FAQ Page 1 - ஆர்பிஐ - Reserve Bank of India

FAQs on Priority Sector Lending (PSL)

K. PSLCs

Clarification: The misclassifications, if any, will have to be reduced from the achievement of PSLC seller bank only. There will be no risk for the PSLC buyer, even if the underlying asset of the traded PSLC gets misclassified.

J. PSLCs

Clarification: There will be a real time settlement of the matched premium. Accordingly, the respective current accounts of the participating banks with RBI will be debited/ credited to the extent of the matched premium.

K. PSLCs

Clarification: The trading platform will match the buy and sell offer by following the Rule of Lowest Sale offer to the Buy offer and then within that on FIFO basis. For example, a buyer offered to pay 2% premium for a particular PSLC type and the same is available at 1.5%, 1.8% and 2%, the portal will first match with the sale deal at 1.5% and for any leftover units, it will then match with the sale offers of 1.8% and then 2% in that order, provided the buy offer is first in the queue (based on the timing of the placement of the buy offer).

Clarification: The order matching will be done on anonymous basis through the portal and the buyer/seller cannot select the counterparty. Partial matching will happen depending on the matching of premium and availability of category-wise PSLC lots for sale and purchase.

Clarification: The normal trading hours shall be from 10 AM to 4:30 PM. The PSLC market operates on all days except Saturdays, Sundays and holidays declared under The Negotiable Instruments Act, 1881 by the Government of Maharashtra.

Clarification: Paras 22, 23 and 24 of the Master Directions on Priority Sector Lending, 2025 permit banks to classify as PSL their lending to NBFCs including HFCs and NBFC-MFIs and other MFIs (Societies, Trusts etc.) which are members of RBI recognised SRO for the sector, for on-lending to eligible priority sectors. Banks may adopt a uniform methodology for PSL classification of on-lending as follows:

a) Classification under PSL:

• The banks can classify on-lending to eligible entities in the respective categories of PSL. The classification will be allowed only when the entity has disbursed the Priority Sector Loans to the ultimate beneficiary after receiving the funds from the bank and the funds remain deployed in PSL assets.

• The entities must provide auditors’ certificate to the banks stating that the individual loans of the portfolio, against which on-lending benefit is being claimed, are not being used to claim benefit from any other bank(s). Also, they must put in place a suitable process to flag such loan(s) in their systems to enable internal/statutory auditors as well as RBI supervisors (in case of NBFCs) to verify the same.

b) Information sharing:

• The banks may devise internal control mechanisms to ensure that the portfolio under on-lending is PSL compliant. The following information/record, at the very minimum, should be collected by the bank from the eligible entities:name of the beneficiary, amount sanctioned, loan amount outstanding, loan tenure, disbursement date, category of PSL.

Clarification: Bank lending to NBFCs (other than MFIs) and HFCs is subject to a cap of 5% of average PSL achievement of the four quarters of the previous financial year. In case of a new bank the cap shall be applicable on an on-going basis during its first year of operations. The prescribed cap is not applicable for bank lending to NBFC-MFIs and other MFIs (Societies, Trusts, etc.) which are members of RBI recognised ‘Self-Regulatory Organisation’ of the sector. Bank lending to such MFIs can be classified under different categories of PSL in accordance with conditions specified in the Master Directions on Priority Sector Lending, 2025.

M. Co-lending by Banks & NBFCs

Clarification: While the guidelines allow sharing of risks and rewards between the bank and the NBFC for ensuring appropriate alignment of respective business objectives, the priority sector assets on the bank’s books should at all times be without recourse to the NBFC.

Clarification: Only if the bank can exercise its discretion regarding taking into its books the loans originated by NBFC as per the agreement, the arrangement will be akin to a direct assignment transaction. If the Agreement entails a prior, irrevocable commitment on the part of the bank to take into its books its share of the individual loans as originated by the NBFC, it shall not be akin to direct assignment transaction.

Clarification: Both entities, the bank and the NBFC, shall be guided by the bilateral Master Agreement entered by them for implementing the Co-lending Model (CLM). The agreement may specify any cap on the number and amount of loans that can be originated by the NBFC under the Co-lending model.

Clarification: If the Master Agreement entails a prior, irrevocable commitment on the part of the bank, it has been advised that the partner bank and NBFC shall have to put in place suitable mechanisms for ex-ante due diligence by the bank. Such due diligence should ensure compliance with RBI regulations on KYC and outsourcing of activities before disbursal of the loans by the NBFC.

Clarification: Back-to-back basis implies that the loans will be first opened by NBFC and then bank will open loan accounts subsequently.

Clarification: The bank and the NBFC can decide on this aspect as per the Master agreement between them.

N. Shortfall calculation

Clarification: The shortfall/excess in achievement is calculated for each quarter of the financial year. The shortfall/ excess for the year is arrived at by taking a simple average of the shortfall/excess for all the four quarters. In case of shortfall in achievement of overall PSL target or any of the prescribed sub-targets, the bank will be required to contribute to specified funds maintained with NABARD/SIDBI/MUDRA/NHB.

Housing Loans

Ensure that the documents being provided to you are not colour photocopies. Check the internet for other modus operandi to fraud and ensure clear title to the asset. Seek advice only from authentic sources such as your bank.

Get the no encumbrance certificate to find the true title holder and if it is mortgaged to any financier. Obtain all tax papers to ensure that all documents are up to date.

Targeted Long Term Repo Operations (TLTROs)

FAQs pertaining to TLTRO 2.0

Ans: In order to provide banks flexibility in investment, this condition will not be applicable for funds availed under TLTRO 2.0.

FAQs on Non-Banking Financial Companies

Exemptions to the companies not accepting public deposits

Retail Direct Scheme

Account opening related queries

Remittances (Money Transfer Service Scheme (MTSS) and Rupee Drawing Arrangement (RDA))

Money Transfer Service Scheme (MTSS)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: If an entity has not ‘received any fresh FDI and/or ODI (overseas direct investment)’ in the latest FY but has outstanding FDI and/or ODI as at end-March of that financial year, then it is required to submit their outstanding position as on March 31 in the FLA return every year by July 15.

Domestic Deposits

I. Domestic Deposits

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Paytm Payments Bank Wallet

Government Securities Market in India – A Primer

11.1 For every transaction entered into by the trading desk, a deal slip should be generated which should contain data relating to nature of the deal, name of the counter-party, whether it is a direct deal or through a broker (if it is through a broker, name of the broker), details of security, amount, price, contract date and time and settlement date. The deal slips should be serially numbered and verified separately to ensure that each deal slip has been properly accounted for. Once the deal is concluded, the deal slip should be immediately passed on to the back office (it should be separate and distinct from the front office) for recording and processing. For each deal, there must be a system of issue of confirmation to the counter-party. The timely receipt of requisite written confirmation from the counter-party, which must include all essential details of the contract, should be monitored by the back office. The need for counterparty confirmation of deals matched on NDS-OM will not arise, as NDS-OM is an anonymous automated order matching system. In case of trades finalized in the OTC market and reported on NDS-OM reported segment, both the buying and selling counter parties report the trade particulars separately on the reporting platform which should match for the trade to be settled.

11.2 Once a deal has been concluded through a broker, there should not be any substitution of the counterparty by the broker. Similarly, the security sold / purchased in a deal should not be substituted by another security under any circumstances.

11.3 On the basis of vouchers passed by the back office (which should be done after verification of actual contract notes received from the broker / counter party and confirmation of the deal by the counter party), the books of account should be independently prepared.

External Commercial Borrowings (ECB) and Trade Credits

D. RECOGNISED LENDERS/ INVESTORS

Foreign Investment in India

Answer: Please refer to the ‘Standard Operating Procedure (SOP) for Processing FDI Proposals’ issued by Department of Industrial Policy & Promotion, Government of India → http://fifp.gov.in/Forms/SOP.pdf

Indian Currency

B) Banknotes

Not necessarily. In terms of Section 24 of the Reserve Bank of India Act, 1934, bank notes shall be of the denominational values of two rupees, five rupees, ten rupees, twenty rupees, fifty rupees, one hundred rupees, five hundred rupees, one thousand rupees, five thousand rupees and ten thousand rupees or of such other denominational values, not exceeding ten thousand rupees, as the Central Government may, on the recommendation of the Central Board, specify in this behalf.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

The Reserve Bank has been empowered under the RBI Act 1934 to register, determine policy, issue directions, inspect, regulate, supervise and exercise surveillance over NBFCs that fulfil the principal business criteria or 50-50 criteria of principal business. The Reserve Bank can penalize NBFCs for violating the provisions of the RBI Act or the directions or orders issued by the Reserve Bank under RBI Act. The penal action may also include cancellation of the Certificate of Registration issued to the NBFC.

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Details of survey launch

Ans.: In case the reporting entity does not receive the soft-form of the survey schedule, they may download the same from RBI website ---> ‘Regulatory Reporting’-→ ‘List of Returns’-→ ‘FCS – Survey Schedule’ or Forms→Survey or send a request to the email: fcsquery@rbi.org.in.

Coordinated Portfolio Investment Survey – India

What to report under CPIS?

Ans: The survey collects details of portfolio investment assets of domestic residents made in securities issued by unrelated non-residents i.e., securities issued by unrelated non-residents and owned by residents.

Core Investment Companies

B. Registration and related matters:

Ans: All companies in the group that are CICs would be regarded as CICs (provided they have accessed public fund) under the extant regulations of Reserve Bank and would be required to obtain a Certificate of Registration from the Bank.

Housing Loans

Give yourself comfortable time. Do not hurry your purchase or loan in any case. Shopping around for a home loan will help you to get the best financing deal. Shopping, comparing, seeking clarification and negotiating with banks may save you thousands of rupees.

a) Obtain information from several banks

Home loans are available from mainly two types of lenders--commercial banks and housing finance companies. Different lenders may quote you different rates of interest and other terms and conditions, so you should contact several lenders to make sure you’re getting the best value for money.

Find out how much of a down payment you are required to pay, and find out all the costs involved in the loan (including processing fees, administrative charges and prepayment charges levied by banks). Knowing just the amount of the EMI or the interest rate is not good enough. Similarly, ask for information on loan amount, loan term, and type of loan (fixed or floating) so that you can compare the information and take an informed decision.

The following is some important information that you will require.

i) Rates

Ask your lender about its current home loan interest rates and whether the rate is fixed or floating. Remember that when interest rates in the economy go up so does the floating rates and hence the monthly re-payment.

If the rate quoted is a floating rate, ask how your rate and loan payment will vary, including the extent to which your loan payment will be reduced when rates go down by a certain percentage. Ask your lender to what index your floating home loan is referenced / linked and the periodicity of updation of that index. Also ask your bank whether the index is internal or external and how and where it is published.

Ask about the loan’s annual percentage rates (APR). The APR takes into account not only the interest rate but also fees and certain other charges that you may be required to pay, expressed as a yearly rate. Banks are obliged to reveal the APR if requested for by the customer.

ii) Reset Clause

Check the reset clause, especially in the case of fixed interest rate loan as the rates will not be fixed throughout the tenure of the loan.

iii) Spread/Mark up

Check if the margin in the case of the floating rate is fixed or variable. The rate of interest you have to pay will vary accordingly.

iv) Fees

A home loan often requires payment of various fees, such as loan origination or processing charges, administrative charges, documentation, late payment, changing the loan tenure, switching to different loan package during the loan tenure, restructuring of loan, changing from fixed to floating interest rate loan and vice versa, legal fee, technical inspection fee, recurring annual service fee, document retrieval charges and pre-payment charges, if you want to prepay the loan. Every lender should be able to give you an estimate of its fees. Many of these fees are negotiable / can be waived also.

Ask what each fee includes. Sometimes several components are lumped into one fee. Ask for an explanation of any fee you do not understand. Also, remember that most of these fees are perhaps negotiable! Do negotiate with your bank before agreeing to a particular fee. See how the all inclusive rate compares with the all inclusive rates offered by other banks. While planning your finances, don't forget to include the costs of stamp duty and registration.

v) Down Payments / Margin

Some lenders require 20/30 percent of the home’s purchase price as a down payment from you. However, many lenders also offer loans that require less than 20/30 percent down payment, sometimes as little as 5 percent .Ask about the lender’s requirements for a down payment and also negotiate with him to reduce the down payments.

b) Obtain the best deal

Once you know what each bank has to offer in terms of rates, fees and down payments, negotiate for the best deal. Ask the lender to write down all the costs associated with the loan. Then ask if the bank will waive or reduce one or more of its fees or agree to a lower rate. Do make sure that the bank is not agreeing to lower one fee while raising another or to lower the rate while raising the fees. Ask for clarification in case you do not understand any particular term. All banks are obliged to explain the most important terms and conditions of the home loan in detail.

Once you are satisfied with the terms you have negotiated, please do obtain a written offer letter from the lender and keep a copy with you. Read the offer letter carefully before signing.

Targeted Long Term Repo Operations (TLTROs)

FAQs pertaining to TLTRO 2.0

Ans: This condition applies only to the fourth TLTRO conducted on April 17, 2020. It does not apply to the TLTROs conducted before April 17, 2020. It also does not apply to TLTRO 2.0.

FAQs on Non-Banking Financial Companies

Exemptions to the companies not accepting public deposits

Domestic Deposits

I. Domestic Deposits

Remittances (Money Transfer Service Scheme (MTSS) and Rupee Drawing Arrangement (RDA))

Money Transfer Service Scheme (MTSS)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: If the Partnership firms, Branches or Trustees have any outward FDI outstanding as on end-March of the latest FY, then they are required to file the FLA return.

Retail Direct Scheme

Account opening related queries

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Paytm Payments Bank Wallet

Government Securities Market in India – A Primer

The following steps should be followed in purchase of a security:

-

Which security to invest in – Typically this involves deciding on the maturity and coupon. Maturity is important because this determines the extent of risk an investor like an UCB is exposed to – normally higher the maturity, higher the interest rate risk or market risk. If the investment is largely to meet statutory requirements, it may be advisable to avoid taking undue market risk and buy securities with shorter maturity. Within the shorter maturity range (say 5-10 years), it would be safer to buy securities which are liquid, that is, securities which trade in relatively larger volumes in the market. The information about such securities can be obtained from the website of the CCIL (http://www.ccilindia.com/OMMWCG.aspx), which gives real-time secondary market trade data on NDS-OM. Pricing is more transparent in liquid securities, thereby reducing the chances of being misled/misinformed. The coupon rate of the security is equally important for the investor as it affects the total return from the security. In order to determine which security to buy, the investor must look at the Yield to Maturity (YTM) of a security (please refer to Box III under para 24.4 for a detailed discussion on YTM). Thus, once the maturity and yield (YTM) is decided, the UCB may select a security by looking at the price/yield information of securities traded on NDS-OM or by negotiating with bank or PD or broker.

-

Where and Whom to buy from- In terms of transparent pricing, the NDS-OM is the safest because it is a live and anonymous platform where the trades are disseminated as they are struck and where counterparties to the trades are not revealed. In case, the trades are conducted on the telephone market, it would be safe to trade directly with a bank or a PD. In case one uses a broker, care must be exercised to ensure that the broker is registered on NSE or BSE or OTC Exchange of India. Normally, the active debt market brokers may not be interested in deal sizes which are smaller than the market lot (usually ₹ 5 cr). So it is better to deal directly with bank / PD or on NDS-OM, which also has a screen for odd-lots (i.e. less than ₹ 5 cr). Wherever a broker is used, the settlement should not happen through the broker. Trades should not be directly executed with any counterparties other than a bank, PD or a financial institution, to minimize the risk of getting adverse prices.

-

How to ensure correct pricing – Since investors like UCBs have very small requirements, they may get a quote/price, which is worse than the price for standard market lots. To be sure of prices, only liquid securities may be chosen for purchase. A safer alternative for investors with small requirements is to buy under the primary auctions conducted by RBI through the non-competitive route. Since there are bond auctions almost every week, purchases can be considered to coincide with the auctions. Please see question 14 for details on ascertaining the prices of the G-Secs.

External Commercial Borrowings (ECB) and Trade Credits

E. AVERAGE MATURITY PERIOD

You may refer to /documents/87730/39016390/12EC160712_A6.pdf for illustration purposes.

Indian Currency

B) Banknotes

The highest denomination note ever printed by the Reserve Bank of India was the ₹10000 note in 1938 which was demonetized in January 1946. The ₹10000 was again introduced in 1954. These notes were demonetized in 1978.

Core Investment Companies

B. Registration and related matters:

Ans: In such a case only C will be registered, provided C is not funding any of the other CICs either directly or indirectly. HCo as well as A and B would not require registration as they neither access public funds directly nor access public funds indirectly through C.

Foreign Investment in India

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

It is illegal for any person/ entity/ financial company to make a false claim of being regulated by the Reserve Bank to mislead the public to collect deposits and is liable for penal action under the Law. Information in this regard may be forwarded to the nearest office of the Reserve Bank and the Police.

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Some important definitions and concepts

Ans.: Indian company which has entered into an agreement with a foreign entity in terms of technology transfer, know-how transfer, use of patent, brand name etc, then such type of agreements are treated as Foreign Technical Collaborations (FTC).

Coordinated Portfolio Investment Survey – India

What to report under CPIS?

Ans: The portfolio investment assets are required to be reported on marked to market basis as at the end of the reference period, with the breakups into type of securities viz., equity securities, short-term debt securities (with and original maturity of up to one year) and long-term debt securities (with an original maturity of more than a year) and country of residence of issuer.

Housing Loans

Targeted Long Term Repo Operations (TLTROs)

FAQs pertaining to TLTRO 2.0

Ans: In terms of the press release 2237/2019-2020 dated April 17, 2020 notifying the TLTRO 2.0 scheme, at least 50 per cent of the total funds availed under the scheme has to be deployed in specified securities issued by small NBFCs of asset size of ₹ 500 crores and below, mid-sized NBFCs of asset size between ₹ 500 crores and ₹ 5000 crores and MFIs. The objective is to ease any liquidity stress and/or impediments to market access that these small and mid-sized entities might be facing. In order to incentivise banks’ investment in the specified securities of these entities, it has been decided that a bank can exclude the face value of such securities kept in the HTM category from computation of adjusted non-food bank credit (ANBC) for the purpose of determining priority sector targets/sub-targets. This exemption is only applicable to the funds availed under TLTRO 2.0.

FAQs on Non-Banking Financial Companies

Net owned fund

Domestic Deposits

I. Domestic Deposits

Savings bank account cannot be opened in the name of the Government Department/ Government Scheme, except in respect of deposits of Government organizations/ agencies listed below:

-

Primary Co-operative Credit Society which is being financed by the bank.

-

Khadi and Village Industries Boards.

-

Agriculture Produce Market Committees.

-

Societies registered under Societies Registration Act, 1860 or any other corresponding law in force in State or a Union Territory.

-

Companies governed by the Companies Act, 1956 which have been licensed by the Central Government under Section 25 of the said Act, or under the corresponding provision in the Indian Companies Act, 1913 and permitted, not to add to their names the word “Limited” or the words “Private Limited”.

-

Institutions other than those mentioned in clause (i) above and whose entire income is exempt from payment of income tax under Income-Tax Act, 1961.

-

Government departments/ bodies/ agencies in respect of grants/ subsidies released for implementation of various programmes/ Schemes sponsored by Central Government/ State Governments subject to production of an authorisation from the respective Government departments to open savings bank accounts.

-

Development of Women and Children in Rural Areas (DWCRA).

-

Self-help Groups (SHGs), registered or unregistered, which are engaged in promoting savings habits among their members.

-

Farmers’ Clubs – Vikas Volunteer Vahini (VVV).

Remittances (Money Transfer Service Scheme (MTSS) and Rupee Drawing Arrangement (RDA))

Money Transfer Service Scheme (MTSS)

Retail Direct Scheme

Know Your Customer (KYC) related queries

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: FLA return and Annual Performance Report (APR) for ODI are two different returns and monitored by two different departments of RBI. So, you are required to submit both the returns if these are applicable for your entity. For more information on APR, please refer to the Master Direction – Reporting under Foreign Exchange Management Act, 1999 on RBI’s website.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Paytm Payments Bank Wallet

External Commercial Borrowings (ECB) and Trade Credits

E. AVERAGE MATURITY PERIOD

Government Securities Market in India – A Primer

Foreign Investment in India

Indian Currency

B) Banknotes

The paper currently being used for printing of banknotes in India is made by using 100% cotton.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

If companies that are required to be registered with the Reserve Bank as NBFCs, are found to be conducting non-banking financial activity, such as, lending, investment or deposit acceptance as their principal business, without obtaining Certificate of Registration from the Reserve Bank, the same would be treated as contravention of the provisions of the RBI Act, 1934 and would invite penal action viz., penalty or fine or even prosecution in a Court of Law. If members of public come across any entity which undertakes non-banking financial activity but does not figure in the list of authorized NBFCs on the Reserve Bank’s website, they should inform the nearest Regional Office of the Reserve Bank, for appropriate action to be taken for contravention of the provisions of the RBI Act, 1934.

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Some important definitions and concepts

Ans.: An Indian company is called as a Foreign Subsidiary if a non-resident investor owns more than 50 per cent of the voting power / equity capital or where a non-resident investor and its subsidiary(s) combined own more than 50 per of the voting power / equity capital of an Indian enterprise.

Coordinated Portfolio Investment Survey – India

What to report under CPIS?

Ans: Reporting entities should report the data in the unit mentioned in the survey schedule (for eg., INR Lakh).

Core Investment Companies

B. Registration and related matters:

Ans: The NBFC would have to apply to RBI with full details of the plan and exemptions could be considered on a selective basis on the merits of the case.

Housing Loans

When other banks reduce the interest rate, you may prefer to close your account with the bank with whom you are banking, to avail of the loan from the bank offering reduced rates of interest. You have to pay pre-payment charges for doing so. In order to ensure that their customers do not approach other banks for availing reduced interest rates, banks allow customers to switch over from a higher interest loan to a lower interest loan by paying a switch over fees which is lesser than the pre-payment charges. Generally switchover fee is taken as percentage of the outstanding loan amount.

Keep up-dating yourself on various changes in the home loan market. Visit the branch, discuss with the officials to get the best out of any changes in the home loan scenario.

Targeted Long Term Repo Operations (TLTROs)

FAQs pertaining to TLTRO 2.0

Ans: The funds availed under TLTRO 2.0 are to be deployed in investment grade bonds, commercial paper (CPs) and non-convertible debentures (NCDs) of Non-Banking Financial Companies (NBFCs) and MFIs in the manner outlined in the press release dated April 17, 2020.

FAQs on Non-Banking Financial Companies

Ceiling on deposits

A. As per the new Regulatory framework, there is no overall ceiling on the borrowings of NBFCs. However, limits have been prescribed for acceptance of Public Deposits as indicated here.

Level of credit rating | Ceiling on public deposits | |

EL/HP Cos. | LC/ICs | |

AAA | 4.0 | 2.0 |

AA | 2.5 | 1.0 |

A | 1.5 | 0.5 |

A - (CRISIL & ICRA) } | ||

BBB (CARE) } | 0.5 | Nil |

BBB- (DCR India) } | ||

It is to be noted that there is an in-built ceiling on the total borrowings of the NBFCs accepting deposits from public, because they are required to maintain a capital adequacy ratio of 10 per cent of their risk weighted assets effective from 31.3.1998 and 12 per cent from 31.3.1999. Their capacity to create assets and raise corresponding borrowings will be restricted because of capital adequacy norms.

Domestic Deposits

I. Domestic Deposits

-

In the case of term deposit standing in the name/s of a deceased individual depositor, or two or more joint depositors, where one of the depositor has died, the criterion for payment of interest on matured deposits in the event of death of the depositor in the above cases has been left to the discretion of individual banks subject to their Board laying down a transparent policy in this regard.

-

In the case of balances lying in current account standing in the name of a deceased individual depositor/ sole proprietorship concern, interest should be paid only from May 1, 1983 or from the date of death of the depositor, whichever is later, till the date of repayment to the claimant/s at the rate of interest applicable to savings deposit as on the date of payment. However, in the case of NRE deposit, if the claimants are residents, the deposit on maturity is treated as domestic rupee and interest is paid for the subsequent period at a rate applicable to the domestic deposit of similar maturity.

Remittances (Money Transfer Service Scheme (MTSS) and Rupee Drawing Arrangement (RDA))

Money Transfer Service Scheme (MTSS)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: If all non-resident shareholders of an entity have transferred their shares to the residents during the reporting period and the entity does not have any outstanding investment in respect of inward and outward FDI as on end-March of the latest FY, then the entity need not submit the FLA return.

Retail Direct Scheme

Know Your Customer (KYC) related queries

-

Enter your PAN card number and date of birth to retrieve details available in CKYC.

-

Provide address details, scanned copy of your signature, bank account details and nominee details.

-

Authenticate the user agreement form using Aadhaar by submitting the OTP sent on your mobile number linked to Aadhaar.

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

Paytm Payments Bank Wallet

Government Securities Market in India – A Primer

14.1 The return on a security is a combination of two elements (i) coupon income – that is, interest earned on the security and (ii) the gain / loss on the security due to price changes and reinvestment gains or losses.

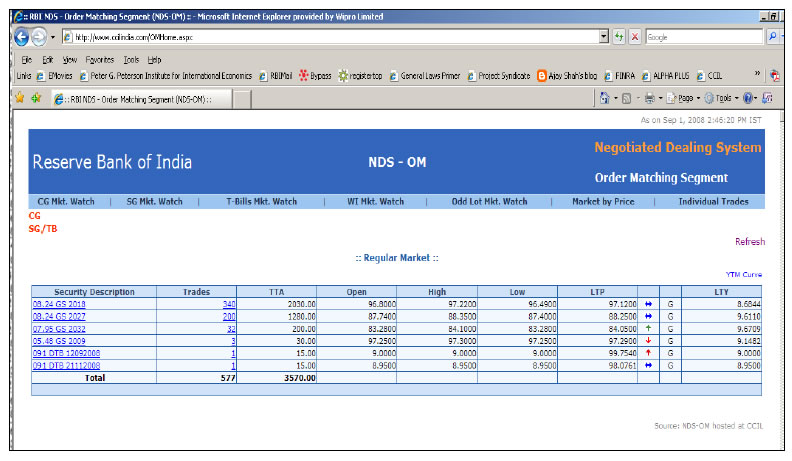

14.2 Price information is vital to any investor intending to either buy or sell G-Secs. Information on traded prices of securities is available on the RBI website http://www.rbi.org.in under the path Home → Financial Markets → Financial Markets Watch → Order Matching Segment of Negotiated Dealing System. This will show a screen containing the details of the latest trades undertaken in the market along with the prices. Additionally, trade information can also be seen on CCIL website http://www.ccilindia.com/OMHome.aspx. On this page, the list of securities and the summary of trades is displayed. The total traded amount (TTA) on that day is shown against each security. Typically, liquid securities are those with the largest amount of TTA. Pricing in these securities is efficient and hence UCBs can choose these securities for their transactions. Since the prices are available on the screen they can invest in these securities at the current prices through their custodians. Participants can thus get near real-time information on traded prices and take informed decisions while buying / selling G-Secs. The screenshots of the above webpage are given below:

NDS-OM Market

The website of the Financial Benchmarks India Private Limited (FBIL), (www.fbil.org.in) is also a right source of price information, especially on securities that are not traded frequently.

External Commercial Borrowings (ECB) and Trade Credits

E. AVERAGE MATURITY PERIOD

Foreign Investment in India

Indian Currency

B) Banknotes

Fifteen languages are appearing in the language panel of banknotes in addition to Hindi prominently displayed in the centre of the note and English on the reverse of the banknote.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

The list of registered NBFCs is available on the web site of Reserve Bank (www.rbi.org.in) under ‘Regulation → Non-Banking’. Further, the instructions issued to NBFCs from time to time through circulars and/ or master directions are hosted on the Reserve Bank’s website under ‘Notifications’, and some instructions are issued through Official Gazette notifications and press releases as well.

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Some important definitions and concepts

Ans.: An Indian company is called as Foreign Associate if non-resident investor owns at least 10% and no more than 50% of the voting power/equity capital or where non-resident investor and its subsidiary(s) combined own at least 10% but no more than 50% of the voting power/equity capital of an Indian enterprise.

Coordinated Portfolio Investment Survey – India

What to report under CPIS?

Ans.: If the responding entity does not have any portfolio investment asset during the reference period, then that entity is required to submit NIL survey schedule to the generic email ID of the Reserve Bank as per the instruction in the survey schedule.

Core Investment Companies

B. Registration and related matters:

Ans: CICs need not meet the principal business criteria for NBFCs.

Targeted Long Term Repo Operations (TLTROs)

FAQs pertaining to On Tap TLTRO/ reversal of TLTRO/ TLTRO 2.0 transactions

Ans: Banks can submit their request for exercising the repayment option till October 28, 2020. On repayment of funds availed under TLTRO/ TLTRO 2.0, the associated securities shall be shifted out of the HTM category. The shifting of the TLTRO/ TLTRO 2.0 investments out of HTM shall be in addition to the shifting of investments permitted at the beginning of the accounting year and subject to adherence to the guidelines contained in the Master Circular – Prudential Norms for Classification, Valuation and Operation of Investment Portfolio by Banks dated July 1, 2015. These investments under TLTRO/ TLTRO 2.0 against which funds are being repaid will not be exempted from reckoning under the large exposure framework (LEF) and computation of adjusted non-food bank credit (ANBC) for the purpose of determining priority sector targets/sub-targets.

Housing Loans

FAQs on Non-Banking Financial Companies

Ceiling on deposits

Domestic Deposits

I. Domestic Deposits

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: Shares issued by reporting entities to non-resident on non-repatriable basis should not be considered as foreign investment; therefore, entities which have issued the shares to non-resident only on non-repatriable basis, is not required to submit the FLA return.

Retail Direct Scheme

Know Your Customer (KYC) related queries

Business restrictions imposed on Paytm Payments Bank Limited vide Press Releases dated January 31 and February 16, 2024

FASTag issued by Paytm Payments Bank

Government Securities Market in India – A Primer

15.1 Transactions undertaken between market participants in the OTC / telephone market are expected to be reported on the NDS-OM platform within 15 minutes after the deal is put through over telephone. All OTC trades are required to be mandatorily reported on the NDS-OM reported segment for settlement. Reporting on NDS-OM is a two stage process wherein both the seller and buyer of the security have to report their leg of the trade. System validates all the parameters like reporting time, price, security etc. and when all the criterias of both the reporting parties match, the deals get matched and trade details are sent by NDS-OM system to CCIL for settlement.

15.2 Reporting on behalf of entities maintaining gilt accounts with the custodians is done by the respective custodians in the same manner as they do in case of their own trades i.e., proprietary trades. The securities leg of these trades settles in the CSGL account of the custodian. Funds leg settle in the current account of the PM with RBI.

15.3 In the case of NDS-OM, participants place orders (amount and price) in the desired security on the system. Participants can modify / cancel their orders. Order could be a ‘bid’ (for purchase) or ‘offer’ (for sale) or a two way quote (both buy and sell) of securities. The system, in turn, will match the orders based on price and time priority. That is, it matches bids and offers of the same prices with time priority. It may be noted that bid and offer of the same entity do not match i.e. only inter-entity orders are matched by NDS-OM and not intra-entity. The NDS-OM system has separate screen for trading of the Central Government papers, State Government securities (SDLs) and Treasury bills (including Cash Management Bills). In addition, there is a screen for odd lot trading also essentially for facilitating trading by small participants in smaller lots of less than ₹ 5 crore. The minimum amount that can be traded in odd lot is ₹ 10,000 in dated securities, T-Bills and CMBs. The NDS-OM platform is an anonymous platform wherein the participants will not know the counterparty to the trade. Once an order is matched, the deal ticket gets generated automatically and the trade details flow to the CCIL. Due to anonymity offered by the system, the pricing is not influenced by the participants’ size and standing.

External Commercial Borrowings (ECB) and Trade Credits

F. LEVERAGE CRITERIA AND BORROWING LIMIT

Foreign Investment in India

Answer: No, refer to Para 7.13 of Master Direction-Foreign Investment in India.

Indian Currency

B) Banknotes

Yes, it is possible to have two or more banknotes with the same serial number, but they would either have a different Inset Letter or year of printing or signature of a different Governor of RBI. An Inset Letter is an alphabet printed on the Number Panel of the banknote. There can be notes without any inset letter also.

All you wanted to know about NBFCs

B. Entities Regulated by RBI and applicable regulations

As part of regulatory framework prescribed by the Reserve Bank for NBFCs, the Reserve Bank prescribes prudential regulations viz., capital adequacy/ leverage, provisioning, corporate governance framework, etc.; conduct of business regulations viz., KYC/ AML regulations, fair practices code, etc.; and other miscellaneous regulations to ensure that NBFCs are financially sound and follow transparency in their operations. The regulations for NBFCs are contained in various master directions and notifications/ circulars issued from time to time, and are available on the website of the Reserve Bank (www.rbi.org.in) under ‘notifications’.

Biennial survey on Foreign Collaboration in Indian Industry (FCS)

Some important definitions and concepts

Ans.: An Indian company is said have Pure Technical Collaboration if the company has only foreign technical collaboration and have not received any foreign direct investment.

Coordinated Portfolio Investment Survey – India

What to report under CPIS?

Ans: If the entity’s accounts are not audited before the due date of submission, then they should report in the survey based on unaudited (provisional) account.

Core Investment Companies

B. Registration and related matters:

Ans: A holding company not meeting the criteria for a CIC laid down in para 2 of Master Direction DoR(NBFC).PD.003/03.10.119/2016-17 dated August 25, 2016 would require to register as an NBFC. However, if such company wishes to register as CIC/ be exempted as CIC, it will have to apply to RBI with an action plan achievable within the specific period to reorganize its business as CIC. If it is not able to do so, it would need to comply with NBFC requirements and prudential norms.

Housing Loans

- At the time of sourcing the loan, banks are required to provide information about the interest rate applicable, the fees / charges and any other matter which affects your interest and the same are usually furnished in the product brochure of the banks. Complete transparency is mandatory.

- The banks will supply you authenticated copies of all the loan documents executed by you at their cost along with a copy each of all enclosures quoted in the loan document on request.

A bank cannot reject your loan application without furnishing valid reason(s) for the same.

Targeted Long Term Repo Operations (TLTROs)

FAQs pertaining to On Tap TLTRO/ reversal of TLTRO/ TLTRO 2.0 transactions

Ans: Banks can use either of the alternatives. However, the request of the bank will be subject to availability of funds as on date of application i.e., funds cannot be guaranteed in case the total amount of ₹1,00,000 crore is already availed.

FAQs on Non-Banking Financial Companies

Ceiling on deposits

Retail Direct Scheme

Know Your Customer (KYC) related queries

-

Upload a scanned copy of your PAN card.

-

Download the XML version of your Aadhaar from the UIDAI website and upload it. Use the 4-digit pin specified while downloading XML version.

-

Provide address details, scanned copy of your signature, bank account details and nominee details.

-

Complete the video KYC by choosing a time slot for later or immediately, depending on the availability at that point of time.

-

Authenticate the user agreement form by Aadhaar using the OTP sent on your mobile number linked to Aadhaar.

Domestic Deposits

II. Deposits of Non-Residents Indians (NRIs)

Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999

Eligible entities and requirements to submit the FLA return

Ans: No, balance sheet or profit and loss (P&L) accounts are not required to be submitted along with the FLA return.