Merchandise exports, based on Directorate General

of Commercial Intelligence and Statistics (DGCI&S) data, recorded a growth

of 19.3 per cent during 2006-07 (April-February), lower than that of 26.3 per

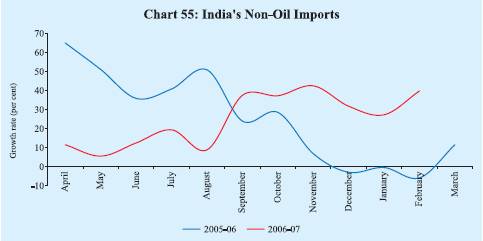

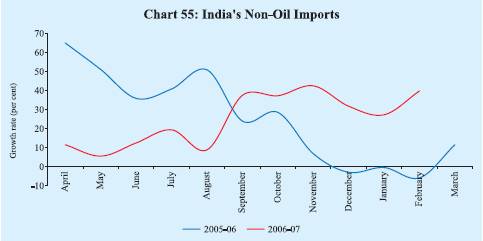

cent in the corresponding period of 2005-06. Growth in non-oil imports was led

by imports of capital goods, indicative of strong investment demand, partly offsetting

the decline in imports of pearls, precious and semi-precious stones. Growth in

oil imports remained large, although there was some deceleration in consonance

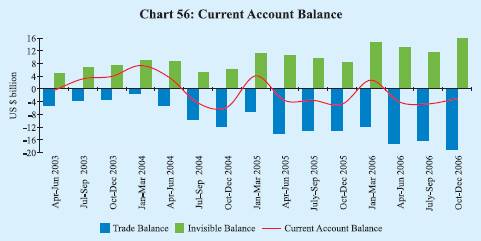

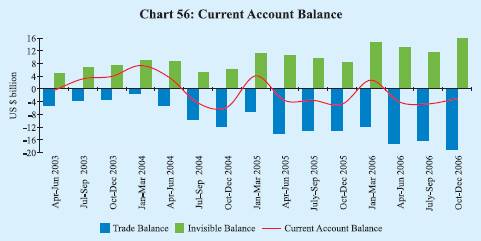

with the moderation in international crude oil prices. Net invisibles surplus

expanded further during the first three quarters of 2006-07, benefiting from continued

growth in exports of services and remittances, and financed a large part of the

deficit on the merchandise trade account. The current account deficit was marginally

lower than a year ago. Capital flows were substantially higher, led by foreign

direct investment (FDI) flows and supported by foreign institutional investors

(FIIs) flows and debt flows (external commercial borrowings and nonresident deposits).

Outward FDI flows associated with acquisitions by Indian corporates abroad also

increased. Capital flows (net) more than financed the current account deficit,

resulting in the net accretion of US $ 47.6 billion in foreign exchange reserves

during 2006-07.

International Developments

Global economic growth at 5.4 per cent during 2006 (4.9 per cent in 2005) turned

out to be stronger than expected, led by a broad-based upswing in advanced economies

and rapid growth in the emerging market economies. After a strong first quarter,

economic activity in the US slowed down on the back of a significant weakening

of the housing market. Nonetheless, for the year 2006, as a whole, economic growth

in the US was marginally higher than in 2005. The economic activity in the euro

area accelerated to 2.6 per cent – the highest since 2001– led by

strong domestic as well as external demand. The Japanese economy expanded at a

higher rate than in 2005. Growth momentum remained strong in China, India and

other emerging economies as well (Table 51). Developing Asia

recorded a growth of 9.4 per cent during 2006, the highest since 1995.

According to the International Monetary Fund (IMF) projections, the global economy

is likely to maintain its run of strong growth during 2007, though with some loss

of momentum (4.9 per cent from 5.4 per cent in 2006) (Table 52).

There are also some downside risks to global growth prospects. These include revival

of inflationary pressures in view of narrowing output gaps, the possibility of

renewed oil price rise, sharper slowdown in the US economy in case the housing

Table

51: Growth Rates – Global Scenario | (Per

cent) | Country | 2004 | 2005 | 2006 | 2007

P | 2008 P | 2005

| 2006 |

| Q4 | Q1 | Q2 | Q3 | Q4 |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

Advanced Economies | | | | | | | | | | |

Euro area | 2.0 | 1.4 | 2.6 | 2.3 | 2.3 | 1.8 | 2.2 | 2.7 | 2.6 | 3.3 |

Japan | 2.7 | 1.9 | 2.2 | 2.3 | 1.9 | 2.8 | 2.9 | 2.1 | 1.5 | 2.3 |

Korea | 4.7 | 4.2 | 5.0 | 4.4 | 4.4 | 5.3 | 6.3 | 5.1 | 4.8 | 4.0 |

UK | 3.3 | 1.9 | 2.7 | 2.9 | 2.7 | 1.8 | 2.4 | 2.7 | 2.9 | 3.0 |

US | 3.9 | 3.2 | 3.3 | 2.2 | 2.8 | 3.1 | 3.7 | 3.5 | 3.0 | 3.1 |

OECD Countries | 3.2 | 2.5 | 3.0 | 2.5 | 2.7 | 3.0 | 3.3 | 3.3 | 2.9 | 3.3 |

Emerging Economies | | | | | | | | | | |

Argentina | 9.0 | 9.2 | 8.5 | 7.5 | 5.5 | 9.1 | 8.6 | 7.9 | 8.7 | 8.6 |

Brazil | 5.7 | 2.9 | 3.7 | 4.4 | 4.2 | 1.4 | 3.4 | 1.2 | 3.2 | 3.8 |

China | 10.1 | 10.4 | 10.7 | 10.0 | 9.5 | 9.9 | 10.3 | 10.9 | 10.7 | 10.7 |

India | 7.5 | 9.0 | 9.2 | 8.4 | 7.8 | 9.3 | 10.0 | 8.9 | 9.2 | 8.6 |

Indonesia | 5.0 | 5.7 | 5.5 | 6.0 | 6.3 | 5.0 | 5.0 | 5.0 | 5.9 | 6.1 |

Malaysia | 7.2 | 5.2 | 5.9 | 5.5 | 5.8 | 5.2 | 5.3 | 6.2 | 5.8 | 5.7 |

Thailand | 6.3 | 4.5 | 5.0 | 4.5 | 4.8 | 4.3 | 6.1 | 5.0 | 4.7 | 4.2 |

P : IMF Projections.

Note

: Data for India in columns 2 to 4 refer to fiscal years 2004-05, 2005-06

and 2006-07, respectively.

Source : International Monetary

Fund; The Economist; and the OECD. | sector continues to

deteriorate, financial market volatility and possible disorderly adjustment of

global imbalances.

Table

52: Select Economic Indicators – World | Item | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007P | 2008P |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

I. | | World

Output (Per cent change) # | 2.5 | 3.1 | 4.0 | 5.3 | 4.9 | 5.4 | 4.9 | 4.9 |

| | | | (1.5) | (1.8) | (2.6) | (4.0) | (3.3) | (3.9) | (3.4) | (3.5) |

| | i) | Advanced

economies | 1.2 | 1.6 | 1.9 | 3.3 | 2.5 | 3.1 | 2.5 | 2.7 |

| | ii) | Other

emerging market and developing countries | 4.3 | 5.0 | 6.7 | 7.7 | 7.5 | 7.9 | 7.5 | 7.1 |

| | | of

which: Developing Asia | 6.0 | 7.0 | 8.4 | 8.7 | 9.2 | 9.4 | 8.8 | 8.4 |

II. | | Consumer

Price Inflation (Per cent) | | | | | | | | |

| | i) | Advanced

economies | 2.1 | 1.5 | 1.8 | 2.0 | 2.3 | 2.3 | 1.8 | 2.1 |

| | ii) | Other

emerging market and developing countries | 6.7 | 5.8 | 5.8 | 5.6 | 5.4 | 5.3 | 5.4 | 4.9 |

| | | of

which: Developing Asia | 2.7 | 2.0 | 2.5 | 4.1 | 3.6 | 4.0 | 3.9 | 3.4 |

III. | Net

Capital Flows* (US $ billion) | | | | | | | | |

| | i) | Net

private capital flows (a+b+c) | 70.2 | 88.3 | 173.3 | 238.6 | 257.2 | 255.8 | 252.7 | 259.3 |

| | | a)

Net private direct investment | 182.8 | 152.2 | 165.3 | 190.0 | 266.3 | 266.9 | 283.7 | 288.9 |

| | | b)

Net private portfolio investment | -80.5 | -90.9 | -12.1 | 25.0 | 29.4 | -76.3 | -62.0 | -52.2 |

| | | c)

Net other private capital flows | -32.1 | 26.9 | 20.1 | 23.5 | -38.5 | 65.2 | 30.9 | 22.6 |

| | ii) | Net

official flows | 6.6 | 2.3 | -44.5 | -57.8 | -122.6 | -143.8 | -96.4 | -116.6 |

IV. | | World

Trade @ | | | | | | | | |

| | i) | Volume | 0.2 | 3.4 | 5.4 | 10.6 | 7.4 | 9.2 | 7.0 | 7.4 |

| | ii) | Price

deflator (in US dollars) | -3.5 | 1.2 | 10.4 | 9.8 | 5.5 | 5.4 | 2.8 | 0.8 |

V. | | Current

Account Balance (Per cent to GDP) | | | | | | | | |

| | i) | US | -3.8 | -4.5 | -4.8 | -5.7 | -6.4 | -6.5 | -6.1 | -6.0 |

| | ii) | China

| 1.3 | 2.4 | 2.8 | 3.6 | 7.2 | 9.1 | 10.0 | 10.5 |

| | iii) | Middle

East | 6.2 | 4.7 | 8.4 | 12.1 | 18.8 | 18.1 | 12.1 | 10.7 |

P : IMF Projections.

# :

Growth rates are based on exchange rates at purchasing power parities. Figures

in parentheses are growth rates at market exchange rates.

* : Net capital

flows to emerging market and developing countries.

@ : Average of annual percentage

change for world exports and imports of goods and services.

Source

: World Economic Outlook, IMF, April 2007. |

Table

53: Growth in Exports - Global Scenario | (Per

cent) | Region/Country | 2005 | 2006 |

1 | 2 | 3 |

World | 14.0 | 15.7 |

Industrial Countries | 8.5 | 12.6 |

US | 10.8 | 14.5 |

France | 4.3 | 10.8 |

Germany | 7.3 | 15.1 |

Japan | 5.2 | 9.2 |

Developing Countries | 21.8 | 19.7 |

Non-Oil Developing Countries | 19.2 | 19.7 |

China | 28.4 | 27.2 |

India | 29.6 | 21.1 |

Indonesia | 18.2 | 16.5 |

Korea | 12.0 | 14.5 |

Malaysia | 12.0 | 14.0 |

Singapore | 15.6 | 18.4 |

Thailand | 14.5 | 18.7 |

Source: International

Financial Statistics, International Money Fund;

DGCI&S for India. |

Global merchandise trade grew at a robust pace in 2006 benefiting from

favourable economic conditions, high commodity prices and recovery in global investment.

Exports of developing countries, notwithstanding some deceleration, continued

to post a higher growth in comparison with industrial countries (Table

53).

Merchandise Trade

According to the

provisional data released by the Directorate General of Commercial Intelligence

and Statistics (DGCI&S), India’s merchandise exports during April-February

2006-07 registered a growth of 19.3 per cent as compared with 26.3 per cent a

year ago. The export growth was strong in the first half (April-September 2006)

of the fiscal at 27.2 per cent, but decelerated to 14.3 per cent during October

2006-February 2007 (Chart 54).

Commodity-wise

data available for April-November 2006 reveal that engineering goods and petroleum

products were the major growth drivers, together contributing almost 64 per cent

of the export growth during this period. Gems and jewellery, textiles, and ores

and minerals, on the other hand, showed decline or deceleration in exports (Table

54). Agriculture and allied products posted strong growth, driven mainly by

the increase in the exports of sugar and molasses and raw cotton. Traditional

export items like tea, coffee, tobacco and spices also maintained high growth,

while exports of rice, wheat, cashew and marine products declined or decelerated.

The US continued to be the major destination of India’s exports with a share

of 15.4 per cent in 2006-07 (April-November) followed by the UAE (9.9 per cent),

China (5.9 per cent), Singapore (5.2 per cent) and the UK (4.5 per cent)

(Table

55). Among the major countries, growth in exports to the UAE accelerated to

57.4 per cent from 22.3 per cent a year ago. On the other hand, growth in exports

to China, Singapore and Hong Kong decelerated.

India’s merchandise

imports registered a growth of 27.8 per cent during April-February 2006-07 on

top of 32.7 per cent growth a year ago. After showing a slowdown in the latter

half of 2005-06, non-oil imports have picked up since

Table

54: Exports of Principal Commodities | Commodity

Group | US $

billion | Variation

(per cent) | 2005-06 | 2005-06 | 2006-07 | 2005-06 | 2005-06 | 2006-07 |

April-November | April-November |

1 | | 2 | 3 | 4 | 5 | 6 | 7 |

1. | Primary

Products | 16.4 | 9.6 | 11.4 | 20.8 | 29.7 | 18.9 |

| of

which: | | | | | | |

a) | Agriculture

and Allied Products | 10.2 | 6.0 | 7.4 | 20.5 | 20.4 | 23.5 |

b) | Ores

and Minerals | 6.2 | 3.6 | 4.0 | 21.4 | 49.1 | 11.2 |

| | | | | | | |

2. | Manufactured

Goods | 72.2 | 45.5 | 53.5 | 18.9 | 25.2 | 17.7 |

| of

which: | | | | | | |

a) | Chemicals

and Related Products | 14.8 | 9.0 | 10.9 | 18.6 | 23.3 | 21.0 |

b) | Engineering

Goods | 21.5 | 13.4 | 18.5 | 23.7 | 33.2 | 38.5 |

c) | Textiles

and Textile Products | 16.3 | 10.1 | 11.0 | 20.6 | 21.8 | 8.6 |

d) | Gems

and Jewellery | 15.5 | 10.3 | 10.2 | 12.8 | 22.5 | -0.8 |

3. | Petroleum

Products | 11.5 | 7.2 | 12.8 | 64.9 | 63.0 | 79.1 |

4. | Total

Exports | 103.1 | 63.9 | 80.9 | 23.4 | 29.4 | 26.6 |

Memo: | | | | | | |

Non-oil Exports | 91.6 | 56.7 | 68.1 | 19.6 | 26.1 | 20.0 |

Source : DGCI&S. |

Table

55: Direction of India’s Exports | Group/Country | US

$ billion | Variation

(per cent) | 2005-06 | 2005-06 | 2006-07 | 2005-06 | 2005-06 | 2006-07 |

April-November | April-November |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

1. OECD Countries | 45.8 | 28.7 | 33.4 | 25.6 | 29.3 | 16.2 |

| of

which: | | | | | | |

| a)

EU | 22.4 | 14.0 | 16.3 | 27.6 | 34.5 | 17.1 |

| b)

North America | 18.4 | 11.6 | 13.2 | 25.6 | 25.6 | 13.0 |

| US | 17.4 | 11.0 | 12.4 | 26.1 | 25.9 | 12.8 |

2. | OPEC | 15.2 | 9.1 | 13.6 | 15.4 | 19.9 | 50.1 |

| of

which: | | | | | | |

| UAE | 8.6 | 5.1 | 8.0 | 16.9 | 22.3 | 57.4 |

3. | Developing

Countries | 39.7 | 24.6 | 32.0 | 25.8 | 35.8 | 30.1 |

| of

which: | | | | | | |

| Asia

| 31.0 | 19.2 | 23.8 | 24.1 | 35.6 | 23.7 |

| People’s

Republic of China | 6.8 | 3.9 | 4.8 | 20.4 | 56.5 | 22.7 |

| Singapore

| 5.4 | 3.6 | 4.2 | 19.3 | 63.0 | 15.3 |

4. | Total

Exports | 103.1 | 63.9 | 80.9 | 23.4 | 29.4 | 26.6 |

Source : DGCI&S. |

September 2006 (Chart 55). During April-February

2006-07, non-oil imports grew by 25.7 per cent and accounted for almost 64 per

cent of the rise in total imports.

Major import items like capital goods

maintained high growth during April-November 2006, while imports of mainly export

related items, particularly, pearls, precious and semi-precious stones declined

(Table 56). Imports of capital goods increased by 38.2 per

cent during April-November 2006, over and above

Table

56: Imports of Principal Commodities | Commodity

Group | US $

billion | | Variation

(per cent) | 2005-06 | 2005-06 | 2006-07 | 2005-06 | 2005-06 | 2006-07 |

April-November | April-November |

1 | 2 | 3 | 4 | 5 | 6 | 7 |

Petroleum, Petroleum Products and | | | | | | |

Related Material | 44.0 | 27.8 | 39.4 | 47.3 | 43.3 | 41.9 |

Edible Oils | 2.0 | 1.5 | 1.5 | -17.9 | -9.2 | 3.2 |

Iron and Steel | 4.6 | 3.2 | 4.1 | 71.3 | 106.4 | 28.4 |

Capital Goods | 37.7 | 19.6 | 27.1 | 49.9 | 45.7 | 38.2 |

Pearls, Precious and Semi-Precious Stones | 9.1 | 6.7 | 5.0 | -3.1 | 30.8 | -25.6 |

Chemicals | 7.0 | 4.7 | 5.2 | 22.5 | 37.5 | 11.8 |

Gold and Silver | 11.3 | 8.0 | 9.6 | 1.5 | 27.4 | 21.3 |

| | | | | | |

Total Imports | 149.2 | 93.5 | 119.4 | 33.8 | 41.2 | 27.8 |

| | | | | | |

Memo: | | | | | | |

| | | | | | |

Non-oil Imports | 105.2 | 65.7 | 80.0 | 28.8 | 40.4 | 21.8 |

Non-oil Imports excluding Gold and Silver | 93.9 | 57.8 | 70.4 | 33.1 | 42.4 | 21.8 |

Mainly Industrial Imports* | 87.5 | 53.3 | 64.5 | 34.7 | 43.8 | 21.1 |

* : Non-oil imports net of gold

and silver, bulk consumption goods, manufactured fertilisers and professional

instruments.

Source : DGCI&S. | the

growth of 45.7 per cent recorded a year ago, reflecting the continued buoyancy

in domestic investment activity. Imports of gold and silver registered a sharp

jump during September-November 2006, offsetting the decline during April-August

2006. As a result, the cumulative growth was 21.3 per cent during April-November

2006.

Oil imports during April-February 2006-07 rose

by 32.6 per cent on top of 49.7 per cent a year ago, reflecting partly the increase

in volumes. In volume terms, oil imports increased by 22.5 per cent during April-November

2006 as compared with a growth of 0.8 per cent a year ago. Growth in the Indian

basket of crude oil prices, on the other hand, decelerated to 12.7 per cent during

2006-07 from 42.3 per cent during 2005-06.

Source-wise, during April-November

2006, China was the major source of imports with a share of 9.3 per cent in India’s

total imports, followed by Saudi Arabia (7.9 per cent), the US (5.8 per cent),

Switzerland (4.9 per cent) and the UAE (4.7 per cent).

Trade deficit

at US $ 55.8 billion during 2006-07 (April-February), according to the DGCI&S

data, was higher by 48.5 per cent than the previous year (US $ 37.6 billion) (Table

57). The deficit on the oil account increased by US $ 6.0 billion during April-November

2006 over the corresponding period of 2005, while the non-oil trade deficit increased

by US $ 3.0 billion.

Table

57: India’s Merchandise Trade | (US

$ billion) | Item | 2004-05 | 2005-06 | 2005-06 | 2006-07 |

| | April-February |

1 | 2 | 3 | 4 | 5 |

Exports | 83.5 | 103.1 | 91.5 | 109.2 |

Imports | 111.5 | 149.2 | 129.1 | 165.0 |

Oil | 29.8 | 44.0 | 39.8 | 52.7 |

Non-oil | 81.7 | 105.2 | 89.3 | 112.3 |

Trade Balance | -28.0 | -46.1 | -37.6 | -55.8 |

Non-Oil Trade Balance | -5.1 | -13.6 | -9.0

* | -11.9 * | Variation

(per cent) | Exports | 30.8 | 23.4 | 26.3 | 19.3 |

Imports | 42.7 | 33.8 | 32.7 | 27.8 |

Oil | 45.1 | 47.3 | 49.7 | 32.6 |

Non-oil | 41.8 | 28.8 | 26.4 | 25.7 |

*: April-November. | | | | |

Source : DGCI&S. |

Current Account

Buoyant net surplus under invisibles

(services, transfers and income taken together) continued to finance bulk of the

trade deficit during 2006-07 (April-December). Amongst major services, net surplus

under software services increased by 29.1 per cent to US $ 20.1 billion during

April-December 2006 (Table 58). Private transfers (net) at

US $ 18.8 billion during April-December 2006 were 11.6 per cent higher than a

year ago. Investment income deficit narrowed from a year ago, on account of higher

earnings on India’s external assets. On balance, the net surplus under invisibles

increased to US $ 40.5 billion during April-December 2006 from US $ 28.1 billion

a year ago.

Table

58: Invisibles Account (Net) | (US

$ million) | Item | 2005-06

PR | 2005-06

PR | 2006-07

P | 2005-06

PR | | 2006-07 | |

April-March | April-December | Oct.-Dec. | April-

June PR | July- Sept. PR | Oct.-

Dec.P | 1 | | | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

Services | 23,881 | 16,416 | 25,064 | 4,690 | 8,612 | 7,459 | 8,993 |

Travel | 1,389 | 788 | 981 | 516 | 220 | -31 | 792 |

Transportation | -1550 | -1,087 | -450 | -405 | -314 | -31 | -105 |

Insurance | 22 | 100 | 365 | -126 | 111 | 162 | 92 |

Government, not included elsewhere

-197 | -107 | -97 | -18 | -24 | -62 | -11 |

Software | 22,262 | 15,597 | 20,143 | 5,755 | 6,601 | 6,678 | 6,864 |

Other Services | 1,955 | 1,125 | 4,122 | -1,032 | 2,018 | 743 | 1,361 |

Transfers | 24,284 | 16,937 | 18,943 | 6,436 | 5,689 | 5,222 | 8,032 |

Investment Income | -4,921 | -4,741 | -3,100 | -2,706 | -1,043 | -1,144 | -913 |

Compensation of Employees | -589 | -465 | -426 | -222 | -131 | -162 | -133 |

Total | 42,655 | 28,147 | 40,481 | 8,198 | 13,127 | 11,375 | 15,979 |

PR : Partially Revised.

P: Preliminary. | The net invisible surplus financed 77.4

per cent of the merchandise trade deficit during April-December 2006. Current

account deficit at US $ 11.8 billion in April-December 2006 was marginally lower

than that in the corresponding period of the previous year on account of higher

net invisibles receipts (Table 59 and Chart

56).

Capital Flows

Capital flows during

2006-07 were substantially higher than a year ago, led by foreign direct investment

(FDI) flows, on the back of strong growth prospects and buoyant investment demand.

FDI inflows at US $ 16.4 billion during April-January 2006-07 were substantially

higher than the inflows in the corresponding period of the previous year (Table

60). FDI was channelled mainly into financial services, manufacturing, banking

services, information technology services and construction. Mauritius, the US

and United Kingdom remain the dominant sources of FDI to India. Outward direct

investment from India also exhibited a significant rise to US $ 8.7 billion during

April-December 2006 from US $ 1.9 billion a year ago due to some large overseas

acquisitions by Indian corporates. Both FDI inflows

Table

59: India's Balance of Payments | (US

$ million) | Item | 2005-06

PR | | 2005-06

PR | 2006-07

P | 2005-06

PR | 2006-07 |

April- March | | April-December | Oct.-

Dec. | April- June PR | July-

Sept. PR | Oct- Dec. P |

1 | 2 | | 3 | 4 | 5 | 6 | 7 | 8 |

Exports | 1,05,152 | | 74,573 | 91,334 | 25,318 | 29,674 | 32,798 | 28,862 |

Imports | 1,56,993 | | 1,14,662 | 1,43,636 | 38,298 | 46,898 | 48,855 | 47,883 |

Trade Balance | -51,841 | | -40,089 | -52,302 | -12,980 | -17,224 | -16,057 | -19,021 |

| | | (-6.4) | | | | | | | |

Invisible Receipts | 92,294 | | 63,594 | 82,633 | 23,990 | 25,056 | 25,576 | 32,001 |

Invisible Payments | 49,639 | | 35,447 | 42,152 | 15,792 | 11,929 | 14,201 | 16,022 |

Invisibles, net | 42,655 | | 28,147 | 40,481 | 8,198 | 13,127 | 11,375 | 15,979 |

| | | (5.3) | | | | | | | |

Current Account | -9,186 | | -11,942 | -11,821 | -4,782 | -4,097 | -4,682 | -3,042 |

| | | (-1.1) | | | | | | | |

Capital Account (net)* | 24,238 | | 13,773 | 27,972 | 110 | 10,475 | 6,950 | 10,547 |

| | | [29,738]@ | | [19,273]@ | | [5,610]@ | | | |

| | of

which: | | | | | | | | |

| | Foreign

Direct Investment 4,730 | | 3,347 | 5,822 | 1,218 | 1,273 | 2,268 | 2,281 |

| | Portfolio

Investment | 12,494 | | 8,161 | 5,170 | 2,748 | -527 | 2,141 | 3,556 |

| | | | | | | | | | |

| | External

Commercial | 2,723 | | -1,211 | 9,104 | -4,136 | 3,947 | 1,324 | 3,833 |

| | | [8,223]@ | [4,289]@ | | | | |

| | Borrowings

$ | | | [1,364]@ | | | |

| | Short-term

Trade Credit | 1,708 | | 1,731 | 1,329 | 759 | 417 | 1,554 | -642 |

| | External

Assistance | 1,682 | | 1,090 | 934 | 681 | 41 | 337 | 556 |

| | NRI

Deposits | 2,789 | | 1,114 | 3,201 | 881 | 1,231 | 798 | 1,172 |

Change in Reserves # | -15,052 | | -1,831 | -16,151 | 4,672 | -6,378 | -2,268 | -7,505 |

PR: Partially Revised.

P

: Preliminary.

* : Includes errors and omissions.

$ : Medium and long-term

borrowings.

@ : Excluding the IMD redemption.

# : On balance of payments

basis (excluding valuation); (-) indicates increase.

Note : Figures

in parentheses are percentages to GDP. |

and

outflows include one transaction amounting to US $ 3.1 billion involving swap

of shares. Net of this transaction, FDI inflows and outflows were US $ 13.3 billion

and US $ 5.6 billion, respectively, also indicating a significant increase over

the previous year.

Portfolio equity inflows by foreign institutional investors

(FIIs) were lower than a year ago due to outflows witnessed during a few months

on the back of global developments such as meltdown in global commodities and

equity markets (May-July 2006), fall in Asian equity markets subsequent to the

tightening of capital controls by Thailand (December 2006) and fall in Asian equity

markets on account of concerns of slowdown in the US economy (late February 2007).

Capital inflows through the issuances of American depository receipts (ADRs)/Global

depository receipts (GDRs) during April-January 2006-07 remained higher than in

the previous year.

Table

60: Capital Flows | (US

$ million) | Components | | Period | 2005-06 | 2006-07 |

1 | | 2 | 3 | 4 |

Foreign Direct Investment (FDI) into India | | April-January | 5,821 | 16,444

# | FDI Abroad | | April-December | (-)1,939 | (-)8,684

# | FIIs (net) | | April-March | 9,926 | 3,224 |

ADRs/GDRs | | April-January | 2,141 | 3,506 |

External Assistance (net) | | April-December | 1,153 | 949 |

External Commercial Borrowings

(net)

(Medium and long-term) | April-December | 4,420

@ | 9,275 | Short-term

Trade Credits (net) | | April-December | 1,731 | 1,329 |

NRI Deposits (net) | | April-January | 1,681 | 3,686 |

# : Include swap of shares of

US $ 3.1 billion.

@: Excluding IMD redemption.

Note : Data

on FIIs presented in this table represent inflows into the country. They may differ

from

data relating to net investment in stock exchanges by FIIs. |

Amongst debt flows, demand for external commercial borrowings (ECBs)

remained strong in consonance with buoyant domestic investment activity. Net disbursements

under ECBs during April-December 2006 were more than double of those a year ago.

Net inflows under various NRI deposits during April-January 2006-07 were also

more than twice that a year ago, partly attributable to higher interest rates

on various deposit schemes up to January 2007. The ceiling interest rate on NRE

deposits was raised by 25 basis points each in November 2005 and April 2006 before

being scaled down by 50 basis points to “LIBOR/SWAP rates of US dollar plus

50 basis points” in January 2007. The ceiling interest rate on FCNR(B) deposits

was raised by 25 basis points to “LIBOR/SWAP rates for the respective currency/

maturity” in March 2006 but was reduced by 25 basis points to “LIBOR/

SWAP rates minus 25 basis points” in January 2007. Foreign

Exchange Reserves

India’s foreign exchange reserves were

US $ 199.2 billion as on March 31, 2007, showing an increase of US $ 47.6 billion

over end-March 2006 levels (Table 61). The increase in reserves

was mainly due to increase in foreign currency assets from US $ 145.1 billion

at end-March 2006 to US $ 191.9 billion as at end-March 2007. As on April 13,

2007, India’s foreign exchange reserves were US $ 203.1 billion.

Table

61: Foreign Exchange Reserves | | | | | | (US

$ million) | Period | Gold | SDR | Foreign | Reserve | Total |

| | | Currency | Position

in | (2+3+4+5) | | | | Assets | the

IMF | | 1 | 2 | 3 | 4 | 5 | 6 |

March 1995 | 4,370 | 7 | 20,809 | 331 | 25,517 |

March 2000 | 2,974 | 4 | 35,058 | 658 | 38,694 |

March 2005 | 4,500 | 5 | 135,571 | 1,438 | 141,514 |

March 2006 | 5,755 | 3 | 145,108 | 756 | 151,622 |

April 2006 | 6,301 | 6 | 153,598 | 772 | 160,677 |

May 2006 | 7,010 | – | 156,073 | 785 | 163,868 |

June 2006 | 6,180 | – | 155,968 | 764 | 162,912 |

July 2006 | 6,557 | 7 | 157,247 | 766 | 164,577 |

August 2006 | 6,538 | 1 | 158,938 | 767 | 166,244 |

September 2006 | 6,202 | 1 | 158,340 | 762 | 165,305 |

October 2006 | 6,068 | 7 | 160,669 | 648 | 167,392 |

November 2006 | 6,494 | 1 | 167,598 | 548 | 174,641 |

December 2006 | 6,517 | 1 | 170,187 | 546 | 177,251 |

January 2007 | 6,529 | 10 | 173,081 | 541 | 180,161 |

February 2007 | 6,883 | 2 | 187,211 | 467 | 194,563 |

March 2007 | 6,784 | 2 | 191,924 | 469 | 199,179 |

April 2007* | 6,784 | 2 | 195,844 | 462 | 203,092 |

- : Negligible.

* : As on April 13, 2007. |

India holds the fifth largest stock of reserves among the emerging

market economies. The overall approach to the management of India’s foreign

exchange reserves in recent years reflects the changing composition of the balance

of payments and the ‘liquidity risks’ associated with different types

of flows and other requirements. Taking these factors into account, India’s

foreign exchange reserves continued to be at a comfortable level and consistent

with the rate of growth, the share of external sector in the economy and the size

of risk-adjusted capital flows.

External Debt

India’s total external debt was placed at US $ 142.7 billion at end-December

2006, an increase of US $ 16.2 billion over end-March 2006. The increase during

the period was mainly on account of higher external commercial borrowings and

NRI deposits. As noted earlier, higher commercial borrowings could be attributed

to sustained investment and import demand, while the rise in NRI deposits was

partly on account of higher interest rates on these deposits for the period. Almost

46 per cent of the external debt stock was denominated in US dollars followed

by the Indian Rupee (19 per cent), SDR (14 per cent) and Japanese Yen (12 per

cent). Sustainability indicators such as the ratio of short-term to total debt

and short-term debt to reserves remained almost unchanged between end-March 2006

and end-December 2006 and continued to be at quite low and comfortable levels

(Table 62). Foreign exchange reserves remain in excess of

the stock of external debt.

Table

62: India’s External Debt | (US

$ million) | Indicator | End-March | End-March | End-March | End-June | End-Sept | End-Dec |

| | 1995 | 2005 | 2006 | 2006 | 2006 | 2006 |

1 | | 2 | 3 | 4 | 5 | 6 | 7 |

1. | Multilateral | 28,542 | 31,702 | 32,559 | 33,101 | 33,594 | 34,569 |

2. | Bilateral | 20,270 | 16,930 | 15,727 | 15,833 | 15,734 | 15,770 |

3. | International Monetary

Fund | 4,300 | 0 | 0 | 0 | 0 | 0 |

4. | Trade Credit | 6,629 | 4,980 | 5,398 | 5,498 | 5,658 | 5957 |

5. | External Commercial Borrowings | 12,991 | 27,024 | 26,869 | 31,114 | 32,421 | 35,980 |

6. | NRI Deposit | 12,383 | 32,743 | 35,134 | 35,651 | 36,515 | 38,382 |

7. | Rupee Debt | 9,624 | 2,301 | 2,031 | 1,915 | 1,921 | 1,983 |

8. | Long-term (1 to 7) | 94,739 | 1,15,680 | 1,17,718 | 1,23,112 | 1,25,843 | 132,641 |

9. | Short-term | 4,269 | 7,524 | 8,696 | 9,105 | 10,625 | 10,015 |

Total (8+9) | 99,008 | 1,23,204 | 1,26,414 | 1,32,217 | 1,36,468 | 142,656 |

Memo: | | | | | | (Per

cent) | Total debt /GDP | 30.8 | 17.3 | 15.8 | .. | .. | .. |

Short-term/Total debt | 4.3 | 6.1 | 6.9 | 6.9 | 7.8 | 7.0 |

Short-term debt/Reserves | 16.9 | 5.3 | 5.7 | 5.6 | 6.4 | 5.7 |

Concessional debt/Total debt | 45.3 | 33.0 | 31.2 | 30.1 | 29.3 | 28.3 |

Reserves/ Total debt | 25.4 | 114.9 | 120.0 | 123.2 | 121.1 | 124.3 |

Debt Service Ratio* | 25.9 | 6.1 | 9.9 | .. | .. | .. |

* : Relates to the fiscal year.

.. : Not available. | International Investment

Position

India’s international assets increased by US

$ 16.4 billion during the half year ended September 2006 over end-March 2006 levels,

mainly on account of an increase in reserve assets. India’s direct investment

abroad also maintained its rising trend, reflecting growing investment interest

by Indian companies in the overseas markets. International liabilities of the

country expanded by US $ 14.5 billion between end-March 2006 and end-September

2006, reflecting inflows on account of direct and portfolio investment, recourse

to commercial borrowings and non-resident deposits. As the increase in international

assets exceeded that in international liabilities during the period, India’s

net international liabilities declined by US $ 1.9 billion between end-March 2006

and end-September 2006 (Table 63).

Table

63: International Investment Position of India | (US

$ billion) | Period | | | March

2005 PR | March 2006

PR | June

2006

PR | September 2006

P |

1 | | | | | 2 | 3 | 4 | 5 |

A. | Assets | | | 168.2 | 183.5 | 191.8 | 199.9 |

| | | | | (23.5) | (22.9) | .. | .. |

| 1. | Direct

Investment | | 10.0 | 13.0 | 13.6 | 14.4 |

| 2. | Portfolio

Investment | | 0.8 | 1.3 | 1.1 | 1.2 |

| | 2.1 | Equity

Securities | 0.4 | 0.7 | 0.5 | 0.5 |

| | 2.2 | Debt

Securities | | 0.4 | 0.6 | 0.6 | 0.7 |

| 3. | Other

Investment | | 15.9 | 17.6 | 14.2 | 18.9 |

| | 3.1 | Trade

Credits | | 2.2 | 0.4 | 0.3 | 2.8 |

| | 3.2 | Loans | | 1.9 | 2.6 | 1.6 | 2.3 |

| | 3.3 | Currency

and Deposits | 8.4 | 11.2 | 8.9 | 10.3 |

| | 3.4 | Other

Assets | | 3.4 | 3.5 | 3.5 | 3.6 |

| 4. | Reserve

Assets | | 141.5 | 151.6 | 162.9 | 165.3 |

| | | | | (19.8) | (19.0) | .. | .. |

B. | Liabilities | | 210.0 | 231.3 | 238.3 | 245.8 |

| | | | | (29.4) | (28.9) | .. | .. |

| 1. | Direct

Investment | | 44.0 | 50.7 | 51.5 | 54.9 |

| | | | | (6.2) | (6.3) | .. | .. |

| 2. | Portfolio

Investment | | 55.7 | 64.6 | 64.8 | 67.4 |

| | | | | (7.8) | (8.1) | .. | .. |

| | 2.1 | Equity

Securities | 43.2 | 54.7 | 52.5 | 54.8 |

| | 2.2 | Debt

Securities | | 12.5 | 9.9 | 12.4 | 12.6 |

| 3. | Other

Investment | | 110.3 | 116.0 | 122.0 | 123.5 |

| | | | | (15.4) | (14.5) | .. | .. |

| | 3.1 | Trade

Credits | | 9.6 | 10.5 | 10.9 | 12.4 |

| | 3.2 | Loans | | 65.7 | 68.2 | 70.7 | 72.2 |

| | 3.3 | Currency

and Deposits | 33.6 | 36.2 | 39.2 | 37.6 |

| | 3.4 | Other

Liabilities | | 1.4 | 1.1 | 1.2 | 1.4 |

C. | Net

Position (A-B) | | -41.8 | -47.8 | -46.4 | -45.9 |

| | | | | (-5.9) | (-6.0) | .. | .. |

PR : Partially Revised.

P : Provisional.

Note : Figures in parentheses are percentages to GDP. |

|

IST,

IST,