IST,

IST,

Asset Reconstruction and NPA Management in India

Shri R. Gandhi, Deputy Governor, Reserve Bank of India

delivered-on செப். 15, 2015

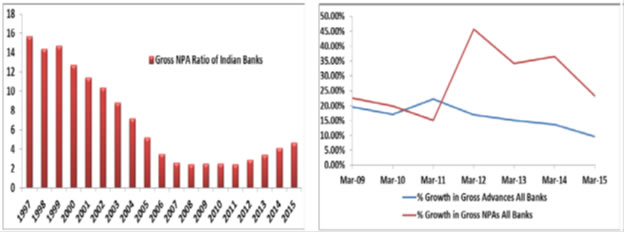

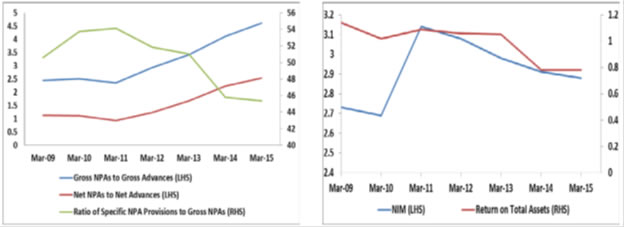

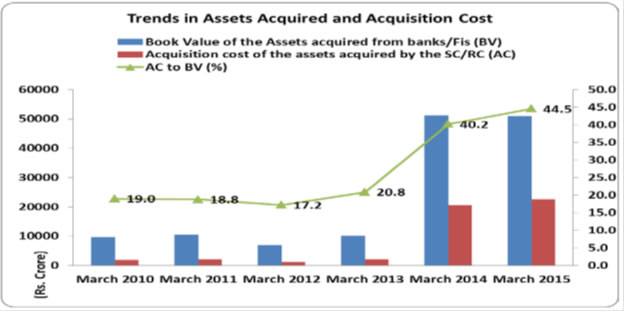

Ladies and Gentlemen, Very Good Morning. 2. It is indeed a pleasure to be present here and interact with you on the important issue of management of non-performing assets in India. Such events are quite important especially when there is a surge in stressed assets in banking in the recent times. Current Position 3. However, if we look a little far back, the asset quality of the Indian banking system was not like this; it had actually been improving significantly since the implementation of reforms in the banking sector and introduction of prudential norms, enactment of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act 2002, Credit Information Companies Act, etc. The gross NPAs ratio steadily declined from 15.7 per cent in 1996-97 to 2.36 percent in 2010-11. However, the amount of non-performing assets witnessed spurt subsequently and as on March 2015, it was at 4.62 per cent of the gross advances of the banks in comparison with 2.36 per cent of the gross advances as at March 2011. The growth in NPAs was much higher than the growth in advances during the last four years. In addition, the ratio of restructured standard assets to gross advances grew to 6.44 per cent as at the end of March 2015 from 5.87 per cent of gross advances as on March 2014. The total stressed assets (i.e., NPAs plus Restructured Assets) as on March 2015 were 11.06 per cent of gross advances.  4. The sharp increase in stressed assets has adversely impacted the profitability of the banks. The annual return on assets has come down from 1.09 per cent during 2010-11 to 0.78 per cent during 2014-15. Considering the effect it has on both capital and liquidity position of the bank, there is an urgent need for banks to reduce their stressed assets and clean up their balance sheets lest they become a drag on the economy.  5. Managing asset quality is always very important and becomes a prominent objective especially during a period of economic downturn. Recognising the importance of effective asset quality management, Reserve Bank has issued various guidelines to banks, from time to time, on various aspects of asset quality management. Preventive Management 6. Reserve Bank has advised banks that the management of credit risk should receive the top management's attention and the process should encompass: a) Measurement of risk through credit rating / scoring; b) Quantifying the risk through estimating expected loan losses and unexpected loan losses c) Risk pricing on a scientific basis; and d) Controlling the risk through effective Loan Review Mechanism and portfolio management. 7. Further, Reserve Bank has also advised the banks to put in place a robust credit risk management system which is sensitive and responsive to various factors affecting credit risk. The guidelines entail involvement of top Management, including the Board of Directors of the bank in actively managing the credit risk of the banks. Banks are required to put in place proactive credit risk management practices like annual / half-yearly industry studies and individual obligor reviews, credit audit which entails periodic credit calls that are documented, periodic visits of plant and business site, and at least quarterly management reviews of troubled exposures / weak credits. Recent Regulatory Initiatives 8. Recently, In January 2014, the Reserve Bank of India had released a comprehensive ‘Framework for Revitalising Distressed Assets in the Economy’. The Framework outlines a corrective action plan that will incentivise early identification of problem cases, timely restructuring of accounts which are considered to be viable, and taking prompt steps by banks for recovery or sale of unviable accounts. In addition, to address the issue of information asymmetry as also to identify the problem early, a Central Repository of Information on Large Credits (CRILC) to collect, store, and disseminate credit data to lenders, was set up. Under this arrangement, banks are reporting credit information, including classification of an account as SMA to CRILC on all their borrowers having aggregate fund-based and non-fund based exposure of ₹50 million and above with them. 9. While having a proper credit risk management is very important for managing asset quality, another issue which is equally important is proper structuring of the credit facilities extended to various borrowers. While granting credit facilities, banks should set realistic repayment schedules on the basis of a proper analysis of cash flows of the borrowers. This would go a long way to facilitate prompt repayment by the borrowers and thus improve the record of recovery in advances. A ‘one size fits all’ approach and providing plain vanilla loans to all clients may not be in the interest of banks as well as its customers. 10. In order to effect a structural change in the way project loans are granted by banks, and considering the need to facilitate banks to offer long term project financing, which may ensure long term viability of infrastructure and core industries sector projects by smoothening the cash flow stress in initial years of such projects, Reserve Bank has issued guidelines on flexible structuring of long term project loans with periodic refinancing option. Reserve Bank has also introduced the concept of ‘standby credit facility’ to fund cost overruns in projects. Such ‘standby credit facilities’ are sanctioned at the time of initial financial closure; but disbursed only when there is a cost overrun. At the time of initial credit assessment of borrowers / project itself, such cost overruns are assessed, agreed to be disbursed in the eventuality of cost over runs, and the Debt Equity Ratio, Debt Service Coverage Ratio, Fixed Asset Coverage Ratio, etc. are determined accordingly. Thus, there may not be any need for the borrower to approach the banks at a later stage for additional finance. Restructure / Rehabilitation 11. However, despite proper credit appraisal and proper structuring of loans, slippages in the asset quality may not be unavoidable, especially when the economic cycles turn worse. Hence, once a weak account is identified, banks need to consider various remedial actions. One of the remedial options is restructuring. In spite of their best efforts and intentions, sometimes borrowers find themselves in financial difficulty because of factors beyond their control and also due to certain internal reasons. For the revival of the viable entities as well as for the safety of the money lent by the banks, timely support through restructuring in genuine cases is called for. The objective of restructuring is to preserve the economic value of viable entities that are affected by certain internal and external factors and minimize the losses to the creditors and other stakeholders. 12. Such support to borrowers who are in temporary financial difficulties need not be contingent upon retention of asset classification status as ‘standard’. There is a tendency among banks to withdraw their support once an account is classified as NPA. Mere classification of an account as non-performing asset need not result in withdrawal of support to viable borrowal accounts. The purpose of asset classification and provisioning is to present a true picture of bank’s balance sheet and not to stigmatize accounts / borrowers. However, while considering their support to accounts under stress, banks should make proper distinction between willful – defaulters / non-cooperative / unscrupulous borrowers on the one hand, and on the other hand, borrowers defaulting on their debt obligations due to circumstances beyond their control. 13. As you may be aware, Reserve Bank has withdrawn special asset classification benefits available to restructuring of assets with effect from April 1, 2015 to align our norms on restructuring with international best practices. Subsequent to that there is a sudden drop in the assets being ‘restructured’ and it seems that banks have become very choosy in restructuring loans to borrowers who are under stress. One of the reasons cited for drop in restructuring of assets is that ‘banks have no incentive in restructuring’. We feel that decision of the banks in restructuring should be driven by their motivation to revive an account which is under temporary financial difficulties and preservation of the economic value of viable entities in the interest of both the creditors and borrowers, rather than merely concentrating on asset classification and provisioning benefits. Recovery / Exit 14. As a first step towards effective recovery / exit framework from accounts which are beyond revival, banks should have a well -defined loan recovery policy which sets down the manner of recovery of dues depending upon the circumstances of each account. Banks may resort to either opt for legal avenues or non-legal avenues for exiting the account. Banks may enter into compromise settlements in terms of their Board approved policy for compromise settlement of NPAs. However, adequate care should be taken to ensure that the compromise settlements are done in a fair and transparent manner. Banks may also sell their NPAs to other banks (which happens outside the SARFAESI Act). There are a few banks which have better recovery expertise and we have seen instances of them purchasing NPAs from other banks. 15. In the event of failure of the above mentioned measures, banks could resort to filing suits with Debt Recovery Tribunals or invoke the provisions of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. An alternate option to enforcement of security interest is that of selling the NPAs to securitisation companies / reconstruction companies (SCs / RCs) registered under the SARFAESI Act. SCs / RCs are expected to do a specialized task of recovering and reconstructing the NPAs thereby reducing the NPAs in the system. The purpose of creation of SCs / RCs was to resolve NPAs of banking system by using their expertise. Asset Reconstruction Companies 16. As on date 15 SCs / RCs are registered with Reserve Bank. Sale of NPAs to SCs / RCs which was relatively sporadic has picked up substantially during the last two financial years.  17. However, only a few of them appear to be successful in acquiring assets from banks. Of 15 registered SCs / RCs, asset size in respect of top three SCs / RCs (viz., ARCIL, ‘JM Financial’ and ‘Edelweiss’) account for more than two thirds of total assets of all SCs / RCs. 18. An analysis of purchase of NPAs by SCs / RCs indicate that acquisition cost as a percentage to book value of assets increased sharply from 20.8 per cent as on March 2013 to 44.5 per cent as on March 2015. In other words, the discount rate at which SCs / RCs are acquiring NPAs from the banks / FIs decreased considerably, possibly on account of (i) developing of improved NPA recovery methods by banks (ii) selling of relatively fresh NPAs (iii) outsourcing the valuation of NPAs (iv) presence of competition among SCs / RCs while auctioning NPAs. 19. On the recovery side, the performance is not very encouraging. As on March 31, 2015, the average recovery rate (assets resolved as a % to assets acquired) of SCs / RCs was at 31.0 per cent. One of the reasons for a dip in the average recovery rate is due to the fact that substantial part of the assets under management of SCs / RCs is acquired recently. Further, a wide variation in recovery rates among SCs / RCs is also observed for the same reason. 20. An analysis of investor class in security receipts (SRs) does not depict any divergence. It is observed that seller banks / FIs have been subscribing majority of SRs. On an average seller banks / FIs have been subscribing 74 per cent of total SRs issued during the period March 2010 to March 2015. In past two years, seller banks subscribed around 80 per cent of total SRs

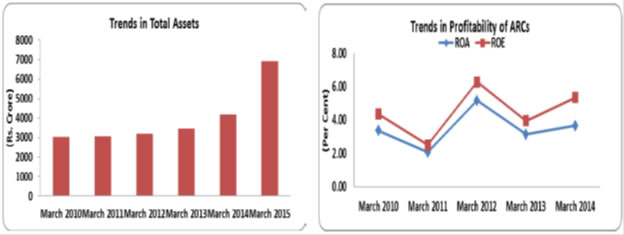

21. The aggregate asset size of SCs / RCs witnessed sharp growth of 64.8 per cent during 2014-15 on top of 21.3 per cent growth witnessed in the previous year. In numerical terms, aggregate asset size of SCs / RCs stood at ₹ 6920 crore as on March 31, 2015. The reported average Return on Assets of SCs / RCs was at 3.48 per cent while the average Return on Equity stood at 4.48 per cent during the period March 2010 to March 2014.  22. RBI has recently taken various steps to improve the system’s ability to deal with distressed assets of banks and financial institutions. Reserve Bank has issued various guidelines relating to the operations of SCs / RCs as also to make transactions between them and banks more transparent. These guidelines were further strengthened with floors on transaction prices and prevention of collusions with promoters in buy back deals. The modified guidelines mandated SCs / RCs to have an increased skin in the game by making it compulsory for them to invest and hold minimum 15% (as against 5% hitherto) of the security receipts issued by them. 23. In order to promote the business of asset reconstruction in India, foreign direct investment cap on SCs / RCs has been increased from 49 per cent to 74 per cent under the automatic route. While foreign institutional investors have also been allowed to participate in the equity of the SCs / RCs, the maximum shareholding by FIIs cannot exceed 10% of the paid up capital of the SC / RC. With a view to facilitate debt consolidation, SCs / RCs are now permitted to acquire debt from other SCs / RCs. SCs / RCs have also been permitted to convert a portion of the debt into shares of the borrower company as a measure of asset reconstruction. Consent threshold for security enforcement actions has been brought down to 60 per cent of the amount outstanding to a borrower as against 75 per cent hitherto. SCs / RCs with acquired assets in excess of ₹ 500 crore can float a fund under a scheme and utilize upto 25% of funds raised from the qualified institutional buyers for restructuring of financial assets acquired. Promoters of the defaulting company / borrowers or guarantors are allowed to buy back their assets from the SCs / RCs subject to certain conditions that are helpful in the resolution process and minimization of cost. Guidelines on Uniform Accounting Standards for SCs / RCs has been issued for reckoning Acquisition cost, Revenue Recognition, Valuation of SRs, etc. to induce transparency in the books of SCs / RCs. Norms for calculation of management fee has also been rationalised. Management fee will now have to be based on the net asset value of the SRs rather than the outstanding SRs issued 24. With these regulatory changes, SCs / RCs will need to focus on actual redeeming of security receipts as it is no longer possible for them to base their profit model on the basis of management fees. In the near term, SCs / RCs may find it difficult to align their pricing to the expectations of the selling banks and the selling banks also may not have yet reconciled to a realistic sale price expectation for the assets that they want to offload, resulting in the reduction in sales. The rationale behind these regulatory changes was to incentivise the process of recoveries / restructuring, as net asset values of SRs is calculated on the basis of the likely rate of recovery of stressed assets. 25. The RBI has also advised that the banks using auction process for sale of NPAs to ARCs should be more transparent, including disclosure of the Reserve Price specifying clauses for non-acceptance of bids, etc. If a bid received is above the Reserve Price and also fulfils the other conditions specified, acceptance of that bid would be mandatory. 26. It is expected that these amendments to the regulations will improve recovery prospect for SCs / RCs. Membership of JLF, lower threshold for consent to enforce the SARFAESI Act, more time set to conduct due diligence and greater disclosures will enhance transparency and lead to better resolution of NPAs. It would also result in lower vintage of NPAs being sold by banks and quicker debt aggregation. NPA Management – New Thoughts 27. Let me now share with you some of the thoughts we have been discussing on NPA management. Enhancing Credit Appraisal Capacity 28. One of the fundamental issues that hampers NPA Management is the inadequacies in the credit appraisal capacity of banks, more specifically on project appraisal. As we know, there is just one technical consultancy firm, besides some specific desks in some banks. With the requirement of independent evaluation for JLFs and the number of JLFs, there is a crying need for emergence of additional technical capabilities to undertake evaluation of projects, restructuring schemes, etc. Banks will have to strengthen their in-house desks as well. Reserve Bank through the Centre for Advanced Financial Research and Learning has taken initiative to organise capacity building program for bankers. Number of members in a consortium 29. Another suggestion that has come relates to limiting the number of banks and financial institutions that should be permitted in a consortium or even in a multiple banking arrangement. It is said that the banks with very meagre share neither have incentives nor inclination to independently assess the proposal and they typically and blindly go by one that has bigger share. Even if the bank has in-house technical capabilities, with a small share it’s voice is not strong enough. Therefore, the suggestion is to have a regulatory limit on the number of members in a consortium or multiple banking arrangements so that every member has at least 10% of the exposure and therefore will have serious independent credit appraisal and credit monitoring. There are counter views about this suggestion, especially with regard to the freedom to be available for a bank or borrower to take the commercial decision on a loan. Ready List of Management and Technical Experts / Specialists 30. Yet another suggestion is to prepare a ready list of management and technical experts and specialists whose services can be availed by banks, financial institutions or the asset reconstruction companies whenever the JLFs decide to change the management under a CAP. Perhaps IBA can prepare and update such a ready list. 31. All these suggestions need further exploration and discussion before we take a final view. Issues faced by SCs / RCs Capital 32. There is no denying the fact that SCs / RCs need capital and that too on continuing basis to be able to grow and be meaningful players in the sector while avenues of raising capital is limited. The networth of 15 ARCs is only around ₹4000 crore whereas stressed assets in the system run into lakhs of crore. The industry being a capital intensive one, SCs / RCs are struggling to raise capital. Deep-pocket investors are interested in the business but cautious on account of slow pace of judicial and administrative environment. While there is limited appetite among the existing sponsors and shareholders, the limit of 50 percent on individual shareholding and the stipulation that the sponsor should not have any controlling interest in the SCs / RCs (as stipulated by the SARFAESI Act) are proving to be stumbling blocks in this regard. However, it needs to be mentioned here that it would not be an easy option for SCs / RCs to raise funds through IPO for the reason that while on the one hand, there is an apparent lack of investor appetite in the domestic market in the distressed space, the performance of SCs / RCs has, so far, remained dismal for a variety of reasons and this may prove to be a road block. SCs / RCs that can raise capital in a timely manner will be better positioned to play an active role in the field. SCs / RCs need to explore more in this regard especially through FDI route. There has also been a demand from the industry that subordinated debts like loans from the sponsors should be designated as Tier II capital and should be taken into account while calculating the capital adequacy of the SCs / RCs. Pricing of NPAs 33. The other important issue is pricing of NPAs. Currently there is no meeting point between price expectation of sellers and bid price by SCs / RCs, which is also evident from the low success rate of auctions. This also proves to be a hindrance while bringing in more investors willing to invest in the SRs being issued by the SCs / RCs to raise funds for acquisition of NPAs. Investors in stressed asset portfolios expect high returns, based on high-risk, high-reward principle which SCs / RCs find impossible to offer if the assets being acquired are not realistically priced. Equilibrium in offer and bid prices is essential for revival of the NPA market. This issue is best resolved by market forces and participants. Indian Banks Association in consultation with Association of Asset Reconstruction Companies may draw contours of mutually acceptable methodology for reserve price valuation. Discovery of fair price for NPAs may definitely help in more deals going through auctions and also generate interest from secondary investors like distress asset funds which can participate via SCs / RCs. Need of Secondary Market for SRs 34. In the absence of third party investor money which is an automatic fall-out of a virtually non-existent secondary market, the bank that sells NPAs doubles up as investor in SRs. A meaningful solution would have been to delink investment in security receipts from only a select group of qualified institutional buyers (QIBs) (as mandated under the SARFAESI Act) and throwing it open for all institutional players in debt trading. Further, as pointed out by the SCs / RCs, in terms of Guidelines issued by SEBI, High Networth Individuals (HNIs) are already allowed to participate in the SR market as Alternate Investment Funds (AIFs) have been notified as QIBs, eligible for investment in SRs issued by SCs / RCs. One possibility is that they may be allowed to participate directly in the SR market, as they have necessary risk capital and risk appetite. This measure may help widen investor base and infuse greater depth to the secondary market for SRs. An active secondary market for SRs will attract special situations funds and QIBs to this market. Reserve Bank has already suggested to the Government of India that Section 7 of the SARFAESI Act may be amended by giving power to RBI to specify the category of the investors from time to time in consultation with SEBI. Debt Aggregation 35. While sale of NPAs by banks depend on various factors like security package available, best price, etc., and therefore many times sale with respect to debt of a single borrower to a single SCs / RCs may not be possible, sale of entire debt of one borrower to single SC / RC would help in effective and efficient resolution. Piece meal sale of an asset particularly with turn around potential by different lenders defeats the purpose itself as it results not only in delays but also pricing hiccups and derails resolution process. Alternatively, SCs / RCs may also need to evolve mechanism to coordinate in successful resolution of those assets, in the best interest of all stake holders. Judicial delays 36. An important factor affecting recovery performance of SCs / RCs is the delay in judicial process: be it under SARFAESI Act or at the level of debt recovery tribunals. A fast and efficient judicial system is a sine qua non for effective resolution of NPAs. Realising the importance of having a strong bankruptcy framework in improving the ease of doing business, Government of India has constituted a Bankruptcy Law Reforms Committee to study the corporate bankruptcy legal framework in India. The Committee has submitted an Interim Report in February 2015 for immediate action and its Final Report is expected to be submitted within 12 months, recommending a Bankruptcy Code. Reserve Bank expects that recommendations of the Committee, when implemented, would result in significant improvement in the bankruptcy framework of the country and enable banks / SCs / RCs to resolve their stressed assets in an effective manner. Conclusion 37. I am sure that with the efforts of the Government in bringing in a strong bankruptcy framework and various regulatory initiatives being taken by the Reserve Bank of India, the effectiveness of the SCs / RCs would improve to a great extent. At the same time, I hope that the market participants iron out the frictions which are best resolved among themselves, without looking for regulatory solutions to such issues. 38. I find that you have a technical sessions on regulatory limitations on unlocking the potentials of NPAs, solutions for managing NPAs and even preventive measures. I wish the event a great success and will look forward to receive your considered suggestions and comments. 39. Thank you very much for your patient attention. Keynote address delivered by Shri R. Gandhi, Deputy Governor at the The Economic Times ReModel in India - Asset Reconstruction & NPA Management Summit, Mumbai on Sep 15, 2015. Assistance provided by Shri A K Choudhary, Smt. Chandana Dasgupta and Shri B. Nethaji is gratefully acknowledged. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: