| Responding institution |

Department of Payment and Settlement Systems, Mumbai Regional Office, Reserve Bank of India |

| Jurisdiction in which the FMI operates |

India |

| Authority regulating, supervising, or overseeing the FMI |

Department of Payment and Settlement Systems, Central Office, Reserve Bank of India |

| The date of this disclosure is |

31.10.2023 |

| Website on which the disclosure is posted: |

Reserve Bank of India Website www.rbi.org.in |

| Contact person for further information of this disclosure |

Chief General Manager

Department of Payment and Settlement System Central Office, Reserve Bank of India cgmdpssco@rbi.org.in |

Chapter I

Executive Summary

In April 2012, the Committee on Payment and Settlement Systems (CPSS) now called the Committee for Payments and Market Infrastructure (CPMI) and the Technical Committee of the International Organisation of Securities Commissions (IOSCO) jointly published the Principles for Financial Market Infrastructures (PFMI). The purpose of these principles is to encourage Financial Market Infrastructures (FMIs) to better manage their risks and make their functioning more efficient. Encompassing a comprehensive range of critical aspects pertaining to FMIs, these principles address key areas such as legal framework, governance, risk management and transparency. The primary public policy objective underpinning the formulation of these principles are to augment safety and efficiency within payment, clearing, and settlement systems, ultimately contributing to the stability and integrity of the domestic and international financial systems.

The Reserve Bank of India (RBI) has adopted the above international standards, i.e. “the PFMIs” as well as the “Central Bank Oversight of Payment and Settlement Systems” for implementation by the FMIs regulated by it, through issuance of Policy document on “Regulation and Supervision of FMIs regulated by RBI”, in June 2013. With changing landscape of the payment ecosystem and the central bank’s responsibility to clearly define and disclose their regulatory, supervisory, and oversight policies with respect to FMIs and Retail Payment Systems (RPSs), the RBI has revised / updated the above existing policy document as “Oversight Framework for FMIs and Retail Payment Systems” in June 2020. Accordingly, all FMIs regulated by RBI are mandated to implement PFMIs.

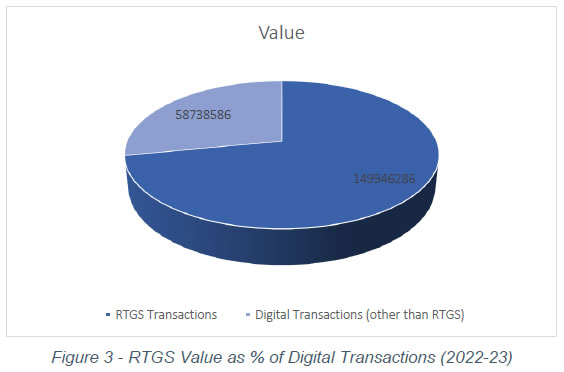

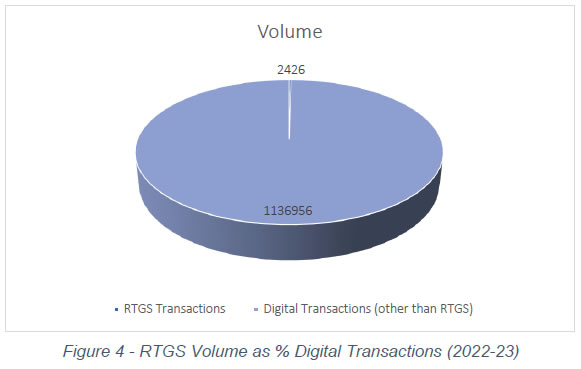

The Real Time Gross Settlement (RTGS) is owned and operated by the Reserve Bank of India (RBI). RTGS was introduced in India in March 2004. Subsequently, it was enhanced to the Next Generation – RTGS (NG-RTGS) built on the ISO 20022 standards with advanced features. NG-RTGS went live on October 19, 2013. RTGS in India is available on a 24x7x365 basis from December 14, 2020. RTGS offers continuous and real time settlement of fund transfers on a transaction-by-transaction and gross basis. Payments made through the RTGS system are final and irrevocable as the settlement takes place in the books of RBI, i.e. the central bank money. The minimum amount for RTGS transaction is set at ₹2,00,000 and there is no upper ceiling. RTGS also settles Multilateral Net Settlement Batch files emanating from other payment systems such as the Unified Payment Interface (UPI), Immediate Payment Service (IMPS), National Automated Clearing House (NACH), National Financial Switch (NFS), etc. RTGS is governed by the RTGS System Regulations, 2013, which are placed in the schedule to the Payment & Settlement Systems Regulations, 2008, which is itself formulated under the powers derived from Section 38 (2) of The Payment and Settlement Systems Act, 2007. RTGS system accounted for approximately 72% of all digital payments by value in 2022-23. RTGS is a critical component of the national payment ecosystem and essential for smooth functioning of the financial system. Taking into account the value of transactions processed and its criticality RTGS is classified as a Systemically Important Payment System (SIPS) and assessed against the PFMIs.

This Report is a summary of the Self-Assessment of RTGS against the PFMIs undertaken by RBI as the owner and operator of the RTGS system. This is in accordance with the CPMI report on PFMI: Disclosure Framework and Assessment Methodology, published in December 2012. The level of observance of each principle by RTGS as per the Self-Assessment is summarised in Table 1 below.

| Table 1 – Observance of Principles |

| Rating |

Principle |

Observed

Any identified gaps and shortcomings, if any, are not issues of concern and are minor, manageable, and of a nature that the FMI could consider taking up in the normal course of its business. |

1 (Legal basis)

2 (Governance)

4 (Credit Risk)

8 (Settlement finality)

9 (Money Settlements)

13 (Participant default rules)

15 (General business risk)

16 (Custody and investment risks)

18 (Access and participation requirements)

21 (Efficiency and effectiveness)

22 (Communication procedures and standards)

23 (Disclosure of rules, key procedures and market data) |

Broadly observed

One or more issues of concern have been identified that the FMI is encouraged to address and follow up to better manage risks or improve operations. The FMI should pursue such improvements in a defined timeline. |

3 (Risk management framework)

5 (Collateral)

7 (Liquidity Risk)

17 (Operational risk)

19 (Tiered participation arrangements) |

Partly observed

The assessment has identified one or more issues of concern that could become serious if not addressed in a timely manner. The FMI should accord a high priority to address these issues. |

Nil |

Not observed

The assessment has identified one or more serious issues of concern that warrant immediate action. Therefore, the FMI must accord the highest priority to address these issues in a timely manner. |

Nil |

| Not applicable* |

6 (Margin)

10 (Physical deliveries)

11 (Central Securities Depositories)

12 (Exchange of value system)

14 (CCP - segregation and portability)

20 (FMI links)

24 (TR - disclosure of market data) |

| * - Principles 6, 10, 11, 14, 20 and 24 are not applicable to payment systems as per the “Principles for financial market infrastructures: disclosure framework and assessment methodology”1 document of CPMI. Principle 12 is not applicable as the RTGS system does not offer either Payment versus Payment or Delivery Vs Payment Services. |

Chapter II

Introduction

1. Introduction to PFMIs

1.1 Financial market infrastructures (FMIs) that facilitate the clearing, settlement, and recording of monetary and other financial transactions play a critical role in maintaining financial stability and may pose significant risks to the financial system, if not managed properly. FMI refers to systemically important payment systems (PS), central securities depositories (CSDs), securities settlement systems (SSSs), central counterparties (CCPs) and trade repositories (TRs).

1.2 The Committee on Payment and Settlement Systems (CPSS), Bank for International Settlements (BIS), published in January 2001 the Core Principles for Systemically Important Payment Systems (CPSIPS). Thereafter, in November 2001, CPSS and International Organization of Securities Commissions (IOSCO), published the Recommendations for Securities Settlement Systems (RSSS). Later, in November 2004, CPSS and IOSCO jointly published the Recommendations for Central Counter Parties (RCCP). In April 2012, CPSS and IOSCO reviewed the three existing standards and published the Principles for Financial Market Infrastructures (PFMI).

1.3 The main public policy objectives of setting these principles are to enhance safety and efficiency in payment, clearing, and settlement systems. These standards are designed to ensure that the infrastructure supporting global financial markets is robust and well placed to withstand financial shocks.

1.4 The Reserve Bank had adopted the PFMIs for supervising and assessing the FMIs regulated by it, which included the RTGS system, through a policy document released in June 2013 titled “Regulation and Supervision of FMIs regulated by RBI”. The scope of the document was limited to oversight activities and tools used for supervision of the FMIs prevailing then. Later in June 2020, RBI has updated the existing policy document as “Oversight Framework for FMIs and Retail Payment Systems (RPSs)” and included the assessment methodology of FMIs under PFMI. This revised policy document describes the approach of RBI in its oversight of FMIs (regulated by RBI) and RPSs operating in India. RTGS was designated as a Systemically Important Payment System (SIPS) and subject to assessment against the PFMIs.

1.5 This report presents a summary of the self-assessment of RTGS against the PFMIs. This self-assessment assesses RTGS as on October 31, 2023.

2. Introduction to RTGS

2.1 RTGS was introduced in India in March 2004. It is owned and operated by the Reserve Bank of India (RBI). RTGS is a Payment and Settlement system where there is continuous and real-time settlement of fund-transfers, individually on a transaction-by-transaction basis (without netting). 'Real Time' means the payment instructions are settled immediately at the time they are received and ‘Gross' means that the settlement of each funds transfer occurs individually without netting. Considering that the funds settlement takes place in the books of RBI, the payments are final and irrevocable. The system is available on all days on 24x7x365 basis with effect from December 14, 2020. While the minimum amount that can be transferred through RTGS is Rs 2,00,000, no upper limit has been set.

2.2 RTGS also settles Multilateral Net Settlement Batch (MNSB) files emanating from ancillary payment systems like Unified Payments Interface (UPI), Immediate Payment Service (IMPS), Aadhaar enabled Payment System (AePS), National Electronic Toll Collection (NeTC), National Financial Switch (NFS), and National Automated Clearing House (NACH).

2.3 Access to RTGS is granted based on the Access Criteria issued by RBI. Membership of RTGS is open to all scheduled / licensed banks, Primary Dealers, clearing corporations, select development financial institutions and certain categories of non-bank Payment System Operators. Entities that do not comply with the access criteria can participate as a sub-member. To overcome short-term shortage of funds (during RTGS business day) for settlement of RTGS transactions, RBI provides Intraday liquidity (IDL) facility to eligible RTGS participants.

2.4 RTGS was subsequently enhanced to the Next Generation-RTGS (NG-RTGS) on October 19, 2013 and is built on the ISO 20022 standards with advanced features such as hybrid functionality, liquidity management functions, etc.

2.5 The payment and settlement systems are regulated and supervised as per provisions contained in the Payment and Settlement Systems Act, 2007 (PSS Act) and Payment and Settlement System Regulations, 2008. Both provide the necessary statutory backing to the Reserve Bank of India for undertaking the oversight function over the payment and settlement systems in the country. The operations of RTGS are governed by the RTGS System Regulations, 2013 which forms part of the schedule to the PSS Regulations, 2008.

2.6 Oversight of payment systems including RTGS is entrusted to the Board for Regulation and Supervision of Payment and Settlement Systems (BPSS). BPSS, a sub-committee of the Central Board of the Reserve Bank of India, is the highest policy making body on payment systems in the country. It formulates policies for the regulation and supervision of all types of payment and settlement systems, sets standards for existing and future systems, authorises payment and settlement systems, determines criteria for membership to these systems and decides on continuation, termination and rejection of membership.

2.7 RTGS is a large value payment system which accounts for 72% by value and less than 1% by volume of payment transactions settled in Indian payment systems. Large value systems are the most critical components of the national payment ecosystem as they can generate and transmit disturbances of a systemic nature to the financial sector. Large value payment systems are, therefore, systemically important FMIs and critical for smooth functioning of the financial system.

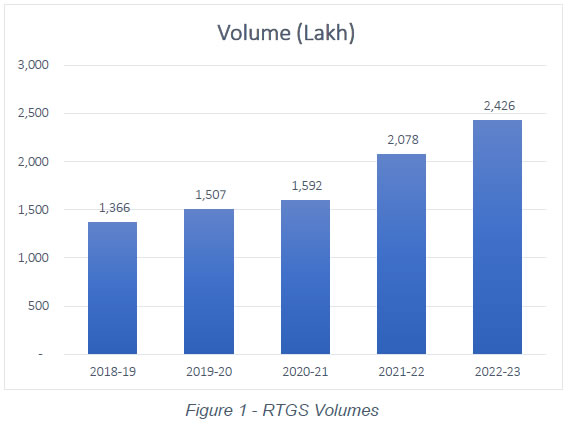

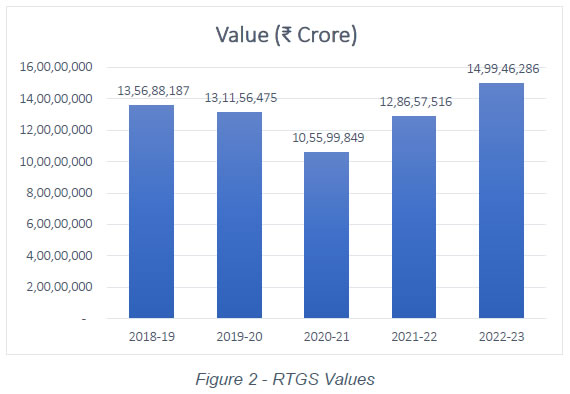

2.8 The volume and value of transactions in RTGS is shown in the graphs below.

3. Methodology of Self-Assessment

The Self-Assessment was carried out by the Mumbai Regional Office which is the operator of the RTGS System. Inputs were taken from the other relevant departments / work areas of the Reserve Bank of India. The Public Disclosure Report based on Self-Assessment of RTGS System against the PFMI has not been endorsed by the Reserve Bank of India in its capacity as the regulator and supervisor of the Payment and Settlement Systems of the country.

Chapter III

Summary of Self-Assessment

Principle 1: Legal basis

| An FMI should have a well-founded, clear, transparent, and enforceable legal basis for each material aspect of its activities in all relevant jurisdictions. |

| Rating: Observed |

The RTGS system is operated by the Regional Director, Mumbai Regional Office (MRO), Reserve Bank of India. RTGS operations are governed by the RTGS System Regulations, 2013 and various circulars issued by RBI, as an operator of RTGS, in accordance with the Payment and Settlement Systems Act, 2007 and Payment and Settlement System Regulations, 2008.

Section 4 of the Payment and Settlement Systems Act, 2007 (PSS Act, 2007), provides legal basis for the Reserve Bank of India to run payment systems in the country.

The legal basis for material aspects such as access, rights and interests of all stakeholders related to RTGS, settlement finality and enforceability, etc., is outlined in the RTGS System Regulations, 2013, Master Direction on access criteria for Centralised Payment Systems and various circulars issued under the PSS Act, 2007 by RBI as the operator of RTGS.

The RTGS System Regulations, 2013, and the circulars issued by RBI are available on the Bank’s website. The aforementioned documents are clear, transparent, and understandable by the participants. The jurisdiction of RTGS extends throughout India. The PSS Act, PSS Regulations, RTGS regulations and relevant circulars issued by RBI, are legally enforceable throughout the country. |

Principle 2: Governance

| An FMI should have governance arrangements that are clear and transparent, promote the safety and efficiency of the FMI, and support the stability of the broader financial system, other relevant public interest considerations, and the objectives of relevant stakeholders. |

| Rating: Observed |

Under the CPMI-IOSCO guidance note on application of the PFMIs to central bank FMIs, where an FMI is operated as an internal function of the central bank, PFMIs are not intended to constrain the composition of the central bank’s governing body or that body’s roles and responsibilities.

The RTGS System is owned and operated by the Reserve Bank of India (RBI) with a view to facilitate round the clock real time large value electronic funds transfers. A robust and efficient RTGS system furthers monetary and financial stability in the country. RTGS is designated as a Systemically Important Payment System and subject to assessment against PFMIs.

RBI, as the owner and operator of RTGS, has established an efficient governance structure for the RTGS system. The overall management and supervision of RTGS system falls under the purview of the Board for Regulation and Supervision of Payment and Settlement Systems (BPSS), which is a subcommittee of the Central Board of RBI.

The Standing Committee for Management of Centralised Payment Systems (RTGS and NEFT) headed by the Regional Director, Mumbai Regional Office, RBI, and having representatives from all stakeholders such as departments of RBI, Public, Private and Foreign Banks, Primary Dealers and non-bank payment system operators, discusses various issues relating to day-to-day operations of RTGS and recommends proposals relating to smooth functioning of RTGS to regulatory department of RBI.

Within the RBI, roles and responsibilities have been clearly defined and designated to different departments / functions. RTGS operations are carried out by Mumbai Regional Office of RBI. A separate department namely, Department of Payment and Settlement Systems, Central Office is the business owner and a separate function within the department is responsible for overall oversight of the RTGS system. An another department namely, Department of Information Technology, Central Office, which facilitates providing IT infrastructure in RBI, is the technology provider for operating RTGS and is responsible for ensuring continued availability of the system. |

Principle 3: Framework for the comprehensive management of risks

| An FMI should have a sound risk-management framework for comprehensively managing legal, credit, liquidity, operational, and other risks. |

| Rating: Broadly Observed |

The risks associated with RTGS include Liquidity Risk, Operational Risk (including cyber-security risk), Market Risk, Reputational Risk, etc. To address these risks, comprehensive risk management frameworks are in place, including a Business Continuity Plan that incorporates Disaster Recovery drills and establishes thresholds for Return Time Objective and Return Point Objective.

The Reserve Bank of India employs the three lines of defense model to effectively manage risks. The first line of defense involves identification of risks that each work area is exposed to and maintenance of the same along with planned control measures in a risk register. The second line of defense consists of the incident reporting and offsite monitoring by the Risk Monitoring Department. The third line of defense comprises periodic risk based inspections and audits.

Appropriate controls have been implemented to monitor and manage the risks inherent in the RTGS system. Participants have access to live information on system activity, empowering them to proactively manage risks on their end. Eligible RTGS participants are provided with Intra-Day Liquidity (IDL) facility, ensuring that transactions are not rejected for want of liquidity during the day. |

Principle 4: Credit Risk

| An FMI should effectively measure, monitor, and manage its credit exposure to participants and those arising from its payment, clearing, and settlement processes. An FMI should maintain sufficient financial resources to cover its credit exposure to each participant fully with a high degree of confidence. In addition, a CCP that is involved in activities with a more-complex risk profile or that is systemically important in multiple jurisdictions should maintain additional financial resources sufficient to cover a wide range of potential stress scenarios that should include, but not be limited to, the default of the two largest participants and their affiliates that would potentially cause the largest aggregate credit exposures to the CCP in extreme but plausible market conditions. All other CCPs should maintain, at a minimum, total financial resources sufficient to cover the default of the one participant and its affiliates that would potentially cause the largest aggregate credit exposures to the CCP in extreme but plausible market conditions. |

| Rating: Observed |

Under the CPMI-IOSCO guidance note on application of the PFMIs to central bank FMIs, the PFMIs are not intended to constrain the central bank policies on provision of credit by the central bank, or the terms of or limits on such provision.

RTGS system is not exposed to any credit risk in a direct manner, except its exposure to participants by way of granting Intra-Day Liquidity IDL facility. Eligible participants can obtain credit against eligible securities in the form of IDL to overcome short-term (intra-day) liquidity requirements for settlement of transactions.

The IDL facility is granted within the business day of RTGS and must be reversed before the End of Day (EoD). Collateral for IDL comprises high-quality, risk-free, and liquid government securities held in the IDL-Subsidiary General Ledger account of the participants. The quantum of IDL is set at three times the participant's latest assessed Tier-1 capital, and IDL is provided after applying sufficient haircut to mitigate any credit risk. IDL operations undergo close monitoring by the operators, and automatic reversal occurs when sufficient balance is available in the settlement account. Any outstanding drawing under IDL is automatically converted to borrowing under the Marginal Standing Facility.

The RTGS System Regulations, 2013 and circulars issued by the RBI, acting as the operator of RTGS, offer clear guidelines and instructions to members regarding the IDL facility in the RTGS system. This ensures transparency and clarity in the utilization of the IDL facility by participants and mitigation of credit risk. |

Principle 5: Collateral

| An FMI that requires collateral to manage its or its participants’ credit exposure should accept collateral with low credit, liquidity, and market risks. An FMI should also set and enforce appropriately conservative haircuts and concentration limits. |

| Rating: Broadly Observed |

Under the CPMI-IOSCO guidance note on application of the PFMIs to central bank FMIs, the PFMIs are not intended to constrain the central bank policies on what can be accepted as eligible collateral in central bank lending operations.

RBI, as operator of the RTGS system, provides Intra-Day Liquidity facility to eligible participants against the collateral of eligible government securities held with RBI.

The IDL facility is limited for each eligible participant to three times their latest assessed Tier-1 Capital and is provided after taking sufficient haircut to minimise credit, liquidity and market risks. As only high-quality risk-free government securities held with RBI are accepted as collateral, mark to market valuation is not done.

No concentration limit is placed as only high quality and liquid government securities are eligible as collateral. RBI performs collateral management in its internal systems and has full operational flexibility. |

Principle 6: Margin

| A CCP should cover its credit exposures to its participants for all products through an effective margin system that is risk-based and regularly reviewed. |

| Rating: Not Applicable |

| As per the CPSS-IOSCO Disclosure framework and assessment methodology document, Principle 6 is only applicable to CCPs. Therefore, Principle 6 is not applicable to the RTGS System. |

Principle 7: Liquidity Risk

| An FMI should effectively measure, monitor, and manage its liquidity risk. An FMI should maintain sufficient liquid resources in all relevant currencies to effect same-day and, where appropriate, intraday and multiday settlement of payment obligations with a high degree of confidence under a wide range of potential stress scenarios that should include, but not be limited to, the default of the participant and its affiliates that would generate the largest aggregate liquidity obligation for the FMI in extreme but plausible market conditions. |

| Rating: Broadly Observed |

As RTGS is a credit push system and all transactions are settled on a gross basis, the liquidity risk faced in RTGS is limited to transactions of individual participants not being processed for want of sufficient liquidity.

To mitigate this risk, RBI provides IDL facility to eligible members against risk free government securities. Members have access to real time dashboard which they use to monitor their account; this helps them track transactions and manage liquidity. Members can also transfer funds from their current account at the RBI to the RTGS settlement account instantaneously via Own Account Transfers, which gives them more operational flexibility to manage their liquidity position. |

Principle 8: Settlement Finality

| An FMI should provide clear and certain final settlement, at a minimum by the end of the value date. Where necessary or preferable, an FMI should provide final settlement intraday or in real time. |

| Rating: Observed |

The RTGS system is designed to provide real time gross settlement for all transactions and settlements affected by ancillary payment systems and other FMIs such as CCIL. Settlement in the RTGS system takes place in the books of RBI, i.e. central bank money, and thus is final.

The PSS Act, 2007 is a legal statute which defines the terms viz., Gross settlement and settlement finality. Settlement Finality is given legal basis in Section 23 of the PSS Act, 2007. The procedure and operational aspects are part of the RTGS Regulations, 2013 and these RTGS Regulations are covered in the schedule of the PSS Regulations, 2008 issued under the PSS Act, 2007. |

Principle 9: Money Settlement

| An FMI should conduct its money settlements in central bank money where practical and available. If central bank money is not used, an FMI should minimise and strictly control the credit and liquidity risk arising from the use of commercial bank money. |

| Rating: Observed |

| Since RTGS is owned and operated by RBI, the central bank of the country, settlements in RTGS occur on a real time basis in central bank money via the RTGS settlement accounts of the participants. RTGS Settlement account balances are held in the books of RBI. |

Principle 10: Physical Deliveries

| An FMI should clearly state its obligations with respect to the delivery of physical instruments or commodities and should identify, monitor, and manage the risks associated with such physical deliveries. |

| Rating: Not Applicable |

| As per the CPSS-IOSCO Disclosure framework and assessment methodology document, Principle 10 is only applicable to CCPs. Therefore, Principle 10 is not applicable to the RTGS System. |

Principle 11: Central Securities Depositories

| A CSD should have appropriate rules and procedures to help ensure the integrity of securities issues and minimise and manage the risks associated with the safekeeping and transfer of securities. A CSD should maintain securities in an immobilised or dematerialised form for their transfer by book entry. |

| Rating: Not Applicable |

| As per the CPSS-IOSCO Disclosure framework and assessment methodology document, Principle 11 is only applicable to CCPs. Therefore, Principle 11 is not applicable to the RTGS System. |

Principle 12: Exchange-of-Value Settlement Systems

| If an FMI settles transactions that involve the settlement of two linked obligations (for example, securities or foreign exchange transactions), it should eliminate principal risk by conditioning the final settlement of one obligation upon the final settlement of the other. |

| Rating: Not Applicable |

| The RTGS system does not offer either Payment versus Payment or Delivery Vs Payment Services. Hence, Principle 12 is not applicable to the RTGS System. |

Principle 13: Participant default rules and procedures

| An FMI should have effective and clearly defined rules and procedures to manage a participant default. These rules and procedures should be designed to ensure that the FMI can take timely action to contain losses and liquidity pressures and continue to meet its obligations. |

| Rating: Observed |

Under the CPMI-IOSCO guidance note on application of the PFMIs to central bank FMIs, the PFMIs are not intended to constrain the central bank policies on maintaining financial stability including managing participant defaults.

RTGS being a real time credit push system, transactions only get settled when sufficient balance is available in the remitting member’s settlement account. In case of temporary shortage IDL is triggered. The possibility of default therefore does not arise. In the case of Multilateral Net Settlement Batch (MNSB) settlement files of ancillary payment systems posted in RTGS, the settlement would not happen in case of shortfall in current account of any participant with RBI. The mechanism to handle such situations is part of the respective Payment System.

RTGS Regulations 2013 provides the process to be followed where participant/s is unable to reverse IDL at end of the day. In such a situation, the Government of India Securities that were taken as collateral can be liquidated and the outstanding amount is converted into borrowing under Marginal Standing Facility.

The documents related to the default procedures which include the RTGS System Regulations, 2013 (which basically contains the rules and procedures for operation of RTGS system), various circulars issued by RBI as operator of RTGS, etc., have been publicly disclosed on the Bank’s website. |

Principle 14: Segregation and Portability

| A CCP should have rules and procedures that enable the segregation and portability of positions of a participant’s customers and the collateral provided to the CCP with respect to those positions. |

| Rating: Not Applicable |

| As per the CPSS-IOSCO Disclosure framework and assessment methodology document, Principle 14 is only applicable to CCPs. Therefore, Principle 20 is not applicable to the RTGS System. |

Principle 15: General Business Risk

| An FMI should identify, monitor, and manage its general business risk and hold sufficient liquid net assets funded by equity to cover potential general business losses so that it can continue operations and services as a going concern if those losses materialise. Further, liquid net assets should at all times be sufficient to ensure a recovery or orderly wind-down of critical operations and services. |

| Rating: Observed |

The RTGS system is a central bank operated FMI. The risk management framework of RBI, as operator of the RTGS system, is based on the three lines of defense model which includes identification of risks and maintenance of a risk register by the operations team; incident reporting framework under which any disruption to RTGS operations is reported to the risk monitoring department; and risk based internal inspection and audit by independent inspection department.

The risk register captures the risks associated with RTGS processes, the impact and likelihood of these risks, combined inherent risk rating, controls to manage the risks and effectiveness of these controls. The risk register is reviewed and revised annually. Sufficient controls and processes have been incorporated and put in place to manage the risks.

However, considering that RTGS is owned and operated by RBI (the central bank of country), the requirement to hold ring-fenced liquid net assets funded by equity to cover business risk and support a recovery or wind-down plan or to raise additional equity does not apply, and thus has not been examined. |

Principle 16: Custody and Investments Risks

| An FMI should safeguard its own and its participants’ assets and minimise the risk of loss on and delay in access to these assets. An FMI’s investments should be in instruments with minimal credit, market, and liquidity risks. |

| Rating: Observed |

Under the CPMI-IOSCO guidance note on application of the PFMIs to central bank FMIs, the PFMIs are not intended to constrain the central bank policies on its investment strategies (including that for reserve management) or the disclosure of that strategy.

RBI does not use any other entity as custodian of assets and holds the assets with itself. Thus, no risk of loss and no delay in access to these assets are observed.

The assets are provided by participants in the form of high-quality government securities when availing Intra-Day Liquidity (IDL) facility. RBI maintains custody of these assets in entirety with itself, and these are promptly accessible by RTGS system. IDL agreement is signed between the member and RBI while granting RTGS membership. The agreement covers aspects related to the enforcement of its interest or ownership rights in assets held in custody. |

Principle 17: Operational Risks

| An FMI should identify the plausible sources of operational risk, both internal and external, and mitigate their impact through the use of appropriate systems, policies, procedures, and controls. Systems should be designed to ensure a high degree of security and operational reliability and should have adequate, scalable capacity. Business continuity management should aim for timely recovery of operations and fulfilment of the FMI’s obligations, including in the event of a wide-scale or major disruption. |

| Rating: Broadly Observed |

Operational risks pose a major challenge to the efficient functioning of the RTGS system and can be classified as people, process, and technological risks. The operational risks have been identified as a part of the risk management framework. The risk management framework of RBI consists of identifying risks, incident reporting, monitoring risks and risk-based audit by independent departments within RBI. When identifying risks, the impact and likelihood of these risks, combined inherent risk rating, controls for managing the risk and control effectiveness are also identified.

Comprehensive structure and guidelines are in place to manage operational risk. The Risk Monitoring Department ensures that the guidelines are followed. This includes periodic internal audits, training to key personnel, periodic BCP/ DR drills, Vulnerability Assessment and Penetration Testing (VAPT), root cause analysis for any incident, etc.

The objective is to provide uninterrupted and dependable RTGS. Thresholds for recovery time, recovery point and downtimes, which ensure operational reliability, have been clearly defined and is put to periodic tests. The capacity of the RTGS system, infrastructure solutions and interfaces are planned based on expected volumes. In the case of addition of new functionality, volume and stress testing are carried out. The capacity utilization is monitored on a regular basis. RBI does regular benchmarking of its system, to ensure that the system has sufficient capacity to process expected volumes. Peak volumes are compared with benchmarked standards on a regular basis. The current benchmarked capacity in RTGS is over 4 times that of peak daily volume of transactions till date.

Physical and Information security policies are put in place and monitored. IS Policies and Standards are designed to maintain the confidentiality, integrity and availability of information. Detailed standards and procedures have been established in areas such as firewall management, Internet access, intrusion detection, password management, remote access, etc. It also encompasses various aspects related to Cyber Security, data storage, etc.

The business continuity plan (BCP) clearly identifies key resources, systems and processes for recovering from any disruption. The objective of the RTGS BCP is to ensure that services are not disrupted and in case of disruption recovery is ensured is as per pre-defined RTO and RPO. Critical business operations and corresponding resources are prioritized, organized and managed. Incident response procedures have been developed and are tested regularly with different scenarios and compositions. Technical back-up sites are available, alternative communication channels are in place for data and telecommunication services. RTGS systems are hosted across three sites to ensure timely recovery from all disruptive events.

DR Drills are conducted on a quarterly basis to ensure familiarity among all stake holders in the recovery process and ensure achievement of RTO and RPO objectives. Various Disaster Scenarios and the recovery procedures involving RTGS, related systems and participants have been captured in detail in the BCP document. |

Principle 18: Access and participation requirements

| An FMI should have objective, risk-based, and publicly disclosed criteria for participation, which permit fair and open access. |

| Rating: Observed |

Under the CPMI-IOSCO guidance note on application of the PFMIs to central bank FMIs, the PFMIs are not intended to constrain the central bank policies on whom to offer central bank accounts to and on what terms.

However, the criteria for participation are covered in the RTGS System Regulations, 2013, and Master Direction on access criteria for payment systems issued by RBI. These documents are available on the RBI website. Membership criteria parameters are objective in nature and there are two sets of access criteria, for banks and for non-banks. The access criteria include financial, legal and operational requirements as specified by the RBI, as the operator of RTGS, from time to time. The requirements are fair and objective. Entities not meeting the requirements may opt for sub membership via a sponsor bank.

The Master Direction on Access Criteria for Payment Systems is designed to ensure the safety, security, and integrity of RTGS System by subjecting participants to certain minimum standards.

Monitoring compliance with access criteria is a part of periodic inspections by supervisory department. Necessary restrictions are placed on participants as per the input received from supervisory departments. Continuation of participants in payment systems is allowed on the recommendation of the concerned regulatory / supervisory department. Suspension and orderly exit are also governed by the Master Direction on access criteria of payment systems.

RTGS has a fair, objective, and transparent access criterion. Compliance to conditions laid in access criteria is monitored periodically and all disclosure are made on the Bank’s website, which is readily accessible to public. |

Principle 19: Tiered participation arrangements

| An FMI should identify, monitor, and manage the material risks to the FMI arising from tiered participation arrangements. |

| Rating: Broadly Observed |

The RTGS system allows for indirect access of sub-members via sponsor banks, as given in the RTGS System Regulations, 2013 and the Master Directions on access criteria for payment systems, however no separate recognition is given to indirect participants. The responsibility of sub-members lies with the sponsor bank.

Detailed responsibilities for sponsor banks are given in the RTGS System Regulations, 2013 and the Master Directions on access criteria for payment systems. The Sponsor bank is required to put in place a risk management framework and a system of continuous monitoring of the risk management practices of the Sub-members sponsored by them. Further, the sponsor bank would be responsible for sending/ receiving the transactions / messages on behalf of their sub-members and redressall of all customer complaints / grievance would be the responsibility of the sponsor bank.

No prior approval is required before sponsoring a sub-member; however, every sponsor bank must immediately report the admission / removal of a bank as a sub-member to the Regional Director, Mumbai Regional Office, RBI. Further, sponsor banks are required to submit a list containing details of sub-members sponsored by them every year, as on March 31.

The responsibilities related to the sub-member lies on the sponsor bank and thus there is no risk to the RTGS system. |

Principle 20: FMI Links

| An FMI that establishes a link with one or more FMIs should identify, monitor, and manage link-related risks. |

| Rating: Not Applicable |

| As per the CPSS-IOSCO Disclosure framework and assessment methodology document, Principle 20 is not applicable for Payment Systems. Therefore, Principle 20 is not applicable to the RTGS System. |

Principle 21: Efficiency and effectiveness

| An FMI should be efficient and effective in meeting the requirements of its participants and the markets it serves. |

| Rating: Observed |

The objective of the RTGS System is to establish a real-time electronic funds transfer system to facilitate an efficient, safe, secure, economical, reliable, and expeditious system of funds transfer and clearing in the banking sector throughout India. RTGS system was designed to ensure settlement finality. The number of transactions and their volume has increased over the years, suggesting the acceptability of the payment system.

RTGS operations are based on best practices and international standards, which are effective and efficient. The RTGS system has robust risk management framework and BCP/DR procedures, which ensure robust operation.

The CPS Standing Committee and Department Level Customer Service committee provide a platform for the operators of RTGS to interact and get feedback from the participants. These forums are also used to address issues faced by participants. Suggestions received from participants at these forums are considered for implementation.

RTGS was enhanced to the Next Generation – RTGS (NG-RTGS) built on the ISO 20022 standards with advanced features, which went live on October 19, 2013. RTGS in India has been made available round the clock on a 24x7x365 basis with effect from December 14, 2020. All these steps were taken to make the system more secure and to serve the markets much better. |

Principle 22: Communication procedures and standards

| An FMI should use, or at a minimum accommodate, relevant internationally accepted communication procedures and standards in order to facilitate efficient payment, clearing, settlement, and recording. |

| Rating: Observed |

| The XML based message format used in RTGS conforms to ISO 20022 standards, an internationally recognized financial messaging standard. |

Principle 23: Disclosure of Rules, Key Procedures, and Market Data

| An FMI should have clear and comprehensive rules and procedures and should provide sufficient information to enable participants to have an accurate understanding of the risks, fees, and other material costs they incur by participating in the FMI. All relevant rules and key procedures should be publicly disclosed. |

| Rating: Observed |

The rules and procedures for the RTGS system, the rights and obligations of the participants, fees and charges, etc. are given in the RTGS System regulations, 2013 and Master directions on Access criteria issued by RBI. All the above-mentioned documents are published on the Bank’s website.

Data on volume and value of transactions settled in RTGS system is also published on the Bank’s website. The data disclosed is comprehensive and consists of daily, monthly, and participant-wise data. The names of all the participants and RTGS enabled branches across the country are disclosed on the bank’s website and updated fortnightly.

Certain restricted information which is related to technical aspects of the RTGS system is shared on a need-to-know basis with the participants over the INFINET system, which is a membership only and closed user group consisting of the RBI and participants. Further, the participants have access to a help menu in the RTGS system.

Any other issues/ feedback can be raised with the CPS Standing Committee, by the participants. |

Principle 24: Disclosures of Market Data by Trade Repositories

| A TR should provide timely and accurate data to relevant authorities and the public in line with their respective needs. |

| Rating: Not Applicable |

| As per the CPSS-IOSCO - Disclosure framework and assessment methodology document, Principle 24 is only applicable for Trade Repositories. Therefore, Principle 24 is not applicable to the RTGS System. |

Annex 1

List of publicly available resources

1. Principles for financial market infrastructures by BIS, April 2012

2. PFMI: Disclosure framework and Assessment methodology, Dec 2012

3. Regulation and Supervision of FMIs regulated by RBI, June 2013

4. Oversight Framework for FMIs and Retail Payment Systems, June 2020

5. Booklet on Payment Systems, Jan 2021

6. Payment and Settlement Systems Act, 2007

7. Payment and Settlement Systems Regulations, 2008

8. Real Time Gross Settlement (RTGS) System Regulations, 2013

9. Payments Vision 2025

10. Frequently Asked Questions on RTGS

11. XSDs, Rules, Sample Messages, revised FAQ w.r.t ISO 20022 for RTGS

12. List of RTGS enabled bank branches

Annex-2

Abbreviations

| BCP |

Business continuity plan |

| BPSS |

Board for regulation and supervision of payment and settlement systems |

| CCIL |

Clearing Corporation of India Limited |

| CCP |

Central counterparty |

| CO |

Central office |

| CPS |

Centralised Payment Systems |

| CRR |

Cash Reserve Ratio |

| CSD |

Central securities depository |

| DIT |

Department of Information Technology |

| DNS |

Deferred net settlement |

| DPSS |

Department of Payment and Settlement Systems |

| DR |

Disaster recovery |

| E-Kuber / CBS |

Core banking solution |

| ERM |

Enterprise Risk Management |

| FAQ |

Frequently Asked Questions |

| GOI |

Government of India |

| G-Sec |

Government securities |

| IDL |

Intraday liquidity |

| INFINET |

Indian Financial Network |

| ISO |

International Organization for Standardization |

| IT |

Information Technology |

| IS |

Information Security |

| LOLR |

Lender of last resort |

| MNSB |

Multilateral net settlement batch |

| NG-RTGS |

New Generation Real Time Gross Settlement |

| NPCI |

National Payments Corporation of India |

| OAT |

Own account transfer |

| PFMI |

Principles for financial market infrastructures |

| PDs |

Primary Dealers |

| PSS Act |

Payment and Settlement Systems Act, 2007 |

| PS |

Payment Systems |

| RBI |

Reserve Bank of India |

| RBI Act |

Reserve Bank of India Act, 1934 |

| RTGS |

Real time gross settlement |

| RPO |

Recovery Point Objective |

| RTO |

Recovery Time Objective |

| SGL |

Subsidiary General Ledger |

| SLR |

Statutory liquidity ratio |

| SFMS |

Structured Financial Messaging System |

| SOP |

Standard operating procedures |

| SSS |

Securities settlement system |

| TR |

Trade Repository |

| XML |

Extensible markup language |

Annex-3

Definition of ratings under PFMIs2

Observed

The FMI observes the principle. Any identified gaps and shortcomings are not issues of concern and are minor, manageable and of a nature that the FMI could consider taking them up in the normal course of its business.

Broadly observed

The FMI broadly observes the principle. The assessment has identified one or more issues of concern that the FMI should address and follow up on in a defined timeline.

Partly observed

The FMI partly observes the principle. The assessment has identified one or more issues of concern that could become serious if not addressed promptly. The FMI should accord a high priority to addressing these issues.

Not observed

The FMI does not observe the principle. The assessment has identified one or more serious issues of concern that warrant immediate action. Therefore, the FMI should accord the highest priority to addressing these issues.

Not applicable

The responsibility does not apply to the authorities because of the particular institutional framework or other conditions faced by the authorities with respect to this responsibility.

|

IST,

IST,