IST,

IST,

Public Credit Registry (PCR) and Goods and Services Tax Network (GSTN): Giant Strides to Democratise and Formalise Credit in India

Dr. Viral V. Acharya, Deputy Governor, Reserve Bank of India

delivered-on ஆக. 20, 2018

|

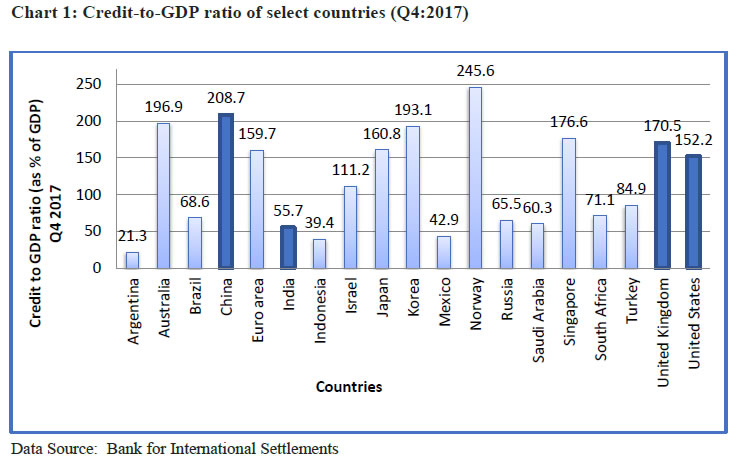

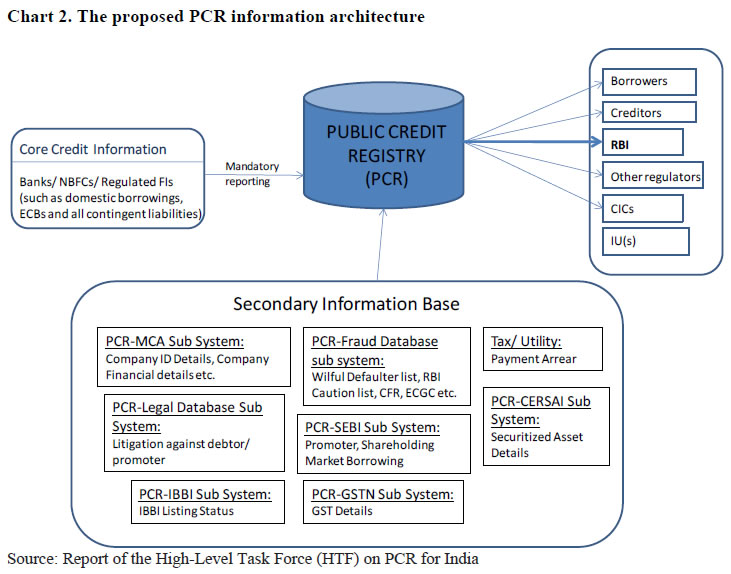

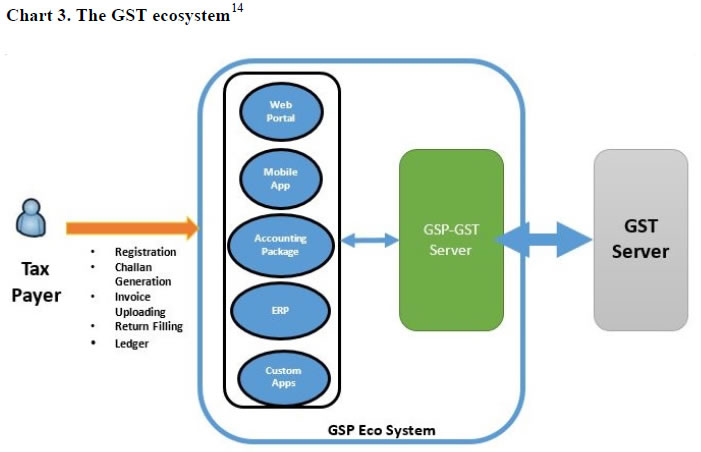

It is a pleasure to be with you all and share with you my thoughts on some recent developments that are expected to have transformative implications for our country. In particular, I wish to draw your attention to some major initiatives in gathering and analysing better credit data that can potentially have a huge impact in creating a financially healthy India. It is a known fact that a large part of the Indian economy is informal. This year’s Economic Survey has given us an estimate, sourced in large part from the implementation of the Goods and Services Tax Network (GSTN). About 0.6 percent of firms – accounting for 38 percent of total turnover, 87 percent of exports, and 63 percent of GST2 liability – are in what might be called the ‘hard core’ formal sector in the sense of being both in the tax and social security net. Estimates also suggest that the informal economy employs nearly 50 per cent of the workforce in India3. The earnings of some in the informal economy may be at par with their formal economy counterparts, but due to its informal nature, people and businesses in this part of the economy are rendered ‘invisible’ to the formal banking system. This ‘invisibility’ adversely affects their ability to grow current income level because of lack of access to formal credit. It is no surprise, then, that India's credit-to-GDP ratio stands at a modest 55.7 per cent, compared to China's 208.7 per cent, United Kingdom's 170.5 per cent and United States’ 152.2 per cent (Bank for International Settlements, Q4 2017 data, see Chart 1).4 In other words, there is financial under-penetration in India. It is in this context that that I will share with you two giant strides being undertaken that will help India move towards more equitable and timely access to credit, especially to the underserved. While these strides are being undertaken independently, together they can democratise and formalise credit in India. Public Credit Registry (PCR) for India The first stride is the creation of a Public Credit Registry, or PCR in short. Last year in my speech5 at the Annual Statistics Day Conference in RBI, I focused on setting up a PCR in India. Till that time, the concept of PCR was not much discussed in our country, though a large number of countries had already established or were in the process of establishing PCRs. Today I am happy to quickly recount with you the progress that we have made in this direction thus far. The constitution of a High Level Task Force (HTF), under the chairmanship of Shri Y.M. Deosthalee, and consisting of eminent experts from various stakeholders, was announced by the RBI in Part B of its monetary policy statement dated October 4, 2017. As enunciated in its terms of reference, the HTF has a) reviewed the current availability of information on credit and assessed the gaps in India that could be filled by a PCR; b) studied the best international practices on PCR to determine the scope and target of a PCR for India including the type of information to be covered; and c) deliberated on the structure of the new information system or whether the existing systems could be strengthened and integrated to get a PCR, thereby suggesting a roadmap, including the priority areas, for developing a transparent, comprehensive and near-real-time PCR for India. The PCR aims to be an extensive database of credit information for all credit products in the country, from point of origination of credit to its termination (repayments, restructuring, default, resolution, etc.), eventually covering all lender-borrower accounts without a size threshold. As of today, information on borrowings from banks, non-banking financial companies (NBFCs), corporate bonds or debentures from the market, external commercial borrowings (ECBs), foreign currency convertible bonds (FCCBs), Masala bonds, and inter-corporate borrowings are not available in a single data repository. The main objective of the PCR is to fill this lacuna and capture all the relevant information about a borrower, across different borrowing products, in one place. Moreover, significant parts of this registry of borrowing contracts and repayment history will be accessible to all stakeholders provided they too share their data with the PCR. The HTF submitted its report6 on April 04, 2018 recommending that a PCR should be setup by the RBI in a phased and modular manner. The report of the task force has been placed in the public domain after the top management of the RBI discussed it and had it reviewed by its Legal Department. An Implementation Task Force has now taken over the job of steering the project. PCR – What are the gains? Though the HTF report has dwelt in detail on the basic questions like (a) why is a PCR necessary in India, followed by the closely linked question (b) what are the functions of the PCR, let me add my thoughts on the same. The PCR in India has been conceived as a data infrastructure that the financial ecosystem within and outside the Reserve Bank would be drawing data from as per the PCR’s access policy. The prospective users will include lenders like banks and non-bank lenders including the new “fin-tech” lenders; others providing data analytics such as rating agencies and credit information companies; as well as regulators. Let me mention here the difficulties faced by the Reserve Bank in the context of the corporate non-performing assets (NPA) problem 5-6 years back. In spite of the private credit bureaus operating for several years and doing a vital job for retail credit scoring, the central bank could not precisely assemble data on the quality of the credit portfolio of banks’ large borrowers at an aggregate level. The data are simply not being reported with integrity and full coverage in case of large corporate borrowers. That is where RBI’s Central Repository of Information on Large Credits (CRILC), initiated in 2014, made a huge difference, even if it was somewhat late to be set up. CRILC provides a timely window on any degradation of credit of a large borrower at a bank to the central bank and to other banks having the same entity as a borrower. The Asset Quality Review (AQR) that followed in 2015 relied heavily on CRILC data to cleanse the Augean stables of massive and unrecognised non-performing assets (NPAs) that have saddled our banks. The credit information system, as a whole, has many such gaps which leave much scope for improvement. In my speech in July last year, I had also provided another example of how research based on data from credit registries can inform better policy-making. In the aftermath of the collapse of Lehman Brothers in September 2008, some economists – by pointing to the robust credit growth in bank loans – asserted that the credit flow in the United States was unaffected. But a deeper analysis of the Thomson Reuters Dealscan data quickly revealed that the credit growth was almost entirely attributable to the corporates drawing down on the existing credit lines (a form of a ‘bank run’). The origination of new loans had, in fact, dried up. In another piece of research, Lima and Drumond (2015)7 discussed the insufficiencies attached to aggregate data when assessing financial stability and showed how micro data available in databases, such as Portugal’s Central Credit Register (CCR), enable an assessment of the causes of the movements behind the aggregates and thus uncover the potential build-up of imbalances such as the one that eventually led to the European Sovereign debt crisis and engulfed Portugal too. India can bring in a similar level of sophistication to its economic research through careful access to near-real-time and comprehensive credit data that a PCR would capture. World Bank’s Doing Business 20188 reports the coverage of the adult population by institutions gathering credit data in select countries, grouped by the existence of only Public Credit Registry (PCR), only Private Credit Bureaus (PCBs), and both PCR & PCBs (Table 1). It is to be noted that some countries have opted to have a PCR only for supervisory purposes, where they cover large credits only. It is also documented that the coverage of adult population by PCR and PCBs varies widely depending on the objectives set by the regulators as well as the prevailing socio-economic condition in these countries. At a broad level, the PCR increases the efficiency of lending institutions by reducing information asymmetry using a PCR, the lender can get a 360 degree view of the borrower’s other outstanding credits and past performance, allowing better screening at time of credit origination and superior monitoring during the life of the credit. This is a well-studied phenomenon and has been recorded in many research studies. The introduction of public registries and private bureaus has been found to raise the ratio of private credit to GDP in many countries by 7 to 8 percentage points over a five-year horizon9. Importantly, credit registries and bureaus do not just increase the amount of borrowing; they are also responsible for improving the quality of borrowing. India currently has a robust and unique digital identification for every citizen in the form of Aadhaar. Similarly, the Corporate Identification Number (CIN) as well as GSTN provide identities to businesses. Moreover, India is one of the few countries to provide an authentication service atop these identity services. These identities can be used in a PCR to aggregate data about borrowers from across multiple institutions with a high degree of confidence in the accuracy of merging and referencing of data. Further, the PCR will be a single source of information that has veracity. It will make reporting for small financial institutions easier and also remove the inconsistencies that come from aggregation across different reporting formats of multiple financial institutions. With a repository of such trusted data available, banks and other lenders will be able to take better credit decisions. It can help them recognize early warning signs of asset quality problems by being able to see performance on other credits. The principle of reciprocity is baked into a PCR. While the lending institutions will be mandated by law to share borrower information, most do it willingly, because, in turn, they want to see similar data from other lenders before they make a credit or rollover decision. Further, lenders can compete and offer attractive rates to borrowers based on their individual risk profile, instead of relying on an average risk profile for all customers in a sector. In the Indian context, where many borrowers do not have a credit history to begin with, the PCR will enable good borrowers to distinguish themselves. The envisaged Indian PCR will mandate recording of all material events for all loans on all credit facilities (funded as well as non-funded) extended by all credit institutions – commercial banks, cooperative banks, NBFCs, MFIs – and also covering borrowings from other sources (Chart 2). This will reduce adverse selection, wherein low-risk borrowers are charged higher prices, while high-risk customers pay lower prices on their loans, as lenders cannot adequately distinguish among borrowers. PCR - Legal angles Let me now touch briefly upon a few key issues around the PCR on the legal front. 1. Organization: The PCR is initially being set up within the existing RBI infrastructure. The Reserve Bank, being a statutory corporation, can do only those activities which are permitted by the Reserve Bank of India Act, 1934 or other legislations. In addition to its core central banking functions, the Reserve Bank also performs certain promotional functions. However, this promotional activity is limited to ‘financial institution’ only10. Since no financing activity is contemplated for the proposed PCR, it might be difficult to label PCR as a ‘financial institution’. This takes it out of the purview of a promotion under the Reserve Bank of India Act, 1934. Another option is to promote an organization for a matter incidental to the functions of the Reserve Bank11 – as part of the Reserve Bank of India Act, 1934 or Banking Regulation Act, 1949 or any other enactment. Collection of information, including credit information, from its regulated entities is an important aspect of the regulatory and supervisory functions of the Reserve Bank. One can find many provisions in different enactments which enable the Reserve Bank to collect such information. If the scope of collection of information for PCR can be deemed to be reasonably incidental to the expressly permitted activities of the Reserve Bank, a subsidiary or a Department for the purpose of setting up and hosting the PCR would be justified. Otherwise, the Reserve Bank of India Act, 1934 can be suitably amended conferring the Reserve Bank powers to conduct the business of PCR. Such a specific conferment of power, with clear enumeration of the functions of PCR, would remove the limitations of incidental powers mentioned above. 2. Confidentiality constraints: An important issue in connection with the setting up of PCR is the overriding of confidentiality provisions in many enactments, which directly or indirectly bar sharing of information, including credit information, except in manner specifically permitted. As the PCR will have to get information from different sources, the inability of the sources to share such information can be a constraint. To this end, the PCR will have a consent-based architecture. The notice and choice framework to secure an individual’s consent is fundamental to data processing practices in a digital economy. It is based on the act of an individual providing consent for certain actions pertaining to his/ her data. It is essential that users provide consent to an entity sharing data (the data provider) before they share data with an entity requesting access (the data consumer). The consent based architecture of the PCR will strengthen privacy of data subjects by ensuring that the data is accessible only to the data consumer, only for stipulated period of time and only for a stipulated purpose, as consented to by the user. 3. PCR Act: Having regard to the complexities discussed above, it is desirable to have a special comprehensive legislation, overriding the prohibitions contained in all other legislations on sharing of information required for the PCR. Otherwise, all such legislations will have to be amended separately, providing an exemption for sharing of information with PCR. It is to be noted that almost everywhere PCRs are backed by a specific enactment of a PCR Act. In India, a PCR Act can enable us transparently address the entire gamut of governance issues including data acquisition and its dissemination through access rights by various users. PCR – Linkages to other Datasets In my speech in July last year, I talked about how the power of information can be substantially enhanced if we can link CRILC data with the Ministry of Corporate Affairs (MCA) database containing financial results of the corporate sector. PCR should help in connecting to and referencing other databases. A portion of the envisioned PCR’s power would derive from these linkages with ancillary information repositories. Chart 2 shows the schematics of how PCR proposes to augment the core credit information reported by regulated entities with linkage to other information sources and deliver the full potential of information to the stakeholders. For example, through the CIN it may connect to the company’s financial statements. It should make alternate data, like utility bill payments records, available for credit decisions. This can significantly help to foster financial inclusion and democratise credit by allowing lending decisions to be based on all cash-flow activity of a borrower, even when physical asset creation has not yet taken place. Goods and Services Tax Network Let me now turn to a seemingly unrelated second stride being undertaken that can help directly address the information asymmetry problem in the credit market. It is one that most of you already know. So I don’t want to spend time explaining it, but instead focus on how it can move in lock-step with the PCR in completing a rich journey for formalising credit in India. I am talking, of course, about the Goods and Services Tax Network. The GSTN, ostensibly, is a way for citizens and businesses to pay their taxes, and claim their input tax credit. However, another way to look at the GSTN is as a trusted repository of matched invoices. Sellers upload their invoices to the GSTN; buyers approve the invoices billed to them. Since internal trade amounts to about 60 per cent of GDP, it is a dataset we cannot ignore. Already, the GSTN has exceeded expectations since its adoption in India. The Economic Survey 2018 estimates that GSTN implementation has increased the indirect taxpayer base by more than 50 per cent, with 3.4 million businesses coming into the tax net12. It appears that the number of GST registrants has risen due to a large increase in voluntary registrations. Small B2C firms want to be part of the GSTN because they buy from large enterprises. In fact, 68 percent of their purchases are from medium or large registered enterprises, giving them a powerful incentive to register, so they could secure input tax credits on these purchases. The Input Tax Credit motivation is a strong push towards digitisation and formalisation of small businesses. Moreover, the acceptance of invoices by the buyers creates a trusted repository of invoices. We know they aren’t just cooking their books; they have verified buyers at the other end who vouch for the invoice generated. This gives one a potentially penetrative view into the otherwise invisible 10 million businesses that are now on GSTN, uploading roughly 1 billion plus invoices every month13. Source: https://www.gstn.org/ecosystem/ The GST ecosystem has a layer between the tax payer and the GST system (Chart 3). The GST Suvidha Providers (GSPs) are envisaged to provide innovative and convenient methods to taxpayers and other stakeholders in interacting with the GST systems. There will be two sets of interactions, one between the App user and GSP and the second between the GSP and the GST System. The GSP can help the taxpayers in GST compliance through their innovative solutions. By design, invoicing data about their own business is made available to users of the GSTN. Continuing the theme from the PCR, we already know that trusted, verifiable data from any registry can significantly improve access to credit. Similarly, we expect an explosion in the number of credit products specifically designed for business flow, such as invoice discounting based on GSTN data. The interplay of PCR and GSTN Now, the PCR can aggregate the information of a borrower using the core credit information repository and information lying in a set of sub-systems spread across multiple agencies (e.g. MCA database, GSTN etc., refer to Chart 2 above), to aggregate information of a borrower. Together, these sub-systems create a universe of verifiable information and allow safe access to the data for all important stakeholders in the financial system. What is noteworthy about these institutions is that they are all digital-native. They have been designed as digital infrastructure, being able to support multiple use cases atop them, without being partial or overly prescriptive on any one use case. This is not happening in a vacuum. Much of this would not be possible if the other roadblocks to going digital weren’t already solved. Other public digital infrastructure such as eKYC for knowing your customer or Unified Payments Interface (UPI) for digital payments are nudging users towards creating larger data footprints, and helping them indirectly improve their creditworthiness. With this infrastructure in place, we expect the costs for on-boarding those users who are currently excluded by formal credit to nosedive. It will become feasible to serve a large number of customers, operating at a much lower average transaction size. Just like in the Fast-moving Consumer Goods (FMCG) sector, banking and access to credit too will be ‘sachetized’ to make it more accessible and affordable for the masses. We want that even a small tea shop vendor should be able to take a 500 rupee loan at fair rates, say, for only a week, based on such data. It doesn’t stop there. These new institutions can also provide better tools to regulators and researchers to monitor the health of, and provide stability to, the national financial system. Let me conclude. In a country with a low credit to GDP as ours, efficiently increasing affordability and access to credit are paramount goals. I am excited for what we can achieve when our small entrepreneurs are not capital-constrained, or when health shocks do not send families to usurious loans, and back into poverty. The PCR and the GSTN are two giant strides that utilize modern technological advances for improving information access and quality. Together, they hold the rich promise of enabling us to democratise and formalise credit in India. 1 Speech delivered at the Annual Global Banking Conference – FIBAC 2018 organised by Federation of Indian Chambers of Commerce and Industry (FICCI) and Indian Banks’ Association (IBA) on August 20, 2018 at Mumbai. A Theme Talk was also delivered on the subject at the 12th Annual Statistics Day Conference organised by the Reserve Bank of India at Mumbai on July 23, 2018. 2 Economic Survey 2017-18, Vol 1. 4 Data from https://stats.bis.org/statx/srs/table/j?m=A 5 A Case for Public Credit Registry in India - /en/web/rbi/-/speeches-interview/a-case-for-public-credit-registry-in-india-1042 6 /en/web/rbi/-/press-releases/report-of-the-high-level-task-force-on-public-credit-registry-for-india-44133 7 https://www.bis.org/ifc/publ/ifcb41k.pdf 8 http://www.doingbusiness.org/data/exploreeconomies/ 9 ‘The national credit bureau: A key enabler of financial infrastructure and lending in developing economies’, McKinsey Working Papers on Risk, No. 14. 10 See: Section 17(8-AA) of the Reserve Bank of India Act, 1934. 11 See: Section 17(16) of the Reserve Bank of India Act, 1934. 13 Estimates available at: https://economictimes.indiatimes.com/news/economy/policy/3-5-billion-invoices-every-month-all-about-the-technology-that-gst-will-bank-on-from-july/articleshow/58907708.cms |

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: