IST,

IST,

Public Debt Management: Reflections on Strategy & Structure

Shri Harun R Khan, Deputy Governor, Reserve Bank of India

delivered-on ஆக. 12, 2014

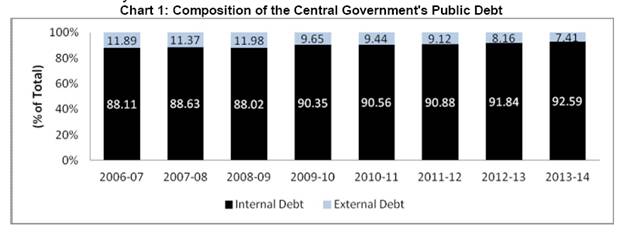

I am thankful to the Centre for Public Policy, Indian Institute of Management, Bangalore and Prof. Charan Singh in particular for inviting me to this conference. As suggested by the organizers, I would like to share some thoughts on the strategy and structure of public debt management in India with the experts and enthusiasts gathered here. 2. Globally it is a well-recognised fact that countries need efficient and effective public debt management as public debt portfolio is the largest portfolio in the economy and its impact could be felt across generations. This prompted Herbert Hoover to remark “Blessed are the young for they shall inherit the national debt”. Policy makers need to bestow special attention on debt management as debt sustainability has implications for financial stability as well as well-being of future generations. 3. The debt management in India has come of age from the phase of administered interest rates and high preemptions in the pre-reform period prior to 1990s. The reforms undertaken both in the debt management framework as well as in the Government securities (G-Sec) market has resulted successful management of large borrowing program with least market distortions or disruptions. From central bank funding budget deficits, we now have a system where all Government borrowings are funded through auctions at market determined rates. Statutory pre-emptions were brought down significantly. The annual gross market borrowing of the Government of India and the State Governments increased from `122.83 billion in 1991-92 to `7602 billion in 2013-14. The amount of outstanding Government of India securities increased from `780.23 billion in 1991-92 to `35,141 billion in 2013-14. Policy action was taken on fiscal front by passing the Fiscal Responsibility and Budget Management (FRBM) Act in 2003, firmly setting targets for fiscal correction. Fiscal consolidation has both political and administrative commitment. G-Sec market has been developed through series of developmental measures. It is reasonably liquid and deep with diverse investor base and instruments. Reforms, such as, introducing new instruments, expanding the investor base, strengthening market infrastructure, etc. have further strengthened the G-Sec market. As a result, we have a yield curve that spans for thirty years, world-class trading and settlement infrastructure and keen foreign investor interest. On the sustainability front, the debt ratios are reasonable. Debt to GDP ratio has declined in the past decade and stands at 39 per cent of GDP for the Central Government (49 per cent of GDP for the total Central Government liabilities) in 2013-14 (RE). Interest payments to revenue receipts ratio of the Central Government at 37 per cent in 2013-14 (RE) was significantly lower than 51 per cent in 2002-03. In line with the renewed move towards fiscal consolidation from 2012-13, GFD declined to 4.6 per cent of GDP in 2013-14 (RE) from 4.8 per cent in 2012-13. It is budgeted to decline further to 4.1 per cent in 2014-15. 4. In this backdrop, I will share my thoughts on the debt management operations of the Reserve Bank of India with special emphasis on management of the Government of India debt. Role of Reserve Bank and the Government in Public Debt Management: Legal and Institutional Framework 5. It is a sound practice to have appropriate legal framework and institutional structure/organizational arrangements in place for public debt and the entities given powers to borrow must be entrusted with clear responsibility and transparency. The Constitution of India gives the executive branch of Government the powers to borrow upon the security of the Consolidated Fund of India. Reserve Bank as an agent of the Government (both Union and the States) implements the borrowing program. The Reserve Bank draws the necessary statutory powers for debt management from Section 21 of the Reserve Bank of India Act, 1934. While the management of Union Government's public debt is an obligation for the Reserve Bank, the Reserve Bank undertakes the management of the public debts of the various State Governments by agreement. The procedural aspects in debt management operations are governed by the Government Securities Act, 2006 and rules framed under the Act. 6. External debt (bilateral and multilateral loans) is managed by the Department of Economic Affairs in the Ministry of Finance (MoF). All debt management functions for marketable internal debt are undertaken in the Reserve Bank. These functions comprise formulation of a calendar for primary issuance, deciding the desired maturity profile of the debt, size and timing of issuance, designing the instruments and methods of raising resources, etc. taking into account government's needs, market conditions, and preferences of various segments while ensuring that the entire strategy is consistent with the overall macro-economic policy objectives. Reserve Bank also undertakes the conduct of auctions and manages the registry and depository functions. 7. Decisions on the implementation of the borrowing program, based on proposals made by the Reserve Bank, are periodically taken by the Monitoring Group on Cash and Debt Management. This is a standing committee of officials from the MoF and the Reserve Bank. While this represents a formal working relationship between the MoF and the Reserve Bank, it is further complemented by regular discussions between the Ministry and the Reserve Bank. 8. With regard to accountability and reporting, the operations of the debt management functions in Reserve Bank are subject to the statutory audit, internal audit and concurrent audit. Recently, the Comptroller and Auditor General (CAG) have started a performance audit of debt management operations in the MoF and the Reserve Bank focusing on three ‘E’s of process excellence viz. Economy, Efficiency and Effectiveness. While the internal debt management activities are reported in the Annual Report of the Reserve Bank, which is a statutory report and is placed before the Parliament (through MoF), the external debt management functions are reported in the Annual Status Report on External Debt presented to the Parliament by the Finance Minister. Further, the MoF is publishing an annual report on Government Debt, the Middle Office in the Budget Division is publishing quarterly reports on the debt issued. Therefore, a robust reporting of debt is in place in our country. 9. As can be seen, we have sound institutional mechanism with roles and responsibilities clearly entrusted to the Reserve Bank and the Government. This has helped in discharging our mandate effectively. Debt Management Strategy Policy Objectives 10. The main objective of debt management is to ensure that the government’s financing needs and its payment obligations are met at low cost over the medium to long run consistent with a prudent degree of risk. Prudent degree of risk ensures that no problems exist in rollover of debt. Further, the debt structure must be sustainable to ensure financial stability across time periods. Another important objective is to promote deep and liquid financial markets to minimize long term borrowing cost markets. The debt management policy must also be consistent with other macro-economic policies including monetary policy. 11. Debt Management Strategy (DMS) comprising objectives, various benchmarks & portfolio indicators and yearly issuance plan (external and domestic funding, instruments, maturity structure, etc.) provides requisite direction to the debt management operations. Its articulation imparts information and transparency, certainty and enables market participants (investors) to chalk out their investment strategy in the G-Sec market. Our DMS revolves around three broad pillars viz., cost minimization, risk mitigation and market development. Cost Minimisation 12. Cost minimization is sought to be achieved over medium to long run by formulating appropriate issuance strategy and developing financial markets. The borrowing needs are estimated and amounts are borrowed in timely fashion thereby minimising the opportunity cost. Proper demand estimation, planned issuance and offer of appropriate instruments would aid in lowering costs. In India, the issuance calendar for market borrowings is announced in advance for each half year with details of the quantum to be borrowed each week, maturity buckets, etc. A week prior to the auction, individual securities along with their issuance size is notified to public. This strategy of sharing information about debt management has enhanced transparency of debt management operations. The borrowings are planned keeping in view the investment preferences/horizons of various investors. As commercial banks are large investors in G-Sec and are interested in short/medium tenor bonds, substantial issuance is in this tenor. Longer tenor bonds are issued keeping in view demand from insurance companies and provident funds. It may be noted that cost minimisation objective refers to the planning horizon of debt management as minimizing costs at any point in time is different from minimizing costs over a longer time horizon. What might seem cost-efficient today may prove rather costly over a number of years. It is exactly the acknowledgment of this distinction that would help mitigate the alleged “dilemma” of minimizing costs while containing risks. The cost minimization attempted over short-term by the debt managers may create sub-optimal debt structures, which may create stress for issuer by enhancing refinancing risks as was seen during the recent European sovereign debt crisis. Recognising the need for appropriate debt portfolio structure, we have desisted from issuance in short tenors as debt maturing in ten years constitutes nearly 60 per cent of total debt. Risk Mitigation 13. The sovereign debt portfolio is exposed to rollover risk, currency/exchange rate risks, sudden-stop risks and interest rate risks which need to be managed. Rollover / Refinancing Risk 14. Elongation of maturity of the portfolio is preferred strategy to limit rollover risk. DMS in India has stressed on elongation of maturity whenever possible and, in turn, cost minimization over the medium term (Table 1). This is achieved by limiting issuances in short tenor bonds and increasing issuance of medium/long tenor bonds taking into account the investor preferences and shape of the yield curve. Though we have issued short term bonds to meet the needs of market borrowings for fiscal stimulus in wake of global financial crisis, we have adopted a conscious strategy of elongating maturity to lessen rollover risk. This is achieved by non-issuance in maturity of 1-5 years, moderating issuance in 5-9 years and increasing issuance in 10-14 year tenor which sees robust demand from banks and other market participants. We have also increased issuance of bonds in tenors more than 15 years to cater to needs of insurance companies and provident funds. Presently, weighted average maturity of India’s debt portfolio at 10 years is one of the longest in the world. With an objective to smoothen redemptions, switching of short-tenor bonds maturing at proximate years with long-tenor bonds is also being attempted and is expected to reduce rollover risks. Exchange Rate Risks 15. Achieving appropriate and stable mix of domestic and foreign currency debt in portfolio is essential. Raising debt in foreign currency could be cost effective and provide a wide and varied investor base. A country with large foreign currency denominated liabilities is, however, exposed to “currency/exchange rate risks” which could impact macro-economic stability. Further, dependence on foreign currency bonds could mean sharp volatility in interest rate and market volumes linked to the uncertainty of external sovereign ratings. Hence, no sovereign foreign currency bonds have been issued so far by India. Sizeable domestic currency bond issuances are necessary to ensure supply of bonds in the domestic bond market which is a very critical ingredient for development of the domestic bonds market. As a conscious strategy, issuance of external debt (denominated in foreign currency) is kept very low in India and external debt as percentage of Central Government’s public debt has come down from 6.4 per cent in 2005-06 to 5.2 per cent during 2011-12 (Chart 1). The external debt in Indian context is entirely bilateral and multilateral loans. Sudden Stop Risk: Stable Investor Base 16. Almost entire internal debt (i.e., more than 90 per cent) of the Central Government (Chart 1) and all the market loans (which form more than 90 per cent of internal debt [Chart 2]) have been raised from the domestic bond markets. An important feature of investor profile of the G-Sec market is the dominance of domestic investors and limited foreign investor participation. The ability of domestic markets to finance government operations is a source of strength of the debt portfolio which is insulated from the currency risk. This is a consciously adopted policy framework. Investment limits for the Foreign Portfolio Investors (FPIs) have been enhanced in a phased manner to US$ 30 billion in G-Sec. The limits are apportioned to different categories of investors with preference towards long term stable investors and investments in longer maturities keeping in view the sensitivity of foreign investors to global macro-economic factors and possible sudden reversals which could potentially impact the systemic stability. Participation of foreign investor in the domestic bond markets also needs to be examined in the light of our policy stance relating to calibrated approach to capital account convertibility and the possibility of interest rate and exchange rate volatility due to large scale reversal of capital flows. 17. The domestic investor base is dominated by banks in short to medium tenor securities and by insurance companies and provident funds at the long end. With the entry of co-operative banks, regional rural banks, pension funds, mutual funds and non-banking finance companies, the institutional investor base has been reasonably diversified (Chart 3). There is very little retail participation in the G-Sec market as the G-Sec market has traditionally been an institutional market. For diversifying the investor base, especially in context of calibrated reduction in mandated investments in form of Statutory Liquidity Ratio (SLR), there is need to focus on new investors, such as, pension funds and retail investors. Reserve Bank has taken several steps to promote retail participation, such as, enabling non-competitive bidding in primary auctions to enable non-institutional investors to participate in auction, introduction of odd lot trading, permitting trading of G-Sec on stock exchanges; mandating retail/ mid-segment targets for primary dealers, web based trading access to gilt account holders, etc. The process of developing the retail and mid-segment investor base will be continued. Interest Rate Risk 18. DMS involves issuance of variety of instruments of varying maturities to cater to the preferences of different investors. For example, some investors (banks and financial institutions) like to invest in floating rate bonds (FRBs) for their duration management. Similarly, institutional investors, such as, insurance companies, provident funds, pension funds, etc. would prefer to buy long term bonds, zero coupon bonds and inflation indexed bonds (IIBs) for their liability management. Floating rate instruments carry interest rate risks on re-fixing. In India, although we have been raising funds by issuing variety of instruments, such as, fixed rate conventional bonds, FRBs, Zero Coupon Bonds, CIBs, the contribution of linkers (FRBs, IIBs, etc.) has remained small, thereby limiting interest rate risk in the debt portfolio. There is, however, a need to increase the share of variable rate bonds to further improve the breadth and width of the G-Sec market and enable market participants to diversify their portfolio. Towards this end, IIBs have been issued linked to the Wholesale Price Index (WPI). A new series is being planned which is linked to Consumer Price Index (CPI). Developing the G-Sec markets 19. Reserve Bank, as regulator of G-Sec market, has taken several steps to create a deep and liquid market for facilitating price discovery, reducing the cost of government debt and serve as a benchmark for other debt instruments. Reserve Bank through carefully and cautiously sequenced measures within a clear cut agenda for primary and secondary market design, development of institutions, enlargement of participants and products, dissemination of market information, prudential guidelines on valuation, accounting and disclosure. Consequently, the G-Sec market has witnessed significant transformation in various dimensions, viz., market-based price discovery, widening of investor base, introduction of new instruments, establishment of primary dealers and electronic trading & settlement infrastructure. 20. For development of bond markets, Reserve Bank of India adopted a strategy for creation of an efficient market infrastructure to enable safe trading. State of the art primary issuance process with electronic bidding and straight through processing capabilities, an efficient, completely dematerialized depository system within the Central Bank, Delivery-versus-Payment (DvP) mode of settlement, Real Time Gross Settlement (RTGS), electronic trading platform (Negotiated Dealing Systems - Order Matching) (NDS-OM) and a separate Central Counter Party (CCP) in the Clearing Corporation of India Ltd (CCIL) for guaranteed settlement are among the steps that were taken by the Reserve Bank over the years towards this end. The system makes G-Sec trading practically risk free and efficient. 21. The system of Primary Dealers (PDs) was established to provide support to the market borrowing programs of the Government and also to impart liquidity in the secondary markets. Subsequent to the withdrawal of the Reserve Bank of India from the primary market, as mandated by Fiscal Responsibility and Budget Management Act 2003, the PD System has been underwriting the entire Government of India market borrowing. 22. To meet the diverse funding and hedging needs of the participants, there is need for a wide array of instruments and products which would also offer benefits of diversification in the portfolio. Over the years, several instruments like zero-coupon bonds, capital-indexed bonds, floating rate bonds, Separate Trading of Registered Interest and Principal of Securities (STRIPs), bonds with call and put options, cash management bills, inflation indexed bonds have been introduced after wide consultations with market participants. Plain vanilla fixed coupon bonds, however, remain the mainstay of issuances. 23. Reserve Bank has always focused on improving liquidity in the debt markets. Reserve Bank has constituted a Working Group (Chairman: Shri. R Gandhi) to examine ways to improve liquidity in Government securities and interest rate derivatives market which made several recommendations including suggestions for consolidation of debt. Many of the Working Group recommendations are being implemented. The recommendations, such as, truncating the time window for bidding in the primary auction; changing the settlement cycle of primary auctions in Treasury Bills (T-Bills) from T+2 to T+1; conduct of primary auctions in G-Sec as a mix of both uniform-price and multiple price formats; re-issuances of existing securities in state development loans; and migration of secondary market reporting of OTC trades in G-Sec (outright and repo) from PDO-NDS to NDS-OM and CROMS, respectively, have been implemented. Work is in progress with regard to recommendations on consolidation of public debt. 24. As a result of the DMS, all sustainability indicators, viz., level of debt, ratio of interest payments to revenue receipts, average cost and few floating rate instruments point towards long term sustainability. To take the process further and improve stability of debt portfolio, Reserve Bank has been striving towards consolidation, both passive and active methods. Passive consolidation is achieved through re-issuances and nearly 95per cent of the bond issuance is through reissuance. We have also embarked on active consolidation through switches and buy-backs, which is expected to reduce roll-over risks significantly. 25. It is against this backdrop, I would like to make some comments on an issue that is engaging attention of policy makers for a decade and half: the issue of separation of debt management from the central bank in India. Institutional Arrangements for Sovereign Debt Management 26. To put the debate in its historical context, with regard to the location of sovereign debt management functions multiplicity of arrangements exist around the world: in the ministry of finance, central bank or autonomous debt management agency. Cross country experience shows that there is no international best practice and the adoption of any particular model could depend on country specific circumstances. In the nineties, several OECD countries entrusted debt management to separate agencies with the objective of providing monetary policy independence to central banks so that they could concentrate on inflation management and not impacted by the conflicting objective of raising debt for the sovereign at low cost. It was also perceived that independent Debt Management Office (DMOs) would improve operations of debt management through improved accountability and specialisation. Many developed nations have followed suit. 27. In India, the genesis of the proposal could be traced back to various Committees/Working Groups, such as, Committee on Capital Account Convertibility (1997); Review Group of Standing Committee on International Financial Standards & Codes (2004), Percy Mistry Committee, Internal Working Group on Debt Management, MoF and finally Financial Sector Legislative Reforms Committee, which suggested separation of debt management from monetary management. During this phase the Reserve Bank, while suggesting separation, has made it conditional on attainment of three milestones: development of the government securities market, durable fiscal correction and an enabling legislative framework. It is argued that separate DMO will help to establish transparency, and assign specific responsibility and accountability on the debt manager and could lead to an integrated and more professional management of all government liabilities, with a focused mandate. 28. The public discourse also focused on three kinds of conflict in sovereign debt management being done by the central bank:

29. In my view, the institutional arrangements for debt management must take into view the country specific context and requirements. To set the context for this debate, we can examine the conflict of interest argument in Indian context. Even as the government’s borrowings had gone up both in absolute and proportional terms, Reserve Bank has raised policy rates several times during the past five years; clearly indicating its commitment to price stability. Inspite of a six-fold increase in the size of the net market borrowing of the Central and State Governments during the decade 2000-10, the average weighted cost of borrowing declined by over 450 bps compared to the previous decade. In 2009-10, during the global financial crisis, Reserve Bank carried out government borrowing of about `4 trillion without disrupting the debt market or elbowing out private sector’s credit requirement. Inspite of rising interest rate scenario, the Reserve Bank was able to complete the Government’s borrowing program in a non-disruptive fashion at a reasonable cost. 30. The FRBM Act, 2003 which precluded the Reserve Bank from participating in the primary auction of the Government bonds has resolved the conflict of interest with the monetary policy. Monetary signalling in India is now done by the repo rate (policy rate) under the liquidity adjustment facility (LAF) and not the bond yields. 31. As regards the SLR issue, it needs to be appreciated that the SLR has been used by the Reserve Bank as an instrument of prudential regulation. This has ensured that at any given point of time, all the banks have a specific percentage of their liabilities in the form of risk-free, liquid instruments. In fact, such requirement for banks to hold a certain percentage of their assets in cash and cash like instruments is one of the key corrective instruments being discussed internationally, and formed integral part of liquidity risk management under Basel III capital framework. In any case, pre-emptive mandated investments are being scaled down as can be seen from SLR reduction from peak levels of 38.5 per cent of NDTL of banking system to the present level of 22 per cent. 32. While theoretical formulations can conjecture conflicts of interest; the validity of assumptions need to be tested by evaluation of experience/performance and on that count, conflict of interest cannot be established with regard to Reserve Bank. 33. Another point that merits attention is that the proponents of separation, while citing examples from countries which differ significantly with regard to institutional milieu from India, pay little attention to nuances of debt management operations. For instance, domestic debt in the UK is managed by DMO, whereas external debt is the responsibility of the Bank of England. The whole concept of an ‘all-in-one debt office’ is a theoretical construct than a real organisation. 34. It is also important to note that sovereign debt management (SDM) is much more than a mere resource raising exercise especially in a developing country context like ours. The size and dynamics of government market borrowing has a much wider influence on interest rate movements, systemic liquidity. An autonomous DMO, driven by specific objectives exclusively focusing on debt management alone, may not be able to manage this complex task involving various trade-offs. 35. With regard to autonomous DMOs focusing on specific responsibilities, the experience of European debt managers is instructive. The experience of DMO in the Euro area (especially Greece, Portugal and Ireland) has been less than satisfactory. The independent DMOs seemed to have been guided by perverse incentives and issued short-term/foreign debt in a disproportionate fashion, intensifying roll-over risk, sovereign risk and financial instability. The debt management strategy and operations have resulted in a skewed maturity profile with balloon payments. For instance, Greece has bunched maturities during 2010–19 with interest payments on public debt constituting nearly 40 per cent of Greece’s budget deficit during 2009. Large proportion (above 70 per cent) of debt of Portugal, Greece and Ireland was held by non-residents. As foreign investors turned risk averse and started withdrawing investments, rating agencies downgraded the debt of these countries. The debt management strategy has jeopardized the fiscal situation and financial stability. Therefore, autonomous DMO focusing on specific objectives, such as, cost minimisation in isolation and not in conjunction with other macro-economic policies may result in sub-optimal debt management outcomes. 36. Persistent fiscal deficit warranting huge borrowings, often at the cost of flow of reserves to the private sector, has been the predominant feature of the Indian economy. Increasing borrowings by the Government, both the Central and the State Governments, have to be strategically planned and tactically executed keeping in view the market conditions, liquidity situation and macro-economic implications. Thus, given the persistently large size of the market borrowings, there is a strong case for confluence of interest between monetary policy and debt management in India. On the other hand, Government’s ownership of majority stake in public sector banks (which own 70 per cent of banking sector assets) could be a source of conflict of interest with its role as debt manager, either directly or through an agency controlled by it. 37. In a situation of excess capital flows requiring forex intervention from the Reserve Bank and the consequent sterilisation through issuance of Government securities under the Market Stabilisation Scheme (MSS), the coordination of SDM with these operations needs to continue. In 2007-08, the volume of MSS issuance was comparable to that of the SDM issuance. With the reversal of capital flows in 2008-09 and the large increase in Government’s market borrowing program, there was significant unwinding of the MSS and the Reserve Bank could manage the situation non-disruptively as both the functions were entrusted to it and it could undertake the necessary liquidity management measures seamlessly. During second half of 2013, the Reserve Bank of India used cash management bills (CMBs) as a measure to contain the volatility in the foreign exchange market. Separation of SDM from the Reserve Bank will make it very difficult to harmonise these operations as is done at present. Post-crisis lessons 38. In the pre-crisis phase, the functions of monetary policy, financial stability and SDM used to be looked upon as an ‘impossible trinity’. Post-crisis, their interdependence is increasingly being recognised. Unlike in the past, central banks’ operations are not currently confined to the shorter end but are carried out across the yield curve. Similarly, Government debt managers, opportunistically or under compulsion, are increasingly operating at the shorter end. This has intensified the interaction between monetary policy and SDM, warranting greater coordination in the interest of policy credibility and financial stability. Internationally, there has been a rethinking on the issue of debt management by Central Banks, with scholars like Charles Goodhart articulating that debt management being a critical element in the overall conduct of macroeconomic policy, central banks should be encouraged to revert to their role of managing the national debt. 39. In this context, the cause of coordination is always better served under the same roof than by a separation from central bank, accompanied by a closer inter-institutional coordination. There could be an argument that coordination mechanism could be designed between the central bank and the DMO, either by statute or executive order. The experience of coordination mechanisms between DMO and central bank, which are vital for economic management, is however, far from satisfactory and impacted debt management. There has been instances of failed auctions, e.g., in the UK (March 2009), causing reputation risk for both the authorities. In the above backdrop, it is strongly felt that given the large size of the market borrowings, there is a confluence of interest between monetary policy and debt management in India. 40. The significant impact of the Government borrowing on the broader interest rate structure in the economy and, therefore, on the monetary transmission process in financial markets, makes it a critical component of the macroeconomic management framework. In such a scenario, central bank involvement in managing the market volatility and market expectations arising out of government debt borrowing becomes necessary. The past experience, reinforced by the recent developments regarding huge market borrowing of the Government, has shown the necessity of this approach. Such will be the case even if the central bank is disassociated from the operational aspects of debt issuance. This being so, it is much better for the central bank to have a hands-on involvement. 41. It is, therefore, imperative that future course of action needs to be decided based on ground realities of our country rather than from an ideological perspective, emerging post-crisis international experience and the fact that the separation of debt management from the central bank could compromise the effectiveness of monetary policy, efficiency of debt management and stability of financial markets. Therefore, there is a strong case for continuance of present system of Central Bank managing debt management in India. In case, however, a decision is taken to move the debt management function to a separate unit, it needs to be preceded by well thought out strategy on timing of commencement of its operations, selection of personnel, their incentive structure, performance evaluation benchmarks from the long term debt sustainability points of view and arrangements for perfect institutional and operational co-ordination among the debt management unit, the Ministry of Finance & the Reserve Bank of India. Concluding thoughts 42. I would like to conclude by adding that the process of managing public debt is an onerous responsibility, with implications for financial stability in the short to medium term and inter-generational equity in the long run. Our debt portfolio is reasonably stable and sustainable and due to our conscious strategy of elongation of maturity, low level of foreign currency debt, large domestic investor base, risks are at low level. There is, however, an unfinished agenda of consolidation of public debt and we are moving towards this goal by active debt management through re-issuances, buybacks and switches. More efforts are needed to develop a deep and liquid G-Sec market that allows the government to borrow more efficiently, different classes of investors to enter & exit the market freely and private sector issuers to price their offerings transparently. We are, therefore, committed to improving liquidity. Reserve Bank has discharged its mandate of managing the public debt in an efficient and effective manner. There is merit in continuance of present institutional arrangement. If at all, separation of debt management from central bank has to be effected, it should be preceded by well thought strategy focussing on perfect co-ordination among the Debt Management Office, the Ministry of Finance and the Reserve Bank of India. Thank you. 1Based on the keynote address delivered by Shri Harun R Khan, Deputy Governor, Reserve Bank of India at the 9th Annual International Conference on “Public Policy & Management: Debt Management” at Indian Institute of Management, Bangalore on August 11, 2014. The contributions of Shri N R V V M K Rajendra Kumar and Km. Renuka Balakrishnan of the Reserve Bank of India are gratefully acknowledged. |

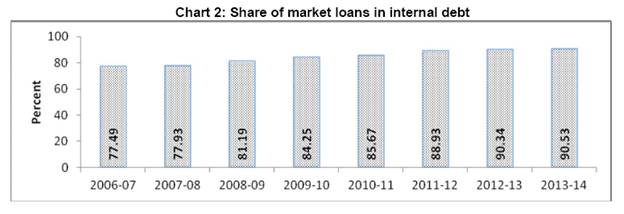

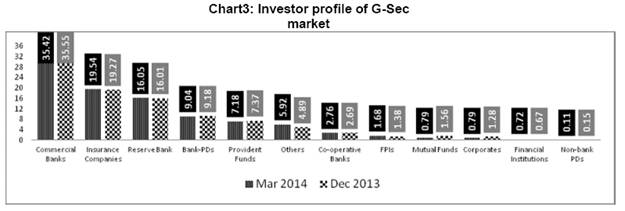

கடைசியாக புதுப்பிக்கப்பட்ட பக்கம்: