IST,

IST,

RBI WPS (DEPR): 03/2023: Competitiveness and Determinants of Agricultural Exports: Evidence from India

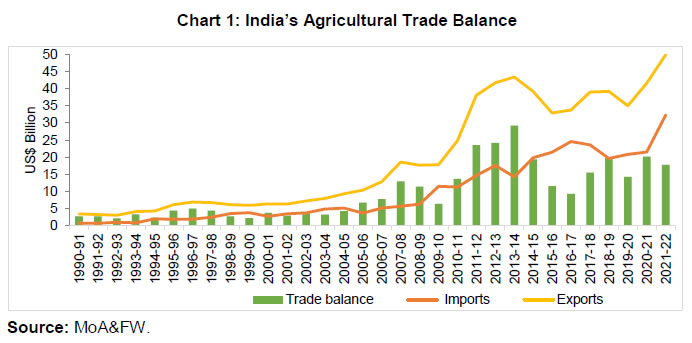

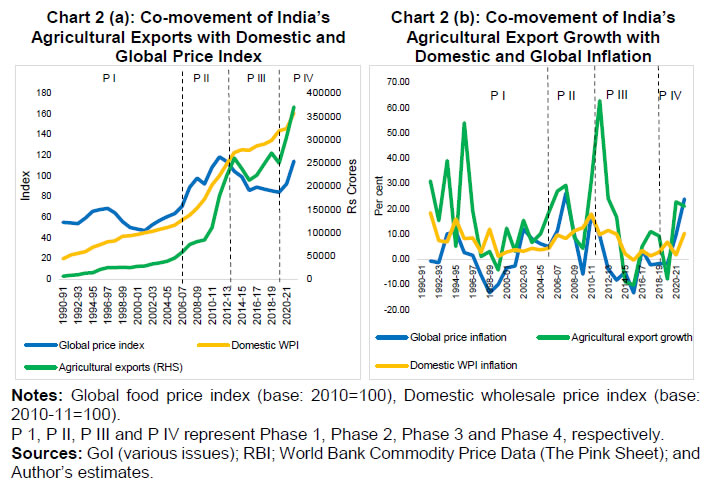

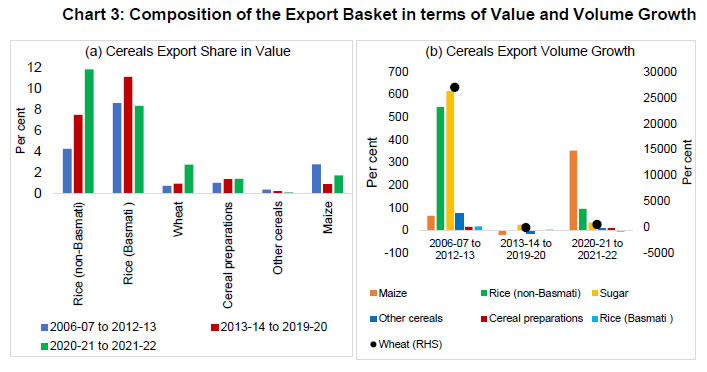

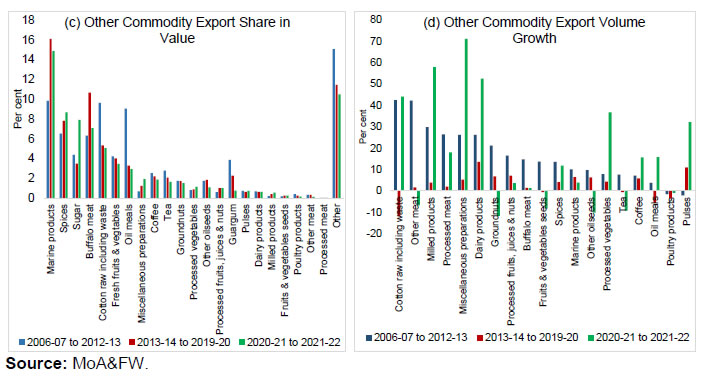

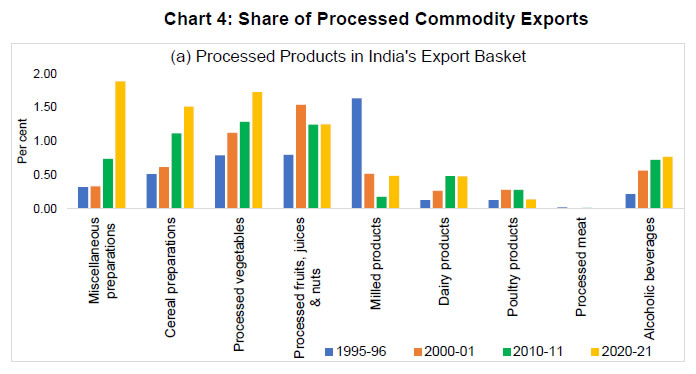

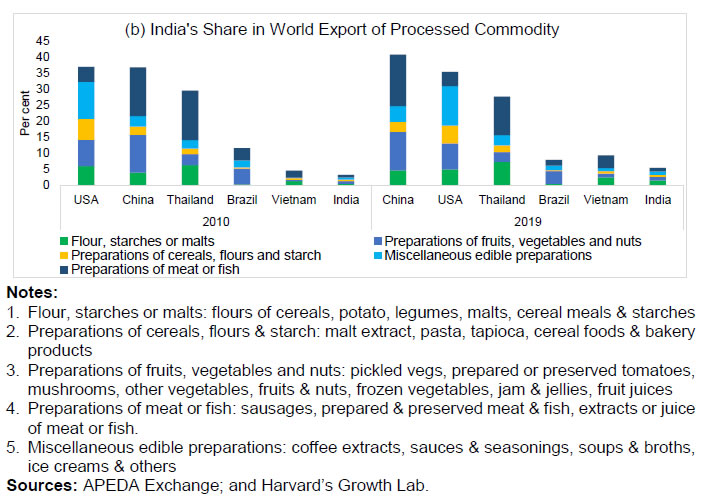

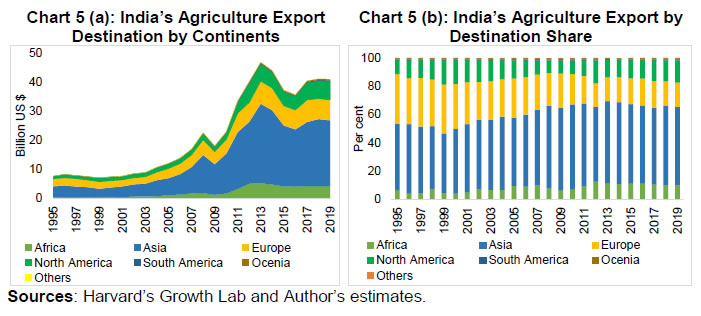

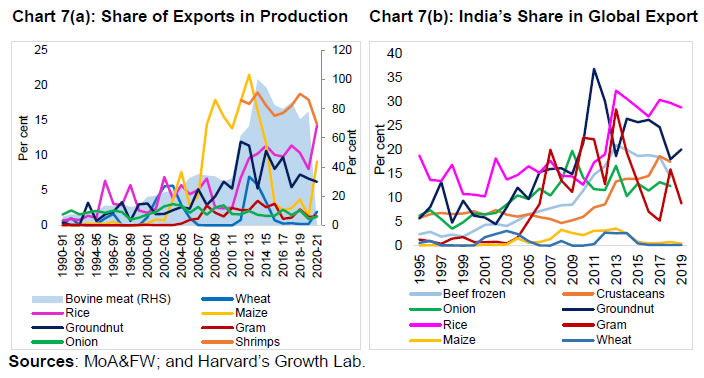

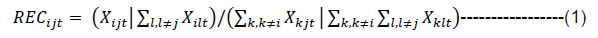

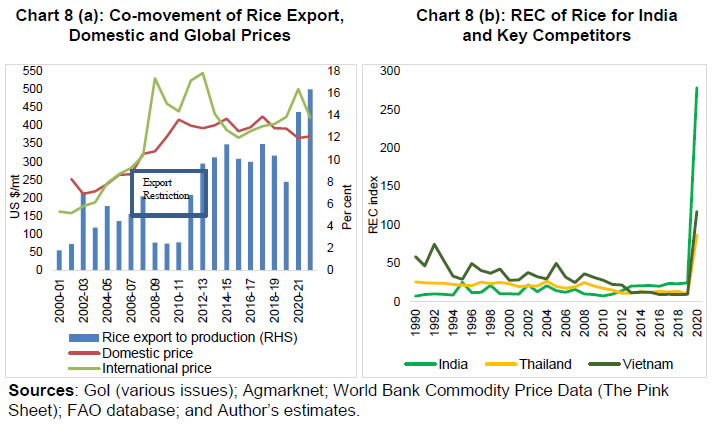

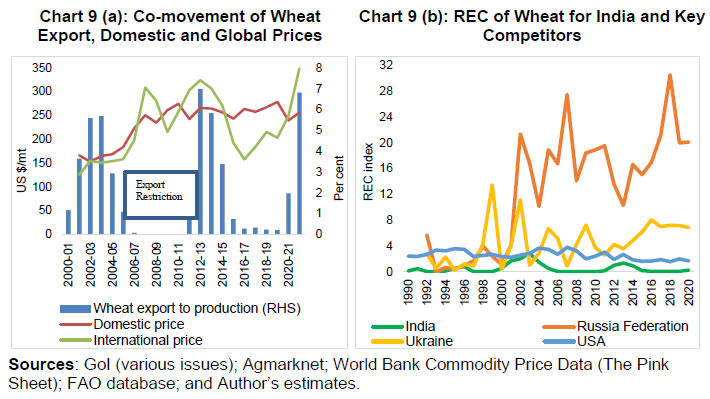

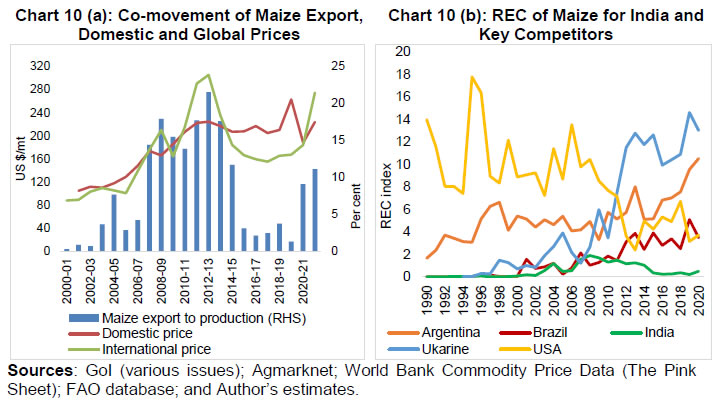

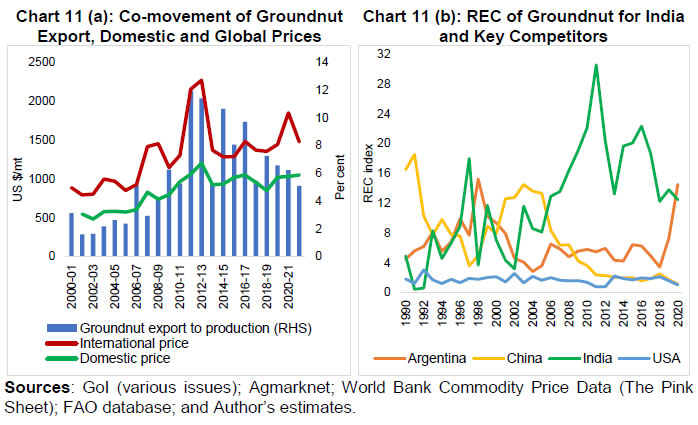

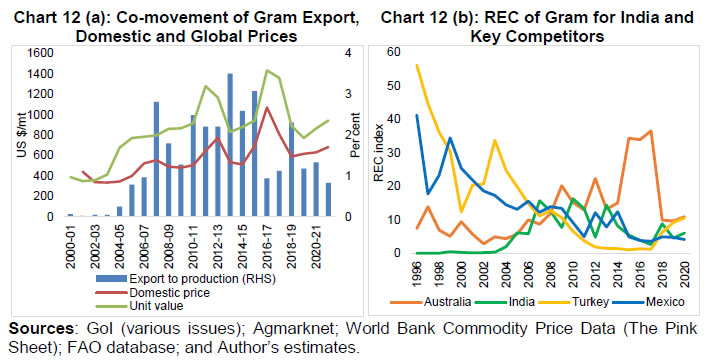

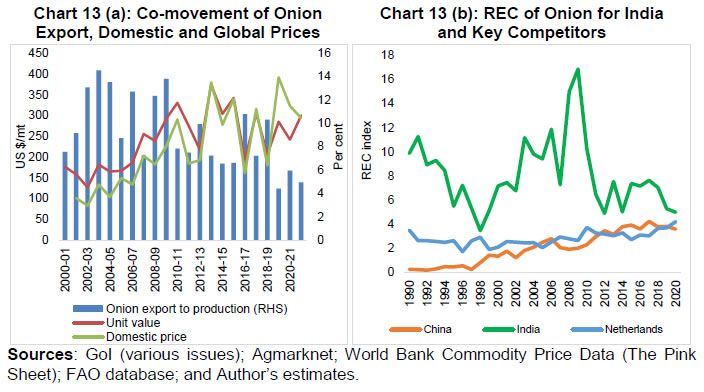

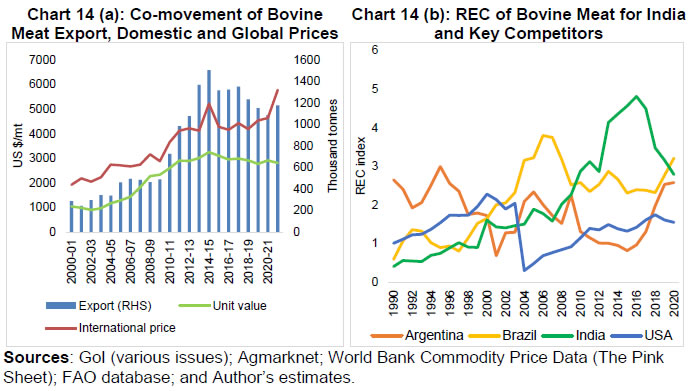

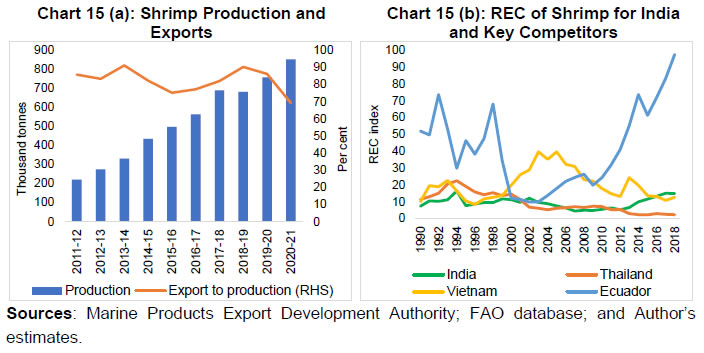

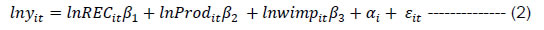

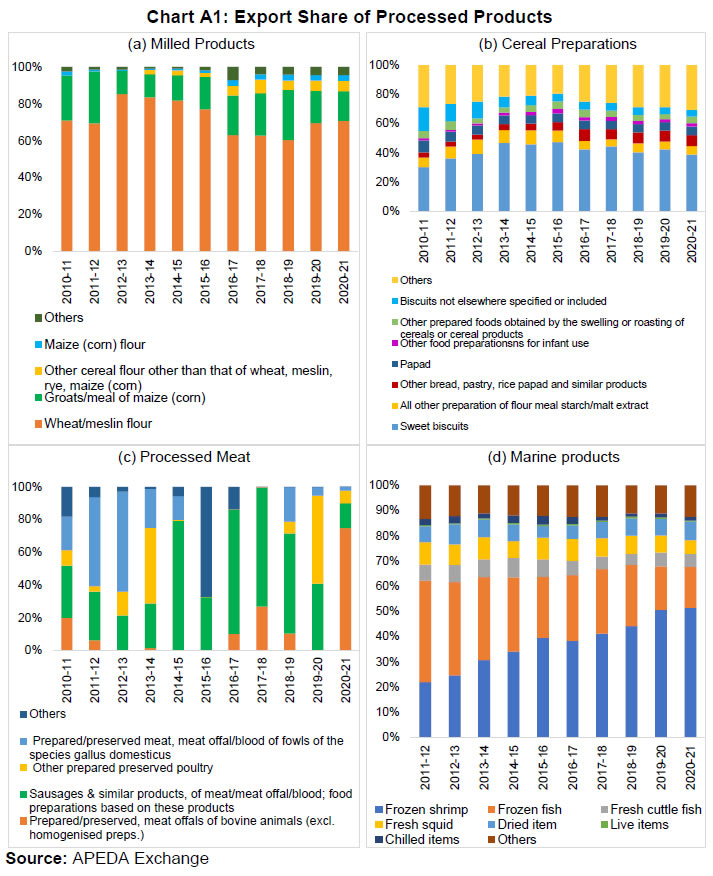

RBI Working Paper Series No. 03 Competitiveness and Determinants of Agricultural Exports: D. Suganthi@ Abstract *The paper examines the relative export competitiveness (REC) of eight agricultural commodities (rice, wheat, maize, gram, groundnut, onion, bovine meat and shrimp) from 1990 to 2020. The findings reveal that India’s export of rice was the most competitive, followed by groundnut, shrimp, gram, onion and bovine meat. The REC has generally been lower for India than its global competitors. It has, however, improved more recently, particularly for rice, groundnut, onion and bovine meat. India’s export competitiveness of agricultural commodities is influenced by the dynamics of domestic and global prices. The panel cointegration analysis shows that higher competitiveness, elevated global prices relative to domestic prices and a stable export policy contribute to improved agricultural export performance. Focusing on improving domestic production through productivity growth, export competitiveness through product differentiation, value addition, access to new markets and branding can promote sustainable growth in agricultural exports. JEL Classifications: Q16, Q17, Q18 Keywords: Export competitiveness, commodity supercycle, panel cointegration, India Introduction India’s agricultural and allied sector exports remained buoyant during 2020-21 to 2021-22, posting a remarkable growth of 18 per cent and 20 per cent in these two years, respectively. This growth was achieved in the midst of a sharp increase in global food prices led by edible oils and cereals. This increase in global food prices was the fallout of COVID-19 pandemic-induced supply disruptions, increase in pent-up demand with the easing of lockdown restrictions and the conflict in Ukraine since February 2022.1 The value of agricultural exports scaled a new record of US Dollar (USD) 50 billion in 2021-22, which was higher by 15 per cent than the previous peak achieved in 2013-14. The Agriculture Export Policy (AEP) of 2018 envisages to double agricultural exports to USD 60 billion by 2022.2 The achievement for 2022 (January to November), at USD 47.8 billion, was lower than the target set under the AEP, considering unprecedented logistical challenges in the form of high freight rates and container shortages, this export performance can be deemed robust, auguring well for doubling farmer’s income. The agricultural and allied activities export growth was stagnant in the pre-pandemic period, despite record production of foodgrains and horticulture crops for four successive years from 2016-17 to 2019-20. The agricultural export as a per cent of agricultural and allied activities Gross Value Added (GVA) decelerated from a peak of 14 per cent in 2013-14 to 7.3 per cent in 2019-20. Even as India emerged as a major producer and a net exporter of food with a significant increase in the shares of several commodities3 in total value of agricultural exports, its share in global exports contracted marginally from 2.6 per cent in 2013 to 2.2 per cent in 2019.4 This came against the backdrop of easing of global commodity prices underpinned by huge global stockpiles and trade protectionism driven by geopolitical tensions. Theories on international trade argue that openness and integration with global markets support economic growth and employment generation in developing countries (McCalla and Nash, 2007). International trade can catalyse economic growth through productivity enhancement by facilitating technological progress, increased flow of investment and efficient resource allocation (Winters, 2004). Several empirical studies have shown that an increase in agricultural exports can fuel growth more than an expansion of domestic market (Aksoy and Beghin, 2004). Evidence from the countries that sustained agriculture trade reforms showed an acceleration in agricultural growth (Valdes, 1998). The agricultural trade policy of India has evolved over several decades. From the overarching objective of achieving food self-sufficiency in the 1960s to 1970s, which resulted in increasing the net availability of foodgrains by the 1990s, to the initiation of agricultural trade reforms in 1995 by joining the World Trade Organisation (WTO), to the promotion of agricultural diversification in favour of High-Value Crops (HVC)5 in the 2000s, and to an explicit focus on doubling farmer’s income (OECD/ICRIER, 2018). In the mid-1990s, the agricultural trade reforms marked a departure from an inward-looking protectionist policy to a freer policy framework which removed quantitative restrictions, export licensing and allowed export of several agricultural commodities which were otherwise restricted owing to food security concerns (Vyas, 1999; Athukorala, 2005; and Bathla, 2006). Following integration with the WTO, India’s agricultural exports remained robust until the deceleration in global commodity prices. Of late, with surplus production, recognising the potential of the export channel to double farmer’s income, the government has undertaken concerted efforts to usher in reforms to boost agricultural exports.6 In the recent past, agricultural exports have exhibited high growth during the years of elevated global food prices (see Section II for details). It has stagnated during periods of subdued global food prices. Given the dynamics between domestic and global agricultural commodity prices, the competitiveness of agricultural commodities changes over time. Therefore, it is imperative to identify commodities in which India is competitive and study the dynamic changes in their competitiveness to promote value addition to achieve higher export growth. Against this backdrop, this paper examines the export competitiveness of major exported agricultural commodities, namely rice, wheat, maize, groundnut, gram, onion, bovine meat and shrimp, over the last three decades. The competitive performance of India’s key global competitors for each export commodity and the supply management policies of competitors are analysed to understand how India’s commodity competitiveness can be improved further going ahead. The paper also examines the factors influencing commodity exports from 1990-91 to 2019-20 by pooling commodity level data in a panel cointegration framework. The paper is organised as follows. The stylised facts are discussed in Section II. Section III analyses the REC of select agricultural commodities. The determinants of commodity exports are examined in Section IV. Section V concludes. II. Agricultural Exports: Stylised Facts India’s agricultural trade balance peaked in 2013-14 with the hardening of global prices from 2006-07 to 2012-13. The robust performance of agricultural exports relative to imports resulted in a buoyant trade balance. Subsequently, the trade balance decelerated until 2019-20 with an intermittent revival. Though the trade balance rebounded during pandemic-period (2020-21 to 2021-22), it still remained low as agricultural imports were high due to an unprecedented surge in edible oil prices against the backdrop of global supply disruptions and geopolitical tensions (Chart 1).  According to the literature, a commodity supercycle is defined as the extended period of prices moving above their long-term trend driven by higher demand. The recent supercycle (2006-07 to 2012-13) was due to rapid growth in the Chinese economy starting mid-2000s and resulted in peaking of the global food price index in 2011 as global prices of key commodities rallied (Erten and Ocampo, 2012). Furthermore, it was intensified by the diversion of foodgrains for biofuels, high crude oil prices pushing up the input costs, adverse weather conditions in major producing countries and speculative trade in commodity markets (Chand, 2010; Nair and Eapen, 2015). During the pandemic period, the increase in pent-up demand and lockdown-induced supply disruptions led to a rise in commodity prices. Furthermore, the Ukraine conflict resulted in a broad-based rise in prices, including crude oil, fertilisers and food commodities. The trends in global food price index, agricultural export growth, and domestic wholesale food price index (industrial worker’s food index) in the last three decades can be broadly classified into three distinct phases (Chart 2a). In phase 1 (1995-96 to 2005-06), the global food price index remained range bound. Subsequently, phase 2 (2006-07 to 2012-13) was marked as the commodity supercycle wherein the index surged sharply. In phase 3 (2013-14 to 2019-20), the global food price index decelerated, which rebounded in phase 4 (2020-21 to 2021-22) during the pandemic period. Generally, agricultural export growth has moved in tandem with international food inflation during all the phases (Chart 2b). In phase 1, following the integration with the WTO and trade reforms in several agricultural commodities, the agricultural exports in absolute values were moderate, and yet the export growth spiked.  In phase 2, marked as the commodity supercycle, the global food price index recovered from its trough and peaked in 2011-12. The global food inflation and agricultural export growth spiked twice, i.e., in 2007-08 and 2011-12, while domestic wholesale food inflation registered an increase but remained range-bound. As the global prices firmed up owing to an imbalance in demand and supply of commodities in the global market, India, like other countries, restricted rice and wheat exports from 2007-08 to 2010-11.7 Concurrently, Thailand restricted its rice exports, thus triggering an unprecedented global food price spike. Upon withdrawal of the export restriction, India’s rice and cereal exports soared up and increased manifold, achieving the highest growth ever in 2011-12. In phase 3, agricultural exports stagnated with moderation in the global food price index between 2013-14 and 2019-20, attributed to the easing of global commodity prices. This easing was owing to the global supply glut, record levels of cereal stockpiles and sluggish demand (RBI, 2019).8 India recorded broad-based agricultural production across several crop groups during this period. The growth in agricultural export was, however, lower than in the previous phases. Lately, in phase 4, starting with May 2020, the global commodity prices have firmed up with pent-up demand as the lockdown restrictions were gradually eased. Even before the demand-driven inflation could subside, the geopolitical conflict in Ukraine beginning in February 2022 shook the global economy leading to high inflation as prices of fuel, fertiliser and food items soared. Consequently, India’s agricultural exports scaled a new peak of USD 50 billion in 2021-22. II.1 Composition of Export Basket The agricultural export value for most of the commodity groups has clocked an increase since 1995-96. In 2021-22, the commodities having a high share in the value of agricultural exports were rice (19.2 per cent), marine products (15.5 per cent), sugar (9.2 per cent), meat (8 per cent) and cotton (5.6 per cent). Rice, marine products and bovine meat have maintained their position since the mid-1990s (Table A2). The firming up of global commodity prices have increased agricultural exports during phase 2 (period of the commodity supercycle) and phase 4 (during the pandemic period). The composition of the value of exports was compared across the phases. The export value growth in phase 2 and phase 4 was primarily driven by cereals. In particular, wheat and maize, despite their minor share in the export basket, exhibited a remarkable growth as compared to rice; this was on account of an increase in their export volume supported by the open trade policy, surplus production and global price competitiveness (Chart 3a and 3b). In phase 2, the export growth was broad-based as compared to phase 4. In phase 4 (pandemic period), key commodities such as buffalo meat, groundnut seed and marine products registered a lower share compared to previous phases, given the fall in the growth of export volume (Chart 3c and 3d). However, the growth in export volume in processed products such as milled products, miscellaneous preparations, dairy products and processed fruits and vegetables clocked an increase. As regards phase 3, with easing of global commodity prices, the growth in both value and volume of exports declined, possibly due to the presence of other competitive players and related competitive disadvantage. To sum up, the commodity export performance was remarkable in phase 2 and phase 4. However, in light of sharp increase in commodity prices, the growth in the volume of exports remained weak across most agricultural commodities except cereals.   II.2 Contribution of Processed Commodities to Exports The agricultural export basket is dominated by products with minimal processing. Though the contribution of processed products under various commodity groups has grown over the last three decades, starting with the 1990s, the pace of diversification has been slow on account of quality issues, lack of market destinations and high logistic costs (Chart 4a). The share of food processing in production is merely 10 per cent due to lack of processable varieties, inadequate storage, processing and logistics infrastructure (GoI, 2016). Thus, the post-harvest losses range from 7 per cent to as high as 16 per cent for fruits and vegetables, while it ranges from 3 per cent to 11 per cent for meat and fish products.9 In 2019, the share of global trade in processed commodity groups in total agricultural trade ranged from 1 per cent to 4 per cent.10 India’s share in world exports of processed content of cereals, meat, fruits, vegetables and fish remained modest as compared to the advanced economies and comparable Asian economies, such as Thailand and Vietnam (Chart 4b). Given India’s modest share in processed commodity exports, there is a need to increase the value addition in marine, meat and cereals by identifying new commodity markets through Free Trade Agreements (FTAs). II.3 Export Destination The destination-specific exports in value terms have waned after peaking in 2013 (Chart 5a). The export share to key destinations between 1995 and 2019 has remained unchanged, with majority confined to Asia. The geographic breakup shows that more than 65 per cent of the agricultural exports go to the Asia-Pacific and African regions (Chart 5b). This can be primarily attributed to the spurt in the bilateral and regional trade agreements between India with other Asian countries between 2000 and 2011 (OECD/ICRIER, 2018). Recently, India has signed the Comprehensive Partnership Agreement (CEPA) with the UAE, which will further boost agricultural exports with duty free access to the UAE market. For commodities like Basmati rice, non-Basmati rice, marine products, buffalo meat, groundnuts, onion and cereal preparations, the major destinations are Asian, African and Gulf countries. However, in the case of dairy products, floriculture products, processed fruits, juices and nuts, processed vegetables, fresh grapes, cucumber and gherkins (prepared and preserved), the dominant export destinations are the US, UK and EU. The agricultural export share to the US has increased, while in the case of EU, it has declined. Thus, to secure untapped export potential, more bilateral negotiations are needed.11    II.4 Refusals by Major Importers The US and EU have remained challenging markets due to their high sanitary and phytosanitary (SPS) norms. The number of US Food Drug Administration (USFDA) refusals for food imports increased from 490 in 2002 to 1650 in 2011, declining to 993 in 2019. Over the decade leading up to 2019, though the number of refusals for spices (including flavour and salts) and fruits and vegetable products decreased, they remained higher than other commodity groups (Chart 6a). While for fishery and seafood, and whole grains (including milled grain products and starch), refusals initially increased, they have come down recently. In most of the commodity groups, the refusals by USFDA were much higher than EU border rejections.  The number of border rejections by the EU for fruits and vegetable products and nuts (including nut products and seeds) were higher than other commodity groups, despite a falling trend in recent years (Chart 6b). The export share of vegetables to Europe ranged between 19 per cent in 1995 and 17 per cent in 2019, while the export share of fruits declined from 48 per cent to 35 per cent during this period. This shows that there is scope to increase exports to the EU. The SPS challenges, however, need to be addressed through bilateral negotiations. III. Relative Export Competitiveness The two main theoretical arguments in the international trade literature are the Ricardian and the Heckscher and Ohlin theorems, which underline the comparative advantage concept. According to the Ricardian theory, a country would benefit by specialising in the trade of commodities that can be produced at a relatively lower cost. However, the Heckscher and Ohlin theory argues that the factor endowments or the factor price difference across countries are the main drivers of international trade12. Studies examining the growth in exports have focused on constructing the Revealed Comparative Advantage (RCA) index using several approaches. While some studies have focused on relative domestic and foreign country prices over a period (Smith, 1988), others have examined the domestic and representative international prices over time (Jha et al., 2007; and Saini and Gulati, 2017). A few others have studied the relative cost of production between the countries (Hu et al., 2004). The most widely used method is the construction of RCA. It was introduced by Balassa (1965) and is constructed using the export trade of the country and the world for a commodity or a sector. Several studies in the literature analyse the RCA index in the context of advanced and emerging economies at the commodity or sectoral levels (Leromain and Orefice, 2014; and Vollrath, 1991). In the Indian context, the bulk of studies has examined the RCA index for agricultural commodities in comparison to the other competitors or with a region or with other countries as part of economic cooperation agreement (Andhale and Kannan, 2015; Chandran, 2012; Shinoj and Mathur, 2008; and Jagdambe, 2016). A few others have modified the index to avoid double counting13 (Narayan and Bhattacharya, 2019) (detailed literature is given in Table A3). Based on their shares in the export basket in value terms, rice, bovine meat, shrimp, groundnut, onion, gram, wheat and maize have been identified for the study; the share of these eight commodities stood at 44 per cent of India’s agricultural exports in 2021-22.14 Wheat and maize, which accounted for the lowest share, averaged around 3 per cent between 1995-96 and 2021-22. However, their share spiked during the years of elevated global commodity prices, making them an interesting case to study the dynamic changes in competitiveness.15  The shares of exports in total production of the eight commodities varied widely from 2 per cent for wheat to 69 per cent for shrimps in 2020-21 (Chart 7a). Over the study period, the share spiked during the global food crisis (phase 2) and again during the pandemic period (phase 4), with intermittent contraction due to the easing of global prices in phase 3 (2013-14 and 2019-20) (Chart 7b). India has emerged as a major player in the global exports of these commodities since the mid-1990s. This is evident from the rise in India’s share in global exports of these commodities during phase 2. Despite the moderation in phase 3, the increase in India’s share in global exports has been significant in the case of rice, bovine meat (frozen), groundnut and crustaceans. The REC measure was constructed for the eight commodities from 1990 to 2020. This index was pioneered by Balassa (1965) and is known as the relative comparative advantage. It measures the share of a commodity in the total exports of the country relative to the commodity share in the total world exports. Subsequently, the index was modified to remove the double-counting issue present in Balassa’s RCA index (Scott and Vollrath, 1992); the modified index was used recently in the Indian context as well (Narayan and Bhattacharya, 2019).16 The general equation of the index is:  where, Xijt represents exports; i refers to commodities; k denotes the total agricultural exports; t refers to time, j and l represent India and the rest of the world, respectively. To avoid double-counting, India is excluded from the calculation of the world market of commodity i (Xilt). Also, export of commodity i is excluded from India’s (Xkjt) and world exports (Xklt). The index captures India’s competitiveness in commodity i to its share in world market relative to its other exports in the global market. The index value above unity indicates that it has a competitive advantage at any point in time. To construct this index, annual time series data for India and other competitors were sourced from the Food and Agriculture Organisation database (FAOSTAT). III.1 Comparison of Commodity-wise REC of India and Key Competitors III.1.1. Rice The global rice trade is thin. It is concentrated in Asia, with Asian countries contributing around 75 per cent of the total rice trade in 2019.17 India has scaled new records in rice production, which has increased by 1.6 times since the 1990s. Its export share in global rice market has increased substantially from 19 per cent to 30 per cent between mid-1990s and 2019.18 Though the export of fine rice variety (Basmati) was always open, the export of common rice (non-Basmati) was opened up in 1995; it was restricted using quotas, Minimum Export Price (MEP) until 1994. With the global food crisis, India imposed restrictions on the exports of common rice from 2008-09 to 2010-11.19 Between 2011-12 and 2019-20, the share of rice exports in total rice production ranged between 8 and 11 per cent. During the pandemic period, however, this share has witnessed a surge. The comparison between domestic and global rice prices (proxied by Thailand's 25 per cent broken rice) reveals that during the global food crisis, international prices were much higher. However, for food security concerns, the exports were restricted. Subsequently, with the removal of the export restriction, rice exports increased. Since 2013-14, with moderating global prices, the gap between the price series has reduced. However, rice exports are still competitive for India. During the pandemic period, global prices spiked, leading to record levels of rice exports (Chart 8a). According to the REC, Indian rice exports were competitive during the 1990s and 2000s. However, the competitiveness of rice exports was lower for India than its competitors (Chart 8b). This is consistent with the findings of Narayan and Bhattacharya (2019). Though the REC for Thailand and Vietnam was higher than India, it has been on a declining trend since the 1990s. In 2012, the REC of Indian rice outpaced both Thailand and Vietnam and has remained strong since then owing to a significant increase in export of non-Basmati milled rice to total rice production; this share increased from 1 per cent in 2000-01 to 4.2 per cent in 2019-20, further to 13 per cent during the pandemic period. The share of Thailand in global rice exports declined moderately from 26 per cent in the mid-1990s to 22 per cent in 2018.20 Nonetheless, its export share in total production was 32 per cent (USDA, 2021a), much higher than India (8 per cent) in 2019-20, indicating the significance of export channel for supply management.  Rice exports have been highly competitive due to surplus production driven by price support-backed procurement. However, rice is a water guzzling crop. Falling groundwater level is a major challenge to sustain rice production, highlighting the need to develop new varieties requiring low level of irrigation. Furthermore, there is a need to shift rice production away from regions with critically low groundwater levels, such as Punjab to more conducive agro-climatic regions. III.1.2. Wheat India consumes most of the domestically produced wheat, which is often supplemented by imports. Therefore, the share of wheat exports in total wheat production for India is much lower than at the global level. For food security concerns, wheat exports are allowed cautiously and have been more prone to export restrictions since its liberalisation in 1995. The first export restriction was imposed from 1996-97 to 1999-00 due to supply scarcity which led to domestic inflation. During the global food crisis period from 2006-07 to 2010-11, high price realisation of farmers from the open market resulted in low procurement and stocks with the government (Saini and Gulati, 2017). With the rally in global wheat prices caused by the Ukraine conflict, Indian wheat exports reached an unprecedented level of 6.8 per cent of production in 2021-22. Subsequently, however, domestic wheat production dropped due to intense heatwave driving up the open market prices, leading to low procurement and stocks, forcing the government to impose export restriction in May 2022.  The domestic price of wheat has mostly remained above the global prices (proxied by US hard red winter wheat number 2: US HRW) except for the episodes of high global food prices. This indicates the existence of more competitive producers globally (Chart 9a). Historically, the US, Canada, Australia and European countries were the major players in wheat exports, which shared a similar cost of production. This was the case until recently, when these countries were outperformed by the Black Sea region countries, comprising Russia, Ukraine and Kazakhstan (Kingwell et al., 2016). The REC of Indian wheat has remained uncompetitive except an intermittent increase in competitiveness during the periods of high global wheat prices. The export competitiveness of Indian wheat has remained low compared with other countries. The REC of Russia and Ukraine has soared in the last two decades, while the REC of the US has shown a gradual decline (Chart 9b). Collectively, the Black Sea countries controlled 31 per cent of the global trade of wheat in 2019, stemming from area expansion, yield improvement and proximity to export destinations.21 Similarly, the share of exports in total production for Russia and Ukraine has soared from less than 1 per cent in the mid-1990s to 72 per cent and 47 per cent in 2019-20, respectively (USDA, 2021a). III.1.3. Maize Maize is the third-most important cereal crop in India. It is traditionally a consumption crop. However, over the years, it has become an important quality feed for the poultry sector. Globally, the use of maize for ethanol production has increased and it is argued that the demand for maize for biofuel production was one of the key drivers of the global food price volatility between 2005 and 2011 (Ranum et al., 2014; Saini and Gulati, 2017 and Foley, 2013).22 The traditional exporters of maize are the US, EU, Brazil and Argentina, while Ukraine and Russia are the emerging players. India has a cost advantage in exporting maize to other Asian countries (Saini and Gulati, 2017). The top export destinations were Nepal, Bangladesh, Bhutan and Myanmar in 2019-20. Though maize exports have been free, due to higher domestic prices relative to global prices (proxied by the US yellow corn no. 2), maize exports have not been competitive except during the global food crisis period and the pandemic period. Despite being a minor player in the global maize market, the share of exports to production remained above 10 per cent from 2007-08 (despite export restriction from July to October 2008) to 2014-15 and during the pandemic period (Chart 10a).  The REC of Indian maize was uncompetitive in the 1990s and early-2000s. However, it improved during the high global food price era. It again turned uncompetitive since 2015, primarily attributed to the movements in global maize prices. In terms of REC, the US maize dominated other exporting countries till 2011. Subsequently, Ukraine and Argentina have outperformed the US (Chart 10b). The US was dominant in global exports, but its share has come down over time. The share of US was 69 per cent in 1995-96, which declined to 27 per cent in 2019-20. Concurrently, the shares of Brazil and Argentina have increased significantly. The share for Brazil increased from less than 1 in 1995-96 to 20 per cent in 2019-20, while the share of Argentina increased from 6 per cent to 23 per cent, respectively. Similarly, the combined share of Black Sea countries (Ukraine and Russia) increased from negligible levels to 19 per cent in 2019-20 (USDA, 2021a). The share of export to production of Brazil and Russia increased from negligible levels in the 1990s to 35 per cent and 29 per cent in 2019-20, respectively (USDA, 2021a). III.1.4. Groundnut In India, oilseeds and edible oils are indispensable. They include nine important oilseeds: groundnut, sesamum, soybean, sunflower, safflower, castor seed, linseed, niger seed, rapeseed and mustard. India is one of the major producers, and yet remains a large importer of edible oils. The global groundnut seed market is thin, with merely 10 per cent of the world groundnut production being traded in 2019-20.  In India, the share of groundnut in total oilseed production is around 30 per cent and has high oil content compared to other major oilseeds.23 Since India opened up groundnut exports in 1994-95, the share of groundnut exports in total production was around 2-3 per cent. With the rising global price (proxied by the US shelled groundnut at the Rotterdam Port), the share of groundnut exports to total production for India increased significantly between 2007-08 and 2012-13. However, with the easing of global prices and restrictive norms to address quality issues, the share of exports has since moderated (Chart 11a). Even after the spike in global groundnut prices during the pandemic period, export share has declined due to reduced demand from China. India has been highly competitive over the last two decades in terms of its REC in groundnut. The REC for China and Argentina has been on a declining trend with the US remaining stable during the same period (Chart 11b). Indian groundnut export has been competitive given the lower domestic prices of groundnut, surplus production and high oil content (except for a few episodes). India’s share in global groundnut seed export has increased from 6 per cent in 1995 to 20 per cent in 2019. During the same period, the shares of China and the US decreased from 27 per cent to 10 per cent, and from 23 per cent to 16 per cent, respectively.24 III.1.5. Gram India is the largest producer, consumer and importer of pulses. Gram is an important pulse (desi and white chickpea), with more than 45 per cent share in domestic production. Though the trade policy restricted the exports of pulses, gram (white chickpea) was always open for export except in 2006-07, when the domestic prices spiked (Saini and Gulati, 2017). Since 2017, all varieties are free to be exported; the quantitative ceiling on organic pulses (up to 10,000 metric tonnes per annum) has also been removed. India’s share in world exports of pulses is 17 per cent, only next to Australia, with a share of 21 per cent in 2018. The key export destinations of Indian chickpeas were Algeria, Bangladesh, Sri Lanka, and the UAE in 2019-20. Gram exports have increased substantially following an increase in domestic production, and elevated export prices (proxied by unit value).25 India’s export share in production was meagre in the 1990s and early-2000s. It has subsequently increased, spiking in 2007-08 and 2013-14. However, since 2013-14, the share has been on a decline (Chart 12a).  As evident from the REC values, the Indian chickpea started gaining competitiveness in the 2000s. It has, however, slid down after 2013-14 (Chart 12b). The stable export policy in the case of gram was conducive to increasing exports. Domestic policy thrust on yield and production also made the Indian gram export competitive. The Australian chickpea also gained export competitiveness; its share in global exports too picked up from 9 per cent to 18 per cent from 1995 to 2019. The REC of Turkey and Mexico fell sharply during this period; Turkey’s share in global exports fell from 42 per cent to 11 per cent, and that of Mexico fell from 26 per cent to 10 per cent, respectively. III.1.6. Onion India’s share in global onion export has increased from 6 per cent in 1995 to 9 per cent in 2019. The Netherlands was the largest exporter of onion, with 18 per cent, followed by China (15 per cent), Mexico (9 per cent) and India (9 per cent) in 2019. The top export destinations of Indian onions are Bangladesh, Malaysia, UAE, Sri Lanka and Nepal. The domestic production of onions has witnessed an uptrend in the last three decades. The exports of onions have increased, as a share of production, they have exhibited volatility and have remained range-bound between 7 per cent and 10 per cent since 2012-13 (Chart 13a). This can be explained through the trade policy for onions – an essential and sensitive commodity in India. Furthermore, the domestic price of onions tends to be volatile owing to the seasonal nature of its production, weather shocks, poor supply chain infrastructure affecting shelf life and inadequate storage facility to smoothen the supply in the off seasons (Saini and Gulati, 2017).26  Since 2015, onion has been covered under the PSF (Price Stabilisation Fund), and NAFED (National Agricultural Cooperative Marketing Federation of India Ltd.) undertakes procurement operations to smoothen the availability of onions during lean months. According to the domestic market conditions, the government tweaks the export policy by either reducing the import duties to zero/ increasing the minimum export price or by completely restricting its exports. These ad hoc and sporadic measures have given rise to high variation in the share of exports in production. A comparison between domestic and international prices (proxied by the unit value, value to volume) shows that in the 2000s, the export share spiked twice in 2003-04 and 2009-10 owing to considerably low domestic prices.27 Since 2012-13, due to strengthening of domestic prices, both the price series have been moving in tandem resulting in a fall in the export share and remains volatile owing to domestic trade policy. The REC value shows that India’s export competitiveness in the case of onions grew weaker till 1998 and revived thereafter (Chart 13b). The increase in REC values over a major part of the 2000s was consistent with lower domestic prices of onions relative to unit value improving their competitiveness. In the 2010s, the REC value dropped sharply, plateauing in more recent years. Nevertheless, Indian onions are preferred over other competitors because of their pungent taste and colour, and hence, enjoy a niche place among the onions produced by Asian countries (Saini and Gulati, 2017). The REC value for the Netherlands has shown little variation, while that of China has increased steadily, consistent with China’s increasing share in global exports.28 III.1.7. Bovine Meat India is the largest producer of carabeef (water buffalo meat). Primarily, herds are raised for milk and as draught animals, and when buffaloes stop producing milk, they are sold for meat production (Saini and Gulati, 2017). In the global trade of boneless frozen beef, India has achieved a spectacular growth. Its share has increased from a mere 2 per cent in 1995 to 20 per cent by 2013, and enjoyed the first rank, followed by Brazil, Australia and the US. Subsequently, India’s share dropped to 12 per cent in 2019 due to stagnation in exports. The trends in India’s bovine meat exports map the trends in international prices of beef, which have declined since 2013-14 (Chart 14a). The wide gap between the export and international prices is due to low pricing of Indian bovine meat in the global market. The low pricing is because Indian bovine meat is not consumed directly as it is tougher than cow meat. It is, however, lean enough to be blended with other ingredients to make value-added products like sausages and hamburgers.29 Moreover, the international price of beef represents the price of bovine meat, which includes cow meat, oxen, calves, bullocks and buffaloes.  The REC of Indian buffalo meat was competitive but remained weak relative to Brazil and Argentina up to 2007. It subsequently outpaced the REC of these two countries and was on a rising trend till 2015. From 2016 onwards, the REC of Indian buffalo meat has declined (Chart 14b). Indian beef has been generally export-competitive as herds are not reared for meat, unlike in Brazil. The cost of rearing herds in Brazil is 20 per cent more than in India.30 III.1.8. Shrimps India is a leading farmed shrimp exporter, with a share of 25 per cent in the global export market in 2018. India’s export share has, in fact, increased from 8 per cent in 1995. The shrimp industry in India has witnessed striking growth in the last decade, establishing it as the second-largest producer next to China (Chart 15a). The other major players are Ecuador, Vietnam and Thailand, collectively accounting for 55 per cent of the global production (GoI, 2020). The top export destinations for India are the EU, China, the US, and Japan in 2019-20. It is exported in the frozen (unprocessed) form. The two main varieties of shrimps grown in India are L. vannamei (white leg shrimp) and P. monodon (black tiger shrimps). Although Thailand and Vietnam were leading shrimp producers in the last decade, they lost momentum due to the outbreak of diseases, consistent with the fall in their REC (Chart 15b). The primary reason for India to emerge as a key player in shrimp exports has been the high-volume of exports with only basic processing, which has helped India to capture several markets. An additional processing, however, could have been more lucrative. Furthermore, domestic consumption has remained weak; it was 5 per cent but has been growing rapidly in recent years. Despite the extraordinary growth in exports of shrimps, there exist a host of vulnerabilities, ranging from low productivity, poor branding, quality issues and lower value addition. Though the low value/raw products provide bulk export of shrimps, the lack of investment in processing and branding has resulted in the underdevelopment of customised market. The customised market of processed shrimp is led by Thailand.  The analysis of REC for eight agricultural commodities (rice, wheat, maize, gram, groundnut, onion, beef and shrimp) from 1990 to 2020 reveals that India’s export competitiveness has been dynamic over the identified phases. The export of rice was most competitive, followed by groundnut, shrimp, gram, onion and bovine meat across these phases. However, the competitiveness moderated in phase 3 (2013-14 to 2019-29) for most commodities except rice, bovine meat and shrimps due to easing global prices despite a broad-based surplus domestic production (Table 1). Wheat and maize have faced competitive disadvantages. Maize, however, enjoyed a few years of competitive advantage during the high global food prices episode. India’s commodity competitiveness was lower than the other global players until the early-2000s. Subsequently, India has outperformed its competitors in rice, groundnut, onion and bovine meat. In the case of gram and shrimps, the REC for India has improved over the years but remains lower than its key competitors. Overall, the analysis shows that these commodities were export-competitive following trade reforms; their competitiveness grew further during the period of commodity supercycle. It has subsequently moderated with subdued global prices except for rice, shrimp and bovine meat. Likewise, the trend in REC of several of the key competitors, viz., the US (wheat, maize and bovine meat), Thailand (rice and shrimps), Vietnam (rice and shrimps), China (groundnut), Turkey and Mexico (chickpea) have shown a gradual decline. There has been an emergence of new players like India (rice, bovine meat, shrimps and chickpea), Australia (chickpea), Brazil (bovine meat), Russia and Ukraine (wheat and maize), whose REC has outpaced that of the traditional players. There are also a few players whose REC has remained stable over time. To illustrate, these include Netherlands and China for onion and Ecuador for shrimp. These trends highlight the changes in the arena of global agricultural commodity trade driven by several supply management measures and export policies (Table A5). The countries could have faced a decline in REC due to subdued global prices. As the REC measure is based on the post-trade data in value terms, if a country’s commodity exports fall, the index would reflect the drop in REC value and vice-versa. Hence, export performance of India and key competitors across commodities was also examined through export volume to production. For phase 3, in comparison to the commodity supercycle period (phase 2), the country’s export share in production increased for rice, bovine meat, shrimps and groundnut, while it decreased for onion, gram, wheat and maize. On the other hand, several key competitors showed an increase in export share to production in phase 3 over phase 2, despite registering a fall in REC in phase 3. This was particularly seen for rice, bovine meat, shrimp, onion and chickpea. This shows that exports for major players grew despite the easing of global prices, highlighting their competitive nature of production system and the significance of export channel for supply management. Contrastingly, India’s export competitiveness is heavily influenced by dynamics between domestic and global commodity prices, implying that an uptick in global commodity prices translates into broad-based export value and volume. Only a select set of commodities have retained their competitiveness over time, notably cereals, bovine meat and marine products. The exports of primary commodities are exposed to international price volatility. Hence, value addition can shield from international price volatility, enhance competitiveness, and generate employment opportunities. Although the share of item-wise processed products in their respective commodity groups shows an uptick, there still exists a huge untapped potential for growth in milled products, cereal preparations, meat sausages and processed marine products (Chart A1a, A1b, A1c and A1d). IV. Determinants of Commodity Exports After analysing the REC of the select commodities, the paper examines the determinants of exports on two outcome indicators, viz., export volume and value by pooling the annual commodity level data in a panel framework for the period from 1990-91 to 2019-20. The literature has identified several factors that influence commodity exports, i.e. production, world imports, per capita GDP, export price, real effective exchange rate and export restriction policy (Alkhteeb and Sultan, 2015; Boansi et al., 2014; Bonansi, 2014; Narayan and Bhattacharya, 2019; Kumar et al., 2008). Some of the potential determinants of exports employed in this paper are production (a proxy for the domestic supply), external demand proxied by world’s imports of the commodity, commodity competitiveness, commodity-specific domestic and international prices. The most commonly used proxy for the export price of the commodity is the ratio of export value to the export volume of the commodity (Bonansi, 2014). Nevertheless, to explicitly capture the competitiveness of the commodity as well as the effect of domestic policy changes on the export, the REC has been employed in this paper.31 A dummy variable was created to control for major export policy changes, it takes value 1 with export restriction and 0 otherwise. Because of data limitations, only six commodities were considered for the analysis i.e., rice, wheat, maize, groundnut, gram and onion.32 IV.1 Model Specification Commodity exports can be described as a function of REC, domestic production and world imports. The empirical model in the log-log form is specified as follows: The relationship of interest is given by the following equation;  where, yit is the commodity export volume or value for commodity i at time t, lnRECit is commodity specific REC, lnProdit is the commodity specific production and lnwimpit represents world import volume of the commodity. In an alternative model specification, the international price of the commodities was incorporated. The effect of REC is expected to be positive i.e., higher the country’s competitive advantage in exports of a commodity, higher are the exports. Increased domestic production and world demand for the commodity are expected to boost exports. Given the relatively long-time dimension of the dataset, the panel cointegration techniques have been used for the estimation of Eq. (2). Exploiting information from both time and cross-section, the panel data methods increase the power of unit root and cointegration tests. Before estimating Eq. (2), panel unit root tests were performed using the Hadri LM test (Hadri, 2000), however, Levin et al. (2002) and Im et al. (2003) unit root tests have also been performed. Next, the presence of cointegrating relationship is tested using the Pedroni (1999; 2004) tests. In the presence of cointegration, the Eq. (2) is estimated to obtain the long-run cointegration parameters using the group mean fully modified ordinary least squares (GM-FMOLS) method proposed by Pedroni (2001). The advantage of this method is that it allows for panel heterogeneity, adjusts for the effects of serial correlation of the errors and potential long-term endogeneity of the regressors, thus providing a consistent and efficient estimation of cointegrating vector. IV.2 Results The panel unit root test results following the method developed by Levin et al. (2002) and Im et al. (2003) show that the null of unit root cannot be rejected for the levels of the variables uniformly (Table A6). However, the test statistics for the first differences show strong rejection of the null hypotheses, implying stationarity of the variables in the first difference form. Similarly, the results for Hadri (2000) panel unit root test, testing for stationarity in heterogeneous panels, show rejection of the null hypothesis (Table 2). From the unit root analysis, it can be concluded that the variables are integrated of order one, indicating the existence of a possible long-run cointegrating relationship among the variables. Next, panel cointegration tests developed by Pedroni (1999), a residual-based procedure is employed to study the presence of long-run equilibrium relationships among the variables. The null hypothesis is that there is no cointegration. The results support a strong rejection of the null hypothesis of no cointegration, implying the importance of use of panel cointegration techniques to estimate Eq. (2) (Table 3). This implies that the commodity exports converge to their long-run equilibrium by correcting any deviation from this equilibrium in the short-run. After establishing cointegration among the variables, cointegration parameters are estimated using GM-FMOLS method developed by Pedroni (2000). The results from various model specification show that an increase in commodity competitiveness and global prices of the commodities significantly improves commodity export volume and value (Table 4). The effect of global prices on export volume is weakly significant as compared to export value, as evident from the decline in export volume growth despite elevated global prices except for cereals. An increase in domestic production and external demand results in higher commodity exports. A stable export policy improves export performance, consistent with the findings of Narayan and Bhattacharya (2019). The results of robustness analysis carried out for a sub-period using the ratio of domestic to global commodity prices as an exogenous variable show similar findings, as reported in Table A7. Overall, the results show that to boost commodity export growth, the policy needs to focus on increasing domestic production and trade competitiveness. This is consistent with the findings of Athukorala (1991) that domestic supply conditions are more important than world demand conditions. To assess the pre-pandemic stagnation in agricultural exports between 2013-14 and 2019-20, this paper examined the REC of eight agricultural commodities (rice, wheat, maize, gram, groundnut, onion, bovine meat and shrimps) from 1990 to 2020. The comparison of India’s REC with its select global competitors indicated that India’s competitiveness was lower than its competitors in the past. Subsequently, it has outpaced the REC of its competitors in rice, groundnut, onion and bovine meat. The estimated REC reveals that India’s export of rice was the most competitive, followed by groundnut, shrimp, gram, onion and bovine meat. The REC of most of these commodities spiked during the years of high global prices relative to domestic prices and moderated till the outbreak of the pandemic, except for rice, bovine meat and shrimp. The Asian and Middle East countries remain the major destinations for Indian agriculture exports, whereas entry into the US and EU markets has remained a challenge due to their high sanitary and phytosanitary (SPS) norms resulting in high refusal or rejection rates for several commodity groups, especially for fruits and vegetables. India’s contribution to global processed commodity exports is lower than many Asian counterparts. And hence, there is a need to champion key value chains by secondary processing of commodities like bovine meat into sausages and burgers, shrimps to ‘ready to cook’ or ‘ready to fry’ products, cereals into cereal preparations, flour and baked products, fruits into juices, syrups, concentrates, jam, jelly and marmalade, etc. to boost exports to the EU, UK and US through strategic bilateral alliances. The panel cointegration analysis for commodity export volume and value shows that commodity competitiveness, adequate domestic supply conditions, higher global prices relative to domestic market and a stable export policy contribute to buoyant commodity export performance. A stable export policy and interventions to spur commodity competitiveness can enhance agricultural export growth. Therefore, there is a need for a policy-driven increase in value addition and product differentiation through export promotion of processed and organic commodities by shaping alliances with new markets. This can improve commodity competitiveness to capture untapped export opportunities. In addition to forming agri-clusters through the scheme ‘One District One Product’, there is also a need to ensure the development of organic or pesticide-free clusters through farmer producer organisations to boost the export of organic products to high-income countries. Additionally, yield improvement and cost-effective production can strengthen export growth. Though the yields of the key crops have increased significantly over the years, they remain lower than other major producers and the world average. The export supply chain infrastructure has withstood the domestic and global headwinds. However, bottlenecks in agriculture markets, cold storage, warehouse and logistics infrastructure needs to be addressed to reduce logistics cost and post-harvest losses. Promoting good agriculture practices, backward integration with the production, primary and secondary processing activities, and proper packaging and certification can reduce border rejections, increase compliance with SPS norms and foster export penetration in high-income countries. @ D. Suganthi (suganthid@rbi.org.in) is Manager in Department of Economic and Policy and Research, Reserve Bank of India. * The views expressed in the paper are those of the author and do not necessarily reflect the views of the Reserve Bank of India. The author is thankful to Atri Mukherjee for overall guidance and support. The author thanks Ganesh Kumar, Sonam Choudhry, the participants of DEPR Study Circle and DEPR Colloquium, Arun Vishnu Kumar, Pallavi Chavan and editorial team for their valuable comments and suggestions. 1 The Food and Agriculture Organisation’s (FAO’s) global food price index, which was easing from its previous peak in June 2011, started to rise from June 2020 and reached a peak of 159.7 in March 2022, but moderated to 135.7 in December 2022. 2 https://commerce.gov.in/wpcontent/uploads/2020/02/NTESCL636802085403925699_AGRI_EXPORT_POLICY.pdf 3 Rice, marine products, meat products, groundnut, spices, fruits, vegetables, milk products, processed vegetables and fruit juices. 4 See Table A1. 5 HVC are agriculture products which are high in value compared to staple grains, for instance, fruits and vegetables, dairy products, eggs, fish, and meat products. The promotion of agricultural diversification was also intended to boost the incomes of the farmers. 6 The Agricultural Export Policy 2018 acknowledged the need for a ‘paradigm shift from residual export after meeting domestic demand to targeted export according to the preferences of the overseas market’, through export-oriented cluster-based cultivation (GoI, 2018a). Likewise, under the Agriculture and Processed Food Products Export Development Authority (APEDA), eight export promotion forums were set up to boost agriculture and horticulture exports (GoI, 2018b). Furthermore, worth Rs.1 lakh crore Agriculture Infrastructure Fund was created in July 2020 to develop the post-harvest infrastructure to improve the processing and agri-business climate through both interest subvention and medium-long term debt financing facility. See https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1656140 7 Also, on the domestic front, production was lower than utilisation due to intermittent adverse weather condition in 2009-10 and resultant lower yield, domestic inflation experienced a steady increase, reaching a level higher than the previous phase. 8 The domestic food inflation remained diverged due to two consecutive drought years putting pressure on domestic prices. However, in the second episode from 2016-17 to 2018-19, though global food inflation remained subdued driven by global supply glut and lower demand (OECD/ICRIER, 2018), with domestic policy push exports improved modestly, but fell sharply in 2019-20. 9 See https://mofpi.nic.in/sites/default/files/english_2019-20_1.pdf 10 Processed commodity groups include flour, cereal preparations, meat preparations, preparations of fruits, vegetables, nut and miscellaneous edible preparations. 11 Vietnam has already ratified its trade agreement with the EU in June 2020, while Africa has ratified its African Continental Free Trade Area with the EU in 2019. India has initiated renewed talks with EU over FTA which was stalled since 2013. See https://www.business-standard.com/article/current-affairs/india-eu-resume-talks-for-free-trade-agreement-after-more-than-8-years-122061701136_1.html 12 But, Leontief (1951) using the US data found that it exported more labour intensive and less of capital intensive goods, although it is abundant in capital, this has been presented as Leontief paradox in the international trade literature. 13 To avoid double counting, the country is excluded from the calculation of the world market of the commodity or world export. 14 Notably, rice, shrimps, bovine meat, groundnut, gram and onion have clocked a significant increase in value share over the three decades. 15 The correlation between international prices and domestic prices has been tabulated in (Table A4). 16 The Balassa RCA index inherently involves the Small Country Assumption (the country’s exports is a very small share of world market), which may not be appropriate for India (chosen commodities such as rice, beef and shrimp) and major producers of other commodities, as their trade policies can influence the world prices of the commodities. Therefore, the modified REC measure drops the world export of the particular commodity from the world export of agriculture exports. 17 See https://atlas.cid.harvard.edu 18 India primarily exports two varieties of rice: Basmati and non-Basmati (milled rice). The common variety is the milled rice that can be either raw or parboiled. It was exported to Nepal, Saudi Arabia, Benin, and the United Arab Emirates in 2019-20, while Basmati (one of the premium varieties) was exported to niche markets in the Arab countries including Saudi Arabia, Iran, UAE, Iraq, and the United States, and Europe. 19 Rice export ban by India further intensified the surge in global rice price. 20 Like India dominates in Basmati export, Thailand leads in the export of aromatic rice, notably, the Jasmine rice, Hom Mali, which attracts high market value. The global rice market is highly product differentiated, wherein Thai rice exports have a huge market in Africa, while Basmati is preferred in Middle East Asia. 21 Middle East and North African (MENA) region and select Asian countries, primarily due to geographical proximity, low freight costs and undemanding quality requirements, which have displaced wheat from other countries due to price competition. 22 See It’s Time to Rethink America’s Corn System - Scientific American 23 For instance, the share of oil content in groundnut is 40 per cent, while it is only 19 per cent in the case of soybean (Saini and Gulati, 2017). 24 See https://atlas.cid.harvard.edu/ 25 Unit value is the ratio of export value to the volume per tonne. 26 Nearly 60 per cent of the onion is produced during the Rabi season that has over 9 months of shelf life and hence can be exported. But demand for onion is spread throughout the year. Hence, weather shock or storage constraints undermine export opportunities. 27 Due to unseasonal rains in 2010-11, onion export growth fell by 30 per cent. Subsequently, a ban was imposed on export shipments from Gujarat and Maharashtra. 28 The Netherlands is the largest exporter and has retained its share of 18 per cent. China has witnessed an upward trend from less than 1 per cent to 15 per cent, while Mexico’s share has been ranging between 8 and 12 per cent from 1995 and 2018. 29 See https://theprint.in/economy/indias-beef-exports-rise-under-modi-govt-despite-hindu-vigilante-campaign-at-home/210164/ 30 See https://www.businesstoday.in/magazine/features/buffalo-meat-exports-thriving-under-narendra-modi-government/story/217143.html 31 Since the commodity level domestic prices are available from mid-2000s onwards, alternatively as a robustness test, a subsample was analysed starting from 2006-07 to 2019-20, wherein, the first episode 2006-07 to 2012-13 is marked by supercycle and moderation thereafter. 32 As long time series data for bovine meat and shrimp was not available. References Aksoy, M. A., & Beghin, J. (2004). Global Agricultural Trade and Developing Countries. In M. A. Aksoy & J. Beghin (Eds.), Global Agricultural Trade and Developing Countries. World Bank. https://doi.org/10.1596/0-8213-5863-4 Alkhteeb, T. T., & Sultan, Z. A. (2015). Determinants of India’s Agricultural Export. European Journal of Business and Management, 7(4), 53–63. Andhale, A., & Kannan, E. (2015). Analysis of India’s Revealed Comparative Advantage in Agro-Processed Products. Indian Journal of Economics and Business, 14(1), 115–130. Arvis, J., Mustra, M., Panzer, J., Ojala, L., & Naula, T. (2016). Connecting to Compete: Trade Logistics in the Global Economy. In World Bank. http://lpi.worldbank.org/international/global Athukorala, P. C. (1991). An analysis of demand and supply factors in agricultural exports from developing Asian countries. 35th Annual Conference of the Australian Agricultural Economics Society. Athukorala, P. C. (2005). Agricultural Trade Policy Reforms in India. South Asia Economic Journal, 6(1), 23–36. https://doi.org/10.1177/139156140500600102 Balassa, B. (1965). Trade Liberalisation and “Revealed” Comparative Advantage. The Manchester School. https://doi.org/10.1111/j.1467-9957.1965.tb00050.x Bathla, S. (2006). Trade Policy Reforms and Openness of Indian Agriculture: Analysis at the Commodity Level. In South Asia Economic Journal (Vol. 7, Issue 1). https://doi.org/10.1177/139156140500700102 Blaich, E. E. (2014). Brazil’s competitiveness in the soybean sector : Will Brazil lose its competitiveness due to its patchy infrastructure ? [Haute école de gestion de Genève]. https://core.ac.uk/download/pdf/43660059.pdf Boansi, D., OdilonKounagbeLokonon, B., & Appah, J. (2014). Determinants of Agricultural Export Trade: Case of Fresh Pineapple Exports from Ghana. British Journal of Economics, Management & Trade, 4(11), 1736–1754. https://doi.org/10.9734/BJEMT/2014/10773 Bonansi, D. (2014). Determinants of Agricultural Export Trade: A Co-Integration. Global Journal of Science Frontier Research: D Agriculture and Veterinary, 14(4), 45–56. Chand, R. (2010). Understanding the nature and causes of food inflation. Economic and Political Weekly, 45(9), 10–13. Chandran, S. (2012). Trade Complementarity and Similarity Between India and ASEAN Countries in the Context of the RTA. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1763299 Flaskerud, G. (2003). Brazil ’s Soybean Production and Impact (Issue July). Geetha, R. S., & Srivastava, S. K. (2018). Export of Maize from India: Performance and Determinants. Asian Journal of Agricultural Extension, Economics & Sociology, 29(1), 1–11. https://doi.org/10.9734/ajaees/2019/45469 GoI. (2016). Government targets doubling food processing levels to 20 per cent World Food Summit to be held in New Delhi in March 2017. GoI. (2018a). Agriculture Export Policy. Department of Commerce, Ministry of Commerce and Industry GoI. (2018b). Export Promotion Forums for specific agri products constituted under APEDA at the behest of Ministry of Agriculture. Ministry of Agriculture & Farmers Welfare. GOI. (various years). Agricultural Statistics at a glance. Ministry of Agriculture & Farmers Welfare Hadri, K. (2000). Testing for stationarity in heterogeneous panel data. The Econometrics Journal, 3(2), 148–161. Hu, X., Tu, W., & Fang, X. (2004). An analysis and comparison of wheat production competitiveness between China and the USA. Journal of Economic Issues. https://doi.org/10.1080/00213624.2004.11506762 Im, K.S., Pesaran, M.H., Shin, Y., 2003. Testing for unit roots in heterogeneous panels. Journal of Economics. 115, 53–74. Jagdambe, Subhahs. (2016). India’s export competitiveness of agricultural products with ASEAN. Journal of Management and Science, 6(1), 72–94. https://doi.org/10.26524/jms.2016.9 Jha, S., Srinivasan, P. V., & Landes, M. R. (2007). Indian Wheat and Rice Sector Policies and the Implications of Reform. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1084557 Kingwell, R., Carter, C., Elliot, P., & White, P. (2016). Russia’s wheat industry: implications for Australia. 104. http://aegic.org.au/wp-content/uploads/2016/09/Russia-wheat-industry-Implications-for-Australia.pdf Kobayashi, H., Thaiyotin, P., Ishida, T., & Inoue, S. (2016). Effects of Government Support on Rice Farming in Contemporary Thailand : A Simulation Analysis. The Japanese Journal of Rural Economics. https://doi.org/10.18480/jjre.18.39 Kumar, N. R., Rai, A. B., & Rai, M. (2008). Export of Cucumber and Gherkin from India : Performance, Destinations, Competitiveness and Determinants. Agricultural Economics Research Review, 21(June), 130–138. https://ageconsearch.umn.edu/bitstream/47370/2/18-NR-Kumar.pdf Leromain, E., & Orefice, G. (2014). New revealed comparative advantage index: Dataset and empirical distribution. International Economics, 139, 48–70. https://doi.org/10.1016/j.inteco.2014.03.003 Liefert, W., & Liefert, O. (2017). Changing Crop Area in the Former Soviet Union Region. https://www.ers.usda.gov/webdocs/publications/82573/fds-17b-01.pdf?v=42787 Levin, A., Lin, C.-F., Chu, C.-S.J. (2002). Unit root tests in panel data: asymptotic and finite-sample properties. Journal of Economics, 108, 1–24. McCalla, F. A., & Nash, J. (2007). Agricultural Trade Reform and Developing Countries: Issues, Challenges, and Structure of the Volume. In F. A. McCalla & J. Nash (Eds.), Reforming Agriculture Trade for Developing Countries (pp. 1–17). World Bank. Nair, S. R., & Eapen, L. M. (2015). Agrarian performance and food price inflation in India: Pre- And post-economic liberalisation. Economic and Political Weekly, 50(31), 49–60. Narayan, S., & Bhattacharya, P. (2019). Relative export competitiveness of agricultural commodities and its determinants: Some evidence from India. World Development, 117, 29–47. https://doi.org/10.1016/j.worlddev.2018.12.013 OECD/ICRIER. (2018). Agricultural Policies in India. OECD. https://doi.org/10.1787/9789264302334 Pedroni, P. (2001). Fully modified OLS for heterogeneous cointegrated panels.Advances in Econometrics, 15, 93–130. Pedroni, P. (2004). Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. EconometricTheory, 20(03), 597–625. Rada, N., Liefert, W., & Liefert, O. (2017). Productivity Growth and the Revival of Russian Agriculture (Issue 228). www.ers.usda.gov Ranum, P., Peña‐Rosas, J. P., & Garcia‐Casal, M. N. (2014). Global maize production, utilization, and consumption. Annals of the New York Academy of Sciences, 1312(1), 105–112. https://doi.org/10.1111/nyas.12396 RBI. (2019). Annual Report. Reserve Bank of India. Saini, S., & Gulati, A. (2017). Price Distortions in Indian Agriculture. http://icrier.org/pdf/Price_Distortions_in_Indian_Agriculture_2017.pdf Scott, L., & Vollrath, T. L. (1992). Global competitive advantage an overall bilateral complementarity in agriculture: A statistical review. US Department of Agriculture, Economic Research Service, Statistical Bulletin No. 850, Washington D. C. Shinoj, P., & Mathur, V. C. (2008). Comparative Advantage of India in Agricultural Exports vis-á-vis Asia : A Post-reforms Analysis. Agricultural Economics Research Review. Smith, H. H. (1988). US Agricultural Export Competitiveness: Export Levels , Trade Shares, and the Law of One Price. In Economic Review Federal Reserve Bank of Dallas. http://dx.doi.org/10.1016/j.jaci.2012.05.050 The Global Economy of Pulses. (2020). In V. Rawal & D. K. Navarro (Eds.), The Global Economy of Pulses. Food and Agriculture Organisation. https://doi.org/10.4060/i7108en USDA. (2019). Grain : World Markets and Trade. In United States Department of Agriculture Foreign Agricultural Service (Issue November). USDA. (2021a). Grain : World Markets and Trade. In United States Department of Agriculture Foreign Agricultural Service (Issue November). USITC. (2012). Brazil: Competitive factors in Brazil affecting U.S. and Brazilian agricultural sales in selected third country markets. In Brazilian Agricultural Competitiveness and Trade. Valdes, A. (1998). Trade Policy Reform and Agriculture.”. In J. Nash & W. Takacs (Eds.), Trade Policy Reform: Lessons and Implications. World Bank. Vollrath, T. L. (1991). A theoretical evaluation of alternative trade intensity measures of revealed a comparative advantage. Weltwirtschaftliches Archiv, 127(2), 265–280. https://doi.org/10.1007/BF02707986 Vyas, V. (1999). Trade Policy and Export Strategy. Economic and Political Weekly, 34(13), 27–33. Wegren, S. K. (2018). Russian grain production: too much of a good thing? Post-Communist Economies, 30(6), 1–12. https://doi.org/10.1080/14631377.2018.1470856 Winters, L. A. (2004). Trade Liberalisation and Economic Performance: An Overview. The Economic Journal, 114(493), F4–F21. https://doi.org/10.1111/j.0013-0133.2004.00185.x Annex

Robustness Check As a robustness analysis, the cointegration parameters were estimated for the period from 2006-07 to 2020-21. This period has two distinct phases, 2006-07 to 2012-13 is marked by high export growth coinciding with the episode of high global food inflation (commodity supercycle), while the period from 2013-14 to 2019-20 shows stagnation of exports coinciding with the easing of global prices driven by a global supply glut. Again, during the pandemic-period, with lingering effects of supply disruption, global agricultural commodity prices escalated leading to a surge in exports from India.35 The dynamic relationship between domestic and global commodity prices influences export outcomes. Therefore, the ratio of domestic to international price was employed alongside other variables, i.e. domestic production, commodity competitiveness, world imports and trade policy captured by the export restriction dummy. Similar to previous results, commodity competitiveness, production and world demand positively influences export volume and value, while lower domestic to international price ratio hikes export volume and value (Table A7). Furthermore, with the REC as the dependent variable, estimation of FMOLS panel cointegration analysis was carried out for the full sample (1990-91 to 2019-20) and sub-sample (2006-07 to 2019-20). The results for the full sample show that higher international prices and stable export policy positively influences commodity export competitiveness. For the sub-sample, with the availability of domestic prices, the ratio of domestic to international prices was employed. The findings show that lower domestic prices relative to international prices and stable export policy improves commodity export competitiveness (Table A8). 33 See https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1684626 34 See https://www.thehindubusinessline.com/markets/commodities/vietnam-lifts-indias-groundnut-exports/article9627820.ece 35 See https://indianexpress.com/article/india/farm-exports-india-covid-19-2020-7175200/ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: