|

7.1. Introduction

The market for government securities is the oldest and most dominant in terms of market capitalisation, outstanding securities, trading volume and number of participants. It not only provides resources to the government for meeting its short term and long term needs, but also sets benchmark for pricing corporate paper of varying maturities and is used by RBI as an instrument of monetary policy. The instruments in this segment are fixed coupon bonds, commonly referred to as dated securities, treasury bills, floating rate bonds, zero coupon bonds and inflation index bonds. Both Central and State government securities comprise this segment of the debt market.

Reserve Bank of India (RBI) administers and manages the Public Debt Operations of the country and conducts the issue and servicing of new loans of the Central and State Governments, primarily Dated Securities, through its Public Debt Offices (PDO). To accomplish the task of administration and management of internal debt, RBI had a decentralized system of operations through 15 Public Debt Offices established at 14 centres. With the computerization of Public Debt Office-cum-Negotiated Dealing System (PDO-NDS), the PDO system now operates as an integrated virtual centralized system.

The key data relevant to the government securities market are captured under various data system, compiled and published in the Bank’s publications following standard definitions, classifications, timeliness and related guidelines conforming to international standards like IMF’s Data Dissemination Standards.

7.1.1. Purpose

Purpose of the document is to provide information in the form of a handbook on the key particulars about the data relating to the Government Securities Market that are published regularly in the Bank’s Publications. The document aims to provide the basic information on the methodological framework covering the details of the basic information system, definitions and measurements, working processes like data capture, compilation and dissemination.

7.1.2. Scope

This document provides the user with guidelines relating to the Published Data in the Bank’s Publications. This will facilitate better understanding, documentation, work-continuity, standardization and historical perspective.

The document is organized as follows: Section 7.2 contains an analytical perspective outlining the significance of the area, measurement needs and key parameters or indicators determining the contours of the data system. Section 7.3 describes the concepts, definitions and classificatory methods for the different kind of data published in various statistics brought out by RBI. Section 7.4 gives a description of the sources and systems used in capturing related data. Section 7.5 contains the list of the Bank’s publications containing similar kind of data sets. A detailed glossary of terms used in various statistical tables as also form and content of each table are appended as ready reckoner.

7.2. Analytical Perspective

The Government Securities (G-Sec) market is the oldest and the largest component of the Indian Debt Market in terms of market capitalization, outstanding securities and trading volumes. The Reserve Bank of India manages public debt and issues Indian currency denominated loans on behalf of the central and the state governments under the powers derived from the Reserve Bank of India Act. The RBI is the debt manager for both the Central Government and the State Governments. It is also the regulator of Government securities market. The Public Debt Act, 1944, provides the framework under which government securities are issued and serviced. Under the RBI Act, 1934, RBI is the manager of Central Government debt by statute. RBImanages the debt of state governments on the basis of separate agreements. External debt of the Government is managed by the Ministry of Finance. As a debt manager for the both Central and State Governments, RBI in consultation with the Government, manages the maturity profile, timing of issue, composition of debt and the type of instruments issued. Operationally, RBI deals with the issue, servicing and repayment of government debt.

Public Debt management is the process of formulating and executing a strategy for managing the government’s debt to raise the required amount of funding, within the ambit of cost/risk objectives. Public Debt management also encompasses other functions such as cash and liquidity management of Central and State governments as also the development of a liquid and deep market for government securities which will facilitate the cost reductions of public debt.

The framework of Government securities market bestows the central bank a very useful tool for conducting of Open Market Operations (OMO) and a backing for its role as note issuing authority. Government security based activities carried out by the RBI involve (a) auctioning the government debt from time to time, (b) introduction of new instruments, smoothening the maturity structure of debt, placing of debt at market related rates and improving depth and liquidity of government securities market by developing an active secondary market for them, (c) liquidity operations as and when required through various instruments, such as, Open Market Operations, Repos and Reverse Repos and issuing MSS bonds.

Historically, the GOI rupee securities used to comprise (i) dated securities of different maturity periods issued by the Central Government in respect of public loans, (ii) Treasury Bills and (iii) ad hoc treasury bills. Under Section 33(1) of the RBI Act, 1934, GOI securities form one of the main assets of the Issue Department of the Bank.

The analytical perspective of the data system relating to the G-sec market relevant to the Bank is based on the data framework of the Weekly Statistical Supplement (WSS) to the RBI Bulletin.It may be mentioned that the genesis of the various Tables published in the WSS is based on the Weekly Statement of Affairs of Issue and Banking Departments of RBI. The specific format of various Tables are in accordance with Section

53 (1) of the RBI Act, 1934 and any major change is effected with the concurrence of the Bank as also the Central Government, as and when necessary.

7.2.1. Developments and Measurement needs of the area

Prior to the nineties, G-sec market was virtually not visible as it used to operate under severe controls on pricing of assets, segmentation of markets and barriers to entry, low levels of liquidity, limited number of players, near lack of transparency, and high transactions cost. Financial reforms have significantly changed the Indian debt markets for the better. Most debt instruments are now priced freely in the markets; trading mechanisms have been altered to provide for higher levels of transparency, higher liquidity, and lower transactions costs; new participants have entered the markets, broad basing the types of players in the markets; methods of security issuance, and innovation in the structure of instruments have taken place; and there has been a significant improvement in the dissemination of market information.

The Nineties have seen significant policy reforms in the government securities (G-sec) market. The early nineties saw the introduction of auction-based price determination for government borrowings; development of appropriate instruments and mechanisms for the borrowing programme; a significant increase in information dissemination on market borrowings and secondary market transactions; and the development of the RBI’s yield curve for marking the G-sec portfolios of banks to the market. In the mid-nineties, RBI introduced the system of primary dealers; the National Stock Exchange was created as the first formal mechanism for trading on G-sec; Delivery versus Payment (DVP) was introduced in securities settlement; number of players in the G-sec markets was increased with the facility for non-competitive bidding in auctions, constituent SGL (Subsidiary General Ledger) accounts and the setting up of gilt funds; and Repos re-emerged as important instruments of short term liquidity-management.

The late nineties have seen the emergence of market based liquidity arrangement through the Liquidity Adjustment Facility (LAF); expansion of the repo markets; growth in the number and volume of secondary market transactions in G-sec; the creation of a market yield curve; the complete stoppage of automatic monetisation of deficits; the creation of on-going review mechanisms such as the Monitoring Group on Cash and Debt Management of GOI; and the emergence of self regulating industry bodies such as the Primary Dealers Association of India (PDAI) and the Fixed Income Money Markets and Derivatives Association (FIMMDA).

Internal Debt Management by the Bank received a focused attention from April, 1992. Management of the public debt of the Central Government is an obligation cast on the Bank under Section 20 of the Reserve Bank of India Act, 1934. The work relating to Policy, planning and execution of the Market Borrowing Programme of Central Government, issuances of Government of India Treasury Bills of varying maturity were made focussed and transparent. The State Finances activity was also brought into a clear focus so as to attend the work of planning and execution of the Market Borrowing Program of the State Governments in a timely and orderly manner. This includes advising the Market Borrowing Programme to respective State Governments on receipt of the details from the Ministry of Finance, attending to the pre-floatation arrangements including convening of State Finance Secretary’s meeting. The present objectives of the Debt Management Operations of the Bank can be summarized as under:

* Undertake debt and cash management operations for the Central and State Governments with the objective of minimising the cost of Government borrowing over a long period consistent with the objective of the monetary policy.

* Develop a deep and liquid Government Securities Market.

* Regulate the government securities market.

* Improve the transmission mechanism for monetary policy and facilitate the use of indirect instruments of monetary policy.

* Develop a yield curve across maturities so as to provide benchmarks for development of debt markets.

* Facilitate the development of hedging products to manage liquidity and market risk.

7.3. Concept, Definition and Classification

7.3.1. Liquidity Adjustment Facility (LAF) –Repo and Reverse Repo

The LAF is intended to primarily meet the day-to-day liquidity mismatches in the system, and is not intended to meet the financing requirements of eligible institutions. The scheme of Liquidity Adjustment Facility (LAF) was introduced from June 5, 2000. Under the scheme Repo auctions (for absorption of liquidity) and Reverse Repo auctions ( for injection of liquidity) were introduced on a daily basis (except Saturdays). But for the intervening holidays and Fridays, the tenor of the Repo was one day. On Fridays, the auction was conducted for three days. The Repo auction was conducted on “Uniform price” basis initially and thereafter it was conducted on “Multiple price” basis. Interest rate in respect of both Repo and Reverse Repo was based on the bids quoted by participants and subject to the cut-off rates as decided by the RBI at Mumbai. In addition to the overnight Repo, RBI had the discretion to conduct Repo up to 14 days. All scheduled commercial banks (excluding RRBs) and Primary Dealers having current account and SGL account with RBI, Mumbai, are eligible to participate in the Repo and Reverse Repo auctions under LAF.

RBI introduced the Liquidity Adjustment Facility – Revised Scheme with effect from March 29, 2004 taking into account the recommendations of the Internal Group on Liquidity Adjustment Facility and suggestions from the market participants and experts. The features of the Revised Scheme were as under (Table 7.1):

Table 7.1: Features of the Revised Liquidity Adjustment Facility Scheme |

1 |

Tenor-Repo Tenor- Reverse Repo |

7 days fixed rate repo conducted daily (1 day repo from November 1, 2004)1 day overnight fixed rate Reverse Repo on week days only |

2 |

Option |

RBI retains the option to conduct overnight repo or longer term repo at fixed rate or variable rates depending on market conditionsRBI will have the discretion to change the spread between repo and reverse repo |

3 |

Participants |

Scheduled commercial banks (excluding RRBs) and Primary dealers having current account and SGL account with RBI |

4 |

Repo Rate |

4.50% (Monetary Policy review-October, 2004 raised the Repo rate to 4.75%) @ |

5 |

Reverse Repo rate |

150 basis points above Repo rate. (Monetary Policy Review – October, 2004 reduced the spread to 125 basis points) @

Therefore, Reverse repo rate is 4.75% + 1.25% = 6.00% |

6 |

Bidding |

The bids will be submitted electronically through NDS Cut off time for submission of bids is 10.30 AM – Auction result will be announced by 12.00 Noon |

7 |

Bid size |

Minimum Rs. 5 crore and multiple of Rs. 5 crore |

8 |

Eligible securities |

All SLR eligible transferable Government of India dated securities/Treasury bills |

9 |

Type |

Repo will be conducted as “Hold-in-custody” type wherein the RBI will act as custodian for the participants and hold the securities on their behalf in the Repo/Reverse repo Constituents’ Accounts |

@ Repo and Reverse Repo rates are revised by RBI from time to time. |

RBI receives the bids for LAF in the morning. The Financial Market Committee meets daily at 12.00 noon to assess the bids. The actual amount of liquidity to be absorbed or injected into the system is determined by the RBI after taking into account the liquidity conditions in the market, the interest rate situation and the stance of policy. The rate of interest depends on the quotes received in the bids. RBI has also rejected all bids in the repo auctions, on few occasions.

In the Monetary Policy Review, October, 2004, the Repo rate has been raised from 4.50% to 4.75% and the spread between Repo rate and Reverse Repo rate has been reduced from 150 basis points to 125 basis points. Accordingly, the Repo rate and reverse repo rate was 4.75% and 6.00%, respectively.

With effect from November 1, 2004, Liquidity Adjustment Facility scheme being operated with overnight fixed rate repo and reverse repo. Accordingly, auctions of 7-day and 14-day repo were discontinued from November 1, 2004. The Reserve Bank continues to have the discretion to conduct overnight/longer term repo/reverse repo auctions at fixed rate or at variable rates depending upon market conditions and other factors.

Some of the recent policy changes that impact the data definitions are as follows:

*

A policy decision was made to adopt the international usage of the term “Repo” and “Reverse Repo” under LAF operations. Effective from October 29, 2004, the term “Repo” is being used for the LAF operations where Reserve Bank of India would inject liquidity to the Banking system (earlier termed as Reverse Repo).

*

To fine-tune the management of liquidity, it was decided to introduce a second LAF (SLAF) from November 28, 2005. SLAF will be conducted between 3.00 P.M. and 3.45 P.M. The spread between the reverse repo rate and the repo rate is 100 basis points.

Daily data on the LAF operations are published in the specific format. The format of the data along with explanatory notes is given in the Annex-7.1.

7.3.2. Treasury Bills

Treasury bills are short-term debt instruments issued by the Central government. Treasury bills play a vital role in cash management of the Government. Being risk-free, their yields at varied maturities serve as short term benchmarks and help pricing varied floating rate products in the market.

Until 1988, the only kind of Treasury bill that was available was the 91-day bill, issued on tap; at a fixed rate of 4.5% (the rates on these bills remained unchanged at 4.5% since 1974). 182-day T-bills were introduced in 1987, and the auction process for T-bills was started. 364 day T-bill was introduced in April 1992, and in July 1997, the 14-day T-bill was also introduced. RBI had suspended the issue of 182-day T- bills from April 1992, and revived their issuance since May 1999. All T-bills are now sold through an auction process according to a fixed auction calendar, announced by the RBI. Ad-hoc treasury bills, which enabled the automatic monetisation of central government budget deficits, have been eliminated in 1997. All T-bill issuances now represent market borrowings of the central government.

91 days Treasury bill on tap: Before, 1960s the 91 days Treasury bills were sold on auction basis. Subsequently, these T-Bills were replaced by Tap sale of T-bills since mid-1960s. The tap bill rates varied consistently with changes in the Bank Rate till 1974 and thereafter the discount rate on tap bill was fixed at 4.6%

Other maturities of T-bills: 182 days T-bills were introduced in November, 1986 on auction basis. The 182 days T-bills were replaced by introduction of 364 days T-bills on fortnightly auction basis since April, 1992. Subsequently, 91 days T-bills were introduced on auction basis in January, 1993. When the ad-hoc T-bills were discontinued in April, 1997, to enable finer cash management of the government and to provide avenue for state governments and some foreign central banks to invest surplus funds, 14-days T-bills were introduced in April, 1997. Subsequently, the 14 days T-bills and 182 days T-Bills were discontinued. Currently, 91 days T-Bills, 182 days T-Bills and 364 days T-Bills are sold on auction basis. Table 7.2 gives a chronology of treasury bills of various maturities introduced and discontinued subsequently.

Table 7.2: Treasury Bills – Chronology of

Developments |

Type of T-Bill |

Introduced |

Discontinued |

91 days T-Bill on

weekly auction |

Before

1950s |

Mid-1950s |

91 days Ad-hoc T-Bill |

Mid 1950s |

April, 1997 |

91 days T-Bill on Tap |

Mid 1950s |

March, 1997 |

182 days T-Bill on

weekly auction |

November,

1986 |

April, 1992 |

14 days T-Bill on

weekly auction |

April, 1997 |

May, 2001 |

364 days T-Bill on

fortnightly auction |

April, 1992 |

|

91 days T-Bill on

weekly auction |

January,

1993 |

|

182 days T-Bill on

weekly auction |

Re-intro-

duced in

June, 1999 |

May,

2001 |

182 days T-Bill on

weekly auction |

Re-intro- uced in April, 2005 |

|

As will be seen from the above table that at present 91 days T-Bills are sold on weekly and 182 days Treasury Bills and 364 days Treasury Bills are sold on fortnightly basis. The auction of 91 days T-Bills are conducted every Wednesday with the notified amount of Rs. 500 crores and the auction of 182 days T-Bills, and 364 days T-Bills are conducted every alternate Wednesday with the notified amount of Rs. 500 crores and Rs. 1000 crores, respectively. The investors in Treasury bills are banks, primary dealers, State governments, Provident funds, financial institutions, Insurance companies, NBFCs, Foreign Institutional Investors and NonResident Indians.

Weekly data on the Treasury Bills auction summary are published in a specific format. The format of the data along with explanatory notes is given in the Annex-7.2.

7.3.3 Government Security

“Government security” means a security created and issued by the Government for the purpose of raising a public loan or for any other purpose as may be notified by the Government in the Official Gazette and having one of the forms mentioned in The Public Debt Act, 1944.

A Government security may, subject to such terms and conditions as may be specified, be in such forms as may be prescribed or in one of the following forms, namely: (i) a Government promissory note payable to or to the order of a certain persons; or (ii) a bearer, bond payable to bearer; or (iii) a stock; or (iv) a bond held in a bond ledger account.

The Central government raises resources in the debt markets, through market borrowings, predominantly to fund the fiscal deficit. Market borrowings, which funded about 18% of the gross fiscal deficits in 1990-91, constituted 68.64% of the gross fiscal deficit in 2000-01, and have emerged as the dominant source of funding of the deficit. The abolition of the automatic monetisation of deficit in 1997 has led to significant increases in market borrowings of the government. The State government bond issuance is presently managed by the RBI along with the central borrowings. A part of state deficits are funded through market borrowings by the RBI.

The issuance process for G-sec has undergone significant changes in the 1990s, with the introduction of the auction mechanism, and the broad basing of participation in the auctions through creation of the system of primary dealers and the introduction of non-competitive bids. RBI announces the auction of government securities through a press notification, and invites bids. The sealed bids (bids received electronically as well as physically) are opened at an appointed time, and the allotment is based on the cut-off price decided by the RBI. Successful bidders are those that bid at a higher price, exhausting the accepted amount at the cut-off price.

The design of treasury auctions is an important issue in government borrowing.

The objectives of auction design are:

* Enabling higher auction volumes that satisfy the target borrowing requirement, without recourse to underwriting and/or devolvement;

* Broadening participation to ensure that bids are not concentrated or skewed; and

* Ensuring efficiency through achieving the optimal (lowest possible) cost of borrowing for the government.

The two choices in treasury auctions, which are widely known and used, are (a) Discriminatory Price Auctions (French Auction) and (b) Uniform Price Auctions (Dutch Auction). In both these kinds of auctions, the winning bids are those that exhaust the amount on offer, beginning at the highest quoted price (or lowest quoted yield). However, in a uniform price auction, all successful bidders pay a uniform price, which is usually the cut-off price (yield). In the case of the discriminatory price auction, all successful bidders pay the actual price (yield) they bid for.

The RBI has the discretion to reject bids when the rates at which bids are received are higher than the rates at which RBI wants to place the debt. Depending on the pricing objective RBI wants to achieve and the bidding pattern of participants, bidding success and devolvement takes place.

Non-competitive bids can also be submitted in treasury auctions by specified institutions. Allotments to these bids will be first made from the notified amount, at the weighted average price of all successful bids.

Some of the key terms used in the primary issuance of dated security are as under (cf. Glossary in Annex – 7.5 for other terms)

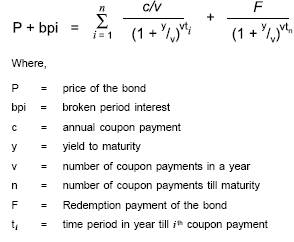

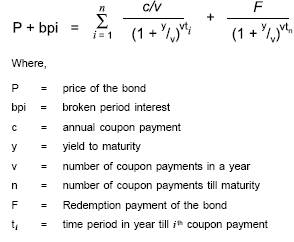

Yield corresponding to each transaction in a security is calculated from the following Yield to Maturity (YTM) and price relationship:

Quarterly data on the primary issuances of dated securities are published in the RBI Bulletin as per pre-designed format. The format of the data along with explanatory notes is given in the Annex-7.3.

7.3.4. Secondary Markets for Government Securities

In the secondary market, outstanding securities are traded. This term differentiates from the primary or initial market when securities are sold for the first time. Secondary market refers to the buying and selling that goes on after the initial public sale of the security.

Government securities are deemed to be listed as soon as they are issued. Markets for government securities are pre-dominantly wholesale markets, with trades done on NDS as also NDS-OM trading platform. Since most institutional participants have to report their trades to the PDO, and effect settlement through the SGL, RBI’s reports on SGL transactions provide summary data on secondary market transactions in government securities. Introduction of NDS has provided certainty to market participants in respect of demand for settlement funds for securities transactions on the day of settlement, leading to improved cash and liquidity management among the market participants.

Apart from banks, provident funds and insurance companies are large holders of government bonds, buying them to comply with prudential norms governing their portfolios. These institutions hold about 20% of outstanding G-secs. However, the fact that provident funds are not actively managed portfolios, and do not mark their portfolios to market, makes them large dormant holders of government bonds.

Primary Dealers hold government bonds either due to devolvement or underwriting commitments, or to enable repo transactions and market making. They are market participants who turn over their portfolios very rapidly, and have enabled liquidity in secondary market to a large extent. Others investors in G-sec include mutual funds, primary and satellite dealers, and Constituent SGL accounts with banks and PDs.

Data on the secondary market transactions in G-sec, both outright and Repos, are published in the Weekly Statistical Supplement, RBI Bulletin and other regular publications of the Bank in a prescribed format. The format of the data along with explanatory notes is given in the Annex-7.4.

|

IST,

IST,