IST,

IST,

Inaugural address at the Indian Institute of Management Kozhikode (IIMK)-National Stock Exchange (NSE) joint Second Annual Conference on Macroeconomics, Banking and Finance - delivered by Shri M. Rajeshwar Rao, Deputy Governor, Reserve Bank of India - February 21, 2025, at Mumbai

Shri M. Rajeshwar Rao, Deputy Governor, Reserve Bank of India

delivered-on பிப். 21, 2025

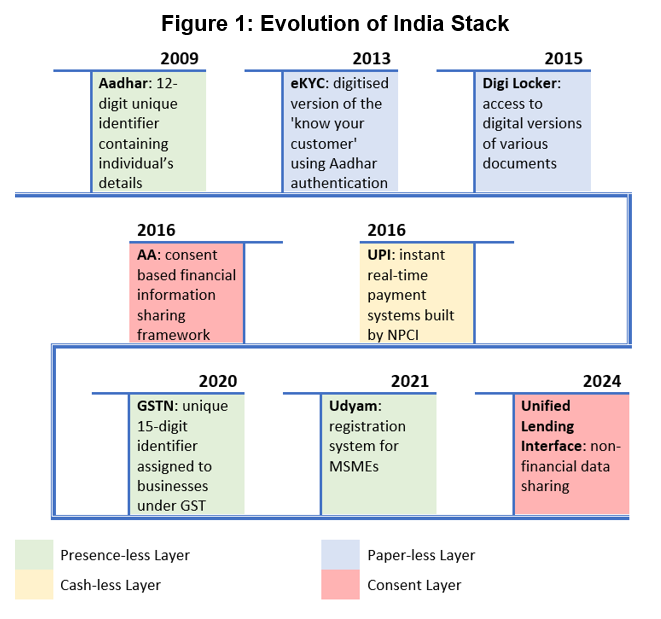

|

Introduction Good Morning All! I thank IIM, Kozhikode and the National Stock Exchange for inviting me to deliver the inaugural address at this Conference. The theme for the conference— “Finance for Growth Amid Creative Disruptions”—captures the essence of the transformation we are witnessing in the financial sector – not just in India but globally. Disruptions in finance are not new, but what sets this era apart is the unprecedented pace and scale of change, fuelled by digitalization, artificial intelligence, and the resulting confluence of these changes leading to emergence of new business models. These changes make it essential for us to understand how to harness them for sustainable economic growth. 2. For India, this transformation is particularly significant as we strive towards Viksit Bharat 2047 — a vision of a developed and self-reliant economy. Our goal of becoming an advanced economy by 2047 will require us to effectively integrate technology with finance to deepen markets, expand financial inclusion, and drive economic productivity. Creative Disruption vis-à-vis Creative Destruction 3. Innovation in finance has always been a double-edged sword—on one side, it drives efficiency and inclusion, but on the other, it can destabilize traditional structures if not managed well. This is where the distinction between creative disruption and creative destruction becomes crucial. While both terms may seem similar, they carry very different implications. Creative destruction, as popularized by economist Joseph Schumpeter, refers to the complete dismantling of old systems to make room for new ones. In contrast, creative disruption is a more nuanced process—it’s about evolving existing systems, refining them, and making them better through technological innovations. We are not simply looking to replace what exists but to transform it for the better. 4. This sets the context for my talk today. I will share my views on how digital transformation is reshaping finance, the role of AI, the way forward for more meaningful financialization and financial inclusion and how the regulatory landscape must evolve to foster responsible growth. Digital Transformation in Finance 5. The financial sector has undergone a profound transformation in the digital era, reshaping how individuals and businesses access and utilize financial services. The shift from cash-driven, paper-based transactions to a seamless, technology-driven ecosystem has been one of the most defining changes in modern finance. India has exemplified creative disruption in finance through innovations like Unified Payment Interface (UPI), Account Aggregator (AA) framework, and the recently launched Unified Lending Interface (ULI). This has complemented the other components of what is collectively known as the “India Stack”. In the context of the creative disruption referred to earlier, these initiatives have not just supplemented the traditional banking system but have strengthened it by making transactions more seamless, expanding financial reach, and improving efficiency. Similarly, the rise of digital lending has not rendered conventional credit channels obsolete but has complemented them, bringing underserved segments into the formal financial fold. 6. In my opinion, what truly sets India apart from global peers is the open approach. Unlike many other countries, where these advancements have come as "walled gardens", India's financial infrastructure is built on the principles of openness and accessibility. Our platforms are designed as plug-and-play systems, enabling any entity to build on top of them, fostering competition, innovation, and inclusion. Whether it is the UPI, the Account Aggregator framework, or the ULI, our guiding philosophy remains the same— creating an open ecosystem. UPI stands as a prime example of open digital infrastructure that fosters both innovation and inclusivity. It provides an interoperable framework for instant payments, enabling several private players to build seamless financial solutions on top of it. As on date[2], there are 39 Third Party Application Providers (TPAP) in the UPI ecosystem enabling UPI payments besides apps of banks. With over 16 billion transactions processed monthly[3], UPI demonstrates how public digital infrastructure can empower private sector innovation for promoting financial inclusion, without the risks of exclusivity. A research article[4] by World Economic Forum (WEF) had estimated that UPI has saved the Indian economy approximately $67 billion since its inception in April 2016. AI/ ML in Finance 7. While the India Stack has successfully built the digital pipelines that power a seamless and inclusive financial system, as we move forward, I believe Artificial Intelligence (AI) and Machine Learning (ML) will become the engines that drive the next phase of financial transformation. These stand among the most transformative advancements of our times. This growing significance is reflected in how both financial institutions and regulators are increasingly engaging with AI-related topics. An analysis (Chart 1) of the annual reports of Scheduled Commercial Banks has revealed a sharp rise in references to AI and its applications in recent years[5]. 8. Further, this trend is not limited to regulated entities—central banks are also devoting more attention to AI in their public interactions. A review (Chart 2) of speeches[6] by central bank officials globally shows a similar pattern, where discussions on AI related topics have increased significantly especially post-2022 generative AI wave. This underscores the increasing awareness and strategic focus on AI within the financial ecosystem. 9. While AI adoption in financial services is increasing, it can make a significant impact in three areas viz. risk assessment and credit scoring, enhancing customer experience, and fraud detection. 10. Traditional credit evaluation relies heavily on structured financial data, such as credit history and income statements. However, AI-driven models enable analysis of vast amounts of alternative data—including transaction patterns, utility bill payments, e-commerce behaviour etc. to assess a borrower’s creditworthiness more holistically. This is not only useful in initial underwriting, but in pro-active monitoring of existing borrowers to detect stress at early stage and take remedial measures. It also enables offerings of hyper-personalized financial products leading to enhanced customer experience. Another use-case gaining prominence is fraud detection. Unlike traditional rule-based fraud detection systems, which rely on predefined parameters, AI based techniques continuously learn and evolve, adapting to new fraud techniques and identifying subtle anomalies in transaction and payment behaviour. This is especially critical in the era of real-time payments and digital transactions, where cyber threats, frauds and use of mule accounts are becoming more sophisticated. Challenges and Ethical Considerations 11. On an earlier occasion[7] , I spoke about the risks associated with AI/ML models and the guiding principles for their responsible use in finance. Today, however, I want to highlight a fundamental point: while AI raises critical issues such as algorithmic bias, fairness, data privacy, and security, the root of these challenges and many other lies in lack of explainability. Critical Need for Explainability and Human Oversight 12. Many advanced AI models, particularly deep learning-based systems, function as "black boxes," producing outputs that even their developers struggle to interpret. In a sector where trust, accountability, and regulatory compliance are paramount, a lack of explainability undermines confidence in AI-driven decisions. In the absence of explainability, human intervention can end up becoming mere rubber-stamping, rather than responsible oversight, increasing the likelihood of systemic errors. Second-Order Effects: Hidden Risks of Unexplainable AI 13. AI models continuously learn and evolve based on new data. While ‘dynamic adaptation’ can be beneficial, it also makes models susceptible to data drift[8] and concept drift[9]. These changes can cause models to misalign with real-world trends, risking incorrect financial decisions and instability. Regular human oversight and explainability are critical to prevent such risks. Danger of Over-Reliance on AI 14. A less appreciated risk of AI-based decision models is "automation complacency," where people rely too much on technology, even when situations need careful judgment. As the aphorism goes, “All models are wrong, but some are useful[10]”. While algorithms can provide valuable insights and efficiency, they should be viewed as tools to support, not replace, human judgment. Skill Gap: A Compounding Factor in the Explainability Challenge 15. A significant yet often overlooked barrier to responsible AI adoption in finance is the shortage of professionals who can interpret and oversee AI models. If financial institutions lack personnel with the necessary skills in AI, data science, and regulatory oversight, the explainability problem is further exacerbated and decisions made by AI models may remain opaque. Bridging the Gaps: Road Ahead for Financial Inclusion 16. Before I delve into the way forward on financial inclusion, another critical distinction is in order. Financialization and financial inclusion are often used interchangeably, but they represent distinct aspects of economic development. Financialization refers to the increasing role of financial markets, institutions, and instruments in an economy. On the other hand, financial inclusion focuses on ensuring that every individual, especially those from underserved and marginalized communities, has access to basic financial services like savings accounts, credit, insurance, and digital payments. The two are inherently complementary—without inclusion, financialization risks being concentrated among a privileged few, limiting broader economic participation. Conversely, without financialization, inclusion remains superficial, as access to banking alone does not empower individuals unless they can also save, invest, and grow their wealth. Present Status of Financial Inclusion 17. Reserve Bank of India’s Financial Inclusion Index (FI-Index), a multidimensional composite index that captures the extent of financial inclusion across the country, stood at 64.2 in March 2024, up from 60.1 in March 2023 and 43.4 in 2017. The index is based on three sub-indices – Access, Quality and Usage. India has made remarkable strides in expanding financial access, with the success of schemes like PM Jan Dhan Yojana, etc. ensuring that 80% of adults now have a bank account[11]. Till date, 54.84 crore bank accounts have been opened under PM Jan Dhan Yojana with a total balance of ₹2.45 lakh crore in the accounts[12] .However, true financial inclusion goes beyond merely opening accounts—it requires meaningful engagement with financial services. As the FI-Index (Chart 3) shows, Usage is the one which is lagging the other two[13]. 18. A bank account should serve as the entry point for individuals to access a broader suite of financial products, including credit, insurance, pensions, and investment opportunities. Without this deeper engagement, financial inclusion remains superficial, and the true benefits of a formal financial system do not reach every individual or business. It was encouraging to note that the improvement in the FI-Index in 2023-24 was largely contributed by the usage dimension, reflecting deepening of financial inclusion[14]. While this shows that we are moving in the right direction, there is still a long way to go wherein the most vulnerable populations and low-income groups have access to secure and affordable finance. 19. One of the significant gaps lies in access to credit, particularly for the informal sector of the economy, which is a major contributor to Indian economy, employing millions. Traditional credit models, which rely heavily on collateral-based lending, fail to accommodate first-time borrowers and small businesses with limited credit histories. As a result, such entities and individuals either remain underfunded or turn to informal sources of credit, often at exorbitant interest rates. Another critical gap is in insurance penetration, which stands at just 3.7% in FY24, significantly lower than the global average of 7%. Similarly, pension assets in India account for only 21.5% of GDP (17% under EPFO and 4.5% under NPS), which pales in comparison to the 80% of GDP in OECD countries[15]. Leveraging Digital Transformation for Greater Financial Inclusion 20. To bridge these gaps, we must harness the power of digital transformation to make financial services more accessible, efficient, and inclusive. Technology-driven solutions can democratize finance by breaking traditional barriers and bringing a wider range of financial products to underserved segments of the population. 21. As I highlighted earlier, having a bank account is not very useful if it does not lead to further financialization i.e. ensuring Quality and Usage. In case of payments, UPI meets all three dimensions of Access, Quality and Usage. Given the omnipresence nature of UPI for retail payments and its ease of usage, it has become essential for many informal sector businesses. This has created financial footprints for a large informal economy which was earlier mostly dealing in cash. Access to these financial footprints has been enabled for the financial service providers through the AA framework and it can be employed by lenders to underwrite them using new-age models and combining with other alternative data to offer hyper-personalized products. This approach is particularly useful in extending credit to new-to-credit individuals, gig workers, and small businesses who may lack formal credit histories but demonstrate strong financial discipline through alternative indicators. Thus, the AA framework acts as a bridge, allowing banks, NBFCs, and other financial service providers to access a more holistic and accurate picture of a customer’s financial profile. 22. Further, increasing formalization of MSMEs through GST, e-commerce sales data, etc. can help lenders assess creditworthiness more accurately. To augment further data-driven financial inclusion, RBI has also facilitated the setting up of ULI as a digital public infrastructure in the lending space, which will unlock critical financial, non-financial and alternate data for lenders to enable informed credit decisions. As on December 6, 2024, over 6 lakh loans amounting to ₹27,000 crore, including 1.6 lakh loans amounting to ₹14,500 crore to MSMEs have been disbursed using the ULI platform. 36 lenders, including various banks and NBFCs have been onboarded. These lenders are using more than 50 data services including, inter alia, authentication and verification services, land records data from six states, satellite service data, transliteration, property search services, dairy/milk pouring data and identity/ document verification. Financial Inclusion not Financial Excesses 23. While technology and digital innovations are driving financial inclusion and access, they also bring with them the risk of excessive exposure and over-leveraging, which can create significant vulnerabilities for both individuals and the broader financial system. However, as it is said that presence of too much light can also lead to blindness, we must be aware of the risk of reckless financialization. Of late we have seen some concerns of excessive borrowing in unsecured segment and from derivative euphoria in the capital markets. The temptation of short-term gains can easily overshadow the long-term financial security of individuals. Financial entities have a duty to ensure that customers fully understand the risks associated with leveraged products and speculative investing. 24. While RBI along with other financial sector regulators is taking progressive steps to educate the customers, financial sector entities also need to shoulder part of the responsibility. Absence of financial literacy leads people to fall prey to unscrupulous players which erodes the trust of the people in the system. Increased financial literacy will help increase trust in the sector and its participants, whose benefits will accrue to the entities themselves. Financial Regulation in the era of fast-paced innovation 25. While educating consumers helps protect them from fraudulent practices, regulation plays a critical role in maintaining stability and preventing systemic failure. Financial services are regulated because their stability is crucial for the broader economy—failures in the financial sector have severe real-world consequences, often requiring costly taxpayer-funded bailouts. The 2008 global financial crisis is a reminder of how lax regulation and excessive risk-taking can lead to widespread economic distress, job losses, and prolonged recessions. The cost of restoring financial stability in such scenarios is often much higher than the cost of preventive regulation. While strong regulation is essential to prevent such crises, determining the optimal level of regulations remains a delicate balance—too little regulation may increase systemic risk, while excessive regulation can stifle innovation, limit credit availability, and raise costs. Thus, regulating finance in an era of fast-paced technological innovation is a delicate balancing act. 26. At the same time, regulated entities must develop the necessary capabilities to implement and comply with evolving regulations. As financial institutions integrate AI, cloud computing, and API-driven finance into their operations, they must invest in robust governance frameworks and risk management protocols to ensure compliance and customer appropriateness. Financial firms cannot afford to view regulation as a barrier to innovation—rather, compliance itself must become a core component of their digital strategy. A strong internal culture of risk awareness, ethical AI usage, and customer-centric innovation will be critical in navigating the evolving financial landscape effectively. Conclusion 27. “Change is the only constant,” wrote an ancient Greek philosopher[16] and yet change can appear daunting, destabilizing, even threatening. So, will the technological changes lead to “creative destruction” and really replace the traditional financial institutions like banks? The specter of banks being ‘dead’ has been raised in the past also. A quarter century back, the issue was examined in the light of disruptive financial innovation of those times such as securitisation which was touted as evidence enough for erasing the need of banks as financial intermediaries[17]. As the passage of time has shown, these predictions proved false, and the banking sector emerged even more resilient from these disruptions. Although, history does not repeat itself, and the potential of the current wave of disruption is arguably bigger, it may be prudent to be cautious while making predictions about future of banking. 28. For banks and NBFCs, however the message is clear: adapt or risk being made obsolete. To remain competitive, financial institutions must invest in digital infrastructure, and pivot to a customer-centric, data-driven approach in this new landscape. At the same time, institutions must navigate the risks of excessive reliance on third-party technology providers, ensuring that regulatory compliance and cybersecurity while ensuring customer protection remain their top priorities. The challenge is ensuring a balanced and resilient financial ecosystem for the future. The key is to harness the benefits while managing the risks. Thank You! [1] Inaugural address delivered by Shri M. Rajeshwar Rao, Deputy Governor at IIMK-NSE 2nd Annual Conference on Macroeconomics, Banking & Finance on February 21, 2025 at Mumbai. Inputs provided by Pramanshu Rajput are gratefully acknowledged. [4] India’s digital leap: the Unified Payment Interface's unprecedented impact on the financial landscape dated June 26, 2023 available at https://www.weforum.org/stories/2023/06/india-unified-payment-interface-impact/ [5] How Indian Banks are Adopting Artificial Intelligence? RBI Bulletin October 2024 [6] Based on text mining analysis of central bank officials speeches available at Bank for International Settlements (2024). Central bank speeches, 2015-2024, https://www.bis.org/cbspeeches/download.htm. [7] Innovations in Banking - The emerging role for Technology and AI, December 22, 2023 - at the 106th Annual Conference of Indian Economic Association in Delhi available at https://rbi.org.in/en/web/rbi/-/speeches-interview/innovations-in-banking-the-emerging-role-for-technology-and-ai [8] Data drift, or covariate shift, refers to the phenomenon where the distribution of data inputs that an ML model was trained on differs from the distribution of the data inputs that the model is applied to. This can result in the model becoming less accurate or less effective at making predictions or decisions (changes in the data due to seasonality, changes in consumer preferences, the addition of new products) [9] Concept drift or drift is an evolution of data that invalidates the data model. It happens when the statistical properties of the target variable, which the model is trying to predict, change over time in unforeseen ways. This causes problems because the predictions become less accurate as time passes. [13] RBI Annual Report 2023-24, page 99 |

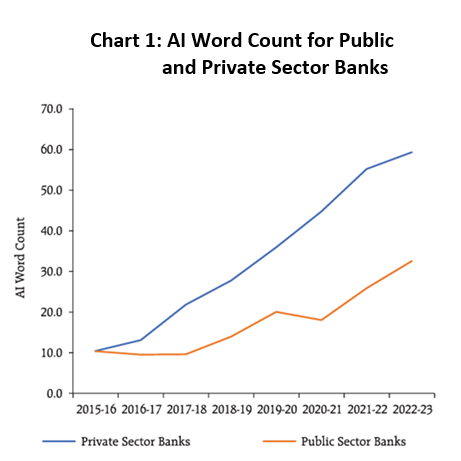

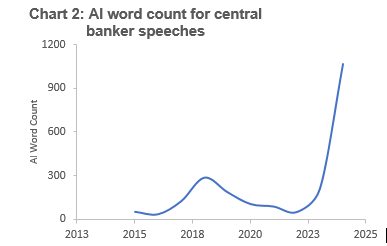

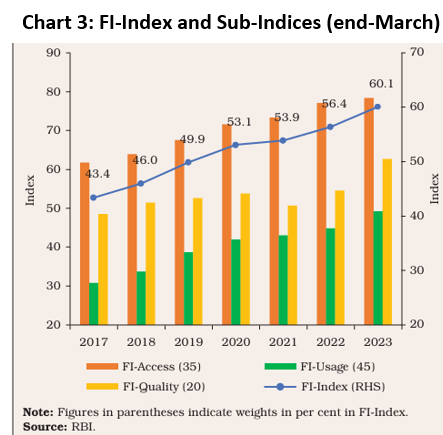

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: