IST,

IST,

Report of the Working Group to Review of the Guidelines for Hedging of Commodity Price Risk by Residents in the Overseas Markets

Table of Contents Chapter 1 1.1 Amongst the various tradable assets classes, commodity prices generally tend to be more volatile compared to say, currencies or equities. Commodity price risk is the risk of loss in an underlying exposure (real or financial) associated with the volatility of commodity prices. It affects different agents in the commodity value chain differently. Broadly, participants would fall into the following categories: -

1.2 Commodities whose price risk is sought to be managed can be broadly divided into four categories – (i) Base metals (aluminum, copper, zinc, lead etc) typically used as inputs in various industries; (ii) precious metals (gold, silver, platinum etc) that are largely used as store of value but also as industrial inputs; (iii) energy products primarily used as fuel to run industries (crude oil, natural gas, coal etc), particularly shipping and transport industries, and also as industrial inputs; and, (iv) agricultural output, including cash crops, that are used as input in food and agro industries. 1.3 Hedging of commodity risk is difficult and complicated. It is difficult primarily due to the inherent basis risk in all commodities that arises from the differences in grade between the physical underlying and the hedging derivative. Many commodity markets, particularly agricultural products, are typical to their geographical setting, further adding to product differentiation. The market structure of every commodity market is unique, based on its historical evolution and its relative significance in the production process. 1.4 Hedging activity in a commodity is also a function of the availability of liquid pricing benchmarks and the internationalization of the benchmark. Generally, the more internationalized the pricing benchmark (e.g., Brent for crude oil or LBMA London Gold price), the easier it is to hedge and therefore the more is the hedging activity. Since liquid benchmarks enable hedging even for large sizes, typically there are not more than a few benchmarks in a commodity. Crude oil, for example, is dominated by Brent in Europe and WTI in US. Most base metal benchmarks are those on London Metal Exchange. 1.5 With commodity benchmarks trading in very few trading centers, and with greater globalization leading to more price equalization across the globe users are subject to global commodity price fluctuations. This generates the need for access to international markets for effective hedging, even for producers who largely source and sell domestically. India, too, felt the need to give domestic producers, processors and consumers access to international markets for their commodity hedging needs in the late 1990s. A brief account of the developments is given below. 1.6 The basic regulatory framework was laid down based on the Report in 1997 of a committee headed by Shri R V Gupta, then Deputy Governor. India at that time lacked a well-developed domestic commodity derivatives market. Indian entities, with genuine underlying commodity price risk exposures, therefore, needed access to off-shore markets. Accordingly, the regulatory framework governing hedging by residents in the overseas markets had been formulated in terms of the provisions of the Foreign Exchange Management Act (FEMA), 1999 (Act 42 of 1999) since hedge transactions required remittance of foreign exchange for the purposes of initial margin, variation margin, mark-to-market settlement etc. Under the framework, Authorized Dealer (AD) banks were envisioned as facilitators, not trade counterparts, for resident hedgers. 1.7 As per the Gupta Committee report, successful commodity hedging requires that two pre-conditions must be satisfied - (a) the hedge transaction should address a genuine/authentic underlying risk, and (b) the hedge transaction should be correctly executed and monitored. In the event either or both these conditions are not met, hedging will acquire a speculative hue and in the process may increase the firm's exposure to risk. The Committee was of the view that there is clear justification on balance for regulatory focus to remain firmly fixed on helping Indian corporates with authentic price exposures to achieve risk-reduction, and not speculation. Regarding hedging instruments, the Committee felt that where effective hedging may not be possible with the help of exchange traded instruments, Over-the-Counter (OTC) products could be availed of. However, the relative OTC markets must necessarily have some depth, liquidity, transparency and equitable access. Evolution of the regulatory framework: 2003 till date 1.8 Following the Gupta Committee recommendations, RBI initially followed a cautious approach – through special dispensations for hedging to acclimatize all stakeholders – but gradually eased overseas access for commodity hedging. The facilities as they have evolved over the years is given below in a chronological order. a. July 1, 2003 - Residents in India, engaged in import and export trade were permitted to hedge the price risk of all commodities in the international commodity exchange/ markets on a specific approval from RBI. b. May 31, 2007 - Hedging for domestic transactions of select metals and aviation turbine fuel: AD banks with specific authorization from Reserve Bank were permitted to allow:

c. November 6, 2007 - Hedging for Domestic Oil Refining and Marketing Companies: Domestic oil marketing and refining companies were permitted to hedge their commodity price risk to the extent of 50 per cent of their inventory based on the volumes in the quarter preceding the previous quarter. d. June 3, 2008 • Hedging of domestic purchases of crude oil and sales of petro-products and anticipated imports of crude oil: Domestic crude oil refining companies were permitted to hedge their commodity price risk

• Remittance related to Commodity Derivative Contracts – Issuance of Bank Guarantee (BG)/ Standby Letter of Credit (SBLC)

e. January 17, 2012 - Liberalization in Commodity Hedging guidelines: Banks were delegated the power to grant permissions to:

In a nutshell, the current hedging arrangement is as follows –

1.9 Over the years, commodity hedging interest of Indian corporates has been growing, not just for the commodities specified but for various other commodities under the approval route. Apart from the hedging done by corporates under the delegated route, the hedging under the approval route itself has been rather high (Table 11). Most of the requests for approval pertain to commodities that have not been delegated for hedging to AD Banks. Clearly, there is a need for opening up the commodity hedging for a wider range of commodities. Besides, too much reliance on case-by-case approvals does not augur too well for efficient and timely hedging, which highlights the need for a more liberalized regulatory dispensation. 1.10 Reserve Bank of India constituted this working group on Sep 14, 2016 to review the guidelines for hedging of commodity price risk by residents in the overseas markets during the development phase of our domestic commodity derivative market. The group had members drawn from RBI, Securities and Exchange Board of India (SEBI), commercial banks and corporates. Composition of the Working Group:

Terms of reference for the working group:

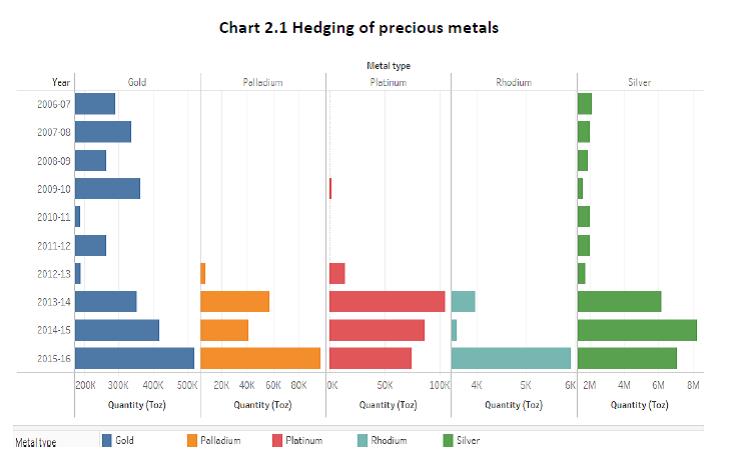

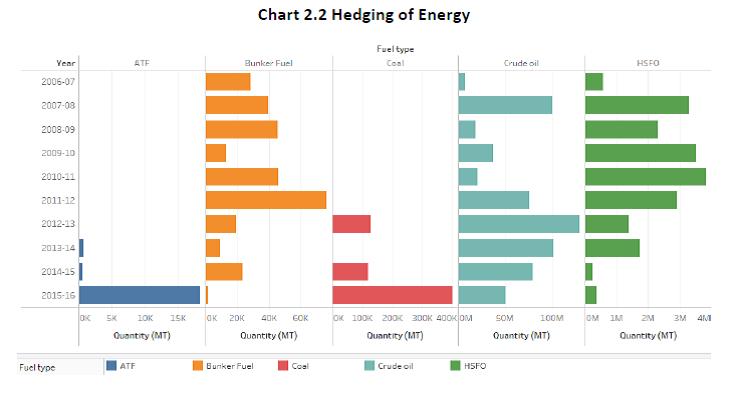

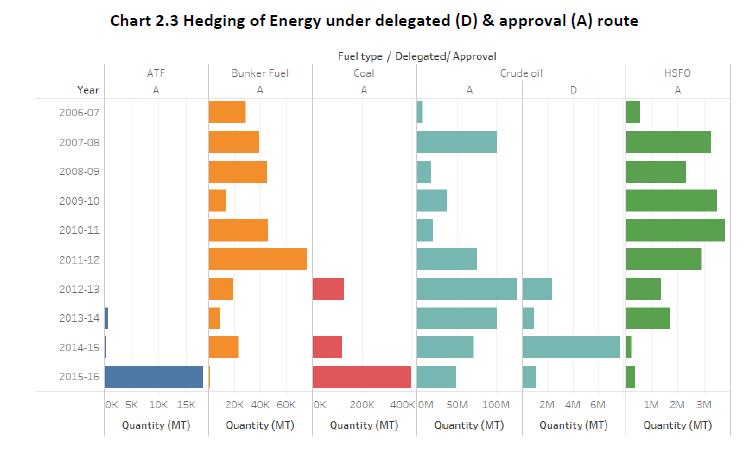

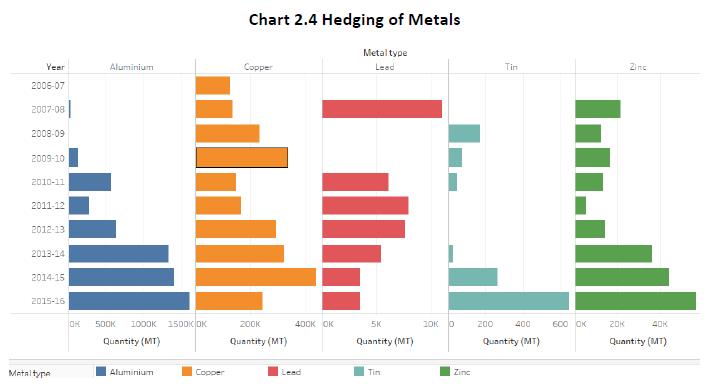

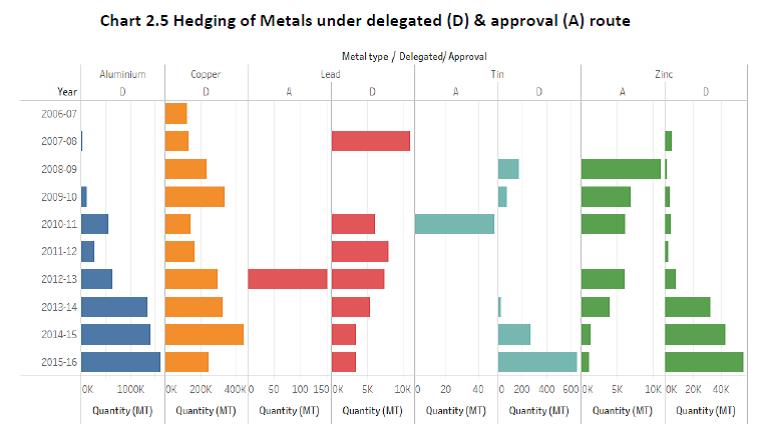

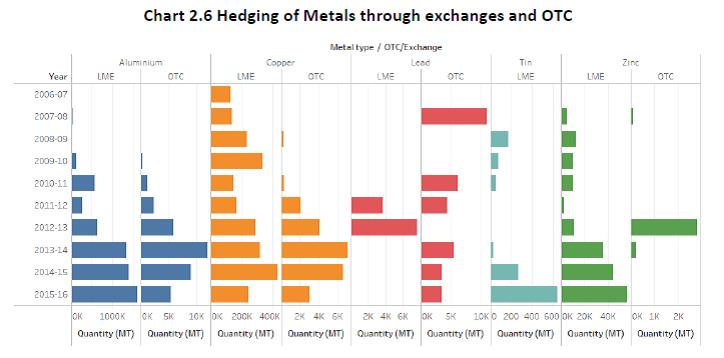

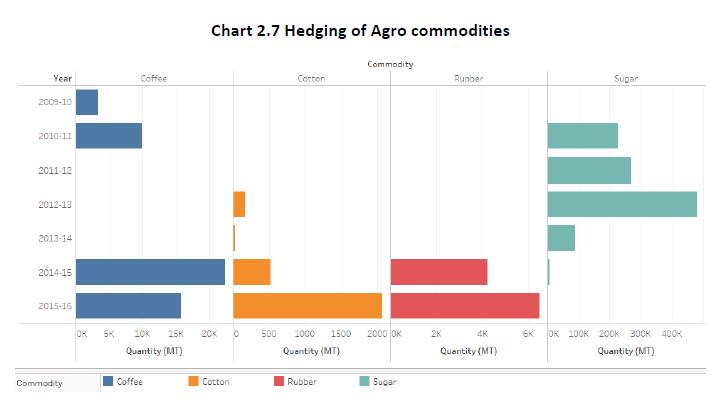

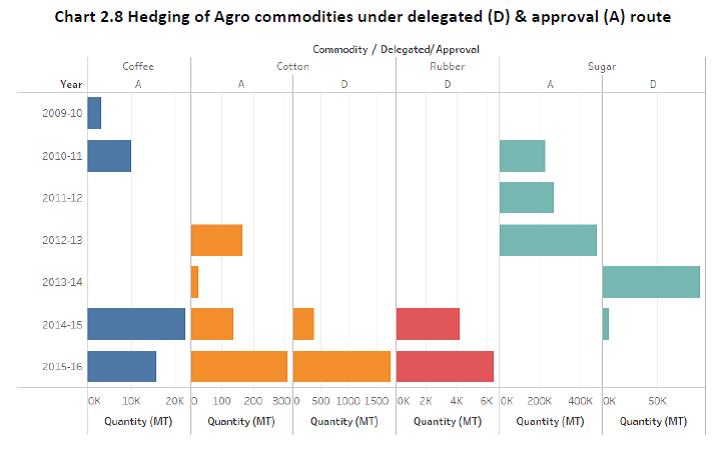

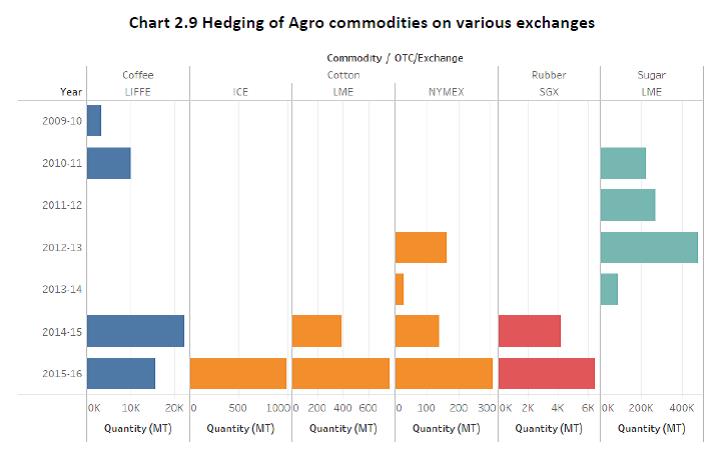

1.11 The Working Group held three meetings between October 14, 2016 and February 27, 2017. During its deliberations, the Group had the benefit of interacting with external experts from the corporate sector, commercial banks and advisory firms. The Group would like to acknowledge the valuable contributions of Shri Anil Mathews and Shri Vikram Sondhi of Hindalco, Shri Johnson Lewis and Shri Manish Goyal of Bank of Nova Scotia. The Group would like to particularly acknowledge the contribution of Shri Muzammil Patel of Deloitte Touche Tohmatsu India LLP for sharing his considerable expertise. The Group would also like to acknowledge the valuable support and assistance extended by the officers of the Financial Markets Regulation Department viz., Shri Nitin Daukia, Shri Deepak Kundu and Smt. Zenobia Kargutkar. 1.12 The structure of this report is as follows. Chapter 2 reviews the commodity price risk hedging activity in all its dimensions. Chapter 3 lays down a model regulatory framework for identification of commodity price risks arising from variable input and output prices taking in to account the Indian commodity profile and state of development and sophistication of domestic markets and participants, respectively. Chapter 4 describes various regulatory issues in the context of commodity price risk management that were examined by the Working Group and makes related recommendations. These include hedging of risks arising out of domestic trade in commodities versus cross-border trade, approach for identifying commodities for hedging price risk, listing as an eligibility criteria for access to hedging markets overseas, inventory hedging, use OTC versus exchange traded products, currency risk arising out of hedging commodity price risk and role of domestic stock exchanges in offering commodity derivatives. Chapter 5 examines the potential role of commercial banks in both encouraging their constituents to hedge their commodity price risk and ultimately to act as market-makers. Chapter 6 summarizes the recommendations of the Working Group. The annexure to the report provides an overview of select domestic commodity exchanges and their products. Chapter 2 2.1 As briefly explained in Chapter 1, the Gupta Committee stressed the need for existence of genuine underlying risk to preempt speculative use of overseas derivative markets. It recognized the need for access to both exchange markets and OTC markets but required that OTC markets must necessarily have some depth, liquidity, transparency and equitable access. Based on the sample data collected from Authorized Dealer banks active in facilitating commodity derivative transactions of residents in the overseas markets, the following broad picture emerges. 2.2 Most hedging activity is in base metals but a reasonably wide variety of products are hedged offshore by Indian corporates. (Table 2.1). 2.3 Table 2.2 provides a snapshot of hedging activities in these commodities2. For energy and precious metals, hedging is entirely in OTC segment. Iron ore (100%) and lead (75%) are the two metals with large OTC hedging. For all other metals as well as agricultural products, hedging is done on established exchanges. Within exchanges, apart from LIFFE (coffee), NYMEX and ICE (Cotton) and SGX (rubber), all hedging is in the London Metal Exchange (LME). 2.4 Hedging is almost entirely under the approval route in energy and precious metal products. Base metal hedging is largely under the delegated route while for agricultural products, hedging is mainly under the approval route for coffee and sugar while it is under the delegated route for cotton and rubber. 2.5 Most hedging interest is for exposure of commodity risk in international trade of importers/exporters. Virtually all hedging is by importers/exporters for agricultural goods and energy products. Significant hedging interest by domestic users (producers and consumers) is visible in both precious metals as well as base metals. A more detailed presentation of category-wise hedging behavior is presented below. Precious metals 2.6 As can be seen in Chart 2.1 below, Gold and silver constituted the majority by volume of the precious metals hedged. All such hedges were booked on the OTC market and under the approval route. Hedging volumes in all precious metals has seen a significant pickup since 2013-14. Energy 2.7 Amongst energy products, crude oil emerges as the commodity against which the maximum hedges have been booked followed by High Sulphur Fuel Oil (HSFO) (Chart 2.2). A majority of such hedges have been booked under the approval route (Chart 2.3) and all hedges have been booked through the OTC route. Metals 2.8 Aluminum, followed by Copper and Tin were the most hedged commodities in the metals basket (Chart 2.4). Most of the hedging was under the delegated route (Chart 2.5). Hedging activity was predominantly on exchanges except for lead (Chart 2.6) Agro commodities 2.9 Sugar dominated the list of agro-commodities hedged till 2012-13. For the last 2 years coffee, rubber and sugar have been the more actively hedged commodities (Chart 2.7). Cotton and rubber are largely hedged under the delegated route while coffee and sugar are hedged under the approval route (Chart 2.8). Agriculture commodity hedges are spread across exchanges – LIFFE for coffee, SGX for rubber, ICE/LME/NYMEX for cotton etc. (Chart 2.9) Domestic Commodity Exchanges: Role of Securities and Exchange Board of India (SEBI) 2.10 There have been significant advances made by the Government and Securities Exchanges Board of India (SEBI) to foster the development of the domestic commodity exchanges. Today, residents can hedge the price risk on a wide range of commodities in domestic commodity exchanges. A brief overview of the domestic commodity exchanges is given in Annex. In 2015-16, the Indian commodity derivatives market witnessed a significant transition when the erstwhile commodities market regulator, Forward Markets Commission (FMC) was merged with SEBI with effect from September 28, 2015 with an aim, “to strengthen regulation of commodity forward markets and reduce wild speculationi”. The Central Government repealed the Forward Contracts (Regulation) Act, 1952 (FCRA) with effect from September 29, 2015 paving the way for the merger of the FMC with SEBI. Commodity price risk management: A holistic examination 3.1 To enable a holistic examination of the problem of commodity price risk management, it is imperative to study the specific nature of commodity price risk. The first issue is the nature of the hedging entity, specifically, what is its position in the value chain: a. Producers (i.e., those involved in exploration, production and farming) are faced with the risk of fall in absolute prices, either because it affects the return on their investment or because it affects their inventory value. b. For commodity processors and refiners, the nature of commodity risk assumes multiple forms viz., margin risk, timing risk, inventory risk and fixed price risk.

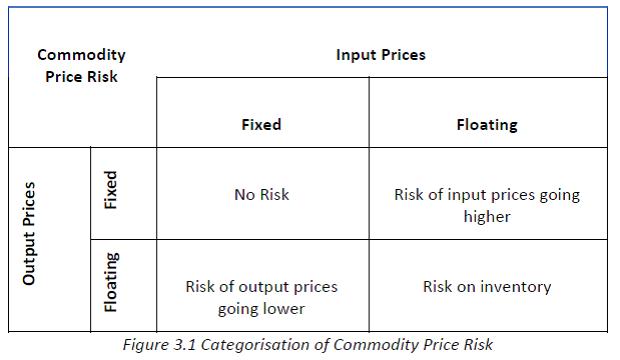

c. Another key player in the value chain i.e. marketing companies who offer fixed price contracts to their customers are exposed to price risk on account of increase in the price of the commodity. d. Finally, the end customers are exposed to the risk of rise in absolute prices. There is generally little correlation between the price of commodities used by consumer industries and the price of the final product they sell. At times, they may be unable to pass on price increases to the end customer. Accordingly, increase in absolute prices directly impact margins of consumer industries. 3.2 There is also the problem of basis risk in commodity price risk management. Basis arises on account of benchmark differential risk, where the benchmark used for settlement of the paper transaction and the benchmark on which the physical transaction is priced are different. Whereas the benchmarks may be closely linked and highly correlated, there is always the possibility of the benchmarks not being identical on settlement of the paper transaction. This is referred to as benchmark differential risk and can make the hedge ineffective. Benchmark differential risk arises mainly due to variations in grades of the commodity. 3.3 Thus, commodity price risk management is a multi-dimensional problem. Keeping this in view and balancing it with the state of the development of the domestic commodity exchanges, the Group recognised the need for a principle based regulatory framework to meet most, if not all, of the commodity price risk management needs of Indian commodity users including the less sopshiticated ones. Such a framework is set out below. 3.4 The basic principle involved in hedging the commodity price risk is that the hedging activity should be undertaken to offset the impact on the profit margin of an entity on account of fluctuation in the commodity prices. In general, a risk framework can be outlined based on the exposure of a company to variability of commodity prices either in raw materials used by the company or in the final product. Based on the variability in prices faced by the company, the commodity price risk of the company can be categorized under four categories. The categorization is illustrated in the following figure and each of the categories are discussed in the following paragraphs.

3.5 The risk profile of a company is defined by its position in the input-output prices matrix (Figure 3.1). The following inferences can be drawn:

Chapter 4 4.1 Based on the commodity risk hedging behavior of Indian businesses examined in Chapter 2, and in the light of the hedging framework set out in Chapter 3, this chapter highlights the major features of a comprehensive hedging framework for commodity price risk with appropriate recommendations. Risk of domestic business entities vis-à-vis risk of exporters/importers 4.2 The current guidelines differentiate facilities based on the geographic location of procurement of the commodity, i.e. domestic sale/purchase or export/import. Exporters/importers can hedge the price risk of any commodity they export or import, respectively. Domestic entities, on the other hand, can only hedge price risk of a limited set of commodities. From a pure risk perspective, such distinction may not be justifiable. Besides, this has led to a relative lack of hedging activity from entities sourcing/selling in domestic markets. Nearly three quarters of all hedging is done by exporters/importers, who account for 100% hedging in energy and agricultural commodities (Table 4.1). Activity of domestic businesses is limited to the metals segment – both base metals and precious metals. To encourage hedging by all businesses facing commodity price risk, such distinction needs to be removed. The downside risk of such removal would be an increase in exchange rate risk of domestic businesses as entities who do not currently hedge commodity risk overseas start hedging in international markets. This aspect if discussed in para 4.10. It may hence be preferable to do away with such differentiated access based on whether an entity is engaged in domestic or international trade and move to a risk based framework, as outlined in the previous chapter. From a risk management perspective, domestic buyers/sellers exposed to commodity risk should be treated on the same footing as exporters/importers. The Group, therefore, is in favour of a uniform approach in extending facilities to hedge commodity price risk in overseas markets that is agnostic to the place of procurement of the commodity, by doing away with the differences in treatment of importer/exporter on the one hand, and domestic buyers/sellers on the other. Commodities that can be hedged 4.3 Under current regulation importers/exporters can hedge the price risk of any commodity which they import/export. On the other hand, domestic commodity buyer/seller are permitted to hedge the price risk of only limited commodities. Since the committee is of the view that the differentiation between entities involved in domestic and international trade may be dispensed with (para 4.2), one approach would be to let any resident entity hedge the price risk of any commodity to which it is exposed. While this can be the approach eventually, it may not be prudent to make this jump from limited commodities to all commodities, unless the foreign currency impact of the move can be assessed. At this stage it may be advisable to continue with a positive list of commodities, exposure to which can be hedged by both domestic entities and importers/exporters. Based on the available information of production and consumption of commodities and actual hedging oversees by Indian residents, such interest is based around the commodities indicated in Table 4.2 below. The Group, therefore, recommends a ‘Positive List’ of commodities which can be hedged in the overseas markets by all residents, i.e., by both domestic users and exporters/importers alike. Reserve Bank could periodically review the list based on market feedback. Inventory Hedging 4.4 In terms of the hedging framework outlined in the previous chapter, companies falling in the bottom-right quadrant will be exposed to price risk on the commodity held as inventory during the processing cycle. In terms of present guidelines inventory hedging is only permitted to domestic oil marketing and refining companies. The Group recommends that this regulation may be liberalized and inventory hedging permitted to entities exposed to price risk, for any commodity on the ‘positive list’, if they meet the following conditions: -

4.5 The Group deliberated on the issue of the amount of inventory that could be permitted to be hedged under this recommendation. It was decided that amount could be based on the average inventory maintained by the company as declared in its financial statements or as certified by their statutory auditors. In respect of certain commodities like precious metals, RBI may lay down additional conditions, if necessary. Price Fix hedge 4.6 A price fix hedge is a hedge designed to lock-in either an input price or an output price for a period of time in future. In a price fix hedge, the hedger secures business margins by locking in input or output prices. Price Fix hedges are different from offset hedges (which are currently permitted), in that they are based on anticipated contracts whereas offset hedges are based on existing contracts where the price is not fixed. Under price fix hedging an important decision is how far into the future the input or output prices are to be locked. Ideally, this decision should be left to the discretion of the edging entity com. Price fix hedges will be appropriate for companies in the top-right and bottom-left quadrant in figure 3.1. The Group, therefore, recommends that price fix hedging be permitted in addition to offset hedging to entities that are faced with a variable price on either input or output, but not both. Over-the-Counter (OTC) vs Exchange 4.7 The Group was of the view that hedging in exchanges is more transparent as compared to hedging in Over-the-Counter (OTC) markets. Current regulations permit hedging in the OTC markets if the risk profile so warrants. In view of the large access to OTC markets (Table 4.3) even in commodities that have active exchange contracts, the Group felt that this avenue may not be amenable to regulatory/supervisory control. The Group is of the view that in respect of OTC transactions, the permitted OTC counterparties may be limited to regulated entities, preferably banks, operating in major financial centers and/or acceptable jurisdictions specified by RBI. In particular, hedging transactions shall not be undertaken with related parties in overseas markets. The Group, therefore, recommends hedging in overseas commodity exchanges due to transparency in pricing. However, if the risk profile so warrants hedging in the OTC market overseas may be allowed but only with regulated entities, preferably banks, as counterparties operating in acceptable jurisdictions specified by RBI. Direct vs Indirect Exposure 4.8 An entity can be exposed to the price of a commodity directly or indirectly. An exposure to a commodity on direct basis is when the entity is a direct user of the said commodity and any fluctuation of the same has material impact on the profit margins of the company. As an example, a tyre manufacturing company is directly exposed to the price of raw rubber since rubber is a major raw material for production of tyres. On the other hand, a car manufacturing company is only indirectly exposed to rubber prices as the cost of tyres in a car is only a fraction of the overall car price and the price of tyres does not fluctuate as frequently as that of raw rubber. However, the calculation of indirect exposures can be complex and the impact of indirect exposures generally tends to be low on overall profitability. The Group, therefore, recommends that in view of the complexity involved in assessing the indirect commodity risk of the user, hedging of only direct commodity price risk may be allowed for now. Hedging of Currency Risk 4.9 Hedging in international markets involves exchange rate exposure, as the price of commodities is denominated in foreign currency. Since exporters/importers are otherwise directly exposed to risk, there is no net additional currency risk from their access to international commodity markets. Domestic buyers/sellers, on the other hand, attain new exposure to currency risk in the process of hedging their commodity risk in international markets and may, therefore, seek to hedge it in the domestic forex market. The Group deliberated on the various aspects of the issue. Empirical evidence suggests that commodity prices are, in general, more volatile than currencies and hence, hedging of commodity price risk offsets a major part of the price risk faced by the user. Further, if this facility is used widely, it could lead to a build-up of sizeable forex derivative positions creating potential for forex market volatility. Besides, forex hedging in the domestic OTC market are generally permitted on a deliverable basis. For the domestic buyer/seller hedging his commodity risk overseas there is no corresponding cash flow in foreign currency of the underlying commodity, hence hedge contracts have to be necessarily cash-settled. On the other hand, some members felt that the impact on domestic forex market may not be significant given current usage. Besides, the size of foreign exchange reserves might comfortably absorb the resulting exchange market pressure. In any case, a calibrated policy could also be adopted wherein initially domestic buyers/sellers of commodities are allowed to hedge commodity price risk overseas on a fully currency-hedged basis. This can be gradually relaxed over time as such entities attain maturity in managing exchange rate risk and also depending on regulatory comfort about the size of such exposure. On balance, the Group recommends that hedging by domestic buyers/sellers of the currency risk resulting from their overseas commodity hedging may be permitted as it will enable effective and complete hedging of international commodity price risk. Hedging on domestic commodity exchanges 4.10 Hedging of commodity price risk overseas involves taking on Rupee currency risk, as discussed in para 4.10. While exporters/importers or large domestic corporates have the necessary skill to undertake currency hedging, for the large number of less sophisticated players like SMEs, currency risk could be material. In this context, domestic exchanges could play an important role as hedging on local exchanges enables hedging of both commodity and currency risk. While it may not be desirable to mandate hedging in the domestic commodity derivatives market, as these markets may not provide the required depth and liquidity at his stage, there is a need to encourage hedging commodity price risk on domestic exchanges. The Group, therefore, recommends that residents who hedge their commodity price risk in overseas market should be encouraged to partly and progressively hedge their risks on the domestic exchanges. Awareness needs to be created by all stakeholders including the exchanges in this regard. Listing Requirement 4.11 At present, apart from exporters/importers, only those domestic companies which are listed on stock exchanges are permitted to hedge commodity risk overseas. Presumably, this requirement arises from a concern that unlisted entities may not have the right attributes in terms of balance sheet size, risk management skills and adequate corporate governance to be allowed direct access to overseas hedging markets. At the same time, it excludes a large majority of small and medium enterprises from hedging their commodity price risk. Apart from leading to potentially unequal market access, this regulation does not stand scrutiny from a risk exposure perspective. The Group is in favour of extending hedging facility to all entities, listed or not. However, to address the concerns behind the current regulation, the group recommends that in respect of domestic sale/purchase of commodities in the positive list, unlisted entities may be permitted to hedge commodity risk overseas with the approval of their AD bank. Subsequently, if and when AD banks are permitted by RBI to deal in commodity derivatives, unlisted entities may hedge with the banks as the counterparty. 5.1 The role of banks in commodity derivatives is limited. As authorized dealers, all payments related to overseas commodity hedging by domestic entities is routed through banks. Banks do not take part in such hedging in any other capacity. Banks also provide clearing and settlement services for commodity derivative transactions in domestic exchanges. However, banks have been financing commodity businesses through their loan portfolios and providing fund and non-fund-based facilities to commodity traders for their working capital requirements. 5.2 The Working Group on Warehouse Receipts and Commodity Futures (Chairman - Shri Prashant Saran) set up by RBI (April 2005) had recommended that banks may be permitted to deal in agricultural commodities and their derivatives on exchanges as this would enable banks to offer such products to farmers. However, this recommendation had not been implemented. 5.3 The Group discussed the role of banks and felt that a wider access for Indian entities to overseas commodity derivative markets requires a more active role for banks than they take on now. This should involve banks dealing in commodity derivatives. One obvious advantage is that small entities, which may otherwise be inhibited from accessing global markets directly will be encouraged to hedge their risk if permitted to do so with local banks. Another advantage is that banks can act as aggregators for such smaller entities which will reduce external access only to net exposure at the level of a bank, leading to more efficient use of foreign exchange. This activity would result in banks running a book in commodity derivatives, which could be increased in a calibrated fashion based on regulatory comfort. 5.4 At present, banks do not have direct exposure to commodities though they are indirectly exposed to commodity risk through their loan book. Considering that the role of banks is pivotal in the Indian financial sector, the Group felt that RBI may consider enabling banks and/or their subsidiaries to offer commodity hedging facility to their constituents. Such facilities can be provided on a back-to-back basis to start with. Later, depending upon regulatory comfort and prudential limits, RBI may consider allowing banks to run modest proprietary positions, subject to prudential limits. The Group, therefore, recommends that domestic banks and/or their subsidiaries active in capital markets be allowed to offer commodity hedging facility to their constituents for better risk management in the economy, initially on a back-to-back basis, on both OTC and exchanges, including on domestic exchanges. Later, when necessary risk management capability has been acquired, banks may be allowed to run a book in commodity derivatives within the umbrella limit of 20% of NOF applicable for investment in equities, venture capital funds (VCFs) & equity linked mutual funds. Further, for this purpose, RBI may consider the necessary legal enablement in the B.R. Act, 1949. Chapter 6 The recommendations made by the Group are listed below. 6.1 Recommendation #1: The Group is in favor of a uniform approach in extending facilities to hedge commodity price risk in overseas markets that is agnostic to the place of procurement of the commodity, by doing away with the differences in treatment of importer/exporter on the one hand, and domestic buyers/sellers on the other. 6.2 Recommendation #2: The Group recommends a ‘Positive List’ of commodities (per Table 6.1) which can be hedged in the overseas markets by all residents i.e. by both domestic users and exporters/importers alike. Reserve Bank could periodically review the list based on market feedback. [Ref. para. 4.3] 6.3 Recommendation #3: The Group recommends that inventory hedging be permitted to entities exposed to commodity price risk, for any commodity on the ‘positive list’ to the extent of the average inventory maintained, if they meet the following conditions: -

6.4 Recommendation #4: The Group recommends that price fix hedging be permitted in addition to offset hedging to entities that are faced with a variable price on either input or output, but not both. [Ref. para. 4.6] 6.5 Recommendation #5: The Group recommends hedging in overseas commodity exchanges due to transparency in pricing. However, if the risk profile so warrants, hedging in the OTC market overseas may be allowed but only with regulated entities, preferably banks, as counterparties operating in acceptable jurisdictions specified by RBI. [Ref. para. 4.7] 6.6 Recommendation #6: The Group recommends that in view of the complexity involved in assessing the indirect commodity risk of the user, hedging of only direct commodity price risk may be allowed for now. [Ref. para. 4.8] 6.7 Recommendation #7: The Group recommends that hedging by domestic buyers/sellers of the currency risk resulting from their overseas commodity hedging may be permitted as it will enable effective and complete hedging of international commodity price risk. [Ref. para. 4.9] 6.8 Recommendation #8: The Group recommends that residents who hedge their commodity price risk in overseas market should be encouraged to partly and progressively hedge their risks on the domestic exchanges. Awareness needs to be created by all stakeholders including the exchanges in this regard. [Ref. para. 4.10] 6.9 Recommendation #9: The group recommends that in respect of domestic sale/purchase of commodities in the positive list, unlisted entities may be permitted to hedge commodity risk overseas with the approval of their AD bank. Subsequently, if and when AD banks are permitted by RBI to deal in commodity derivatives, unlisted entities may hedge with the banks as the counterparty. [Ref. para. 4.11] 6.10 Recommendation #10: The Group recommends that domestic banks and/or their subsidiaries active in capital markets be allowed to offer commodity hedging facility to their constituents, initially on a back-to-back basis, on both OTC and exchanges, including on domestic exchanges. Later, when necessary risk management capability has been acquired, banks may be allowed to run a book in commodity derivatives within the umbrella limit of 20% of NOF applicable for investment in equities, venture capital funds (VCFs) & equity linked mutual funds. For this purpose, RBI may consider the necessary legal enablement in the B.R. Act, 1949. [Ref. para. 5.4] An Overview of the Domestic Commodity Derivatives Exchanges At present, the Indian commodity futures market active eco-system comprises of three national exchanges (NCDEX, MCX and NMCE) and three commodity specific regional exchanges (Hapur Commodity Exchange, The Rajkot Commodities Exchange and IPSTA Kochi). While 91 commodities have been notified by the Central Government to be eligible for trading in the commodities futures market, contracts on around 39 commodities are currently being traded at these exchanges, of which 29 are agricultural and 10 are non-agricultural commodities. Futures in commodities shown in the table below are being offered by the three national exchanges.

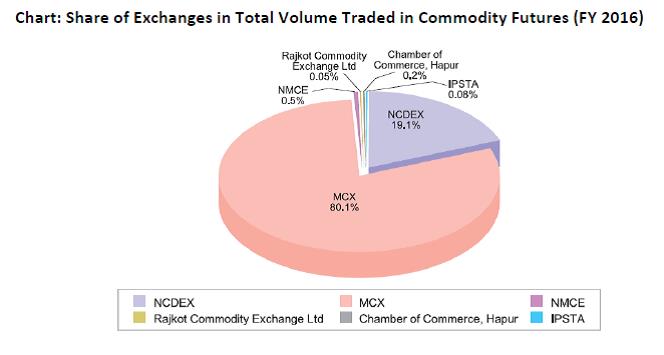

iiTurnover/Volume traded/Open Interest The aggregate turnover at all the exchanges in the domestic commodity derivatives segment increased by 9.1 per cent to ₹ 66,96,380 crore in 2015-16 from ₹ 61,35,672 crore in 2014-15. Further, the aggregate turnover at all the exchanges in the domestic commodity derivatives segment for 2016-17 (till February 2017) was ₹ 59,83,146 crore. The highest share in the all-India turnover of approximately 90.7 per cent was recorded at MCX, followed by 8.9 per cent at NCDEX and 0.4 per cent at NMCE. The chart below shows the respective share of exchanges in the consolidated volume traded across exchanges for FY 2016. In terms of the total volume traded in Commodity futures, MCX held the dominant position with 80.1 per cent share, followed by NCDEX (19.1 per cent) and NMCE (0.5 per cent).  MCX In 2015-16, the total turnover at MCX increased by 8.7 per cent to ₹ 56,34,194 crore compared to ₹ 51,83,707 crore in 2014-15. Further, the total turnover at MCX in 2016-17 (till February end) is ₹ 54,25,289 crore. Bullion with the highest share in turnover witnessed a decline of 3.9 per cent in 2015-16 over 2014-15. As compared to 2014-15, turnover in energy increased by 17.7 per cent in 2015-16. The metals segment recorded an 18.1 per cent increase in turnover in 2015-16 while the agriculture segment witnessed a 10.4 per cent increase in turnover. Open interest at the exchange increased from ₹ 8,715 crore in 2014-15 to ₹ 9,080 crore in 2015-16. NCDEX At NCDEX, the total turnover in 2015-16 was ₹ 10,19,588 crore, representing an increase of 12.8 per cent from ₹ 9,04,063 crore in 2014-15. Further, the total turnover at NCDEX in 2016-17 (till February end) is ₹ 5,32,775 crore which represents the sharp decline. Turnover in the agriculture segment witnessed an increase of 14.7 per cent in 2015-16, while that in bullion declined by 36.5 per cent in 2015-16 over the previous year. Open interest at the exchange declined from ₹ 6,087 crore in 2014-15 to ₹ 4,703 crore in 2015-16. NMCE At NMCE, the total turnover in 2015-16, contributed entirely by agriculture segment was ₹ 29,368 crore, a decrease of 18.5 per cent from ₹ 36,040 crore in 2014-15. Further, the total turnover at NMCE in 2016-17 (till February end) is ₹ 25,083 crore. Open interest at the exchange increased from ₹ 46 crore in 2014-15 to ₹ 61 crore in 2015-16. Hapur Commodity Exchange At Hapur Commodity Exchange, which is a commodity specific exchange for rape/mustard seed, the total turnover in 2015-16 was ₹ 11,192 crore, an increase of 31.3 per cent from ₹ 8,521 crore in 2014-15. Open interest at the exchange increased from ₹ 13 crore in 2014-15 to ₹ 23 crore in 2015-16. Rajkot Commodity Exchange Ltd. At the Rajkot Commodity Exchange Ltd., which is a commodity specific exchange for Castor seed, the total turnover in 2015-16 was ₹ 1,976 crore, a decrease of 37.5 per cent from ₹ 3,163 crore in 2014-15 (Table 2.54). At IPSTA, the commodity specific exchange for pepper, the total turnover in 2015-16 was ₹ 62 crore, a decrease of 65.2 per cent from ₹ 178 crore in 2014-15. Product Segment-wise Turnover/Volume traded Of the aggregate all India turnover, 88.6 per cent was contributed by non-agri commodities while the remaining 11.4 per cent was contributed by agri commodities. As against the previous years, there has been a distinct shift in the relative shares of traded commodity groups at MCX. The share of bullion, the dominant product segment, declined from 41.5 per cent in 2014-15 to 36.7 per cent in 2015-16 and further to 35.5 percent in 2016-17 (till February end). Energy contributed a 32.8 per cent share in turnover followed by metal at 29.3 per cent and agriculture at 2.3 per cent. At NCDEX, agriculture had the highest share in turnover at 98 per cent followed by bullion at 2 per cent in 2015-16 and nearly 100 percent in 2016-17 (till February end). At NMCE, the entire turnover was that of the agriculture segment. Agri Commodities On the whole, 27 agri commodities were traded at the Indian commodities futures exchanges, of which NCDEX traded 19, MCX (6) and NMCE (11) during 2016-17. A few commodities like kapas, castor seed, mustard seed, cotton and guar seed, etc., were traded at more than one exchange. In addition to the above, the regional exchanges are commodity specific as the Rajkot Commodity Exchange Ltd. trades castor seed; the Hapur Commodity Exchange, trades mustard seeds, and IPSTA trades pepper. At MCX, the share of agri commodities in the total turnover for 2016-17 was a miniscule 2.3 per cent. Crude palm oil (CPO) was the most traded agri commodity with a percentage share of 0.79 per cent in the total turnover at the exchange. Apart from CPO, mentha oil, cotton, cardamom and kapas were the only agri commodities traded at MCX during 2015-16. At NCDEX, the share of agri commodities in the total turnover for 2015-16 was almost 100 percent. The top 10 agri commodities contributed 89.7 per cent of the turnover of the exchange. Chana was the most traded agri commodity with a percentage share of 15.7 per cent in the total turnover at the exchange. Soya oil with a share of 14.0 per cent and guar seed with a share of 11.3 per cent were the other most traded commodities at NCDEX during the year. At NMCE, rape/mustard seed was the most traded agri commodity with 22.0 per cent share of per cent in the total turnover, followed by isabgul seed at 20.7 per cent. Non-Agri Commodities At MCX, in 2016-17 the share of non-agri commodities in the total turnover was 97.7 per cent. Crude oil was the most traded non-agri commodity with a percentage share of 29.8 per cent in the total turnover at the exchange. Gold was the other most traded commodity with a share in turnover of 22.1 per cent followed by silver at 14.7 per cent. Trading in non-agri commodities in NCDEX was negligible. List of sources: i SEBI PR No. 237/2015 dated September 28, 2015 ii Annual Report 2015-16 of Securities and Exchange Board of India (SEBI) 1 Based on data collected from large user banks. 2 The table is based on data collected from large user banks and is only indicative. | ||||||||||||

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: