IST,

IST,

Policy Environment

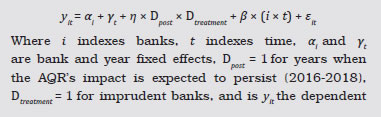

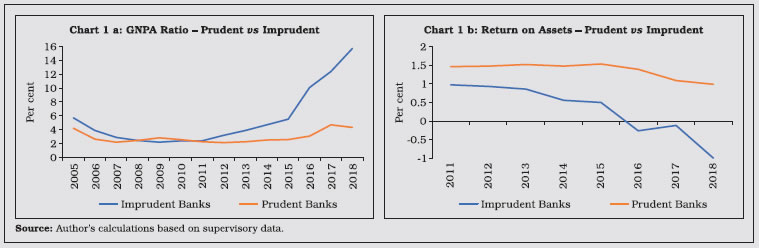

During 2018-19, the Reserve Bank introduced a prudential framework for resolution of stressed assets, which aimed at ring-fencing and protecting the banking sector from the build-up of non-performing assets. The macroprudential framework was further aligned to the best international practices, while monetary policy responded to the emerging macroeconomic developments. The Reserve Bank improved governance and reporting practices of banks. Concerted efforts were undertaken to strengthen the liquidity and regulatory framework governing non-banking financial companies and also to remove the regulatory arbitrage, while catalysing liquidity flows to the sector. Modernisation of payment and settlement systems was a concomitant pursuit. 1. Introduction III.1 The setting and conduct of policies for the financial sector in India in 2018-19 and 2019-20 so far confronted testing challenges against the backdrop of slowing global and domestic activity. In addition, heightened uncertainty triggered by global spillovers, geopolitical and trade tensions, and bouts of turbulence in financial markets clouded the outlook. In this environment, the policy focus turned to strengthening the prudential framework for resolution of stressed assets, incentivising resolution under the Insolvency and Bankruptcy Code (IBC), regulatory harmonisation across banks and non-banking financial companies (NBFCs), improving their financials, including through lowering the cost of capital and recapitalisation of public sector bank (PSBs), and calibrating macroprudential regulations to the best international norms. Modernisation of payment and settlement systems was a concomitant pursuit. III.2 Against this backdrop, the rest of the chapter gives an overview of policy initiatives in the banking and non-banking spheres in 2018-19 and 2019-20 so far. Section 2 comprises developments in monetary policy and liquidity management. Policies for the resolution of stressed assets within the overarching macroprudential framework are covered in Section 3. Regulatory measures undertaken during the year are presented in Section 4. Initiatives of the Reserve Bank relating to banks in the supervisory realm are summarised in Section 5, while those for NBFCs are covered in Section 6. Measures for promoting financial inclusion, credit delivery, and improving customer protection are covered in Sections 7 and 8, respectively. The Reserve Bank’s initiatives for improving access to new age payment products in a safe and secure environment are set out in Section 9. The chapter concludes with an overall assessment in Section 10. 2. Monetary Policy and Liquidity Management III.3 The monetary policy committee (MPC) of the Reserve Bank met six times during 2018-19 and five times during 2019-20 so far (April-December 2019) in accordance with its bi-monthly schedule. During this period, the policy repo rate was initially increased by 25 basis points each in June and August 2018 to head off the hardening of underlying inflation pressures. The stance of monetary policy shifted from neutral to calibrated tightening in October 2018 as elevated levels of oil prices exacerbated risks to the inflation outlook. Subsequently, with inflation outcomes surprising on the downside, the focus turned to slowing growth. Accordingly, the policy rate was reduced successively in the next five meetings of the MPC in February, April, June, August, and October 2019 as inflation ebbed and households’ expectations remained anchored. In its August 2019 meeting, the MPC voted to reduce the policy rate by an unconventional 35 basis points, taking into consideration weak domestic economic activity amidst a deepening global slowdown. In its December 2019 meeting, the MPC kept the policy rate unchanged. The policy stance was altered in February 2019 from calibrated tightening to neutral and to accommodative from June 2019 onwards. Liquidity Management III.4 Systemic liquidity underwent sizeable shifts during the period under review. While the Reserve Bank’s forex operations and currency expansion were the primary drivers of durable liquidity during the year, government spending shaped frictional liquidity movements. Consistent with the stance of monetary policy, therefore, the Reserve Bank employed various instruments at its disposal viz. fixed and variable rate repo and reverse repo under the liquidity adjustment facility (LAF) and outright open market operations (OMOs), to align the weighted average call rate (WACR) – the operating target – with the policy repo rate. In March 2019, the Reserve Bank expanded its liquidity management toolkit with the introduction of a foreign exchange buy-sell swap of US$ 5 billion (₹ 34,561 crore), followed up by another one of a similar amount in April 2019. III.5 During 2018-19, the WACR generally traded below the policy repo rate till January 2019 but hardened intermittently thereafter and spiked at the year-end. Overall, the WACR remained 8 basis points (bps) below the policy rate in 2018-19 (10 bps in H1 vis-a-vis 6 bps in H2). III.6 Fine-tuning operations through variable rate auctions were the key instrument to manage frictional liquidity. During 2018-19, while liquidity amounting to ₹ 6,39,900 crore was injected through variable rate repos of maturities ranging from overnight to 56 days in addition to the regular 14-day repos, liquidity of ₹ 42,54,800 crore was absorbed through reverse repos of maturities ranging from overnight to 14 days. III.7 The Reserve Bank injected daily average liquidity of ₹ 51,403 crore during April and May 2019. Subsequently, however, as surplus liquidity set in during June-December 2019 (up to December 15, 2019), the variable rate reverse repos were conducted in addition to the regular fixed rate reverse repos, on an average absorbing ₹ 1,58,893 crore daily. In view of the build-up of large surplus liquidity which is expected to continue for some time, it was decided to conduct longer term variable rate reverse repo auctions starting from November 4, 2019. III.8 In order to meet durable liquidity requirements, the Reserve Bank also conducted 27 OMO purchase operations aggregating ₹ 2,98,500 crore during 2018-19. Durable liquidity amounting to ₹ 52,500 crore was injected during April-December 2019 (up to December 15, 2019) through the conduct of four OMO purchase auctions. Facility to Avail Liquidity for Liquidity Coverage Ratio III.9 Earlier, the assets allowed as Level 1 High Quality Liquid Assets (HQLAs)1 for the purpose of computing the liquidity coverage ratio (LCR) of banks included, inter alia, government securities to the extent of 11 per cent of the bank’s net demand and time liabilities (NDTL) under Facility to Avail Liquidity for Liquidity Coverage Ratio (FALLCR). To enable banks to meet the LCR requirements prescribed under Basel III, the Reserve Bank decided to permit banks with effect from October 1, 2018 to reckon government securities held by them up to another 2 per cent of their NDTL, under FALLCR, as Level 1 HQLA, thus increasing the FALLCR to 13 per cent. III.10 It was decided with effect from April 4, 2019, to permit banks to reckon an additional 2 per cent (in four increments of 50 bps) government securities held by them under FALLCR within the mandatory SLR requirement as Level 1 HQLA for the purpose of computing LCR, in a phased manner, taking it to 15 per cent of bank’s NDTL by April 1, 2020. The second and third increases in FALLCR by 50 bps each took effect on August 1 and December 1, 2019, respectively. On July 5, 2019, banks were permitted to reckon this one per cent increase in FALLCR for computing LCR, to the extent of incremental outstanding credit to NBFCs and Housing Finance Companies (HFCs) over and above the credit already on their books. This frontloading of FALLCR of one per cent will form part of general FALLCR as and when the increase in FALLCR takes place as per the original schedule. Furthermore, it was decided to reduce the statutory liquidity ratio (SLR) by 25 bps every calendar quarter commencing January 2019 until it reaches 18 per cent of NDTL so as to align the SLR with the LCR requirement2. External Benchmarking of Lending Rates III.11 Drawing on the recommendations of an Internal Study Group (ISG) and after due consultation with stakeholders, the Reserve Bank decided to link all new floating rate retail loans and floating rate loans to micro and small enterprises extended by banks with effect from October 01, 2019 to one of the specified external benchmarks. These benchmarks consist of the policy repo rate, Government of India 3-months or 6-months Treasury Bill yields, or any other benchmark indicated by the Financial Benchmarks India Private Ltd (FBIL). Banks have been given the freedom to decide the spread over the external benchmark; however, the credit risk premium may be altered only when borrower’s credit assessment undergoes a substantial change. Furthermore, other components of the spread, including operating cost, can be changed only once in three years. Interest rates are required to be reset at least once in three months. Existing loans and credit limits linked to the MCLR, the base rate or the Benchmark Prime Lending Rate (BPLR) may continue till repayment or renewal. III.12 The Reserve Bank introduced a prudential framework for resolution of stressed assets, which aimed at ring-fencing and protecting the banking sector from build-up of non-performing assets (NPAs) stress. It also undertook several measures to unclog bank lending to NBFCs. 3.1 Prudential Framework for Resolution of Stressed Assets III.13 The instructions pertaining to the prudential framework for resolution of stressed assets were revised on June 7, 2019 with a view to provide a pre-IBC window for banks to resolve stressed accounts. The modified framework aims at providing early recognition, reporting and time bound resolution of stressed assets, while providing strong disincentives in the form of additional provisioning for delays in initiation of resolution or insolvency proceedings. Under the modified framework, the lenders will get 30 days review period to decide on resolution strategy once there is a default in the account. In cases in which a resolution plan (RP) is to be implemented, an inter-creditor agreement (ICA) is required to be executed by all lenders within the review period. The ICA will provide, inter alia, that any decision agreed by lenders representing 75 per cent by value of outstanding credit facilities and 60 per cent of lenders by number will be binding upon all lenders. The RP is required to be implemented within 180 days from the end of the review period. III.14 In case a viable RP in respect of a borrower is not implemented within 180 days, lenders are required to make additional provisions over and above the provisions already held or the provisions required to be made as per the asset classification status of the borrower’s account. After the first 180 days from the end of review period, the asset would attract 20 per cent additional provisioning, which will be increased by another 15 per cent (i.e., total additional provisioning of 35 per cent) after 365 days from the commencement of the review period. The framework provides incentives for application of the Insolvency and Bankruptcy Code (IBC) by allowing half the additional provisions to be reversed on filing an insolvency application. The remaining additional provisions may be reversed upon admission of the borrower into the IBC’s insolvency resolution process. The new framework is applicable to SCBs, Small Finance Banks (SFBs), Systemically Important Non-Deposit taking NBFCs (NBFC-ND-SI) and Deposit taking NBFCs (NBFC-D) and All India Term Financial Institutions. III.15 Going ahead, this framework is expected to induce timely recognition of stressed assets, thus helping in strengthening the financial health of the banks. Empirical evidence suggests that the profitability of banks which delay recognition and adequate provisioning for impaired assets is adversely affected as compared to those that act in a timely manner (Box III.1). 3.2 Deferment of Increase in Capital Conservation Buffer III.16 The capital conservation buffer (CCB) is designed to ensure that banks build up capital buffers during normal times, which can be drawn down as losses are incurred during a stressed period. Currently, the CCB of banks stands at 1.875 per cent of the risk-weighted assets, which was scheduled to increase to 2.5 per cent as on March 31, 2019. In view of the macroeconomic conditions and persisting overhang of stress in the banking sector, the implementation of the last tranche of 0.625 per cent of the CCB has been deferred to March 31, 2020.

3.3 Leverage Ratio III.17 In order to mitigate risks of excessive leverage, the Basel Committee on Banking Supervision (BCBS) designed the Basel III Leverage Ratio (LR) as a simple, transparent, and non-risk-based measure to supplement existing risk-based capital adequacy requirements. LR is defined as the ratio of Tier I capital to the bank’s exposure. The Reserve Bank has been monitoring banks against an indicative LR of 4.5 per cent for the purpose of disclosures and also as the basis for parallel run by banks. The final guidelines issued by the BCBS in December 2017 prescribe a minimum of 3 per cent LR requirement at all times. Keeping in mind financial stability and with a view to moving further towards harmonisation with Basel III standards, the minimum LR was set at 4 per cent for Domestic Systemically Important Banks (DSIBs) and 3.5 per cent for other banks with effect from quarter commencing October 1, 2019. 3.4 Large Exposures Framework (LEF) III.18 Guidelines for banks’ large exposures were revised on June 03, 2019, subsuming and superseding certain earlier provisions. In order to capture exposures and concentration risk more accurately and to align the framework with international norm, the revised LEF excludes entities connected with the sovereign from the definition of the group of connected counterparties, provided they are otherwise not connected. It also introduces economic interdependence as a criterion in the definition of connected counterparties with effect from April 1, 2020 for entities where a bank has an exposure greater than 5 per cent of its eligible capital base in respect of each entity, and mandates a look-through approach in the determination of relevant counterparties in case of collective investment undertakings, securitisation vehicles and other structures. Further, as a transition measure, non-centrally cleared derivatives have been kept outside the purview of LEF till March 31, 2020. Also, for the purpose of LEF, Indian branches of foreign Global Systemically Important Banks (G-SIBs) shall not be treated as G-SIBs. Furthermore, on September 12, 2019 it was decided that a bank’s exposure limit to any single NBFC (excluding gold loan companies) would be raised to 20 per cent of the eligible capital base as against the earlier 15 per cent. Bank lending to NBFCs that are predominantly engaged in extending loans against gold—which is presently capped at 7.5 per cent of the former’s capital funds—is allowed to go up to 12.5 per cent if it is for on-lending to the infrastructure sector. 3.5 Risk Weights for Exposures to NBFCs III.19 Exposures to all NBFCs, excluding Core Investment Companies (CICs), will be risk-weighted as per the ratings assigned by the rating agencies registered with SEBI and accredited by the Reserve Bank. This is intended to facilitate the flow of credit to well-rated NBFCs and to harmonise risk weights applicable to banks’ exposure to various categories of NBFCs under the standardised approach for credit risk management in a manner similar to that of corporates under the extant regulations. Exposures to CICs, rated as well as unrated, will continue to be risk-weighted at 100 per cent. 3.6 Risk Weights for Consumer Credit III.20 Consumer credit, including personal loans and credit card receivables but excluding educational loans, attract a higher risk weight of 125 per cent or higher. On a review, the risk weight was reduced to 100 per cent. The relaxation is not applicable to credit card receivables. III.21 As the regulator of the banking sector, the Reserve Bank emphasised improving governance and reporting practices of banks. The Reserve Bank’s regulatory ambit also extends to niche-centric lending institutions, including NBFCs, HFCs, Payments Banks (PBs), SFBs and RRBs. In order to encourage further competition, the Reserve Bank recently issued final guidelines for ‘on-tap’ licensing of SFBs, in the private sector. 4.1 Corporate Governance in Banks III.22 Guidelines on ‘fit and proper’ criteria for shareholder directors in the PSBs were reviewed comprehensively in August 2019. The revised guidelines enhance the due diligence required and align the eligibility requirements with that required for other directors. III.23 The Reserve Bank issued compensation guidelines for whole time directors, CEOs, material risk takers and control function staff of all private sector banks (PVBs) on November 04, 2019 to be effective from April 1, 2020. The revised guidelines align the remuneration standards of PVBs with the principles of Financial Stability Board (FSB) for sound compensation practices, while not restricting overall compensation. 4.2 Central Information System for Banking Infrastructure III.24 The Reserve Bank maintains a directory of all Banking Outlets (BOs)/offices in India. Consistent with the needs of branch licensing and financial inclusion, a new reporting system, the Central Information System for Banking Infrastructure (CISBI), has been web-deployed to replace the legacy Master Office File (MOF) system. The CISBI has provision to maintain complete details of banks and All India Financial Institutions (AIFIs) and a history of all the changes with a time stamp. Banks/AIFIs can also use the facility to access/ download data relating to them. All the information reported by banks in the past has been migrated to the CISBI. 4.3 Amendments to the Know Your Customer (KYC) Framework III.25 KYC instructions were amended on May 29, 2019 to align with the amendments dated February 13, 2019 in the Aadhaar and money laundering related laws. Banks have been allowed to use Aadhaar authentication or offline-verification only for individuals who volunteer and give specific consent for the same. Any proof of possession of Aadhaar number is now added to the list of officially valid documents. Regulated entities (REs) are required to ensure that the customers, who are not beneficiaries of any benefit or subsidy, redact or blackout their Aadhaar number while submitting it for customer due diligence. However, banks are required to obtain the Aadhaar number from an individual and carry out its authentication using e-KYC authentication facility of Unique Identification Authority of India (UIDAI), in case the individual is desirous of receiving any benefit or subsidy under any scheme notified under Section 7 of the Aadhaar Act, 2016. 4.4 Branch Authorisation Policy for Regional Rural Banks III.26 On May 31, 2019 the Reserve Bank introduced the concept of banking outlet (BO) for RRBs. A BO is a fixed-point service delivery unit, manned by either the bank’s staff or its business correspondent where services of acceptance of deposits, encashment of cheques/ cash withdrawal or lending of money are provided for a minimum of four hours per day for at least five days a week. For Tier 5 and 6 centres, RRBs have general permission for opening BO with post facto reporting. However, RRBs would be required to obtain prior approval of the Reserve Bank for opening brick and mortar branches in Tier 1 to 4 centres (as per Census 2011) subject to conditions. Furthermore, they would also be required to open at least 25 per cent of the new BOs in unbanked rural centres every year. 4.5 Basic Savings Bank Deposit Accounts III.27 In the interest of improving customer service, the Reserve Bank advised all SCBs, PBs, SFBs, LABs and co-operative banks to offer some basic minimum facilities in the Basic Savings Bank Deposit (BSBD) account free of charge and without any requirement of minimum balance. These facilities include, inter alia, deposit of cash at bank branches as well as ATMs/CDMs, receipt of money through any electronic channel or by means of cheques drawn by central/state government and agencies, providing ATM/debit cards, and a minimum of four withdrawals in a month, including ATM withdrawals. 4.6 Credit Discipline III.28 On December 5, 2018 the Reserve Bank issued guidelines on loan system for delivery of bank credit, in order to improve credit discipline among large borrowers who are beneficiaries of working capital facility from the banking system. Borrowers with aggregate fund based working capital facility of ₹ 150 crore and above are subject to a minimum level of ‘loan component’ of 40 per cent from April 1, 2019, which further increased to 60 per cent effective from July 1, 2019. Furthermore, a credit conversion factor of 20 per cent is applied to the undrawn portion of cash credit or overdraft limits of these large borrowers from April 1, 2019. 4.7 Bulk Deposits III.29 On February 22, 2019 the definition of ‘bulk deposits’ was revised to provide operational freedom to banks to raise these deposits. Under the amended definition, single rupee term deposits of ₹2 crore and above for SCBs (excluding RRBs) and SFBs have been classified as bulk deposits. III.30 The Board for Financial Supervision (BFS), constituted in November 1994, acts as an integrated supervisor for the financial system covering SCBs, SFBs, PBs, CICs, AIFIs, co-operative banks, NBFCs and ARCs. During July 2018 to June 2019, 10 meetings of the BFS were held. Besides prescribing the course of action to be pursued in respect of institution-specific supervisory concerns, the BFS provided guidance on several regulatory and supervisory policy issues and the framework for enforcement action against regulated entities. III.31 Some of the major issues deliberated upon by the BFS, inter alia, included restrictions imposed on banks under the prompt corrective action (PCA) framework, harmonisation of bank licensing guidelines, review of extant instructions on ownership and governance in PVBs, and recommendations made by expert committee on NPAs and frauds (Chairman: Shri Y.H. Malegam). 5.1 Prompt Corrective Action (PCA) framework III.32 Prior to January 2019, there were eleven PSBs and one PVB under the PCA framework. Consequent upon infusion of fresh capital by the central government in some of the PSBs from November 2018, accompanied by improved compliance with the PCA parameters and various systemic and structural improvements achieved by these banks, it was decided to remove five PSBs out of the PCA framework. III.33 On January 31, 2019 Bank of India and Bank of Maharashtra were taken out of this framework as they met the regulatory norms including Capital Conservation Buffer (CCB) and had net NPAs of less than 6 per cent. In the case of Oriental Bank of Commerce, the Government infused sufficient capital to bring the net NPA to less than 6 per cent. III.34 Allahabad Bank and Corporation Bank received capital infusion to the tune of ₹ 6,896 crore and ₹ 9,086 crore, respectively. This shored up their capital funds and also increased their loan loss provision to ensure that the PCA parameters were complied with. Noting that the CRAR, CET1, net NPA and leverage ratios of these banks are no longer in breach of the PCA thresholds, these banks were taken out of the PCA framework on February 26, 2019. III.35 Additionally, Dhanlaxmi Bank was also taken out of the framework as it did not breach any of the PCA thresholds. Further, one of the PSBs under PCA viz. Dena Bank was merged with a non-PCA PSB viz. Bank of Baroda. III.36 Currently, there are six banks (4 PSBs and 2 PVBs) under the PCA framework. The performance of these six banks, and the banks (five PSBs and one PVB) which have been taken out of the PCA framework, are being continuously monitored by the Reserve Bank through various financial indicators. Periodic meetings with the top management of these banks are also being held. 5.2 Merger of PSBs III.37 Various committees5 have recommended consolidation of PSBs, given underlying benefits/ synergies. Keeping in view the potential benefits of consolidation and to take advantage of the resulting synergies, Vijaya Bank and Dena Bank were merged with the Bank of Baroda with effect from April 1, 2019 without any discrimination among customers. III.38 Furthermore, the government has proposed an amalgamation of 10 PSBs to form 4 merged entities with a view to creating next generation banks with strong national and global presence. Oriental Bank of Commerce and United Bank of India are proposed to merge with Punjab National Bank to form the country’s second-largest lender. Syndicate Bank and Canara Bank will merge to create the fourth largest PSB. Andhra Bank and Corporation Bank will be merged into the Union Bank of India, and will form the country’s fifth largest PSB. The merger of Allahabad Bank with Indian Bank will result in strong branch networks in the south, north and east of the country. 5.3 Change of Ownership of IDBI Bank III.39 The Life Insurance Corporation of India (LIC) acquired 51 per cent of the total paid-up equity share capital of the IDBI bank during 2018-19. Consequently, the Reserve Bank re-categorised IDBI Bank as a private sector bank for regulatory purposes with effect from January 21, 2019. 5.4 Audit-related Developments III.40 The Reserve Bank has put in place a framework to take enforcement action against audit firms by way of not approving their appointments for a specific period to undertake statutory audit assignments for past lapses. This is expected to serve as a deterrent to audit firms from committing similar or other lapses and help in improving the quality of statutory audit. 6. Non-Banking Financial Companies III.41 NBFCs have faced challenges relating to asset liability mismatches and overleveraging in the recent period. In view of the important role of the sector in complementing credit delivery by the banking sector, especially in last mile financial intermediation and in financial inclusion, the Reserve Bank and the Government undertook concerted efforts to strengthen the liquidity and regulatory framework governing NBFCs and also to remove the regulatory arbitrage, while catalysing liquidity flows to the sector. III.42 The NBFC sector has been at the forefront of adopting digital innovation and fintech services through digital platforms such as peer-to-peer (P2P) lending. The proposed enhancement of exposure limit of lenders is expected to give a further fillip to these platforms. 6.1 Strengthening Supervision over NBFCs III.43 The RBI Act, 1934 was amended through the Finance (No. 2) Act, 2019 to enhance the regulatory and supervisory powers of the Reserve Bank over NBFCs. The amendments empowered the Reserve Bank to remove the directors; supersede the board and appoint administrators for NBFCs (other than government-owned NBFCs) in order to protect the interests of depositors and creditors; increase the quantum of penalties in case of non-compliance with various requirements; and enabled the Reserve Bank to resolve NBFCs by amalgamation, reconstruction or splitting into different units or institutions. 6.2 Regulation of Housing Finance Companies (HFCs) III.44 Under the provisions of the National Housing Bank (NHB) Act, 1987, the HFCs were regulated and supervised by the NHB. Over time, the mandate of the NHB has been widened and it assumed the role of refinancer and lender to the sector. Recognising the conflicting aspects of the mandate, the Union Budget 2019-20 proposed to return the regulatory authority over the housing finance sector from NHB to the Reserve Bank. Henceforth, the certificate of registration to HFCs will be issued by the Reserve Bank, which has also been empowered to direct inspections of HFCs by the NHB and to impose penalties on the former. III.45 On November 11, 2019 the exemptions granted to HFCs from the provisions of Chapter IIIB (except Section 45-IA) of the RBI Act, 1934 were withdrawn. 6.3 Harmonisation of various NBFC Categories III.46 The evolution of the NBFC sector over the years has resulted in several categories of NBFCs, based on specific asset classes/ sectors with different sets of regulatory prescriptions. Regulations for deposit acceptance were harmonised in November 2014. On February 22, 2019 the regulations governing Asset Finance Companies (AFCs), Loan Companies (LCs) and Investment Companies (ICs) were harmonised and they were merged into a new category called NBFC – Investment and Credit Companies (NBFC-ICCs). With this harmonisation, there are now 11 categories of NBFCs (Section 2, Chapter VI) 6.4 Liquidity Risk Management Framework III.47 In order to strengthen and raise the standard of asset-liability management (ALM) framework of NBFCs, including CICs, the Reserve Bank has revised the extant guidelines on liquidity risk management on November 4, 2019. The revised guidelines build upon the existing framework by specifying more granular maturity buckets and tolerance limits, and adoption of liquidity risk monitoring tools. The guidelines recommend monitoring of liquidity by using a stock approach in addition to the measurement of structural and dynamic liquidity. They also extend the principles of sound liquidity risk management to various aspects, including stress testing and diversification of funding. The framework requires maintenance of a liquidity buffer in terms of a LCR starting at 50 per cent for all NBFCs-D and all NBFCs-ND with an asset size of ₹ 10,000 crore and above and 30 per cent for all NBFCs-ND with an asset size of ₹ 5,000 crore and above, but less than ₹ 10,000 crore, from December 1, 2020 to reach 100 per cent on December 1, 2024. 6.5 Partial Credit Guarantee Scheme III.48 In pursuance of the announcement made in the Union Budget 2019-20, the Government of India has rolled out a scheme offering to provide a one-time partial credit guarantee for first loss up to 10 percent to public sector banks (PSBs) for purchase of high-rated pooled assets amounting to ₹ 1,00,000 crore from financially sound NBFCs and HFCs. On its part, the Reserve Bank will provide required liquidity backstop to the banks against their excess G-sec holdings. 6.6 Temporary Relaxation of Minimum Holding Period III.49 With several NBFCs facing difficulties in availing funds in the aftermath of default by a systemic NBFC, the Reserve Bank took several measures to ameliorate the situation. In order to encourage NBFCs to securitise/assign their eligible assets, the minimum holding period (MHP) requirement for originating NBFCs was relaxed in November 2018 in respect of loans of original maturity above 5 years, subject to certain conditions. The relaxation, initially given for a period of six months i.e. up to May 2019, was subsequently extended till December 31, 2019. 6.7 Priority Sector Lending by NBFCs III.50 On August 13, 2019 the Reserve Bank allowed bank credit to registered NBFCs (other than micro finance institutions (MFIs)) for on-lending to agriculture and micro and small enterprises (MSEs) to be treated as priority sector lending, subject to certain restrictions. Only fresh loans sanctioned by NBFCs can be classified as priority sector lending by the banks. Furthermore, on-lending by NBFCs for term-lending component under agriculture will be allowed up to ₹ 10 lakh per borrower and up to ₹ 20 lakh per borrower to micro and small enterprises. To qualify for priority sector lending, the limit for onlending to HFCs for housing loans was enhanced to ₹ 20 lakh per borrower as against the earlier limit of ₹ 10 lakh. 6.8 Chief Risk Officer for Large NBFCs III.51 NBFCs have significant inter-linkages with the rest of the financial sector in terms of their access to public funds and participation in credit intermediation. It was decided to augment their risk management practices in order to mitigate potential systemic risks arising out of this interconnectedness. Accordingly, Investment and Credit Companies, Infrastructure Finance Companies, Micro Finance Institutions, Factors and Infrastructure Debt Funds with an asset size of more than ₹ 5,000 crore were required to appoint a functionally independent Chief Risk Officer (CRO) with clearly specified role and responsibilities. 6.9 Licensing as Authorised Dealer III.52 In order to increase accessibility and efficiency of the services extended to the members of the public for their day-to-day non-trade current account transactions, the Reserve Bank allowed systemically important non-deposit taking Investment and Credit Companies to apply for AD - Category II license, effective April 16, 2019. 6.10 Review of Household Income and Lending Limits for Non-Banking Financial Companies-Micro Finance Institutions (NBFC-MFIs) III.53 Taking into consideration the important role played by NBFC-MFIs in delivering credit to those in the bottom of the economic pyramid and to enable them to play their assigned role in a growing economy, the household income limits for borrowers of NBFC-MFIs have been raised from the current level of ₹ 1,00,000 for rural areas and ₹ 1,60,000 for urban/semi urban areas to ₹ 1,25,000 and ₹ 2,00,000, respectively along with increase in lending limit from ₹ 1,00,000 to ₹ 1,25,000 per eligible borrower effective November 8, 2019. 6.11 Technical Specifications for all participants of the Account Aggregator (AA) ecosystem III.54 NBFC-Account Aggregator (NBFC-AA) consolidates financial information of a customer held with different financial entities, spread across financial sector regulators having different IT systems and interfaces. In order to ensure secured, duly authorized, and seamless movement of data, a set of core technical specifications (framed by Reserve Bank Information Technology Private Limited (ReBIT)) have been prescribed for the participants of the AA ecosystem namely NBFC-AA, Financial Information Providers, and Financial Information Users. 6.12 Fit and Proper Criterion for Asset Reconstruction Companies (ARC) Sponsors III.55 The Reserve Bank issued directions on fit and proper criteria for ARC sponsors on October 25, 2018, in accordance with the amendment to the SARFAESI Act (Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002) in 2016. The directions seek to ensure that sources of funds are legitimate and sustainable and that the integrity of management of the ARC is beyond reasonable doubt. Furthermore, the directions mandate continuous monitoring of the fit and proper status of sponsors. III.56 The amendment also brought ARCs under the definition of ‘financial institution’ and thereby enabled one ARC to acquire financial assets from other ARCs, which was hitherto allowed only for the purpose of debt aggregation. III.57 During the year, three companies were given Certificate of Registration (CoR) to function as ARC, and one company’s CoR was cancelled. 6.13 Acquisition of financial assets by ARCs from sponsors and lenders III.58 To address the concerns relating to transparency and price discovery in bilateral transactions, ARCs have been advised to acquire financial assets from their lenders, sponsors or group entities through auctions which are conducted in a transparent manner, on arm’s length basis and at prices determined by market forces. 7. Credit Delivery and Financial Inclusion III.59 Creation and strengthening of efficient credit delivery mechanisms that ensure adequate and timely delivery of financial resources to the productive sectors of the economy has remained a policy priority. Several initiatives were aimed at the priority sector, including MSMEs, agriculture and minorities. Furthermore, a national strategy for financial inclusion was designed to secure greater inclusion in a time bound and co-ordinated manner. 7.1 Interest Subvention Scheme for Micro, Small and Medium Enterprises (MSMEs) III.60 An interest subvention scheme for MSMEs in both manufacturing and services sector was introduced by the Government in 2018. This scheme is aimed at increasing productivity and providing incentives for onboarding the GST platform, thereby helping in greater formalisation of the sector, while reducing the cost of credit. Interest subvention of 2 per cent was made available for GST-registered MSMEs with valid Udyog Aadhaar Number, for two years starting from 2018-19. The scheme was made available on fresh or incremental loans up to ₹ 100 lakh for loans issued by SCBs and NBFCs-ND-SIs. 7.2 Interest Subsidy on Export Credit III.61 The Government of India increased the interest subsidy on post and pre-shipment export credit from 3 per cent to 5 per cent to provide a boost to MSME sector exports effective from November 2, 2018. All SCBs (excluding RRBs), SFBs and Primary Co-operative banks were directed by the Reserve Bank to implement the scheme effectively. 7.3 Restructuring of Advances to MSME III.62 In order to facilitate meaningful restructuring of MSME accounts that have become stressed, a one-time restructuring of existing loans to MSMEs that were in default but ‘standard’ as on January 1, 2019, was permitted without an asset classification downgrade. The restructuring has to be implemented by March 31, 2020. The scheme was made available to MSMEs that qualify in terms of certain criteria, including a cap of ₹ 25 crore on total borrowings from banks and NBFCs, and being GST-registered before implementation of the restructuring package. Additional provisioning of 5 per cent is required for accounts restructured under the scheme. 7.4 Kisan Credit Card III.63 The Kisan Credit Card (KCC) scheme aims at providing adequate and timely bank credit support under a single window with flexible and simplified procedure to the farmers for short-term crop loans. In the Union Budget 2018-19, this facility was extended, along with interest subvention, to farmers engaged in animal husbandry and fisheries for loans up to ₹ 2 lakh. The interest subvention is allowed for short-term loans and is being implemented for two years, starting from 2018-19. III.64 Keeping in view the overall increase in agriculture input costs, it was decided on February 7, 2019 to raise the limit for collateral free agricultural loan from ₹ 1 lakh to ₹ 1.60 lakh. 7.5 New Framework for External Commercial Borrowings (ECBs) III.65 In January 2019, the Reserve Bank rationalised the frameworks for ECBs and rupee denominated bonds (RDBs) to improve the ease of doing business. Tracks I and II have been merged under “foreign currency denominated ECB”, and track III and RDBs have been merged under “rupee denominated ECB” under a single new ECB framework. The list of eligible borrowers has been expanded to include all entities eligible to receive foreign direct investment (FDI), apart from other specified entities. Additionally, recognised lenders’ list was expanded to any resident of Financial Action Task Force (FATF) or International Organisation of Securities Commission (IOSCO) compliant country, subject to certain conditions. Furthermore, ECBs upto USD 750 million, irrespective of the sector, which are compliant with the parameters and conditions set out in the new ECB framework, have been made eligible for automatic route, not requiring the prior approval of the Reserve Bank. The general minimum average maturity period (MAMP) has been specified at 3 years for all ECBs, irrespective of the amount, subject to certain utilisation criterion. Also, permitted end-uses criterion have been changed from a positive list to a negative list, thereby expanding the scope of utilisation of ECB proceeds. 7.6 ECB Facility for Resolution Applicants under Corporate Insolvency Resolution Process III.66 Resolution applicants under the Corporate Insolvency Resolution Process (CIRP) were allowed to raise ECBs from recognised lenders (except branches/ overseas subsidiaries of Indian banks), for repayment of rupee term loans of the target company under the approval route. 7.7 Rationalisation of End-use Provisions III.67 On July 30, 2019 end-use restrictions relating to ECBs were relaxed for working capital requirements, general corporate purposes and repayment of rupee loans. Eligible borrowers were permitted to raise ECBs with an MAMP of 10 years for working capital purposes and general corporate purposes, and 7 years for repayment of rupee loans availed domestically for capital expenditure. Borrowing by NBFCs for on-lending for these purposes was also permitted. III.68 ECBs can be raised for repayment of rupee loans availed domestically for capital expenditure in manufacturing and infrastructure sectors if classified as SMA-2 or NPA, under any one-time settlement with lenders. Lender banks are also permitted to sell, through assignment, such loans to eligible ECB lenders, except foreign branches/ overseas subsidiaries of Indian banks, provided the resultant ECB complies with all-in-cost, MAMP and other relevant norms of the ECB framework. 7.8 National Strategy for Financial Inclusion III.69 A national strategy for financial inclusion (NSFI) for India 2019-2024 was prepared under the aegis of the Financial Inclusion Advisory Committee. It specifies financial inclusion goals, an action plan to reach the goals and the mechanism to measure progress. The strategy envisages making formal financial services available, accessible, and affordable to all the citizens in a safe and transparent manner to support inclusive and resilient multi-stakeholder led growth. 7.9 Classification of Exports under Priority Sector III.70 In order to boost credit to the export sector, on September 20, 2019, the Reserve Bank enhanced the sanctioned limit to be eligible under priority sector norms. The limit was raised from ₹ 25 crore to ₹ 40 crore per borrower. Furthermore, the existing criterion of ‘units having turnover of up to ₹ 100 crore’ was removed. III.71 The Reserve Bank has been proactive in ensuring that consumers served by its regulated entities receive fair treatment and consumer rights are adequately protected. In view of the increasing number of transactions undertaken using the digital modes, especially using payment systems operated by non-banks, the Reserve Bank extended the customer protection schemes to these areas as well. 8.1 Limiting Customer Liability for Non-Bank Authorised PPI Issuers III.72 Customers using pre-paid payment instruments (PPIs) issued by banks are protected by limiting their liability towards unauthorised electronic transactions. With effect from March 01, 2019, this facility was extended to customers using non-bank issued PPIs as well. An enhanced customer grievance redressal framework was also implemented, prescribing the limits up to which a customer may bear liability under various scenarios like contributory frauds, negligence or deficiency on part of non-bank PPI issuer, third party breach where the deficiency lies neither with the issuer nor with the customer, and scenarios in which the loss is due to negligence of the customer. 8.2 Harmonisation of Turn Around Time (TAT) for failed transactions III.73 A large number of customer complaints originate on account of unsuccessful or ‘failed’ transactions due to, inter alia, disruption of communication links, non-availability of cash in ATMs and time-out of sessions, which may not be directly assignable to the customer. Moreover, the process of rectification and amount of compensation to the customer for these ‘failed’ transactions was not uniform. III.74 Accordingly, the Reserve Bank introduced a framework on Turn Around Time (TAT) for resolution of customer complaints and compensation across all authorised payment systems on September 20, 2019. This framework aims to provide prompt and efficient customer service in all the electronic payment systems. Under the framework, the TAT for failed transactions and compensation were finalised to improve consumer confidence and bring consistency in processing of the failed transactions. 8.3 Ombudsman Scheme for Digital Transactions III.75 With the digital mode for financial transactions gaining traction in the country, a need was felt for a dedicated, cost-free and expeditious grievance redressal mechanism for strengthening consumer confidence in this channel. Accordingly, an ombudsman scheme for digital transactions was implemented with effect from January 31, 2019. The purpose of the scheme is to serve as a complaint redressal mechanism relating to deficiency in customer service in digital transactions conducted through non-bank entities that are regulated by the Reserve Bank. 8.4 Internal Ombudsman for Non-Bank Pre-paid Payment Instruments III.76 To further strengthen the grievance redressal mechanism at the entity level itself, large non-bank PPI issuers were mandated to institutionalise an internal ombudsman scheme in October 2019. 8.5 Ombudsman Scheme for NBFCs III.77 The ombudsman scheme for NBFCs was initially operationalised for all NBFCs-D. In April 2019, the scheme was further extended to NBFCs-ND having customer interface, with asset size of ₹ 100 crore or above. 9. Payment and Settlement Systems III.78 Efficient payment systems reduce the cost of exchanging goods and services and are indispensable for the functioning of financial markets. The Reserve Bank constituted a high-level committee on Deepening of Digital Payments (CDDP) (Chairman: Shri Nandan Nilekani) in January 2019. The Committee recommended various actions to be taken by the Reserve Bank, Government and other industry participants for promoting and increasing the use of electronic payments. The recommendations of the committee are in line with the ‘Payment and Settlement Systems in India: Vision 2019–2021’ released by the Reserve Bank. The core theme of the vision document is ‘Empowering Exceptional (E)payment Experience’ and aims at empowering every Indian with access to a bouquet of e-payment options that is secure, convenient, quick and affordable. 9.1 Tokenisation of Card Transactions III.79 In January 2019, the Reserve Bank authorised card payment networks to offer tokenisation services, irrespective of the app provider, use case and token storage mechanism. There is no relaxation in the additional factor of authentication (AFA) or PIN entry requirement for authenticating the tokenised card transactions. Furthermore, registration for tokenisation service is purely voluntary for customers and they need not pay any charges for availing this service. At present, this facility is being offered through mobile phones and tablets. 9.2 Processing of e-mandate on cards and PPIs for recurring transactions III.80 To balance convenience with safety and protection in card transactions, the Reserve Bank issued a framework that facilitates cardholders (credit card, debit card, prepaid cards or wallets) to register their e-mandates with their bank or non-bank for recurring small value transactions up to ₹ 2,000. An additional authentication aimed at validation by the issuer is mandatory during registration, modification and revocation of e-mandate, as well as during the first transaction. Card issuers are required to send alerts to cardholders before and after the transaction is effected, giving the cardholder the option to withdraw the e-mandate before the transaction or at any other point of time. Furthermore, a new PPI instrument which can be used only for purchase of goods and services upto a limit of ₹ 10,000 is proposed to be introduced. 9.3 National Electronic Toll Collection III.81 National Electronic Toll Collection (NETC) is an interoperable i.e. multiple issuers-multiple acquirers electronic toll collection system which allows customers to pay the toll fare using passive tags linked to their bank accounts. The Reserve Bank granted final approval to the National Payments Corporation of India (NPCI) for operating the NETC system. 9.4 National Common Mobility Card III.82 The Reserve Bank allowed relaxation in the requirement of additional factor of authentication for the National Common Mobility Card (NCMC) for contactless offline transit payments in December 2018. This was done on account of the nature of fast checkout time for transit payments, to enhance the use of electronic payments and facilitate interoperability across all public transport operators. 9.5 Real Time Gross Settlement System III.83 In view of increasing customer demand, the timings for customer transactions in the Real Time Gross Settlement (RTGS) System have been extended and the RTGS system is now available from 7:00 am to 6:00 pm. The final cut-off timings for the RTGS system however, remained unchanged at 7:45 pm. III.84 The sending of positive confirmations to remitters regarding the completion of the funds transfer was implemented for customers of the RTGS system, and banks were advised to ensure its operationalisation by January 15, 2019. This system, which was already available in the National Electronic Funds Transfer (NEFT) system, provides an assurance to the remitter that the funds have been successfully credited to the beneficiary account. 9.6 Waiver of Charges levied by the Reserve Bank in RTGS and NEFT systems III.85 With effect from July 01, 2019 the Reserve Bank waived off the processing charges and time varying charges, levied by it on banks, for outward transactions undertaken using the RTGS system as also the processing charges levied by it for transactions processed in the NEFT system in order to provide an impetus to the digital funds movement. Banks were advised to pass on this benefit to their customers. 9.7 Deepening Digital Payments Ecosystem III.86 The Reserve Bank directed all State and UT Level Bankers Committees (SLBCs and UTLBCs) to identify one district in their respective states and UTs, to make it 100 per cent digitally enabled within one year. It is envisaged that a bank with a significant footprint in the selected district will be engaged to enable every individual to make or receive payments digitally in a safe and convenient manner. 9.8 Regulatory Sandbox for Financial Service Providers III.87 Based on the recommendations of an inter-regulatory working group and after a consultative process with stakeholders, an enabling framework for a regulatory sandbox (RS) was introduced in August 2019. The RS envisages live testing of new products or services in a controlled/test regulatory environment for which regulators may (or may not) permit certain regulatory relaxations for the limited purpose of testing. Areas that can potentially get a thrust from the RS include microfinance, innovative small savings and micro-insurance products, remittances, mobile banking and other digital payments. III.88 On November 4, 2019 the Reserve Bank announced the opening of the first cohort under the RS, with ‘retail payments’ as its theme. This is expected to spur innovation in digital payments space and help in offering payment services to the unserved and underserved segment of the population. Mobile payments, including feature phone-based payment services; offline payment solutions; and contactless payments are among the innovative products and services to be considered for inclusion under RS. 9.9 Bharat Bill Payment System (BBPS) III.89 BBPS is an interoperable platform for repetitive bill payments, which covered bills of five segments viz. Direct to Home (DTH), electricity, gas, telecom and water. During the year, the Reserve Bank expanded the scope and coverage of BBPS to include all categories of billers who raise recurring bills (except prepaid recharges) as eligible participants, on a voluntary basis. 9.10 ‘On-tap’ Authorisation of Payment Systems III.90 In order to diversify risk and to encourage innovation and competition, the Reserve Bank issued instructions for providing ‘on tap’ authorisation to desirous entities. The authorisation is subject to criteria such as merits of the proposal, capital and KYC requirements, and the interoperability among different retail payment systems. So far, Bharat Bill Payment Operating Unit (BBPOU), Trade Receivables Discounting System (TReDS), and White Label ATMs (WLAs) have been offered on-tap authorisation. III.91 The banking and non-banking sectors are emerging from a turbulent and stressful period which has hampered their functioning and impeded financial intermediation more generally. The decision regarding mergers of the PSBs announced by the government is likely to transform the face of the banking sector. With the emergence of stronger, well-capitalised banks aided by cutting-edge technology and state-of-the-art payment systems, Indian banks have the potential to become global banking leaders. As current liquidity strains recede and solvency is shored up, NBFCs are expected to regain their niche in the financial system and expand the reach of the credit market to include all productive agents of the economy. The government and the Reserve Bank have played an active role in this revival of both categories of intermediaries. Going forward, the need of the hour is to continue the policy co-ordination with a view to developing a vibrant and secure banking system and a competitive and resilient NBFC sector. 1 The assets allowed as Level 1 High Quality Liquid Assets (HQLAs) for the purpose of computing LCR of banks include, inter alia, government securities in excess of the minimum SLR requirement and, within the mandatory SLR requirement, government securities to the extent allowed by the Reserve Bank under the Marginal Standing Facility (MSF) [presently 2 per cent of the bank’s NDTL] and Facility to Avail Liquidity for Liquidity Coverage Ratio (FALLCR). 2 From the quarter commencing October 2019, the fourth round of reduction became effective, which brought down the SLR to 18.50 per cent of NDTL. 3 It is possible that some banks did not immediately recognise NPAs but did so in later years, which would imply that this classification is prone to some exclusion errors – banks which are actually imprudent are getting labelled as prudent. However, such a misclassification will only underestimate the true impact of this NPA shock, not overestimate it. 4 The Reserve Bank revised the Prompt Corrective Action (PCA) framework in April 2017. Subsequently, five banks were placed under PCA as at end-June 2017, and another five as at end-December 2017, which restricted some of their activities. This may have had an impact on their profitability for the year 2017-18. To take into account this fact, the same regression specification for the period 2011-2017 is run which confirmed the robustness of the results. 5 Narasimham Committee (1998), Leeladhar Committee (2008) and Nayak Committee (2014). | |||||||||||||||||||||||||||||||

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: