while the P/E ratio of public sector banks ranged between 5.0 and 26.0, the P/E ratio of private sector banks ranged between 4.8 and 143.6 with one bank (United Western Bank) having negative P/E ratio (Table III.44). Shareholding Pattern in Public Sector Banks 3.96 The process of diversification of ownership of public sector banks continued during 2005-06. The number of public sector banks in which private shareholding ranged between 40-49 per cent increased from six at end-March 2005 to 11 as at end-March 2006. In three public sector banks, the private shareholding ranged between 30-40 per cent, and in another three between 20-30 per cent. However, there were still four public sector banks in which Government shareholding was more than 90 per cent (Table III.46 and Appendix Table III.31). 3.97 Foreign Financial Institutions (FFIs) continued to show interest in Indian banks during 2005-06. As at end-March 2006, there were 20 Indian banks (twelve public sectors banks, five new private sector banks and three old private sector banks) in which shareholding of Financial Institutions (Non-Resident) was more than 10 per cent (Table III.47).

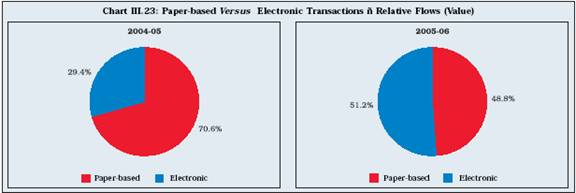

banking sector has made a quantum leap forward in terms of switching over from paper-based transactions, which include use of currency notes, cheques or challans, to electronic means, which include Real Time Gross Settlement (RTGS), National Electronic Fund Transfer (NEFT) and other electronic modes. Computerisation of banking business received high importance in 2005-06. For this purpose, banks invested heavily in technology. Between September 1999 and March 2006, public sector banks incurred an expenditure of Rs.10,676 crore on computerisation and development of communication networks (Appendix Table III.32). 3.99 The number of branches providing ëcore banking solutionsí (CBS) has increased significantly in recent years. The CBS provides a host of benefits such as ëanywhere bankingí, ëanywhere accessí and quick funds movement at optimal costs and in an efficient manner. While new private sector banks, foreign banks and a few old private sector banks have already put in place core banking solutions, public sector banks are increasingly adopting similar systems. The total number of branches providing CBS increased from 11.0 per cent as on March 31, 2005 to 28.9 per cent as on March 31, 2006 (Table III.48 and Appendix Table III.33). Many of the PSBs having fully computerised branches adopted CBS during the year.

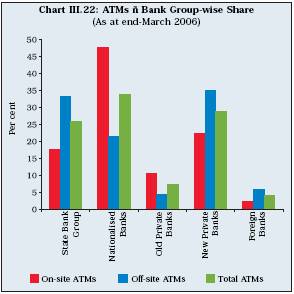

3.100 More than 95 per cent branches of public sector banks at end-March 2006 were fully or partially computerised. Out of 27 public sector banks, branches of as many as ten public sector banks were 100 per cent computerised, while branches of another 12 banks were more than 50 per cent computerised (Table III.49). Branches of only five PSBs were less than 50 per cent computerised. 3.101 Total number of ATMs installed by the banks were 21,147 at end-March 2006. Nationalised banks accounted for the largest share of installed ATMs, followed by the new private sector banks, SBI group, old private sector banks and foreign banks (Table III.50). While SBI group, new private sector banks and foreign banks had more off-site ATMs, nationalised and old private sector banks had more on-site ATMs (Chart III.22).

3.103 Convenience and easy acceptability of credit cards and technological advances have resulted in a continuous rise in retail electronic and card-based mode of payments. The volume and value of card and electronic based payments more than doubled in 2006 from the previous year (Table III.51).

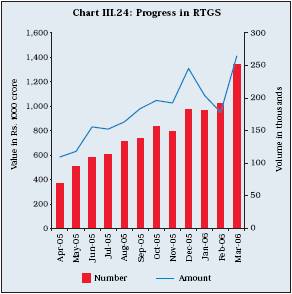

3.105 The RTGS was operationalised on March 26, 2004. Its usage for transfer of funds, especially for large values and for systemically important purposes, has increased since then. The inter-bank paper-based clearing was discontinued at all the RBI centres from June 2005. All inter-bank transactions are now settled through RTGS. Apart from inter-bank funds transfer, the RTGS system facilitates customer transactions. As at end-March 2005, the number of RTGS branches reached about 23,000. The volume crossed 200,000 transactions a month by March 2006 (Chart III.24).

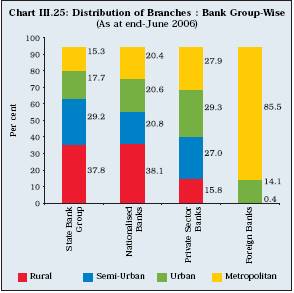

3.106 The total number of branches of SCBs at end-June 2006 increased to 69,417 (from 68,549 at end-June 2005), comprising 30,776 rural branches, 15,370 semi-urban branches and 23,271 urban and metropolitan branches. The share of rural branches declined further to 44.3 per cent during 2005-06 from 44.9 per cent in the previous year, while those of metropolitan branches increased marginally from 16.0 per cent to 16.2 per cent. The share of semi-urban and urban branches during the year remained almost unchanged at around 22.0 per cent and 17.0 per cent, respectively. The decline in the share of rural branches was on account of a large number of new branches opened in the urban and metropolitan centres (Chart III.25 and Appendix Table III.35). 3.107 The top hundred centres arranged according to the size of deposits accounted for 67.0 per cent of total deposits, and the top hundred centres arranged according to the size of bank credit accounted for 76.5 per cent of total bank credit at end-March 2006 (Table III.53). The share of top hundred centres in total deposits and total bank credit increased from their respective levels at end-March 2005.

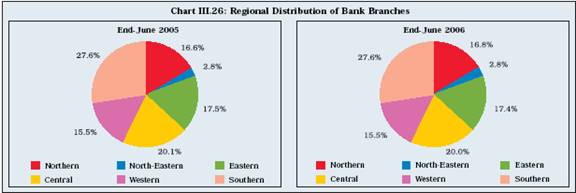

3.108 The Southern region continued to account for the highest percentage of existing bank branches, followed by the Central, the Eastern, the Northern and the Western regions. The share of North-Eastern region remained low at 2.8 per cent at end-March 2006. During 2005-06, most of the new branches were opened in the Northern (286) and Southern (252) regions. The average population served by a single bank branch in various regions remained more or less at the previous yearís level (Chart III.26 and Appendix Table III.36).

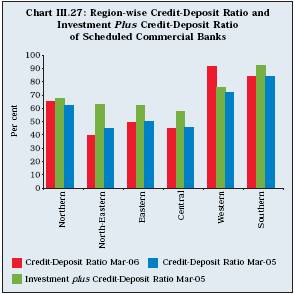

3.109 The all-India C-D ratio (as per sanctions) increased sharply to 72.5 per cent at end-March 2006 from 66.0 per cent at end-March 2005. The credit-deposit ratio as well as investment plus credit-deposit ratio of Western and Southern regions remained higher than the all-India level (Chart III.27). While credit-deposit (C-D) ratio in most of the States increased in line with the all-India trend, C-D ratio of some of the States, viz., Chandigarh, Daman and Diu, Goa, Jammu and Kashmir, Meghalaya and Nagaland witnessed a moderate to sharp decline (Appendix Table III.37). The credit-deposit ratio in six States/ Union Territories, including Andhra Pradesh, Chandigarh, Karnataka, Maharashtra, Rajasthan and Tamil Nadu was higher than the all-India level.

Foreign Banksí Operations in India

3.114 Offshore Banking Units (OBUs) of banks set up in Special Economic Zones (SEZs) operate like foreign branches of the Indian banks, but located in India. These OBUs are exempt from CRR and SLR requirements. They provide finance to SEZ units and SEZ developers at international rates. As such, under the scheme for Offshore Banking Units, 14 approvals were issued to 10 banks for opening of such units. Initially, six banks viz., State Bank of India, Bank of Baroda, Union Bank of India, Oriental Bank of Commerce, Punjab National Bank (PNB) and ICICI Bank were given ëin principleí approval to open nine OBUs in SEZs: six in SEEPZ, Mumbai and one each in Kandla, Surat and Cochin. Subsequently in the second phase, five banks (viz. PNB, Canara Bank, Bank of India, HDFC Bank and Vijaya Bank) were given permission to open five OBUs: two in Noida, UP and three in SEEPZ, Mumbai. Vijaya Bank, which was permitted to open an OBU in SEEPZ, Mumbai in 2003, did not renew its licence. Currently, six banks, viz. State Bank of India, Bank of Baroda, Union Bank of India, Punjab National Bank, ICICI Bank Ltd. and Canara Bank have opened seven OBUs (up to September 2006). Of the seven functioning OBUs, five are located in SEEPZ, Mumbai and one each in SEEPZ, Noida (Canara Bank) and Kochi, Kerala (SBI). 3.115 The Reserve Bank has been taking measures, on an ongoing basis, for protection of customersí rights, enhancing the quality of customer service and strengthening the grievance redressal mechanism in banks. To address the issue of banking services to the common man in particular, the Reserve Bank appointed the Committee for Procedures and Performance Audit of Public Services (CPPAPS) (Chairman: Shri S.S. Tarapore), and constituted a separate Customer Service Department (CSD). 3.116 The Reserve Bank has been making concerted efforts to promote financial inclusion since 2004. In November 2005, banks were specifically advised to make available a basic banking ëno-frillsí account with low or nil balances as well as charges, to expand the outreach of such accounts to vast sections of the population. Several banks have since introduced such ëno-frillsí accounts with and without value-added features.† According to the information available with the Reserve Bank, about five lakh ëno-frillsí accounts were opened till March 31, 2006, of which about two-third were with public sector banks and one-third with private sector banks. 3.118 Regional rural banks (RRBs) have a special place in the multi-agency approach adopted to provide agricultural and rural credit in India, particularly for providing loans to the target groups, including the priority sector. In order to provide a thrust to agricultural lending, the Government of India announced a policy in 2004 to double the flow of credit by banks to the agriculture in three years. With a view to providing guidance to RRBs and monitoring credit flow to agriculture, the Reserve Bank constituted Empowered Committees at all its Regional Offices. In order to make RRBs an important vehicle of credit delivery in rural areas, the Reserve Bank announced, in December 2005, a special package with the following salient features. First, sponsor banks were advised to provide lines of credit to RRBs at reasonable rates of interest to enhance their resource base. Further, RRBs were given access to inter-RRB term money/borrowings and also to the repo/CBLO markets. Second, RRBs were permitted to set up off-site ATMs, issue debit/ credit cards and also to handle pension/ Government business as sub-agents of banks authorised to conduct Government business. Third, the Reserve Bank indicated that taking into account their financial position, requests from RRBs could be considered for opening of currency chests. Fourth, the Reserve Bank is reviewing the existing norms for conduct of various types of foreign exchange transactions by RRBs with a view to allowing them to undertake non-trade related current account transactions relating to release of foreign exchange for certain specified purposes such as overseas education, business travel, medical treatment and private visits. The role of RRBs and their financial performance have been evolving in response to policy initiatives as well as changing business environment (Box III.5). 3.119 In order to reposition RRBs as an effective instrument of credit delivery in the Indian financial system, the Government of India - after consultation with NABARD, the concerned State Government/s and the sponsor bank/s-initiated State-level amalgamation of RRBs, sponsor bank-wise in September 2005 (Box III.6). Box III.5: Emerging Role of RRBs Regional Rural Banks (RRBs) were set up under the Regional Rural Banks Act, 1976. RRBs were expected to operate as State sponsored, region based and rural oriented commercial banks. The basic objective of this set of rural financial institutions was to have a feel and familiarity with local need, and professionally managed alternative channel for credit dispensation to small and marginal farmers, agricultural labourers, socio-economically weaker sections of population for development of agriculture, trade, commerce, industry and other productive activities. RRBs were expected to mobilise resources from rural areas and play a significant role in developing agriculture and rural economy by deploying mobilised resources in rural sectors for the needy not covered by SCBs despite their large network. Keeping this objective in view, the capital of RRBs is held by the Central Government, concerned State Government and sponsor bank in the proportion of 50:15:35. During the first decade of their operations, RRBs concentrated on expanding credit services, which were reflected in the credit-deposit ratio of more than 100 per cent up to 1987. Thereafter, the C-D ratio declined, reflecting a reorientation in their activities. However, the credit-deposit ratio improved to 55.7 per cent in 2005-06 from 41.3 per cent in 2000-01. This resulted in an increase in the share of income from advances from 34.7 per cent in 2000-01 to 53.8 per cent in 2005-06 (Table 1). The share of income from investment, in contrast, declined to 39.5 per cent in 2005-06 from 60.5 per cent in 2000-01. In the wake of introduction of financial sector reforms in 1991-92, the commercial viability of RRBs emerged as the most crucial factor in deciding about their desired role in the emerging economic scenario. The financial health of RRBs turned weak mainly due to its limited business flexibility with hardly any scope of expansion/diversification, smaller size of loans with higher exposure to risk-prone advances and professional inefficiency in financial deployment. To strengthen RRBs and improve their performance, the Reserve Bank

allowed RRBs to lend to non-target groups, deregulated their deposit and lending rates, and permitted investment of their surplus funds in profitable avenues. These measures were supported with well-defined business plan preparation from the branches, time bound implementation for attaining profitability, human resource development programmes, and organisational development initiatives as an integrated tool for turnaround.

Box III.6: Amalgamation of RRBs The Advisory Committee on Flow of Credit to Agriculture and Related Activities (Chairman: Shri V.S. Vyas) in June 2004 recommended restructuring of RRBs. Following this, an Internal Working Group on RRBs was set up in the Reserve Bank to examine various alternatives available within the existing legal framework for strengthening RRBs. The Group, in its Report submitted in June 2005, observed large variations in the number of districts covered and the branch network of RRBs. While 47 RRBs covered only one district each, 111 RRBs covered 2-3 districts, 29 RRBs 4-5 districts and 9 operated in 6-9 districts. Similarly, 72 RRBs had up to 50 branches, 87 RRBs 51-100 branches, 21 RRBs 101-150 branches and 16 had more than 150 branches. As many as 6 sponsor banks had only one RRB sponsored by them. While 11 sponsor banks had 2 - 4 sponsored RRBs, 3 sponsor banks had up to 10 RRBs and 8 sponsor banks had more than 10 RRBs sponsored by them in various States. Of these, only 2 sponsor banks had more than 20 RRBs. In order to improve the operational viability of RRBs and take advantage of the economies of scale (by reducing transaction cost), the route of merger/amalgamation of RRBs was suggested taking into account the views of various stakeholders. The merged entities would have a larger area of operation and the merger process would help in strengthening some of the weak RRBs. A two-phase restructuring was suggested: (i) merger between RRBs of the same sponsor bank in the same State; and (ii) merger of RRBs sponsored by different banks in the same State. Merger of RRBs with the sponsor bank is not provided for in the RRBs Act 1976. Further, such mergers would go against the spirit of setting up of RRBs as local entities and for providing credit primarily to weaker sections. The Government of India has initiated the first phase of amalgamation of RRBs sponsor bank-wise at State level to overcome the deficiencies prevailing in RRBs and making them viable and profitable units. The process of amalgamation of RRBs sponsor bank-wise at the State level started on September 12, 2005 with the issue of notification in respect of formation of 9 amalgamated entities. As on March 31, 2005, 196 RRBs were operating in 26 States across 523 districts (525 in 2005-06) with a network of 14,484 branches (14,489 in 2005-06). RRBs had a large branch network in the rural areas, which constituted nearly 45 per cent of rural branch network of all commercial banks. Till October 31, 2006, 137 RRBs were amalgamated to form 43 new RRBs, sponsored by 18 commercial banks in 15 States, bringing down the total number of RRBs in the country to 102 from 196. The amalgamation process of phase I is in process of being completed. Revised guidelines regarding organisational set-up, appointment of Chairmen and fixation of seniority of staff were issued by NABARD to sponsor banks for implementation in their respective RRBs in the post-amalgamation period. NABARD is providing full guidance and support to smoothen the process of amalgamation. After amalgamation, RRBs would become bigger in size with a larger area of operation, which would enable them to function in a competitive environment more effectively by taking advantage of the economies of scale and reduction in transaction cost. The process of bringing down the number of RRBs would also make it more convenient for the sponsor banks to manage the affairs of RRBs. Financial Performance of RRBs 3.120 The consolidated balance sheet of RRBs expanded by 15.1 per cent during 2005-06, notwithstanding the decline in the number of RRBs to 133 at end-March 2006 (due to amalgamation) as compared with 196 at end-March 2005 (Table III.56). On the asset side, net advances of RRBs increased by 21.1 per cent during 2005-06. Among the major items on the liabilities side, borrowings increased by 32.2 per cent and total deposits by 14.8 per cent during the year.

3.121 In view of amalgamation of RRBs, the number of both profit-making and loss-making RRBs declined to 111 and 22, respectively, at end-March 2006 from 166 and 30, respectively, at end-March 2005 (Table III.57). The sharper decline in income as compared with the expenditure resulted in lower net profits of Rs.510 crore for RRBs during 2005-06 as compared with Rs.748 crore during 2004-05. The ratio of gross and net NPAs declined sharply during the year to 7.3 per cent and 4.0 per cent, respectively, enabled by improved recovery to the extent of 80 per cent. 3.122 RRBs issued loans to the extent of Rs.32,871 crore during 2005-06, out of which the share of priority sector was 79.3 per cent. As at end-March 2006, the outstanding advances of RRBs were Rs.39,713 crore, of which the share of priority sector was 81.7 per cent (Table III.58). The share of agricultural loans increased to 54.0 per cent at end-March 2006 from 50.8 per cent at end-March 2005, while the share of non-agricultural loans declined to 46.0 per cent from 49.2 per cent during the period.

11. Local Area Banks 3.123 Four local area banks (LABs) were functional at end-March 2006. These were: Coastal Local Area Bank Ltd, Vijayawada; Capital Local Area Bank Ltd., Phagwara, Navsari; Krishna Bhima Samruddhi Local Area Bank Ltd., Mehboobnagar; and the Subhadra Local Area Bank Ltd., Kolhapur. Assets, deposits and gross advances of all local area banks increased significantly during 2005-06 (Table III.59). 3.124 The income of LABs registered a sharp rise during 2005-06. The high growth of income was mainly on account of interest income. On the expenditure side, interest expenditure and operating expenditure registered a significant rise during the year. The rise in income was more than the expenditure, resulting in higher net profit of 2.8 per cent as compared with 0.9 per cent in the previous year (Table III.60).

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: